-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Information Science

p-ISSN: 2163-1921 e-ISSN: 2163-193X

2019; 9(1): 1-5

doi:10.5923/j.ijis.20190901.01

Structural Modeling Using AMOS to Identify the Demographic Factors Affecting Shopping through E-payment

K. M. Salah Uddin1, Md Tuhinur Rahman2

1Associate Professor, Department of Management Information Systems, University of Dhaka, Dhaka, Bangladesh

2Lecturer, Department of Management Information Systems, University of Dhaka, Dhaka, Bangladesh

Correspondence to: K. M. Salah Uddin, Associate Professor, Department of Management Information Systems, University of Dhaka, Dhaka, Bangladesh.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In the recent years the world is sensing the rapid growth of e-commerce and people around the world are using electronic payment system for shopping and purchasing their necessities. It is happening because of the introduction of new technologies for business. Nowadays people use e-payment system for shopping which saves their time and money at a time and this is an easier way of paying the shopping bill. The objective of this paper is to identify the demographic factors which are affecting shopping through e-payment. It is clear that people are being influenced by demographic factors (age, gender, income, education) for shopping using e-payment. For this purpose a research model was constructed and using AMOS the relationships were tested as well as the reliability and the fitness of the model were also tested. The study shows that demographic factors which are age, gender, income and education have considerable impact on people use of e-payment for their shopping purposes.

Keywords: Demographic factors, e-payment, Mobile Payment System (MPS), Technology Adoptation

Cite this paper: K. M. Salah Uddin, Md Tuhinur Rahman, Structural Modeling Using AMOS to Identify the Demographic Factors Affecting Shopping through E-payment, International Journal of Information Science, Vol. 9 No. 1, 2019, pp. 1-5. doi: 10.5923/j.ijis.20190901.01.

Article Outline

1. Introduction

- In this 21st century, technology has become the foundation of our day to day activities. It’s is making the life of people easier than it was before of its introduction. Because of this the world is now digitalized and don’t need to be physically available for doing many of your important activities like- shopping. You can do that just staying at your place or even while travelling in your car and the most important this is that you don’t even need to think about the payment of those shopping. Nowadays you needn’t to go with wallet full with money because you can do the transaction by making a single click in your mobile phone for digitally enabled payment systems and e-payment. So this digital way of paying the bill of your purchased items has opened the new era of payment system which we actually call e-payment system. This new form of payment system is not only saving your time but also it will keep you away from physically going there. Many people all over the world are using this form of payment and enjoying the unlimited benefits of this system. Van der Heijden (2002) stated that it should not be any surprise to make transaction through mobile payment. As today people are using this form of payment system along with other e-payment system like credit card, debit card, digital cash, digital accumulating balance payment system, digital credit accounts, and online stored value system etc. today you will see that businesses are being converted to the digital form or e-commerce which is giving the businesses a new dimension of doing business through using Internet. For the business e-payment system is working as facilitator where transactions are being completed without having any face to face communication. So it can be said that e-payment is the magic touch of the unbelievable growth of e-commerce. Electronic payment is more convenient and people are rapidly using this when it comes to choose the payment options for shopping or buying anything. When it comes for comparison with other payment options available in the market then it is visible that mobility is the most important factor which is making this payment system popular among people. There are many factors which are actually motivating people to use this e-payment system for purchasing like- trust, perceived usefulness, usability, reputation, mobility, demographic factors etc. researcher from all over the world have done excellent work on all those factors but it is the demographic factors which don’t get enough attention in their research. Some of them may have cited about the impact of demographic factors butt in a combined way which were not broad enough to explore the exact impact of those demographic factors on purchasing through e-payment. In this paper, it is aimed to address those demographic factors in a broader sense so that the impact of those factors gets attention. So this paper aims to find the demographic factors which actually affect the buying decision through e-payment system.

2. Literature Review

- User’s acceptance promotes any new technological implementation whether it creates small or large scale of change. Because of that human behavior or attitude is considered as the most influential factor for implementing any new technology. Vankatesh et al. (2003) developed a Unified Theory of Acceptance and Use of Technology (UTAUT) model by extending the earlier one where he showed the intension of people to use technology and also stated about that the demographic variables like gender, age, experience and voluntariness are moderating the relationships between dependent and independent factors. Luarrn and Lin (2005) stated about how to make this model fit for the study in the current context. In this paper technology acceptance is measured through analyzing the demographic factors affecting the purchasing behavior of people through e-payment. Davis (1989) introduced technology acceptance model and through that model he identified and showed the behavior of the technology users. Lu et al. (2003) said that the popularity of this technology acceptance model for predicting information technology usage and user’s intension. IAB (2010) showed that now-a-days for reaching to the customers for e-commerce, mobile technology or mobile payment system is very crucial which is actually making people’s life easier and providing numerous benefits to the companies. That’s why people all over the world are rushing towards the digital way of transaction which is actually saving their time and money at the same time. As a payment system, you will see people are using mobile technology payment system or other form of e-payment systems and most of the cases there are seen the e-payment system is being used to activate, initiate and confirm the payment of any purchase (Karouskos and Fokus, 2004). So in short e-payment is a payment system which is conducted using electronic device like- mobile phone, tablet or even debit or credit cards. Around the world there has been conducted many surveys on the adaptation of electronic payment system and what are the factors affecting that payment system. Schierz et al. conducted a survey where 1447 individuals participated and that survey was about the factors which are affecting the MPS (Mobile Payment System) for any transaction (Schierz et al., 2010). In their study, the factor which has significant impact on the buying decision through using mobile payment was perceived compatibility. Another research was conducted on how the factors affect MPS adoption and the results were like- perceived usefulness and perceived ease of use (Kim et al., 2010). In that survey other factors were innovativeness, m-payment knowledge, mobility, reachability, compatibility, convenience (Kim et al., 2010). If you study further about the background of the factors affecting shopping or buying through e-payment then you will see that this payment system is affected or influenced directly or indirectly through behavioral beliefs, social influence and personal traits which are considered as very significant factors about the adoption of this payment system (Yang et al., 2012). In another study Zohu (2013) stated that in the use of MPS (Mobile Payment System) is necessary to be continued then it is the flow and trust which is very important factor. Puschel et al. (2010) described that compatibility and relative advantage are influencing the attitude of the Brazilian customers and that they are accepting the online way of payment for transaction. Trust is also considered as essential factor which is actually affecting people to use or adopt mobile payment system or electronic payment system for shopping or purchasing anything (Mallat, 2007; Chandra et al., 2010; Zohu, 2013). Many studies have found that investment in e-payment or some other mobile payment will also generate sustainable development for any country. Islam (2015) said that if investment is made on digitalization then the economic condition will be developed which actually opens the opportunity for e-payment system. Davis, F.D (1989) stated about the perceived usefulness, perceived ease of use and user acceptance of information technology where he showed how people are being affected by different factors or accepting technology for their purposes. Singh et al. (2010) showed how social influence and behavioral intention affect people to use mobile payment system or mobile banking and the factors are visible which are affecting people to choose the payment system. Yu, C.S. (2012) stated some factors which are affecting people or influencing people to adopt mobile banking technology for their transaction or purchasing purposes. In that paper there is shown how people are getting motivated and using that electronic form of banking system for their daily life. In another paper there is shown about an important factor, absence of that can create huge loss, which is security and the researcher found that because of poor security issues people lost their money which is very alarming for e-payment system (Moretaza, 2015).

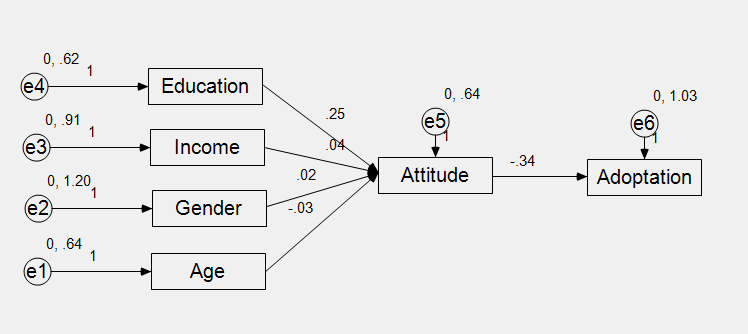

3. Research Model and Hypothesis

- The research model is developed based on the objective of the research which is to identify the demographic factors which are affecting people to use e-payment for shopping. At the first part there is analyzed the relationship between the factors and the attitude and in the second part there is the relationship between the attitude to the actual adaptation of e-payment. All the papers regarding the acceptance model of technology showed all other related factors which are affecting actual adaptation except the demographic factors. But in this paper the main focus is on the impact of demographic factors on the adaptation of e-payment for shopping. The demographic factors are the following:Age: Age is an important demographic factor which affects people regarding the decision of whether they will use the e-payment system for shopping or not. Different studies around the world show that demographic factors affect the adaptation of technology but none did ever cited about the impact of age on taking the decision of accepting e-payment. At a certain age like 21-35, found in this study, people are more interested in using e-payment system for shopping. That’s why age is a considerable factor.H1: There is a significant relationship between age and the attitude to use e-paymentGender: depending on the gender the shopping behavior of people change. Like- female are more likely to shopping whereas male are not that much. Among the female most of them now-a-days are using e-payment system for shopping and through this research that is being tried to be identified. In this paper it is found that 45% of the respondent are female and are using this e-payment system for shopping. H2: There is a significant relationship between gender and the attitude to use e-payment.Income: Another important factor which didn’t get proper attention in others study is income. Depending on income level the acceptance of e-payment for shopping varies. The people with higher income are more interested in using e-payment for shopping while people with less income are reluctant in using e-payment. Because of income varies, the life styles also varies and the uses of technologies for daily necessities also vary. H3: There is a significant relationship between income and the attitude to use e-paymentEducation: Education actually makes the people familiar with the technological advancement which is not easily possible for the uneducated people. That’s why education has impact on the adaptation of e-payment system for shopping. The level of education of people encourages them to use the e-payment system for shopping as it is very easy way of doing shopping nowadays.H4: There is a significant relationship between education and the attitude to use e-paymentAdaptation: Adaptability means changes behavioral style or method of approach when necessary to achieve a goal; adjusts style as appropriate to the needs of the situation. Responds to change with a positive attitude and a willingness to learn new ways to accomplish work activities and objectives has the impact on the adaption for e-payment for shopping.H5: There is a significant relationship between attitude and the adaptation of e-payment

4. Methodology

4.1. Research Objective

- The major objective of this study is to identify the demographic factors which are affecting people to use e-payment for shopping.

4.2. Sampling and Data Collection

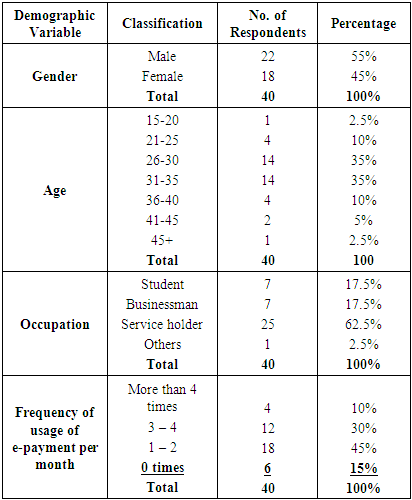

- For the purpose of this paper a questionnaire was developed and circulated to the respondents through online and by this way the responses from people were collected. In this survey 45 people were participated but 5 of them had no experience about the e-payment. That’s why they are left out of the analysis. The analysis is done using the responses from the 40 people.

|

4.3. Data Analysis

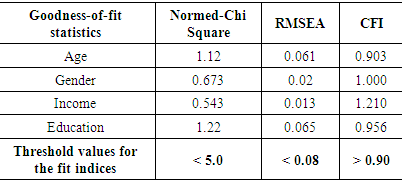

- The proposed research model with the path coefficient is shown in the following table. The path coefficients are represented by the numbers on the line. Where the value of path coefficient is less than 0.05 (p<0.05), that path (hypothesis) is supported by the test result. So in this model all hypothesis are supported by the test result except the line between education and attitude where the p value is more than 0.05. The model is inspired from the Unified Theory of Acceptance and Use of Technology (UTAUT) model but used in a different situation where the impact of demographic factors on the adaptation of e-payment for shopping is shown.

| Figure 1. Research model |

|

|

5. Conclusions, Limitation and Future Research

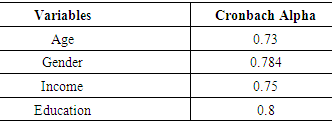

- This paper is aimed at finding out the demographic factors which are influencing people to accept the e-payment system for shopping. Age, gender, income and education are considered as demographic factors. A sample size of 40 was used for this study and the internal consistency of the measurement items meets the threshold value. Because the lowest Cronbach’s Alpha is 0.73 and highest is 0.8 which indicates the acceptability of this model and the factors associated with this. The current study shows that the demographic factors age, gender, income and education have considerable impact on the acceptance of e-payment system for shopping of people now-a-days. In many study the demographic factors are shown but in a limited way or in a combined way but in this study the demographic factors are shown in a separate way. Through this way, it was tried to find out the individual impact of each of this demographic factor on the adaptation of e-payment system for shopping. This paper shows that people are affected positively by these demographic factors for using e-payment at the time of shopping. This paper is not out of limitations as there are some limitations in this paper. As using a sample it is not possible to fully describe the whole scenario of the people. The sample size of 40 respondents could be increased and the number of factors used in this paper could also be increased. As a suggestion for future work it can be said that as the study is conducted taking sample from Bangladesh, so it can be analyzed on different regions as well as the number of demographic factors can be increased to see the impact.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML