-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2024; 13(2): 39-44

doi:10.5923/j.ijfa.20241302.02

Received: Jun. 27, 2024; Accepted: Jul. 20, 2024; Published: Jul. 27, 2024

How to Derive Financial Segmentation Using Digital Transformation

Jayesh Jhurani

ServiceTitan, Atlanta, GA, USA

Correspondence to: Jayesh Jhurani, ServiceTitan, Atlanta, GA, USA.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Financial Segmentation is a key aspect of financial management, enabling organizations to make informed decisions in the ever-evolving landscape of business operations. The study highlights the challenges organizations face in accurately attributing salaries and other costs among identified Financial Segments, especially when individuals contribute to multiple product categories simultaneously. The integration of advanced tools like allocation engines exemplifies the contemporary approach to finance management, emphasizing automation and accuracy in the dynamic landscape of organizational finances. The ability to maintain reporting stability at the Cost Center level and explore diverse financial perspectives empowers organizational leadership to make intelligent decisions, strategically allocate resources, and thrive in a dynamic business environment.

Keywords: Accounting, Allocations, Cloud Technology, Digital Transformations, ERP, Financial Segments

Cite this paper: Jayesh Jhurani, How to Derive Financial Segmentation Using Digital Transformation, International Journal of Finance and Accounting , Vol. 13 No. 2, 2024, pp. 39-44. doi: 10.5923/j.ijfa.20241302.02.

Article Outline

1. Introduction

1.1. Background

- Financial Segmentation involves examining the Gross Profit of an organization by categorizing the products and services it offers. In the pursuit of its objectives, every business invariably seeks not only to address challenges but also to yield profits. Indeed, profitability stands out as one of the primary and intrinsic drivers for the very existence of any business entity. This fundamental aspect gains heightened significance, particularly during the nascent stages or when the business operates on a smaller scale. [2]The process of calculating profit becomes relatively uncomplicated for smaller businesses. It involves a straightforward computation, where business expenses are subtracted from the total revenue generated. A positive outcome in this calculation signifies that the business has achieved profitability, while a negative result indicates that the business is operating at a financial loss. This financial metric assumes paramount importance due to its direct correlation with the overall financial health and viability of the business.In light of this, the meticulous scrutiny of profit becomes a normative practice undertaken by business owners and individuals with a vested interest in the success and sustainability of the enterprise. The profit calculation serves as a barometer, offering valuable insights into the business's fiscal performance. It plays a pivotal role in shaping strategic decisions, influencing resource allocation, and facilitating the establishment of long-term financial objectives. As such, the dynamic and ongoing analysis of profit not only reflects the current state of the business but also informs future planning, ultimately contributing to the overall success and endurance of the business venture.

1.2. Problem Statement

- As organizations undergo growth and expansion, the once straightforward calculation of profit becomes more intricate, evolving beyond a simple evaluation of revenue and expenses. The complexity arises from the emergence of various departments within the organization, each playing distinct roles. Some departments actively contribute to revenue generation, while others, though not revenue-generating, are essential for administrative purposes. Additionally, organizations often establish dedicated departments focused solely on fostering growth.With the introduction of new products onto the market, the intricacy of profit calculation further intensifies. This complexity necessitates a nuanced approach to financial analysis, requiring organizations to delve into their financial data in multifaceted ways. The need to comprehend the financial landscape from different perspectives becomes crucial as organizations navigate the dynamic interplay of growing departments and the diverse array of products they bring to market.In this evolved scenario, the analysis of profit transcends a basic computation, transforming into a strategic exercise that involves a comprehensive examination of the financial intricacies within each department. Organizations must now consider the varying impacts of revenue, expenses, and growth initiatives across the entire spectrum of their operations. This multifaceted analysis becomes instrumental in gaining a holistic understanding of the financial health of the organization and facilitates informed decision-making.Therefore, the evolving nature of profit calculation in growing organizations underscores the importance of adopting sophisticated financial analysis methodologies. The Financial Segmentation approach allows organizations to adapt to the expanding complexities brought about by growth, diverse product offerings, and the multifunctional roles of different departments. Ultimately, the ability to navigate and analyze financial data in diverse ways becomes integral to sustaining profitability and fostering continued success in a dynamic business landscape.

2. Structure

- The Profit & Loss (P&L) statement, a cornerstone of financial reporting for any organization, delineates its financial landscape into four pivotal areas:

2.1. Revenue (Rev)

- This category encapsulates the total income generated from the sale of goods or services, serving as the starting point for financial analysis.

2.2. Cost of Revenue (COR)

- COR encompasses the direct costs associated with the production or delivery of goods and services, spanning expenses such as materials, labor, and manufacturing costs.

2.3. Research & Development Spend (R&D)

- Representing the investment in innovation, R&D expenses cover the costs incurred in the exploration and development of new products, services, or technologies.

2.4. General & Administrative Spend (G&A)

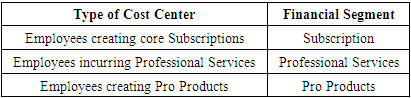

- G&A includes the operational and administrative expenses of the organization, including salaries, rent, utilities, and other overhead costs crucial to daily operations.The financial health of a company is often gauged through a comprehensive formula derived from these integral components:Gross Profit = Revenue (Rev)−Cost of Revenue (COR) [1] [2]This Gross Profit metric serves as a critical indicator, revealing the company's efficacy in translating revenue into profit after factoring in the direct costs of production.Notably, Research & Development Spend (R&D) and General & Administrative Spend (G&A) are subject to control through various mechanisms. This heightened control underscores why Chief Executive Officers (CXOs) and investors express keen interest in understanding Gross Profit, derived by subtracting COR from Revenue. Gross Profit provides crucial insights into the balance between revenue generation and the associated expenditures.Delving deeper, Financial Segmentation emerges as a strategic process, leveraging the analysis of Gross Profit and employing digital transformation techniques. This approach aims to unravel a detailed understanding of what a company sells and the corresponding costs involved in creating a viable product or service. By scrutinizing these financial dynamics, organizations gain valuable insights into the strengths, weaknesses, and optimization opportunities within their product or service offerings, fostering informed decision-making in a dynamic business environment.In the context of companies offering cloud software solutions, it is a common practice for them to extend their services beyond the core software offering. This extension typically involves the provision of professional services for the implementation of the software solution and the sale of additional products, hereafter referred to as "Pro products," which complement the core software solution. In the course of our research, we categorize these revenue streams as Core Subscription, Professional Services, and Pro Products.While establishing Financial Segmentation from Revenue for the aforementioned categories is relatively straightforward, involving the simple tagging of a dimension to each product, the complexity arises when calculating the Cost of Revenue. Specifically, determining which salaries should be allocated to each of the defined Financial Segments poses a significant challenge. This complexity is magnified by the fact that individuals, such as software developers, may be concurrently engaged in the development of both core subscription products and Pro products.The intricate nature of cost attribution necessitates a nuanced approach. Organizations encounter difficulties in effectively segregating the cost of revenue associated with each segment, particularly when the same personnel contribute to multiple product categories. As shown in Figure 1, a software developer might be simultaneously involved in the creation of both core subscription products and Pro products, leading to ambiguity in allocating their salaries to specific Financial Segments.

| Figure 1. Employee Relationship with Financial Segments |

3. Methodology

3.1. Evaluation

- Before delving into the methodologies employed, it is imperative to comprehend the mechanisms by which the cost of revenue is categorized within large organizations. A fundamental dimension utilized for this purpose is termed the "Cost Center." This pivotal dimension involves associating employees with specific Cost Centers, enabling a systematic slicing of expenditure data in accordance with defined categories. The initial step in establishing a system that involves assigning specific accountability for decision-making and defining the structure of responsibility centers within a particular company or enterprise. [3]

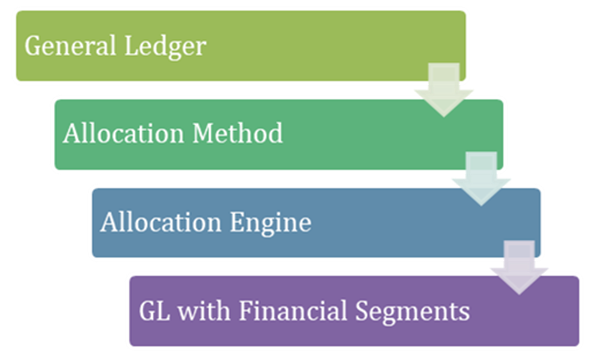

3.2. Direct Cost Method

- One method employed for meticulous segmentation of the cost of revenue is the Direct Cost method. Within this approach, a direct and one-to-one relationship is established between the cost center and the financial segment. Here, employees are systematically grouped based on the specific product they are involved in constructing or manufacturing.This methodological alignment ensures a granular breakdown of costs, directly linking each cost center to the corresponding financial segment. Such precision becomes particularly invaluable in scenarios where employees are engaged in the development or production of distinct products concurrently. The Direct Cost method, through its tailored approach, enables organizations to precisely attribute costs to the specific products or services for which they are incurred.By leveraging the direct cost-center-to-financial-segment relationship, organizations can attain a nuanced understanding of their cost structure, facilitating a more accurate representation of financial dynamics. This methodology not only enhances financial transparency but also enables businesses to strategically allocate resources and manage costs effectively.In essence, the utilization of the Cost Center dimension and the Direct Cost method underscores a meticulous approach to financial segmentation, ensuring that the cost of revenue is intricately aligned with the distinct products or services being developed or manufactured within large organizations. This nuanced methodology serves as a foundational element for robust financial analysis, enabling organizations to derive meaningful insights from their cost structures and make informed decisions in the ever-evolving landscape of business operations.

|

3.3. Mixed Method

- Contrary to the one-to-one relationship established in the Direct Cost method, an alternative approach emerges where the cost center and Financial Segmentation lack a direct correspondence. This method recognizes the complexity inherent in scenarios where a single cost center is involved in the creation of various types of products, rendering a straightforward segmentation of the Cost of Revenue data challenging. In response to this intricate landscape, the Mixed method is introduced as a pragmatic solution.The Mixed method operates on the premise that a nuanced and percentage-based association can be defined for each cost center with respect to different financial segments. Rather than adhering to a rigid one-to-one relationship, this method allows for a more flexible and dynamic allocation of costs. The initial step in the Mixed method involves delineating the percentage distribution of each cost center's association with distinct financial segments.This percentage-based approach acknowledges the multifaceted contributions of a single cost center to diverse products or services. By quantifying the proportional involvement of each cost center in various financial segments, organizations gain a comprehensive understanding of how costs are distributed across different aspects of their operations.The Mixed method thus offers a tailored and adaptable framework for financial segmentation, accommodating the intricate scenarios where a cost center plays a multifaceted role in product development. This methodology not only enhances the accuracy of cost allocation but also reflects the nuanced nature of modern business operations, where versatility and adaptability are paramount.The Mixed method stands as a strategic response to the challenges posed by diverse product creation within a singular cost center. Its percentage-based approach ensures a more realistic and dynamic representation of cost distribution, empowering organizations with a nuanced understanding of their financial landscape for informed decision-making in the ever-evolving business environment.

4. Technical Details

4.1. Prerequisite

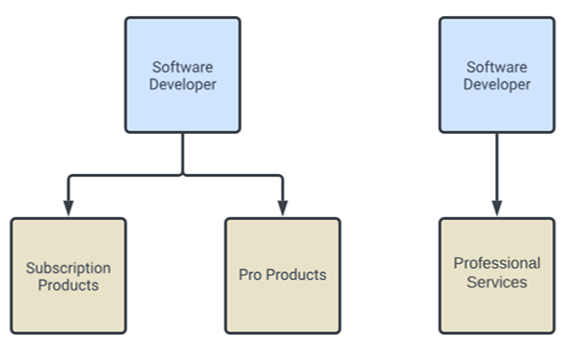

- The process of allocations, as employed in financial management, involves the systematic distribution or apportionment of specific amounts or costs among various accounts or entities. This allocation process is guided by predefined rules or criteria, aiming to achieve an accurate representation of financial transactions. The overarching objective is to ensure that costs are judiciously assigned to the pertinent departments, projects, or cost centers within an organization, fostering transparency and accountability in financial reporting.Following the determination of percentage data for each cost center, a pivotal step in the allocation process involves feeding this data into a dedicated statistics table. This table functions as a crucial input to the allocation engine, serving as the mechanism through which the predetermined percentages are operationalized in the allocation process.The allocation engine, a sophisticated component of the financial system, then takes charge of executing the allocation. It operates by accessing the designated source for Financial Transactions, utilizing the prepared statistics, and orchestrating the movement of costs to the pre-defined Financial Segments. This dynamic engine plays a pivotal role in automating the allocation process, ensuring efficiency, accuracy, and consistency in the assignment of costs across various segments.

4.2. Functional Design

- Essentially, the integration of percentage data into a statistics table, coupled with the deployment of an allocation engine, forms a comprehensive and streamlined methodology for precise cost distribution. This method aligns with the overarching goal of allocations — that of transparently and equitably assigning costs to specific segments within an organization, facilitating robust financial reporting and strategic decision-making. The utilization of advanced tools like allocation engines exemplifies the contemporary approach to financial management, emphasizing automation and accuracy in the dynamic landscape of organizational finances.

| Figure 2. Allocation Workflow |

5. Use Cases

- • Implementing Financial Segmentation allows the organization to break down revenue and costs associated with each product line. This detailed analysis helps identify which products are most profitable and where cost-saving measures can be applied.• By using Financial Segmentation, the company can attribute costs accurately to each department and product line. This enables the management to allocate resources more effectively, ensuring that high-performing areas receive adequate investment while identifying and addressing inefficiencies.• Utilizing the Mixed Method of cost allocation, the organization can proportionally assign costs based on the time and effort employees dedicate to each project. This ensures a fair and precise distribution of expenses, aiding in better financial planning and reporting.• Financial Segmentation provides granular data on existing product performance and associated costs. This data can guide strategic decisions, helping the company to forecast potential profitability and resource requirements for new ventures.• By segmenting financial data, the organization can measure the performance of different departments and product lines against benchmarks. This helps in identifying areas of strength and opportunities for improvement, driving overall performance enhancement.

6. Conclusions

- In conclusion, the process of Financial Segmentation plays a pivotal role in unraveling the financial intricacies of an organization, particularly in the context of evolving business landscapes. Starting with the fundamental examination of Gross Profit, Financial Segmentation extends its reach to encompass detailed insights into revenue streams, cost structures, and the allocation of resources. The Profit & Loss statement serves as a cornerstone, delineating key components such as Revenue, Cost of Revenue, Research & Development Spend, and General & Administrative Spend.As organizations grow, the simplicity of profit calculation transforms into a more intricate process, necessitating a nuanced approach to financial analysis. The adoption of the Financial Segmentation approach becomes crucial in adapting to the expanding complexities brought about by growth, diverse product offerings, and the multifunctional roles of different departments.The study highlights the challenges organizations face in accurately attributing costs to revenue-generating segments, especially when individuals contribute to multiple product categories simultaneously. Two methodologies, the Direct Cost method and the Mixed method, offer tailored solutions to address this complexity, ensuring precise alignment between costs and distinct financial segments.Furthermore, the research emphasizes the importance of robust cost accounting methodologies for accurate distribution of salaries and other costs among identified Financial Segments. This pursuit of precision is essential for organizations seeking a holistic understanding of their financial dynamics and making informed decisions in the dynamic landscape of business operations.In the pursuit of effective Financial Segmentation, the choice of suitable software solutions becomes crucial. Workday Financials stands out as a robust solution, providing a versatile and global platform for managing core financial functions. Its integration with Human Capital and Financial Applications exemplifies a comprehensive approach to modern business needs, aligning with the growing trend of remote work and globalized business operations.The methodologies employed in Financial Segmentation, including the Direct Cost method, Mixed method, and allocations, contribute to a nuanced understanding of cost structures and financial dynamics. The integration of advanced tools like allocation engines exemplifies the contemporary approach to financial management, emphasizing automation and accuracy in the dynamic landscape of organizational finances.In essence, Financial Segmentation, coupled with advanced methodologies and software solutions, equips organizations with the tools and insights needed to navigate the complexities of modern financial management. The ability to maintain reporting stability at the Cost Center level and explore diverse financial perspectives empowers organizational leadership to make informed decisions, strategically allocate resources, and thrive in a dynamic business environment.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML