-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Logistics Management

2015; 4(1): 1-8

doi:10.5923/j.logistics.20150401.01

Mapping and Analysis the Operational Distribution System of Digital Multimedia Products

Wiwiek Rabiatul Adawiyah1, Daryono2

1Faculty of Economics and Business (Quality Management), Universitas Jenderal Soedirman, Purwokerto, Indonesia

2Faculty of Economics and Business (Operation Management), Universitas Jenderal Soedirman, Purwokerto, Indonesia

Correspondence to: Daryono, Faculty of Economics and Business (Operation Management), Universitas Jenderal Soedirman, Purwokerto, Indonesia.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Carrying the “Astro” brand, PT Direct Vision (“PT DV”) provides subscription-based television access for homes and commercial establishments. PT DV transmits up-to-the-minute information and the latest in local and international entertainment to its satellite in orbit, which returns the signal to the Southeast Asia region. The transmission can only be translated into audio video using a digital multimedia system (“DMS”) made up of an outdoor mini-satellite dish, a decoder, and a smart card. DMS products are manufactured abroad and imported to be distributed to new subscribers. The purpose of this Final Project is to evaluate the current distribution system of DMS products and suggest alternatives to promote cost efficiency in the logistical operations. Overall cost of distribution was considered relatively high and opportunities to lower cost can be attributed to better planning and key performance indicators. The process reference model was used as an approach to evaluate the current distribution system and to present alternatives for improvement. Of the proposed alternatives, major points for improvement include utilizing regional distribution centers, appointing a third party logistics service provider, optimizing economic order quantity, and establishing key performance indicators.

Keywords: Information, Communication industry, Process reference model, Distribution system, Key performance indicators, Cost efficiency

Cite this paper: Wiwiek Rabiatul Adawiyah, Daryono, Mapping and Analysis the Operational Distribution System of Digital Multimedia Products, Journal of Logistics Management, Vol. 4 No. 1, 2015, pp. 1-8. doi: 10.5923/j.logistics.20150401.01.

Article Outline

1. Company Profile

1.1. Company History

- PT Direct Vision (“PTDV”) was established on 28 February 2006 as a joint venture company between Astro All Asia Networks plc and PT Broadband Multimedia.

1.2. Scope of Business

- Astro is a subscription-based direct broadcast satellite (DBS) or direct-to-home satellite television and radio service in Malaysia, Brunei and Indonesia. The service is broadcast from the All Asia Broadcast Centre (ABC) located in Bukit Jalil, Kuala Lumpur, Malaysia. Astro is owned by MEASAT Broadcast Network Systems, a subsidiary of Astro All Asia Networks plc.The service was launched in 1996 following the launch of the MEASAT-1 satellite with an initial bouquet of 22 television and 8 radio channels. Currently, the service consists of 60 television, 17 radio, and 4 pay per view channels plus various interactive services. The television service comprises all six Malaysian terrestrial TV networks (RTM 1, RTM 2, TV3, ntv7, 8TV & TV9), a number of vernacular channels (packaged in house by ASTRO), as well as a selection of international English and Chinese language networks. Astro's own News Channel carries programming from the news channel Al Jazeera, available in dual language, Arabic and Malay, as well as the Australia Network. It also airs Astro News, a half-hour locally produced news program.

2. Business Process

2.1. Main Business Process

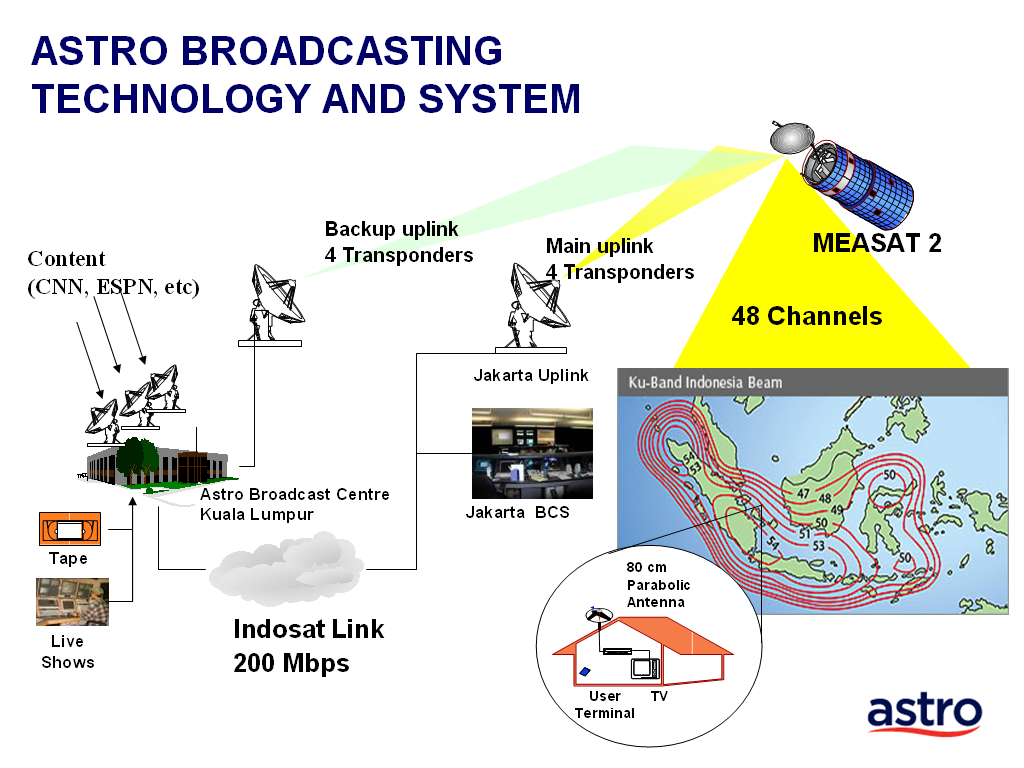

- The main business of PT Direct Vision is the distribution of television content to its subscribers. 24 hours per day, television content is distributed from its main control center sent to its MEASAT-2 (Malaysia East Asia Satellite). Television content is currently sent to the Satellite via four transponders, each with a capacity of 12 channels which totals to Astro’s current 48-channel line-up. The signal is then reflected back and captured by the individual outdoor units facing east towards the satellite.This however will not be possible without the successful distribution of necessary equipment of to facilitate the broadcast of television content from the satellite to its subscribers. These equipments are made of two main products which are the Outdoor Unit (ODU), which receives the television signal transmitted via satellite, and the decoder, which picks-up the radio-frequency signal and translates digital information into television channels.

| Figure 2.1. ASTRO Broadcasting Technology and System (Adopted from ASTRO) |

2.2. Supporting Business Process - Logistics

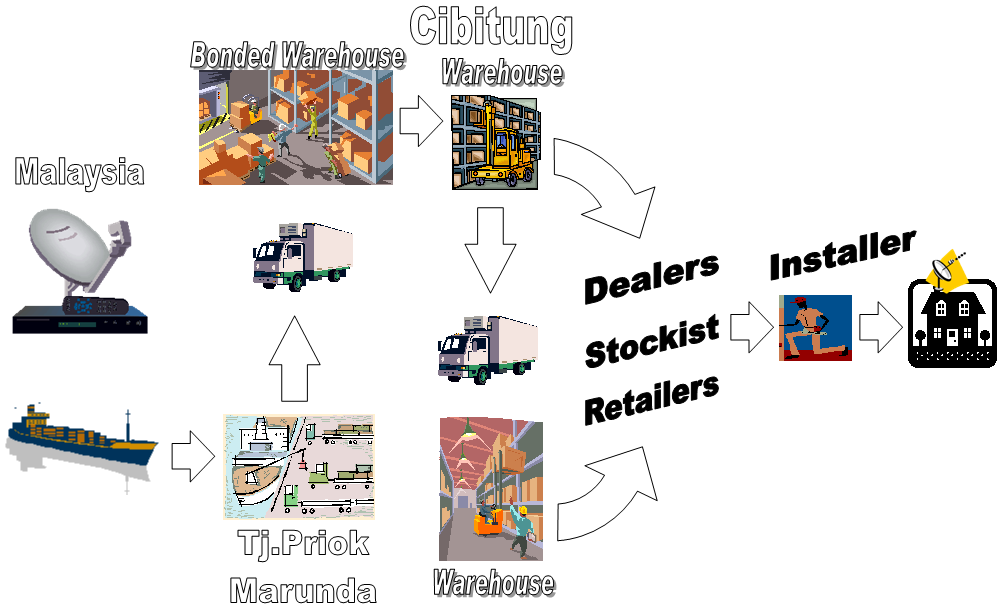

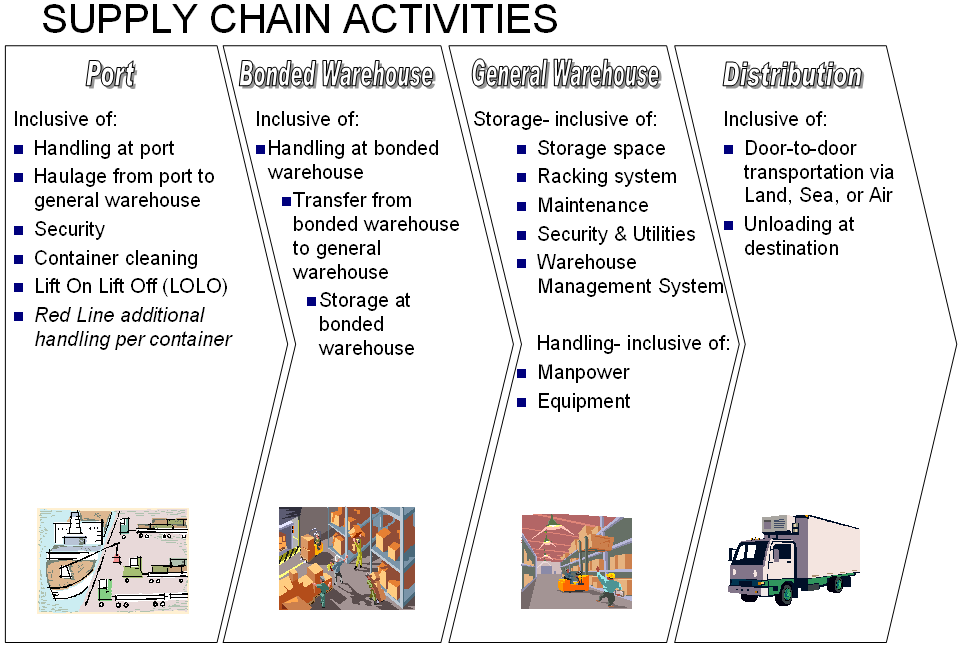

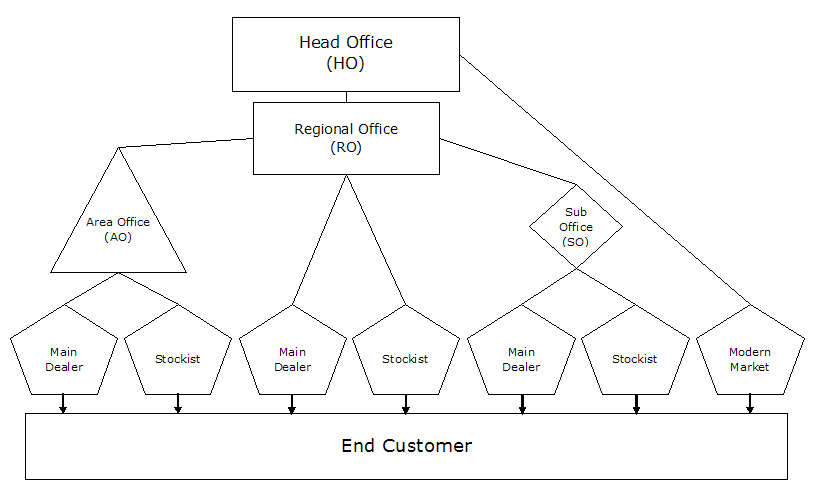

- Both products, the Outdoor Unit (ODU 80i) and the Integrated Receiver Decoder (IRD) are currently being imported from Malaysia. Both the ODU and the IRD are produced specifically for Astro. The products are delivered FOB shipping point in Kuala Lumpur then shipped to Jakarta. Currently, the responsibilities of the PTDV logistics team begins with receiving the shipment at the port all the way thru distribution to the main dealers, stockists, or modern markets (Hypermart, Electronic City, etc.). The actual processing of customs, warehousing, and delivery however are not performed by the logistics team as these tasks are outsourced to third parties. The responsibilities of the team are to oversee the operations as well as perform administrative duties.The following slide portrays the current flow of these two products from supplier to end customers.PTDV currently engages two Logistics Service Providers (LSP’s) however only one is tasked with customs clearance through its bonded warehouse. Once the products are cleared through customs, the pallets are delivered and stored at either the Cibitung warehouse or Marunda warehouse. Upon request from Astro, the LSP’s will deliver the products via air, sea, or land to specified locations across the country, whether it is a main dealer, a stockist, or a modern market. These distribution channels will then conduct sales and delivery to end customers.The main dealer (MD) is tasked with conducting sales in the area of operation through its network of local dealers. MD’s stock equipment and distribute to its dealers. When stock is low, they will contact the Sub-Office, Area Office, or Regional Office (whichever they are assigned to) and orders equipment to be shipped to their site. All requests are pooled at the respective Regional Office (RO) who will compile and forward requests to the head office (HO). Following approval from top management of Sales & Distribution dept (S&D), the warehouse team will then send request to the LSP to send equipment to the MD’s. In return for their services, the MD’s are awarded a fixed commission per activation of equipment.The same process applies to the stockist. A stockist by definition is a retailer that stocks goods. Differences between the two channels include the fixed commission amount per subscription activation and the way the equipment reaches end customers. When a new subscription request is granted, HO will call a third-party installer to pick up the equipment at a stockist and install at the new customer’s premises.

2.3. External Communications Structure

- PTDV has a structure of representative offices across the country to connect with their distribution channels. The Indonesian market is currently divided into 5 regions represented by regional offices (RO) in Jakarta, Bandung, Medan, Semarang, and Surabaya. In addition, three area offices (AO) currently support the regional offices for areas surrounding Denpasar, Palembang, and Pekanbaru.

2.4. Business Strategy

- Business strategy of PT Direct Vision can be portayed with analyses of internal and external factors through SWOT (Strength, Weaknesses, Opportunities and Threat) analysis. This has been done by PT Direct Vision to formulate a company business strategy, as well as measure its competitive position towards the business environment in the pay television industry in Indonesia.

| Figure 2.2. Diagram flow of products from factory to end customer |

| Figure 2.3. Diagram flow of products monitored by logistics division |

| Figure 2.4. Regional Communications Network |

3. Topic Identification

3.1. Topic Background

- PT Direct Vision’s entrance into the Indonesian market is not one that is welcomed with open arms by PT Indovision. The company faces a challenge to gain and increase market size and market share by providing quality broadcasting cheaply and effectively.During its first year of operations, PTDV entered the market with huge financial support from its parent companies. Now into its second year, management is tasked with finding ways to decrease its annual budget. Most of the budget reduction is targeted towards the Sales & Distribution department, especially in Distribution. Consequently, the company opened a tender to appoint new LSP to lower prices.

3.2. Selection of Topic

- This topic was chosen because the logistics division is new in this company. During its first year going commercial, the company focused on marketing and sales, building awareness and comany infrastructure for operations. As the company is moving well into its second year and are exploring ways to operate more effectively and efficiently, this final project aims to identify potential improvements in the warehousing and distribution processes of the company.

3.3. Purpose of Study

- The purpose of this study is to learn and understand the importance of supply chain management at PTDV. More specifically this study will identify aspects of the demand and supply planning of products for improvement, applying up to date theories in supply chain management. It is also the intention to present an alternative solution to effective and efficient supply and distribution of products.

3.4. Limitations in Scope of Study

- Due to time, confidentiality, and scope of responsibility, the following limitations are applicable:1. This study is focused on the logistics division, which is under the Sales & Distribution department of PT Direct Vision.2. Focus of study is only on the distribution of DMS products between the main distribution center (warehouse) and sub distribution centers (dealers, stockists, or retailers).3. Quantitative and qualitative analyses performed are only focused on the supply and distribution of mini-satellite and decoder products at the main distribution center level.4. Sales demand is aggregate.5. Information provided may not be as detailed.

4. Discussion & Analysis

4.1. Methodology

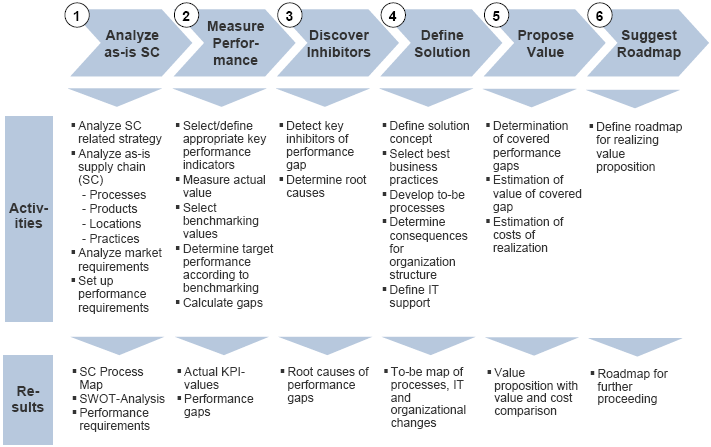

- The methodology used for this final project is the Process Reference Model. This model integrates the well-known concepts of business process reengineering, benchmarking, and best practice analyses into a cross-functional framework.In the Business Process Reengineering concept, the “as is” state of a process is captured and the “to be” desired future state of the process is derived. In Benchmarking, operational performance is quantified and internal targets are established based on best in industry standards. Finally in the Best Practice Analysis concept, management practices and software solutions that will result to best in industry performance is characterized.These concepts and processes interact in the Process Reference Model as seen in Figure 4.1 below.

| Figure 4.1. Process Reference Model |

4.2. “As is” Supply Chain Analyses

- In the first part of the model, the current supply chain in operations at the company is identified, observed, and analyzed. A general, overall process have been discussed in chapter 2 of this paper. This portion will attempt to discuss relevant processes in more detail.The company is in the business of distributing television content for knowledge and entertainment purposes and are currently regulated under the Ministry of Information and Communications as well as the Ministry of Trade. These two governmental bodies regulate different portions of the business.

5. Implementation Plan

5.1. Suggest Road Map

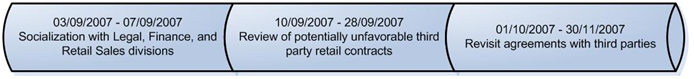

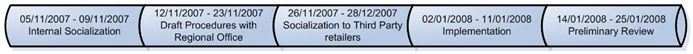

- Most of the solutions proposed in the previous chapter can be realised within a relatively short period of time. A few however may take up a longer period of time.In the immediate short term, PTDV must concentrate all efforts into finding new third party LSPs for its port clearance, warehousing, and outbound distribution to its sub-distribution networks. In addition, they can also take care of the minor proposals such as establishing key performance indicators, responsibilities, and standard procedures. The proposed timeline for each activity are as follows:A. Sort out third party contractsPhase I:Socialization with Legal, Finance, and Retail Sales divisionsPhase II :Review of potentially unfavorable third party retail contractsPhase III :Revisit agreements with third parties

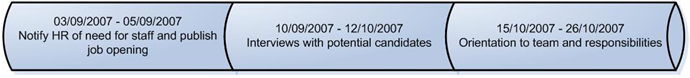

B. Hire inventory specialistPhase I:Notify HR of need for staff and publish job openingPhase II :Interviews with potential candidatesPhase III :Orientation to team and responsibilities

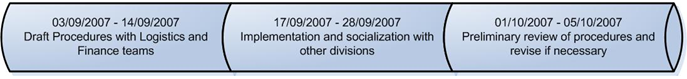

B. Hire inventory specialistPhase I:Notify HR of need for staff and publish job openingPhase II :Interviews with potential candidatesPhase III :Orientation to team and responsibilities  C. Create procedures and responsibilites to monitor inventoryPhase I:Draft Procedures with Logistics and Finance teamsPhase II :Implementation and socialization with other divisionsPhase III :Preliminary review of procedures and revise if necessary

C. Create procedures and responsibilites to monitor inventoryPhase I:Draft Procedures with Logistics and Finance teamsPhase II :Implementation and socialization with other divisionsPhase III :Preliminary review of procedures and revise if necessary D. Establish reporting system from Sub DC to Head OfficePhase I:Socialization with Regional Office, Finance, IT and LogisticsPhase II :Draft Procedures with Regional Office who will be in charge of gathering data in their respective jurisdiction and FinancePhase III :Socialization to Third Party retailersPhase IV :ImplementationPhase V :Preliminary review

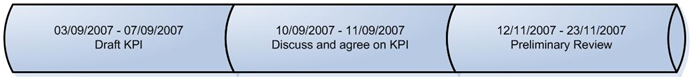

D. Establish reporting system from Sub DC to Head OfficePhase I:Socialization with Regional Office, Finance, IT and LogisticsPhase II :Draft Procedures with Regional Office who will be in charge of gathering data in their respective jurisdiction and FinancePhase III :Socialization to Third Party retailersPhase IV :ImplementationPhase V :Preliminary review E. Establish KPI for supply chain/distribution departmentPhase I:Draft KPIPhase II :Discuss and agree on KPIPhase III :Preliminary review

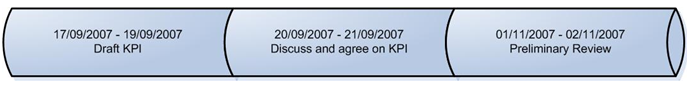

E. Establish KPI for supply chain/distribution departmentPhase I:Draft KPIPhase II :Discuss and agree on KPIPhase III :Preliminary review F. Establish KPI to monitor inventory levels at Sub DCPhase I:Draft KPIPhase II :Discuss and agree on KPIPhase III :Preliminary review

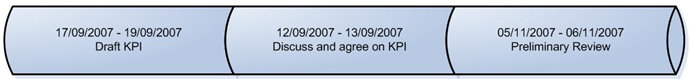

F. Establish KPI to monitor inventory levels at Sub DCPhase I:Draft KPIPhase II :Discuss and agree on KPIPhase III :Preliminary review G. Establish KPI to monitor inventory levels at Main DCPhase I:Draft KPIPhase II :Discuss and agree on KPIPhase III :Preliminary review

G. Establish KPI to monitor inventory levels at Main DCPhase I:Draft KPIPhase II :Discuss and agree on KPIPhase III :Preliminary review H. Replacement of refurbished goodsPhase I:Sell remaining refurbished boxesPhase II :Order replacement boxes

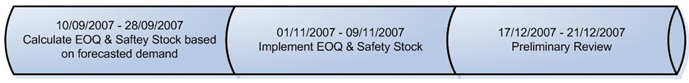

H. Replacement of refurbished goodsPhase I:Sell remaining refurbished boxesPhase II :Order replacement boxes  I. Establish economic order quantityPhase I:Calculate EOQ & Saftey Stock based on forecasted demandPhase II :Implement EOQ & Safety StockPhase III :Preliminary Review

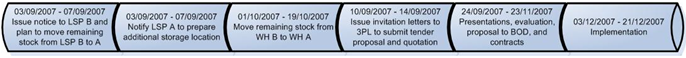

I. Establish economic order quantityPhase I:Calculate EOQ & Saftey Stock based on forecasted demandPhase II :Implement EOQ & Safety StockPhase III :Preliminary Review J. Switch logistics service providerPhase I:Issue notice to LSP B and plan to move remaining stock from WH B to WH APhase II :Notify LSP A to prepare additional storage locationPhase III :Move remaining stock from WH B to WH APhase IV :Issue invitation letters to 3PL to submit tender proposal and quotation Phase V :Presentations, negotiations, evaluation, proposal to BOD, and contractsPhase VI :Implementation

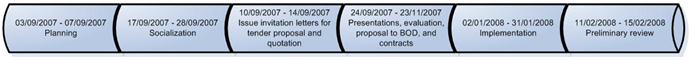

J. Switch logistics service providerPhase I:Issue notice to LSP B and plan to move remaining stock from WH B to WH APhase II :Notify LSP A to prepare additional storage locationPhase III :Move remaining stock from WH B to WH APhase IV :Issue invitation letters to 3PL to submit tender proposal and quotation Phase V :Presentations, negotiations, evaluation, proposal to BOD, and contractsPhase VI :Implementation K. Establish decentralized distribution systemPhase I:PlanningPhase II :Internal socializationPhase III :Issue invitation letters to 3PL to submit tender proposal and quotationPhase IV :Presentations, negotiations, evaluation, proposal to BOD, and contractsPhase V :Implementation Phase VI :Preliminary review

K. Establish decentralized distribution systemPhase I:PlanningPhase II :Internal socializationPhase III :Issue invitation letters to 3PL to submit tender proposal and quotationPhase IV :Presentations, negotiations, evaluation, proposal to BOD, and contractsPhase V :Implementation Phase VI :Preliminary review

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML