-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2024; 13(1): 20-27

doi:10.5923/j.ijfa.20241301.02

Received: May 15, 2024; Accepted: May 29, 2024; Published: Jun. 7, 2024

The Impact of Audit Committees on the Financial Performance of Commercial Banks in Burundi

Bigawa Bazira Abel1, 2, Igirubuntu Merveille1, Nshimirimana Théon2, Ntakirutimana Leonard2, 3

1Faculty of Economics and Management Sciences (FSEG), University of Burundi (UB), Bujumbura, Burundi

2Business School (ISCO), University of Burundi, Bujumbura, Burundi

3Faculty of Agronomy and Bioengineering (FABI), University of Burundi (UB), Bujumbura, Burundi

Correspondence to: Bigawa Bazira Abel, Faculty of Economics and Management Sciences (FSEG), University of Burundi (UB), Bujumbura, Burundi.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The Audit Committee plays a crucial role in safeguarding the interests of shareholders and stakeholders in commercial banks. This study aims to examine the impact of audit committee characteristics on the financial performance of Commercial Banks in Burundi. The audit committee characteristics considered in this study are the size of the committee and the number of meetings held per year. The financial performance is measured by Return on Equity (ROE) and Return on Assets (ROA) models. An empirical analysis was carried out using a panel data regression model built on a sample of 4 Burundian Commercial Banks observed over a period of eight years between 2013 and 2020. The results of the study showed that there is a positive but not significant relationship between the size of the audit committee and the financial performance measured by ROE and ROA, whereas, the results of the frequency of audit committee meetings showed that there is a more significant positive relationship between the number of audit committee meetings and financial performance for ROE and ROA. Moreover, the results confirmed only the second hypothesis of the study, which suggested that there is a positive and significant effect of the number of meetings of the Audit Committee on performance. With these results, this study concluded that the frequency of meetings held by the Audit Committee in its control and monitoring role has a direct impact on the performance of Burundian commercial banks.

Keywords: Audit Committee, Audit Committee characteristics, Financial performance, Commercial Banks

Cite this paper: Bigawa Bazira Abel, Igirubuntu Merveille, Nshimirimana Théon, Ntakirutimana Leonard, The Impact of Audit Committees on the Financial Performance of Commercial Banks in Burundi, International Journal of Finance and Accounting , Vol. 13 No. 1, 2024, pp. 20-27. doi: 10.5923/j.ijfa.20241301.02.

Article Outline

1. Introduction

- Financial performance is a major challenge for the banking sector. It is the overriding factor or essential factor that determines the profitability of credit institutions. Improved performance leads to a sound and efficient banking system.As a result of various financial crises around the world over the years, financial institutions, particularly banks operating in a volatile and uncertain environment (Naylor, 1995), find themselves in the need to improve their corporate governance practices by establishing an independent audit committee to assist the board of administrators in carrying out its responsibilities (Hillman & Dalziel, 2003).Various studies have shown that audit committees play a key role in protecting the interests of shareholders through mechanisms for monitoring, controlling, and supervising the day-to-day management of a company (Kallamu & Saat, 2015). The audit committee is a key element of corporate governance and risk reduction related to the quality of financial reporting (Afify, 2009; Abernathy et al., 2015). More generally, various authors have shown the importance of setting up audit committees to improve the quality of an institution’s governance, and more specifically the impact of these committees on the financial performance of enterprises (Ahmed Bamahros et al., 2017; Chen & Komal, 2018; Amin et al., 2018). Establishing an audit committee can be an opportunity to increase the enterprise's resources, especially if its composition includes independent administrators who bring additional skills useful to the bank. This positive contribution is evident in the Board of Administrators but also in the financial management, which thus has a competent and independent privileged interlocutor. Some countries like Burundi have recognized the role of audit committees and have introduced regulations on the establishment of audit committees in financial institutions. The role of audit committees, which are legally constituted by external administrators with expertise in internal control and financial analysis, is to monitor the effectiveness of the internal audit system under relevant regulations and follow up on issues related to the preparation and control of accounting and financial information.In Burundi, the audit committee, an offshoot of the Board of Administrators, is the guarantor of the financial information disclosed and internal control procedures. The audit committee works closely with internal and external auditors (Bertin & Godowski, 2012).For many years, the Burundian economy has been affected by various crises linked to weather hazards and socio-political fluctuations that have affected the entire sub-region, increasing the risk of insolvency among Burundian bank customers. To stabilize the country’s financial system, the Bank of the Republic of Burundi (BRB) issued the implementing regulations for Law No. 1/17 of 22 August 2017 governing banking activities, intending to further strengthen and clarify the regulatory requirements for all financial institutions in Burundi.Among these implementing texts, the obligation to set up an audit committee is enacted by Circular No. 07/2018 relating to the Internal Control of Credit Institutions, while Circular No. 21/2018 relating to the governance of credit institutions stipulates that the audit committee is responsible for "reviewing and giving its opinion on the annual report including the institution's financial statements before it is forwarded to the board of administrators or supervision board for approval". The introduction of regulations on audit committees by the BRB is intended to strengthen the level of confidence in the Burundi's financial sector and enable the various stakeholders, chiefly financial or institutional investors, to obtain the means to exercise genuine control over the management of their assets. It is therefore recommended that Burundian banks set up audit committees. Indeed, the BRB's regulation on the establishment of audit committees implies recognition of their legal missions, which contribute to increasing the responsibility of their members compared to other board of Administrators. This point currently seems to be a real concern, in terms of the level of responsibility, among the members of audit committees of various Burundian banks.Thus, the institutionalization of the audit committee at the level of Burundi’s financial institutions is not always considered a strategic solution for improving performance, but rather a constraint by those involved in the sector. It should be recalled, however, that Burundian banks face various challenges related to their activities, the environment in which they operate, and, above all, the gradual adaptation of governance practices to the legal framework for the operation of audit committees. Since banks are key institutions in strengthening a country’s economy, improving performance through audit committees would help develop an efficient and healthy banking sector, as some authors have noted in their studies (Tsafack Nanfosso & Nguena, 2015).Taking into account the above, this study aims to analyze the impact of the audit committee on the financial performance of financial institutions and more particularly Burundian Commercial Banks. The study covers a period of 8 years, from 2013 to 2020.

2. Literature Review

2.1. Theoretical Review

- The audit committee is established by the board of Administrators to improve the governance of companies, to ensure the transparency and integrity of financial reports, and to maintain the confidence of savers. Most of the studies that are interested in this committee's study have focused on two different theoretical perspectives, namely agency theory and resource dependence theory. According to the theory of the agency, to ensure the effectiveness of an audit committee, managers are encouraged to prepare financial statements in an adequate manner allowing them to specify the return generated by the companies. Beasley (1996) and Felo et al. (2003) based on agency theory predict the existence of a positive and significant relationship between the presence of an audit committee and the quality of financial statements. Similarly, McMullen (1996), based on agency theory, finds a positive relationship between the existence of an audit committee and the reliability of financial statements. Some researchers, like Wild (1994) and Klein (1998) have studied the impact of audit committees on financial performance. Wild (1994) saw that the market reacted more positively to income statements after the establishment of an audit committee, on the other hand, Klein (1998) observed that the presence of an audit committee did not affect financial performance. She concluded that the composition of the audit committee did not generate any abnormal returns. Similarly, Vafeas & Theodorou (1998) refute the idea that the structure of board subcommittees significantly affects performance. Furthermore, Klein (2002) emphasized the importance of the existence of an internal member who can improve the quality of committee reports. The agency theory states that the presence of an audit committee within the board of directors is sufficient to ensure the reliability of financial statements. However, the mere presence of an audit committee does not necessarily mean that the committee is effective in performing its oversight role. The effectiveness of the audit committee increases when the members who sit on it increase. That said, the resources are dependent on the number of members that appear (Rahmat et al., 2009). However, if this vision appears systematic, it can be contested when the resources depend on the characteristics of the members of the committee and not on their number. Depending on their professional experiences, members can improve the ability of the audit committee to assess the accuracy of accounting methods, and economic and operational transactions, which generates a determining quality of financial reporting (Cohen et al., 2008). This has been widely argued by several authors including Dechow et al. (2012) and McMullen & Raghunandan (1996) for whom, the presence of the audit committee eliminates fraud in financial statements. Hillman et al. (2000) considered that the executive needs expertise to reduce uncertainty in various strategic cases.

2.2. Empirical Literature

- Although the audit committee performs an important function in overseeing financial reporting and disclosure (Huang & Thiruvadi, 2010), studies vary in their selection of audit committee characteristics (Abbott et al., 2004; Klein 2002). These characteristics may include the size of the audit committee, the independence of the audit committee, the meetings of the audit committee, and the education of the members of the audit committee considered to be financial expertise. In this article, we have chosen to analyze two characteristics, namely: (1) the size of the Audit Committee and (2) the number of meetings of the Audit Committee.

2.2.1. Size of the Audit Committee and Financial Performance

- The size of the audit committee corresponds to the number of its members. Several empirical studies have shown that a larger audit committee can improve the financial performance of the company by ensuring better monitoring of its financial activities. The agency’s theory holds that more audit committee members can improve the company’s financial performance by ensuring better monitoring. Therefore, this theory implies a positive relationship between the size of the audit committee and the financial situation of the company.Similar to the argument supporting larger audit committees, the theory of resource dependency calls for a small audit committee to lack diverse skills and experience, and is therefore ineffective (Al Matari et al., 2014).Hamdan et al (2013) examined the effect of the characteristics of the audit committee in Amman and found a relationship between the size of the audit committee and the ROE-measured financial performance of 106 financial sector companies listed on the Amman Stock Exchange over the period 2008 to 2009.Beasley (1996) and Felo et al. (2003), relying on the agency’s theory, predict a positive and significant relationship between the presence of an audit committee and the quality of the financial statements.Gao & Huang (2018) found that an audit committee with an odd number of members is associated with a lower probability of accounting restatements than an audit committee with an even number. According to this theory, an audit committee with more members would do better than one with few members.Following the above discussion, we posit the following hypothesis:H1: There is a positive and significant effect of the audit committee size on financial performance.

2.2.2. Number of Audit Committee Meetings and Financial Performance

- The main objective of audit committee meetings is to strengthen internal control for good governance practices (Puspitaningrum and Atmini, 2012). Therefore, frequent meetings of the Audit Committee imply a more effective supervisory system.Khalifa’s research (2018) demonstrated a significant and positive relationship between the number of audit committee meetings and the financial performance measured by the ROA and the ROE in the UAE. It concluded that the meetings of the Audit Committee have a positive influence on the ROE. Therefore, the results of the ROA and ROE in this study strongly support the agency's theory that a high level of committee activities, such as meetings, leads to better monitoring of the company's financial activities and better financial performance.Thus, an increase in the number of audit committee meetings presumably improves the company's ROA or ROE.Kyereboah-Coleman (2008) found a positive relationship between the number of audit committee meetings and the company’s performance.Yeh et al (2011) found that the number of audit committee meetings has a positive effect on bank performance in times of crisis. By contrast, the number of audit committee meetings had no impact on the performance of the Japanese and French banks.Bansal & Sharma (2016), by studying 235 non-financial public companies in the period 2004-2013, show that the introduction of the characteristics of the audit committee has made a change in the relationship between financial performance as measured by the ROA.Salloum et al (2014), in determining the impact of audit committee characteristics on healthy and financially distressed Lebanese banks, find that banks’ financial distress is negatively and significantly related to the frequency of audit committee meetings and the size of the bank.Toumi (2016) noted that the number of meetings of the audit committee had a significant negative effect on the performance of German banks. Thus, the high frequency of the number of meetings within the audit committee can increase conflicts of interest, which worsens the level of performance, which is in line with the results found by Chou & Buchdadi (2017) in Indonesian banks.Around the world, there has been a large body of empirical work examining the links between corporate governance mechanisms and financial results. Overall, most of the research results support the recommendations of Baxter & Cotter (2009) to increase the level of activity of an audit committee to increase its efficiency and improve the quality of its benefits.From the above, we posit the following hypothesis:H2: There is a positive and significant effect of the number of meetings of the Audit Committee on performance.

3. Methodology

3.1. Sample and Data Collection

- This study attempted to explore the effects of audit committee characteristics on the financial performance of Banks. It used a quantitative research approach based on the annual reports of commercial banks operating in the Burundian banking sector over a period of 8 years, that is, between 2013 and 2020. The study used a convenience sampling process and 4 banks out of a total of 12 commercial banks operating in Burundi were selected. The selection criteria comprised the existence of an audit committee and the availability of annual reports from 2013 to 2020.In order to overcome the problems caused by a sample size on the validity of the results, we organized the data in a panel, which led us to 32 observations (4 banks observed over 8 years).This small sample for the research process is due to constraints in data availability, stemming from the small size of Burundi's banking sector, time limitation, and the availability of annual reports for the period under consideration.However, it is important to note that the sample of 32 observations used in this study is not inadequate when compared to similar studies by other authors. For example, Firer & Meth (1986) used 36 annual reports, April et al. (2003) used 20 observations based on annual reports, and Ali & Amir (2018) used 56 annual report observations for their research.

3.2. Variables Definition and Model Specification

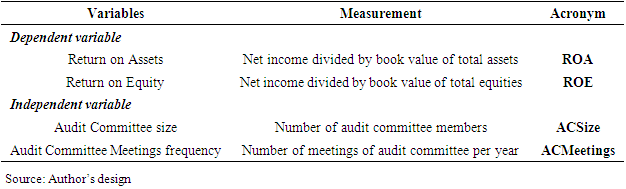

- For measuring the financial performance of banks, several studies have shown that different variables can be used such as Tobin's Q, Return on Investment (ROI), Return on Assets (ROA), Return on Equity (ROE), Sales Revenue, or Earnings Per Share (EPS). To analyze the impact of the characteristics of the audit committee on the financial performance of Burundi's commercial banks, the study takes into account two types of dependent variables, namely Return on Assets (ROA) and Return on Equity (ROE) as shown in Table 1.

|

3.3. Model Specification

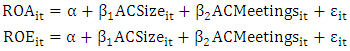

- In order to analyze the impact of the Audit Committee on the financial performance of Burundi’s commercial banks, the Multiple Panel regression model used is based on models found in the work of Beck and Katz (1995), Bebeji et al. (2015), and Palaniappan (2017).The models used for the analysis are as follows:

Where ROA is the Return on Assets, ROE is the Return on Equity, ACMeetings is the audit committee meeting frequency; ACSize is the audit committee size; α is the constant; β is the Intercept; i is the Bank Intercept; t is the Time Intercept; ε is the error term.

Where ROA is the Return on Assets, ROE is the Return on Equity, ACMeetings is the audit committee meeting frequency; ACSize is the audit committee size; α is the constant; β is the Intercept; i is the Bank Intercept; t is the Time Intercept; ε is the error term.4. Results

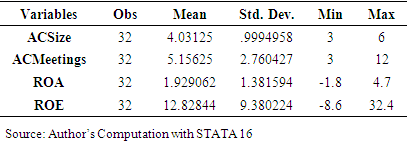

4.1. Descriptive Statistics

- Table 2 presents the descriptive statistics of the variables used in the study. Based on 32 data samples from 4 Burundian commercial banks from 2013 to 2020, descriptive statistics of dependent and independent variables were computed with STATA 16.

|

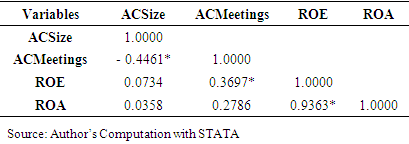

4.2. Correlation Analysis

- Table 3 shows the results of the correlation matrix to ensure the suitability of the variables and the independence of the explanatory variables used in this study. To avoid multicollinearity issues resulting from a high correlation between independent variables (Alqatamin et al. 2017), Pearson correlation analysis is performed to verify that the values are within a threshold of 0.8 (Hair et al., 2010; Gujarati and Porter, 2009).

|

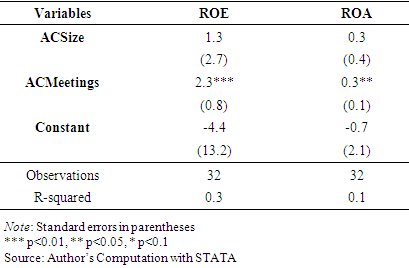

4.3. Empirical Results

- To study the impact of the Audit Committee on commercial banks' performance in Burundi, the panel linear regression method was used and the results are presented in Table 4 below:

|

5. Conclusions

- This study assessed the effects of audit committee characteristics on the performance of Burundian commercial banks. To this end, the number of committee members and the frequency of meetings were used as audit committee characteristics, while the performance of commercial banks was analysed in terms of ROE and ROA.The results showed a positive but not always significant correlation between the number of audit committee members and the frequency of meetings. We note that the number of audit committee members has a positive but not significant effect on both ROE and ROA. In the Burundi context, this implies that the number of audit committee members has no much impact on the performance of commercial banks. These results are consistent with the reality of the Burundian banking sector, since the Central Bank (BRB), does not currently regulate the minimum number of audit committee members for commercial banks.The results also showed that the frequency of audit committee meetings has a positive and significant effect on both ROE and ROA. This implies that the more meetings the Audit Committee holds in its control and monitoring role, the more the probability of improving the performance of banking institutions increases. The regulatory number of audit committee meetings is 4 per year. Still, given the results of this study the BRB should strengthen the role of audit committees in the banking sector on the one hand, and on the other hand commercial banks should increase the number of meetings to improve monitoring and performance.This analysis has certain limitations due to the limited size of the sample of available data on audit committee activities for commercial banks in Burundi from 2013 to 2020. This study only examined two characteristics of the audit committee due to the limitation of available data. Future research on the Burundian banking sector could explore more characteristics of an audit committee (e.g. independence, gender diversity, expertise, etc.) and performance factors.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML