-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2023; 12(1): 20-27

doi:10.5923/j.ijfa.20231201.03

Received: Sep. 7, 2023; Accepted: Sep. 22, 2023; Published: Nov. 13, 2023

Factors Influencing Initial Public Offerings (IPOs) in the UK Market

Jinyoung Hwang

Into Manchester, Lambert and Fairfield House Granby Row Manchester M60 7LH United Kingdom

Correspondence to: Jinyoung Hwang, Into Manchester, Lambert and Fairfield House Granby Row Manchester M60 7LH United Kingdom.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In the UK's dynamic financial environment, factors affecting Initial Public Offerings (IPOs), which are important to investors, regulators, and the media, are examined in this study. IPOs give companies a chance to gain visibility, acquire funding for growth, and have access to a variety of financing choices. The UK is a desirable location for initial public offerings (IPOs) due to its prestigious London Stock Exchange (LSE), strict Financial Conduct Authority (FCA) regulation, and large investor base. This study emphasizes the importance of corporate governance in enhancing IPO success by using mixed methodologies (qualitative interviews and quantitative analysis). Timing of IPOs is only slightly impacted by market circumstances, highlighting the importance of additional factors. The significance of using appropriate pricing techniques is highlighted by the negative correlation between underpricing and IPO performance. Market integrity is ensured and investor interests are protected by a strong regulatory environment. In this study, the complex dynamics of UK IPOs are revealed, with a focus on corporate governance, a warning against severe underpricing, and an acknowledgment of regulatory stability. These insights support companies, investors, and governments as they navigate the difficulties of this dynamic economy.

Keywords: IPOs, Corporate Governance, Market Conditions, Underpricing, Regulatory Framework, London Stock Exchange

Cite this paper: Jinyoung Hwang, Factors Influencing Initial Public Offerings (IPOs) in the UK Market, International Journal of Finance and Accounting , Vol. 12 No. 1, 2023, pp. 20-27. doi: 10.5923/j.ijfa.20231201.03.

Article Outline

1. Introduction

- Background and significance of IPO in the UK marketThe Initial Public Offering (IPO) procedure plays a significant part in the dynamic financial climate of the UK market, serving as a crucial mechanism for companies to generate capital and access public markets. According to McBride (2019; Brown & Wiles, 2020), prominent IPOs of companies like Royal Mail, Aston Martin, and Just Eat attracted a lot of attention and had a big impact on the economy and financial markets. IPOs are essential for supporting economic growth and prosperity because they provide companies with capital for expansion, research, acquisitions, and debt management, which promotes innovation and job growth (McBride, 2019).Going public also improves a business' visibility, reputation, and future access to a variety of financial sources (Brown & Wiles, 2020). Due to the prominence and liquidity of the London Stock Exchange (LSE), a strong regulatory environment overseen by the Financial Conduct Authority (FCA), and a broad investor base, the UK market is particularly alluring for IPOs (Attenborough, 2019). This article explores the complex dynamics of IPOs in the UK market, illuminating their causes, effects, and ramifications. It aims to educate all parties—businesses, regulators, and investors—in order to promote informed decision-making and aid in the more nimble and perceptive navigating of the IPO landscape.Research RationaleA comprehensive knowledge of the relevance of IPOs in the UK market may be gained from the study on variables influencing IPOs from these three perspectives: policy, academic, and business. By including various viewpoints, the research increases academic understanding, helps firms navigating the IPO landscape, and aids in the creation of successful legislation. In the end, this study hopes to encourage the UK market's capital market expansion, investor trust, and sustainable business growth. Policymakers and regulatory agencies must thoroughly understand the variables affecting Initial Public Offerings (IPOs) in the UK market. Formulating effective laws and regulations that support the expansion of the capital market and investor protection requires an understanding of the dynamics of IPOs and their effects on the whole economy (Carbone et al., 2022). Policymakers may learn how to establish a supportive climate that encourages firms to go public, draws investment, and promotes market transparency by looking into the factors that affect IPOs. A fair and effective IPO process is ensured by policymakers' awareness of the regulatory framework surrounding IPOs, which also enables them to see any gaps or potential improvement areas in current legislation.From an academic standpoint, researching the elements affecting IPOs in the UK market adds to the body of information already available on capital markets, finance, and corporate governance (Carbone et al., 2022). It enables researchers to expand on earlier work and create fresh theoretical frameworks and models that describe IPO behavior and results. Academics may offer evidence-based insights into the economic, market, regulatory, and company-specific issues that affect IPO decisions and success by conducting rigorous empirical research (Carbone et al., 2022). This study advances our knowledge of initial public offerings (IPOs) as a critical vehicle for capital formation and adds to the larger scholarly conversation on corporate finance, investing, and market efficiency. Laws, which guarantee a just and effective IPO procedure.From a business standpoint, it's critical for businesses considering going public or those who are already listed to comprehend the elements that affect IPOs. Businesses may learn important lessons about the ideal timing, pricing tactics, and governance procedures that result in successful IPOs through empirical study and case studies. This information enables businesses to make well-informed choices regarding their capital-raising tactics and successfully negotiate the challenging IPO process (Carbone et al., 2022). Companies may better align their strategy with market expectations, boost investor confidence, and improve long-term performance by understanding the elements that affect investor attitude, market circumstances, and regulatory requirements.Purpose and ObjectiveThis dissertation's goal is to research and examine the variables affecting initial public offerings (IPOs) in the UK market. Understanding the motivations and dynamics underlying IPOs is critical for businesses, investors, regulators, and policymakers since it plays a significant role in the capital markets. This dissertation explores this subject in an effort to add to the body of knowledge and offer insightful analysis of the IPO landscape in the UK market.The following are the specific objective of this dissertation:1. To assess how corporate governance affects the success of IPOs. 2. To evaluate the listing standards and legal framework that control IPOs in the UK market. 3. To look at how underpricing and investor sentiment affect IPOs. 4. To investigate how market conditions affect the timing of IPOs in the UK market.

2. Literature Review

- IPO Performance and Long-Term Returns According to Bennouri, Falconieri & Weaver, (2023) studies, looked at the short- and long-term performance of IPOs in the UK market. Their research on the initial public offerings (IPOs) in the UK outlined mixed results; it found significant underpricing, while in others instances, they found mild underpricing (Bennouri, Falconieri & Weaver, 2023). Conflicting results that came from studies on long-term performance; although some have revealed evidence of significant abnormal returns for IPOs in the UK market, others have claimed that IPOs frequently underperform over the long run (Varada, 2023). According to Varada (2023) established that factors such firm size, industry, offering size, and market conditions have an impact on the performance of initial public offerings and long-term returns in the UK market.Determinant of IPO UnderpricingNumerous studies have examined the elements that result in underpricing of IPOs in the UK market. In this study, underpricing has been connected to a number of variables, including industry-specific aspects like company size, profitability, growth potential, and ownership structure (Bhullar & Sahoo, 2023). Furthermore, it has been found that market conditions, investor attitudes, and the dynamics of supply and demand at the time of the IPO all have a significant impact on underpricing in the UK market. The regulatory environment, including listing requirements and legal frameworks, has been examined as a factor determining underpricing in studies looking at the implications of regulatory changes on IPO price and underpricing levels.Marketing Conditions and Timing of IPOsMarket circumstances and the timing of IPOs have drawn considerable attention from researchers in the field of finance. The impact of market circumstances on businesses' decision-making over when to go public has been examined in a number of studies. According to Secic (2023) studies, companies tend to go public when the market is positive and investor mood is strong. This pattern is known as the "hot issue" phenomenon. Hot market times see a surge in IPO activity, and companies are more likely to see better early returns and more demand for their shares. In contrast, IPO activity tends to fall during cold market times marked by low investor sentiment and unfavorable market circumstances, and businesses may encounter difficulties in pricing their shares and piquing investor interest (Varada, 2023).According to Varada, (2023) market timing theories, companies schedule their initial public offerings (IPOs) to benefit from favorable market circumstances and increase their worth. According to Pietraszewski, Gniadkowska- Szymańska, & Bolek (2023) studies, businesses seek to issue their shares during upbeat market conditions so they may raise money at higher prices and reduce underpricing. To understand their influence on the timing of IPOs, they looked at a variety of market timing indicators, including stock market indexes, interest rates, industry-specific variables, and macroeconomic data. The empirical studies identified positive relationships between market conditions and IPO activity.The timing of IPOs is also influenced by market turbulence and uncertainty. To lessen the risk of unfavorable pricing circumstances or to wait for a more stable market environment, companies may postpone their initial public offerings (IPOs) during times of significant market volatility (Varada, 2023). The timing of IPOs may also be affected by macroeconomic and regulatory uncertainty. In uncertain times when economic conditions, regulatory changes, or political events might have an influence on the success of their services, businesses may be hesitant to go public.

3. Methodology

- Research Design and Approach A mixed-methods research approach is used in this study to collect thorough and reliable data on the variables affecting IPOs in the UK market. This design combines quantitative and qualitative methods, enabling a more thorough comprehension of the research issue. The qualitative technique entails the investigation of subjective perceptions and experiences through interviews with important stakeholders, whereas the quantitative approach comprises the analysis of numerical data from financial reports, prospectuses, and market statistics.Data Collection Method Both primary and secondary data sources were used in this study's data collection techniques. Semi-structured interviews with influential industry insiders, such as firm executives, investment bankers, regulators, and institutional investors, used to gather primary data. These interviews offer insightful information about the motivations, experiences, and decision-making procedures around IPOs. To support and validate the conclusions from the interviews, secondary data gathered from a variety of sources, such as financial records, prospectuses, academic publications, and industry reports.Sampling technique and Sample size The participants for the interviews were chosen using a purposive sampling technique. By using this sample strategy, the study is sure to include people who have the necessary knowledge and experience about IPOs in the UK market. The principle of data saturation, which states that data collecting and analysis should continue until no new insights or information can be gleaned from the interviews, will be used to establish the sample size.25 people were interviewed and 5 firm were studied making up the sample, which reflected a wide variety of IPO process stakeholders.Data analysis technique Both qualitative and quantitative data analysis methods will be used to examine the information gathered from interviews and secondary sources. Thematic analysis, which involves finding patterns, themes, and categories in the interview transcripts, is a component of the qualitative data analysis. This analysis will offer deep and nuanced insights into the research issue and assist in identifying significant factors driving IPOs. Descriptive statistics and statistical tests, such as regression analysis or correlation analysis, will be used in the quantitative data analysis to look at correlations between variables and test hypotheses.Diagnostic testThe validity of the data that was gathered was tested using diagnostic tests.Test of MulticollinearityThe occurrence of significant correlation between independent variables is referred to as multicollinearity. This implies that one variable can be used to forecast another. In that one can contrast the impact of one variable against all others, multicollinearity has an impact on the outcome. Testing of multicollinearity. Through the correlation coefficient matrix, where one of the variables should have been taken out of the model if r was close to -1 or +1, indicating a multicollinearity issue. A correlation of 0.5 or less is considered acceptable.Unit Root testFor stationarity testing, the unit root test was used. The data should be corrected using the first difference under the null hypothesis that there is a unit root. The test was conducted using the Harris-Tzavalis unit root test for icfs, where a P value of less than 0.05 means that the null hypothesis and the absence of a unit root are to be rejected.Data AnalysisStata software version 12 was used in this study to assist with the analysis. The data analysis process employed both quantitative and qualitative methods. This involved producing both inferential statistics through the use of correlation and Panel data regression analysis as well as descriptive statistics that included the mean and standard deviation. Tables were used to exhibit the data after analysis. In the formats below, the regression model would either be POLS, a Fixed Effect Model (FE), or a Random Effect Model (RE): OLS Regression Equation:IPO Success = β0 + β1Corporate Governance + β2Market Conditions + β3Underpricing + εRegression Equation for Fixed Effects (FE) Model:IPO Success it = β0 + β1Corporate Governance it + β2Market Conditions it + β3Underpricing_it + μi + ε_itRegression Equation for Random Effects (RE) Model:IPO Success it = β0 + β1Corporate Governance it + β2Market Conditions it + β3Underpricing_it + u_i + itWhere: β0 = Regression constant (y-intercept)ε_it = Error termwit = Ɛ i + Ɛ itƐ i = Error term due to variation between firm variation

= Error across timeUi = Error within entity

= Error across timeUi = Error within entity4. Results

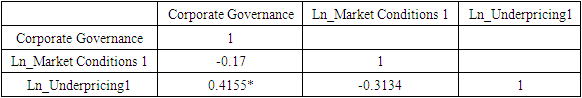

- Results of the diagnostic analysis of the panel data were given in this section. The existence of time-related fixed effects and the viability of fitting pooled regression models as opposed to panel data models were also covered in this section. The investigation also identified the presence of serial correlation and heteroscedasticity. In order to choose between fixed effects and random effects models for the study, a data analysis was lastly performed.Multicollinearity testTo find out if there were any correlations between the independent variables, a multicollinearity test was conducted. The investigation of multicollinearity involves examining the connection between a study's independent variables. Since high correlations are often discouraged, multicollinearity is prevented. If the correlation coefficient is 0.7 or higher, there is no multicollinearity, and this was amply demonstrated in this study.

|

|

|

|

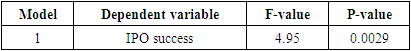

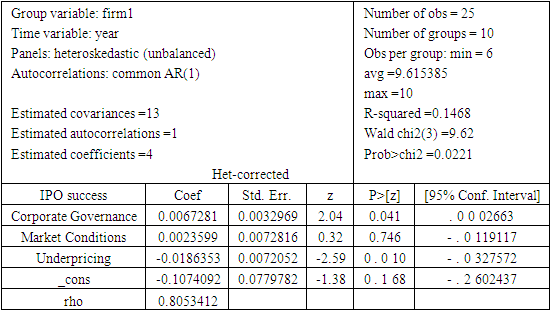

5. Discussion

- Corporate Governance and IPO Performance of firms listed at London Securities Exchange.According to the study's regression analysis, the corporate governance coefficient was calculated to be 0.0067281, with a matching p-value of 0.041. This suggests a favorable and statistically significant association between initial public offerings (IPOs) of publicly traded companies in the UK market and their corporate governance.The positive coefficient shows that the likelihood of successful IPOs tends to grow along with an increase in corporate governance. The results of this study concurred with those of Titman and Wessels (2008), Lopez-Gracia and Sanchez-Andujar (2007), and Simerly and Li (2000), in that, businesses with better corporate governance procedures are more likely to have profitable initial public offerings (IPOs) on the UK market. Furthermore, the association between corporate governance and IPO performance is not likely to have happened by chance alone, according to the statistically significant p-value of 0.041. The outcomes show that corporate governance has a significant impact on how IPOs in the UK market turn out.Overall, the study's conclusions show how crucial sound corporate governance procedures are to improving the chances of a successful IPO. This shows that in order to increase the likelihood of a successful outcome in the IPO process, investors, regulators, and businesses should concentrate on creating and maintaining effective corporate governance frameworks.Market Conditions and IPO Performance of firms listed at London Securities Exchange.According to the study's findings, the market conditions coefficient is 0.0023599, which is more than 0.05 but not statistically significant at the 5% level. Its p-value is 0.746. According to the findings, there was a negligible positive correlation between market conditions and publicly traded companies' IPOs performance. The results indicate that there is only a weak positive correlation between IPO performance and market circumstances as measured by the factors included in the regression model. This suggests that variations or modifications in the general market environment, such as market trends, economic considerations, or investor attitude, may only have a minor influence on the outcome of initial public offerings for publicly traded companies.It is crucial to remember that the lack of statistical significance does not imply that there is no connection between market circumstances and IPO performance. The sample size, the accuracy of the data, or the particular variables chosen to assess market conditions in the study could all be contributing factors to the non-significant coefficient. Additional research and investigation may be necessary to fully comprehend the connection between market circumstances and IPO performance. This might entail improving the way market conditions are measured, taking into account different factors or approaches, and performing further research on a bigger or more varied sample.The study supported the findings of Eljelly (2004), and Shilitsa (2015) who found that overall, based on the results of this analysis, the data reveals that there is little or no statistically significant association between market circumstances and the performance of initial public offerings for publicly traded companies in the UK market. Further investigation is urged to further explore the relationship; however, it is important to take these findings into account within the constraints and context of the study.Underpricing and IPO Performance of firms listed at London Securities Exchange.The study's results show a statistically significant correlation between underpricing and the success of initial public offerings (IPOs) for publicly traded companies listed on the London Stock Exchange, with a significant coefficient for underpricing of -0.0186353 and a p-value of 0. 010. The negative coefficient shows that underpricing and IPO performance are not correlated. In other words, IPO performance tends to worsen as the level of underpricing rises. This conclusion shows that the performance of initial public offerings is adversely affected when companies offer their shares at a lower price than their market value.The coefficient's magnitude (-0.0186353) sheds lighter on the link. It shows that for publicly traded businesses listed on the London Stock Exchange, a 1% rise in underpricing is linked to a 1.86353% decline in the performance of IPOs. This indicates that underpricing affects IPO success significantly, with greater levels of underpricing resulting in a more pronounced fall in IPO performance. The significance of the coefficient (p-value of 0.010) enhances the validity of the conclusion by showing that the observed correlation between underpricing and IPO performance is not likely to be the result of pure chance. In agreement with Campbell et al., (2015) the findings demonstrate that underpricing is a critical factor in determining the success of initial public offerings for publicly traded companies on the London Stock Exchange. These discoveries have applications for businesses and investors alike. In order to reconcile luring in investors and optimizing the long-term success of their shares, companies thinking about an IPO need to carefully evaluate the best price approach. On the other hand, investors should be aware of the potential effects of underpricing on the subsequent performance of IPOs and take this into consideration when making investment decisions. It is crucial to recognize that the factors and research approaches used in this analysis are unique to the London Stock Exchange. The relationship between underpricing and IPO performance may be better understood with additional study and analysis conducted in various markets and using different variables.For publicly traded companies listed on the London Stock Exchange, the study's findings show a significant inverse relationship between underpricing and the success of IPOs. To get the best IPO performance, underpricing techniques must be carefully considered, as demonstrated by the negative coefficient and its relevance.

6. Recommendations

- The following suggestions are made based on the findings of this research study on the variables impacting the performance of initial public offers (IPOs) for publicly traded companies listed on the London Stock Exchange. First and foremost, businesses preparing for an IPO need to prioritize and improve their corporate governance procedures. Establishing strong governance frameworks, open reporting systems, and efficient board management are all part of this. Companies that do this can increase investor trust and their chances of a successful IPO. Second, even though this study indicated that market conditions have little bearing on IPO performance, it is nevertheless crucial for businesses and investors to conduct in-depth market research. Making judgments about pricing and timing can be aided by evaluating market trends, economic variables, and investor attitude.Thirdly, the study showed how underpricing and the success of an IPO have a strong negative relationship. A company's price strategy should be carefully considered, with an eye toward striking a balance between luring investors and maximizing long-term profitability. Setting a good offer price might be aided by using detailed appraisal techniques and market analysis.Fourthly, investors shouldn't just concentrate on the first price change after an IPO. Instead, they ought to assess IPOs' potential for long-term performance. Making wise investment decisions can benefit from extensive due diligence, financial forecast analysis, and a review of the company's growth possibilities.Finally, regulators and policymakers can use the study's findings to evaluate and improve the rules already in place governing IPO procedures. The importance of good company governance and the potential consequences of underpricing are emphasized in the study. Regulators can promote a more open and effective IPO market by coordinating legislation with best practices and investor protection.With the help of these suggestions, businesses, investors, and regulators should be able to approach initial public offerings (IPOs) more effectively. Stakeholders can more successfully manage the complexity of the IPO market and improve their chances of attaining successful IPO results by implementing these guidelines.

7. Conclusions

- This research study examined the variables affecting the performance of initial public offers (IPOs) for publicly traded businesses listed on the London Stock Exchange. Several significant conclusions were drawn after thorough data analysis and interpretation. First, the study found a strong correlation between successful IPOs and corporate governance. Strong governance frameworks are crucial for the IPO process, and companies with superior corporate governance practices were more likely to have successful IPOs.Second, it was discovered that the performance of IPOs was hardly affected by market conditions. The investigation found no statistically significant link between market conditions and IPO success, proving that changes in the general market had no bearing on how successful IPOs for publicly traded companies turned out. The study also revealed a significant negative correlation between underpricing and IPO performance. Higher degrees of underpricing were linked to worse IPO performance, indicating that selling shares at a discount to their market value can have a detrimental effect on how well an IPO performs over time.These conclusions have applications for businesses and investors. To increase their prospects of a successful sale, companies preparing an IPO should put sound corporate governance processes at the top of their priority list. The price plan should also be carefully thought out, keeping in mind the possible adverse effects of underpricing on IPO performance. When assessing IPO chances, investors should take corporate governance into account. They should also carefully assess the long-term performance prospects of IPOs and be wary of any potential dangers related to underpricing. It is significant to emphasize that the variables and procedures used were the subject of this research study, which was exclusive to the London Stock Exchange. To gain a more thorough understanding of IPO success, greater study in more markets, the use of alternative variables, and consideration of new aspects would all be helpful.Overall, this research study offers insightful information about the variables affecting the performance of initial public offerings for publicly traded companies. The results underline the importance of corporate governance, issue a warning against extreme underpricing, and draw attention to the minimal influence of market conditions on IPO performance. Companies and investors can improve their knowledge of and approach to IPOs by taking into account and applying these insights into decision-making processes, thus increasing their chances of success in the dynamic and competitive IPO market.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML