-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Game Theory

p-ISSN: 2325-0046 e-ISSN: 2325-0054

2013; 2(1): 1-8

doi:10.5923/j.jgt.20130201.01

Bilateral Oligopoly with a Competitive Fringe

Somdeb Lahiri

School of Petroleum Management PD Petroleum University P.O. Raisan Gandhinagar, 382007, Gujarat India

Correspondence to: Somdeb Lahiri, School of Petroleum Management PD Petroleum University P.O. Raisan Gandhinagar, 382007, Gujarat India.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

In this paper we consider a bilateral oligopoly on whose fringe there is a market comprising price taking buyers. The sellers in both markets are the same. The sellers and the buyers in the bilateral oligopoly behave strategically as in a Shapley-Shubik market game. We define the concept of an exact active equilibria and show that if the economy is replicated giving rise to a convergent sequence of (type) symmetric exact active equilibria (i.e. exact active equilibria where all replica of an agent in the original economy choose the same strategy) then the corresponding sequence of price-allocation pairs converge to a competitive equilibrium for the original economy. In a final section we discuss an example of an economy where all buyers have Cobb-Douglas utility functions and show that the concepts introduced in this paper (as also the convergence result) are non-vacuous.

Keywords: Strategic Market Game, Bilateral Oligopoly, Exact Active Equilibrium, Asymptotic Convergence, Competitive Equilibrium

Cite this paper: Somdeb Lahiri, Bilateral Oligopoly with a Competitive Fringe, Journal of Game Theory, Vol. 2 No. 1, 2013, pp. 1-8. doi: 10.5923/j.jgt.20130201.01.

Article Outline

1. Introduction

- The model of strategic market games due to[1],[2] and[3] is based on the assumption of strategic behaviour on the part of buyers and sellers. Unlike Cournot who assumed that buyers are price takers, in strategic market games all the agents are assumed to behave strategically. A particular case of the more general strategic market games is the case of a bilateral oligopoly. In this paper we are concerned with the version of bilateral oligopoly due to[4]. However, we assume that on the fringe of this bilateral oligopoly is a market in which the buyers act as price takers. Thus in our model there are two goods X and Y. X is the numeraire good and also plays the role of money in our model. The other good is Y which is a consumption good. The sellers of Y are initially endowed with Y and no X; the buyers of Y are initially endowed with X and no Y. Ordinarily, with price-taking behaviour on the part of buyers, and all agents caring for both X and Y, our model would be no different from the one proposed by[5] and reproduced in[6] and[7]. In this paper we assume that while buyers care for both X and Y, sellers care only for X and hence are profit maximizers. The sellers are assumed to behave strategically and there are two types of buyers- those who behave strategically and those who are price takers. In the bilateral oligopoly, each seller offers a portion of his initial endowment of Y to the buyers who submit bids in units of X. If the total bids and offers in this market are positive, then the price of Y is determined solely by the ratio of bids to offers. This also determines the price of Y in the market where buyers are price takers. In fact if the price of Y differed on the two markets there would always be scope for arbitrage- someone could buy Y on the market where it is cheaper and sell it for a profit on the market where it is more expensive. The price-taking or competitive buyers express the quantity of Y that they demand at this price. Since the sellers have no use for Y, they offer to the competitive buyers whatever of Y that remains after they have made offers to the strategic buyers. The allocation that is determined after the bids and offers are submitted is as follows. Each seller recovers the value of his offer in the bilateral oligopoly from the strategic buyers. Each strategic buyer gets the quantity of Y that he can purchase with the bid that he has placed in the market for Y. The amount that the sellers offer on the competitive market is distributed among the buyers by using a proportional rule: each buyer obtains an amount of Y that is proportional to the quantity of Y that he demands. Each competitive buyer pays for the Y that he has purchased its value in units of X at the price determined by the bilateral oligopoly. Each seller sells an amount of Y that is proportional to the quantity of Y that he offered on the market and recovers from the competitive market its value in units of X. There are two possibilities in the competitive market: (a) there is excess demand for Y so that the buyers are rationed; or (b) there is excess supply so that each buyer gets whatever of Y he demanded but the sellers sell only a portion of what they offered in the competitive market. We look for an equilibrium in this model where each seller is satisfied with the quantity he offers in the bilateral oligopoly, given the bids and offers of all other strategic players and each strategic buyer is satisfied with his bid, given the bids and offers of all other strategic players. In other words the equilibrium is self enforcing.It turns out that in this model there is a trivial equilibrium: one in which no bids or offers are submitted. Hence we narrow our scope to a particular case of non-trivial equilibrium, i.e. an active equilibrium, one in which all strategic players submit either a positive bid or a positive offer. In this class we further narrow down our interest to only those equilibria where no one is rationed in the competitive market. We call such equilibria, exact active.Our main result says that if the economy is replicated giving rise to a convergent sequence of (type) symmetric exact active equilibria (i.e. exact active equilibria where all replica of an agent in the original economy choose the same strategy) then the corresponding sequence of price-allocation pairs converge to a competitive equilibrium for the original economy. This result is analogous to the asymptotic convergence of Cournot equilibria that is discussed in [8] or[9]. In other words as the number of agents become large, there is at least one sequence of equilibrium price-allocation pairs that approximates a competitive equilibrium, provided there exists a convergent sequence of symmetric exact active equilibria. In a final section we discuss an example of an economy where all buyers have Cobb-Douglas utility functions and show that the concepts introduced in this paper (as also the convergence result) are non-vacuous. Similar analysis for oligopoly in the context of pure exchange economy can be found in[10].Ordinarily the justification for competitive price taking behaviour is the presence of a large number of agents on the same side of the market. However, here we see that even with a small number of agents there is the distinct possibility of price-taking behaviour being sustainable. We do not need an auctioneer to call out the prices on the competitive market. The price is determined by strategic interaction that takes place in a bilateral oligopoly on whose fringe the competitive market is located. Hence this is one case where competitive price formation is possible without either an auctioneer or the assumption of a large number of buyers.Our model should be contrasted with the line of research that originates with the work of Gabszewicz and Vial in[11] where in there is sequential trading between the large traders and the competitive buyers. In this paper we are less concerned with modelling the interaction between buyers and sellers. Our main emphasis is on competitive price formation on the fringe of a bilateral oligopoly. This is an issue that is completely ignored by the literature on imperfect completion irrespective of whether the economy is finite as is usually the case or large as assumed by Shitovitz in[12] and the research that follows from it.

2. The Model

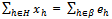

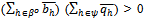

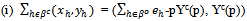

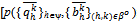

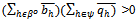

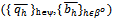

- We consider an economy with two goods X and Y. The players are partitioned into two sides of the market for Y. The set of players is a non-empty finite set H with H = ψ ∪ β where ψ∩β =

. Players in ψ are sellers and those in β are buyers of good Y. The initial endowments of the two goods are (eh, 0) if h∈β and (0, eh) if h∈ψ, where eh > 0 for all h∈H. Payments for Y are to be made in units of account of X. X is the numeraire good. It is assumed that the sellers have no use for Y and are only interested in X. Thus sellers maximize profits measured in units of X.An allocation is a list {(xh, yh)}h∈H, such that for all

. Players in ψ are sellers and those in β are buyers of good Y. The initial endowments of the two goods are (eh, 0) if h∈β and (0, eh) if h∈ψ, where eh > 0 for all h∈H. Payments for Y are to be made in units of account of X. X is the numeraire good. It is assumed that the sellers have no use for Y and are only interested in X. Thus sellers maximize profits measured in units of X.An allocation is a list {(xh, yh)}h∈H, such that for all ,

,  and

and  . We assume that each player h∈β has a utility function

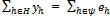

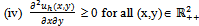

. We assume that each player h∈β has a utility function  such that:(i) uh is continuous on

such that:(i) uh is continuous on .(ii) uh is smooth, strongly increasing (i.e. both first partial derivatives are positive) and strongly concave (i.e. the Hessian matrix is negative definite) on

.(ii) uh is smooth, strongly increasing (i.e. both first partial derivatives are positive) and strongly concave (i.e. the Hessian matrix is negative definite) on .

.

For

For  , let uh (x,y) denote the marginal rate of substitution

, let uh (x,y) denote the marginal rate of substitution  evaluated at (x,y). It is easy to see that (iv) along with the assumptions that uh is strongly increasing and strongly concave implies that if (x,y) and (x',y') are distinct points belonging to

evaluated at (x,y). It is easy to see that (iv) along with the assumptions that uh is strongly increasing and strongly concave implies that if (x,y) and (x',y') are distinct points belonging to  with x x' and y ≤ y' then uh (x,y) > uh (x',y'). Further this implication of (iv) implies that the goods X and Y are gross substitutes.The set of buyers β is further divided into two disjoint sets βc and βo, i.e. β = βc∪βo with βc∩βo =

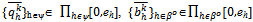

with x x' and y ≤ y' then uh (x,y) > uh (x',y'). Further this implication of (iv) implies that the goods X and Y are gross substitutes.The set of buyers β is further divided into two disjoint sets βc and βo, i.e. β = βc∪βo with βc∩βo =  . The players in Ho = ψ∪βo behave strategically. The buyers in βc behave competitively. In what follows we assume that |ψ| ≥ 2 and |βo|≥ 2 and |βc| ≥ 1. The strategy set of each player h∈Ho is [0,eh].A strategy for h∈ψ denoted qh is the quantity of Y that seller h offers to sell to the buyers in βo and consequently eh – qh is what he offers to sell to the buyers in βc. We write Q to denote

. The players in Ho = ψ∪βo behave strategically. The buyers in βc behave competitively. In what follows we assume that |ψ| ≥ 2 and |βo|≥ 2 and |βc| ≥ 1. The strategy set of each player h∈Ho is [0,eh].A strategy for h∈ψ denoted qh is the quantity of Y that seller h offers to sell to the buyers in βo and consequently eh – qh is what he offers to sell to the buyers in βc. We write Q to denote  , and Eψ to denote

, and Eψ to denote  . For h∈ψ, we use Q-h to denote Q -qh and

. For h∈ψ, we use Q-h to denote Q -qh and  to denote

to denote  . A strategy for h∈βo denoted bh is the quantity of X that buyer h bids for Y. We write B to denote the aggregate bid

. A strategy for h∈βo denoted bh is the quantity of X that buyer h bids for Y. We write B to denote the aggregate bid  and for h∈βo we write

and for h∈βo we write  to denote B – bh.A strategy profile is an array ({qh}h∈ψ ,

to denote B – bh.A strategy profile is an array ({qh}h∈ψ ,  ) where for h∈ψ,qh is a (offer) strategy for seller h, and for h∈βo, bh is a (bidding) strategy for buyer h.

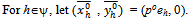

) where for h∈ψ,qh is a (offer) strategy for seller h, and for h∈βo, bh is a (bidding) strategy for buyer h.3. The Competitive Buyers

- The procedure that the competitive market adopts is the following. Given a price p > 0, a competitive buyer h∈βc being a price taker solves the following optimization problem:Maximize uh(eh-pyh, yh).Given our assumption on preferences, we know that for all p > 0 and h∈βc there exists a unique

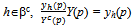

which solves the problem.Under our assumptions, the function

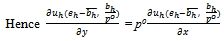

which solves the problem.Under our assumptions, the function  is continuously differentiable and

is continuously differentiable and  for all p > 0.Let

for all p > 0.Let  be the function such that for all p > 0,

be the function such that for all p > 0,  . Clearly Yc is continuously differentiable and for all

. Clearly Yc is continuously differentiable and for all .Given a strategy profile ({qh}h∈ψ ,

.Given a strategy profile ({qh}h∈ψ ,  ), let Y(p) = Min

), let Y(p) = Min . Since the competitive buyers cannot purchase more than

. Since the competitive buyers cannot purchase more than , any excess demand requires to be rationed.

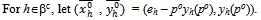

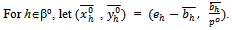

, any excess demand requires to be rationed.4. The Market Game

- Given a strategy profile ({qh}h∈ψ ,

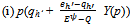

) for which BQ > 0, we define a price

) for which BQ > 0, we define a price .The allocation {(xh, yh)}h∈H corresponding to the strategy profile ({qh}h∈ψ ,

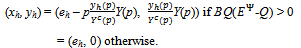

.The allocation {(xh, yh)}h∈H corresponding to the strategy profile ({qh}h∈ψ ,  ) is the following.For h∈βc:

) is the following.For h∈βc: For h∈βo:

For h∈βo: For h∈ψ:

For h∈ψ: Note that for

Note that for  if and only if Y(p) = Yc(p). Otherwise we use the proportional rule to ration the competitive buyers.For h'∈ψ and strategy profile ({qh}h∈ψ ,

if and only if Y(p) = Yc(p). Otherwise we use the proportional rule to ration the competitive buyers.For h'∈ψ and strategy profile ({qh}h∈ψ ,  ) we will write xh’({qh}h∈ψ ,

) we will write xh’({qh}h∈ψ ,  ) to denote :

) to denote :  , if

, if  ; (ii)peh’, if BQ > 0,

; (ii)peh’, if BQ > 0,  ; and (iii) 0, otherwise.For h'∈βo, we shall denote the consumption bundle of h' corresponding to a strategy profile ({qh}h∈ψ ,

; and (iii) 0, otherwise.For h'∈βo, we shall denote the consumption bundle of h' corresponding to a strategy profile ({qh}h∈ψ ,  ) by (xh’, yh’)({qh}h∈ψ ,

) by (xh’, yh’)({qh}h∈ψ ,  )(i.e. (i)

)(i.e. (i)  if BQ > 0; and (ii) 0, otherwise).Given a strategy profile ({qh}h∈ψ ,

if BQ > 0; and (ii) 0, otherwise).Given a strategy profile ({qh}h∈ψ ,  ) and h'∈Ho we shall write:(i) ({q-h’}h∈ψ\{h’} ,

) and h'∈Ho we shall write:(i) ({q-h’}h∈ψ\{h’} ,  ) to denote the same strategy profile with the strategy qh’ of h' replaced by

) to denote the same strategy profile with the strategy qh’ of h' replaced by , provided h'∈ψ.(ii) ({qh}h∈ψ ,

, provided h'∈ψ.(ii) ({qh}h∈ψ ,  ) to denote the same strategy profile with the strategy bh’ of h' replaced by

) to denote the same strategy profile with the strategy bh’ of h' replaced by  , provided h'∈βo.An equilibrium is a strategy profile ({qh}h∈ψ ,

, provided h'∈βo.An equilibrium is a strategy profile ({qh}h∈ψ ,  ) such that:(i) For all h'∈ψ: xh’({qh}h∈ψ ,

) such that:(i) For all h'∈ψ: xh’({qh}h∈ψ ,  ) ≥ xh’({q-h’}h∈ψ ,

) ≥ xh’({q-h’}h∈ψ ,  ) whenever

) whenever .(ii) For all h'∈βo: uh’((xh’, yh’)({qh}h∈ψ ,

.(ii) For all h'∈βo: uh’((xh’, yh’)({qh}h∈ψ ,  ) ≥ uh’((xh’, yh’)({qh}h∈ψ\{h’} ,

) ≥ uh’((xh’, yh’)({qh}h∈ψ\{h’} ,  ) for all

) for all .The following proposition is easily established.Proposition 1: Let ({qh}h∈ψ ,

.The following proposition is easily established.Proposition 1: Let ({qh}h∈ψ ,  ) be a strategy profile such that B = Q = 0. Then ({qh}h∈ψ ,

) be a strategy profile such that B = Q = 0. Then ({qh}h∈ψ ,  ) is an equilibrium. It is called a trivial equilibrium.In view of Proposition 1 we have the following definition.A non-trivial equilibrium is an equilibrium strategy profile ({qh}h∈ψ ,

) is an equilibrium. It is called a trivial equilibrium.In view of Proposition 1 we have the following definition.A non-trivial equilibrium is an equilibrium strategy profile ({qh}h∈ψ ,  ) such that BQ > 0.A non-trivial equilibrium ({qh}h∈ψ ,

) such that BQ > 0.A non-trivial equilibrium ({qh}h∈ψ ,  ) is said to be an active equilibrium if:(i) For all h∈ψ: eh > qh > 0.(ii) For all h∈βo: bh > 0.

) is said to be an active equilibrium if:(i) For all h∈ψ: eh > qh > 0.(ii) For all h∈βo: bh > 0. An active equilibrium ({qh}h∈ψ ,

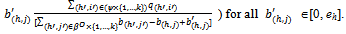

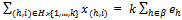

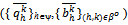

An active equilibrium ({qh}h∈ψ ,  ) is said to be an exact active equilibrium if

) is said to be an exact active equilibrium if  . Proposition 2: Let ({qh}h∈ψ ,

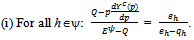

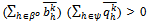

. Proposition 2: Let ({qh}h∈ψ ,  ) be an exact active equilibrium. Then

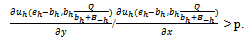

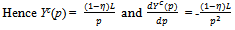

) be an exact active equilibrium. Then (ii)For all h∈βo:

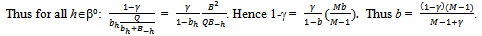

(ii)For all h∈βo: Thus for all h∈βo:

Thus for all h∈βo:

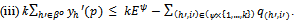

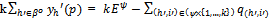

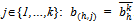

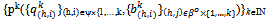

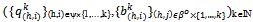

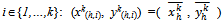

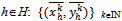

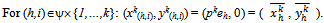

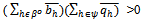

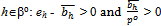

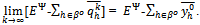

5. Replications of the Basic Economy

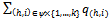

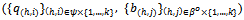

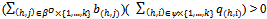

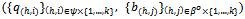

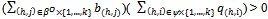

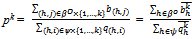

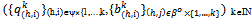

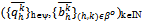

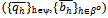

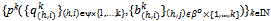

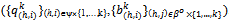

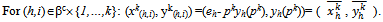

- Let us refer to the model that we have discussed above as the basic economy and denote it by E1. We are primarily concerned with the consequences of expanding the basic economy E1. One way to do this is to simultaneously replicate all the agents in the economy a finite number of times. We let IN denote the set of natural numbers. Let kIN. The replicated economy Ek consists of (|ψ|+|β|)k agents, where for each seller h in E1 now there are k sellers each having the same utility function uh and the same initial endowment of Y, eh>0; and for each buyer h in E1 now there are k buyers each having the same utility function uh and the same initial endowment of X, eh > 0. In Ek each seller i{1,…,k} of type h is denoted by (h,i) and each buyer j{1,…,k} of type h is denoted by (h,j). The (offer) strategy q(h,i) of seller (h,i) to the non-competitive buyers belongs to the closed interval[0,eh]. Thus the aggregate supply of good Y to the non-competitive buyers in Ek is

. Let p > 0 be the price of good Y in terms of good X that the competitive buyers face. Then each competitive buyer (h,j)∈βc{1,2,…,k} solves the following optimization problem:Maximize uh(x,y)

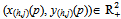

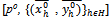

. Let p > 0 be the price of good Y in terms of good X that the competitive buyers face. Then each competitive buyer (h,j)∈βc{1,2,…,k} solves the following optimization problem:Maximize uh(x,y) Under our assumption on preferences there is a unique pair

Under our assumption on preferences there is a unique pair  which solves this problem. Further x(b,j)(p) + py(b,j)(p) = eh for all p > 0. Thus (x(b,j)(p), y(b,j)(p)) = (xb(p), yh(p)) for all j{1,…,k}. The aggregate quantity of Y demanded by the competitive buyers is

which solves this problem. Further x(b,j)(p) + py(b,j)(p) = eh for all p > 0. Thus (x(b,j)(p), y(b,j)(p)) = (xb(p), yh(p)) for all j{1,…,k}. The aggregate quantity of Y demanded by the competitive buyers is  .Each non-competitive buyer (h,j)∈βo{1,…,k} submits a bid b(h,j)∈[0, eh] in units of X.A strategy profile is a list

.Each non-competitive buyer (h,j)∈βo{1,…,k} submits a bid b(h,j)∈[0, eh] in units of X.A strategy profile is a list  such that for each (h,i)∈ψ{1,…,k},

such that for each (h,i)∈ψ{1,…,k},  is the offer of seller (h,i) and for each (h,j)∈βo{1,…,k},

is the offer of seller (h,i) and for each (h,j)∈βo{1,…,k}, is the bid of the non-competitive buyer (h,j).If

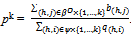

is the bid of the non-competitive buyer (h,j).If , then the price of Y,

, then the price of Y,  . At strategy profile

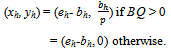

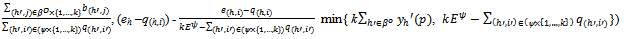

. At strategy profile  (i) each (h,i)∈ψ{1,…,k} consumes

(i) each (h,i)∈ψ{1,…,k} consumes

(ii) each (h,j) ∈βo{1,…,k} consumes

(ii) each (h,j) ∈βo{1,…,k} consumes  (iii) each (h,j)∈βc{1,…,k} consumes

(iii) each (h,j)∈βc{1,…,k} consumes

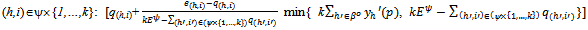

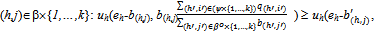

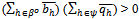

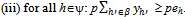

An equilibrium for Ek is a strategy profile

An equilibrium for Ek is a strategy profile such that:(i) For all (h,i)∈ψ{1,…,k}:

such that:(i) For all (h,i)∈ψ{1,…,k}:

(ii) For all

(ii) For all

A non-trivial equilibrium for Ek is an equilibrium strategy profile

A non-trivial equilibrium for Ek is an equilibrium strategy profile  such that

such that .A non-trivial equilibrium

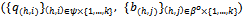

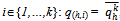

.A non-trivial equilibrium  is said to be an active equilibrium for Ek if:(i) For all (h,i)∈ψ{1,…,k}: eh > q(h,i) > 0.(ii) For all (h,j)∈βo{1,…,k}: b(h,j) > 0.

is said to be an active equilibrium for Ek if:(i) For all (h,i)∈ψ{1,…,k}: eh > q(h,i) > 0.(ii) For all (h,j)∈βo{1,…,k}: b(h,j) > 0. An active equilibrium for

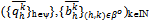

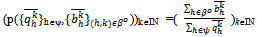

An active equilibrium for  is said to be an exact active equilibrium (for Ek) if

is said to be an exact active equilibrium (for Ek) if  .An allocation in Ek is a list {(x(h,i), y(h,i))}(h,i)∈H{1,…,k}, such that for all (h,i)∈H{1,…,k},

.An allocation in Ek is a list {(x(h,i), y(h,i))}(h,i)∈H{1,…,k}, such that for all (h,i)∈H{1,…,k},  ,

,  and

and . For kIN, let

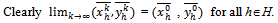

. For kIN, let  be a strategy profile in Ek. Let

be a strategy profile in Ek. Let  for all hψ and

for all hψ and  for all hβo. Thus

for all hβo. Thus  and

and  is a strategy profile for E1.Note that if

is a strategy profile for E1.Note that if  , then the price of Y,

, then the price of Y,  .For kIN, say that a strategy profile

.For kIN, say that a strategy profile  is symmetric if (i) for all hψ and

is symmetric if (i) for all hψ and  , and (ii) for all h∈βo and

, and (ii) for all h∈βo and  . Lemma 1: Let

. Lemma 1: Let  be a sequence of strategy profiles in the successive economies {Ek}kIN. Suppose that the corresponding sequence of average strategies

be a sequence of strategy profiles in the successive economies {Ek}kIN. Suppose that the corresponding sequence of average strategies  satisfy

satisfy  and converges to some point

and converges to some point  with

with . Then the sequence of prices

. Then the sequence of prices  converges to

converges to  . Moreover, (i) for every sequence

. Moreover, (i) for every sequence  with

with  for all kIN, and for every sequence of integers {ik}kIN with 1 ≤ ik ≤ k for all kIN, the sequence of prices

for all kIN, and for every sequence of integers {ik}kIN with 1 ≤ ik ≤ k for all kIN, the sequence of prices  with

with  for all kIN also converges to p0; (ii) for every sequence

for all kIN also converges to p0; (ii) for every sequence  with

with  for all kIN, and for every sequence of integers {ik}kIN with 1 ≤ ik ≤ k for all kIN, the sequence of prices

for all kIN, and for every sequence of integers {ik}kIN with 1 ≤ ik ≤ k for all kIN, the sequence of prices  with

with  for all kIN also converges to p0.

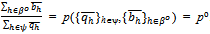

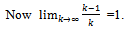

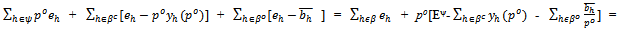

for all kIN also converges to p0. Now since the sequence

Now since the sequence  converges to

converges to  with

with , the sequence

, the sequence  converges to

converges to . Thus the sequence of prices

. Thus the sequence of prices  converges to po.

converges to po. Since the sequences

Since the sequences  and

and  both belong to[0,eh] and are thus bounded

both belong to[0,eh] and are thus bounded . Thus

. Thus

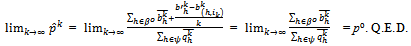

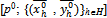

6. Asymptotic Convergence to Competitive Equilibrium

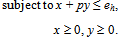

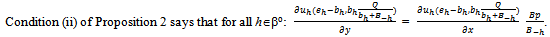

- A price-allocation pair[p; {(xh, yh)}hH] where the latter is a feasible allocation in E1 is said to be competitive if:

(ii) for all h∈βo: (xh, yh) solves Maximize uh(x’, y’) s.t. x’= eh-py’.

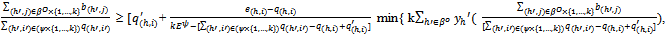

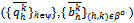

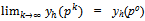

(ii) for all h∈βo: (xh, yh) solves Maximize uh(x’, y’) s.t. x’= eh-py’. Theorem 1: Let

Theorem 1: Let be a sequence of symmetric exact active equilibria in the successive economies {Ek}kIN. Let

be a sequence of symmetric exact active equilibria in the successive economies {Ek}kIN. Let ; {(xk(h,i), yk(h,i))}(h,i)H{1,…,k}] be the price-allocation pair associated to

; {(xk(h,i), yk(h,i))}(h,i)H{1,…,k}] be the price-allocation pair associated to  . Then for all kIN, hH there exists

. Then for all kIN, hH there exists  such that for all

such that for all  . Assume that the sequence

. Assume that the sequence  converges to some

converges to some  with

with . Then the price sequence {pk}kIN where

. Then the price sequence {pk}kIN where  for all kIN converges to some p0 > 0, and for all

for all kIN converges to some p0 > 0, and for all  converges to some

converges to some . Further

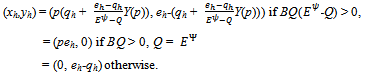

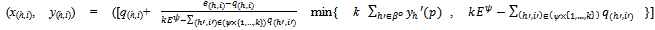

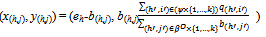

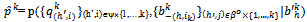

. Further is a competitive equilibrium of the economy E1.Proof: Note that the allocation corresponding to the symmetric exact active equilibrium is the following:

is a competitive equilibrium of the economy E1.Proof: Note that the allocation corresponding to the symmetric exact active equilibrium is the following:

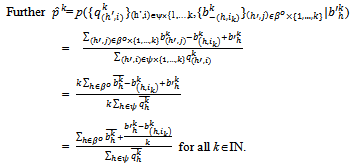

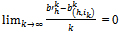

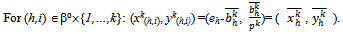

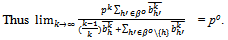

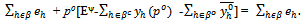

Now by condition (ii) of Proposition 2, for each (h,i) ∈βo{1,…,k}:

Now by condition (ii) of Proposition 2, for each (h,i) ∈βo{1,…,k}:  Since

Since converges to some

converges to some  with

with ,

, .

.

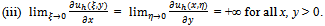

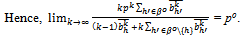

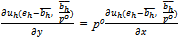

Since preferences have been assumed to be C1 on

Since preferences have been assumed to be C1 on  and since marginal utililites have been assumed to be unbounded as the consumption of a commodity goes to zero, it follows that for all

and since marginal utililites have been assumed to be unbounded as the consumption of a commodity goes to zero, it follows that for all  .Since for all h∈βc, yh(.) is C1,

.Since for all h∈βc, yh(.) is C1,  and

and

Also

Also

Since for all h∈H we have

Since for all h∈H we have , it must be the case that for all

, it must be the case that for all  solves Maximize uh(x', y') s.t. x'= eh-poy'.Thus

solves Maximize uh(x', y') s.t. x'= eh-poy'.Thus  is a competitive equilibrium. Q.E.D.

is a competitive equilibrium. Q.E.D.7. The Cobb-Douglas Economy

- Suppose ψ = {1,…,N}, βo = {1,…, M} and βc = {1,…, L}. Suppose eh = 1 for all h∈H and there exists γ and η∈(0,1) such that for all

(i) uh(x, y) = xγ y1-γ whenever h∈βo.(ii) uh(x, y) = xη y1-η whenever h∈βc.

(i) uh(x, y) = xγ y1-γ whenever h∈βo.(ii) uh(x, y) = xη y1-η whenever h∈βc.

By the symmetry of the problem within each type of agent, at any active equilibrium ({qh}h∈ψ ,

By the symmetry of the problem within each type of agent, at any active equilibrium ({qh}h∈ψ ,  ) there exists q, b > 0 such that: (i) for all h∈ψ: qh= q; (ii) for all h∈βo: bh = b.

) there exists q, b > 0 such that: (i) for all h∈ψ: qh= q; (ii) for all h∈βo: bh = b.

At an exact active equilibrium total amount of Y consumed by the buyers is N.

At an exact active equilibrium total amount of Y consumed by the buyers is N.

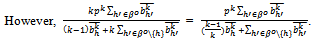

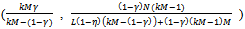

Note that the profit of each seller is the price p.Further by the symmetry of the problem the offer that each seller submits in the bilateral oligopoly is

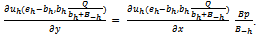

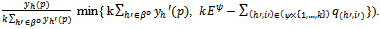

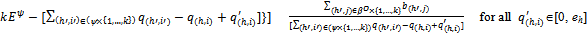

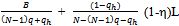

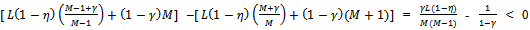

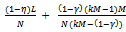

Note that the profit of each seller is the price p.Further by the symmetry of the problem the offer that each seller submits in the bilateral oligopoly is  .We need to verify that no seller can benefit by a unilateral deviation from offering q. There are two possibilities: (a) a unilateral deviation that leads to a decrease in the price of Y, and (b) a unilateral deviation that leads to an increase in the price of Y.Since each seller exhausts his entire supply of Y at an exact active equilibrium, it is not possible for any seller to sell any more. Thus a decrease in price could only lead to a fall in revenue for the sellers and any unilateral deviation by a seller that leads to a decrease in the price that prevails at an exact active equilibrium could not be beneficial for him. Hence we have to see whether a unilateral deviation by a seller that leads to an increase in the price of Y, is beneficial for him. Such a unilateral deviation would involve making an offer less than q. Since such a price rise would lead to a decrease in the quantity of Y demanded in the competitive market, there would be a situation of excess supply in the competitive market and the suppliers would have to be rationed. Since the preference of a competitive consumer is Cobb-Douglas with parameter , each such consumer would spend (1-) on Y and hence the aggregate expenditure of the competitive consumers on Y is (1-)L irrespective of the price. Hence for qh(0, q], the revenue that seller h gets by offering qh when all other sellers offer q is

.We need to verify that no seller can benefit by a unilateral deviation from offering q. There are two possibilities: (a) a unilateral deviation that leads to a decrease in the price of Y, and (b) a unilateral deviation that leads to an increase in the price of Y.Since each seller exhausts his entire supply of Y at an exact active equilibrium, it is not possible for any seller to sell any more. Thus a decrease in price could only lead to a fall in revenue for the sellers and any unilateral deviation by a seller that leads to a decrease in the price that prevails at an exact active equilibrium could not be beneficial for him. Hence we have to see whether a unilateral deviation by a seller that leads to an increase in the price of Y, is beneficial for him. Such a unilateral deviation would involve making an offer less than q. Since such a price rise would lead to a decrease in the quantity of Y demanded in the competitive market, there would be a situation of excess supply in the competitive market and the suppliers would have to be rationed. Since the preference of a competitive consumer is Cobb-Douglas with parameter , each such consumer would spend (1-) on Y and hence the aggregate expenditure of the competitive consumers on Y is (1-)L irrespective of the price. Hence for qh(0, q], the revenue that seller h gets by offering qh when all other sellers offer q is  . The derivative of the function

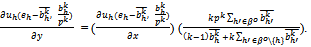

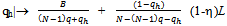

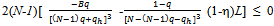

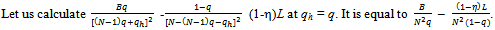

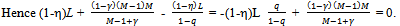

. The derivative of the function  with domain (0,q] is

with domain (0,q] is

The second derivative of this function is

The second derivative of this function is  . Hence this function is concave. If we show that its first derivative at qh = q is non-negative then we are done, since it would imply that the function is maximized at qh = q, and thus there is no unilateral deviation from q that is beneficial to the deviator.

. Hence this function is concave. If we show that its first derivative at qh = q is non-negative then we are done, since it would imply that the function is maximized at qh = q, and thus there is no unilateral deviation from q that is beneficial to the deviator.

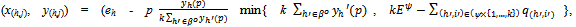

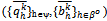

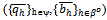

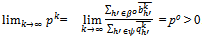

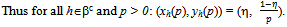

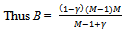

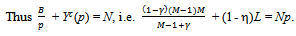

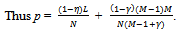

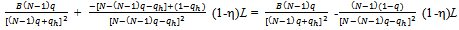

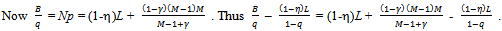

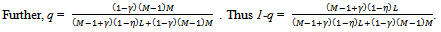

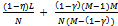

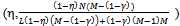

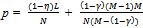

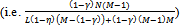

In view of the above we have the following proposition.Proposition 3: At an exact active equilibrium for the Cobb-Douglas economy the price p of Y is

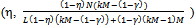

In view of the above we have the following proposition.Proposition 3: At an exact active equilibrium for the Cobb-Douglas economy the price p of Y is  Each non-competitive buyer consumes

Each non-competitive buyer consumes  and each competitive buyer consumes

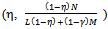

and each competitive buyer consumes . (a) The price p goes up if N (the number of sellers) remains fixed and either M (the number of non-competitive buyers) or L (the number of competitive buyers) goes up. (b) The price goes down if N goes up with M and L being held fixed. (c) As N goes up (with M and L held fixed) each buyer is better off and each existing seller is worse off. (d) If L goes up (with N and M held fixed) then each existing buyer is worse off and each seller is better off. (e) If M goes up (with L and N held fixed) then again each existing competitive buyer is worse off and each seller is better off. Each non-competitive seller is eventually worse off.Proof: Since (a) to (d) are quite obvious we will prove (e). Suppose M goes up. Consider the price p which is also the profit of a seller. Now

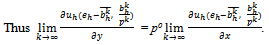

. (a) The price p goes up if N (the number of sellers) remains fixed and either M (the number of non-competitive buyers) or L (the number of competitive buyers) goes up. (b) The price goes down if N goes up with M and L being held fixed. (c) As N goes up (with M and L held fixed) each buyer is better off and each existing seller is worse off. (d) If L goes up (with N and M held fixed) then each existing buyer is worse off and each seller is better off. (e) If M goes up (with L and N held fixed) then again each existing competitive buyer is worse off and each seller is better off. Each non-competitive seller is eventually worse off.Proof: Since (a) to (d) are quite obvious we will prove (e). Suppose M goes up. Consider the price p which is also the profit of a seller. Now  . As M goes up

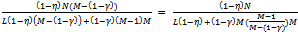

. As M goes up  increases (towards 1) and M also increases. Thus p goes up and each seller is better off.Consider a competitive buyer. His consumption of X remains fixed at η. His consumption of Y is

increases (towards 1) and M also increases. Thus p goes up and each seller is better off.Consider a competitive buyer. His consumption of X remains fixed at η. His consumption of Y is  . As before, with an increase in Y,

. As before, with an increase in Y,  increases (towards 1) and M also increases. Thus a competitive buyer’s consumption of Y decreases and each existing competitive buyer is worse off.Consider a non-competitive buyer. As M increases

increases (towards 1) and M also increases. Thus a competitive buyer’s consumption of Y decreases and each existing competitive buyer is worse off.Consider a non-competitive buyer. As M increases  decreases (towards 1) and so

decreases (towards 1) and so  (decreases towards γ). Thus, as M increases his consumption of X decreases.

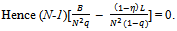

(decreases towards γ). Thus, as M increases his consumption of X decreases.  Now

Now if and only if M(M-1) > (1-γ)γ(1-η)L.Thus a non-competitive buyer’s consumption of Y

if and only if M(M-1) > (1-γ)γ(1-η)L.Thus a non-competitive buyer’s consumption of Y  decreases if and only if M(M-1) > (1-γ)γ(1-η)L. Hence as M increases each existing non-competitive buyer is eventually worse off. Q.E.D.In order to compare the consumption of Y between non-competitive and competitive buyers, set M = L and γ = η. Then the consumption bundle of each competitive buyer is

decreases if and only if M(M-1) > (1-γ)γ(1-η)L. Hence as M increases each existing non-competitive buyer is eventually worse off. Q.E.D.In order to compare the consumption of Y between non-competitive and competitive buyers, set M = L and γ = η. Then the consumption bundle of each competitive buyer is  and the consumption bundle of each non-competitive buyer is

and the consumption bundle of each non-competitive buyer is  . Since

. Since , each non-competitive buyer consumes more of X than the competitive buyer. Since

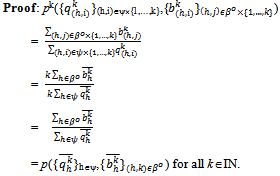

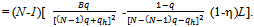

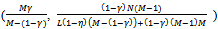

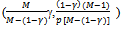

, each non-competitive buyer consumes more of X than the competitive buyer. Since , each non-competitive buyer consumes less of Y than each competitive buyer.What happens if the above economy is replicated k times, where k is any natural number? In the k-replica of the above economy there are kN sellers, kM non-competitive buyers and kL competitive buyers. As before each seller is a profit maximize and is initially endowed with 1 unit of Y. Each buyer is endowed with 1 unit of X. The utility function of each non-competitive buyer h is uh(x, y) = xγ y1-γ and the utility function of each competitive buyer h’ is uh’(x, y) = xη y1-η.Proposition 4: At an exact active equilibrium for the k-replica of the above Cobb-Douglas economy the price p of Y is

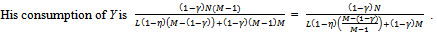

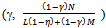

, each non-competitive buyer consumes less of Y than each competitive buyer.What happens if the above economy is replicated k times, where k is any natural number? In the k-replica of the above economy there are kN sellers, kM non-competitive buyers and kL competitive buyers. As before each seller is a profit maximize and is initially endowed with 1 unit of Y. Each buyer is endowed with 1 unit of X. The utility function of each non-competitive buyer h is uh(x, y) = xγ y1-γ and the utility function of each competitive buyer h’ is uh’(x, y) = xη y1-η.Proposition 4: At an exact active equilibrium for the k-replica of the above Cobb-Douglas economy the price p of Y is  Each non-competitive buyer consumes

Each non-competitive buyer consumes  and each competitive buyer consumes

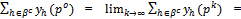

and each competitive buyer consumes . As k goes to infinity the price converges to

. As k goes to infinity the price converges to  As k goes to infinity each non-competitive buyer’s consumption bundle converges to

As k goes to infinity each non-competitive buyer’s consumption bundle converges to  . As k goes to infinity each competitive buyer’s consumption converges to

. As k goes to infinity each competitive buyer’s consumption converges to  .From Proposition 4 it is clear that as k tends to infinity, the sequence of price-allocation pairs converges to the unique competitive equilibrium of the original economy.

.From Proposition 4 it is clear that as k tends to infinity, the sequence of price-allocation pairs converges to the unique competitive equilibrium of the original economy. ACKNOWLEDGMENTS

- I would like to thank without implicating Giulio Codognato for his observations and comments on the paper. I deeply indebted to an anonymous referee of this journal for useful comments based on a detailed reading of the manuscript.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML