-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Inspiration & Resilience Economy

2019; 3(1): 17-23

doi:10.5923/j.ijire.20190301.03

The Impact of Information Asymmetry on the Bank Financing of SMEs in Algeria: An Econometric Study

Mazeri Abdelhafid, Saadouni Mohammed

University of Tahri Mohamed, Bechar, Algeria

Correspondence to: Mazeri Abdelhafid, University of Tahri Mohamed, Bechar, Algeria.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Improving the access of small and medium-sized enterprises to funding sources is an interest shared by governments, central banks and supervisory ministries ... this interest explains in an important aspect the problem of asymmetric information which is become more and more interesting, especially after the development of the information economy and economies of uncertainty since the early eighties. Banks consider that the lack of information production and the weak financial structure of small and medium enterprises are key factors in the mistiness of their relationship, which explains why banks are hard to deal with this type of institution. The theory of microeconomics addresses the problem that is at the heart of the modernization of microfinance theory. We will try to identify the most important implications for the financing decisions of banks under asymmetric information, and then drop those concepts on the case of Algeria by addressing the following axes:• The problem of asymmetric information in economic theory; • The impact of asymmetric information on the financing decisions of banks towards small and medium enterprises; • The impact of asymmetric information on the banking finance of small and medium enterprises in Algeria.

Keywords: Small and Medium-Sized Enterprises, Information Economy, Asymmetric Information, Bank Financing, Algeria

Cite this paper: Mazeri Abdelhafid, Saadouni Mohammed, The Impact of Information Asymmetry on the Bank Financing of SMEs in Algeria: An Econometric Study, International Journal of Inspiration & Resilience Economy, Vol. 3 No. 1, 2019, pp. 17-23. doi: 10.5923/j.ijire.20190301.03.

Article Outline

1. Introduction

- The importance of small and medium enterprises for economic and social development has been dictated by the transformations and economic developments resulting from the phenomenon of globalization and economic blocs, which led investors and businessmen to reconsider their interventions, especially in the field of investment, where they favor the trend towards the small and medium enterprises Which are characterized by the ability to adapt quickly with economic changes, rather than the huge economic structures that have often been disrupted by the economic crises in the world.Locally, the economic choices of the past have encouraged the achievement of big economic groups. Thus, small and medium enterprises in Algeria do not have a tradition of value, which requires giving it a chance in the process of restructuring the national economic structure, especially as it is better aligned with the demands of market economy.Accordingly, we will proceed from the following question: What is the impact of asymmetric information on the banking finance of small and medium enterprises in Algeria Where the study focuses on the period after the year 2001 as a time frame for the study, especially after the issuance of the Guideline law for Small and Medium Enterprises.

2. Literature Review

2.1. The Problem of Asymmetric Information in Economic Theory

- The general equilibrium theory assumes that all goods are homogeneous and that prices are determined according to supply and demand, but this analysis is not always the case. Sometimes the quality of a commodity is not known to one of the parties [1]. GEORGE AKERLOF contributed through his founding article In the clarification of the impact of Quality on price by the famous example about the used car market [2]. AKERLOF assumes that there are 100 sellers and 100 buyers in a used car market. To simplify, 50 cars are supposed to be in good condition and 50 are in bad condition. Only sellers know the quality of their cars. Bad car owners are asking for a price of $ 1,000 to $ 1,200, while good car owners are asking for a price of $ 2,000 to $ 2,400. If it is possible to distinguish between the qualities of cars by observation, it is not a problem, and the owners of bad cars will sell their cars at prices ranging between 1000 and 1200 dollars, and the owners of good cars sell their cars at prices between 2000 and 2400 dollars. But what if the quality of cars cannot be distinguished?In this case, buyers will predict the value of each car, and as long as the probability of get a good car is equal to the probability of get a bad car, buyers are willing to pay the price: 2/1 × 1200 + 2/1 × 2400 = 1800.According to this price, good car owners will refuse to sell their cars and will go out of the market and buyers will get bad cars with prices higher than the real prices.The distortion that led to this situation is what can be called the problem of asymmetric information, where one party has all the information about the transaction at the expense of the other party, without cost, leading to economic decisions are not sound.This problem is particularly prominent in the field of insurance economics (the contract between securer and secured), financial markets (through nominal value and real value of securities), banking economics (the relationship between lender and borrower).Two major problems can be results from the situation of information asymmetry:

2.1.1. Adverse Selection

- According to Akerlof's conclusion on the used car market, bad goods eliminate good goods because of the high cost of owning the information [3]. If we drop the example on the reality of bank financing for small and medium enterprises, this phenomenon arises as a result of the bank's offer the same rate of interest for Projects with varying degrees of risk [4]. Institutions that are in a difficult position are more willing to accept loans no matter how high the interest rate is, while good institutions respond negatively to accept loans with increasing of interest rates, which leads to the following result:"Because of the problem of information asymmetry, the most insistent SMEs in obtaining loans are most likely to produce unsatisfactory results for lenders (because of high risk), while at the same time they are more likely to get loans."We note that adverse selection is located from a time perspective before contracting [5].

2.1.2. Moral Hazard

- Unlike the adverse selection problem that can occur prior to a transaction, the problem of moral hazard appears only after the contract, so that the borrower uses the finance obtained in unproductive or high risk activities, which increases the likelihood of default, This is Usually associated to the problem of agency [6], especially in the financial markets through the inability of managers of companies as agents of shareholders to maximize the wealth of these individuals, and bondholders also may be exposed to this type of problems, which raises the problem of how to guide the behavior of these agents in the direction of achieving the objectives of secutities Campaign [7]. The reason for a lender's or investor's exposure to risk of moral hazard remains the inability to consistently monitor the activities of the borrower or issuer, as this process requires the costs of time and effort that he cannot afford and even with the lender's insistence that the borrowing contract Limits the borrower's ability to undertake high risk activities, but is still exposed to these risks if he does not consistently monitor the activities of the borrower to determine compliance with the terms of the contract.The problem of moral hazard can be summed up as a problem with the behavior of the borrower, which the lender cannot predict [8], and it is more likely present in financing of small and medium-sized enterprises compared to financing big enterprises because of their lack of financial transparency, ownership structure and their owners' concealment of the real purpose of the project [9].

2.2. Impact of Asymmetric Information on the Banks Financing Decisions towards SMEs

2.2.1. The Relation Bank/SME

- Although there is a very strong correlation between banks and small and medium enterprises, which is considered as first source of her financing, the nature of the relationship between them Characterized by conflicting interests because of the divergence of objectives and interests of both parties [10]. some economists [Mayer, Porter] see that the long-term relationships between banks and small and medium enterprises is a positive indicator of economic growth and prosperity - and support their views on both the German and Japanese economies - others in particular [Hellwig] see that this relation is a source of many problems, Banks are forced to bear bad customers for too long, and this is in the interest of small and medium enterprises, whose behavior becomes opportunistic and exploitative, which leads to inefficient allocation of loans at the macroeconomic level, and this is detrimental on the level of economic growth [11]. The analysis of the status of bank loans for small and medium enterprises is not a microeconomic concern, but rather an examination of ways of promoting and improving the relations between small and medium enterprises in order to promote economic growth.

2.2.2. Impact of Asymmetric Information on the Efficiency of the SME Loan Market

- The theory of market efficiency, according to its founder Fama (1965), is based on the premise that "prices find their effect directly on the market and reflect all available information [12]." The efficient market can be defined as a market where all pertinent information is available to all participants at the same time, and where prices respond immediately to available information, and this assumes that all market participants can access information whether it is current or past information. Stock markets are considered the best examples of efficient markets.Grossman and Stiglitz (1980) argue that even in highly efficient markets, the expectation of the evolution of financial asset prices and transactions is not possible because competency requires multiple conditions (free circulation of information, useful information and no costs, Rationalizing the behavior of investors, ...) [13], which confirms the ongoing debate about the relative efficiency of markets. However, it is difficult to achieve all the efficiency requirements combined in the SME loan market [14].

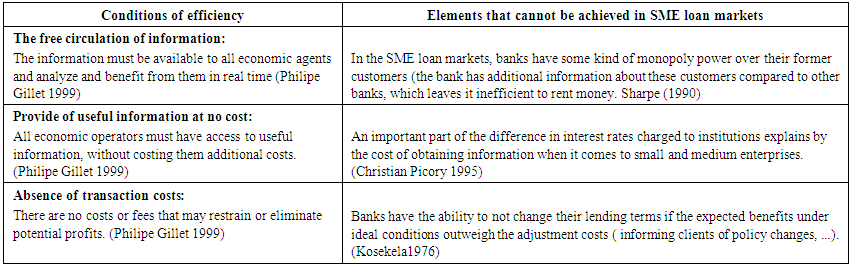

| Table (1). The most important conditions of efficiency that cannot be achieved in SME loan markets |

2.3. Financing Decisions in Case of Asymmetric Information

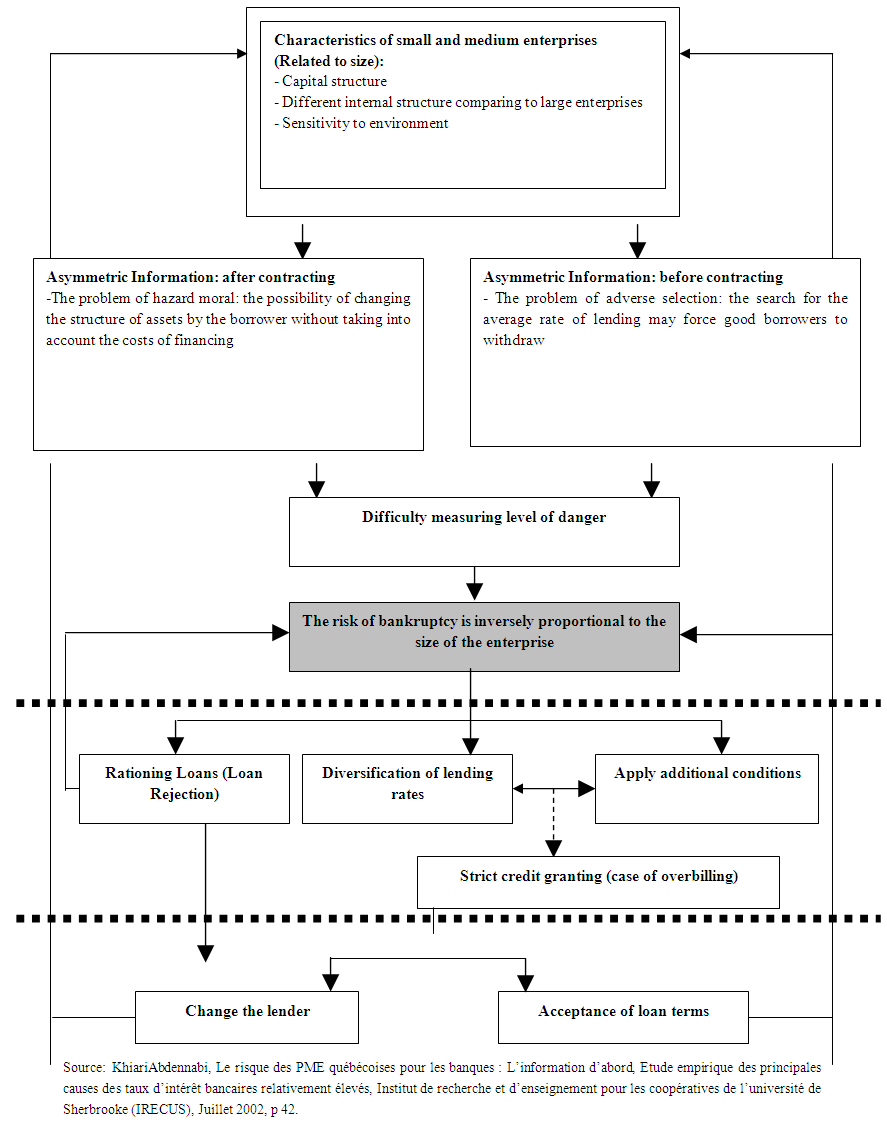

- Decision making process is important in economic analysis, any economic action resulting from a decision or set of decisions taken under certain conditions and with regard to the financing decisions taken by banks under conditions dominated by the problem of information asymmetry, it can be summarized in figure (1).

| Figure (1). Risk Assessment Model for Small and Medium Enterprises |

3. Problem Modelling

3.1. Impact of Asymmetric Information on the SMEs Banking Finance in Algeria

- After presenting the problem of asymmetric information and related problems that impede the financing possibilities of small and medium enterprises through the two previous axes, we will attempt to drop these concepts on the reality of SME financing by studying the loans granted by the local development bank and Its relationship to some explanatory variables, and we try to determine the extent to which the implications of this problem contribute to influencing the bank's financing decisions.

3.2. Database and Model

- The database on the institutions covered by the study is based on a set of accounting information and some information related to the granting of loans at the level of the local development bank. Based mainly on the work of Catherine Refait (2002), Cieplysylvie (2002).We try to write the estimation of a regression equation for loans granted by the local development bank Based on explanatory variables that theoretically assume that they reflect this problem.

3.3. Variables Identified

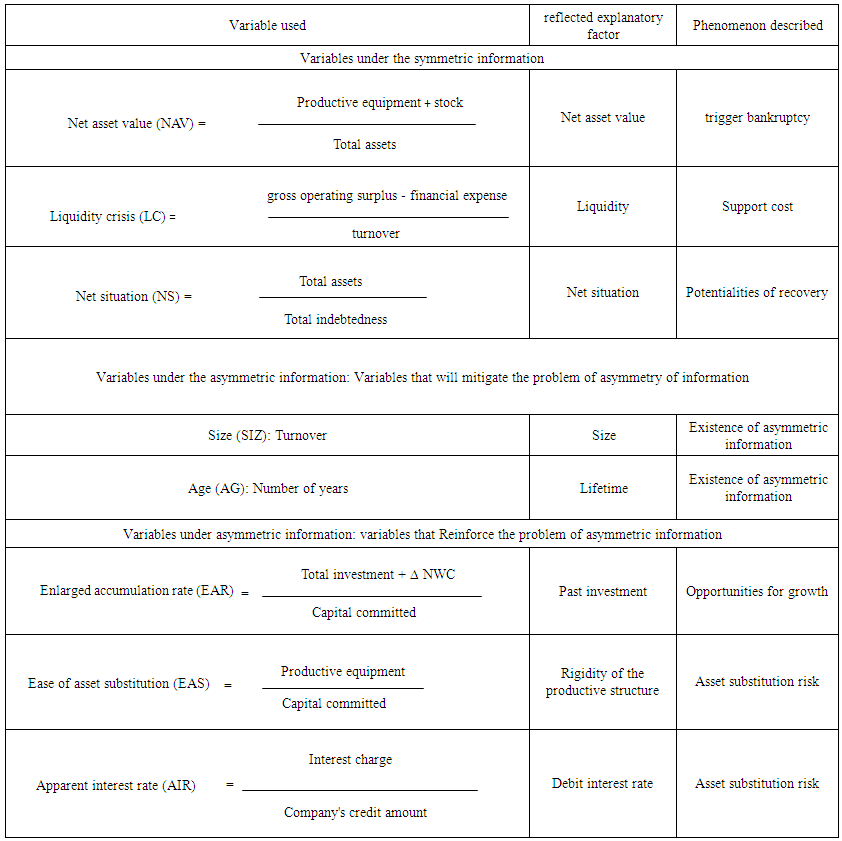

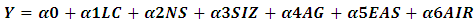

- It is very difficult to obtain the variables related to the problem of asymmetric information in the field of information economics, and it presents several problems when trying to model them, but often resort to some of the approximate variables that reduce these difficulties, and in this regard can be organized These variables are in three main groups:These variables can be modelled using the linear regression method using EVIEWS as follows:

With y the amount of credit granted to the company, ɛ is an error term of zero mean and constant variance; model parameters measure the variables sensitivity to Grant of credit.

With y the amount of credit granted to the company, ɛ is an error term of zero mean and constant variance; model parameters measure the variables sensitivity to Grant of credit. | Table (2). Explanatory variables used in the model |

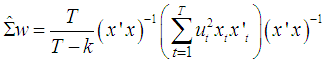

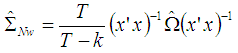

However, we will use another estimate, (the Newey-west estimate) because this estimate also gives unbiased covariance of estimated parameters in the presence of heteroskedasticity and autocorrelation problems, as in the model, as follows:

However, we will use another estimate, (the Newey-west estimate) because this estimate also gives unbiased covariance of estimated parameters in the presence of heteroskedasticity and autocorrelation problems, as in the model, as follows: And therefore, the model after correction becomes:

And therefore, the model after correction becomes:

4. Results

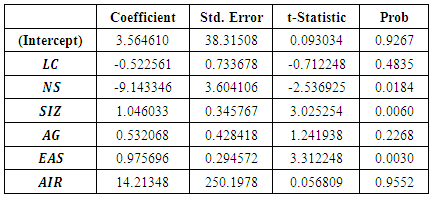

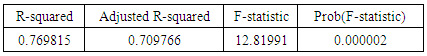

- After modifying the studied model, the following results were obtained:

A t-test was used to examine the influence of every independent variable in the model of Grant of credit. After testing the hypotheses by comparing the student statistics of the estimated parameters to the table student value, the results show significant of NS, SIZ, EAR at 5%. It can be seen that the coefficients of these variables are significantly different from 0 as indicated by Student calculated ratios, that are higher than the theoretical value of the Student table, the values P-value that is less than 5%, while LC, AG, and AIR variables are not significant in the interpretation of the loan granting process.

A t-test was used to examine the influence of every independent variable in the model of Grant of credit. After testing the hypotheses by comparing the student statistics of the estimated parameters to the table student value, the results show significant of NS, SIZ, EAR at 5%. It can be seen that the coefficients of these variables are significantly different from 0 as indicated by Student calculated ratios, that are higher than the theoretical value of the Student table, the values P-value that is less than 5%, while LC, AG, and AIR variables are not significant in the interpretation of the loan granting process. F-test was used to determine significance of the model. The results of F-test on 5% importance level was F-estimate>F-Table (12.81>2.53). So the model was meaningful at 5% importance level. The results indicated that it was adequate to explain the effects of independent variables on dependent variable.Multiple determination coefficient of the model (R-square) is 0.76, adjusted multiple determination coefficient is 0.70 and this shows that the variables in the model explain 70% of the grant of loans variable. The remaining 30 % is about the influence of unregistered or not considered factors.

F-test was used to determine significance of the model. The results of F-test on 5% importance level was F-estimate>F-Table (12.81>2.53). So the model was meaningful at 5% importance level. The results indicated that it was adequate to explain the effects of independent variables on dependent variable.Multiple determination coefficient of the model (R-square) is 0.76, adjusted multiple determination coefficient is 0.70 and this shows that the variables in the model explain 70% of the grant of loans variable. The remaining 30 % is about the influence of unregistered or not considered factors.5. Discussion

- The obtained results show that LC, AG, and AIR variables do not statistically affect the decision to grant the loan, which can be explained as follows:- the variable LC:It appears that the bank does not care about this problem when granting the loan, and this may be due to its study of the possibilities of improvement in order to find out if this problem is temporary or structural, and also because most of the small and medium enterprises that apply for loans suffer from this problem (It should be remembered that this variable is obtained under the symmetric information).- the variable AG:Can be interpreted as insignificant in the decision of lending due to the government policy that encourage the establishment of small and medium enterprises as the ministry of sector aspires to reach 1000000 institutions, in addition to the agreements with some financial institutions and banks to facilitate the financing of this type of institutions, which can explain the lack of statistical significance of this variable at the model level.- the variable AIR:With regard to this variable, the absence of financing alternatives for small and medium enterprises - which may offer lower interest rates or other alternative financing formulas -obliged them to be directly linked to bank financing. Therefore, the bank is not interested about the costs of interest to be paid by Small and medium enterprises (which would create a problem of hazard moral in the form of asset change).While the variables explaining the phenomenon of granting loans at the level of the bank are:- the variable NS:The results show that the variable NS is negatively related to the decision to grant the loan. This means that whenever there is a negative liquidity position within the institution, there is a reservation in granting loans.- the variable SIZ:There is a positive influence between the size of the institution and the loan granting process, as the volume of loans increases with the size of the institution; in other words, larger institutions are more likely to obtain loans (this problem is not posed between big enterprises and SME, but list even within small and medium enterprises themselves).- the variable EAS:Whenever the structure of production is rigid, whenever confidence that assets cannot be easily changed and thus more likely to obtain loans.

6. Conclusions

- The results of the econometric study based on the accounting data of the surveyed sample institutions lead us to the fact that the financing of small and medium enterprises at the level of the local development bank is characterized by:- The theoretical results are consistent with the results obtained with regard to the net situation (NS), the size of institution (SIZ) and the ease of asset substitution (EAS) by the bank when making the financing decision.- The bank neglects the considerations of the liquidity problem LC, the age of the corporation AG and apparent interest rate AIR when making the decision to finance, which is contrary to the theoretical assumptions, as the bank's funding for newly established institutions make the information around them very limited, which opens a wide area of the problem of asymmetric information, The failure to take into account the high costs of interest may also lead the borrower to change the asset structure, especially in the absence of alternative sources of financing (limited to traditional financing, associated with traditional guarantees).Thus, we conclude that the financing of small and medium enterprises - in light of the results reached - is characterized by conditions dominated by the problem of asymmetry of information, which confirms the financing problems suffered by the sector of small and medium enterprises in Algeria, In light of this difficult reality, It is very important to adjust the behavior of both banks and small and medium enterprises in order to improve the conditions of access to information, thereby enhancing confidence in their financing relationships.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML