-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Game Theory

p-ISSN: 2325-0046 e-ISSN: 2325-0054

2017; 6(1): 1-6

doi:10.5923/j.jgt.20170601.01

Extensions of Bertrand's Differentiated Products Model

Yigal Gerchak

Department of Industrial Engineering, Tel-Aviv University, Israel

Correspondence to: Yigal Gerchak, Department of Industrial Engineering, Tel-Aviv University, Israel.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

We consider two extensions of Bertrand's celebrated duopoly and tri-opoly models of differentiated products. One extension consists of generalizing linear production costs to convex ones. For quadratic costs, we obtain the symmetric equilibrium explicitly. The other is a two-period model where the demand in the second period depends on the price in the first period (reference price) as well. We obtain an explicit solution to the second period problem and characterize the optimal first period price.

Keywords: Bertrand, Non-Linear Costs, Reference Prices

Cite this paper: Yigal Gerchak, Extensions of Bertrand's Differentiated Products Model, Journal of Game Theory, Vol. 6 No. 1, 2017, pp. 1-6. doi: 10.5923/j.jgt.20170601.01.

Article Outline

1. Introduction

- Bertrand's model is one of the classical models of differentiated duopoly and is a forerunner of the Nash equilibrium. In this model demand for each firm increases in the competitor's price while decreasing in its own price [1-3]. In this classical model production costs are usually assumed to be linear. As such is often not the case, (e.g. [4, 5]), we explore duopoly and tri-opoly [6] scenarios with increasing marginal production costs. We also consider a two-period model where a firm's demand in the second period depends on its and its competitors’ price in the first period ("reference price"), as well on the second period prices [7, 8]. While such consumer behavior may not be entirely rational, there is ample empirical evidence in the marketing and psychology literature for its prevalence.For completeness, we first sketch the well-known Bertrand's linear duopoly model of differentiated products [2, 9] and then do so for a tri-opoly (cf. [6, 10]) and we include comparative statics. We show conditions under which a tri-opolist would charge a higher price than a duopolist. We then generalize them to non-linear production costs, where we focus on the case of quadratic costs for which we obtain an explicit solution. Finally, we consider a two-period duopoly with reference prices.

2. The Basic Model

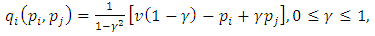

- The basic Bertrand duopoly model of differentiated products is

where

where  and where

and where  and

and  are, respectively, the prices set by duopolists i and j, and

are, respectively, the prices set by duopolists i and j, and  the resulting demand of duopolist i (e.g. [2, 9]).

the resulting demand of duopolist i (e.g. [2, 9]). is the cross effect of

is the cross effect of  on

on  .

. is the quantity demanded when prices are zero. Thus this quantity is between

is the quantity demanded when prices are zero. Thus this quantity is between  and

and  .

.  are assumed to be identical for both duopolists, so the model is symmetric. Now,

are assumed to be identical for both duopolists, so the model is symmetric. Now,  is positive if

is positive if  and

and  or if

or if  and

and  . Note that

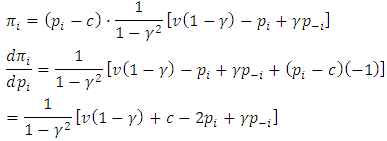

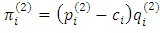

. Note that  profit is

profit is where

where  is the unit production cost, and

is the unit production cost, and

.

.

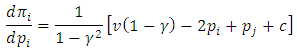

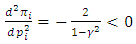

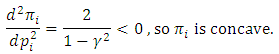

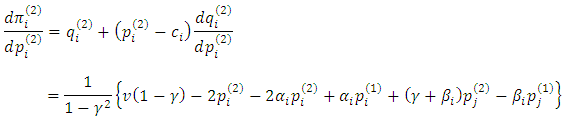

, so

, so  is concave in

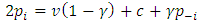

is concave in  .Here the Nash-equilibrium is the solution of

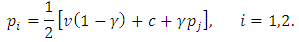

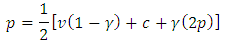

.Here the Nash-equilibrium is the solution of The symmetric solution

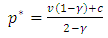

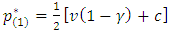

The symmetric solution  is thus

is thus  , which increases in

, which increases in  and

and  and decreases in

and decreases in  . (Note that since for a monopolist with this parametrization

. (Note that since for a monopolist with this parametrization  , therefore

, therefore

, which increases in

, which increases in  , decreases in

, decreases in  and increases in

and increases in  if

if

, which increases in

, which increases in  and decreases in

and decreases in  and

and  ; all are intuitive.For example, if

; all are intuitive.For example, if  and

and

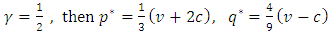

3. Three Firms

- Here the assumption is that

so the effect of other products’ prices on the demand of a product is symmetric (cf. [6]). So

so the effect of other products’ prices on the demand of a product is symmetric (cf. [6]). So Denoting

Denoting  by

by  , we have

, we have

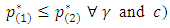

The optimality condition implies that

The optimality condition implies that So the symmetric solution is

So the symmetric solution is and thus

and thus which increases in

which increases in  ,

,  .

. which increases in

which increases in  and decreases in

and decreases in

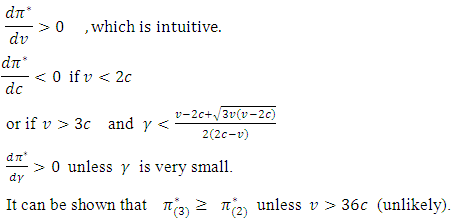

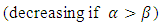

Here are some relevant comparative statics.

Here are some relevant comparative statics.

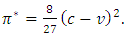

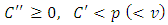

4. Non-Linear Costs Duopoly

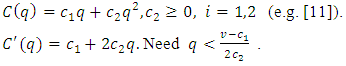

- Here

are the possibly, non-linear costs of duopolist

are the possibly, non-linear costs of duopolist  producing

producing  units, with

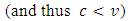

units, with  and

and  thus

thus

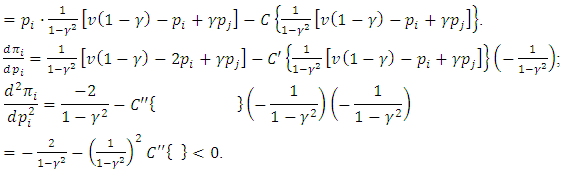

To obtain an explicit solution we need a specific (family of) function(s) C.Example

To obtain an explicit solution we need a specific (family of) function(s) C.Example

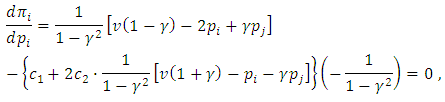

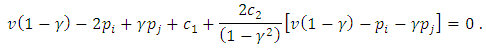

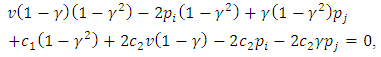

so

so Thus

Thus so

so i.e.,

i.e., For the symmetric solution

For the symmetric solution

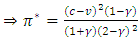

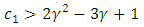

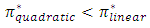

so we have:Proposition 1 For quadratic costs

so we have:Proposition 1 For quadratic costs , which increases in

, which increases in  and

and  .

.  if

if  or

or  .Under this condition

.Under this condition

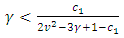

, which increases in

, which increases in  and decreases in

and decreases in  . It decreases in

. It decreases in  if

if  . Under this condition

. Under this condition

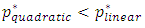

i.e.,

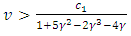

i.e., It is possible to demonstrate that if

It is possible to demonstrate that if  then

then  .

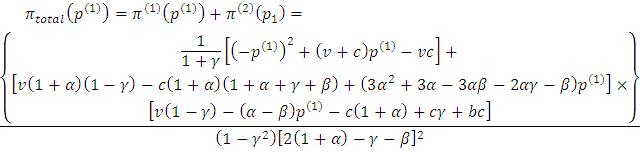

.5. With Reference Price(s)

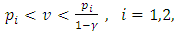

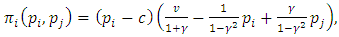

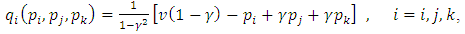

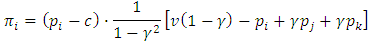

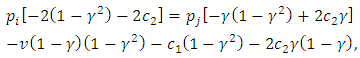

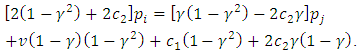

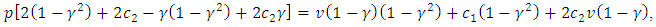

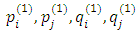

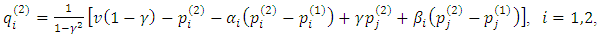

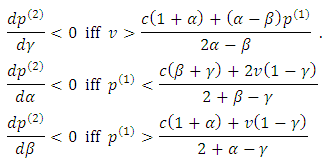

- See Güler et al. [8] and Popescu and Wu [7] for suggestions for incorporating reference prices in supply chain models, motivated by Marketing and Psychological studies (e.g. [12, 13] that found it to be prevalent in (consumer) behavior.Let

be the prices and quantities in period 1, and similarly for period 2.2nd period:The demand model for the second period(*) is

be the prices and quantities in period 1, and similarly for period 2.2nd period:The demand model for the second period(*) is where

where  is the effect of own price change, and

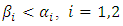

is the effect of own price change, and  , the effect of competitor's price change. We shall assume that

, the effect of competitor's price change. We shall assume that  .Note that if

.Note that if  and

and  the contribution of the first reference-price difference is negative, and of the second positive. If

the contribution of the first reference-price difference is negative, and of the second positive. If  and

and  , the signs of these contributions reverse, but the expressions remain the same.Also,

, the signs of these contributions reverse, but the expressions remain the same.Also,  [noise has no effect]. Thus

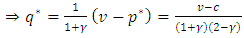

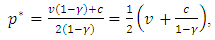

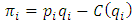

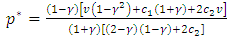

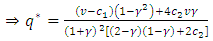

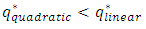

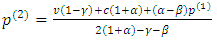

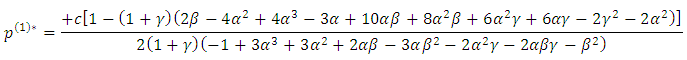

[noise has no effect]. Thus Proposition 2In the symmetric case

Proposition 2In the symmetric case . Note that the denominator is positive since

. Note that the denominator is positive since  and

and  .

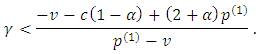

. As for comparative statics,

As for comparative statics,  is linear in

is linear in

. It is increasing in v and c.

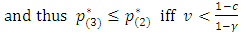

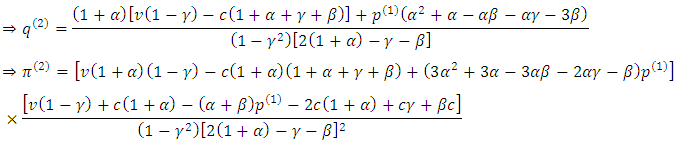

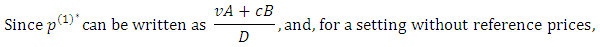

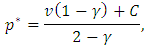

. It is increasing in v and c. Or, in different form, if

Or, in different form, if

increases in

increases in  and decreases in

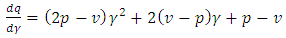

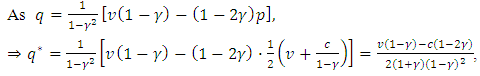

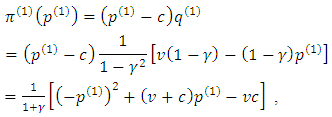

and decreases in  .Now, moving to the first period,

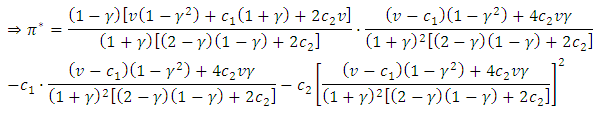

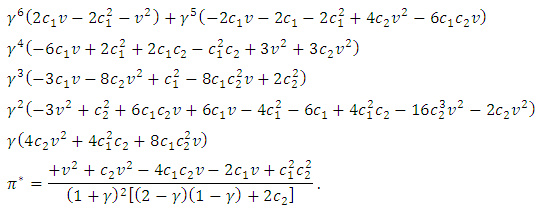

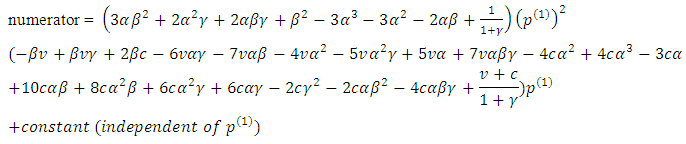

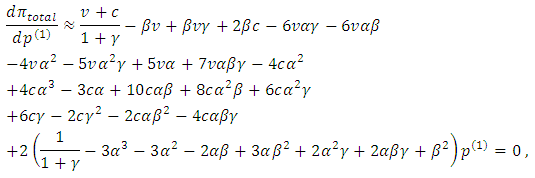

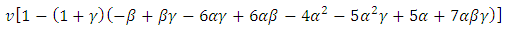

.Now, moving to the first period,  and

and As the denominator is independent of

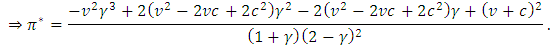

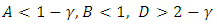

As the denominator is independent of  , and positive, we shall focus on the numerator.It can be shown that

, and positive, we shall focus on the numerator.It can be shown that Thus

Thus where

where  means “has the same sign as”.So

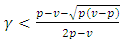

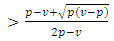

means “has the same sign as”.So

sufficient conditions for

sufficient conditions for  are

are  . These conditions hold with some restrictions on the parameters.

. These conditions hold with some restrictions on the parameters.6. Concluding Remarks

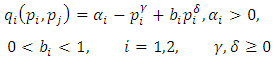

- We generalized the basic Bertrand model of differentiated duopoly in three ways: 1. Extension from two firms to three (tri-opoly). 2. Extension from linear to non-linear (convex) production costs (with two and three firms). 3. Extension to a two-period model where demand in the second depends also on the price in the first (reference price). Note that the term "reference effects" is used in some literature when the price of a product influences one's attitude to the price of another (e.g., [14]) which is a totally different meaning than our temporal "reference effect".The tri-opolists are shown to charge, under certain conditions, higher price than the duopolists (who charges a higher price than a monopolist). For non-linear costs, we used a quadratic function. We provide complete comparative statics.Our reference price model assumes that demand in the second period depends on one's own price difference and competitor's price difference between periods one and two. We find the optimal price and profit in the second period (as a function of the price in the first), then add to it the profit in the first period (which is also a function of the price in that period) and then optimize the sum over that price.One possible extensions is to embed non-linear production costs in the reference price model.One other possible generalization of the Bertrand model and its extensions is to assume a non-linear demand model, like

(e.g. [15] and references therein).Another direction is the extension of the reference price model to more than two periods (for a continuous time model where demand always also depends on the price at time zero, see Fibich et al. [16]).

(e.g. [15] and references therein).Another direction is the extension of the reference price model to more than two periods (for a continuous time model where demand always also depends on the price at time zero, see Fibich et al. [16]).Note

- (*) For the first period, we still have

as in the basic model.

as in the basic model. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML