-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Inspiration & Resilience Economy

2018; 2(1): 11-17

doi:10.5923/j.ijire.20180201.02

Comparing Financial Performances of Conventional and Participation Banks: Case of Turkey (2005 – 2015)

Imanou Akala

Sakarya University, Business Department, Accounting and Finance, Turkey

Correspondence to: Imanou Akala, Sakarya University, Business Department, Accounting and Finance, Turkey.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Following the evolution of the balance sheets, income statements, assets, profitability, deposits, loans, equity, capital adequacy, liquidity, and some other ratios; financial performances of both participation and conventional banks are compared in our study.In this work the usage of financial technique analysis methods such as ratios analysis as well as trend analysis through tables and graphs thanks to the interactive monthly bulletin data (2005 – 2015) collected from BDDK2 and TKBB3. At the end of the study, it is seen that, Conventional Banks perform better than Participation Banks, but it is essentially noticed that Participation Banks are the fastest growing industry with more stability and constancy than Conventional Banks.

Keywords: Participation Banks, Conventional Banks, Financial Performances, Growth

Cite this paper: Imanou Akala, Comparing Financial Performances of Conventional and Participation Banks: Case of Turkey (2005 – 2015), International Journal of Inspiration & Resilience Economy, Vol. 2 No. 1, 2018, pp. 11-17. doi: 10.5923/j.ijire.20180201.02.

Article Outline

1. Introduction

- Born from the awakening of political Islam with the intellectual and political campaign of economic Islamization in Muslim countries in the 20th century, Islamic Banking and finance is experiencing real development with financial globalization in view of its contribution to the world economy. Over the past few decades Islamic finance has received increasing attention, not only within Muslim economies, but all around the world, as illustrated by the involvement of numerous non-Muslim public and private institutions. In 3Q 2015, total global Islamic assets under management (AuM) stood at USD 60.2 billion. The sector is conservatively projected to grow by 5.05% per annum for the next five years to reach USD77 billion in value by 2019. This is substantiated by a number of facts, such as the average growth rate of Islamic funds at 9.55% per annum over the past five years. And the most important factor enabling the industry to reach today’s figures was the economic crisis in 2008 while conventional banks suffered a loss of profitability, Islamic banks maintained their growth and profitability and during that period, contrary to Islamic banks, the conventional banks have benefited from the financial assistance of the Government to avoid bankruptcy. The fastest growing Islamic financial institution is the banking sector (Total Assets: banking sector 79%, sukuk 4.3%, interest-free investment funds 2.9%, interest-free stocks 2.9%, interest-free insurance “tekaful” 0.7%) which has a growth at a compound annual growth rate CAGR of 17% in the last 5 years to reach USD$ 778 billion (IDB reports). Turkey since 1983 is among the countries which have included Islamic banking to their banking sector under the name of Special Financial Institutions/Houses SFIs (özel Finans Kurumlar) which became Participation Banks PBs (Katılım Bankalar) by 2005; prior to 2005 SFIs couldn’t show any development in term of asset size and product variety due to the lack of necessary legislations. The legislation of 2005 paved the way for a real growth of the sector and start competing with its counterpart (Conventional Banks: CBs). In 2013 PBs represent 5.13% of the whole banking sector, their share in total deposits 6.15 % and their share in total credits to 6.03%, 4% share of countries in Islamic banking asset4, and actually with 47 banks that represent the whole banking sector 5 are PBs with a total asset of 136.476M TL, and the Participation Banks Association of Turkey working to raise the market share of participation banking sector to 15% by 20255.

1.1. Understanding the Meaning of CBs and PBs

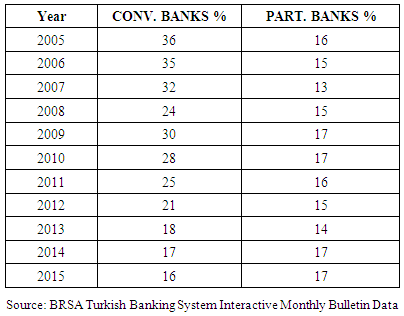

- Conventional banks (CBs) are financial institutions that provide services, such as accepting deposits, giving business loans, mortgage lending, and basic investment products like savings accounts and certificates of deposit. The traditional commercial bank is a brick and mortar institution with tellers, safe deposit boxes, and vaults. However, some commercial banks do not have any physical branches and require consumers to complete all transactions by phone or Internet. In exchange, they generally pay higher interest rates on investments and deposits, and charge lower fees6. However, PBs are the institutions that operate in the financial sector, finance the reel economy and provide banking services. Participation banks put the funds that they collect from savers to good use in projects within the scope of the principles of interest-free finance (making funds available for consumers and enterprises) and share with savers profit or loss generated7 by the operations.One key difference is that CBs earn their money by charging interest and fees for services, whereas Islamic banks earn their money by profit and loss sharing, trading, leasing, charging fees for services rendered, and using other sharia contracts of exchange. Moreover, most participation Banks have a compliance committee, commonly known as the Sharia Board, which independently establishes the conditions for the validity of transactions according to Sharia rules and principles.CBs and PBs as well as development and investment banks are active in the Turkish banking system. The following table shows the banking sector’s total personnel, branches, assets, credit.

| Table 1. Turkish Banking Sector Status (December 2015) |

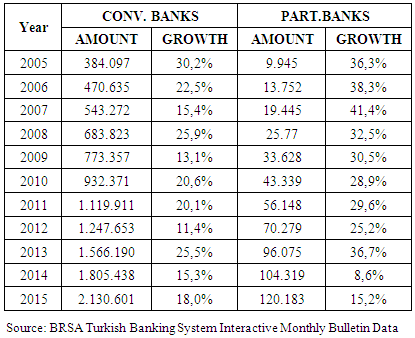

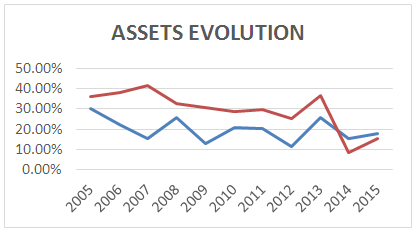

2. Assets

|

| Graph 1. Assets Evolution |

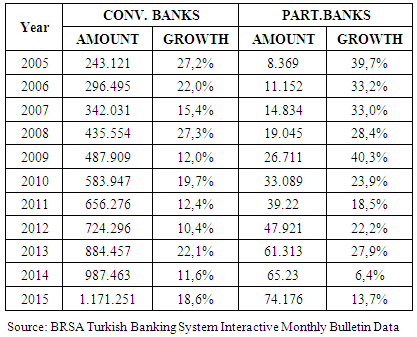

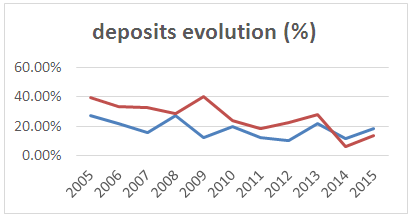

3. Deposit

|

| Graph 2. Deposit evolution |

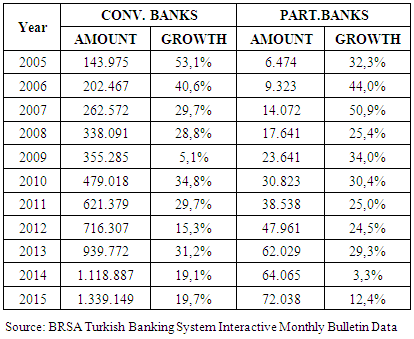

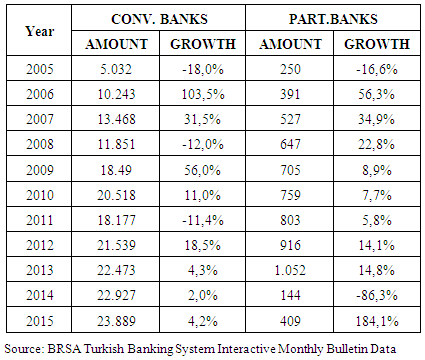

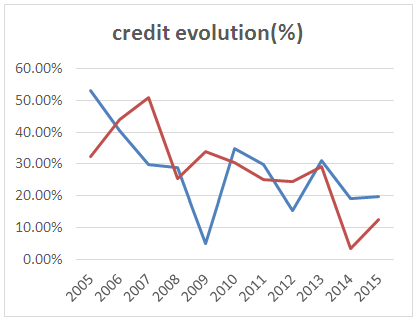

4. Credit

|

| Graph 3. Credit evolution |

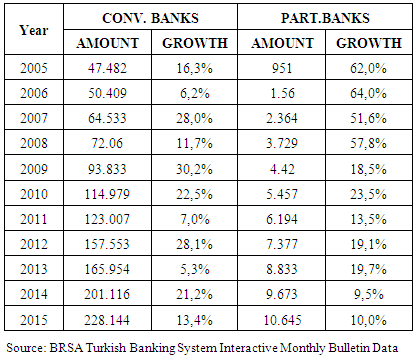

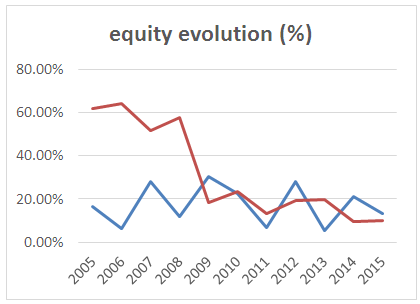

5. Equity

|

| Graph 4. Equity evolution |

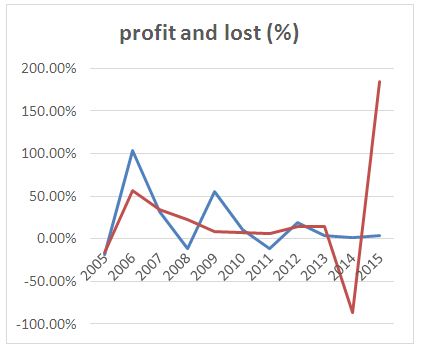

6. Profit and Lost

|

| Graph 5. Profit and lost evolution |

7. Ratios

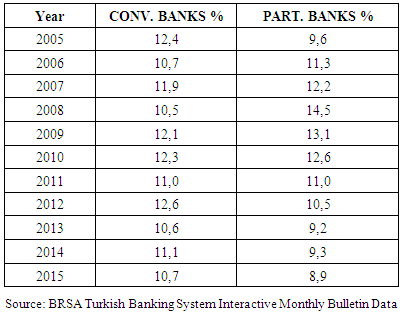

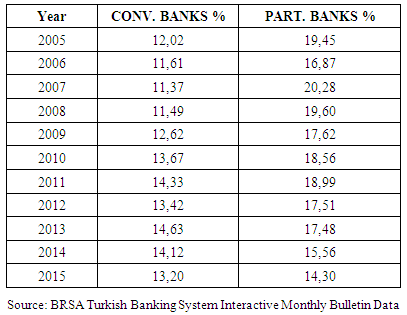

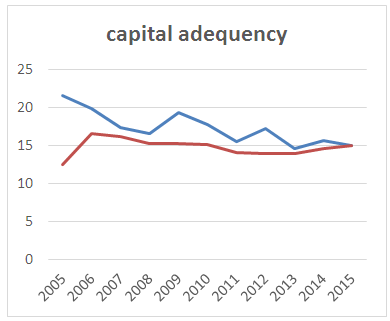

7.1. Capital Adequacy Ratio

|

| Graph 6. Capital Adequacy Ratio |

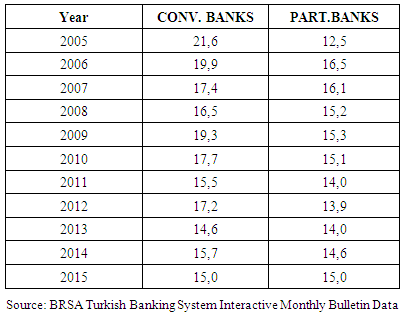

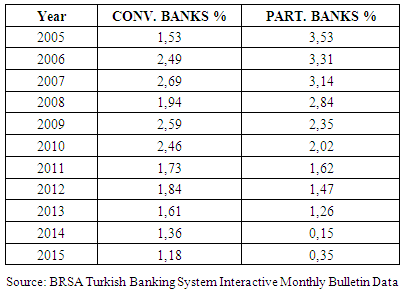

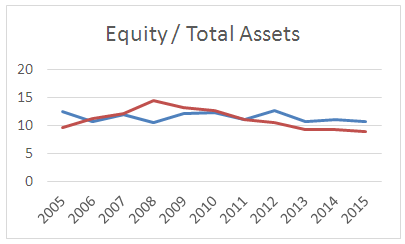

7.2. Equity / Total Assets

|

| Graph 7. Equity / Total Assets |

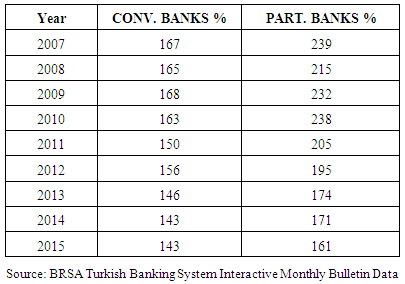

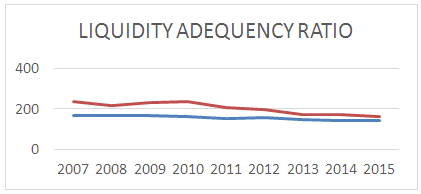

7.3. Liquidity

|

| Graph 8. Liquidity Adequency Ratio |

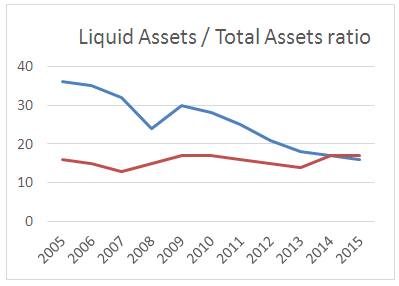

7.4. Liquid Assets / Total Assets Ratio

|

| Graph 9. Liquid Assets / Total Assets ratio |

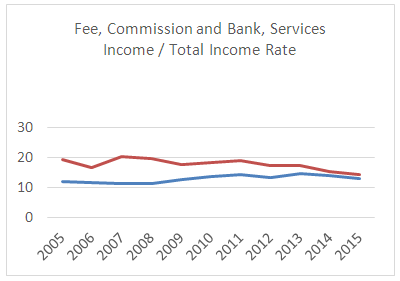

7.5. Fee, Commission and Bank, Services Income / Total Income Rate

|

| Graph 10. Fee, Commission and Bank, Services Income / Total Income Rate |

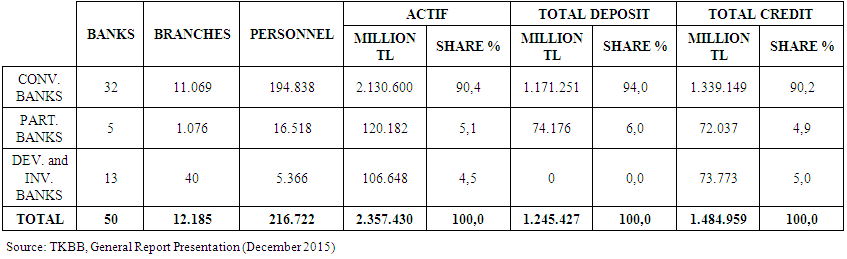

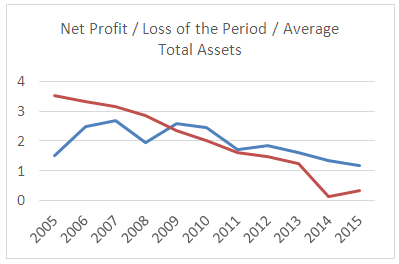

7.6. Net Profit / Loss of the Period / Average Total Assets

|

| Graph 11. Net Profit / Loss of the Period / Average Total Assets |

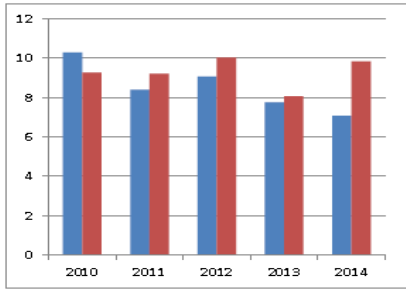

8. Interest Rate / Dividend

- Conventional banks interests.Participation banks dividends

| Source: TKBB, General Report Presentation |

9. Conclusions

- The instability and other problem that have been affecting the country have also adversely affected the banking secteur in terms of assets, deposits, loans and profits. Although PBs have diversified fund resources through sukuk issuances in recent years, reducing both the cost of resources and the prolongation of the maturity, making liquidity conditions more liquid than CBs liquidity ratios, their capital adequacy ratios are lower than CBs and they are seen to be riskier than CBs.From the preceding financial indicators, it is clear that Conventional Banks with the highest rate of financial assets (90.6%) perform more than Participation banks PBs, but it is very important to notify that, the fastest growing sector in the whole banking sector is PBs, and therefore the sector need a support from the government, the Central Bank, private sector and other financial institutions to realize a real integration which can boost and improve the sector’s financial performances and make Turkey a hub of Islamic Banking.Notes 1. Imanou AKALA: International 2nd year Masters student in Business department: Accounting and Finance, in Sakarya University (http://www.sakarya.edu.tr/en, Esentepe Campus 54187 Serdivan / SAKARYA / TURKEY) imanovic7@gmail.com2. BDDK: Bankacilik Duzenleme ve Denetleme Kurumu: (BRSA: Banking Regulation and Supervision Agency)3. TKBB: Turkiye katilim Bankalari Birligi (Participation Banks Association of Turkey)4. world Islamic banking competitiveness report 2014-15 – PBAT5. TKBB reports 20136. Faleel jamaldeen, (2012) islamic finance for dummies, published by john wiley & sons, inc.111River st7. Serfettin ozsoy, (2012) katilim bankaciligina giris kuveyt Turk. Proje genel koodinatoru: Dr Ahmet ALBAYRAK.8. TKBB, General Report Presentation (December 2015)9. Mesut Doğan (2013) Comparison of Performances Between Participation and Conventional Banks: Evidence from Turkey Journal of Accounting and Finance, 2013 - journal.mufad.org.tr

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML