-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2024; 13(3): 57-66

doi:10.5923/j.ijfa.20241303.02

Received: Nov. 22, 2024; Accepted: Dec. 19, 2024; Published: Dec. 21, 2024

The Fiscal Gap Resulting from the Non-Application of Standards by Auditors in Lebanon

Georges Richa1, Amal Abou Fayad2

1Phd Candidate at Holy Spirit University of Kaslik- Usek, Lebanon

2Lebanese University, Ecole Doctorale de Droit et des Sciences Politiques Administratives et Economiques, Sin El Fil, Beirut, Lebanon

Correspondence to: Amal Abou Fayad, Lebanese University, Ecole Doctorale de Droit et des Sciences Politiques Administratives et Economiques, Sin El Fil, Beirut, Lebanon.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Tax non-compliance remains a significant challenge in Lebanon, characterized by a persistent fiscal gap that undermines the nation’s economic stability. Despite governmental efforts to modernize tax administration and encourage compliance, the tax compliance rate is alarmingly low, at just 25%. This study investigates the impact of the non-application of accounting standards by auditors on the widening fiscal gap in Lebanon. A mixed-method approach, including surveys, interviews, and documentary analysis, was employed to collect data from auditors and businesses of various sizes and sectors. The findings reveal that weak enforcement of standards, limited regulatory oversight, and systemic corruption significantly contribute to tax evasion and underreporting of income. The study underscores the critical role of auditors in mitigating these challenges and highlights the need for regulatory reforms and enhanced training to strengthen auditing practices. By addressing these deficiencies, Lebanon can reduce its fiscal gap, enhance financial transparency, and foster a culture of tax compliance, thereby supporting sustainable economic development.

Keywords: Lebanon, Fiscal gap, Accounting standards, Auditors

Cite this paper: Georges Richa, Amal Abou Fayad, The Fiscal Gap Resulting from the Non-Application of Standards by Auditors in Lebanon, International Journal of Finance and Accounting , Vol. 13 No. 3, 2024, pp. 57-66. doi: 10.5923/j.ijfa.20241303.02.

Article Outline

1. Introduction

- The fiscal gap, a complex and multifactorial phenomenon, represents a major concern for modern economies. In Lebanon, this issue is exacerbated by the lack of rigorous enforcement of standards by auditors, key players in the financial system. These professionals, responsible for verifying the accuracy and compliance of companies' financial statements, play a crucial role in preventing tax fraud and ensuring financial transparency [1].The tax system forms the foundation of all challenges, whether short-term or long-term. The current inefficient system, with its narrow base, significant gaps, and steep decline in revenue, requires major reforms [2].In order to increase tax revenues over time while building a more inclusive and productive society, the tax system must be restructured to make it fairer and more equitable [3], improve tax discipline, and expand the tax base. This also requires replacing multiple tax exemptions that serve rent-seeking motivations with others that benefit the broader population. More importantly, it also requires strengthening the values of fiscal integrity and citizenship [4].Often, the Ministry of Finance calls on taxpayers to correct their tax and legal situations. It also conducted a field survey across all Lebanese territories in 2023 to activate tax compliance [5].This article aims to examine the underlying causes of this shortfall, its consequences on the Lebanese economy, especially the volume of the resulting fiscal gap, and the necessary measures to enhance the rigor and effectiveness of financial audits in the country. The primary purpose of this study is to investigate the role of auditors in the non-application of accounting and auditing standards in Lebanon and its direct and indirect contributions to the fiscal gap. Specifically, the research aims to identify the underlying causes of the fiscal gap attributed to the auditing profession, evaluate the extent to which non-compliance impacts tax revenue collection, and propose actionable solutions to address these issues. By focusing on the auditing practices within the Lebanese economic and regulatory context, this study seeks to provide a detailed analysis of how systemic weaknesses, including regulatory gaps, limited training, and conflicts of interest, exacerbate tax evasion and financial opacity.Furthermore, the research intends to highlight the potential for improved enforcement of auditing standards as a means to enhance financial transparency, boost tax compliance, and strengthen public trust in the fiscal system. Ultimately, the study aims to contribute to policymaking by offering evidence-based recommendations for reforming the auditing profession and addressing structural inefficiencies to reduce the fiscal gap in Lebanon. This focus aligns with broader objectives of fostering economic stability and sustainable development in the country.

2. Literature Review

2.1. The Fiscal Gap: Definition and Context

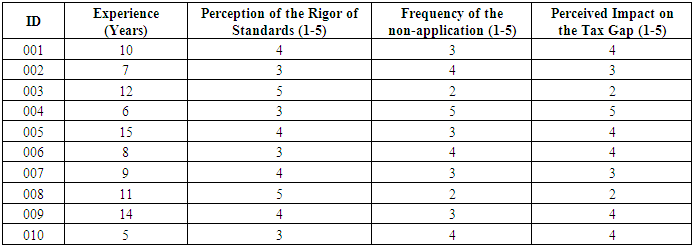

- The difference between the total amount of taxes owed to the state and the amounts actually collected is known as the fiscal gap, which encompasses various forms of tax non-compliance such as tax evasion, fraud, unintentional errors, and administrative issues [6]. This concept is essential in modern economies because it directly influences the state's ability to finance essential public services, ensures tax fairness, and maintains social stability [7]. This distinction allows for the measurement of the effectiveness of tax policies and the identification of sectors in need of reform. Intentional tax evasion, complex fraud, legal tax avoidance, errors arising from a poor understanding of tax laws, or inefficiencies in tax collection by authorities may all be indicators of a fiscal gap [8]. In general, this gap is assessed using macroeconomic methods or individual audits, which provide an estimate of the volume of uncollected revenue [9].The fiscal gap in Lebanon is accentuated by a complex history and persistent economic and political issues. Lebanon's economy was thriving before the civil war (1975-1990) [10], and its tax system was relatively simple and governed by indirect taxes. And so, the economy was damaged, institutions weakened, and tax collection disrupted, which worsened tax evasion.Below is a graph showing the amount of taxes collected from the national product for comparison between developing and developed countries, where it appears. The variation in tax compliance in these countries is evident:

| Figure 1. Source: https://www.wider.unu.edu/project/grd-government-revenue-dataset |

2.2. The Role of Auditors

2.2.1. Accounting Standards and Audits

- Auditors are tasked with ensuring the accuracy and transparency of corporate financial statements, enabling them to play a crucial role in the financial system. Additionally, they strive to ensure that these reports faithfully reflect the financial position of the audited company, in compliance with applicable accounting standards [16]. These standards, both international and local, aim to harmonize accounting methods, ensure the comparability of financial statements, and promote financial transparency, which is vital for enhancing the confidence of investors, regulators, and the public [17].- International Financial Reporting Standards (IFRS)The International Financial Reporting Standards (IFRS) are a set of international accounting standards issued by the International Accounting Standards Board (IASB), aimed at standardizing the presentation of financial statements. Many countries, including Lebanon, adopt them to ensure transparency, comparability, and the quality of financial information [20]. According to the IFRS, auditors must verify not only the compliance of financial statements but also the consistent application of accounting principles, such as revenue recognition, asset valuation, and the presentation of information.- Lebanese Local StandardsIn addition to international standards, Lebanon also has local accounting standards, which may sometimes differ from the IFRS due to the country’s legal and economic specificities. These standards are supervised by local institutions such as the Lebanese Order of Certified Public Accountants (OEC). Therefore, it is the responsibility of auditors to be familiar with and apply both international and local standards to ensure the relevance and legality of the financial statements of companies operating in Lebanon [21].- Issues of non-applicationAlthough these standards exist, their rigorous implementation remains a significant challenge in Lebanon, further exacerbating the fiscal gap and weakening trust in the financial system. Various factors contribute to this situation:1- Political and Economic InstabilityLebanon is facing a major political and economic crisis, characterized by constant instability, widespread corruption, and a faltering economy. Institutions are weakened by this instability, often compromising the strict implementation of standards. Auditors work in an environment where external political or economic constraints can impact their autonomy and ability to rigorously apply the standards [19].2- Conflicts of Interest and CorruptionCorruption remains a major concern in Lebanon, affecting various sectors, including auditing. Auditors may face situations of conflicts of interest, where they are prompted to overlook irregularities or ignore them in order to preserve the interests of their clients or avoid penalties. The independence and quality of their audits are jeopardized due to this situation, which can lead to non-compliance with standards, or even the falsification of financial statements [22].3- Lack of Oversight and RegulationDespite its existence, the regulatory framework in Lebanon is often inadequate to ensure effective oversight of the application of accounting and auditing standards. Regulatory bodies lack the resources, qualified personnel, and sometimes the political will to monitor auditors rigorously [18]. In the absence of thorough checks and adequate sanctions, deviations from standards can be ignored or tolerated.- Restricted Training and QualificationsIt is crucial for auditors to possess technical expertise and receive continuous training to comply with accounting and auditing standards. However, professional development opportunities in Lebanon may be limited [23], due to scarce resources or a lack of appropriate training structures. In such circumstances, auditors may not be aware of the latest developments in international standards and auditing practices, thereby limiting their ability to perform audits that adhere to the required standards.- Economic Concerns and LimitationsEconomic pressures can also be placed on auditors, such as increasing competition in the auditing field, which may lead them to reduce costs and the time allocated to audits [24]. In an environment where profits are limited, some auditors may be tempted to reduce the accuracy of their examinations in order to satisfy clients or protect their market share. This results in superficial checks and non-compliance with standards, thereby jeopardizing the quality of financial statements [25].- Weak Compliance CultureFinally, a weak culture of compliance within Lebanese companies also has a detrimental effect on the enforcement of accounting and auditing standards. Auditors may face obstacles or limited cooperation if companies themselves do not prioritize compliance or view audits as merely a formality.

2.2.2. Issues of Non-Application

- Several factors undermine the rigorous application of standards by auditors in Lebanon. The lack of strict sanctions and effective control mechanisms reduces the pressure on these professionals to comply with established standards, thereby creating an environment in which non-compliant practices can emerge. Furthermore, economic constraints and commercial pressures sometimes encourage audit firms to make concessions at the expense of standard adherence, particularly to meet client expectations. Finally, the lack of continuous training and the updating of auditors' professional skills also contributes to an inadequate or outdated understanding of the standards, thus exacerbating non-application issues. These factors highlight the need to strengthen the regulatory framework and promote a culture of strict compliance in Lebanon [26].

2.3. Economic Consequences of Non-Application of Standards

2.3.1. Impact on the Economy

- The non-application of standards by auditors in Lebanon has significant repercussions on the national economy, particularly concerning the fiscal gap. When financial audits are not conducted with rigor, it results in underreporting of income and increased tax evasion [27]. The state is directly affected by this situation, leading to a lack of revenue and a reduction in available resources for public investments and social services. Furthermore, non-compliance weakens the trust of both local and international investors, thus hindering foreign investment flows that are essential for the country’s economic recovery. The ensuing economic instability exacerbates social inequalities and slows overall economic development.

2.3.2. Comparative Studies

- An analysis of the tax and audit systems of other countries, whether different or similar, underscores the importance of the rigorous application of standards to ensure a healthy economy. For instance, in countries like Germany or Canada, where financial audits are conducted with exemplary rigor, the fiscal gap is significantly reduced, allowing the state to maximize its tax revenues and maintain a robust economy. In contrast, in countries where standards are applied laxly, as is sometimes the case in certain emerging economies, fiscal gaps are higher, leading to budget deficits and economic instability [28]. These examples demonstrate that the demand for rigor in financial audits is not limited to regulatory compliance but is a key element for the economic stability of a country.

3. Research Methodology

3.1. Data Collection

- To assess the impact of the non-application of audit standards on the fiscal gap in Lebanon, a mixed-method approach was adopted, combining both quantitative and qualitative methods for a comprehensive analysis.SamplingThe sample for this study consisted of two main groups:1. Auditors: A random sample of 50 auditors was selected from the registers of the Lebanese Order of Certified Public Accountants. Selection criteria included at least five years of experience in the auditing field and active involvement in auditing companies of various sizes.2. Companies: A sample of 100 companies, distributed among small, medium, and large enterprises, was selected. These companies operate in various sectors, including retail, industry, and financial services. The sample was stratified to ensure fair representation of different types of businesses.

3.2. Methods of Data Collection

- 1- Questionnaires:ο Auditors: A structured questionnaire was distributed to selected auditors, containing closed-ended questions and Likert scale items to evaluate their perception of the application of auditing standards, the challenges encountered, and the perceived impact on the tax gap.ο Businesses: Another questionnaire was administered to the financial managers of selected companies, aiming to collect information on their auditing practices, their experience with auditors, and their compliance with tax obligations.2- Semi-Structured Interviews:ο Semi-structured interviews were conducted with a subgroup of 10 auditors and 15 business executives. These interviews aimed to deepen the insights gained from the questionnaires and explore in greater detail the reasons behind non-compliance and the perceived economic consequences.3- Documenter Analysis:ο An analysis of the annual financial reports of the companies in the sample was conducted to assess the level of compliance with auditing standards. This analysis facilitated the triangulation of data obtained from the questionnaires and interviews and verified the reported tax gaps.4- Secondary Data:ο Secondary data were collected from reports by international organizations (such as the World Bank and the IMF) and academic publications, providing a comparative framework with other countries that have similar or different tax systems.

3.3. Data Collection Procedures

- The questionnaires were administered online through a secure platform, while the interviews were conducted either in person or via videoconference, depending on the participants' preferences. All collected data were anonymized to ensure the confidentiality of respondents.

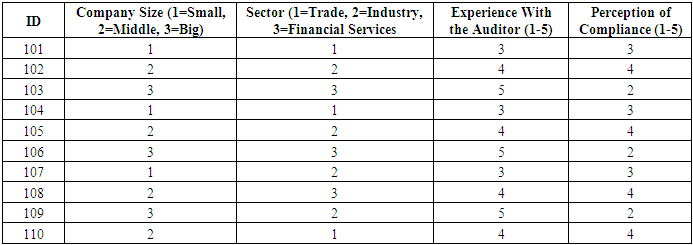

3.4. Confidentiality and Anonymity

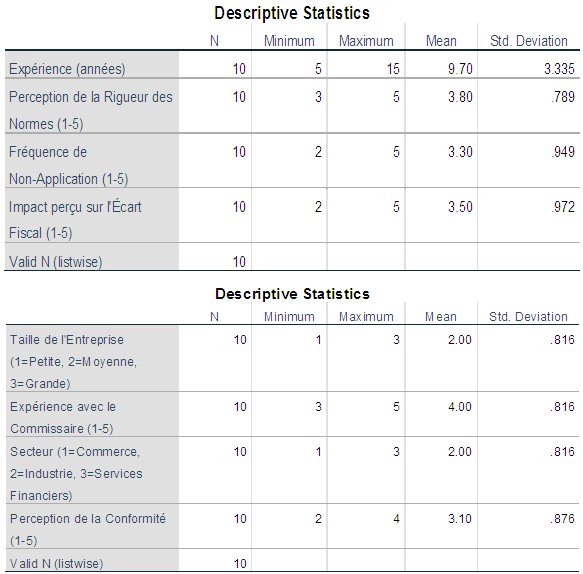

- To safeguard the confidentiality of participants and ensure data reliability, all responses were anonymized. The design of the questionnaires and interviews precluded the identification of individual participants or companies. This anonymity measure was crucial to encourage honest and open responses and to protect sensitive information. The data collected are used solely for research and analysis purposes, in compliance with prevailing ethical standards. Table 1 summarizes data collected from auditors regarding their experience, perception of standards' rigor, frequency of non-application, and perceived impact on the tax gap. This table highlights key insights into the auditors' professional practices and their relationship with non-compliance and fiscal gaps.

|

|

3.5. Data Procession

- In this study, data processing was conducted using SPSS (Statistical Package for the Social Sciences), a robust tool for statistical analysis. The process began with importing the dataset into SPSS, where each row represented an individual case and each column corresponded to a specific variable. Subsequently, the data were cleaned to ensure quality by removing outliers and addressing missing values. After this preparation phase, descriptive analyses were performed to summarize the key characteristics of the data, followed by more complex statistical analyses, such as regression models or hypothesis testing, to address the research questions. The results were visualized through tables and graphs generated by SPSS, facilitating the interpretation and communication of the findings.

3.6. The Hypotheses

- 1) The strict non-application of audit standards by auditors significantly contributes to the increase in the tax gap in Lebanon.2) The lack of effective sanctions and oversight is one of the main causes of non-compliance with audit standards.3) Improving the regulatory framework and control mechanisms could reduce the tax gap and strengthen investor confidence.

4. The Results

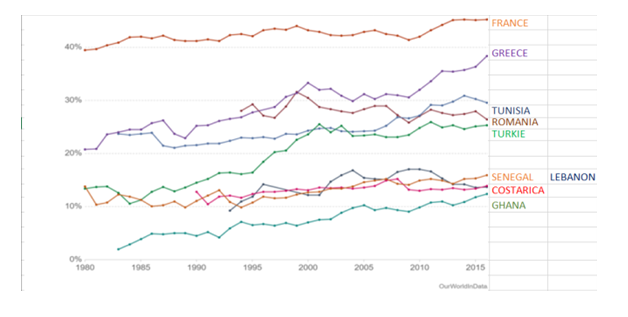

- In this section, we present the results obtained from the data analysis regarding the perceptions of Lebanese companies on tax compliance and the role of auditors. The results are detailed through frequency tables and descriptive statistics for each variable studied.

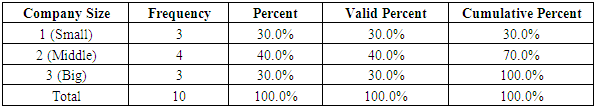

4.1. Company Size

- The participating companies were classified into three categories: small (1), medium (2), and large (3). The results show a relatively balanced distribution among the different company sizes, with 30% of respondents from small companies, 40% from medium-sized companies, and 30% from large companies.

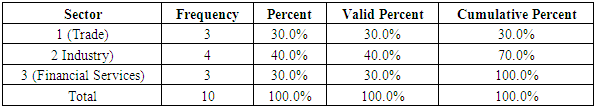

4.2. Sector of Activity

- The companies were also classified by sector of activity: trade (1), industry (2), and financial services (3). The results indicate that 30% of the companies are from the trade sector, 40% from the industrial sector, and 30% from financial services, highlighting a distribution similar to that of the company sizes.

4.3. Experience with the Auditors

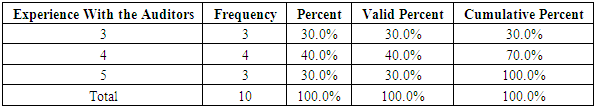

Experience with auditors was evaluated on a scale of 1 to 5. The companies reported an average level of experience with their auditors, with 30% of companies assigning a score of 3, 40% a score of 4, and 30% a score of 5.

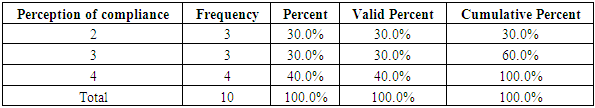

Experience with auditors was evaluated on a scale of 1 to 5. The companies reported an average level of experience with their auditors, with 30% of companies assigning a score of 3, 40% a score of 4, and 30% a score of 5.4.4. Perception of Compliance

- The perception of compliance was also measured on a scale of 1 to 5. The results show a distribution where 30% of companies have an average perception of compliance (score of 3), while 40% believe compliance is high (score of 4).

4.5. Descriptive Statistics

- Descriptive statistics provide an overview of the variables studied, including the mean and standard deviation, which respectively indicate the average value and the dispersion of the responses.

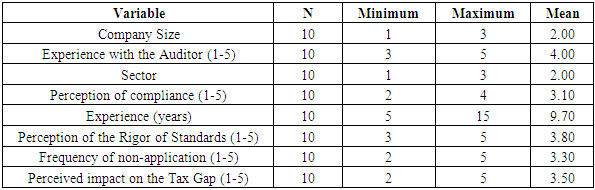

4.6. Analysis by Variable

- - Experience (years): The surveyed companies have varying levels of experience, ranging from 5 to 15 years, with an average of 9.7 years.- Perception of the Stringency of Standards: The majority of companies perceive the standards as stringent, with an average rating of 3.8 out of 5.- Frequency of Non-Compliance: The frequency of non-compliance with standards is perceived as moderate, with an average rating of 3.3 out of 5.- Perceived Impact on the Tax Gap: The perceived impact of non-compliance with standards on the tax gap is also moderate, with an average rating of 3.5 out of 5.These findings illustrate the diversity of perceptions and experiences among Lebanese companies regarding tax compliance and the role of auditors. They highlight the importance of strengthening the rigor of financial audits to reduce the tax gap and improve financial transparency in the country.The precise results of SPSS

5. Discussion of the Results

5.1. Auditor Compliance and Perception of Standards

- The results indicate that auditors perceive the rigor of standards as moderate (average score of 3.8 out of 5), yet there is a notable frequency of non-compliance (3.3 out of 5). These findings align with studies like those of Slimene (2021), which emphasize that weak regulatory enforcement and limited oversight often reduce adherence to auditing standards. Moreover, the perceived impact of non-compliance on the fiscal gap (3.5 out of 5) corroborates prior research, such as Mandzila (2019), which highlighted the significant role of auditors in mitigating fiscal discrepancies.

5.2. Business Size and Compliance Perception

- The analysis revealed that the size of the business did not significantly affect perceptions of compliance, suggesting that tax compliance challenges are widespread across company sizes. This aligns with findings from Tristram (2005), who argued that systemic weaknesses, such as inadequate auditing frameworks and limited state intervention, affect businesses uniformly regardless of their size or sector.

5.3. Sectoral Differences in Tax Compliance

- While compliance perceptions were consistent across sectors, businesses in the financial services sector demonstrated slightly better engagement with auditing processes. This observation is consistent with research by Geourjon (2019), which identified financial services as more likely to adopt international auditing standards due to their exposure to global markets and investor scrutiny.

5.4. Impact of Auditor Practices on the Fiscal Gap

- The results emphasize the moderate yet significant contribution of non-compliance to Lebanon's fiscal gap. This finding is supported by Takieddine (2018), who highlighted the compounding effects of non-compliance, corruption, and weak oversight in widening fiscal discrepancies. However, unlike studies in other regions, such as those by Gertler (2011) on developing economies, the Lebanese context is uniquely influenced by political instability and economic pressures, further exacerbating non-compliance.

5.5. Regulatory Framework and Training

- The findings suggest that gaps in professional training and weak regulatory enforcement contribute significantly to non-compliance. These results are consistent with Pigé’s (2003) research on the audit market, which demonstrated that insufficient training and economic constraints compromise auditing quality. The need for systemic reforms, including enhanced regulatory oversight and capacity building for auditors, resonates with recommendations by Demaria (2007) for addressing compliance gaps.

6. Practical Implications

- The findings of this study highlight critical areas where policymakers and practitioners can implement changes to address the fiscal gap in Lebanon. These practical recommendations are rooted in the study’s analysis and provide targeted strategies for improvement:Strengthening Regulatory OversightOne of the most significant findings of this study is the lack of robust regulatory enforcement. Policymakers should focus on establishing independent oversight bodies with adequate resources and authority to monitor and enforce auditing standards. This includes creating a clear framework of sanctions for non-compliance, such as fines or license suspensions for auditors failing to meet required standards. Additionally, streamlining the regulatory process can help eliminate bureaucratic inefficiencies that undermine enforcement efforts. Empowering these institutions with advanced technology, such as automated compliance monitoring systems, can further enhance their effectiveness in detecting irregularities and ensuring accountability.Mandatory Professional DevelopmentThe study emphasizes a critical gap in auditors’ professional training and knowledge of international standards. Practitioners must have access to regular, mandatory training programs to stay updated on evolving standards and best practices. Professional organizations, such as the Lebanese Order of Certified Public Accountants (OEC), should collaborate with global entities like the International Federation of Accountants (IFAC) to design and implement specialized training modules. Additionally, mentorship programs pairing experienced auditors with newer professionals could help build a culture of excellence and compliance.Promoting Tax Awareness and Public EngagementA lack of public awareness about the importance of tax compliance contributes to the fiscal gap. Policymakers should launch nationwide awareness campaigns to educate businesses and taxpayers about the long-term economic benefits of transparency and compliance. These campaigns can include workshops, public service announcements, and the distribution of informational material. For example, highlighting case studies that demonstrate how tax compliance supports public services—such as healthcare, education, and infrastructure—could resonate with both businesses and individuals. Partnering with civil society organizations can further amplify the reach and impact of these initiatives.Enhancing Collaboration Between StakeholdersEffective collaboration between auditors, regulatory bodies, businesses, and policymakers is critical for achieving sustainable reforms. For instance, joint task forces comprising representatives from these groups could be established to identify systemic challenges and propose practical solutions. These collaborations could also facilitate the sharing of data and best practices, fostering a more unified approach to addressing tax compliance issues. Policymakers should also ensure that auditors are protected from undue external pressures, such as political interference or client demands, which can compromise their independence and effectiveness.Incentivizing CompliancePolicymakers should explore the implementation of incentive-based strategies to encourage voluntary compliance among businesses. These could include financial rewards, such as tax credits or reduced audit frequencies for companies with a proven record of compliance. Additionally, offering administrative benefits, such as expedited licensing or access to government contracts for compliant businesses, could motivate more organizations to adhere to auditing standards. These incentives should be coupled with strict penalties for deliberate non-compliance to create a balanced approach.

7. Limitations of the Study

- While this study provides valuable insights into the role of auditors in Lebanon’s fiscal gap, several limitations must be acknowledged to contextualize the findings and guide future research:Sample Size and RepresentationThe study’s sample of 50 auditors and 100 businesses, while diverse, may not fully capture the complexity of Lebanon’s fiscal ecosystem. Expanding the sample size to include a larger and more varied set of participants—such as auditors from smaller firms, businesses in rural areas, and informal economic actors—could provide a more comprehensive understanding of the issue. Additionally, including international auditors working in Lebanon could offer insights into the challenges of applying global standards in a local context.Focus on Self-Reported DataMuch of the data was collected through questionnaires and interviews, which are inherently subject to self-reporting biases. Participants may have overstated compliance or understated challenges due to social desirability or fear of repercussions. Future studies could complement these methods with observational data or third-party audits to verify reported practices and ensure a more objective analysis.Contextual ConstraintsThe findings of this study are deeply rooted in Lebanon’s socio-political and economic conditions, which are unique and marked by instability. As such, the conclusions may not be directly transferable to other countries or regions with different regulatory environments or economic systems. A broader comparative analysis could provide additional context for interpreting these findings.Limited Examination of External FactorsThis study primarily focused on the role of auditors and businesses, without delving deeply into broader external factors such as international financial pressures, regional economic dynamics, or the role of foreign aid. These factors could significantly influence Lebanon’s fiscal gap and warrant further exploration.

8. Future Research Directions

- Building on the findings of this study, several avenues for future research are proposed to deepen the understanding of Lebanon’s fiscal gap and the broader implications of auditing practices:Comparative Studies with Other EconomiesFuture research could compare Lebanon’s auditing and tax compliance challenges with those of other countries facing similar fiscal pressures. For example, examining how countries with successful compliance models, such as Germany or Canada, have implemented reforms could offer practical lessons for Lebanon. Similarly, comparing Lebanon with countries experiencing similar instability, such as Iraq or Syria, could highlight shared challenges and potential regional solutions.Longitudinal StudiesTo assess the long-term impact of reforms and initiatives, longitudinal studies are necessary. These studies could track the effects of newly implemented policies, such as auditor rotation laws or public awareness campaigns, over several years. Such research would provide valuable insights into the sustainability and effectiveness of these measures.Exploration of Informal EconomiesThe role of informal economic activities in widening the fiscal gap remains an underexplored area. Future research could investigate how informal businesses navigate tax compliance and the challenges of integrating them into the formal economy. This could include analyzing the socio-economic factors driving informality and proposing strategies for formalization.Stakeholder Perceptions and DynamicsExpanding the scope of research to include the perspectives of policymakers, regulatory bodies, and taxpayers would provide a more holistic understanding of the systemic challenges. Exploring the dynamics between these stakeholders could reveal areas of misalignment and opportunities for collaboration.Technological Solutions for Tax ComplianceWith the rise of technologies such as blockchain and artificial intelligence, future studies could explore how these tools can improve tax compliance and auditing practices in Lebanon. For example, blockchain could provide tamper-proof records of financial transactions, while AI-powered analytics could identify patterns of non-compliance more effectively than traditional methods.Impact of Political Stability on Fiscal ReformGiven the critical role of political stability in enabling economic reform, future research could examine how shifts in Lebanon’s political landscape influence regulatory enforcement and tax compliance. This could provide valuable insights into the interplay between governance and fiscal policy.

9. Conclusions

- This study has delved into the critical issue of the fiscal gap in Lebanon, particularly as it relates to the non-application of auditing and accounting standards by auditors. The findings reveal a complex interplay of systemic weaknesses, regulatory deficiencies, and economic pressures that perpetuate tax non-compliance and hinder the nation’s economic stability.The research highlights that auditors hold a pivotal position in the financial ecosystem, where their adherence to rigorous auditing standards could significantly reduce fiscal discrepancies. However, widespread non-compliance, driven by external constraints such as weak enforcement mechanisms, corruption, and political instability, undermines this potential. Auditors often find themselves in a precarious position, balancing professional integrity against economic pressures and client demands. This environment compromises the quality of audits and contributes to the underreporting of taxable income, a direct factor in Lebanon’s widening fiscal gap.The study also uncovers the systemic nature of these challenges, with compliance issues prevalent across businesses of all sizes and sectors. This uniformity suggests that the problem lies not only in individual practices but in the structural inefficiencies of Lebanon's tax administration and auditing framework. Political instability, coupled with the lack of institutional resources, exacerbates these deficiencies. Despite efforts by the Lebanese government to modernize administrative systems and implement progressive policies, such as mandatory auditor rotation and transparency laws, these initiatives have yet to yield significant improvements due to inconsistent enforcement and limited public trust in governmental institutions.Moreover, the findings emphasize a critical gap in professional training and development among auditors. Many lack the tools and updated knowledge to effectively implement international standards, which is compounded by the absence of comprehensive oversight mechanisms. This weakens the overall credibility of financial audits and further erodes investor confidence, both locally and internationally. The practice of circumventing mandatory auditor rotation requirements, as revealed in this study, reflects deeper cultural and regulatory challenges that need urgent redress.At the broader economic level, the implications of these findings are profound. The fiscal gap, fueled by systemic tax evasion and inadequate auditing practices, deprives the Lebanese state of critical revenue needed for public services and infrastructure. This not only exacerbates socio-economic inequalities but also undermines efforts toward sustainable economic recovery. International comparisons reveal that countries with stricter auditing and compliance frameworks have smaller fiscal gaps and more resilient economies, underscoring the urgency of implementing similar reforms in Lebanon.To address these challenges, this study advocates for a multifaceted approach. Strengthening the regulatory framework is paramount, requiring the allocation of sufficient resources to oversight bodies and the enforcement of strict penalties for non-compliance. Professional training programs for auditors should be prioritized to ensure alignment with international best practices and the latest standards. Furthermore, fostering a culture of accountability and compliance within businesses is essential. Awareness campaigns targeting both auditors and businesses can help shift perceptions and emphasize the mutual benefits of transparency and tax compliance.In conclusion, the study not only identifies the critical role of auditors in bridging Lebanon’s fiscal gap but also underscores the systemic reforms required to enable them to fulfill this role effectively. By enhancing the rigor of auditing practices, strengthening regulatory enforcement, and addressing the socio-economic and political factors that fuel non-compliance, Lebanon can take significant strides toward economic stability and fiscal integrity. The success of these measures depends on a collective commitment from policymakers, regulatory bodies, auditors, and businesses to prioritize transparency and accountability as the foundation of a resilient and equitable economy.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML