-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Inspiration & Resilience Economy

2017; 1(1): 1-9

doi:10.5923/j.ijire.20170101.01

Asia in Crisis- Repairing the Cracks of the Shock

Marwan Abdl-Malik Thanoon

Associate Professor, University of Mosul, Mosul, Iraq

Correspondence to: Marwan Abdl-Malik Thanoon, Associate Professor, University of Mosul, Mosul, Iraq.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The global economic crisis led to a decline in the economic growth of developed and developing countries. I hypothesize that the vulnerability increases with the number and size of linkages with other foreign markets. This study apply a GMM dynamic heterogeneous panel model along with a Random Effects GLS model to examine the relationship between economic growth and crisis through two external channels, international trade and foreign capital inflows, on a sample of selected Asian countries over the two crisis periods 1997-2000 and 2008-2011. The main finding is that foreign capital and exchange rates during crises have negative impact on economic growth, while export earnings have a positive effect.

Keywords: Crisis, GMM, Trade and Foreign Capital

Cite this paper: Marwan Abdl-Malik Thanoon, Asia in Crisis- Repairing the Cracks of the Shock, International Journal of Inspiration & Resilience Economy, Vol. 1 No. 1, 2017, pp. 1-9. doi: 10.5923/j.ijire.20170101.01.

Article Outline

1. Introduction

- There are many similarities between international economic crises; this is especially true for the 1997 Asian financial crisis and the current global financial crisis 2008 (“The Great Recession”). The recent global financial crisis has had more impact than any other crisis and no end appears to be in sight (as of the date of publication). For example, during the periods leading up to both of the crises, “low nominal interest rates, ample liquidity, low financial market volatility, and a general feeling of complacency encouraged many types of investors to take on more risk” (Kodres, 2008, p. 9).There are various ways that economic crises may spread from advanced economies to the rest of the world; these channels include trade and financial linkages. Moreover countries with vulnerabilities – such as high current account deficits, high indebtedness, low reserves, or strong credit growth, may have been more likely to feel the effects of a global recession. Conversely, countries with effective policies such as flexible exchange rates, a strong fiscal position, or a credible institutional framework, should have withstood the crisis better. Some countries, however, fared better than others. … Did their stronger performance reflect differences in trade or financial openness, underlying vulnerabilities to external forces or the strength of their economic policies, which helped insulate them from global shocks? (Berkman, Gelos, Rennhack, & Walsh, 2010, p. 29-30).This paper starts with a brief discussion of how the 1997 and 2008 financial crises impacted the developing countries of Asia. In addition, in this paper we explore the differences between the two crises and examines how the Asian developing countries coped with the two crises. We then estimate the real impacts of the global economic crisis on Asian developing countries’ economic growth through foreign trade and foreign capital inflows. To answer our research questions, we apply General Method of Moments (GMM), a dynamic heterogeneous panel estimator Arellano and Bond (1991) and the System –GMM suggested by Blundell and Bond 1998. The choice of this methodology can be explained with several reasons. 1. The lagged dependent variable is introduced in all estimated equations. This inclusion can lead to a correlation between the regresses and the error term. Comparing other available methods which can correct for country specific effects as well as time specific effects, the GMM technique is the preferred estimator. 2- The GMM method allows removes any endogeneity in explanatory variables. 3- Finally, GMM estimation ensures that all variables of interest are stationary. We include in the above equation two separate dummies. The first one denoted “crisis” takes the value of 1 from 1997-2000 and 0 in all other periods. The second denoted “crisis 2” takes the value of 1 from 2008-2011 and 0 in all other periods to account for the appearance of two financial crises over the studies period. This study tries to answer the following questions: 1. Does the movement of foreign capital have a negative effect on economic growth rates during both crises period?2. Do total exports and exports from the USA have a positive effect on economic growth rates during the first crisis period and a negative effect during the second crisis period? 3. Do exchange rates have a negative effect on economic growth during both crises, and is the effect deeper during the Asian crisis than during the USA crisis?4. Do both crises have a negative effect on economic performance in all Asian countries, but do these effects differ depending on the openness of the countries to the international trade and foreign capital. This paper starts with a brief summary about the trade and foreign capital inflow to Asia countries and discuss the channels through which the 1997 and 2008 financial crisis can affect developing Asian, what is the differences between two crisis? And how the Asian copy with them? When then Endeavour to econometrically investigate the real impacts of this global crisis on Asian economic growth through two main channels “foreign trade and foreign capital inflows”. For this purpose we apply General Method of Moments (GMM) a dynamic heterogeneous panel of Arellano and Bond (1991) and Blundell and Bond (1998).

2. The Trend of Foreign Trade and Capital Inflows in Asia

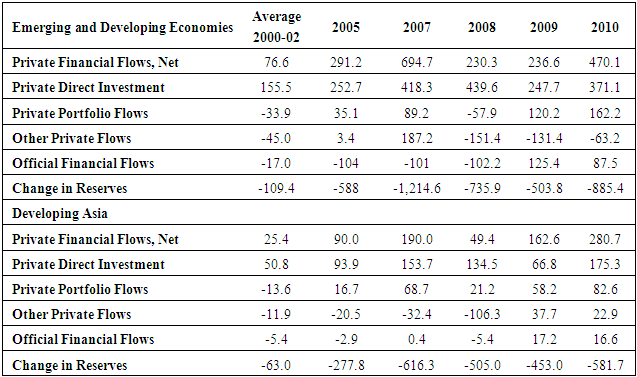

- The share of private capital flows to the Asian countries increased compared to that of other developing sub-regions from about 68 billion in 2002 to 349 billion in 2007. Net private capital flows to East Asia and Pacific remained strong at $228 billion in 2007, up from 203 billion in 2006. Net FDI inflows remained robust at $117 billion (105 billion), while the net portfolio equity inflow decline from 54.8 to 48.6 in the same period. The net debt increased from 35.1 billion to 58.4 bill, much of this debt was from private creditors which increased from 42.7 to 60.7 billion- medium and long debt increased from 15 to 28.8, while the short term increased from 27.7 to 37.9 billion), and the net official flows continued to be negative at 7.6 and 2.3 billion in 2006 and 2007 respectively). (Insert Table 1)

|

|

3. Back to the Problem

- The 1990s was a period of increased globalization; the nations of the world became increasingly integrated in terms of trade and financial markets. The policies of many nations in Asian shifted towards more open borders. Many Asian firms became strong competitors in global markets. Financial capital increasingly crossed borders as countries opened their financial accounts and established full currency convertibility. Economic liberalization was related to increased economic growth through increased trade and capital inflows. However, by the late 1990s problems began to emerge. Capital flows began to reverse direction. Many Asian nations had their currencies depreciate by as much as up to 50% of their values. Debtors with foreign currency denominated debt faced bankruptcy as the value of the local currencies plunged. A massive selloff occurred in equity markets as investors sought a safe haven in other markets. The economies of several developing nations in Asia were on the brink of collapse and unemployment and poverty rates rapidly increased. “The East Asian countries at the centre of the crisis were admired for years as some of the most successful emerging market economies, owing to their rapid growth and the striking gains in their populations' living standards. With their generally prudent fiscal policies and high rates of private saving, they were widely seen as models for many other countries” (Staff, 1998, p. 18). Factors that contributed to the crisis included pegged exchange rates, insufficient financial market governance, the lack of financial market transparency, and investors’ underestimation of risk (Staff, 1998). Research shows that the probability of a financial crisis occurring in a country increased significantly if that country had high bilateral trade and financial linkages with countries in crisis (Glick & Rose, 1999).

4. How did the Asian Economies Cope with the 1997 Crisis?

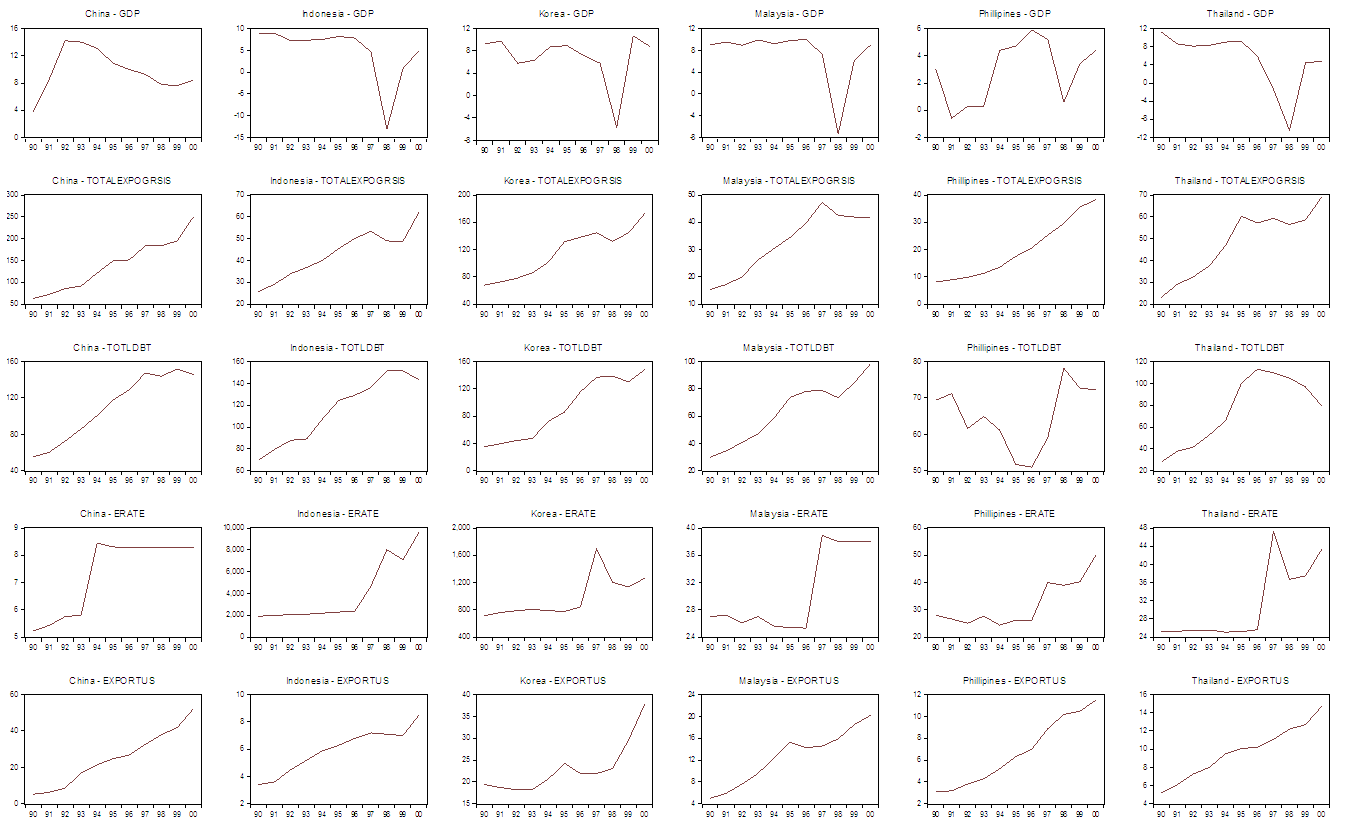

- Figure (1) show that during the Asian Crisis, positive international circumstances helped the Asian economies to quickly recover. The devaluation of Asian currencies led to a large increase in exports to the US and Europe, which led to an increase in the surplus of foreign currency. In addition, the availability of foreign capital in international markets caused a large increase in foreign capital flows to the Asian economies which helped lead to a recovery of the trade deficit.

| Figure (1). The trend of growth rate, external trade and foreign capital during Asian Crisis |

5. The Recent Global Crisis 2008

- How did we get here and who is to blame? At the risk of oversimplifying, the crisis was caused by two factors amid long standing structural weaknesses: first, the simultaneous and large deleveraging of three major segments of the global economy- the housing sectors, the financial sector, and consumer demand in the United States, and second, the inability of both markets and policies to quickly accommodate suck intense deleveraging at both the national and international levels (El-Erian, 2008, p. 15).In short, Asian economies have become tightly linked through both trade and capital flows with the US and global economies. For Asian countries, the breadth and severity of the crisis have underscored the risks of globalization. Over the past 15 years, many of those countries had opened to the world, revamping their macroeconomic policies and their framework for private investment. With expanding opportunities for trade and strong inflows of capital, those improvements made possible a long run of rapid economic growth, accompanied in many places by impressive reductions in poverty. Unfortunately, the channels of integration with the world economy have operated in reverse during the current crisis, as a falloff in demand for developing countries’ goods and services and reduced access to international capital markets have sparked a sharp decline in growth and in capital flows to developing countries in general and in Asian in particular (Bank, 2009, p. 73).The empirical studies of the effects of the recent global crisis on growth in Asia economies indicate that they are likely to lead to a substantial decline in export earnings and foreign capital inflows. The negative effect of the current crisis reduces the demand for their exports, since these markets are the important destinations form any of the Asian economies’ exports. Figure (2) show how the Asian economies dealt with the recent crisis. The decrease in foreign capital and the recession in developed countries led to lower growth rates in most of Asian countries. The impact of the recent global economic crisis on Asia has been swifter and often deeper than in other regions and had a more negative impact than the Asian crisis, partly because of Asia's export dependence and close integration into international markets. Together with the declines in exports earning and capital flows, the economic growth rates of Asian economies have decreased from 9.4% in 2008 to 7.7% in 2011.

| Figure (2). The trend of the growth rate, external trade and foreign capital during the 2008 Crisis |

6. What Happened During the 2008 Crisis

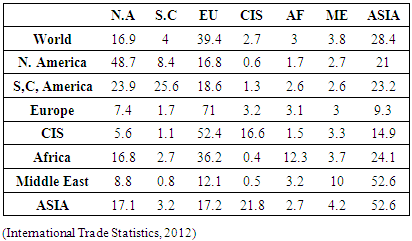

- The global financial crisis has helped drive what started as a growth slowdown in the industrialized world into recession. The US, Europe and the Japan are all showing negative growth. The critical questions are how long will it last? And will the recession become global in scope? Recent signs are not good. We are seeing a direct impact on developing Asia; particularly in the more open newly- industrialized economies such as Korea, Singapore, as well as increasingly among ASEAN members. World trade growth is slowing sharply as demand from major industrial countries slumps, reducing export production in emerging market economies, and slowdown in GDP growth there for this year to around 7%. From 8% and 9% in 2008, 2009 respectively.In addition, global financial conditions will continue to be tight, and the world trade growth is expected to slow sharply. Volatility in capital inflows remains a significant risk. We saw how short term foreign capital took flight immediately following the onset of financial turmoil in 2009. Asia's stock market indexes fell even more sharply than advanced market. A sudden reversal in capital inflows from 1.2 trillion 2008 to 680 in 2009 to 186 billion in 2010 could exert significant macroeconomic pressure on emerging Asia. Rapidly deteriorating external demand in industrialized countries is already affecting many Asian economies. Trade links between developing Asia and major industrial economies remain substantial despite a gradual decline in overall trade share. In some developing Asia's countries, 60% exports go to the US, Europe and Japan, so the region could be hurt precisely where growth has been strong, tempering economic output in countries where domestic demand remains weak.

7. What Happen after the Crisis?

- Asian economies have so far weathered the onslaught of the latest global downturn with greater ease than in previous crisis. Financial systems in the region are also stronger, in particular, banking systems financial indicators have improved over the past decade. So Asian can now increase investment spending to meet higher demand at home as they rebalance toward domestic sources of growth and make the most of the global upswing. Three challenges for Asia need to do it1. Asia needs to rethink its growth model. Asia still very much has an export driven growth but we need to forward to a domestic consumption driven model to make growth much more balanced and sustainable.2. Financial sector reform. The crisis taught us that a strong financial sector plays a very important role in macroeconomic management. For example, Asian does not have a deep bond market, which is absolutely important for long term financing. Asia has been working on that for years, but there is much more to be done.3. Asia needs to deal with global capital flows. The surge in capital flow to emerging Asia presents big challenges for the region.The Asian economies need to handle this issue very carefully and design proper policies to bring lasting solutions. What the global financial crisis means for developing Asia, and how the reforms they undertaken over the past decade have left them in better shape to maintain economic growth in the face of the global downturn. The financial foundation, domestic demand, investment and trade become appreciably Strength firmer since the Asian financial crisis of more than a decade ago. But such are the strengths of global financial linkages these days that this in no guarantee of immunity from the global crisis. There is growing spill over from the recession in the industrialized world into Asia real economy. The Asian economies open as they are and highly dependent on exports and foreign capital inflow are suffering as demand contracts and reverses from industrialized world and international market. Today, in emerging Asia, the risk of a currency and banking crisis is substantially lower than it was 13 years ago when the Asian financial crisis struck. The primary reason is that crisis affected economies have taken action to rectify their macroeconomic imbalances and address financial weaknesses. Their macroeconomic fundamentals are much healthier now, we can now see more prudent fiscal management, reduced external debt, more flexible exchange rate regimes, and development of local currency bond markets has also helped to reduce currency and maturity mismatched. Post crisis reforms such as improved economic policies and institutional frameworks have also helped to build up economic resilience. These have not only favoured price stability and reduce output volatility, but also helped protect against the danger of shocks generated by adjustments in international financial markets. This all gives some reason to believe that Asian financial systems can avoid the worst affects of the global financial turmoil and avert a crisis on the scale of that of 1997\98.

8. What are the Differences between Two Crisis

- 1. Today's crisis is broader and deeper than the Asian financial crisis of 1997-1998, it is also more complex. 2. The Asian financial crisis arose from structural weaknesses in financial and monetary systems at home. This time the damage has come from financial and economic meltdowns in the advanced countries. The US subprime mortgage collapse, shattered confidence in major global financial institutions and instruments, massive developing, crashing equity prices, and frozen credit markets reversed credit and investment flows to Asia. Wounded Asian stock prices and exchange rates, and interrupted a decade of record economic expansion and social progress in developing Asia. 3. During the earlier crisis, healthy growth and growth in the developed world and increases the flows of liquidity from the international capital markets helped support Asia's recovery. This time, however, the US, Japan and Europe are in recession and their business confidence, trade, consumption and FDI other foreign capital, on which the region has long depended, are in decline.4. The crisis has hit export dependent Asian the hardest. Growth in East Asia overall declined from 10.4% in 2007 to 6.6% in 2008 and 3.6% in 2009 and in 2010. As import demand faded in the advanced economies and their recessions set in, export growth plunged in East and Southeast Asia. It was down by about 30% in 2009 compared to 2008. Lost export revenues have crimped income and cast a cloud over investment in export manufacturing, import growth has followed suit. The gloomy global outlook has sapped business confidence across developing Asia. 5. External financing, a key driver of economic expansion in Asia has been cut bake radically, developed world investors have withdrawn funds to repair balance sheets at home. The slump in net private flows for both direct and portfolio investment will continue in 2010. A sudden reversal in capital inflows to developing countries from 1.2 trillion 2008 to 680 in 2009 to 186 billion in 2010 could exert significant macroeconomic pressure on emerging Asia.

9. Methodology and Sources of the Data

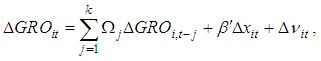

- To control for country-specific factors and joint endogeneity, we use Generalized-Method-of Moments (GMM) estimator for dynamic panel data models developed by Arellano and Bond (1991). This estimator deals with country specific effects and potential endogeneity of the explanatory variables. The control for endogeneity is achieved by the use of “internal instruments”, that is to say, instruments based on lagged values of the explanatory variables. This estimates in a system the regression equations in differences and levels, each with its specific set of instrumental variables. This estimator works in the following way: first, take first differences of a model to remove time-invariant like (6) which, generalized to a model containing (k) lagged dependent variable as regresses, and second the first differences eliminates the time invariant components

This solves the problem of omitted variables bias, leave:

This solves the problem of omitted variables bias, leave: Where

Where  . First differencing gets rid of the country specific effects, but leads by construction a correlation between the differenced lagged saving variable and the differenced error term. Namely endogeneity since it is clear that

. First differencing gets rid of the country specific effects, but leads by construction a correlation between the differenced lagged saving variable and the differenced error term. Namely endogeneity since it is clear that  is endogenous to the error terms through

is endogenous to the error terms through  To overcome this problem, an instrument variable needs to be used for

To overcome this problem, an instrument variable needs to be used for  Anderson and Hsiao (1982) proposed using

Anderson and Hsiao (1982) proposed using  or

or  as instruments. Arellano and Bond (1991) show that using the lagged level,

as instruments. Arellano and Bond (1991) show that using the lagged level,  as instrument is superior and that in fact the list of instruments can be extended1 to include further

as instrument is superior and that in fact the list of instruments can be extended1 to include further

The GMM estimator will be consistent if the lagged levels of explanatory variables are valid instruments for differenced explanatory variables. This will hold if the error term is not serially correlated. These assumptions can be tested through the tests proposed by Arellano and Bond. The first is a Sagan test of over-identify restrictions, which tests the overall validity of the instruments. Failure to reject the null hypothesis given support to the model. The second is a test for serial correlation in the error term. If such test does not reject the null hypothesis of the second order correlation absence, it can be concluded that original error term does not have serial correlation. In order to maximum use of both time and cross-country dimensions of available data sets, we use an extended set of panel data covering annual data of 6 Asian countries from 1990-2011 to carry out our empirical analysis and to make econometric results more confident. Our data are collected from Asian Development bank, IMF and World Bank various issue and are expressed in logarithms to include the proliferate effect of time series.

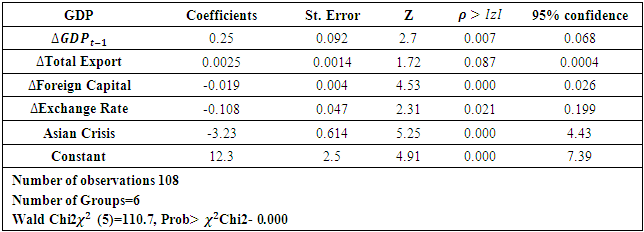

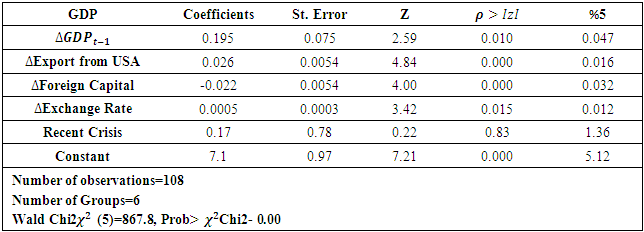

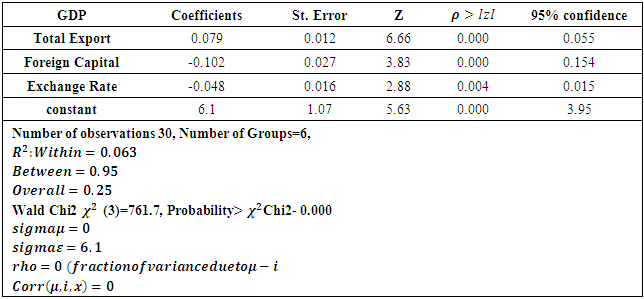

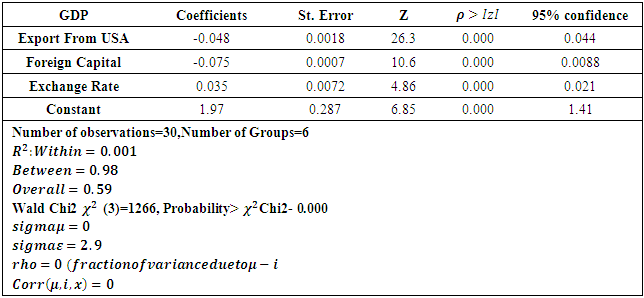

The GMM estimator will be consistent if the lagged levels of explanatory variables are valid instruments for differenced explanatory variables. This will hold if the error term is not serially correlated. These assumptions can be tested through the tests proposed by Arellano and Bond. The first is a Sagan test of over-identify restrictions, which tests the overall validity of the instruments. Failure to reject the null hypothesis given support to the model. The second is a test for serial correlation in the error term. If such test does not reject the null hypothesis of the second order correlation absence, it can be concluded that original error term does not have serial correlation. In order to maximum use of both time and cross-country dimensions of available data sets, we use an extended set of panel data covering annual data of 6 Asian countries from 1990-2011 to carry out our empirical analysis and to make econometric results more confident. Our data are collected from Asian Development bank, IMF and World Bank various issue and are expressed in logarithms to include the proliferate effect of time series.10. Results and Discussion

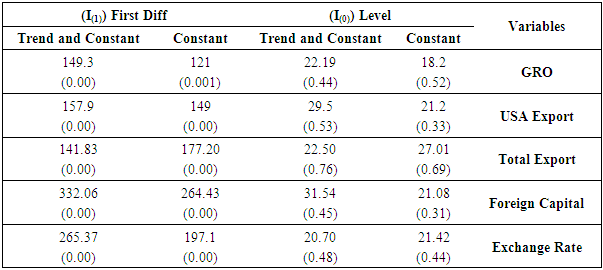

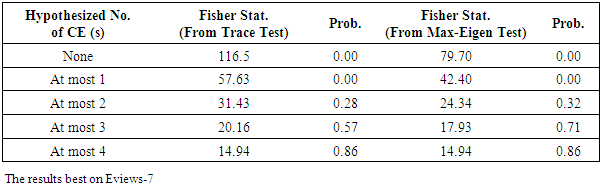

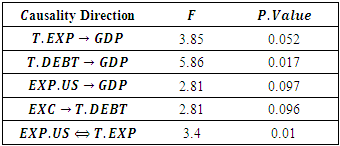

- Panel unit root testWe begin our analysis by showing the univariate properties of the various variables of interest using (Fisher-PP) test for unite root tests. The results in Table 3 uniformly indicate that the null hypothesis of a unit root could not be rejected for all variables in the levels. The null hypothesis, however, was overwhelming rejected for all the series in first-differences.

|

|

|

|

|

|

|

11. Lessons for Asia

- In the medium and long term, the US subprime crisis highlights the need for Asian countries to continue and build upon the post crisis structural reforms of their financial sectors, including further strengthening of their regulatory infrastructures. While those reforms have helped to protect the region from the global financial meltdown this time, the more general lesson for Asia is that even financially advanced economies are susceptible to risks arising from lax regulation and reckless lending. It is also important that the region’s policymakers do not draw the wrong lessons from the current crisis. In particular, it is not financial innovation per se that precipitated the crisis but rather the failure of prudential regulation to stay on top of innovation. Finally, in the long term, the unsustainable nature of the global current account imbalances that have contributed to this crisis has some implications about Asia’s economic growth strategy. In particular, it suggests that Asia may have an enlightened self-interest in modifying its growth strategy toward a greater reliance on domestic demand (James et al 2008, p. 73).Finally, the Asian countries are still at a very early stage in the recovery cycle. Financial crises take time to build. Hence, it is very important that policymakers take pre-emptive measures today to prevent even bigger problems in the future.

Note

- 1. It is assumed that there is no second-order autocorrelation in the differenced idiosyncratic error term.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML