-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2023; 12(2): 29-38

doi:10.5923/j.ijfa.20231202.01

Received: Nov. 4, 2023; Accepted: Nov. 20, 2023; Published: Nov. 29, 2023

Effect of Spot Market on Food Security in Kenya

Raude John O. Messo

Messo and Associates, Certified Public Accountant of Kenya and School of Business and Economics, Masinde Muliro University of Science and Technology, Kenya

Correspondence to: Raude John O. Messo, Messo and Associates, Certified Public Accountant of Kenya and School of Business and Economics, Masinde Muliro University of Science and Technology, Kenya.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study investigated the effect of spot market on food security in Kenya, which is one of the major concerns in the Kenyan Government's Big Four Agenda. The government has launched several initiatives to support farming, livestock rearing, and fish production and provide affordable inputs to reduce farm input costs and increase earnings, all aimed at ensuring food security and adequate nutrition for all Kenyans. To achieve this, a mixed research design that utilized descriptive and inferential statistics and the ANOVA technique was applied to a sample of 1000 farmers from Kakamega, Bungoma, Busia, Kisumu, Siaya, Homabay, Transnzoia, Kisii, Migori, and Vihiga Counties, collected through questionnaires and schedules. The research results showed that the effects of spot market on food security in Kenya are statistically significant, with a p-value of zero in all measures of constructs. These findings will be helpful to farmers, agriculturalists, policy makers, researchers, scholars and the general public. Farmers can trade their produce and determine fair prices, while policymakers will use the findings to regulate and control agricultural and commodity markets and design policies. Additionally, this study will supplement existing research in the field and contribute to future research efforts.

Keywords: Spot price, Food security, Price discovery, Commodity exchange

Cite this paper: Raude John O. Messo, Effect of Spot Market on Food Security in Kenya, International Journal of Finance and Accounting , Vol. 12 No. 2, 2023, pp. 29-38. doi: 10.5923/j.ijfa.20231202.01.

Article Outline

1. Introduction

1.1. Background of the Study

- Despite the Kenyan government's efforts through policy papers and established organizations like the Agricultural Corporation (AFC), the National Cereal and Produce Board (NCPB), and the Parliamentary Committee on Agriculture (PCA), Kenya continues to suffer an annual shortfall of maize, which is its primary food source, according to Kirimi, Odhiambo, Onyango, Kinyumu, Bii, and Njagi (2018). A European Commission (2023) study confirms that Kenya's food security situation will likely deteriorate to an unprecedented level. According to the European Commission (2023), as of June 2022, over 5.4 million Kenyans experienced acute food insecurity, which is expected to worsen in the coming months. Analysis by the Integrated Food Security Phase Classification (2022) reveals that from July to September 2022, about 3.5 million people, approximately 24 percent of the Arid and Semi-Arid Lands population, are experiencing high levels of acute food insecurity.AFC, NCPB and PCA aim to support farmers obtain funding, create a strategic reserve, and oversee the agricultural sector's activities to ensure Kenyans have access to a diverse and nutritious diet. However, the shortage persists, and Kenya has to import food from other countries to meet its demands. According to Statista (2022), Kenya's maize production declined from 44.9 million bags in 2018 to 44 million bags in 2019 to 42.1 million in 2020, 36.7 million in 2021, and 34.3 million in 2022. According to the Kenya National Bureau of Statistics (2017), the average annual maize production in Kenya from 2012 to 2016 was 40.24 million bags. Still, the country faced an average deficit of 20 million bags yearly. The same bureau (2023) reported that in 2022, the agriculture sector's real Gross Value Added (GVA) shrank by 1.6 percent, as compared to a contraction of 0.4 percent in 2021. Due to the low production of essential food crops like maize, potatoes, and vegetables, the prices of these items were significantly high in 2022. The Kenya Agricultural and Livestock Research Organization (KALRO) (2022) estimates the average annual maize production to be 3.0 metric tons.The low production of maize has multiple causes. Decreased rainfall is reported by the Global Information and Early Warning System on Food and Agriculture (2021) as one of the primary factors. The Integrated Food Security Phase Classification (2022) identifies a combination of shocks, including a fourth consecutive below-average rainy season. KALRO (2022) suggests drought, low soil fertility, pests, and diseases have also played a role. Alila and Atieno (2006) have pointed out that limited access to modern farming technologies and inadequate marketing facilities are also to blame. Institutions also impose constraints on increasing agricultural production, including poor access to financial resources, limited high-potential agricultural land, over-reliance on rain-fed agriculture, insufficient diversification of farming output, poor rural infrastructure, declining research in agriculture, and lack of a comprehensive land-use policy.The shortage of maize in Kenya can also be attributed to several factors, including the high cost of inputs and the residual effects of maize lethal necrosis diseases. However, according to the Monitoring African Food and Agricultural Policies Project (MAFAP) (2013), the Ministry of Agriculture has failed to mention other factors, such as political unrest in 2007/2008, drought in 2009, and the limited impact of NCPB on domestic maize prices. All of these factors contribute to food insecurity in the country.Food security was first discussed in the mid-1970s during conversations about global food problems. The focus was on ensuring basic foodstuffs' availability and price stability internationally and nationally. The United Nations (1975) defined food security as the "availability of adequate world food supplies of basic foodstuffs to sustain a steady expansion of food consumption and to offset fluctuations in production and prices." The definition was later expanded by FAO (1983) to include "ensuring that all people at all times have both physical and economic access to the basic food that they need." According to the Food and Agriculture Organization (1996), food security exists when all people have physical and economic access to sufficient, safe, and nutritious food that meets their dietary needs and food preferences for an active and healthy life.This study investigated the impact of the spot market on food security in Kenya to contribute to the Kenyan government's Big 4 Agenda on food security. A spot market is a market within a commodities exchange - an organization that sets rules and procedures for trading commodity contracts and investment products. According to the United Nations in New York and Geneva (2009), a spot market is where buyers and sellers exchange commodity-linked contracts under the exchange's regulations. Roche (2021) defines a commodity exchange as a physical or electronic marketplace for buying, selling, and trading commodities. The commodity exchange aims to provide a reliable and organized marketplace for exchange members to trade commodities for their clients, ranging from farmers to speculators. According to the United Nations Conference on Trade and Development (2009), commodity futures markets play a crucial role in price discovery and the transfer of price risk from market participants that have an interest in the physical commodities (i.e. producers and consumers) to other agents that are willing to assume the price risk, driven by speculative motives. According to Koh (2007), one way financial investors can gain exposure to commodity markets is through spot market activities, such as buying and accumulating physical commodities in inventories. This strategy has contributed to the price increases in relatively small markets for precious metals, such as gold and silver. Some exchanges offer spot or forward delivery, while others provide futures and options, where delivery is rare or settlement is in cash. Through a bidding system and market rules, commodity exchange creates an advanced electronic integrated market platform for price discovery, transforming the agricultural sector and enabling various agricultural and derivative products to be traded on prices ranging from spot to swaps.FAO (2010) states that the objective of the Commodity Exchange Market is "to ensure the development of an efficient modern trading system" that would "protect the rights and benefits of sellers, buyers, intermediaries, and the general public." Unlike trading securities in a company or stocks for a finished product or market, the commodities exchange involves trading in raw materials, including those materials' future availability and trading prices, and has Futures characteristics. According to the United Nations Conference on Trade and Development in 2009, farmers can use exchange services to improve their marketing and risk management abilities. Farmers can also benefit from a transparent online platform for price discovery by accessing commodities exchange, reducing their exposure to production and price risks. Farmers often indirectly benefit from exchange services through contracts with cooperatives, banks, or purchasers.According to Sabiou and Vernon (2022), neoclassical price theory was established on the principles that the buyer or seller has no influence on the market price and has to accept the prevailing price as given and the law of one price in a market. However, these principles conflict with a theory of endogenous price discovery in markets. Classical economists, including Adam Smith, described the price discovery process as being based on the buyer's and seller's reservation values and their motivation to buy low and sell high. The classical framework for price formation provides a solid basis for a modern theory of price discovery.The theory of price discovery explains that when demand is greater than supply, the price of an asset or commodity increases, and buyers are willing to pay more due to its scarcity. Conversely, if the supply exceeds the demand, buyers are eager to pay only as much as the supply is low.Recent studies have examined price discovery in futures markets, such as Gong, Tang, and Xu (2021) analysis of trading behaviors. Xueyan and Yanbing (2021) study explored the impact of capital market opening on price discovery efficiency from stock price information content and price reaction speed to information. Roche (2021) study focused on the success criteria for commodity exchanges.This study focuses on Kenya, which has a single commodity exchange known as the Nairobi Coffee Exchange. It examines the economic and developmental accomplishments of countries that have recently established commodity exchanges. The study analyzes the impact of commodity exchange on farming in Kenya, drawing on these contextual factors.In financial markets, price discovery determines a fair and consistent price for a specific asset or commodity. This involves exchanging information between buyers and sellers, facilitated by futures markets that provide real-time bid and ask prices to all participants worldwide. This efficient process ensures everyone involved can access the most current and accurate pricing information.

1.2. Statement of Research Problem

- Every country has a responsibility to ensure that its citizens have access to basic food needs and essential items. However, Kenya faces unique challenges in managing production fluctuations and prices, which has led to acute food insecurity. Reports from the European Commission (2023), Integrated Food Security Phase Classification (2022), data from the Kenya National Bureau of Statistics (2017 and 2023), Faria (2021), and production estimates from the Kenya Agricultural and Livestock Research Organization (KALRO) all confirm this problem. Policymakers, farmers, agricultural researchers, and the general public are worried about the situation. It is on this basis that this study examined the effects of the spot market on food insecurity in Kenya to find solutions to this pressing issue.

1.3. Objective of the Study

- The primary aim of this study was to analyze the effects of the Spot market on food security in Kenya.

1.4. Research Hypotheses

- The following null hypothesis was formulated:H0: The spot market did not significantly effect on food security in Kenya.

1.5. Significance of the Study

- This study has the potential to benefit several groups of people. Firstly, farmers and agriculturalists can sell their products at competitive prices both locally and internationally, which can increase their income through price discovery. Secondly, the government and policymakers can gain a better understanding of how to regulate and control the activities of the exchange, market, and market players. Thirdly, scholars, researchers, and learners will have access to valuable data that can complement their existing studies, help conduct new research, or test the validity of previous research in this field. Finally, the study's findings will serve as a reference for future research, contributing to knowledge and strengthening the foundation for further studies.

2. Literature Review

2.1. Introduction

- This chapter explores theories of price discovery, spot trade, storage costs, and risk allocation, as well as their empirical findings on food security.

2.2. Theory of Price

- The price theory, formulated by Milton Friedman, Gary Becker, and George Stigler, is based on the relationship between supply and demand. This microeconomic concept determines a commodity or service's optimal market price point. The theory suggests that the equilibrium price is the point at which the marginal cost of the supplier meets the benefit gained by those who demand the good or service. Milton, Becker, and Stigler used this theory to formulate economic theory and policy development. Recent publications on price theory, such as Bloch (2018) examination of Schumpeter's theory and Glen (2019) argument for its complementary role in market design and international trade, have contributed to a resurgence of research in this area.The price theory is essential in determining the equilibrium point where the quantity of supplied commodities or services matches the demand of the corresponding market. This concept allows for price adjustments as market conditions change, leading to price discovery. By using an economic principle to determine prices based on demand and supply, the price theory enables the realization of optimal market prices when the cost of producing goods meets the money paid for them by consumers.

2.3. Spot Trade Theory

- In finance, spot trade refers to immediately buying or selling foreign currencies, financial instruments, or commodities. Such trades occur in a spot market, where supply and demand determine the price. The spot price or rate is the cost of the transaction. Spot markets are crucial in setting prices for futures, options, and other needs.

2.3.1. Cost of Storage Theory

- The concept of storage cost originates from the classical theory of storage supply, first introduced by Williams in 1935. Later, Kaldor, working in 1939 (1949), and Telser in 1958, extended this theory. Martínez and Hipolit (2023) conducted a study on the pricing of United Kingdom natural gas futures, testing various implications of the storage theory. They found some evidence that partially supports the theory of storage as a complete explanation for the pricing of these futures contracts. Recent studies on storage theory have shed light on the topic. Joseph, Nicholas, and Juo-Han (2022) carried out a study on commodity storage and the cost of capital. The study revealed a significant share of commodity-storing firms consider changes in the cost of capital when deciding how much production to hold in inventory following a seasonal harvest period. The concept of storage cost is explicitly related to commodity futures. According to the theory, the difference between futures and spot prices, known as the futures premium, is a risk-free return for commodity holders. This premium should equal the net cost of storing the commodity to ensure it is held willingly. It's important to note that futures markets become obsolete when physical commodity short-selling is possible, and transaction costs are negligible. The theory is based on the principle that rational commodity stores and processors' speculative and precautionary storage activity mainly governs commodity price dynamics in the modern storage model. The economic theory of storage suggests that firms will store until the marginal benefit of holding inventories equals the marginal cost. The Cost of Storage Theory is significant in this study because it links futures prices to the spot price, the interest forgone in storing the commodity, the warehousing costs, and the convenience yield on the inventory, according to Beatriz and Hipòlit (2023).

2.3.2. Risk Allocation Theory

- According to Pärna (2017), the Risk Theory was introduced by Lundberg in 1909. Lundberg's initial work focused on calculating the likelihood of financial ruin, also known as the Lundberg inequality. However, since the theory was developed before the general theory of stochastic processes, its mathematical rigor may be limited. Risk Allocation Theory is a method that uses futures contracts to manage risks. This theory considers futures contracts as tools for risk management, which reflect expectations of future spot prices, with an additional premium for risk. This perspective is similar to Keynes' hypothesis that commodity futures should be discounted to spot prices to compensate speculators for providing price insurance to producers. However, managing risks using futures markets is limited by transaction costs and short-selling constraints. The Risk Allocation Theory emphasizes that risks should be assigned to the party capable of managing them. This incentivizes effective management and improves economic efficiency by reducing the valuation of risks.

2.3.3. Food Security Theory

- Food security is defined as the consistent availability of basic foodstuffs to sustain a steady expansion of food consumption and to offset fluctuations in production and prices at an affordable cost. It encompasses three elements: supply, availability, and price. Availability refers to the physical presence of food, whether obtained from farms or markets. Access involves having the necessary resources to acquire food for a healthy diet, while utilization refers to the body's ability to absorb nutrients from the food consumed. Recent research has highlighted the significance of nutritionally adequate food for smallholder family farmers to ensure food and nutrition security and access to food security. Understanding the food security theory is critical in promoting essential nutrition, economic stability, long-term health, women's empowerment, and environmental sustainability. In 1983, the Food and Agriculture Organization redefined food security as "Ensuring that all people at all times have both physical and economic access to the basic food that they need," based on the principles of availability, access, utilization, and stability.

2.4. Empirical Theory

- Ameur, Ftiti, and Louhichi (2021) investigated the relationship between spot and futures commodity markets. They used a framework called nonlinear autoregressive distributed lag (NARDL) to account for asymmetry and nonlinearity in the long and short term. The researchers analyzed the daily returns of six commodity indices, divided into three commodity types. The findings of the study suggest that the futures market has a significant impact on commodity prices. Marwa, Maria, and Zoltan (2021) conducted a bibliometric evaluation of statistical outcomes from 899 scientific publications related to the link between food security and food price dynamics from 1979 to June 2020. Their research found a significant shift in scientific research trends associated with food security analysis, which is now more closely linked with health and food nutrition status. This shift has had a considerable impact on the subject.Mutea, Rist, and Jacobi (2020) studied household food insecurity. They found that the lack of private property rights was not the sole cause of food insecurity, as many farmers still possessed their rights. Instead, the main obstacle for food-insecure households seeking access to productive resources was the inability to acquire farm technology, such as hand tools and implements.

3. Research Methodology

3.1. Introduction

- This chapter outlines the methodology, including the philosophical perspective, research design, target population, sample size, sampling procedure, data collection, and analysis.

3.2. Philosophical Perspective

- A mental discipline that evaluates all human endeavors with logic and rationality is known as research philosophy. This philosophy involves a researcher's beliefs and assumptions about how knowledge is developed and is crucial when conducting research. It includes assumptions about the realities encountered during research, human knowledge, and how a researcher's values can affect the research process. According to Yoon, Lars, and Anthony (2019), the Positivism model aligns with the hypothetico-deductive science model, which verifies a priori hypotheses and experiments by operationalizing variables and measures. The outcomes obtained from hypothesis testing are then used to advance science. Crotty (1998) defines Positivism as a natural scientist's philosophical stance that involves working with observable social reality to produce law-like generalizations. Based on Macionis and Gerber's (2010) argument that Positivism is a philosophical theory based on natural phenomena, properties, and relations and the use of quantifiable data and statistical analytical techniques in data analysis, Positivism research philosophy was found appropriate to achieve the study's objectives.

3.3. Research Design

- This study utilized a Descriptive Survey Research Design to systematically and accurately describe the population. Trochim (2006) notes that this type of design is crucial for keeping research projects organized. A Descriptive Design, as defined by Rakesh and Priya (2019), is a study that describes the distribution of one or more variables without considering any causal or other hypotheses.The Descriptive Design has several advantages, including diverse data collection methods, thorough information, quality data, and providing a basis for decision-making. It was helpful in this study as it reported summary data of central tendency and dispersion, such as the mean, deviation from the mean, and variation percentage. It also defined respondent characteristics in a population, measured data trends, and conducted comparisons. This information is valuable for resource planning.In contrast, the Causal Design establishes a relationship between the independent and dependent variables. According to Copper and Schindler (2006), it determines the cause-effect relationship among variables and explains how the independent variables produce a change in the dependent variable.

3.4. Target Population

- The research was conducted in twelve counties in western Kenya, namely Trans Nzoia, Bungoma, Kakamega, Busia, Kisumu, Siaya, Homabay, Kisii, Uasin Gishu, Nandi, Kericho, and Bomet. However, it could not determine the exact number of farmers targeted due to inconsistent data from various studies and agencies. For example, the Farm to Market Kenya Country Brief of 2022 suggests that there are 7.5 million small-scale farmers in Kenya, while the Agriculture Sector Transformation and Growth Strategy 2019 estimates the number to be around 4.5 million small-scale farmers.

3.5. Sample Size

- Purposive sampling was used to collect data from 100 respondents in each of the ten counties in Western Kenya.

3.6. Data Collection Instruments and Procedure

- The data was collected using questionnaires and schedules. The questionnaires were divided into three parts: Part A gathered general information, Part B focused on spot trades, and Part C focused on pricing over five years from 2017 to 2022. The study employed research assistants who visited the areas of the study and administered the questionnaires to the respondents. The research assistants also helped the respondents with any difficulties in answering the questions. In addition, the study had research seniors who visited 10 percent of the sampled respondents to work with the data collected by the research assistants. The research seniors conducted data validity checks, quality checks, and assumptions testing to minimize any unforeseen issues with data collection.

3.7. Validity and Reliability of Research Instruments

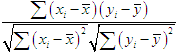

- This study used Pearson’s correlation model to verify the intensity of the linearity between variables and measure the linear association between quantitative variables.

| (1) |

3.8. Data Presentation and Analysis

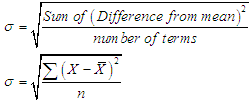

- The study utilized tables to present the data. Additionally, descriptive statistics such as means and standard deviations were used to systematically and accurately describe the population. The study then employed inferential statistics, specifically the Analysis of Variance (ANOVA) technique with a significant level of 5 per cent, to draw conclusions. Before conducting the analysis, the study tested the six assumptions of ANOVA and ran the Normality and Homogeneity of Variances tests. Moreover, the study ensured that the dependent variables assumption, independent variables assumption, and independence of observations were observed.(i) Standard DeviationFormula

| (2) |

| (3) |

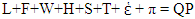

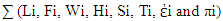

| (4) |

is profit, P is the selling price, Q is the quantity produced,

is profit, P is the selling price, Q is the quantity produced,  is the error term, and i is an individual farmer. The research profit model is akin to the accounting profit model. However, it varies in that the former is founded on information obtained from respondents, which may necessitate higher precision. Conversely, the accounting profit model is based on concrete data.

is the error term, and i is an individual farmer. The research profit model is akin to the accounting profit model. However, it varies in that the former is founded on information obtained from respondents, which may necessitate higher precision. Conversely, the accounting profit model is based on concrete data.4. Results and Discussions

4.1. Introduction

- This chapter presents the results and discussion on spot market and food security in Kenya. The effects of spot markets on maize are analyzed using descriptive and inferential statistics and presented and discussed.

4.2. Descriptive Statistics

- This study presents descriptive statistics summarizing input, Pricing, and profit data, including means and standard deviations.

4.2.1. Inputs

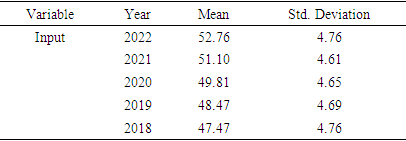

- Descriptive statistics in Table 1 indicate means ranging from 47.47 to 52.76, with standard deviations between 4.65 and 4.76 for the study period.

|

4.2.2. Pricing

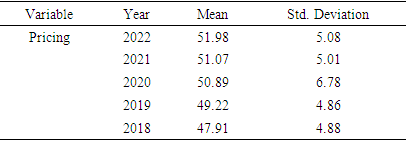

- Descriptive statistics in Table 2 indicate means ranging from 47.91 to 51.98, with standard deviations between 4.86 and 6.78 for the study period.

|

4.2.3. Profits

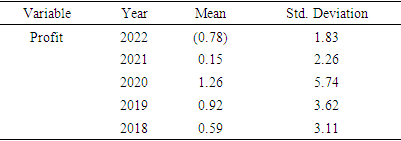

- Descriptive statistics in Table 3 indicate means ranging from 47.91 to 51.98, with standard deviations between negative 0.78 and 1.26 for the study period.

|

4.2.4. Causes of Food Insecurity

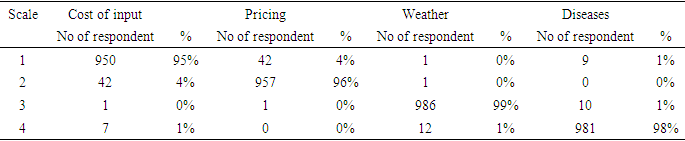

- This study asked the respondents to rate the causes of food insecurity in Kenya. Among them, 950 (95 percent) believed inputs were the most probable cause. Pricing came second, with 957 (96 percent) respondents stating it was likely. Weather was considered the third most likely cause, with 986 (99 percent) respondents saying it was less likely. Finally, disease ranked fourth, with 981 (98 percent) respondents considering it not probable.

|

4.3. Hypothesis Test

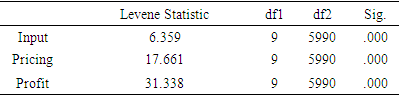

- The study formulated a null hypothesis that pricing has no significant effect on food security in Kenya. The homogeneity of variances, normality, and significance between means were tested using the Levene Statistic, Kolmogorov-Smirnova, and ANOVA techniques.

4.3.1. Test of Homogeneity of Variances

- The Levene Statistic test indicated that the variances of a continuous dependent variable are not equal across groups of a categorical independent variable (p < .05). Hence, the data failed to meet the assumption of homogeneity of variance.

|

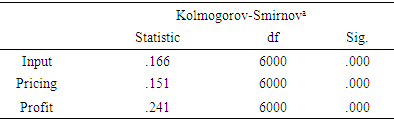

4.3.2. Tests of Normality

- The Kolmogorov-Smirnov tests to determine the suitable measures of central tendency and statistical data analysis techniques, are shown in Table 6. The results were significant at α=.05, suggesting that the data did not follow a normal distribution.

|

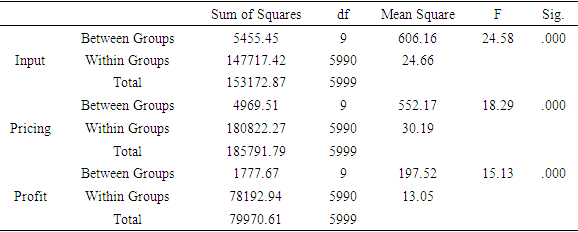

4.3.3. Test of Significance

- The results of one-way ANOVA to compare the means of unrelated groups as shown in Table 7 indicated significant differences between the groups in terms of Inputs, Pricing, and Profits at a significant at α=.05. These findings suggest that the effects of Inputs, Pricing and profits significantly affected the food security situation in Kenya.

|

5. Summary, Conclusions and Recommendations

5.1. Introduction

- This chapter presents a summary of the findings from the previous chapters. Based on the results, the chapter draws conclusions, provides recommendations, and suggests areas for further research.

5.2. Summary of the Findings

- This study investigated the effects of Commodity Exchange on Food Security in Kenya. The conceptual constructs were Spot Trade, Futures Trade and Options, as independent variables, measured by the Inputs, Pricing and Profits. The data needed to conduct this study was derived from one thousand farmers from ten counties in Western Kenya namely: Kakamega Bungoma, Busia, Kisumu, Siaya, Homabay, Kisii, Migori Trans Nzoia and Vihiga counties. Questionnaire and schedules were used to collect data. Mean, Standard deviation, and ANOVA techniques were used to analyze the data.The results revealed a p-value of zero in all constructs of measures, implying the effects of Commodity Exchange on Food Security in Kenya is statistically significant. This result indicated that the farmers were indecisive in setting prices for their commodities and bargaining for the input costs. Similarly, the study results revealed a p-value of zero for profits, implying the effect of profits on Food Security in Kenya significant. Hence a probable cause for food insecurity.

5.3. Conclusions

- Based on the findings, the study concludes that the effects of a Spot Price on Food Security were significant.

5.4. Recommendations

- The data, factors, and methodology used in this study suggest possible directions for further research. As previous studies in this area are limited, the new insights uncovered by this study can benefit farmers in Kenya. The study also reveals similarities, differences, and results not previously covered, which could be valuable for farmers.Stronger regulations are necessary to ensure compliance among brokers and market players, improve food production and establish relevant policies to enhance farming efficiency that will build the confidence of investors and the public.Corporate customers, such as Maize Millers, enter futures contracts with farmers to take advantage of fair liquidity, gain a consolidated view of markets to avoid the micro risk of stocks, remain agnostic to direction, and limit downside risk in stock positions.Establishing a Commodity Exchange in Kenya would improve market efficiency through price discovery, storage facilities, and logistics services, benefiting farmers with hedging, liquidity, and investment portfolios.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML