-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Probability and Statistics

p-ISSN: 2168-4871 e-ISSN: 2168-4863

2015; 4(1): 32-35

doi:10.5923/j.ijps.20150401.03

Extreme Value Theory in Financial Risk Management: The Random Walk Approach

Michael L. Bukwimba

Research Scholar in the Department of Statistics at Acharya Nagarjuna University, Nagar India, And he is working for the Institute of Finance Management, Dar es Salaam, United Republic of Tanzania

Correspondence to: Michael L. Bukwimba, Research Scholar in the Department of Statistics at Acharya Nagarjuna University, Nagar India, And he is working for the Institute of Finance Management, Dar es Salaam, United Republic of Tanzania.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Insurance companies, financial institutions and any other business firms should conduct what we call self evaluation on whether they are playing within the risk free boundaries by applying the random walk technique in determining the extreme points. This paper will concentrate on evaluating the memory less timeTat which the company is assumed to reach the highest return, or at which the company will achieve weak minimum return. At either point, it is said to be unsafe for the profit oriented firms to operate. The extreme value theory is highly employed in Actuarial Industry particularly in financial risk management when the company or firm wants to set out the risk free demarcations to operate or play around, and in the situations where the Company wants to conduct self performance evaluation, making forecast over a period of time and making any Economical based decisions. The author believe that, there is a more and detailed information contained in the text that follows, and it is his sincere hope that this paper will increase motivation of researchers interested in a more broadly based risk management in finance.

Keywords: Random Walk, Financial risk Assessment, Stopping Times, Memory less Time, Peaks and Dips

Cite this paper: Michael L. Bukwimba, Extreme Value Theory in Financial Risk Management: The Random Walk Approach, International Journal of Probability and Statistics , Vol. 4 No. 1, 2015, pp. 32-35. doi: 10.5923/j.ijps.20150401.03.

Article Outline

1. Introduction

- The extreme value theory is a blend of an enormous variety of applications involving natural phenomena such as rainfall, floods, wind gusts, Air pollution, corrosion etc (Chang Hsien-kuo).Historically, work on extreme value problem may be dated back to as early as 1709 when Nicolas Bernoulli discussed the mean largest distance from the origin when points lie at random on a straight line of length . [see Gumbel, 1958]In the history of finance, risk management has been identified as one of the most important field of interest to financial and risk Managers in the 20th century, or rather as among the three major areas of interest following the Markowitz portfolio theory and the Black-Sholes-Merton option pricing theory (Cairns A, 2004). In recent years, we have noticed evidences all over the world the huge development of the field of financial risk management which resulted from the global financial crisis that emerged in 2008 which intensified the need of risk management among financial institutions and insurance companies (TANG Qihe).The Extreme value theory (EVT) holds promise for advancing assessment and management of extreme financial risks. Recent literature suggests that the application of Extreme value Theory generally results in more precise estimates of extreme quantiles and tail probabilities of financial asset returns (Embrechts P. et al, 1999).In regard to this paper, the author will discuss concisely the application of Extreme value theory in the field of financial risk management which is the foremost objective for financial institutions and insurance companies by the help of the Random Walk concept.

1.1. Extreme Value Theory

- Extreme value theory (EVT) is a tool used to determine probabilities (Risks) associated with extreme events. It is used by Investors in situations where there is/expected to occur higher stress on investment portfolios. The EVT is also used to model the behavior of tips (Maxima) and or dips (Minima) in a series of asset returns etc.VaR approach was the standard measure of financial risks and other risks such as Industrial risk management etc. Basically, it used to measure the expected loss over a period of time for known distribution of for known probability and under normal market conditions. (Longuin, 1999).Recently, Portfolio managers, Investors, Risk managers, Claim managers etc, have become more concerned over occurrences under “Extreme market conditions”.This paper is organized as follows: Section 2 introduces the risk management and approaches to minimize financial risks, section 3 describes the Random walk movement as a result of extremes, and section 4 concluding.

2. Risk Management

- Risk management is the process of Identification, Assessment and Decision making over the risks facing an Organization. It can be Formal process which involves Procedures, Quantitative and Qualitative assessments, or it can be Informal (Peter Moles, 2013).

2.1. Approaches for Decision Making

- After the risk has been identified on its nature and type, assessment has taken place i.e how big the risk is, the probability to occur and when it is going to happen, then, the decision makers of the Organization or Firm may opt on the following three generic approaches:• Hedging: Eliminate risk by selling into the market place through cash or spot market transactions or through Forward, Future and Swap contracts.• Diversification: This reduces risk by combining risks which are not perfectly correlated to form a portfolio.• Insurance: Risks are transferred from the buyer (Policyholder) to the seller i.e Insurer (Peter Moles, 2013).

3. Intuition of the Random Walk

- It is essential for Insurance Companies, Financial Institutions and any profit oriented firm to conduct an evaluation as to when the company is expected to earn a maximum returns or highest profit together with the question how much is that maximum return value.On the other hand, it would be of important interest for the company to know when it is expected to be ruined so that the required but optimal measures can be adopted against the crisis and also to rescue from loss of potential shareholders and against bad reputation to customers. The company may also be interested to learn whether it will remain liquid forever i.e what happens to the company’s returns at

, and ultimately what will be the distribution of the value of

, and ultimately what will be the distribution of the value of  so that it can ensure the capital of their shareholders as well as to ensure continuous dividend payments and other benefits to its customers.This paper tried to explore some mathematical techniques which will be helpful in computing the time at which the company will be at the highest peak (maximum returns) or the least dip (minimum returns), as well as when

so that it can ensure the capital of their shareholders as well as to ensure continuous dividend payments and other benefits to its customers.This paper tried to explore some mathematical techniques which will be helpful in computing the time at which the company will be at the highest peak (maximum returns) or the least dip (minimum returns), as well as when  .The returns will be mainly expressed in discrete time (Random Walk) and then studying a variety of stopping times using the strong Markov property. The cycles which are generated by stopping times iterates are assumed to be independent and identically distributed.Let us now introduce the memory less time

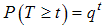

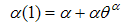

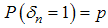

.The returns will be mainly expressed in discrete time (Random Walk) and then studying a variety of stopping times using the strong Markov property. The cycles which are generated by stopping times iterates are assumed to be independent and identically distributed.Let us now introduce the memory less time  with distribution

with distribution  where is smaller than (but close to 1 so that

where is smaller than (but close to 1 so that  is large). Since we are interested with the maximum and minimum before

is large). Since we are interested with the maximum and minimum before  , these will be determined by the last peak stopping time

, these will be determined by the last peak stopping time  and the last dip stopping time

and the last dip stopping time  before time

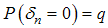

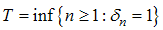

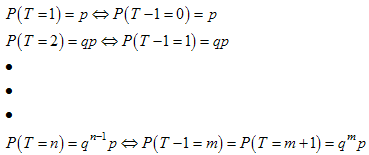

before time  respectively.Now, by distribution

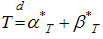

respectively.Now, by distribution  Where

Where  and

and  are independent stopping times, similarly

are independent stopping times, similarly Where

Where  denotes the sum of independent random variables, and that

denotes the sum of independent random variables, and that  and

and  is the value at the highest peak stopping time and the value at the least dip stopping time respectively and they are said to be independent random variables.

is the value at the highest peak stopping time and the value at the least dip stopping time respectively and they are said to be independent random variables.3.1. Random Walk

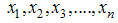

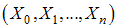

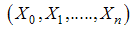

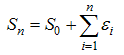

- The idea of Radom Walk originated from considering a completely a drunk person who walks with no sense of direction. So she /he may move forward with equal probability that she/he moves backwards. A similar notion is found in financial environment or financial markets where the returns from a single asset have found to be mutually independent and identically distributed.By definition: If we let

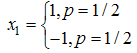

be a sequence of independent and identically distributed

be a sequence of independent and identically distributed  random variables (Returns), and that

random variables (Returns), and that  to be a stochastic process, then

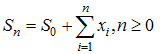

to be a stochastic process, then Where

Where  Again let us also consider the following situationIf

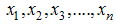

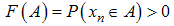

Again let us also consider the following situationIf  are independent and identically distributed (i.i.d) random variables and let us fix some set A such that

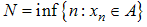

are independent and identically distributed (i.i.d) random variables and let us fix some set A such that  i.e the first time any member of

i.e the first time any member of  to be contained in set A. also we know that

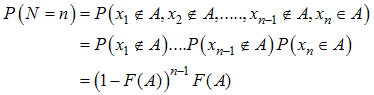

to be contained in set A. also we know that  Then

Then The geometric Random walk model implies that the future is independent of the past and therefore it is not possible to predict the future deviation trends.

The geometric Random walk model implies that the future is independent of the past and therefore it is not possible to predict the future deviation trends.3.2. Stopping Times

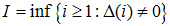

- Stopping time is a random variable

which takes place in units of time such that

which takes place in units of time such that  is a function of

is a function of  for all

for all  . Examples is like the first time returns of the company reach a certain peak, and or the first time a share price reaches a certain level after dropping by a specified amount.Let us now consider the iterates of a stopping time

. Examples is like the first time returns of the company reach a certain peak, and or the first time a share price reaches a certain level after dropping by a specified amount.Let us now consider the iterates of a stopping time  such that, if we define

such that, if we define  be the n-th iterate, and let

be the n-th iterate, and let  be defined by

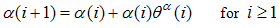

be defined by  , then we can say that

, then we can say that Thus, in general

Thus, in general  In this case a set of independent random stopping times are generated i.e

In this case a set of independent random stopping times are generated i.e  . In other words we can say that

. In other words we can say that  for

for  are the peaks such that the returns reaches before falling, and therefore

are the peaks such that the returns reaches before falling, and therefore

in terms of their magnitudes.But our major interest is on the last peak before time

in terms of their magnitudes.But our major interest is on the last peak before time  Let,

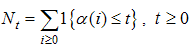

Let,  Be the counting process associated to the iterates of stopping times

Be the counting process associated to the iterates of stopping times  , then

, then  , for all

, for all  Where

Where  becomes the last time before memory less time

becomes the last time before memory less time  of which we are interested in.

of which we are interested in.3.3. Random Walk Stopping Times and the Strong Markov Property

- A stopping time is a random variable taking values in the time – set including possibly the value of

such that

such that  is a deterministic function of

is a deterministic function of  for all

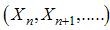

for all  .The Markov property states that: For any

.The Markov property states that: For any  the future process

the future process  is independent of the past process

is independent of the past process  if we know the present

if we know the present  , and thus this remains true if we replace the deterministic

, and thus this remains true if we replace the deterministic  by a random stopping time

by a random stopping time  .Strong Markov property: Suppose

.Strong Markov property: Suppose  is a time – homogeneous Markov chain. Let

is a time – homogeneous Markov chain. Let  be a stopping time, then conditional on

be a stopping time, then conditional on  and

and  , the future process

, the future process  is independent of the past process

is independent of the past process  and has the same law as the original process started from

and has the same law as the original process started from  .

.3.4. Stopping Times Path into Cycles

- Let us also consider another random walk

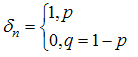

By tossing a fair coin, let

By tossing a fair coin, let  where

where  and

and  , also let us define

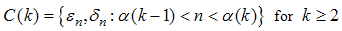

, also let us define  be the first cycle to contain

be the first cycle to contain  and that

and that  for which

for which And that

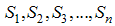

And that  are independent and identically distributed random cycles produced by stopping times iterates such that;

are independent and identically distributed random cycles produced by stopping times iterates such that;

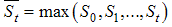

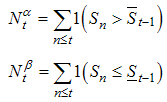

3.5. Peaks and Dips of Cycles

- In this section therefore, we will concentrate on peaks and dips of various cycles formed during the process, particularly the last peak and dip before success time

, that is before the time at which the company attains the maximum value and or the weak minimum value.Let

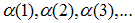

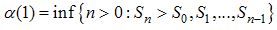

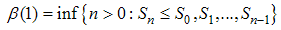

, that is before the time at which the company attains the maximum value and or the weak minimum value.Let  be the time for the first peaki.e

be the time for the first peaki.e  it follows that

it follows that for and

for and  Similarly,Let

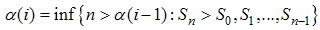

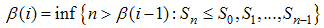

Similarly,Let  be the time for the first dipi.e

be the time for the first dipi.e  and hence

and hence for

for  and

and  And therefore we can say that

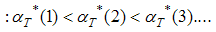

And therefore we can say that  is the k-th time

is the k-th time  value becomes strictly larger than all previous values defined by

value becomes strictly larger than all previous values defined by  Similarly we can also say that

Similarly we can also say that  is the k-th time

is the k-th time  takes smaller value than or equal to all previous ones, defined by

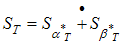

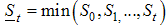

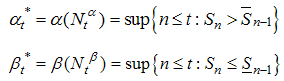

takes smaller value than or equal to all previous ones, defined by  Thus, the corresponding counting processes are

Thus, the corresponding counting processes are For this reason we can say that,

For this reason we can say that, Where

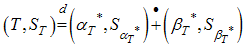

Where  and

and  are the last peak and dip before hitting time

are the last peak and dip before hitting time  respectively.Now, from section 1.4, we know that

respectively.Now, from section 1.4, we know that  and

and  ; again let us think the situation when

; again let us think the situation when  and define

and define  then

then After several observations of tosses of a biased coin, assume now that we got the cycle that contain success. Let us now define the following notations.

After several observations of tosses of a biased coin, assume now that we got the cycle that contain success. Let us now define the following notations. be the last peak before success time

be the last peak before success time

be the last dip before success time

be the last dip before success time  Also, let

Also, let  and

and  be the values of the last peak and dip before success time

be the values of the last peak and dip before success time  respectively. And since

respectively. And since  and

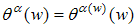

and  they have nothing in common (they are independent), then

they have nothing in common (they are independent), then

4. Conclusions

- The extreme value theory is highly employed in Actuarial industry, particularly in the situations where the Company wants to conduct self performance assessment, identifying investment risks, financial risk assessment, making forecast over a period of time and making any Economical based decisions.Returns evaluation or financial risk management and time at which the firm is expected to achieve the maximum/minimum returns (profit/loss) are fundamental tasks to the company and to all profit oriented firms (Risk/Claim managers) as this will help them to identify their risk free operating limits in the sense that; it is too risky for the company to operate at extreme points. For managerial purposes therefore, returns evaluation / assessment has a greater importance to managers and other decision makers to know their risk free operating boundaries.Lastly, since the computations involve strong mathematical models, we clearly need computer software to be able to reach the targeted goals as it is realy convolution to get solution by hand.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML