-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Advanced and Multidisciplinary Social Science

2023; 8(1): 1-7

doi:10.5923/j.jamss.20230801.01

Received: Oct. 4, 2023; Accepted: Oct. 23, 2023; Published: Oct. 28, 2023

The Effects of Foreign Direct Investment on Sub-Saharan African Region’s Economic Growth

Agu Okwudili Chijioke

School of Economics, Hebei University, Baoding City, China

Correspondence to: Agu Okwudili Chijioke, School of Economics, Hebei University, Baoding City, China.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This research evaluates the effect of foreign direct investment on Sub-Saharan Africa’s economic growth from 2010-2020, using selected countries from the Sub-Saharan Africa region as sample size for the research. The study is made up of two sections namely; theoretical review and empirical analysis. The theoretical section reviews the basic concepts about foreign direct investment as well as an overview of the Sub-Saharan Africa region. The second section focuses on the empirical analysis which deploys secondary data and selected variables to analyse the effects of FDI on the economic growth of the Sub-Saharan African region. The data used for analysis were obtained from world bank data (world development indicators). The instrument for data analysis were divided into static panel data approach and dynamic panel data approach and results were compared on coefficient significance basis. The results from the research shows that foreign direct investment has a negative effect on Sub-Saharan Africa region’s economic growth between 2011-2020.

Keywords: Effects, Foreign Direct Investment, Sub-Saharan Africa, Economic Growth

Cite this paper: Agu Okwudili Chijioke, The Effects of Foreign Direct Investment on Sub-Saharan African Region’s Economic Growth, International Journal of Advanced and Multidisciplinary Social Science, Vol. 8 No. 1, 2023, pp. 1-7. doi: 10.5923/j.jamss.20230801.01.

Article Outline

1. Introduction

- In the last few decades, foreign direct investment has proven to be an important driving force in the growth and development of an economic unit, and even more important for the economic growth of developing countries, as majority the Sub-Saharan African countries belongs to this category. Many studies attest to the notion that foreign direct investment positively correlates to economic growth, (Borensztein and Gregory, 2010) whose findings shows that foreign direct investment can promote technology development and transfer, enhance human capital and market competitiveness, enhance domestic economy and world economy, and ultimately promote the positive development of enterprises. However, there are some studies that conclude foreign direct investment does not bring about a positive effect on the host country’s economic growth. (Cao Ju, 2012) using China’s provincial panel data found foreign direct investment has a negative development effect on domestic enterprises.The reasons for the differences in results can be attributed to many factors including factors inherent in the host country’s economy prior to foreign direct investment inflow as well as the investment strategies and motives of the investing country. In many developing countries, foreign direct investment has become the most stable and largest component in achieving economic growth. This is because foreign direct investment is relatively flexible in providing employment, improves skills through technology innovation and transfer, as well as increase the general competitiveness of the local market.The Sub-Saharan African region accounts for a greater majority of Africa’s population and economic livelihood source, the region houses 49 countries, most of which represents the core of Africa’s economy, with Nigeria and South Africa the leading countries. The Sub-Saharan Africa region has recorded significant increase in foreign direct investment inflow over the years from different investing countries, majority of which are from Europe, America and Asia. According to the World Bank global economic outlook database, 2013: report shows that among all the trading partners of the Sub-Saharan African region, China has emerged as the most important trading partner owing to its continuous increased investment in the region, aid funds most of which channel towards infrastructure construction which is very necessary for the economic growth and development of the Sub-Saharan region.Compared to the United States and other European trading partners, the Sub-Saharan Africa region’s trade with China has been growing more rapidly. By 2009 China subsequently replaced the United States as the largest trading partner to the region, and by 2013, 22% of Sub-Saharan region trade volume was occupied by China, China’s direct investment increased more than six times mainly in mining and manufacturing sector, with China’s aid fund to the region increasing from $500million in 2000 to $3.2billion in 2013 thereby making Sub-Saharan Africa region the largest recipient of Chinese aid fund.Even though there is continued increase in foreign direct investment inflow into the Sub-Saharan African region from different investing countries, however there is a resultant corresponding increase in economic growth which raises many questions concerning the true motives of the investing countries as well as the efficacy of Sub-Saharan African countries government towards the utilization and management of foreign direct investment funds. This study seeks to find the effects of foreign direct investment on Sub-Saharan Africa’s economic growth. For this purpose, this research is sectioned into two parts, with the first part being a theoretical review which sheds light on the basic concepts concerning foreign direct investment, the current economic situation of the Sub-Saharan African region as well as an overview of foreign direct investment inflow into the region between 2011-2020. The second part consists of the empirical analysis which makes use of secondary data on the Sub-Saharan region obtained from world bank data (world development indicators). Using the static and dynamic panel approach, data is analyzed to generate recommendations were based on the results of the findings. It is important to note that there has been many research work carried out in this area of study with different results, this paper thereby intends to carryout a detailed analysis on the subject matter and take a valid stand based on the empirical results obtained as well as put forward valuable suggestions for subsequent studies in this area of research.

2. What is Foreign Direct Investment?

- There are basically two forms of foreign investment namely; foreign direct investment and foreign indirect investment. While there are countless cases of gross misconception of the both, it is important to note that foreign direct investment mainly refers to the economic operation whereby the investor directly opens its enterprises or operates other enterprises abroad, it is the direct investment of their capital into the operation and management of an enterprise abroad. Foreign indirect investment refers to securities investment and capital investment abroad normally in the form of medium or long term credit as well as economic development aids and assistance. For the purpose of this study, we focus our attention on foreign direct investment.A noteworthy understanding of foreign direct investment is provided by The United Nations Conference on Trade and Development (UNCTAD, 2005) which defines foreign direct investment as investment involving a long-term relationship and reflecting a lasting interest and control by a firm in an enterprise resident in a foreign country. Foreign direct investment normally has three components namely; equity capital (the purchase of shares in the foreign enterprise), re-invested earnings(those earnings not distributed as dividends by foreign affiliates or remitted to the investor enterprise and intra company loans or debt transactions (borrowing and lending between parent and foreign affiliate enterprises. The organization for Economic Co-operation and Development’s benchmark definition (OECD, 1996) defines foreign direct investment as “the resident of one country (direct investor) and the resident of another country (direct investment enterprise) outside the investor’s country with activities carried out for the purpose of obtaining lasting benefits”. The meaning of lasting interest here is that there is a long-term relationship between direct investors and enterprises, and direct investors have a significant impact on the management of the enterprises. It is also important to note that both the subsequent transactions and the initial transactions that led to the establishment of the co-operation between the direct investor and the direct investment enterprise all constitute direct investment, transactions which does not give rise to any form of monetary settlement (transactions settled using shares) must also be taken record of in the balance of payment and in the index of industrial production.Foreign direct investment does not imply a mere outward investment of capital, it also extends to the transfer of management knowledge, technology, capital and skills from a particular industrial sector of the home investing country to that of the host investment country. It can occur in the form of co-operative operation, joint venture, sole proprietorship, assembly trade, international leasing and various other forms. As a result of the positive transformations that goes with foreign direct investment, it is viewed by many developing countries as a means to supplement the shortfalls in domestic investment, increase employment opportunities as well as improve the standard of living of its citizens. However, in spite of all the benefits that it affords, various incentives and policies needs to be put in place in order to attract foreign direct investment as well as ensure its consistency with the country’s economic development goals. To reap its maximum benefits, foreign direct investment requires policies that support the investment environment and also the building of institutional and human capacities to ensure proper execution. Foreign direct investment is not a direct cure to an ailing economy but it can serve as a positive driver of economic growth through the robust economic transformation it provides.

2.1. The Sub-Saharan African Region in Numbers

- The Sub-Saharan region is a home to 49 countries on the African continent namely Nigeria, South Africa, Ghana, Cameroon, Rwanda, Ethiopia, Sudan and South Sudan to mention a few. It is the region of Africa below the Sahara desert and accounts for the vast majority of the African continent with the exception of the North African countries. The Sub-Saharan Africa region is rich in culture as it embodies hundreds of ethnic groups who speak over 2000 languages. According to the World Banks Open Data (2020), the Sub-Saharan African region boasts a population of 1.14 billion people with 60% of the region’s population being below the age of 20years, thereby making it the most youthful region in the world. Despite the promise of a youthful population, the flip side it records 38% poverty headcount ratio, an annual population growth rate of 2.6% and a life expectancy of 62years.On the economic front, the Sub-Saharan region has a gross domestic product of $1.71 trillion, a per-capita income of $1501.2 and a GDP growth rate of -2% (World Bank Data, 2020). The inflation of consumer prices stands at 3.3% while foreign direct investment as a percentage of GDP is 1.8% in 2020. Nigeria is the largest economy in the region with a population of nearly 200 million people. South Africa is a modern economy with modernized industries, financial systems and a GDP of 335 billion dollars. The majority of the Sub-Saharan African countries economies depend on trading such as cocoa, rubber, and crude oil.The Sub-Saharan Africa is geographically well positioned, richly endowed both with natural resources and a youthful labour force thereby placing it in a privileged position to become one of the top destinations for foreign direct investment. However, the reverse has been the case as poor leadership, bribery and corruption and other societal vices have plagued its development for years, as (UNCTAD, 2020) reports that as at 2020, Sub-Saharan Africa still accounts for less than 4% of world total investment.

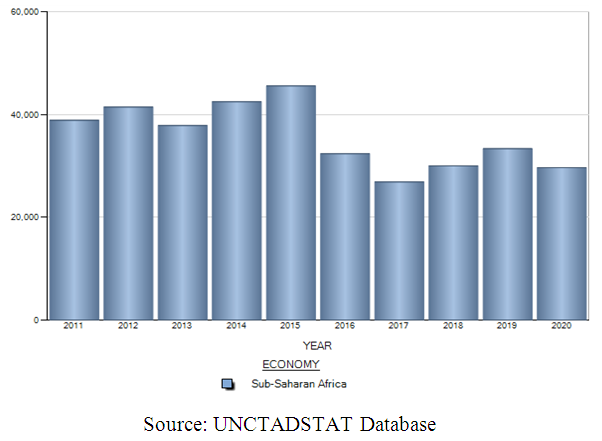

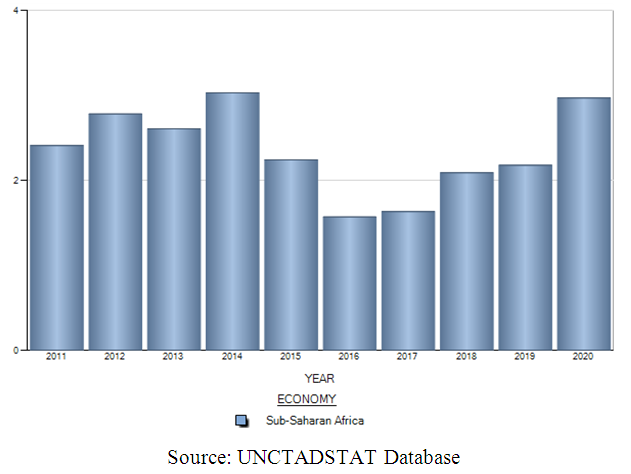

2.2. A Brief Analysis of Foreign Direct Investment Inflow into the Sub-Saharan African Region (2011-2020)

- The majority of the countries in the Sub-Saharan African region are mainly developing countries whose economy largely depend on commodity trading. Foreign direct investment is viewed by the region as a means of making up for shortfalls in domestic investments as well as driving economic growth. However, foreign direct investment inflow into the region also comes with certain economic implications, this study therefore intends to take a deeper dive into the actual implications of foreign direct investment inflow into the region by reviewing the foreign direct investment inflow data. Data used in this section are obtained from UNCTAD database.Sub-Saharan Africa region Total Foreign Direct Investment Inflow (2011-2020) USD at current market price (millions)

| Figure 1 |

| Figure 2 |

3. Empirical Analysis

3.1. Source of Data collection and Data Description

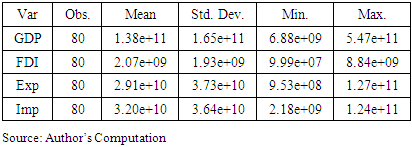

- The empirical analysis carried out in this of this paper is based on panel data analysis. The basic data used in the course of this empirical analysis is a set of panel data obtained from 8 countries of the Sub-Saharan African region and the time frame in consideration is 2011-2020. The gross domestic product of the Sub-Saharan African countries in the sample size served as the dependent variable, while foreign direct investment net inflow, net import of goods and services, net export of goods and services were used as the independent variables. The data for the variables used in the empirical analysis were obtained from the World Bank data(World Development Indicators). The research method used in this section is divided into two namely; static panel data approach and the dynamic panel data approach. The Fixed Effect(FE), Random Effect(RE) and the Generalized Least Square(GLS) methods all belong to the static panel data approach while the Hausman test was used to choose between the Fixed and Random Effect. The Generalized Method of Moment (GMM) represented the dynamic panel data approach and results obtained from the static panel data analysis were compared to the dynamic panel data analysis on a coefficient significance basis. The empirical analysis will be carried out using the STATA application.

3.2. Method of Data Analysis

- The Fixed Effect (FE) belongs to the static panel data analysis method. It strives to explain the relationship between dependent and independent variables within a unit. Since each unit has its own individual characteristics which may or may not be correlated to the explanatory variables, there is need to control for bias which may arise from the correlation of the unit and its predictor or predicted variable and this is the foundational idea behind correlation in the fixed effect model. The FE method does not allow for time invariant variables to serve as predictor variables and this ensures that only the net effect of the predictor variables is being considered. In the event where the FE is not suitable, the random effect model will be preferred as a better approach to model the relationships within the economic unit.The Random Effect (RE) also belongs to the static panel data analysis method. The RE method assumes that individual characteristics of an economic unit is random and uncorrelated with the explanatory variables within the unit. The RE unlike the FE allows for time invariant variables to serve as explanatory variables since the explanatory variables are assumed to be uncorrelated to the error term. A major challenge faced when using the RE is that of the problem of omitted variables which may arise due to unavailability of some variables due to missing data.The Hausman’s test is a universally accepted test for choosing between the fixed effect and the random effect. It tests the the null hypothesis (RE is preferable) and alternative hypothesis (FE is preferable) by considering the co-efficient estimated by the models. Either the fixed effect or random effect is preferred depending on how significant the estimates of the P-value is.The Generalized least Square is a panel data approach that is introduced as a result of certain statistical limitations that is associated with the ordinary least square which may lead to poor decisions arising from case of homoskedasticity. The GLS is used in a linear regression model to estimate unknown parameters and is applied when there is a certain level of correlation between the variables in the model.The Generalized Method of Moments belongs to the dynamic panel data analysis method. The GMM aids resolve the problem of endogeneity of explanatory variables and at the same time gives room for the inclusion of lagged dependent variable as an independent variable. The GMM has been developed over the years first by Holtz-Eakin et Al (1988), Arrellano and Bond (1991), Arellano and Bover (1995), and Blundell and Bond (1997). This paper inculcates a one-step GMM as part of the dynamic panel data approach.

3.2.1. Research Hypothesis

- HO = Foreign direct investment has a positive effect on Sub-Saharan Africa’s economic growth.H1 = Foreign direct investment has no positive effect on Sub-Saharan Africa’s economic growth.

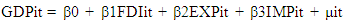

3.2.2. Empirical Model Specification

- The linear equation model we developed below presents the variables to be used in the model in their logarithmic form below:

| (1) |

4. Analysis and Results

4.1. Descriptive Statistics: Country Coverage for Equation 1

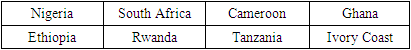

- For the purpose of the empirical analysis, a panel of eight (8) Sub-Saharan African countries were selected to serve as the sample size. These countries embody majority of the attributes associated with the region, and were carefully selected based on their recent trends in economic growth and FDI inflows, hence this serves as a strong justification to use them as part of the sample size and make inferences based on the results obtained. The countries are listed in Table 1.

|

|

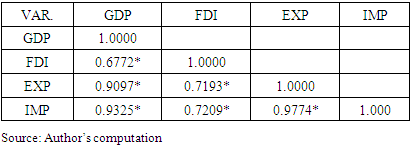

4.2. Correlation Matrix for Equation 1

- This study uses the pairwise correlation matrix to show the level of correlation that exists among the variables under consideration. Table 3. presents the correlation matrix for equation 1.

|

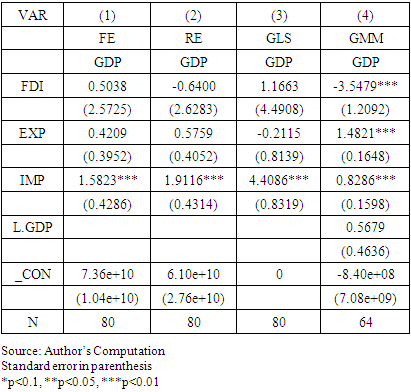

4.3. Empirical Results Interpretation

- This section of the empirical analysis presents the results of the estimates obtained from the Fixed Effect(FE), Random Effect(RE), Generalized Least Square (GLS) and the Generalized Method of Moments. The estimates obtained will be compared on a co-efficient significance basis.

|

4.4. Conclusions

- Foreign direct investment inflow into the Sub-Saharan region has experienced lots of fluctuations between 2011-2020, with the second half of the decade witnessing a downward trend in investment inflow. Scattered across face of the Sub-Saharan region are countless projects and foreign investments that have not produced the expected result, and this has raised many questions especially among the African elites about credibility, accountability, motive and ultimate consequences of these investments on the Sub-Saharan region economic growth and development.This study examined the effect of foreign direct investment on Sub-Saharan Africa’s economic growth. The study sets out by laying a theoretical foundation of what foreign direct investment is all about, a brief introduction of the Sub-Saharan Africa region supported by statistical figures and an analysis of foreign direct investment situation in the region between 2011-2020. The study then proceeds to the empirical section which used a panel data of eight countries from the Sub-Saharan Africa region as sample size and the time period taken into account was 2011-2020. The results shows that the main variable of interest foreign direct investment have negative effects on the economic growth of the region, while other variables such as import and export of goods and services proved to have positive effects on the region’s economy. This proves that foreign direct investment not only have not contributed to the economic growth of the region within the time frame but also have hampered the economic growth of the Sub-Saharan Africa region given the negative co-efficient shown by the results. This view is supported by Blomstrom, (2005), whose research ‘Does Foreign Direct Investment Promote Development’ also projects the same notion that foreign direct investment can as well lead to negative effects on a country’s economic growth and development.The findings from the study proves that foreign direct investment has a negative effect on Sub-Saharan African region’s economic growth between 2011-2020.

4.5. Recommendations

- The results drive the following recommendations:Re-examining of Existing FDI projectsResults indicates that most foreign direct investment inflows into the Sub-Saharan region in most cases hinder economic growth. Therefore, there is need to first address the problem of unproductive and failed investments within the region, and then ensure a proper appraisal of incoming foreign direct investment proposals to avoid approval of investments that do not support the economic well-being of the Sub-Saharan region.Ensure that New FDIs into the Region Meet the Required StandardThe Sub-Saharan region is not only bedeviled by the problem of failed investments. In addition there is also a risk of approving new foreign direct investments that do not meet the required standard into the region, this ends up recycling a vicious cycle of failures in investments which negatively affects economic growth. Therefore, ensuring that new investments into the region meet the required standard will go a long way facilitate economic growth in the region. Promulgation of Effective Foreign Direct Investment Management PolicyJust like every seed needs a fertile ground to produce good fruit, so does foreign direct investment need an effective management policy to yield economic growth. Some investments go bad because the situation of the domestic economy does not support its flourishing. There is need for government of Sub-Saharan economies to set up effective management policies that enables both foreign direct investment and domestic investment to thrive in order to provide optimum economic benefits for the region. A balanced blend of both investments will go a long way to help arrest the failures of foreign direct investment and the subsequent economic decline in the Sub-Saharan Africa region.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML