-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Advanced and Multidisciplinary Social Science

2016; 2(1): 1-10

doi:10.5923/j.jamss.20160201.01

The Impact of Pensions on the Mean Residual Life Time of Retirees in Tanzania

Michael L. Bukwimba

Department of Statistics, Acharya Nagarjuna University, India

Correspondence to: Michael L. Bukwimba , Department of Statistics, Acharya Nagarjuna University, India.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The paper examines the future life time of retirees after retirement in the United Republic of Tanzania with emphasis on exploring the impact of Pensions on the life a retiree is expected to live just after retirement (longevity). Studies which explore or examine human behavior or status for considering assorted variables such as this require the understanding of overall population characteristics of the area of scrutiny if it should be realistic and meaningful for policy purposes or otherwise. However, in order to achieve this objective the author used primary data which were collected from four selected regions in the country where by a systematic sampling technique was employed and a sample size of 115 retirees who specifically retired in 2007 were obtained. Empirically, the study found out that there are exists strong evidence that retirement pensions implicate the future status of the retirees whether being died or remain alive in a short period of time (i.e 2007 - 2015). The study found that 86.49% of those who depend heavily on pensions as their major source of income have higher mortality risk just after getting retired. Lastly, the study has shown a close link between Retirement pensions and Education level of the retirees.

Keywords: Retirement Mortality, Retirement Pensions, Mean Residual Time, Retirement

Cite this paper: Michael L. Bukwimba , The Impact of Pensions on the Mean Residual Life Time of Retirees in Tanzania, International Journal of Advanced and Multidisciplinary Social Science, Vol. 2 No. 1, 2016, pp. 1-10. doi: 10.5923/j.jamss.20160201.01.

Article Outline

1. Introduction

- This paper examines the future life time of retirees after retirement in the United Republic of Tanzania with emphasis on exploring the factors that affect retirement mortality (retirees’ longevity). Studies which explore or examine human behavior or status for considering assorted variables such as this require the understanding of overall population characteristics of the area of scrutiny if it should be realistic and meaningful for policy purposes or otherwise. On this background it is imperative to present the population characteristics of Tanzania. According to National Bureau of Statistics (NBS) 2012 census the population of the United Republic of Tanzania (Mainland) in 2012 is 43.7 million persons of whom 51% are women, 49% are men and 44% are children under the age of 15 years. It was also showed that out of this population, persons at the age of 60 and above were 2.4 million which accounts for about 5.5%.Every human being is vulnerable to risks and uncertainties at different levels in life with respect to income as a means of life sustenance. In order to fight against these risks, every person requires some form of social security guaranteed by family, community and the society at large. The international Labour Organization (ILO) took some steps in order to insure people at different ages and different levels in life by setting an instrument which was adopted at its 35th session in June 1952, known as “Social Security (minimum standards) conversion No. 102”. The conversion listed down a number of contingencies and benefits required, namely: Old age, Invalidity, Survivorship, Employment injury, Maternity, Medical care, Sickness, Unemployment and Death.Most Literature such as (Wald and Watt, 1997; Musick, 1996; Hummer, 1996; Lee, 1995; Allison et al, 1999; Rogers, 1995 etc.) considered Alcohol taking, Education level, Gender, Health behavior, Income, Marital status, Obesity, Occupation status, Race and Ethnicity, Age and Smoking as among the factors which may affect mortality of older people after retirement (Robert L. Brown and Joanne McDaid, 2013). With regard to this study, the researcher worked on the following factors: Income (Retirement Pensions), and Education level before and after retirement.

1.1. Retirement Pensions (Life Annuity)

- Social Security Schemes in Tanzania as it is supported by the Oxford Policy Management (2010), the retirement benefit in Tanzania has been portioned into two: As a lump sum and as a life Annuity. This means that, some of the retirement benefit is paid as a lump sum on retirement and the remaining is automatically converted into life Annuity1. Life Annuity is seen as a major source of income particularly for low income earners before retirement and who do not have any other source of income such as Asset investment, Shares investment etc.

1.2. Education Level

- Education is an integral aspect of development because well-educated masses are better equipped to make large scale social improvements by means of business or government action Lisa et al (2008). Education was regarded as a major link between employment, income and access to health facilities. In formal sectors therefore, higher education implies higher income (Salary) and hence mortality in all age groups is minimized.The Statistical Bulletin (1975) states that, occupation; education and income are associated with health and longevity. On the other hand Rogers et al (2000b) has commented that not only does education has some effects on mortality through its link to employment, income generation and access to information, but also it affect mortality by influencing health behavior and access to health facilities.Some empirical researches examined the relationship of combined variables (See: Hurd et al, 1996; Knox and Tomlin , 1997; Preston and Elo, 1995) and others report on factors that affect retirement mortality and hence the mean residual life is shortened, but these studies are found to concentrate on developed economies and notably few in developing countries and so limited studies in Tanzania context especially those that link the longevity of retirees and different factors such as retirement pensions and education to be more specific. Despite the fact that many studies have been conducted on the factors affecting retirement mortality and on its related topics worldwide, but in the United Republic of Tanzania little is known on the extent that Retirement Pensions may affect the mean residual life time (Retirement Longevity) of retirees. In response to this gap, this has been designed to bridge and in particular narrow down the gap on one hand and to examine systematically the association between the future life time after retirement (Mean Residual Life Time) and retirement pensions as the major source of income for most retirees. This study is important in the sense that its findings will add relevant knowledge to what is known in the field of Actuarial Science on whether the future life time of the retirees is being affected by Education level prior retirement and Retirement Pension (Life Annuity), assuming other factors are held constant. The rest of the paper is organized as follows; section 2, data and methodology; section 3, Results and discussion, Retirement pensions and education, section 4, Conclusion and implication.

2. Data and Methodology

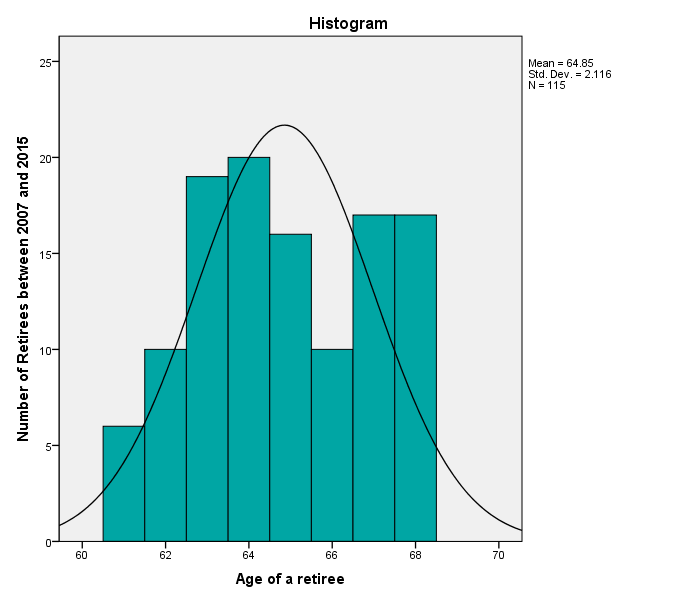

- In order to achieve this end the author used primary data which were collected from four selected regions and a systematic sampling employed to obtain a sample size of 115 retirees. However, a structured questionnaire used to capture information from 2007 retirees. Cross tabulations were constructed as well as survival analysis was performed to identify which group of retirees is at high risk of dying.

3. Results and Discussion

- With regard to insufficient resources such as time and other important resources, this paper constrained its self on examining only two factors namely: Retirement pension and Education level.

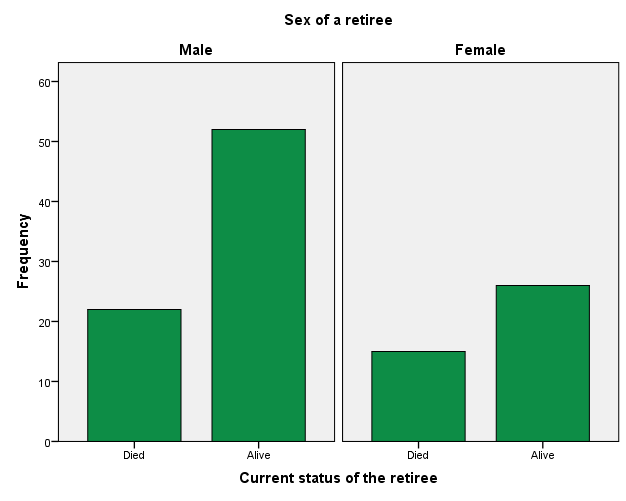

3.1. The Effect of Pension Amounts on Life after Retirement

- An employee who is governed by the Pension Scheme gets a recurring monthly payment termed as pension for life on reaching the age of superannuation or if she/he is retired earlier in accordance with existing rules and regulations. According to Social Security Regulatory Authority (SSRA) on the social security schemes (pension Benefit Harmonization) Rule, 2014 under the Social Security Regulatory Authority Act.8 of 2008 as amended; stipulates the harmonized formula to all pension schemes and the type of factors considered in realizing the pension amounts.Monthly Pension = (1/580 x Number of Months contributed X Annual Pensionable Emoluments) x 75% x 1/12And the factors considered are:F The annual accrual factor which is 1/580 per monthF The commutation rate shall be 75 per centum of the annual full amount of the pensionThus, from the above formula we can now draw that, the smaller the Annual Pensionable Emolument the smaller the old age pension amounts. In order to understand the effect of pension amount on life after retirement it is imperative to firstly describe the current status of retirees in the country. Figure 3.1 below depict the retirees’ status quo by sex as of 2007 retirees.

| Figure 3.1. The 2007 Retirees’ Current Status by Sex |

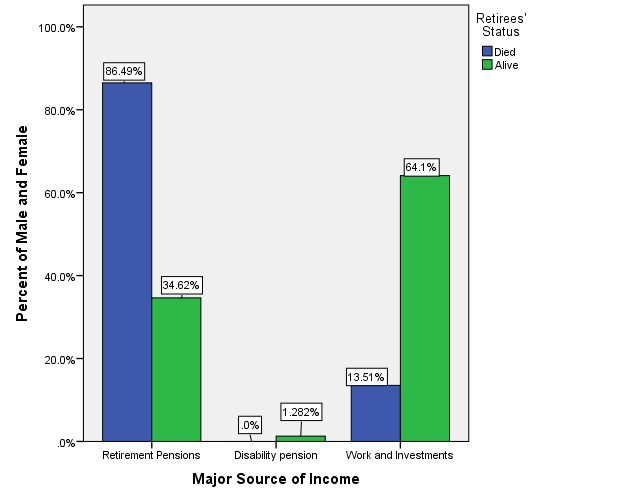

3.2. Pensions as a Major Source of Income

- The major source of income to most of older people in the world is said to depend highly on public and private pension in form of earnings related or resource – tested benefits which account for an average of nearly 59% of their income in the 34 OECD countries (OECD, 2013). In the United Republic of Tanzania to be more specific, the situation is even worse simply because it indicates that 51.3% of retirees interviewed depend greatly on pensions as their major source of income (see Fig 3.2 below). This is due to the fact that Tanzania is among the poorest countries in the world and hence the per capita income and economic status of the country is relatively low compared to OECD countries such that even if they depend highly on pension (59%) the retirees may still experience a fairly good standard of living.

| Figure 3.2. Major Source of Income of the 2007 – 2015 Retirees |

3.3. Poverty as a Cause of Immediate Death after Retirement

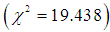

- Quite a number of literature evidenced that poverty is a multidimensional social phenomenon that affect people`s life span. Poverty is significantly measured using various quantitative methods Sen (1997); Foster and Sen (1997); Lipton and Ravallion (1995). All of them commented that the definition of poverty and its causes vary by gender, age, culture and other socio – economic contexts. For instance, most men in rural Tanzania associate poverty with the lack of material assets where as for women poverty is taken as food insecurity.According to (Latvia, 1998); poverty is humiliation, the sense of being dependant on them and of being forced to accept rudeness, insults, and indifference when we seek help. Now with regard to pension being the major source of income to most of retirees in the United Republic of Tanzania and given the fact that the amounts paid to them as pension payments is insufficient; to them Poverty is associated with the lack of ability to generate income, being dependant to meager payments made by public and private pension schemes and forced to accept a non-participatory planning.It has been observed that 81% of the retirees who found died within the first eight years of their retirement (2007 - 2015) lived below the poverty line. In other words, two groups namely those received pensions less than 50,000TZS and those received between 50,000 – 100,000TZS inclusive constitute an 81% of the retirees died due to the fact that they lived below the poverty line. It also indicates an expenditure of USD1.542 per person per day (see table 3.1). This is being evidenced by one of the mechanisms used by World Bank to measure poverty. The World Bank considered USD1.25 per person per (PPP) day as the value of resources needed to survive above the poverty line, and hence anyone who lives on less than the daily amount is considered to be poor (World Bank, 2005).

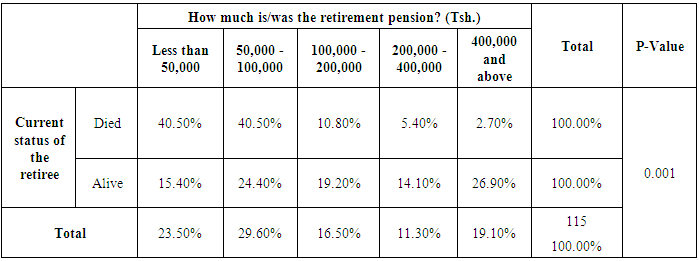

|

and the p-value

and the p-value  give us strong statistical evidence to reject the hypothesis as the p-value is far below the significance level of 5%, and hence the current status of the retiree (either Died or Alive) is being influenced greatly by the pension amounts received by a retiree per month.

give us strong statistical evidence to reject the hypothesis as the p-value is far below the significance level of 5%, and hence the current status of the retiree (either Died or Alive) is being influenced greatly by the pension amounts received by a retiree per month.3.4. How Education Level Affects Pension Amounts?

- Education is one of the most important investments a country can make to her people and its future, at the same time education is termed to be a key factor in reducing if not completely eradicating poverty and inequality.Higher education level attained by an employee during working life has a greater implication on both terminal benefits and on pension amounts as it influences appointments or promotion to higher positions of which brings in more income (higher salaries and other fringe benefits) much better than the previous positions. From the figure 3.3 below we clearly see that as the education level of a person who is still employed rises from secondary eduacation and tertiary education level to University education level, brings in some positive financial impact at retirement life. Pension amounts grows significantly from below 50,000TZS to 400,000TZS and above.

| Figure 3.3. Relationship between Pension Amounts and Education Level |

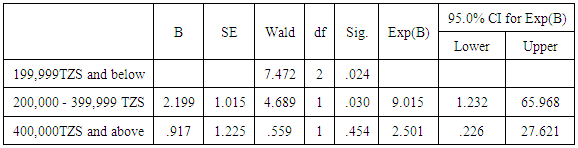

3.5. The Cox Regression Model

- The Cox model sometimes it is referred to as the Cox Proportional Hazard model (PH) is a statistical technique for exploring the relationship between the survival of a patient and several explanatory variables. In our case, it is concerned with exploring the relationship between the survival of the 2007 ritirees over retirement pensions and education as explanatory variables.The Cox model allowed us to estimate the hazard (or risk) of death for a retiree given the explanatory variables (see table 3.3 below). The hazard function is the probability that an individual will experience an event (eg. Death) within a small interval of time, given that an individual has survived up to the beginning of the time interval.

|

, 2:

, 2:  and 3:

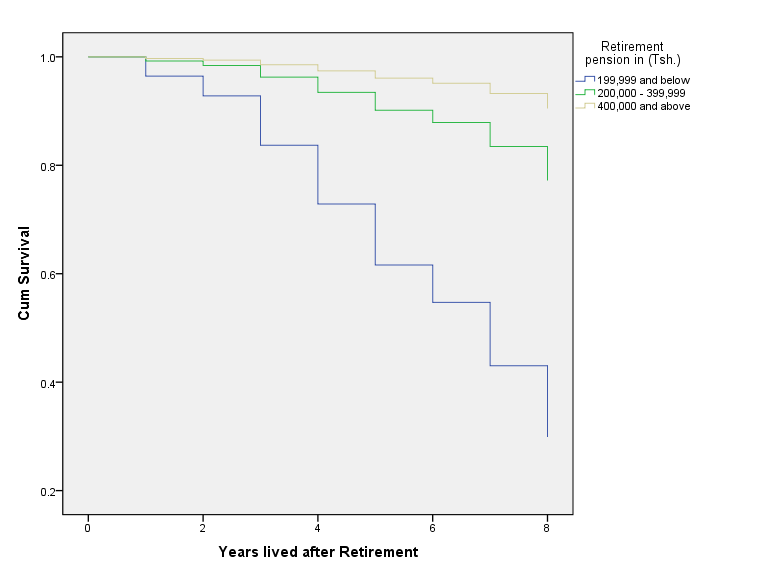

and 3:  as indicated in table 3.3 above.The coefficients of the regression model from table 3.3 above (i.e

as indicated in table 3.3 above.The coefficients of the regression model from table 3.3 above (i.e  ) are all positive which indicates a higher risk, though the third group has lower risk relative to second and first groups. A similar observation on the proportional hazard ratio decreases with an increase in pension amounts. That is to say, the hazard proportional ratio of being in group 2 (200,000 – 399,999TZS) is 9.015 lower than group 1 i.e. those who earn (199,999TZS and below) with a 95% confidence interval of 1.232 to 65.968. the p-value (p=0.030) suggests a statistical significance at the 5% level and thus, there is these two groups experience different risks where by the former is in higher risk compared to the later group.Similarly, the proportional hazard ration of being in group 3 i.e.

) are all positive which indicates a higher risk, though the third group has lower risk relative to second and first groups. A similar observation on the proportional hazard ratio decreases with an increase in pension amounts. That is to say, the hazard proportional ratio of being in group 2 (200,000 – 399,999TZS) is 9.015 lower than group 1 i.e. those who earn (199,999TZS and below) with a 95% confidence interval of 1.232 to 65.968. the p-value (p=0.030) suggests a statistical significance at the 5% level and thus, there is these two groups experience different risks where by the former is in higher risk compared to the later group.Similarly, the proportional hazard ration of being in group 3 i.e.  relative to reference group is 2.501 that is to say, this group experience even less risk relative to group 1(one) as a reference group. and the p-value (p=0.454) suggests that there is no statistical significance at 5% level. That is to say, the retirees’ reference group

relative to reference group is 2.501 that is to say, this group experience even less risk relative to group 1(one) as a reference group. and the p-value (p=0.454) suggests that there is no statistical significance at 5% level. That is to say, the retirees’ reference group  and the one which receives higher amounts

and the one which receives higher amounts  experiences two different risks of death, such that those earning

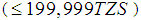

experiences two different risks of death, such that those earning  per month has relatively lower risk of dying given that retirement pensions is the solely means of income.Figure 3.4 below is the survival function of three retirees’ groups divided on the basis of their retirement pensions. It depicts that the group earning higher retirement amounts of

per month has relatively lower risk of dying given that retirement pensions is the solely means of income.Figure 3.4 below is the survival function of three retirees’ groups divided on the basis of their retirement pensions. It depicts that the group earning higher retirement amounts of  seems to be in better position of living longer that other two groups as shown below. The group of retirees which seems to have lower survival rate is one that earns

seems to be in better position of living longer that other two groups as shown below. The group of retirees which seems to have lower survival rate is one that earns  , the figure portrays that, this group has better survival rate within the first three years of their retirement and it approaches zero as twenty years of their retirement time. The truth is that group one as per categorization above

, the figure portrays that, this group has better survival rate within the first three years of their retirement and it approaches zero as twenty years of their retirement time. The truth is that group one as per categorization above  has lower survival rate as indicated in figure 3.4.

has lower survival rate as indicated in figure 3.4. | Figure 3.4. 2007 Retirees’ Survival Function |

.

. | Figure 3.5. 2007 Retirees’ Hazard Function |

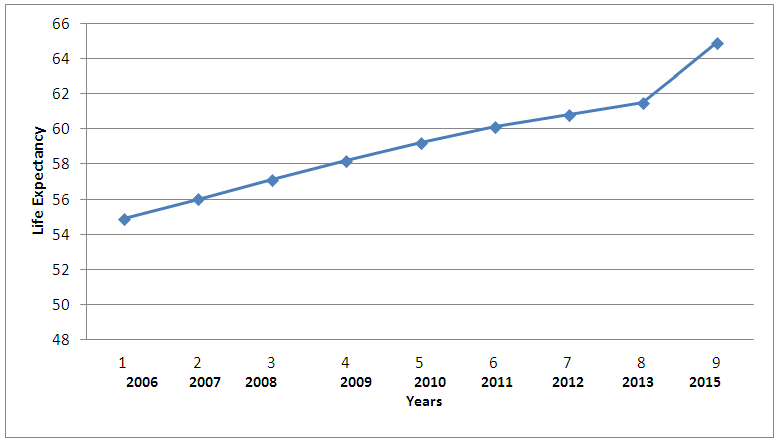

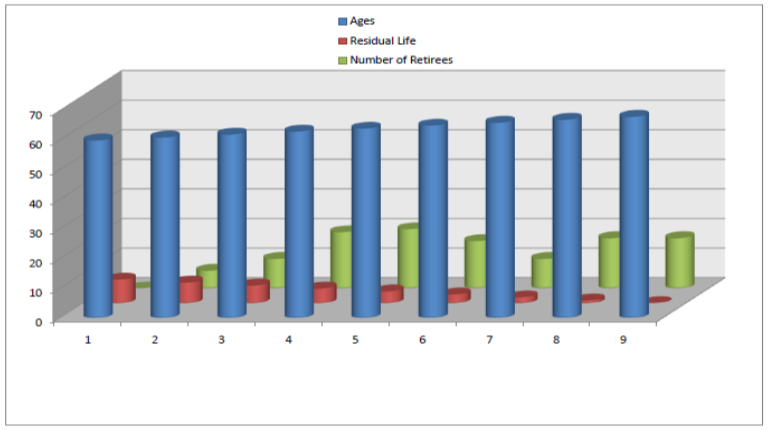

3.6. Average Future Life Time (Mean Residual Life) of the Retirees

- The findings indicate that the total life expectancy at birth (both male and female) in the United Republic of Tanzania in 2015 is 64.9 years that means, most of the respondents had an average age of around 64 years. On the other hand it was found that the life expectancy for male was 64 years while that of female was 67 (see figure 3.6) below.

| Figure 3.6. Years lived after Retirement |

| Figure 3.7. Tanzanians’ Life Expectancy at Birth Trend |

| Figure 3.8. Residual Life for Retirees from 2007 to 2015 |

4. Conclusions and Implication

- Empirically, the paper found out that there are exists strong evidence that retirement pensions implicate the future status of the retirees whether to die soon or remain alive. The study found that 86.49% of those who depend heavily on pensions as their major source of income they are at higher risk of dying just after getting retired. On the other hand the study found some supporting evidence that, having multiple sources of income improves the well being of a human being and hence early death just after retirement is minimized, that is, there is only 13.51% of those having multiple sources of income (i.e Pensions, Postretirement work and investment income) experienced death while 64.1% of those with multiple income survived within eight years of their retirement period.Nevertheless, the study considered the 2007 group of retirees due to a number of reasons including the scarce resources like fund, time and other resources which were allocated for the study, but the aim was to explore retirees’ situation given a short period of time i.e from 2007 to 2015. It was found that, the Mean Residual Life (MRL) of retirees’ is only 5 years from the date of retirement but it diminishes quickly as the retirees are getting older and older (see fig. 3.8). Education is explained to be a critical link to retirees’ future life time through pensions as it has been shown in the discussion above. Therefore, since education is the key criterion for a person to be employed, promoted and or being appointed to a higher position, employees who are expected retirees in fact are supposed to educate themselves in order to attain higher levels of education during their working life so as to improve their income in terms of salary and hence improve retirement pensions. Therefore the findings of this study should also send alarming information to the Social Security Regulatory Authority (SSRA) on behalf of the Government to formulate appropriate rules, regulations and policies to suite the present and future life times of the retirees.

Notes

- 1. Monthly payment to the retiree is offered until he/she dies2. www.bloomberg.com/quote/USDTZ:CUR as retrieved on 30/09/20153. www.data.worldbank.org/indicator as retrieved on 13/11/2015

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML