-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2023; 12(1): 13-19

doi:10.5923/j.ijfa.20231201.02

Received: Aug. 30, 2023; Accepted: Sep. 19, 2023; Published: Sep. 22, 2023

Administrative Strategies and Revenue Collection Efficiency within the Devolved Governments in Kenya: Case of Machakos County

Gladys Bunyasi1, Micah Odhimbo Nyamita2, Mark Yawatha Mutio1

1School of Business and Public Management, KCA University, Kenya

2Faculty of Business and Economics, Tom Mboya University, Kenya

Correspondence to: Micah Odhimbo Nyamita, Faculty of Business and Economics, Tom Mboya University, Kenya.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The revenue collection within the county governments in Kenya has remained insufficient in funding the development projects and ensuring effective service delivery. However, administrative strategies, such as revenue diversification, human capital management and technology adoption, have been adopted by most of these county governments to enhance revenue collection efficiency. Hence this study sought to assess the effect of these administrative strategies on revenue collection efficiency within Machakos County in Kenya. The descriptive research design was applied to gather information using a structured questionnaire. Descriptive statistics and inferential analysis were used to analyze the data, which indicated that the adopted administrative strategies have positive influence on revenue collection efficiency within the devolved government systems, particularly the technology adoption strategy. The study recommends that the County Governments in Kenya should therefore put more effort on coming up with administrative strategies which are technology oriented in order to boost their revenue collections.

Keywords: Administrative strategies, Revenue diversification, Technology adoption, Human capital management, Revenue collection efficiency, Devolved governments

Cite this paper: Gladys Bunyasi, Micah Odhimbo Nyamita, Mark Yawatha Mutio, Administrative Strategies and Revenue Collection Efficiency within the Devolved Governments in Kenya: Case of Machakos County, International Journal of Finance and Accounting , Vol. 12 No. 1, 2023, pp. 13-19. doi: 10.5923/j.ijfa.20231201.02.

Article Outline

1. Introduction

- Many Sub-Saharan African countries, such as Kenya, with their devolved governments, have enacted a lot of tax reforms, with an aim of improving the tax revenue collections [1]. Administrative strategy reforms, such as revenue diversification, human capital management and technology adoption, has been a major concept on the fiscal reform efforts in many developing countries, with an aim of restoring macroeconomic stability and restructure tax systems to make them more effective, simpler to administrate, and less disorderly to economic forces [2]. Additionally, many countries have developed and implemented revenue administration strategies in order to respond to emerging challenges which results from the devolved systems of governance [3]. Therefore, the study sought to assess the effect of administrative strategies on revenue collection efficiency within the devolved governments in Kenya. Administration and decision theories, such as complexity theory, public choice theory and public administration theory, have tried to link administration strategies to revenue collection efficiency within the public sector [4,5]. In agreement with the proposition of these theories, Sausi, Kitali, and Mtebe [6] and Mbedzi and Gondo (2010) [7] showed that effectiveness of revenue among the local government authorities is influenced more by revenue administration, where ineffective revenue administration strategies negatively influence revenue collection strategies, since decline of revenue collection efficiency courses a diminution in its revenue (funding). Therefore, this study focused on revenue collection efficiency within local governments in Kenya.The local governments from most developing countries, such as Kenya, are constitutionally authorized to collect tax revenue and spend locally in order to ensure effectiveness in service delivery and development locally, instead of depending on the national government entirely [8]. Therefore, for the devolved governments to attain the targeted development and service delivery, they must seek to adopt administrative strategies which enhances revenue collection efficiency. However, most devolved governments in Kenya are not collecting satisfactory revenue to sustain their service delivery and budgeted development [9]. On the other hand [10] found out that organizational structure or strategies have positively influence fiscal performance of devolved governments in Kenya. Machakos County, which is one of the devolved governments in Kenya, has reported positive performance triggered by newly adopted management information system strategies within the county [11]. Therefore, this study, in addition to adoption of technology, introduced other administrative strategies, such as revenue diversification and human capital management, and tempted to assess how these administrative strategies influence revenue collection efficiency in Machakos County, Kenya. Specifically, the study sought to establish the effect of revenue diversification on revenue collection efficiency in Machakos County, the effect of technology adoption on revenue collection efficiency in Machakos County and the effect of human capital management on revenue collection efficiency in Machakos County.

2. Literature Review

- The portfolio theory advocates that different ways of financial strategies or investments would help in reducing uncertainty on expected returns [12]. Portfolio theory proposes that through introduction of different administrative strategies, such as revenue diversification, an organization may reduce its financially related risks caused by fluctuations in financial expectations, such as revenue collection effectiveness. The mixture of several sources of revenue, which is an administration strategy, can work towards maximization of the effectiveness of generation of tax and reduction of the financial burden within devolved governments.Henri Fayol’s administrative theory implies that efficient human capital management is one of the administrative strategies which organizations should adopt in order to sustain their financial operations on the basis of a strong team work [13]. Every organization, including the devolved governments, endeavor to improve their human capital management to reduce employees’ turnover and sustained productivity [14]. Hence, the effectiveness of operations, like tax collection within the devolved governments, will greatly be impacted by the human resource management strategies adopted by the devolved governments. Most public organizations have embrace the new public management (NPM) theory, which advocates for reforms including modern administrative strategies that are technology oriented in their operations [15]. It is argued that the supremacy of citizens involvement in policy development and demand for superior service delivery from the governmental units have propelled lot of reforms in administrative strategies within the units [4]. With the adoption of the these public sector reforms, which majorly targets the administrative strategies, the financial productivity of most public organizations, such as revenue collections within the government units have been enriched. Therefore the portfolio theory, Henri Fayol’s administration theory and new public management concept, among others, are proposition advocating for administrative strategies, such as revenue diversification, human capital management and technology adoption, as the major strategies that drive the efficiency of revenue collection within the governmental units like the devolved governments. However, the empirical research statistics have given varied results. Studies such as Ashyari and Rokhim [16], Kimm [17] and Jaafar, Latiff, Daud, and Osman [18] found that revenue diversification improves the financial operations of organizations particularly their net operating margin and revenue collections, including tax revenues. However, Yan [19], Shon [20] and Chen [21] found that revenue diversification within the local governments increases the instability of revenue collection significant when the economic base of the governmental unit is stable. Jaikampan [22] highlighted that tax administrative measure are effective in circumstances where revenue diversification is low and particularly under stable form of governments such as county governments.On human capital management, Alasfour [23] argued that governments including the devolved units, need to enhance human resource strategies that cultivate a culture of trust and strong ethical values which works towards reduction of tax evasion and improved revenue collection. Empirically, studies such as Afosah [24], Mbedzi and Gondo [7] and Davis [25] have highlighted the fact that weak human resource management strategies within the local governments and tax authorities reduces their effectiveness in revenue collections. Other studies also have found that human capital management strategies like performance appraisal, performance management and result oriented management, cause deterioration in performance of the local government units due to varied challenges, including political influence [26,27].There is enough empirical evidence on adoption of technology as an administrative strategy embraced by the devolved governments world over to improve efficiency in operations and performance within the government organizations [28]. Particularly, Carter, Ludwig, Hobbs, and Campbell [29] found that the major determinants of technology adoption within the tax collection systems are effort efficiency, performance efficiency and social influence. Other studies such as Majeed and Ismail [30], Sausi et al. [6], Masunga, Mapesa, and Nyalle [31] and Hussein, Norshidah, Abd Rahman, and Mahmud [32] determined that adoption of technology by the local governments have succeeded in improving the efficiency of revenue collection within the governmental units. However, Mu, Nigatu Mengesha, and Zhang [33] argued, form their findings, that technology existence is not a guarantee that it will be applied efficiently by the users. This fact is confirmed by Mallick [34] and Nnubia, Okafor, Chukwunwike, Asogwa, and Ogan [35] who surprisingly found out that there is no significant influence of technology adoption on revenue collection. Therefore, this study sought to find out the effect of technology adoption and other administrative strategies, such as revenue diversification and human resource management, on the efficiency of revenue collection within the devolved governments in Kenya, particularly Machakos County.

3. Methodology

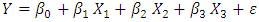

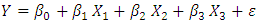

- The study applied descriptive research design to analyze, approximate, describe and forecast the associative relationships between administrative strategies and revenue collection efficiency within the devolved governments. The target population of the study consisted of 67 administrative employees of Machakos County, which was made up of 11 chief officers, 8 sub county administrators, 8 chief revenue officers and 40 revenue collection officers. Data was collected from all the 67 respondents using a standardized questionnaire. The validity and reliability test where performed on the data collection instrument, with the Cronbach's Alpha coefficient being 7.89. Thereafter the data was analyzed using both descriptive and inferential statistics. The regression model applied in inferential statistics was:

| (1) |

represent revenue collection efficiency and

represent revenue collection efficiency and  represents the constant coefficient.

represents the constant coefficient.  ,

,  and

and  are coefficients of the independent variables

are coefficients of the independent variables  ,

,  and

and  representing revenue diversification, technology adoption and human capital management strategies, respectively.

representing revenue diversification, technology adoption and human capital management strategies, respectively. 4. Results

- Out of the targeted 67 administration staff of the devolved government unit, 56 responded by submitting back fully filled research instruments. This indicated a response rate of 83.58%, which is acceptable rate for further analysis [36]. The highest response rate of 90% was from the revenue collection officers who formed the bulk of the respondents, followed by the county chief officers at 81.82%, chief revenue officers at 75%, and lastly the sub county administrators at 62.50%. The descriptive statistics, based on the study variables i.e. revenue diversification, technology adoption and human capital management, and the research instrument on a Likert scale score of 5 (strongly agree) to 1(strongly disagree) was applied. The scores were converted into numeric data with 1-1.8 denoting strongly disagree, 1.8 to 2.6 disagree, 2.6 to 3.4 neutral, 3.4 to 4.2 agree and above 4.2 to 5.0 denoting strongly agree. The results are represented as follows:

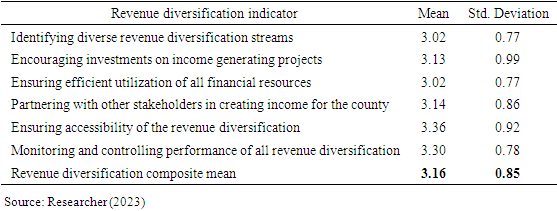

4.1. Revenue Diversification

- The study results in table 4.1 below shows that revenue diversification is one of the administrative strategies of the county government, though moderately practiced with a mean score of 3.16. The factor of ensuring accessibility of the revenue diversification within the county government indicated the highest score of 3.36, with the identifying diverse revenue diversification streams and encouraging investments on income generating projects scoring the lowest at 3.02. These results indicates that the county government has not put intense effort on developing different streams or sources of income and could be depending mostly on disbursements from the central government, which could be inadequate. Less effort on revenue diversification may also compromise the revenue collection efficiency since the economic base of the county will not be stable with less streams of finances [19].

|

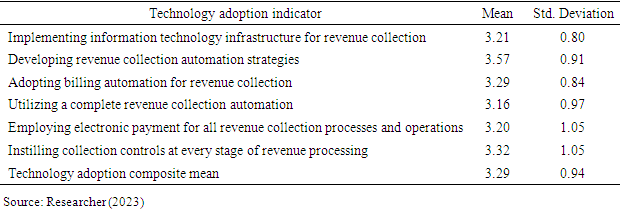

4.2. Technology Adoption

- Results in table 4.2 below indicates that the county has put slightly more effort on embracing technology in revenue collection, which is the trend worldwide [28]. The technology adoption within the county has a mean score of 3.29, with developing revenue collection automation scoring the highest at 3.57. The adoption of technology within the county government’s operation systems, including revenue collection systems, may have improved the overall efficiency and financial performance of the county [11]. However, the lowest score is on utilizing a complete revenue collection automation at 3.16, which could work towards reduction of revenue collection efficiency within the county government [33].

|

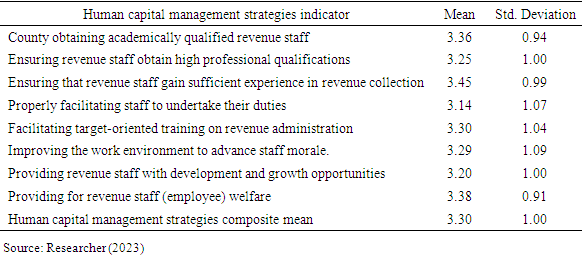

4.3. Human Capital Management

- The administrative strategy of human capital management is also one of the strategies that the county government of Machakos has put effort in enhancing as highlighted by the results in table 4.3 below. The strategy has enumerated a mean score of 3.30, which is above average, implying that in the effort of increasing efficiency within the operational systems of the county government, lot of emphasis has been but on the advancement of human capital [25]. The results show that more effort on human capital management has been towards ensuring that revenue staff gain sufficient experience in revenue collection with a score of 3.45. Nevertheless, more effort should also be put on properly facilitating staff to undertake their duties which has a lower score of 3.14, which my work towards enhancing trust and ethics among the staff and in return improve efficiency in revenue collection within the county [23].

|

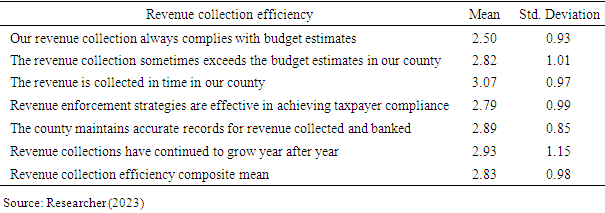

4.4. Revenue Collection Efficiency

- The results in table 4.4 below shows that the mean score of revenue collection efficiency is below average at 2.83, with a standard deviation of 0.98. This confirms the argument of Nyabwengi and K’Akumu [9] that most of the devolved governments in Kenya are not collecting satisfactory revenue to sustain their service delivery and budgeted development projects. The results show that in all the low performance in revenue collection efficiency, the factor of “revenue is collected in time” in the county has scored the highest at 3.07. However, the score on the “revenue collection always complies with budget estimates” is the lowest at 2.50 indicating an experience of budget deficit which may impact negatively on development within the county government of Machakos.

|

4.5. Regression Results

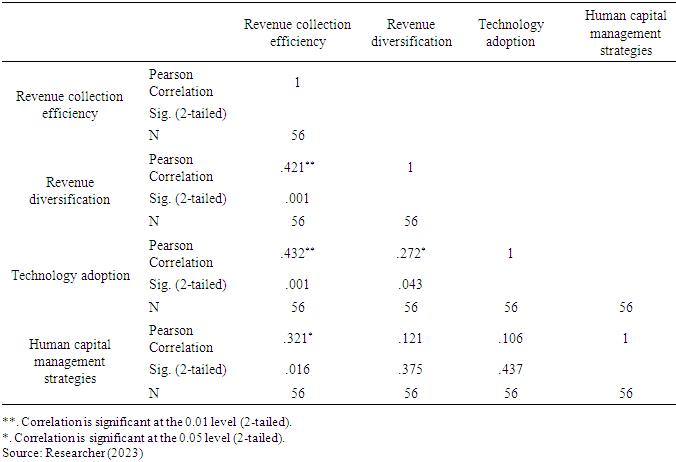

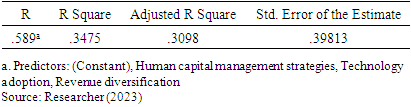

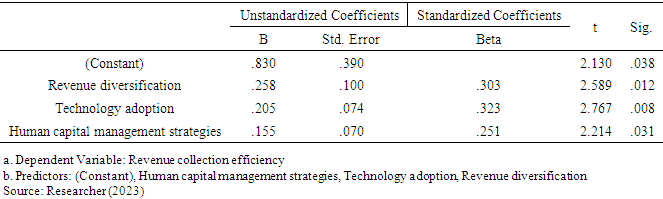

- The inferential statistical analysis process required the diagnostic tests to be performed before the regression analysis. Hence, the normality test was performed using the Shapiro-Wilk Test with p values of the revenue diversity, technology adoption, human capital management and revenue collection efficiency variables recording 0.298, 0.084, 0.272 and 0.314, respectively (i.e. all p>0.05) indicating that the data is normal [37]. Linearity test was also conducted using scatter plot diagrams which showed that the data distribution for all the variables presented linear trend with almost persistent variances [38]. Further, Multicollinearity test was performed using VIF, with independent variables of revenue diversity, technology adoption and human capital management VIF values recoding 1.090, 1.086 and 1.02, respectively (i.e. all VIF<10) indicating absence of Multicollinearity [39]. Lastly the Heteroscedasticity test was also done using Glejer test, with the p-values of the variables revenue diversity (0.488), technology adoption (0.154), and human capital management (0.209) being p> 0.05 indicting that Heteroscedasticity is absent [40].In addition to diagnostic test, correlation analysis using the Pearson r statistic was conducted to compute bivariate correlations between the study variables and the results presented in table 4.5 below. The results shows that there exists a strong significant positive correlation between the study independent variables of revenue diversification and technology adoption and the dependent variable of the study; revenue collection efficiency.

|

| (2) |

represent revenue collection efficiency and

represent revenue collection efficiency and  represents the constant coefficient.

represents the constant coefficient.  ,

,  and

and  are coefficients of the independent variables

are coefficients of the independent variables  and

and  representing revenue diversification, technology adoption and human capital management strategies, respectively.

representing revenue diversification, technology adoption and human capital management strategies, respectively.

|

|

|

5. Conclusions

- It is event from the results that the types of administrative strategies adopted by the devolved governments in Kenya influences revenue collection efficiency. Particularly, the influence of revenue diversification strategies on the revenue collection efficiency is more enhanced in comparison to technology adoption strategies and human capital management strategies, which also influence revenue collection efficiency within the devolved governments in Kenya. However, the most sensitive administrative strategy is the adoption of technology. Therefore in addition to advancing technology and human capital, more emphasis should also be placed on identifying different types of revenue sources within the devolved governments in Kenya.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML