-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Game Theory

p-ISSN: 2325-0046 e-ISSN: 2325-0054

2025; 14(1): 1-8

doi:10.5923/j.jgt.20251401.01

Received: Feb. 6, 2025; Accepted: Mar. 5, 2025; Published: Mar. 28, 2025

Evaluation of the Monopoly as a Stable Second Best

Olivier Lefebvre

Olivier Lefebvre Consultant, France

Correspondence to: Olivier Lefebvre, Olivier Lefebvre Consultant, France.

| Email: |  |

Copyright © 2025 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

When one considers competitive equilibrium with differentiated products (Bertrand competition) it occurs that the Nash equilibrium is unstable. One product should be withdrawn from the market: the asset concerned is bought then closed down, and it is profitable. Therefore, this question is posed to the regulator: what is the second best, the Nash equilibrium with only two products or the monopoly selling three products? In the article, one states that there are three cases: - The monopoly is the second best. One demonstrates that this involves that if the monopoly sells a new product, it creates more consumers ‘surplus. Indeed, a monopoly selling a new product, can create, or not, more consumers’ surplus. To give examples of both, is easy. - The second best is the Nash equilibrium (with two products) but the monopoly selling a new product creates more consumers’ surplus. - The second best is the Nash equilibrium (with two products) and the monopoly selling a new product does not create more consumers’ surplus. The strength of the monopoly is the stability: it keeps the diversity of the products sold. But it chooses high prices. In the first case, the monopoly is the second best because there is a real diversity of the products sold. In the third case, there is a pseudo-diversity of the products sold. The second case is intermediate. The monopoly selling a new product creating more consumers’ surplus, is a criterium for the diversity of the products sold.

Keywords: Bertrand competition, Regulation, Consumers' surplus

Cite this paper: Olivier Lefebvre, Evaluation of the Monopoly as a Stable Second Best, Journal of Game Theory, Vol. 14 No. 1, 2025, pp. 1-8. doi: 10.5923/j.jgt.20251401.01.

Article Outline

1. Introduction

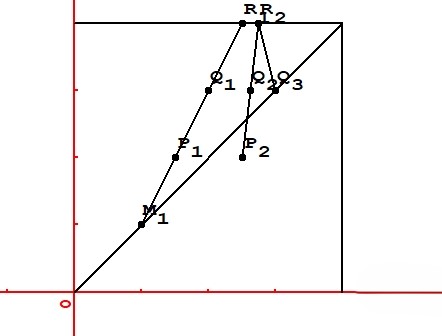

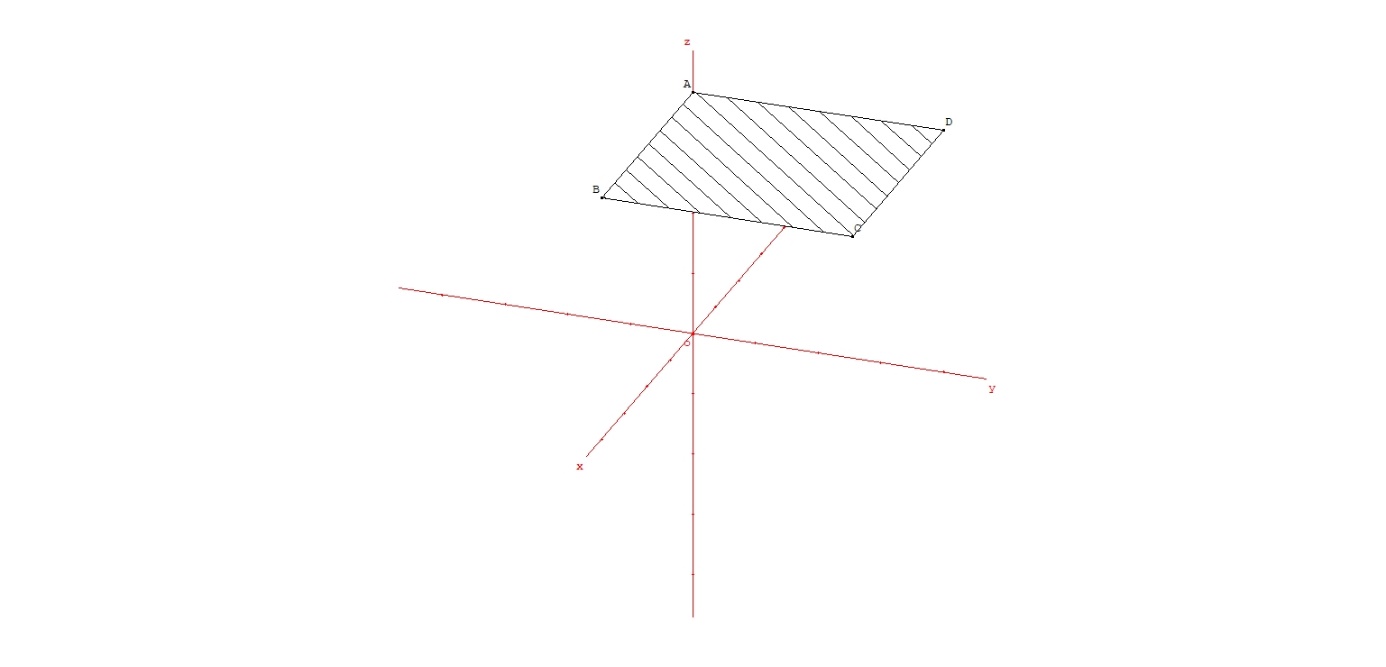

- When one considers competitive equilibrium between differentiated products (Bertrand competition), it occurs that the Nash equilibrium is unstable. That is to say: a spontaneous process is possible, such that one product is withdrawn from the market. The concerned asset is bought then closed down, and the two operations are profitable [1]. A question is posed to the regulator, supposed to be unable to prohibit this process, which is detrimental to the consumers (the prices increase) [1]. This question is: what is the second best he should choose, the monopoly selling three products, or the Nash equilibrium after the withdrawal of a product (only two products are sold). The article deals with this question.One demonstrates in the article that there are three situations:- The second best is the monopoly selling three products. Also, and it is a necessary condition, when the monopoly sells a new product, if generates more consumers’ surplus.- The second best is the Nash equilibrium (two products being sold), but the monopoly selling a new product creates more consumers’ surplus.- The second best is the Nash equilibrium (with two products sold) and the monopoly selling a new product does not create more consumers’ surplus.A multiproduct monopoly has a strength and a weakness. The strength: it keeps the diversity of the products sold. It never cancels the sale of a product, its benefit would decrease. The weakness: it chooses high prices. So, the existence of two cases is explained. Either there is a real diversity of the products sold, and there is more consumers’ surplus created when the third product is sold (by the monopoly). Either it is a pseudo-diversity of the products sold, and the Nash equilibrium (only two products being sold) creates more consumers’ surplus than the monopoly (selling three products), because of the low prices. The second case is an intermediate one. It is easy to provide examples of both.It is also the opportunity to present the method used, Bertrand competition the demands being deduced from the consumers’ utilities. Here, in a frame Ou1u2u3 (0 ≤ ui ≤ 1) the density of utility is linear, homogeneous, equal to 1 / √2, on the bisectors of the faces of the cube ui = 0 (figure 1). If it is the Nash equilibrium, the Bertrand paradox applies, and (with obvious notation): p1 = p2 = p3 = 0, P1 = P2 = P3 = 0. So, the player E1 can buy and close E3, then E2, paying ε / 2 to each. Now the density is on O u1, equal to 2/3, with a weight 1/3 at O. E1 chooses p1 = ½, its profit is 1/6 – ε, the consumers surplus is 1/12. If the regulator chooses the monopoly, the prices are p1 = p2 = p3 = ½, and the consumers’ surplus is 1/8. Therefore, the monopoly is the second best. But, of course, the first best if the Nash equilibrium with three products sold, since the consumers’ surplus is ½. But it is unstable.

| Figure 1. The density of utility is linear homogeneous and on the bisectors of the faces ui = 0 |

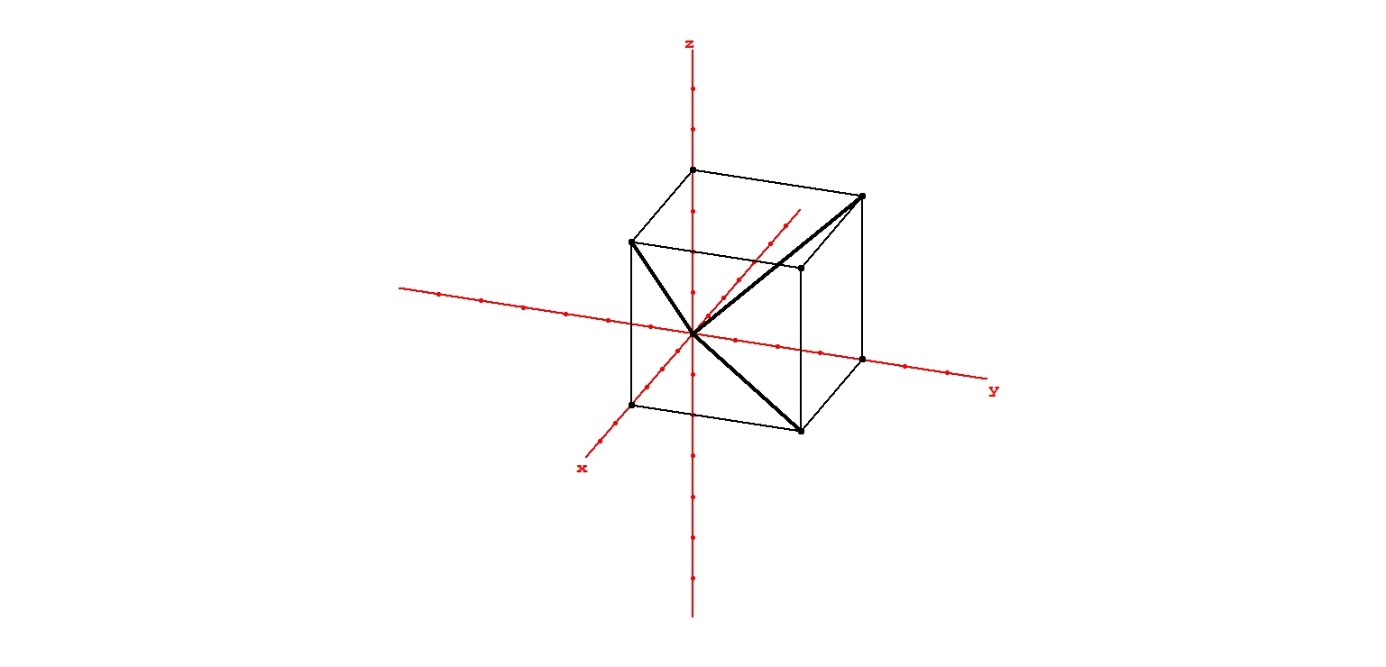

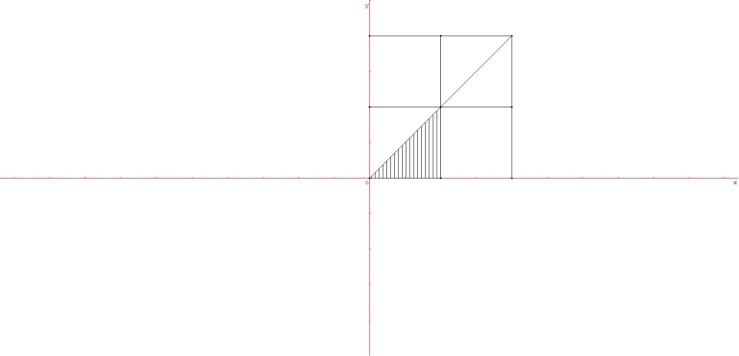

| Figure 2. The density of utility is linear homogeneous on (0, 0, 1), (0, 1, 1) and (0, 0, 1), (1, 0, 1). |

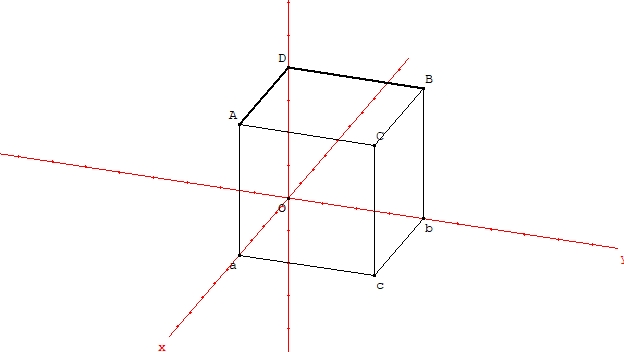

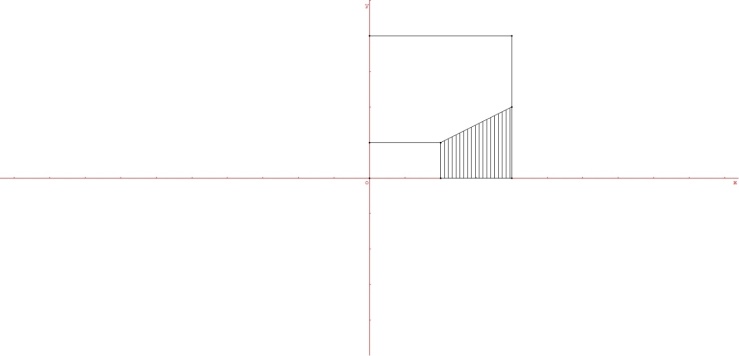

| Figure 3. The density of utility is linear, homogeneous on the axes O ui between 0 and 1 |

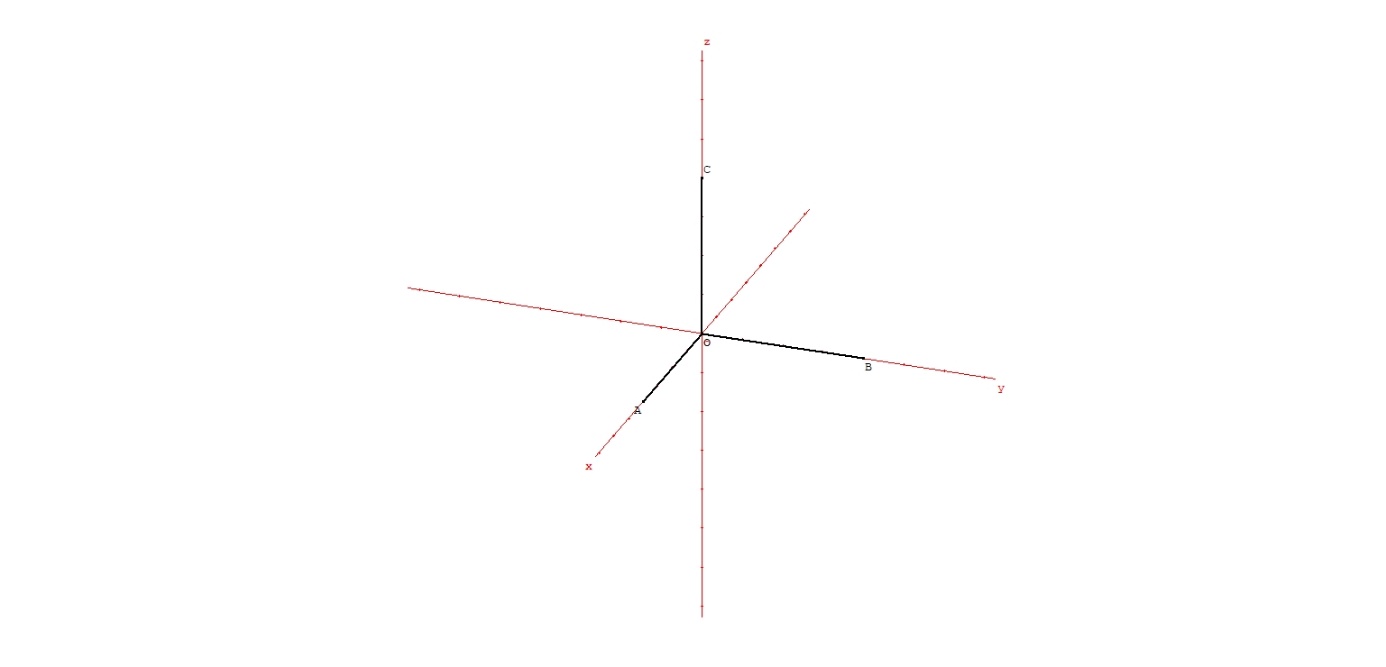

| Figure 4. The density is areal, homogeneous, equal to 1, in the plane u3 = 1 |

2. The Framework

- In the frame O u1 u2 u3 (0 ≤ ui ≤ 1) there is a density of utility, the points (u1, u2, u3) representing consumers with these gross utilities. For (p10, p20, p30), D1 (p10, p20, p30), the demand for the product 1, is the quantity in the “pocket”:u1 – p10 ≥ u2 – p20u1 – p10 ≥ u3 – p30u1 – p10 ≥ 0.It corresponds to the consumers buying the product 1 because their net utility is maximized when they buy the product 1. It is obvious that Di is decreasing in pi, increasing in pj and pk. Also, if CS (p10, p20, p30) is the consumers’ surplus, it is straightforward that d CS = -D1 dp1 -D2 dp2 – D3dp3, so (D1, D2, D3) derives from a potential (-CS) and ∂Di / ∂pj = ∂Dj / ∂pi. It is called Slutsky’s relation [3]. There are other interesting mathematical relations, such as ∂D1 / ∂p1 + ∂D2 / ∂p2 + ∂D3 / ∂p3 ≤ 0. Some will be used further in the article. The functions Di are supposed to be analytical, two times continuously derivable. Concerning Bertrand competition, for p3 fixed, one supposes a best response function R1 (p1, p2) and R2 (p1, p2): if the best response p10 is obtained a single time (for p20), R1 is monotonic, and increasing because it is observed that the price increases from Nash equilibrium to monopoly (corresponding to p2 = 1, that is to say D2= 0). So, the prices are strategic complements. One supposes a unique Nash equilibrium, therefore it is stable (in the sense that groping led the players to the equilibrium).If the density is volumic, Di = 0 if pi = 1, for any pj, pk. One supposes also a symmetry of the utilities about the planes ui = uj.Now, one refers to figure 5.

CS from R1 to Q3 is positive, Δ CS from R2 to Q3 is more, therefore it is positive. It is a necessary condition.- If the Nash equilibrium is the second best (in R1), Δ CS between R1 and Q3 is negative. Possibly, if the monopoly selling two products sells a new product, the consumers’ surplus increases (Δ CS is positive between R2 and Q3). It is the intermediate case. The tractable example below is thus. Possibly, when the monopoly selling two products sells a new product, it makes the consumers’ surplus decrease.Therefore, the strength and the weakness of the monopoly appear. It keeps the diversity of the products sold, and it is favorable to the consumers. But choosing high prices is unfavorable to them. In case of a real diversity of the products, it creates more consumers’ surplus when it sells the product 3 and should be the second best. In case of pseudo-diversity of the products sold, when it sells the product 3, it makes the consumers’ surplus decrease. It is sure that the second best is the Nash equilibrium.And there is the intermediate case: the products are differentiated, but not enough. The monopoly selling the product 3 makes the consumers surplus increase, but there are high prices, so the second best is the Nash equilibrium (with two products sold).

CS from R1 to Q3 is positive, Δ CS from R2 to Q3 is more, therefore it is positive. It is a necessary condition.- If the Nash equilibrium is the second best (in R1), Δ CS between R1 and Q3 is negative. Possibly, if the monopoly selling two products sells a new product, the consumers’ surplus increases (Δ CS is positive between R2 and Q3). It is the intermediate case. The tractable example below is thus. Possibly, when the monopoly selling two products sells a new product, it makes the consumers’ surplus decrease.Therefore, the strength and the weakness of the monopoly appear. It keeps the diversity of the products sold, and it is favorable to the consumers. But choosing high prices is unfavorable to them. In case of a real diversity of the products, it creates more consumers’ surplus when it sells the product 3 and should be the second best. In case of pseudo-diversity of the products sold, when it sells the product 3, it makes the consumers’ surplus decrease. It is sure that the second best is the Nash equilibrium.And there is the intermediate case: the products are differentiated, but not enough. The monopoly selling the product 3 makes the consumers surplus increase, but there are high prices, so the second best is the Nash equilibrium (with two products sold).3. Results and Demonstrations

- Several demonstrations are needed.Proof that the curve C2 is on the right of C1.The point of C2 (choice of the monopoly selling the products 1 and 2, p3 fixed) is such that ∂ P1 + P2 / ∂ p1 = ∂ P1 + P2 / ∂ p2 = O. Since ∂ P1 / ∂ p2 ≥ 0, ∂ P1 / ∂ p1 ≤ 0, the point is on the right of the point where ∂ P1 / ∂ p1 = 0 (on C1).Proof that C3 is on the right of C2.A point of C3 is such that ∂ P1 + P2 + P3 / ∂ p1 = ∂ P1 + P2 + P3 / ∂ p2 = 0 (p3 fixed) so ∂ P1 + P2 / ∂ p1 ≤ 0, since ∂ P3 / ∂ p1 ≥ 0. The point is on the right of the point where ∂ P1 + P2 / ∂ p1 = 0 (on C2). Lemma.When p3 increases the unique point on the bisector, where ∂P3 / ∂ p3 = 0, moves to the right.Oner writes: ∂ P3 (p, p, p3) = 0. One differentiates: 2 ∂2 P3 /∂ p3 ∂ p1 dp + ∂2 P3 / ∂ p32 dp3 = 0. The second term is negative (concavity of P3 (p1, p2, p3) for p1 = p2 = p, p3 varying, and dp3 ≥ 0). Therefore, dp ≥ 0 if ∂2 P3 /∂ p3 ∂ p1 ≥ 0. For p2 = p fixed, consider the plane O p1 p3. The point where ∂ P3 / ∂ p3 = 0 is on the reaction function R3, with a positive slope. Therefore ∂2P3 /∂ p3 ∂ p1 ≥ O (one differentiates the equation of R3 ∂ P3 / ∂ p3 = 0 in the plane O p1 p3). A point such that ∂ P3 / ∂ p3 = 0 on the bisector (p3 fixed), exists, because for any p1 = p2 fixed, when p3 increases P3 varies from 0 (p3 = 0) to 0 (p3 = 1). And this point is unique. The intersection of the surface ∂ P3 / ∂ p3 = 0 and the plane u1 = u2 is an increasing curve. When p3 starts increasing from 0, the point ∂ P3 / ∂ p3 = 0 meets C1, first, in M1, the Nash equilibrium with three products: ∂ P1 / ∂ p1 = ∂ P2 / ∂ p2 = ∂ P3 / ∂ p3 = 0. Then, p3 increasing, it meets C2 in P2, representing the equilibrium of E selling the products 1 and 2, and E3 selling the product 3: ∂ P1 + P2 / ∂ p1 = ∂ P1 + P2 / ∂ p2 = 0 and ∂ P3 / ∂ p3 = 0. Then, p3 increasing, the point is on the right of Q3, the choice of the monopoly selling three products, on the bisector p1 = p2 = p3. Indeed, in Q3, ∂ P1 + P2 + P3 / ∂ p3 = 0, therefore ∂ P3 / ∂ p3 ≤ 0 since ∂ P1 + P2 / ∂ p3 ≥ 0. Proof that the slope of C1 is positive.One differentiates ∂ P1 / ∂ p1 = 0 in p1 and p3: ∂2 P1 / ∂ p12 dp1 + ∂2 P1 / ∂ p1 ∂p3 dp3 = 0. For dp3 ≥ 0, dp1 ≥ 0 because: ∂2 P1 / ∂ p12 ≤ 0 (concavity of P1 (p1, p3) in p1 for p2 fixed), and ∂2 P1 / ∂ p1 ∂p3 ≥ 0 (this is demonstrated considering the plane p2 fixed, the axes O p1 p3, the point is on the reaction function R1which has a positive slope).The curve of the reaction function R1 is moving to the right, the curve R2 is moving upward, the equilibrium point is moving on the right on the bisector p1 = p2. The slope of C1 is infinite at the point R1. Indeed, ∂2 P1 / ∂ p1 ∂p3 is equal to 0 at this point. ∂2 P1 / ∂ p1 ∂p3 = ∂ D1 / ∂ p3 + p1 ∂2 D1 / ∂ p1 ∂ p3. Also, ∂ D1 / ∂ p3 = ∂ D3 / ∂ p1. As D3 (p1, p2, 1) = 0 for any p1 and p2, ∂ D3 / ∂ p1 = 0, ∂ D1 / ∂ p3 = 0 and ∂2 D1 / ∂ p1 ∂ p3 = ∂2 D3 / ∂ p12 = 0.Proof that the slope of C2 is positive. Indeed, the sign of the slope of C2 is not known. It depends on the sign of ∂2 P1 + P2 / ∂ p1 ∂ p3 (p, p, p3). The sign of the slope is the same. One is sure that the slope is positive in R2. It has been already demonstrated that ∂2 P1 / ∂ p1 ∂ p3 = 0 if p3 = 1. And ∂2 P2 / ∂ p1 ∂ p3 = p2 ∂2 D2 / ∂p1 ∂p3 is positive. In general, ∂2 Di / ∂pj ∂pk is positive. It is easily demonstrated. It is a consequence of the definition of the demands (the “pockets”). If one supposes the curve C2 monotonic, it is increasing. It is to add a hypothesis. In any way the sign of the slope of C2 does not matter very much, given the purpose of the article (what matters is the sign of the slope of C3). The sign of the slope of C2 at P2 is uncertain. What is demonstrated in the article of the author [1] is this: when the close down is profitable, with obvious notation, pindependent increases as far as a common value with pkept while pclosed increases as far as 1. If the common value is reached with pkept increasing, R1 is on the right of P2. It is obvious if P2 is above the bisector (p3 ≥ p1). But P2 is below the bisector (as it is represented on the figure 5). At P2, ∂ P3 / ∂ p3 = 0 and ∂ P1 / ∂ p1 ≤ 0. In a plane p2 fixed, in the axes O p1 p3, P2 is on the reaction function R3, with ∂ P1 / ∂ p1 ≤ 0, it is on the strand NE of R3 and p1 ≥ p3. One does not know if R1 is on the left or on the right of P2. If it is on the right, the curve C2 (supposed monotonic) is increasing, because R2 is on the right of R1. And the close down makes the consumers’ surplus decrease (the points P2 and R1 do not describe the close down, but the consumers’ surplus at P2 and R1 are the consumers’ surpluses before and after the close down). The point R1 could be on the left of P2.If the point R1 is on the left of P2, given that the slope of C2 is positive at R2, the curve C2 (supposed monotonic) is increasing.Proof that the slope of C3 is negative.The demonstration is awkward and is put in Appendix 1.

4. A Tractable, Particular Case

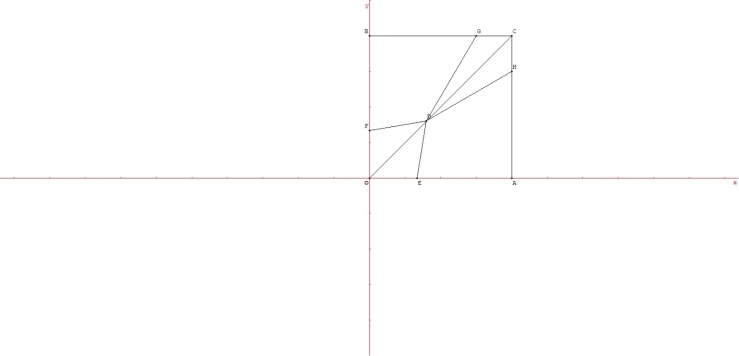

- In this example, the density of utility is homogeneous, equal to 1. The formulas giving the demands depend on the values of p1, p2, p3. There are regions in a plane p3 fixed (see figure 6). For instance, a region is: p2 ≤ p1 ≤ p3.

| Figure 6. The six regions in the plane O p1 p2 with 0 ≤ pi≤ 1 when p3 = 1 / 2. The hatched region corresponds to p2 ≤ p1 ≤ p3 |

| Figure 7. The density is areal and equal to 1. The demand D1 is shown for p1 = 1 /2 and p2 = 1 / 4 |

5. Conclusions

- Interaction is not a catchword. It is a complex phenomenon, which deserves an accurate modelling. In this article the chosen model is Bertrand competition, the demands being deduced from the consumers’ utilities. One has made several hypotheses: (1) the reaction functions exist and are increasing (2) symmetry of the consumers’ utilities about the three planes ui = uj (3) unicity of the equilibria. In these conditions, it is difficult to state that one affords an accurate twin of the reality. Rather, an “experience of thought” is proposed. That game theory allows “experiences of thought” is set out by Ariel Rubinstein, a specialist of game theory [5]. A game theory model makes ponder: effects are isolated, studied and the model says how they add to give a kind of result. But it is an artefact, useful to allow reasonings.An example is the “experience of thought” proposed in this article. A multiproduct monopoly has a strength and a weakness:- The strength is that it keeps the diversity of the products sold. A monopoly sells a new product as soon as it can, since it makes more profit. And it never closes down an asset (cancelling the sale of a kind of product). It is easily explained. One compares a multiproduct monopoly and a multiproduct firm with a competitor. The multiproduct firm with a competitor can possibly close down an asset, making a profit, because … it has a competitor. When the asset is closed down, the competitor increases its price (it is the strategic effect) and then, the firm which sells only one product, now, makes a gain. And it chooses a new price to optimize its profit. The strategic effect compensates and besides the loss due to the closing down (direct effect). It cannot occur if a multiproduct monopoly is concerned. - The weakness is high prices. The multiproduct monopoly does not fear the stealing of market shares: in case of stealing of a market share, there is a gain compensating the loss, since the product the market share of which increases, is also owned by the multiproduct monopoly. Finally, as one or the other of the two opposite effects is stronger, one has the three situations already described:- The second best is the monopoly (selling three products). The diversity of the products sold matters. Also, if the multiproduct monopoly selling two products sells a new product, the consumers’ surplus increases. In some way, this is a criterium for a real diversity (differentiation of the products sold): when the monopoly sells a new product, selling three products, the consumers’ surplus increases. - There is an intermediate situation. The diversity of the products sold is real (when the monopoly sells a new product, the consumers” surplus increases), but it is not enough. The prices are high. The Nash equilibrium (with two products) creates more consumers’ surplus. - The second best is the Nash equilibrium (with two products). There is not a real diversity of the products sold. When the monopoly sells a new product, it does not create more consumers’ surplus.So, two interesting criteria have appeared: - A criterium for the Nash equilibrium (with three products) stable. It is: the entry of the third product increases the joint profit [1].- A criterium for the diversity (differentiation of the products sold). It is: when the multiproduct monopoly sells a new product, the consumers’ surplus increases.Notice that when the second best is the monopoly (selling three products) the close down triggers a decrease of the consumers ‘surplus. It is easily demonstrated, considering the consumers’ surplus during a chain of operations: P2 → R1 → Q3 → P2. This has a meaning for the regulator. Suppose he is coping with a product possibly withdrawn from the market (because the close down is profitable). If he must keep the diversity of the products sold (because the second best is the monopoly selling three products), there is a sign for him: the close down makes decrease the consumers’ surplus. Of course, empirical studies are needed to check the validity of these criteria. For instance, such a study is the article quoted in the author’s article [1]. It is “Antitrust and innovation: welcoming and protecting disruption” [6]. So, the experience of thought allows reasonings and explanations, and also provides questions. Empirical studies complete the experience of thought, if they deal with the questions which are arisen by the experience of thought. In particular, it would be interesting to empirically study this question: does a multiproduct monopoly selling a new product, creates more consumers’ surplus? We live in a “liquid society” [7]. All our choices are transitory and liquid: the city where we live, the job, the consumers’ s tastes etc. The assets are also liquid. Not only in the financial sense: an asset is liquid when it can be sold immediately, for a sum of money. But in this sense: an asset is deliberately close down, without any reason of bankruptcy. The author has already commented some cases [8]. The management of multiproduct firms can be very complex. In a portfolio of brands, there can be … thousands of brands [9]. Suppose a multiproduct firm closing down an asset. It is because it drives the prices down. The competitors outside the multiproduct firm, will increase their prices. It remains a competitor, inside the multiproduct firm, after the closing down. It benefits from the increase of prices (of the competitors outside the multiproduct firm). And the loss (due to the close down) is compensated and besides, by the gain. There are two possible reasons when an asset can be closed down, and it is profitable: (1) the product generates a small utility, so the seller chooses low prices, to succeed in sales (2) the product is weakly differentiated from another product sold. This triggers a price war.

Appendix 1

- Proof that the slope of the curve C3 is negative.One starts demonstrating that if p3 = 1, ∂2 P1 + P2 + P3 / ∂ p1 ∂ p3 is negative.The quantity ∂2 P1 + P2 + P3 / ∂ p1 ∂p3 can be written (at the point (p, p, 1):∂ D1 / ∂ p3 + ∂ D3 / ∂ p1 + p [∂2 D1 + D2 + D3 / ∂ p1 ∂ p3] + (1 – p) ∂2 D3 / ∂ p1 ∂ p3. ∂ D1 / ∂ p3 = ∂ D3 / ∂ p1 is equal to 0 (D3 = 0 if p3 = 1).The quantity between brackets is negative. It is a consequence of the definition of the demands (the “pockets”). And ∂2 D3 / ∂ p1 ∂ p3 is negative if p3 = 1.If p3 = 1, ∂ D3 / ∂ p1 d p1 = 0 (with d p1 ≥ 0).If p3 is just a little below 1 (d p3 ≤ 0): ∂ D3 / ∂ p1 d p1 > 0.Therefore, ∂2 D3 / ∂ p1 ∂ p3 is negative.Then one demonstrates that in Q3, ∂2 P1 + P2 + P3 / ∂ p1 ∂ p3 ≤ O.In Q3 there is the unique maximum of P1 + P2 + P3. Given the symmetry one has: ∂2 P1 + P2 + P3 / ∂ pi2 = a and ∂2 P1 + P2 + P3 / ∂ pi ∂ pj = b.The Hessian matrix has for coefficients aii = a and aij = b. An obvious eigen value is b – a. Therefore b – a ≤ 0 and a being negative, b ≤ 0.The slope of C3 in Q3 and R2 is negative. One has to make one of these hypotheses:- C3 is monotonic- C3 is on one side, left of right, of the vertical passing by Q3. - Considering the vertical passing by Q3, the value of ∂2 P1 + P2 + P3 / ∂ p1 ∂p3 is negative when p3 = 1 and in Q3. Suppose that this value is negative at any point of the segment. R2 cannot be on the right side of the vertical. C3 should cross the vertical, starting to the left from Q3, then reaching the point R2. And at the point of intersection, the slope should be positive. But this is impossible.Accepting one of these hypotheses, the consequence is that the strand of C3 is on the left side of the vertical. And R2 is on the left of Q3.

Appendix 2

- One wants to prove that the curve R1 (p3 fixed), in the plane O p1 p2, is increasing. One studies the SE strand. At the start, when p3 = 1, it is easy to prove it. The prices are strategic complements (figure 8).

| Figure 8. The reaction functions R1 and R2 when p3 = 1 are shown. The shape is not linear. The strand SE, which is studied, goes from (1/3, 0) to (0,41, 0,41) |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML