-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Game Theory

p-ISSN: 2325-0046 e-ISSN: 2325-0054

2017; 6(2): 38-42

doi:10.5923/j.jgt.20170602.02

Worst Welfare under Supply Function Competition with Sequential Contracting in a Vertical Relationship

Aika Monden

Graduate School of Business Administration, Kobe University, Kobe, Japan

Correspondence to: Aika Monden, Graduate School of Business Administration, Kobe University, Kobe, Japan.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

We compare equilibrium welfares under Cournot, Bertrand, and supply function competitions. Although it is a natural result that equilibrium outcomes under the supply function competition are intermediate between those under Cournot and Bertrand competitions, we show that the supply function competition may yield the smallest social welfare. To obtain this result, we consider a vertical market where an upstream firm sequentially contracts with two downstream firms.

Keywords: Supply function competition, Price discrimination, Sequential contracting

Cite this paper: Aika Monden, Worst Welfare under Supply Function Competition with Sequential Contracting in a Vertical Relationship, Journal of Game Theory, Vol. 6 No. 2, 2017, pp. 38-42. doi: 10.5923/j.jgt.20170602.02.

Article Outline

1. Introduction

- Fierce competition generally brings down price and raises social welfare. Recognizing this, antitrust authorities implement competition policies to intensify market competition. An index that can measure the competition intensity is the type of competition, that is, whether Cournot or Bertrand competition prevails. Previous studies focus on other indicators such as the number of firms and the degree of product differentiation, but regardless of the indicator is employed, tougher competition is desirable for society. Thus, several papers focus on a situation where equilibrium social welfare decreases with the competition intensity (Lahiri and Ono, 1988; Mukherjee and Zhao, 2009; Fanti, 2013). Thus, the literature on industrial organization compares outcomes under Cournot competition with those under Bertrand competition and finds that in many cases, Bertrand competition yields outcomes that are more desirable for society.For example, a classic study that compares Cournot competition with Bertrand competition is by Singh and Vives (1984). They show that the equilibrium price in Bertrand competition is lower than that in Cournot competition. Studies that followed indicate that this relationship is reversed (e.g., Delbono and Lambertin, 2016a; Häckner, 2000; Zanchettin, 2006).Some recent studies consider an intermediate competition type between Cournot and Bertrand competitions. One of them is supply function competition (Grossman, 1981; Klemperer and Meyer, 1989). Some recent studies analyze properties of supply function competitions (e.g., Delgado and Moreno, 2004; Ciarreta and Gutierrez-Hita, 2006; Menezes and Quiggin, 2012; Delbono and Lambertini, 2015, 2016b). Under the supply function competition, it is common wisdom that the supply function equilibrium is intermediate between that under Cournot and Bertrand (Delbono and Lambertini, 2015). However, Delbono and Lambertini (2016b) challenge this well-known result. They consider a market with quadratic cost and show that the supply function competition creates the largest social welfare among the competitions.Following Delbono and Lambertini (2016b), we reconsider a welfare ranking between Cournot, Bertrand, and the supply function competitions. There are some differences between our model and theirs. In particular, we consider a vertically related market where an upstream firm sequentially contracts with two downstream firms. Our formulation of a sequential contract is the same as that of Kim and Sim (2015). In other words, we introduce the supply function competition into the model with the sequential contract presented by Kim and Sim (2015).Because the supply function competition leads to Cournot and Bertrand equilibria as special cases, considering a supply function competition model suffices to examine whether Bertrand is the best outcome and Cournot, the worst. When comparing the two competition structures with other cases in the supply function competition, we show that Cournot and Bertrand competitions do not lead to the worst outcomes. That is, at parameter values where equilibrium outcomes are not the same as those under Cournot and Bertrand competitions, we obtain the minimum social welfare. This result is quite different from that in Delbono and Lambertini (2016b).The paper proceeds as follows. The next section presents the model. Section 3 calculates the equilibrium and provides the main results. Section 4 concludes the paper.

2. The Model

- We consider a market with upstream firm

and two asymmetric downstream firms

and two asymmetric downstream firms  To produce one unit of product, each downstream firm must purchase one unit of input from the upstream firm. We assume that the upstream firm can choose different prices for the downstream firms. We denote the wholesale price for downstream firm

To produce one unit of product, each downstream firm must purchase one unit of input from the upstream firm. We assume that the upstream firm can choose different prices for the downstream firms. We denote the wholesale price for downstream firm  by

by  Let

Let  denote the output of downstream firm

denote the output of downstream firm  We assume that the marginal cost of upstream firm

We assume that the marginal cost of upstream firm  is zero, that of downstream firm

is zero, that of downstream firm  is also zero, and that of downstream firm

is also zero, and that of downstream firm  is

is  Following the literature on supply function competition, we assume that downstream firm

Following the literature on supply function competition, we assume that downstream firm  uses a linear supply function

uses a linear supply function  , where

, where  is the price, intercept

is the price, intercept  is an endogenous variable chosen by each firm, and

is an endogenous variable chosen by each firm, and  is an exogenous parameter.Menezes and Quiggin (2012) and Delbono and Lambertini (2015) show that as

is an exogenous parameter.Menezes and Quiggin (2012) and Delbono and Lambertini (2015) show that as  converges to zero, equilibrium outcomes under the supply function competition converge to those under Cournot competition; however, as

converges to zero, equilibrium outcomes under the supply function competition converge to those under Cournot competition; however, as  diverges to infinity, equilibrium outcomes converge to those under Bertrand competition. Therefore, to compare equilibria under Cournot, Bertrand, and the supply function competitions, it suffices to consider the supply function competition with

diverges to infinity, equilibrium outcomes converge to those under Bertrand competition. Therefore, to compare equilibria under Cournot, Bertrand, and the supply function competitions, it suffices to consider the supply function competition with  Moreover, as an increase in

Moreover, as an increase in  moves equilibrium outcomes closer to those in Bertrand competition, we can interpret

moves equilibrium outcomes closer to those in Bertrand competition, we can interpret  as the index of competition intensity. As downstream firm

as the index of competition intensity. As downstream firm  is relatively inefficient, for large

is relatively inefficient, for large  the equilibrium output of

the equilibrium output of  would take a value of zero. To guarantee a positive outcome, we assume

would take a value of zero. To guarantee a positive outcome, we assume  We assume that the inverse demand function is

We assume that the inverse demand function is  As we assume a linear supply function, substituting

As we assume a linear supply function, substituting  into the inverse demand function and solving it for

into the inverse demand function and solving it for  we have

we have Substituting this equation into

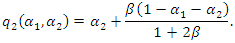

Substituting this equation into  we have the following supply functions:

we have the following supply functions:

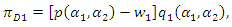

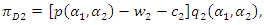

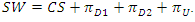

Using the above equations, we define the profits of downstream and upstream firms as follows:

Using the above equations, we define the profits of downstream and upstream firms as follows:

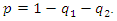

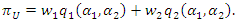

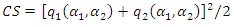

Consumer surplus

Consumer surplus  and social welfare

and social welfare  Following Kim and Sim (2015), we consider the sequential contracts between the upstream and downstream firms. In the first stage, the upstream firm decides wholesale price

Following Kim and Sim (2015), we consider the sequential contracts between the upstream and downstream firms. In the first stage, the upstream firm decides wholesale price  and in the second stage, downstream firm

and in the second stage, downstream firm  chooses

chooses  in its supply function. After these decisions, in the third stage, the upstream firm offers wholesale price

in its supply function. After these decisions, in the third stage, the upstream firm offers wholesale price  and in the fourth stage, downstream firm

and in the fourth stage, downstream firm  determines

determines  in its supply function. We could justify this timing of the game as follows. When the upstream firm already creates a long-term relationship with downstream firm

in its supply function. We could justify this timing of the game as follows. When the upstream firm already creates a long-term relationship with downstream firm  the contract may express a commitment effect. Then, given the contract with downstream firm

the contract may express a commitment effect. Then, given the contract with downstream firm the upstream firm and downstream firm

the upstream firm and downstream firm  must negotiate their contract. Hence, a Stackelberg timing structure is a natural assumption here.We assume complete information. The model is solved by backward induction. Only pure strategies are considered throughout this paper.

must negotiate their contract. Hence, a Stackelberg timing structure is a natural assumption here.We assume complete information. The model is solved by backward induction. Only pure strategies are considered throughout this paper.3. Calculating Equilibrium and Condition Yielding Worst Welfare

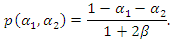

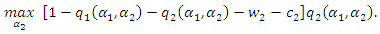

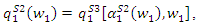

- The profit maximization problem of downstream firm

is

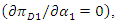

is The first-order condition

The first-order condition  yields

yields where superscript

where superscript  represents that the outcomes are in stage 4. Substituting this outcome into

represents that the outcomes are in stage 4. Substituting this outcome into  and

and  we have

we have  and

and  Substituting the above results into the profit of the upstream firm, the maximization problem is

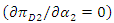

Substituting the above results into the profit of the upstream firm, the maximization problem is The first-order condition

The first-order condition  leads to

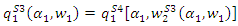

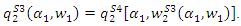

leads to where superscript

where superscript  represents that the outcomes are in stage 3. Substituting this outcome into

represents that the outcomes are in stage 3. Substituting this outcome into  and

and  we have

we have  and

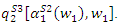

and  Substituting the above results into the profit of downstream firm

Substituting the above results into the profit of downstream firm  the maximization problem is

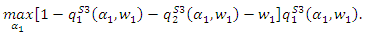

the maximization problem is From the first-order condition

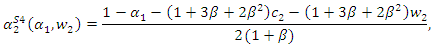

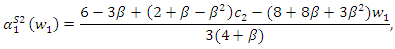

From the first-order condition  we have

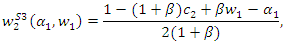

we have where superscript

where superscript  represents that the outcomes are in stage 2. Substituting this outcome into

represents that the outcomes are in stage 2. Substituting this outcome into

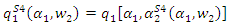

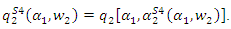

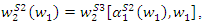

and

and  we have

we have

and

and

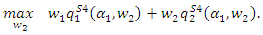

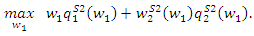

Substituting the above outcomes into the profit of upstream firm, the maximization problem is

Substituting the above outcomes into the profit of upstream firm, the maximization problem is The first-order condition

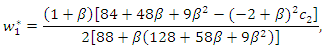

The first-order condition  leads to

leads to where superscript

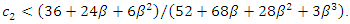

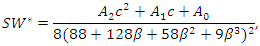

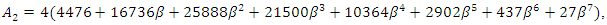

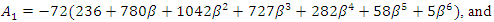

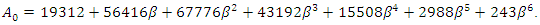

where superscript  represents that the outcomes are in equilibrium. Summarizing the above results, we obtain the following proposition:Proposition 1. The equilibrium social welfare is

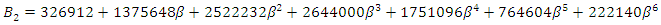

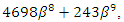

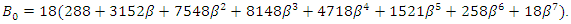

represents that the outcomes are in equilibrium. Summarizing the above results, we obtain the following proposition:Proposition 1. The equilibrium social welfare is Where

Where

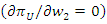

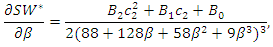

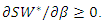

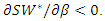

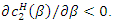

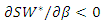

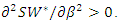

Differentiating

Differentiating  with respect to

with respect to  we have

we have where

where

and

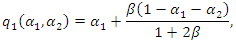

and  After a tedious calculation, we obtain the following proposition:Proposition 2. When we can freely choose a value of

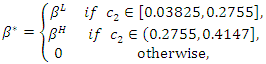

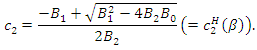

After a tedious calculation, we obtain the following proposition:Proposition 2. When we can freely choose a value of  the equilibrium social welfare is minimized at the following

the equilibrium social welfare is minimized at the following

such that

such that  satisfies

satisfies  and

and  satisfies

satisfies  where

where

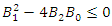

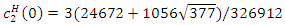

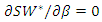

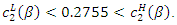

Proof. First, using the discriminant of the numerator for

Proof. First, using the discriminant of the numerator for  we show that the value of

we show that the value of  that minimizes

that minimizes  does not exist in

does not exist in  As the sign of denominator is positive, the sign of first derivative is the same as that of numerator. The numerator is the quadratic function of

As the sign of denominator is positive, the sign of first derivative is the same as that of numerator. The numerator is the quadratic function of  and the coefficient of

and the coefficient of  is positive

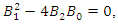

is positive  Then, if the sign of discriminant

Then, if the sign of discriminant  is non-positive, we will have

is non-positive, we will have  Numerically solving

Numerically solving  for

for  we have

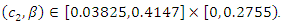

we have  Hence, the value of

Hence, the value of  that minimizes

that minimizes  does not exist in

does not exist in  Next, we consider the case with

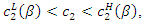

Next, we consider the case with  We will show that the equilibrium social welfare increases with

We will show that the equilibrium social welfare increases with  if

if  or

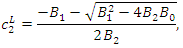

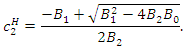

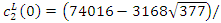

or  As the discriminant takes a positive value, we have two solutions:

As the discriminant takes a positive value, we have two solutions:  and

and  which satisfy

which satisfy  Solving

Solving  for

for  we have

we have

Then, if

Then, if  we have

we have  Here, from numerical calculation, we show that

Here, from numerical calculation, we show that

and

and  This result implies that the maximum value of

This result implies that the maximum value of  such that

such that

at some

at some  is derived from

is derived from  and the minimum value of

and the minimum value of  such that

such that  at some

at some  is obtained from

is obtained from  . That is,

. That is,

and

and

Hence, if

Hence, if  or

or  then the social welfare is minimized at

then the social welfare is minimized at  Finally, we consider the case with

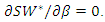

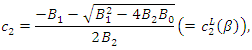

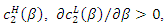

Finally, we consider the case with  From numerical calculation, we have

From numerical calculation, we have  Hence,

Hence,  is a strictly convex function of

is a strictly convex function of  Then, the first-order condition

Then, the first-order condition  characterizes the value

characterizes the value  that minimizes

that minimizes  That is, by solving the first-order condition for

That is, by solving the first-order condition for  we have

we have  and

and  From the discriminant

From the discriminant  we have

we have  Then, given the value of

Then, given the value of  that minimizes equilibrium social welfare is implicitly determined as follows:

that minimizes equilibrium social welfare is implicitly determined as follows: where

where  satisfies

satisfies  and

and  satisfies

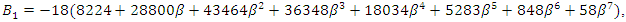

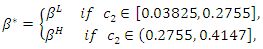

satisfies  Therefore, we obtain the proposition.We can depict the result of Proposition 2 in Figure 1. In this figure, there are three regions. In the right area, as we have

Therefore, we obtain the proposition.We can depict the result of Proposition 2 in Figure 1. In this figure, there are three regions. In the right area, as we have  we omit this parameter range; in the shadow area, we have

we omit this parameter range; in the shadow area, we have  in the bottom area, we have

in the bottom area, we have

Hence, given

Hence, given  the boundary between the shadow and bottom areas determines

the boundary between the shadow and bottom areas determines  that leads to the minimum social welfare.

that leads to the minimum social welfare. | Figure 1. Effect of  |

is in the range

is in the range  , the equilibrium social welfare is minimized neither at

, the equilibrium social welfare is minimized neither at  nor for

nor for  In other words, under the supply function competition except where

In other words, under the supply function competition except where  and

and  the equilibrium social welfare is smaller than those under Cournot and Bertrand competitions. Now, we explain an intuition behind Proposition 2. Since we consider the case of a sequential contract, follower

the equilibrium social welfare is smaller than those under Cournot and Bertrand competitions. Now, we explain an intuition behind Proposition 2. Since we consider the case of a sequential contract, follower  faces a residual demand after leader

faces a residual demand after leader  decides its output. Thus, the follower behaves less aggressively than in the case with a simultaneous contract. Then, to encourage the follower’s production, the upstream firm reduces the wholesale price for follower

decides its output. Thus, the follower behaves less aggressively than in the case with a simultaneous contract. Then, to encourage the follower’s production, the upstream firm reduces the wholesale price for follower  As leader

As leader  knows this action, it reduces its own output. If a decrease in

knows this action, it reduces its own output. If a decrease in  output dominates an increase in

output dominates an increase in  output, the total output reduces. Since in this case, an increase in

output, the total output reduces. Since in this case, an increase in  reduces social welfare and in the other case, the rise of

reduces social welfare and in the other case, the rise of  decreases the social welfare, there exists a positive

decreases the social welfare, there exists a positive  such that social welfare is minimized.

such that social welfare is minimized.4. Conclusions

- We consider the supply function competition structure in a vertical market with a sequential contract. We show that if the technological difference between downstream firms is moderate, an intermediate competition intensity yields the minimum social welfare. This result indicates that a competition policy that enhances competition, measured by the type of competition, is not desirable for society.

ACKNOWLEDGEMENTS

- I would like to express my cordial gratitude to Tomomichi Mizuno for his sincere encouragement, constructive and helpful comments, and in-depth discussion during the various stages of preparation. Needless to say, all remaining errors are mine.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML