-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Game Theory

p-ISSN: 2325-0046 e-ISSN: 2325-0054

2014; 3(2): 24-30

doi:10.5923/j.jgt.20140302.02

Signalling and Imperfections – A Risk Taker and Risk Averse Game

Suresh Ramanathan, KianTeng Kwek

Economics Department, Faculty of Economics and Administration, University Malaya, Malaysia

Correspondence to: Suresh Ramanathan, Economics Department, Faculty of Economics and Administration, University Malaya, Malaysia.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

Monetary policy signalling and financial market imperfections are evaluated in the context of a pay-off matrix, with an underlying theme of studying the behaviour of risk taker and risk averse. We conclude, beyond a certain monetary policy signalling threshold level, behavioural pattern of risk takers could be detrimental to financial markets, whereby imperfections could increase while behavioural pattern of being risk averse could reduce imperfections The threshold level of monetary policy signalling acts as the barometer of equilibrium for financial market imperfections, with outcomes of monetary policy signalling closely linked to perfect information and moral hazard incentive for financial markets.

Keywords: Monetary Policy Signalling, Financial Market Imperfections, Pay-off matrix

Cite this paper: Suresh Ramanathan, KianTeng Kwek, Signalling and Imperfections – A Risk Taker and Risk Averse Game, Journal of Game Theory, Vol. 3 No. 2, 2014, pp. 24-30. doi: 10.5923/j.jgt.20140302.02.

Article Outline

1. Introduction

- The link between monetary policy signalling and financial market imperfections relies significantly on the flow of information. Poole et. al [1] indicate that if financial markets and central banks have the same set of information, then financial market interest rates do not provide the central bank with any new information it does not already have1. Disruptions in financial markets during crisis period motivate modifications of monetary policy models used for policy analysis and as such the recent Global Financial Crisis (GFC) of 2008 has spurred researchers to investigate the role of central banks in monetary policy signalling. In financial market-related interest rates, Agénor and Aynaoui [2] show that the demand for excess reserves is determined by precautionary factors and the opportunity cost of holding cash. Excess liquidity in financial markets could impart greater stickiness to the deposit rate in response to a monetary policy contraction and induce an easing of collateral requirements on borrowers, which in turn lowers the financial market risk premium and lending rates. Given the asymmetric pricing behaviour under excess liquidity conditions, it hampers contractionary monetary policy to lower inflation. In evaluating the effects of asymmetry information in financial market related interest rates, Singh [3] finds that significant asymmetry is observed in the transmission of policy interest rate changes between the surplus and deficit financial liquidity conditions, particularly at the short end of financial market-related interest rates. This suggests that maintaining a suitable liquidity environment is critical to yielding improved pass-through effects of monetary policy. There is also considerable asymmetry evident in the transmission of monetary policy to financial markets, depending on the tight or easy cycles of monetary policy. This shows the criticality of attaining a threshold level for policy interest rate under each cycle in order to have the desired pass-through effect. This paper conceptualizes the link between monetary policy signalling and financial market imperfections. The approach is based on a pay-off matrix with two players, two strategies and four outcomes with the objective to indentify the behavioural pattern of risk taker and risk averse given perfect information and imperfect information.

2. Gaming Model

- In configuration of the link between monetary policy signalling and financial market imperfections, it is imperative to identify the behaviour of financial markets in an asymmetric and perfect information environment. Asymmetric information includes bounded rationality2, adverse selection3 and moral hazard4. The alternative to asymmetric information is perfect information5. In the context of bounded rationality, Weber [4] uses a model with time varying preferences, bounded rationality and perpetual learning on behalf of the private sector and different institutional arrangements that show central banks may need to be careful not to confuse the public with extra information. Though information is vital in the decision making process for financial markets, excess information may work against achieving the desired objective of monetary policy signalling. Mishkin [5] indicates that financial crisis is a non-linear disruption to financial markets in which asymmetric information problems such as adverse selection and moral hazard become so much worse that financial markets are unable to efficiently channel funds to economic agents who have the most productive investment opportunities. A financial crisis therefore prevents the efficient functioning of financial markets, which leads to a sharp contraction in economic activity. In the case of a rise in interest rates, it increases excessive risk-taking by financial institutions as shown by Agur et al [6]. In particular, risk of moral hazard occurrence is due to monetary policy being less effective at reducing excessive risk taking. Moral hazard interacts or more precisely interferes with the effectiveness of monetary policy. This is also evident based on findings by Schumacher [7] that show high interest rates worsen the quality of bank loans because of moral hazard that eventually leads to a lower level of economic activity. In evaluating the role of perfect and asymmetrical information between financial markets and the central bank in an economy affected by shocks that are imperfectly known, the communication of the central bank interlinks with the design of optimal monetary policy. Baeriswyl and Cornand [8] find that in extreme cases of transparency and opacity, optimal monetary policy is a function of the firms belief and thereby is a function of the communication strategy of the central bank. The firms’ belief can be shaped by monetary policy whenever the interpretation of monetary policy is ambiguous, therefore monetary policy instruments take on a dual stabilizing role as a policy response that directly influences the economy and as a vehicle for information that partially reveals the central bank’s assessment of the economy to firms. In analysing the link between monetary policy signalling and financial market imperfections, this study uses two approaches. The first approach is a simplified representation while the second approach is a phase diagram representation.

2.1. Simplified Representation

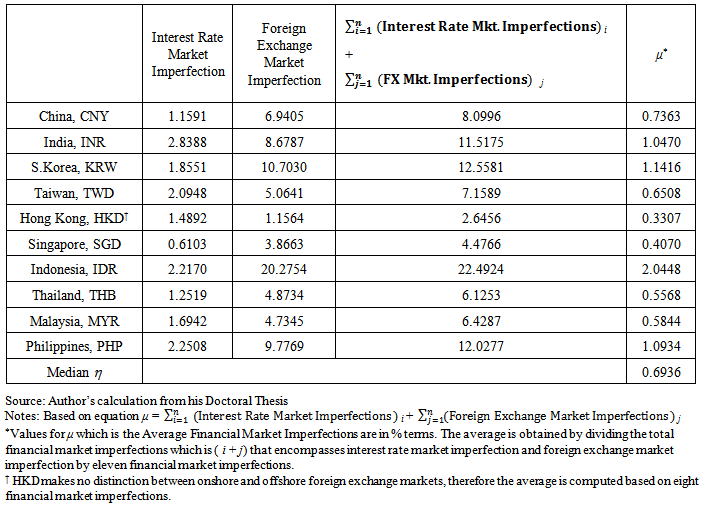

- The link between monetary policy signalling and financial market imperfections is based on a pay-off matrix with two players, two strategies and four outcomes. Pay-off matrix between two players which consists of monetary policy signalling and financial market imperfections, there are two strategies. These two strategies are weak and strong monetary policy signalling against high and low financial market imperfections (see Figure 1). The four outcomes include;(i) Strong monetary policy signalling and low financial market imperfections, as reflected by quadrant a with a pay-off matrix of (1,1). This outcome is within perfect information which is the most desirable.(ii) Weak monetary policy signalling and low financial market imperfections as reflected by quadrant b with a pay-off matrix of (1,0). This outcome is within bounded rationality.(iii) Weak monetary policy signalling and high financial market imperfections as reflected by quadrant c with a pay-off matrix of (0,0). This outcome is within adverse selection and is the least desirable.(iv) Strong monetary policy signalling and high financial market imperfections as reflected by quadrant d with a pay-off matrix of (0,1). This outcome is within moral hazard.

| Figure 1. Simplified Representation of Pay-off Matrix between Financial Market Imperfections and Monetary Policy Signalling |

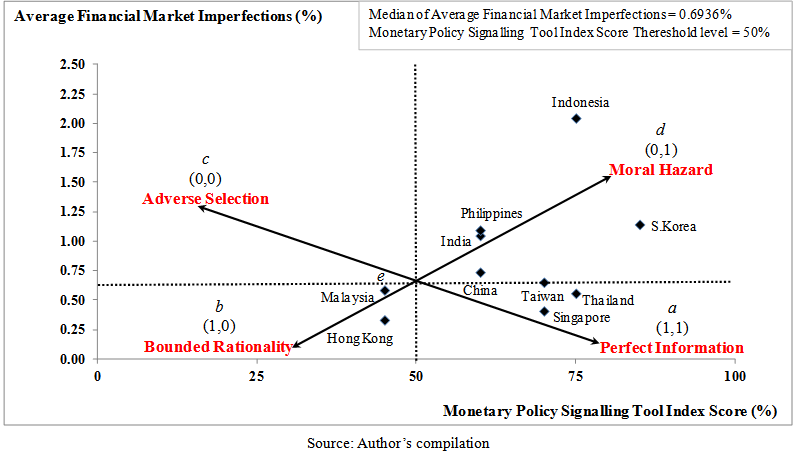

2.2. Phase Diagram Representation

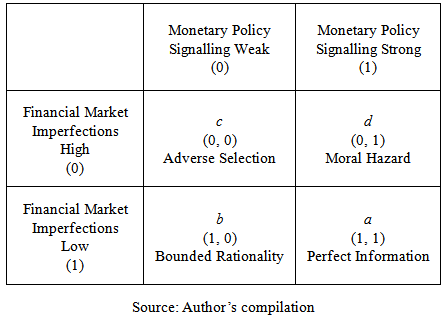

- The pay-off matrix for monetary policy signalling and financial market can be represented in a phase diagram which shows the dynamic structure of the link (see Figure 2).

| Figure 2. Phase Diagram Representation of Pay-off Matrix between Financial Market Imperfections and Monetary Policy Signalling |

2.2.1. Perfect Information

- Given changes in monetary policy signalling tool, the equilibrium point moves to point a with a pay-off matrix of (1,1). The point a is the most desirable, where as monetary policy signalling increases, financial market imperfections reduce accordingly. The desired path of monetary policy signalling by central banks in this context is that financial markets remain less volatile and reaction in financial market are predictable. The perfect information situation in point a, assumes financial markets are rational and behave accordingly given the monetary policy signalling.

2.2.2. Adverse Selection

- A move from the equilibrium point e to point c is the least desired path where the pay-off matrix is (0, 0). At point c, as monetary policy signalling reduces financial market imperfections increase. At point c, volatility in financial markets increase given monetary policy changes is unpredictable by financial markets. Point c also signifies the adverse selection behaviour of financial markets given the reduction in monetary policy signalling. The financial market process in this context results in undesired results to occur.

2.2.3. Bounded Rationality

- In the event the of the equilibrium point e moving towards point b, the pay-off matrix is (1,0), which signifies as monetary policy signalling falls below the threshold level of s, financial market imperfections fall accordingly below the median of the average financial market imperfections level. In this context, financial markets behave in a bounded rationality manner given the limitation of monetary policy signalling tools that are available. Point b also shows that financial markets are increasingly risk averse when monetary policy changes occur, since the cost of increased risk taking will be borne by financial markets in whole or in part. The path taken on decision-making by financial markets is based on a rational manner and bounded by the limitation of monetary policy signalling.

2.2.4. Moral Hazard

- A move from the equilibrium point e to point d with a pay-off matrix of (0,1) shows that as the monetary policy signalling is above the threshold level, financial market imperfections increase beyond the median η of the average financial market imperfections level. The positive relationship between the monetary policy signalling and financial market imperfections suggest that financial markets in this setting behave in a moral hazard manner. Financial markets are increasingly willing to take risks knowing very well that the potential costs for taking such risks will be borne by the central bank in whole or in part. The shift in equilibrium point of e towards b and d within the plane of 0B1 indicates the relationship between the monetary policy signalling and financial market imperfections as positive and does not necessarily need to be in an inverse relationship as reflected by the movement within the plane of AA1. Point b and d indicate scenarios of bounded rationality and moral hazard occurrence in a positive relationship between the monetary policy signalling and financial market imperfections. In an inverse relationship, the occurrence of perfect information and adverse selection is the likely outcome, as reflected by points a and c.

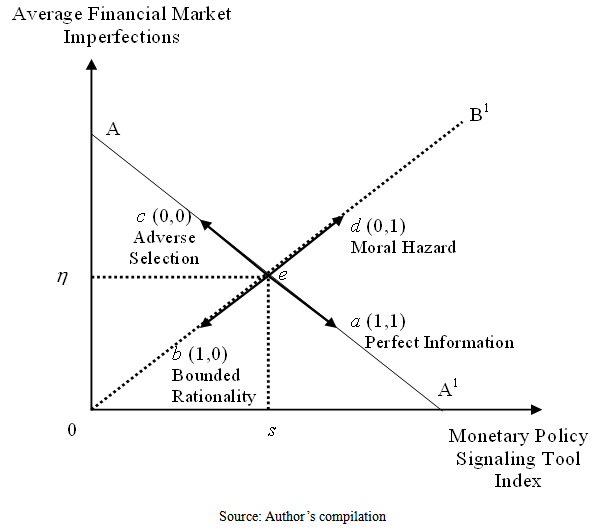

2.3. Financial Market Imperfections, Monetary Policy Signalling and Financial Market Behaviour

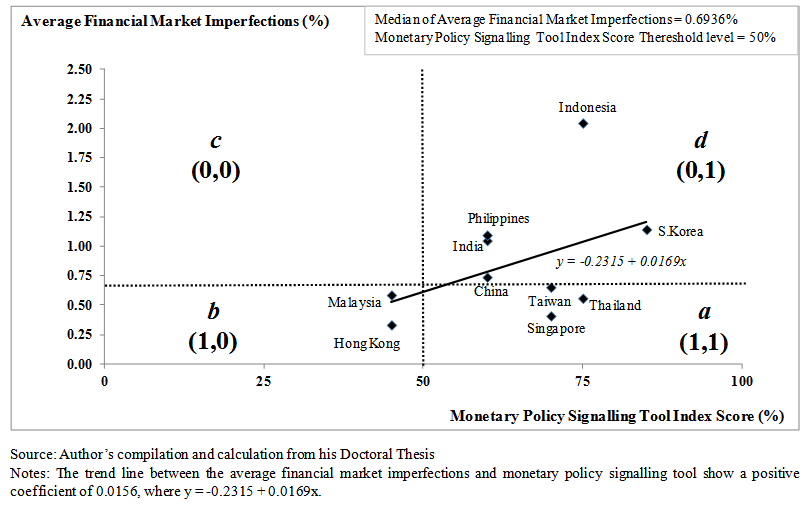

- In evaluating financial market risk in the context of a pay-off matrix, the identification of risk taker and risk averse provide fresh insights on the complexity of financial market behaviour (see Figure 3).

| Figure 3. Financial Market Imperfections, Monetary Policy Signalling and Financial Market Behaviour |

3. Evidence

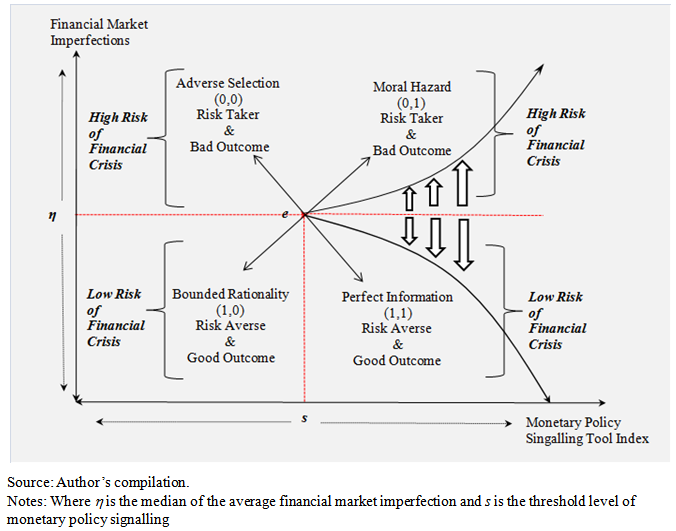

- Respective interest rate market imperfection and foreign exchange market imperfection for each Emerging Asia financial market show free market economies of Hong Kong and Singapore as in a better stead vis a vis the rest of Emerging Asia financial markets (see Table 1).

|

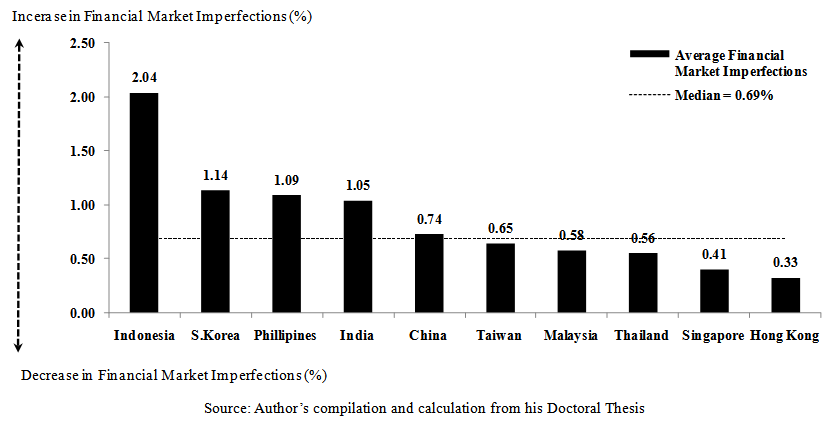

| Figure 4. Average Financial Market Imperfections Ranking in Emerging Asia (%) |

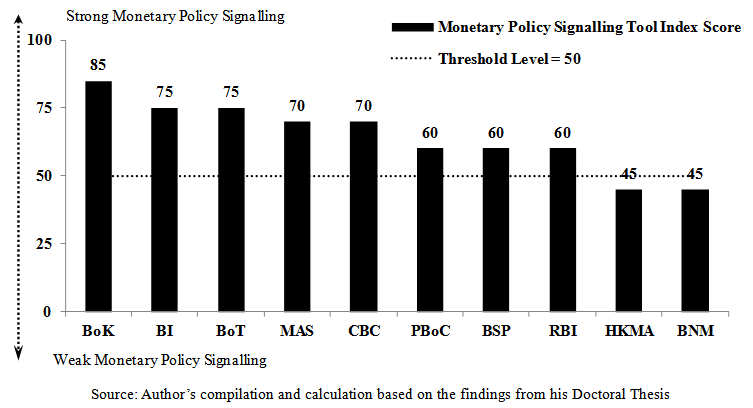

| Figure 5. Monetary Policy Signalling Tools Index Score in Emerging Asia (%) |

| Figure 6. Representation of Average Financial Market Imperfections and Monetary Policy Signalling Tool Index |

| Figure 7. Phase Diagram Representation of Average Financial Market Imperfections and Monetary Policy Signalling Tool Index |

4. Conclusions

- We conclude, beyond a certain monetary policy signalling threshold level, behavioural pattern of risk takers could be detrimental to financial markets, whereby imperfections could increase while behavioural pattern of being risk averse could reduce imperfections The threshold level of monetary policy signalling acts as the barometer of equilibrium for financial market imperfections, with outcomes of monetary policy signalling closely linked to perfect information and moral hazard incentive for financial markets.

Notes

- 1. Their findings suggest that the main feature of financial markets that leads to imperfection is . As central banks transmit monetary policy signalling, it is perceived that financial markets will accept this signalling to reduce imperfections but for financial markets the signalling could either provide an arbitrage opportunity for profit maximization or minimization of losses. In both these conditions, the behaviour of financial markets is constrained by profit maximization or minimization of losses that causes imperfections to occur when financial markets react upon monetary policy signalling. 2. Bounded rationality indicates rational decision making by individuals with the limited information they have. In a different perspective bounded rationality occurs because decision-makers lack the ability and resources to arrive at an optimal solution and instead apply their rationality only after evaluating the choices available.3. Adverse selection refers to a market process in which undesired results occur when buyers and sellers have and the selection of goods or services is the worse compared to the alternatives that are available.4. Moral hazard indicates where a party will have a tendency to take risks because the costs that could incur will not be felt by the party taking the risk. It reflects a tendency to be more willing to take risk, knowing that the potential costs or burden of taking such risk will be borne in whole or in part by others. 5. Perfect information refers to which an agent has all the relevant information with which to make a decision. In the case of , perfect information describes the situation when a player has the same information available to determine all of the possible games as would be available at the end of the game.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML