-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Networks and Communications

p-ISSN: 2168-4936 e-ISSN: 2168-4944

2017; 7(3): 63-70

doi:10.5923/j.ijnc.20170703.03

Secondary Users Market Equilibrium Pricing with an Opportunistic Perspective in Cognitive Radio Networks

B. Basaveswar Rao1, Edwin Marco Kwesigabo2, K. Gangadhara Rao3, K. Chandan4

1Programmer, University Computer Centre, Acharya Nagarjuna University, Guntur, India

2Research Scholar, Department of CSE, Achary Nagarjuna University, Guntur, India

3Associate Professor, Department of CSE, Acharya Nagarjuna University, Guntur, India

4Professor, Department of Statistics, Acharya Nagarjuna University, Guntur, India

Correspondence to: Edwin Marco Kwesigabo, Research Scholar, Department of CSE, Achary Nagarjuna University, Guntur, India.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper analyses opportunistic access and pricing equilibrium of secondary user in cognitive radio networks. Secondary users opportunistically access (buy) the spectrum of primary user (sell) if the channel is idle. The primary users are admitted on channel within bounds which allows admission of secondary user packet. Within the bound primary user has preemptive priority over optimal secondary user, secondary users access the channel opportunistically, primary user does not need to care about the existence of secondary user when it has data to transmit. A time slotted is assumed in which the secondary user sense the state of spectrum at each of the beginning of slot to know if it is occupied or idle. If the slot is idle it is utilized for secondary transmission after satisfaction with price charged per slot. Sensing state of each slot minimize packet delay by preventing the interference with PU. The number of packets and their waiting time is calculated using M/D/1 queuing model. Through using bound as [6], the spectrum demand is determined. By using spectrum size, primary arrival in bounds, spectrum price and operation cost secondary service which depends on secondary packet arrived is calculated. Through market trade off basing on spectrum trading mechanism of selling and buying, size of spectrum equilibrium is calculated.

Keywords: Cognitive Radio Network (CRN), Spectrum demand, Pricing, Spectrum Supply, Spectrum equilibrium, Total spectrum size

Cite this paper: B. Basaveswar Rao, Edwin Marco Kwesigabo, K. Gangadhara Rao, K. Chandan, Secondary Users Market Equilibrium Pricing with an Opportunistic Perspective in Cognitive Radio Networks, International Journal of Networks and Communications, Vol. 7 No. 3, 2017, pp. 63-70. doi: 10.5923/j.ijnc.20170703.03.

Article Outline

1. Introduction

- Radio spectrum is becoming scarce resource due to increase in the usage wireless communication devices and its underutilization. Studies on spectrum utilization show that only small parts of fixed spectrum are actually used at a certain time and location [6]. Cognitive Radio Network has risen as technology of improving spectrum management which solves spectrum underutilization problem. Through using CRN secondary user opportunistically use idle licensed spectrum bands temporarily given that there is no interference with licensed user. Opportunistic spectrum access is the new area of research interest in which the SU opportunistically access idle channel of primary user (PU) to maximize its utilization while creating opportunities for spectrum owner to generate some revenue through selling its idle spectrum. CRN uses the concept of dynamic spectrum sharing in which it share the radio spectrum. The economics of spectrum sharing is referred to as spectrum trading [1]. Spectrum trading between primary user (PU) and Secondary user (SUs) is a popular and efficient way of fulfilling spectrum sharing [12]. Spectrum trading involves spectrum selling and buying process. Major issues in spectrum trading is pricing as price impacts the incentive of primary service providers in selling spectrum services and satisfaction of secondary users in buying services.Through spectrum trading spectrum owner maximizes its revenue by supplying more services depending on spectrum demand, price and operation cost. SU maximizes its satisfactions by utilizing available idle spectrums at the lowest price. Price is important factor which determines spectrum demand and supply as it creates equilibrium in which producer decides how to set price depending spectrum demanded.Optimal SU is admitted within bounds; no optimal SU admitted out of bound [6]. Within bounds spectrum owner is willing to increase spectrum price to maximize its profit while SU needs to utilize spectrums at lowest price to maximize its satisfactions. This paper determines the price for equilibrium point between spectrum supplied and spectrum demanded. The contribution for this paper is spectrum determination size which satisfy spectrum owner and optimal secondary user at different primary arrival rate, spectrum price and operation cost. It has presented a spectrum sharing and pricing scheme between the licensed user (PU) and unlicensed spectrum user (SU) based on spectrum supply and demand functions. The market equilibrium price which satisfies both primary and secondary users is considered as spectrum market solution for demand and supply. Through using demand and supply function optimal total spectrum size has determined in which all spectrum available are utilized and there is no spectrum surplus or shortage. The remaining paper is organized as follows. In section II the review of the literature is presented. The assumed CRN model is depicted in section III. The derived expressions for the utility and supply function of secondary optimization

are presented in section IV. The numerical illustration is given in Section V. Finally conclusions and future scope of research are given.

are presented in section IV. The numerical illustration is given in Section V. Finally conclusions and future scope of research are given.2. Review of the Literature

- The literature on spectrum trading has conduct on most of studies on which secondary users optimizes spectrum utilization. In our knowledge there is no studies conducted on optimum spectrum size for equilibrium in given primary arrivals bounds in deterministic model. Niyato and Hossain, [1] Have proposed a market-equilibrium-based model for spectrum trading between the primary and secondary services using the supply and the demand functions to determine equilibrium. Learning algorithm secondary service has used to estimate spectrum price and adjusted to determine the size of spectrum demand. Spectrum trading equilibrium have achieved through using distributed and iterative algorithm. Niyato, Hossain, and Han, [2] have investigated three different pricing models, market-equilibrium, competitive, and cooperative pricing models for spectrum trading in a cognitive radio environment. In pricing models, primary service providers have different behaviors (i.e., competitive and cooperative behaviors) to achieve objectives of spectrum trading. In market equilibrium pricing model, primary service provider does not care the existence of other primary service; price chosen is that which matches between spectrum supply from primary service and spectrum demand from the secondary users. In the competitive pricing, primary service competes with each other by adjusting price to achieve individual highest profit. They analyzed competitive environment using non cooperative game, and Nash equilibrium. (Paper and Boulder) and (Cao, Zhang, Mark, Cai and Poor) [3, 4] have considered cooperative pricing as win to win situation in which secondary user transmits primary user packet to increase slots in turn secondary user transmit their own packets, they assumed cooperation and exchange of profit information among primary services. (Chun and La, n.d.) [5] Have studied problem of designing a suitable secondary spectrum trading market with multiple sellers and buyers. They proposed general framework and demonstrated features which encourage spectrum trading between potential sellers and buyers. Rao, Kwesigabo, Rao, and Chandan, [6] have analyzed opportunistic access of secondary user in cognitive radio network (CRN) using analytical M/D/1 queuing model. Through spectrum sharing, secondary users opportunistically share/buy spectrum and primary user/sell spectrum when it is idle. In spectrum sharing spectrum owner generates revenue and opportunistic buyer maximizes its satisfaction with spectrum utilization. Number of secondary users and their packet waiting time in the system is calculated. Numerical illustration for the same is presented using utility function upper bound and lower bound of primary arrival was determined. Rao et al., [7] Used primary arrival upper bound and lower bound to determine optimal secondary arrival, maximum spectrum price, minimum spectrum operation cost and service rate bound. Results indicate that optimal secondary arrival increases and decreases depending on reward and state of primary user’s arrivals. Tan, n.d. [8] have investigated impact of price war in Dynamic Spectrum Access market. They modeled a non cooperative pricing game using profit as the payoff. They modeled contention among multiple spectrum providers for higher market price using a non cooperative pricing game. Through using Pareto optimal pricing strategies they analyzed motivation behind the price war. The results demonstrate the efficiency of the Pareto optimal strategy for the game and price impact among all user. (Suliman and Lehtom) and (Khedun and Bassoo)[9, 10] Used modified M/D/1 queuing model to calculate waiting time of PUS’s and SU’s packets in Cognitive Radio Networks. They used simulation result to compare with theoretical results which enabled identification of the feasibility of opportunistic access in slotted system. Sun, Tian, Xu and Wang [11] have analyzed spectrum market in CRN in which spectrum owner uses auction mechanism to maximize profit by setting minimum price without informing SU’s and allows them to compete for available slots, slots are allocated to higher price bidder. They have introduced the affiliated value into bidding decision process of SU’s and proposed the value function for spectrum considering other SU’s, also they have introduced proper auctioning mechanism which prevents auctioneer cheating as it may reduce profit. They proposed repeated auction that resist cheating to maximize spectrum owner profit and SU’s satisfactions. D. Pang et al, [12] have presented a novel spectrum trading mechanism which operates among secondary users. In which some secondary users lease spectrum from PUs by subletting its spectrum to other SUs to reduce their own leasing spectrum cost. They used Nash decentralized algorithm to find Nash equilibrium of this two tiers game with only local information. Simulations are provided to illustrate the convergence and effectiveness of the proposed algorithm. Chu et al., n.d. [13] Have proposed general model of agents based spectrum trading in which an agent plays a third party role in spectrum trading process. In spectrum trading process spectrum owner lease its idle spectrum to SU using agents in which agents makes profit. They have addressed the challenge of finding the most profitable strategy of agent with confidence of spectrum availability. The PU’s and agents performs negotiation on spectrum size can be provided and its average price. Gandhi, Buragohain, Cao, Zheng, and Suri, C. [14] proposed a real-time spectrum auction framework to distribute spectrum among a large number wireless users under interference constraints. Their approach achieves conflict free spectrum allocations which maximizes auction revenue and spectrum utilization. Their design includes a compact and yet highly expressive bidding language, various pricing models to control tradeoffs between revenue and fairness, and fast auction clearing algorithms to compute revenue-maximizing prices and allocations. Both analytical and experimental results verify the efficiency of the proposed approach. They concluded that bidding behaviors and pricing models have significant impact on auction outcomes. A spectrum auction system must consider local demand and spectrum availability in order to maximize revenue and utilization. Borgonovo, Cesana and Fratta [15] have considered a network scenario in which primary and secondary users potentially share a common radio spectrum, the secondary user completely avoid to generate interference on primary users by accessing idle spectrum portions only. They studied impact on throughput and delay across traffic interference (primary against secondary). They found the performance of secondary transmission (throughput and delays) is favored by the knowledge of primary user utilization factor

3. System Model

- The system model is adopted from M/D/1 priority model as suggested [9] and pricing model as suggested [1], in these models has two users PU and SU, where in PU has higher priority and it has preemptive privilege when it has data to transmit. The system uses time slot in which the SU perform spectrum sensing at the beginning of each slot to know if the slot is occupied by primary user or not. The spectrum owner sells unused slots by PU in spectrum trading process to SU.In this model two functions as given in [1] has considered, which are spectrums supply/selling and spectrum demand/buying function. Spectrum supply function was derived from revenue earned from the ongoing connectivity minus discount given to the remaining primary user in the system due to performance degradation caused by spectrum sharing. The spectrum demand function was delivered from spectrum profit function. Each primary and secondary packet is informed slot price on arrival. The transmission is done if packets satisfied with the price charged otherwise connection is rejected. M/D/1 has considered in which its time is divided into fixed slot and each slot is assigned to one packet. A packet arrives on the channel according to a poison process and has deterministic service time. The buffer size has unlimited queue length. The service discipline for admitted packet on the channel are served one by one basing on first come first serve depending on packet level priority, in which licensed user has preemptive priority to use the channel over unlicensed user. When unlicensed user wish to transmit it sense the beginning of each slot and can only transmit if it sense idle slot. AssumptionsŸ Admitted packets are patient (no balking, reneging or jockeying), once packet satisfied with spectrum price joins queue and it waits until served.Ÿ Perfect sensing considered, secondary transmission has the capability of sensing primary traffic.Ÿ No sensing error and false alarm detectionŸ Single channel queuing systemŸ Packets are admitted on channel according to Poison distribution with mean arrival rate λ.Ÿ Have deterministic service rate µŸ Queuing discipline rule use first come first served depending on priority of the packet.Notations

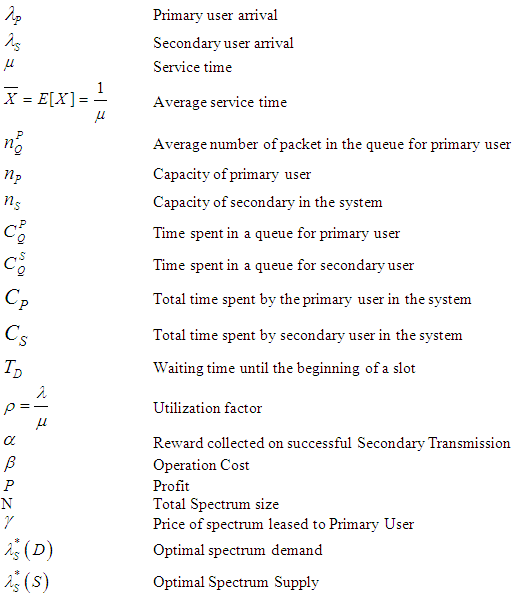

Tradeoff spectrum sharing and pricingThe aim of spectrum owner is to maximize the profit through selling its free spectrum while a secondary user maximizes its satisfaction on channel utilization. If the spectrum charges are higher, its revenue becomes higher, but higher charges reduce secondary user satisfaction and decreases demand. If

Tradeoff spectrum sharing and pricingThe aim of spectrum owner is to maximize the profit through selling its free spectrum while a secondary user maximizes its satisfaction on channel utilization. If the spectrum charges are higher, its revenue becomes higher, but higher charges reduce secondary user satisfaction and decreases demand. If  and spectrum price are lower, spectrum demand increases and spectrum availability decreases. To maximize profit for spectrum utilization, equality of spectrum needed at given price is considered. In this case when demand and price increases supply increases and vise versa when demand and price decreases the supply decrease, in this case only equilibrium demand and supply at given price is considered, through using equilibrium method there is no spectrum surplus and negative optimal secondary arrivals.Spectrum owner sells spectrum in trading process and the secondary user is the spectrum buyer in this trading process. Spectrum owner obtains profit through leasing its idle spectrum to primary and secondary user. Revenue considered is that collected from primary user and that obtained due to spectrum sharing with secondary user. The cost in the profit function results from the performance degradation due to spectrum sharing. Let

and spectrum price are lower, spectrum demand increases and spectrum availability decreases. To maximize profit for spectrum utilization, equality of spectrum needed at given price is considered. In this case when demand and price increases supply increases and vise versa when demand and price decreases the supply decrease, in this case only equilibrium demand and supply at given price is considered, through using equilibrium method there is no spectrum surplus and negative optimal secondary arrivals.Spectrum owner sells spectrum in trading process and the secondary user is the spectrum buyer in this trading process. Spectrum owner obtains profit through leasing its idle spectrum to primary and secondary user. Revenue considered is that collected from primary user and that obtained due to spectrum sharing with secondary user. The cost in the profit function results from the performance degradation due to spectrum sharing. Let  denote primary packet arrival at the begging of the slot, if the slot is free it start transmission on arrival, if slot is occupied with all PU it wait for some time until completion of the slot or packet is removed from the channel over occupied with SU. When the available spectrum are equal allocated to each packet arrived the spectrum owner profit function is expressed as follows [1].

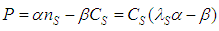

denote primary packet arrival at the begging of the slot, if the slot is free it start transmission on arrival, if slot is occupied with all PU it wait for some time until completion of the slot or packet is removed from the channel over occupied with SU. When the available spectrum are equal allocated to each packet arrived the spectrum owner profit function is expressed as follows [1]. | (1) |

are the weights for the revenue from primary connection and cost due to performance degradation to primary user connection delay, and

are the weights for the revenue from primary connection and cost due to performance degradation to primary user connection delay, and  denote the capacity of primary user and it depends on

denote the capacity of primary user and it depends on  The total spectrum size N, the spectrum owner shares its spectrum with

The total spectrum size N, the spectrum owner shares its spectrum with  at

at  per each secondary packet arrival. Due to spectrum sharing, the remaining spectrum size for other arriving

per each secondary packet arrival. Due to spectrum sharing, the remaining spectrum size for other arriving  packets becomes low/smaller, which can cause quality of service (QoS) degradation to

packets becomes low/smaller, which can cause quality of service (QoS) degradation to  arriving packet. Due to this case the spectrum owner provides discount, which is considered as cost of spectrum sharing with secondary user.The spectrum supply

arriving packet. Due to this case the spectrum owner provides discount, which is considered as cost of spectrum sharing with secondary user.The spectrum supply  is obtained based on maximizing profit of spectrum owner for a given price charged to the secondary use

is obtained based on maximizing profit of spectrum owner for a given price charged to the secondary use  Spectrum owner lease its spectrum to secondary user with these condition,

Spectrum owner lease its spectrum to secondary user with these condition,  and

and  must be non negative and also

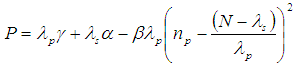

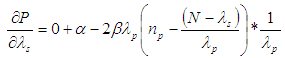

must be non negative and also  must be smaller than total spectrum size (N) available.The spectrum supply function is obtained by differentiating the profit function with respect

must be smaller than total spectrum size (N) available.The spectrum supply function is obtained by differentiating the profit function with respect

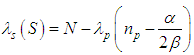

To get optimal secondary arrival we equate to zero the above equation

To get optimal secondary arrival we equate to zero the above equation | (2) |

| (3) |

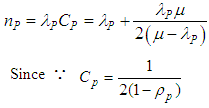

| (4) |

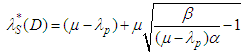

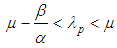

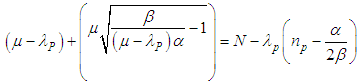

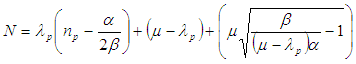

. For maximizing the secondary satisfactions we have considered utility function which its primary arrival is within boundaries [6].

. For maximizing the secondary satisfactions we have considered utility function which its primary arrival is within boundaries [6]. | (5) |

| (6) |

| (7) |

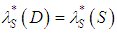

at given price. If the price is higher than the equilibrium spectrum supplier increases but spectrum demand decreases, these causes some of spectrums remains unused and violet spectrum management principle. The objective of spectrum management is utilizing efficiently all available spectrum.Through using market clearance principle we determine optimum total spectrum size needed at particular time and location by user.

at given price. If the price is higher than the equilibrium spectrum supplier increases but spectrum demand decreases, these causes some of spectrums remains unused and violet spectrum management principle. The objective of spectrum management is utilizing efficiently all available spectrum.Through using market clearance principle we determine optimum total spectrum size needed at particular time and location by user. Optimum spectrum size is

Optimum spectrum size is | (8) |

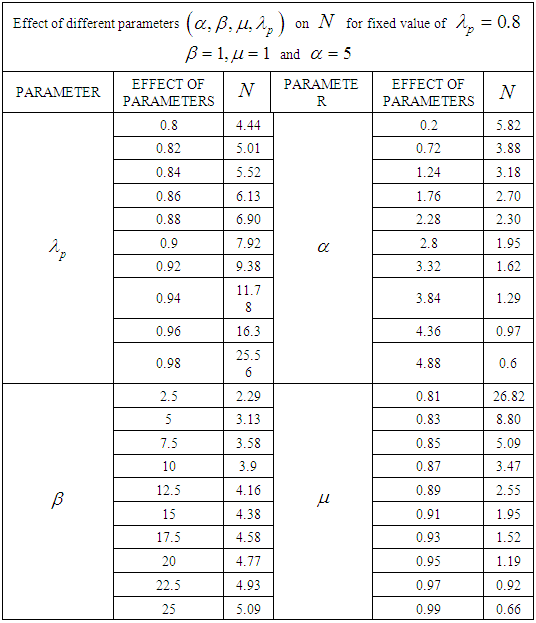

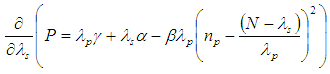

4. The Numerical Illustration

- The position of total optimal spectrum size is determined by primary arrival

, spectrum price

, spectrum price  , service rate

, service rate  and operation cost

and operation cost  . Four scenarios are considered for finding the optimum total spectrum size. They are effect on

. Four scenarios are considered for finding the optimum total spectrum size. They are effect on  effect on

effect on  effect on

effect on  and effect on

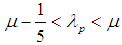

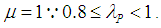

and effect on  Bound for primary arrival given

Bound for primary arrival given  and

and  are in the following range

are in the following range ,

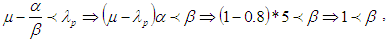

, Minimum operation cost bound is derived from

Minimum operation cost bound is derived from  lower bound which is given as

lower bound which is given as

Maximum spectrum price is also derived from

Maximum spectrum price is also derived from  lower bound as

lower bound as  and service rate bound is given as

and service rate bound is given as  The results are shown in the table 1 and the effects on different values are shown in the graphs.

The results are shown in the table 1 and the effects on different values are shown in the graphs.

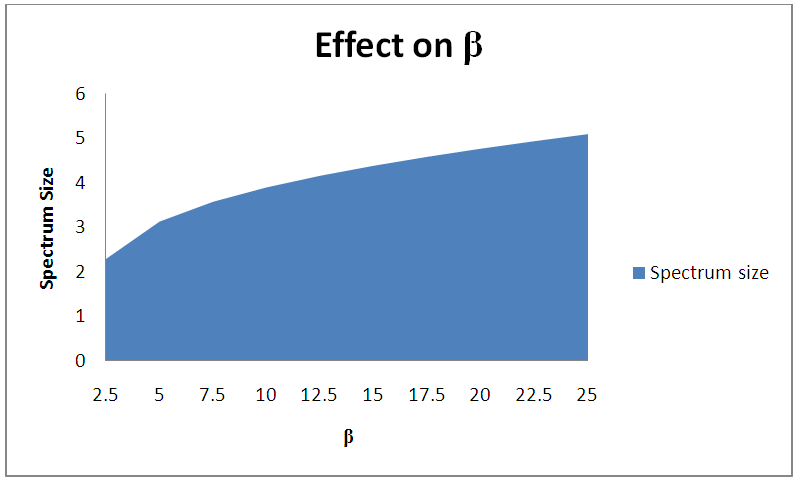

|

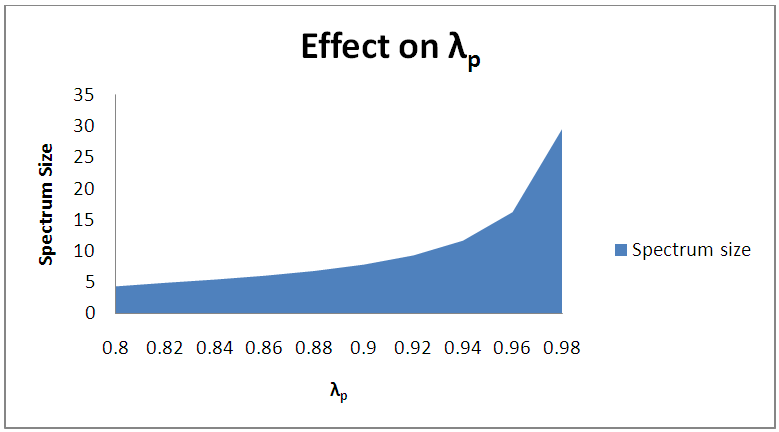

service rate

service rate  and operation cost

and operation cost  , as primary arrival

, as primary arrival  increases, idle slots for secondary user decreases and most of secondary packet remains in buffer waiting for idle slot. To get the equilibrium between spectrum demand and supply more total spectrum size is needed. Also when

increases, idle slots for secondary user decreases and most of secondary packet remains in buffer waiting for idle slot. To get the equilibrium between spectrum demand and supply more total spectrum size is needed. Also when  decreases total optimal spectrum size decreases as ongoing

decreases total optimal spectrum size decreases as ongoing  decreasing which decrease the number of primary packets in the system and increases idle slot, idle slot decreases secondary packet and equilibrium size. Spectrum price increases or decreases depending on amount of primary user in the packet. If there is no primary packet or if the number of primary packet are low most of spectrum is idle so its price is low as number of slots for sharing with secondary user are high. If number of primary user are high, idle spectrum available to be shared by secondary user are low, which cause high spectrum price. Spectrum owner set maximum spectrum price as

decreasing which decrease the number of primary packets in the system and increases idle slot, idle slot decreases secondary packet and equilibrium size. Spectrum price increases or decreases depending on amount of primary user in the packet. If there is no primary packet or if the number of primary packet are low most of spectrum is idle so its price is low as number of slots for sharing with secondary user are high. If number of primary user are high, idle spectrum available to be shared by secondary user are low, which cause high spectrum price. Spectrum owner set maximum spectrum price as  given

given  ,

,  and

and  when spectrum price increases due to increased operation cost or improved service rate or increased primary arrival it decreases optimal spectrum equilibrium size as spectrum demand decreases. When spectrum price

when spectrum price increases due to increased operation cost or improved service rate or increased primary arrival it decreases optimal spectrum equilibrium size as spectrum demand decreases. When spectrum price  decreases due to decreased operation cost or decreased service rate or decreased primary arrival optimal total spectrum size increases as spectrum demand increases.

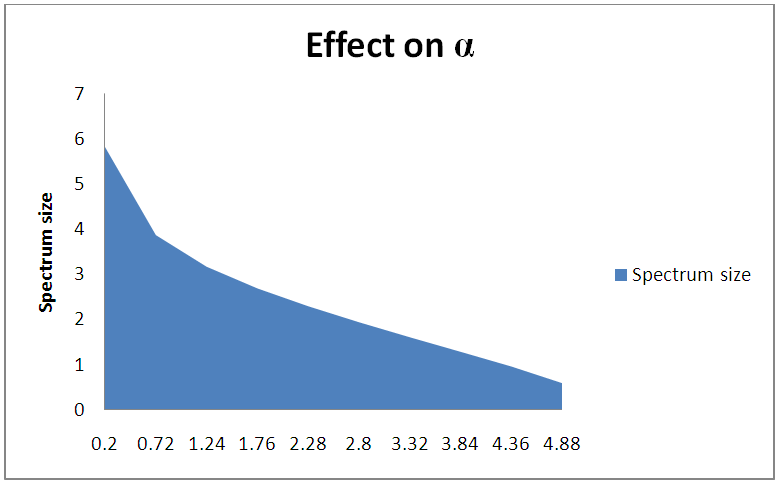

decreases due to decreased operation cost or decreased service rate or decreased primary arrival optimal total spectrum size increases as spectrum demand increases.  | Figure 1. Effect on λP |

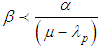

| Figure 2. Effect on α |

given primary arrival rate

given primary arrival rate  , spectrum price

, spectrum price  and service rate

and service rate  when

when  increases it improves the quality of the spectrum which lead spectrum demand to increase, increasing spectrum demand cause the total optimum spectrum size to increases. When

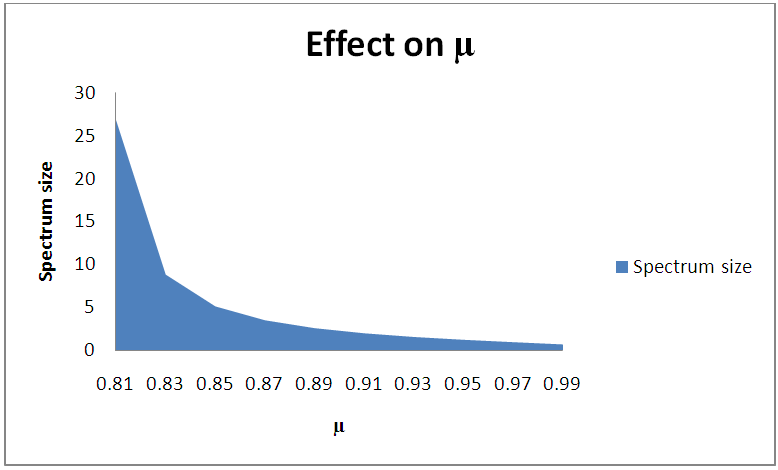

increases it improves the quality of the spectrum which lead spectrum demand to increase, increasing spectrum demand cause the total optimum spectrum size to increases. When  decrease, it decreases the quality of spectrum and spectrum demand decreases, this cause total optimum spectrum size to decrease.From figure 4 as service rate

decrease, it decreases the quality of spectrum and spectrum demand decreases, this cause total optimum spectrum size to decrease.From figure 4 as service rate  increases at given primary arrival rate

increases at given primary arrival rate  , spectrum price

, spectrum price  and operation cost

and operation cost  , optimal secondary arrival

, optimal secondary arrival  decreases as admitted optimal secondary packet are transmitted within short time which enable more packet to be admitted and transmitted. Decreasing optimal secondary arrival

decreases as admitted optimal secondary packet are transmitted within short time which enable more packet to be admitted and transmitted. Decreasing optimal secondary arrival  decrease the total spectrum size and decreasing

decrease the total spectrum size and decreasing  it causes

it causes  to increase, this increases the spectrum size.

to increase, this increases the spectrum size. | Figure 3. Effect on β |

| Figure 4. Effect on µ |

5. Conclusions

- This paper has considered spectrum trading problem in CRN. In the system M/D/1 queuing model under consideration, has determined optimal secondary under bounds of primary arrivals and optimal secondary arrivals supplier using spectrum supply function. The model considered is market equilibrium pricing. The market equilibrium depends on spectrum price, operation cost, service rate and primary arrival rate. Supplying than spectrum equilibrium causes spectrum surplus which is not allowed in spectrum management and supplying under equilibrium causes spectrum shortage which cause loss of income to spectrum owner and spectrum unavailability to spectrum user, which violet spectrum management principle. Through using optimal spectrum demand and supply, optimal total spectrum size has delivered. Using optimal total spectrum size there is no shortage or surplus as all available spectrums are fully utilized. Optimal spectrum size is much affected by price and operation cost. Spectrum owner set maximum price depending on spectrum demand and allows bidder to compete and spectrum is allocated to those who bids higher price, these enables higher profit. Operation cost increases and decrease depending on availability of idle slots, service rate and spectrum price. If there are many primary packet in the channel, few slots is available for sharing with secondary packet and operation cost is low as few secondary packets are available in channel and if there are few primary packet in the channel, many slots are available for secondary packet and operation cost is high. As a future research the spectrum trading problem can be applied to multi-channel system.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML