-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2022; 11(1): 9-19

doi:10.5923/j.ijfa.20221101.02

Received: Dec. 8, 2021; Accepted: Dec. 31, 2021; Published: Apr. 21, 2022

A Cointegration Approach Towards the Real Exchange Rate Effects on Balance of Trade in India: Marshall Learner Condition

Dhanya Jagadeesh

Economics Lecturer at BA Isago University, Gaborone, Botswana

Correspondence to: Dhanya Jagadeesh, Economics Lecturer at BA Isago University, Gaborone, Botswana.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

According to the Marshall-Lerner, the sum of trade elasticities should be greater than one for a change in exchange rate to have a positive impact on the country’s trade balance. In this study we tested the existence of the Marshall-Lerner condition in India with its seven major trading partners which are USA, UK, UAE, Saudi Arabia, Singapore, China and Hong Kong. The study conducted the stationarity test and Johansen cointegration test VECM and ARDL to estimate the trade elasticities in the case of 6 countries and the empirical results indicate that imports and exports respond significantly to a change in the exchange rate in India in the case of six countries, i.e. USA, UK, Saudi Arabia, UAE, China and Hong Kong., while there is no evidence of the Marshall-Lerner condition in India in the case of Singapore.

Keywords: Marshall Learner Condition, VECM, ARDL, Elasticities, Export, Import

Cite this paper: Dhanya Jagadeesh, A Cointegration Approach Towards the Real Exchange Rate Effects on Balance of Trade in India: Marshall Learner Condition, International Journal of Finance and Accounting , Vol. 11 No. 1, 2022, pp. 9-19. doi: 10.5923/j.ijfa.20221101.02.

Article Outline

1. Introduction

- Most of the nations in the world are integrated with the global economy through the channels of capital flows & international trade in which India is not an exception. Since independence, India’s one of the main objective was to achieve economic self- reliance, which had to be realized through import substitution. But during independence our technology as well as the food availability was in a backward stage, Hence India had to be established essential industries which required importing a huge amount of capital goods. After that when India opened its market for foreign companies as part of globalization, it signed trade agreements with many other countries as being a member of the World Trade Organization (WTO) and reduced tariffs on its imports, thereby imports again increased and India couldn’t reap the benefits of globalization due to its poor manufacturing base.Thus India’s over all imports have been growing fast which estimated US $ 1273M, in 1950 -51 and US$ 15869 million in 1980-81, and it increased again to US$ 465,581 million in 2017-18. During the time trade deficit was increased from US$ 4 million to 7383million in 1950 and 1980 respectively. During 1990-91, it was decreased to US $ 5932 million, though in 2017-18 it was increased again to US $ 162,054 million. Despite the long history of the downward trend in trade balance, it has turned positive and recorded a current account surplus of $600 million, or 0.1 per cent of GDP, for the period of January-March 2020, Reserve Bank of India (RBI). This is a rare occurrence because since 1976-77, there has not been a single year when India gained substantial merchandise trade surplus. This positive improvement in trade balance has been driven mainly by a decline in import due to Covid 19, and it may lead to a contraction in demand in the real economy (Pay & Ray, 2020). Briefly India is facing continuous trade deficit while other East Asian neighbouring countries enjoy all the prosperities of international trade. In International Economics, there has always been debate on adjustments in exchange rate and its feasibility in solving BOP issues, many of the conventional trade theories proposed devaluation as an instrument to improve the trade balance for a country. Among which Marshall & Learner has given the most useful insight on how can the Balance of Payment be improved in such situation. However India never manipulated it's currency to gain benefit of exports like many other countries do.Therefore the main objective of this study is to apply the Marshall Learner condition to evaluate the effect of devaluation on imports and exports in India using Annual series from 1996 to 2010. According to Alfred marshall and Abba Learner the trade balance is expected to worsens first, and improve further. And the theory lay down 3 conditions which are known as marshall learner condition.Exd + Emd >1Exd + Emd <1Exd + Emd =1The above condition indicates that the BOT will improve only if the sum of price elasticity for imports and exports is greater than one and if this sum is less than 1 then the devaluation will make the BOT worse and the exchange rate will leave the balance of payment if it is equal to 1. However, the overall effect of the devaluation makes an impact on the BOT of a country. Devaluation in the exchange rate influences the trade balance of a country through two ways even though the impact may vary due to different level of economic development. Firstly, devaluation encourages exports as these become cheaper for the foreign market. Secondly, it reduces the quantity of imports as they become costlier for domestic market, which leads to import substitution and enhances competitiveness in the exporting sector.

1.1. Statement of the Problem

- The research was concerned about India’s long time deterioration in balance of payment since its independence, Despite India’s GDP reached US$ 2880000 million in 2019-20*, India reported a trade deficit of US$ 152880 million in 2020. Total exports from India including Merchandise and Services stood at US$ 528450 million in 2019-20, while total import was estimated at US$ 598610 million according to data from the Ministry of Commerce and Industry. Merchandise exports alone estimated at US$ 314310 million in 2019-20, while merchandise import stood at US$ 467190 million in the same period. (Foreign Trade Policy of India, Aug, 2020).A BOT deficit might leads to wider structural economic problems, like loss of confidence, inadequate foreign investment, a decline in competitiveness in foreign market, and, a change in comparative advantage towards neighboring countries. Therefore it is vital to be studied in detail and to investigate the issues and solutions attached to that.

2. Literature Review

- The application of Marshall Learner condition is not new to the world of economics especially in the economy of India. Therefore we summarize some of the relevant literature published so far, as follows.Bahmani-Oskooee and Kara (2003) and Bahmani-Oskooee and Kara (2005) applied the Auto Regressive distribution Lag Method to analyse the price elasticities of Import & export demand for 28 countries and the study reported that the absolute values of the coefficients of price elasticities of import & export became greater than one for most of the countries in concern, except in Europe, where there the condition was not met. Mahmud et al. (2004) applied non-parametric technique to test the M-L condition, While the majority of the literature in the same concept utilizes cointegration methods, Langwasser (2009) analysed the sources of imbalances in balance of trade within the Euro area, using VECM to estimate the price elasticities of export and import, the study focused more on short-run dynamics and the long run received less attention. Therefore no conclusion is made about the Marshall -Learner condition in this study. Liu et al. (2006) also used VECM approach in the economy of Hong Kong and confirmed the M-L condition.Junz and Rhomberg (1973), Magee (1973), Miles (1979), Levin (1983), Meade (1988), Noland (1989), Rose (1990), Bahmani-Oskooee and Malixi (1992), Boyd et al. (2001), Lee and Chinn (2002), Lal and Lowinger (2002), Hacker and Hatemi-J (2004), and others also played an important role in the contribution of the international trade and Balance of payment issues by applying M-L condition for countries other than India. Bahmani- Oskooee and Ratha (2004a) concluded that the devaluation of currency has different impact on trade balance in the short run and in the long run where the real depreciation of the currency improves the trade balance in the long run.A study by Sinha (2001) also confirmed the Marshall-Lerner condition for all the five Asian countries in choice such as India, Japan, Philippines, Sri Lanka and Thailand with the exception of Sri Lanka.Hsing (2010) also investigated the evidence of the Marshall Learner condition in eight Asian countries among which the validity of Marshall Learner condition only in Singapore and Malaysia was rejected. Eita (2013) also reported the evidence in favour of the Marshall Lerner Condition for India’.Brooks (1999) empirically estimated the Marshall Learner condition for the bilateral trade balance between the US and G7 countries using Johansen-Juselius FIML estimation method and Error Correction Model in the economy of USA and the results of the study indicate that the that the depreciation of dollar improve the trade balance of USA . Dash (2013) investigated the correlation between the trade balance and exchange rate devaluation with its four major trading partners using Johansen-Juselius multivariate cointegration approach. The findings of the study indicated that there is no evidence in favor of India’s trade with US and UK, and the Marshall Learner condition hold only in case of trade with Germany. Panda & Reddy (2016) estimated the bilateral trade relationship between China and India using ARDL and ECM model and the study rejected the validity of M-L condition thereby the study concluded that Rupee devaluation doesn’t make any impact on the improvement in trade balance of India with China. Another study by Tripti and Gargi Bandyopadhyay (2016) tested Marshall-Lerner Condition in India based on a sugar industry using the cointegration via SAS and finally OLS technique in the Pre reform (1962-1990) and Post reform interlude (1991-2013) considering the annual data of five variables namely; Exports, Imports, GNI, Exchange Rate and the World Income. The study reported that the Marshall- Lerner condition is satisfied in both periods.Adnan Ali Shahzad (2017) used the panel data from seven Asian countries such as Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri-Lanka to analyses the effect of devaluation on trade balance for the period of 1993 to 2010 and adopted the random effects model to estimate the price elasticities of export and import. The study realized that the, M-L condition does not fulfill.Ritesh Pandey (2013) attempted to examine the Marshall Lerner condition in relation to India’s international trade using a multivariate cointegration approach. And the research confirmed that Marshall Lerner condition holds for the case of India. Yu Hsing (2010) The study applied in the economy of US with its trading partners Hong Kong, Japan, Korea, Malaysia, Pakistan, Singapore, Thailand, and India and confirmed marshall Learner condition in Korea, Japan and Pakistan, India, Hong Kong, Singapore and Thailand using while it wasn’t confirmed in Malaysia. Sandeep Ramesh &Deepak Garg(2005) used import and Export demand functions for India to empirically analyse the income and exchange rate elasticities using Johansen Co-integration model and VECM is used to establish the cointegration between the variables in concern and there was no evidence for Marshall-Lerner condition in India.

3. Methodology

- In this study, the annual data series from 1990 to 2018 has been used which was collected from the various sources such as International Financial Statistics (IFS), WITS & the World Bank database for each variable. The study used time series data for the real effective exchange rate for India (REERi), India’s exports (Xi) and imports (Mi), India’s annual income (Yi) as well as the income of major trading partners (Y*t) which were converted into logarithms and tested for stationarity using the ADF test. If the series are found to be integrated of the same order, we test cointegration using Johansen’s maximum eigenvalue test otherwise use ARDL model. Guidelines for deciding on the number of lags for the test specification is provided by various information -based criteria like Akaike Information Criterion (AIC), If the variables cointegrated the study will have to use VECM to estimate India’s import and export trade elasticity with each of its major partnering countries separately.

3.1. Model Building

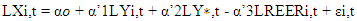

| (1) |

| (2) |

3.2. Empirical Estimations

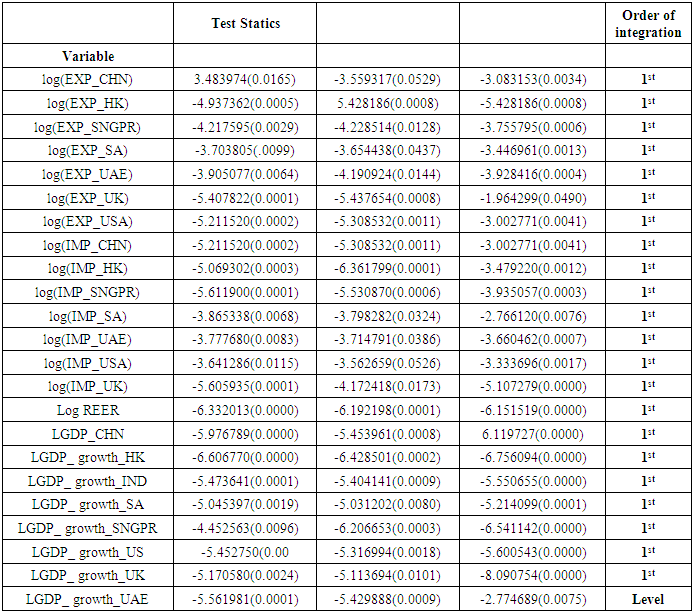

- Empirical Estimation in this study is a long- run phenomenon as the main objective of the study is to check whether the Marshall-Lerner condition holds in India. The appropriate methodology for testing the Marshall- Learner condition is cointegration analysis. Here we used Johansen Cointegration and ARDL to check the long - run relationship between the variables and further used Vector Error Correction model to estimate the price elasticities of export and the import. However, the order of integration is a pre-condition when deciding whether to go for Johansen Cointegration or Auto Regressive Distribution Lag (ARDL) approach. Therefore the unit root tests based on ADF test was performed which was given in Table 1 below:

|

3.2.1. Unit Root Testing

- The table above indicates that all the variables are non-stationary at its level except the log GDP of UAE. Therefore the appropriate method was Johansen Juselius co-integration to check the coinegration of India’s trade relationship between those countries in concern except UAE, as the UAE‘s GDP growth is stationary at its level, which we use ARDL method to analyze India’s trading relationship with UAE. Furthermore, as a precondition to follow the necessary tests, we decided the variable’s lag length and we rely on Akaike information criterion (AIC) and Schwarz information criterion (SC). The results points out that they are almost consistent across different lag order choices.

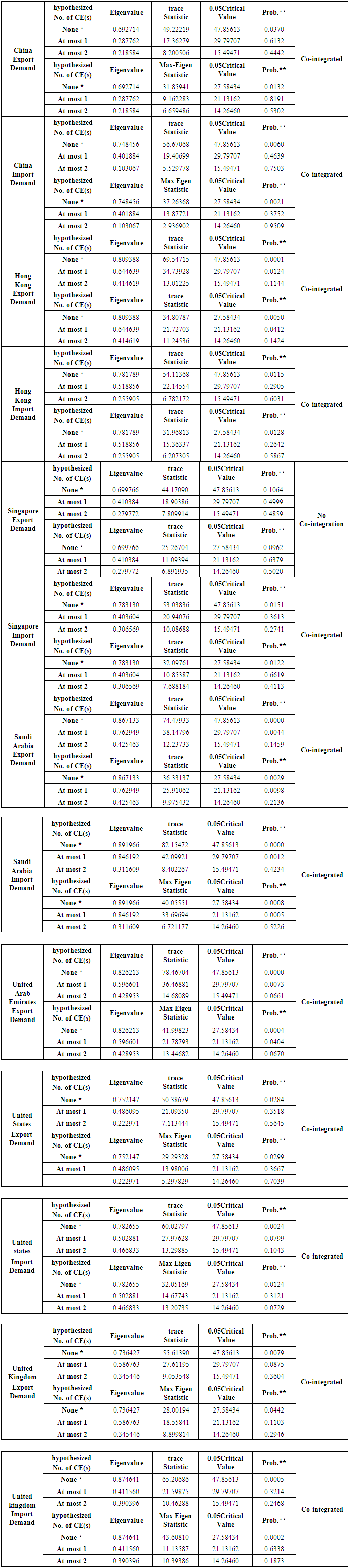

3.3. Johansen Cointegration Test

- According to the information reported in Table 1, the "appropriate method was Johansen Juselius co-integration for all the variables which are integrated I (1), Johansen cointegration use the maximum Eigen value statistics and the Trace test to determine the number of cointegrating vectors. Table 2 reports these two statistics for all six cases.

|

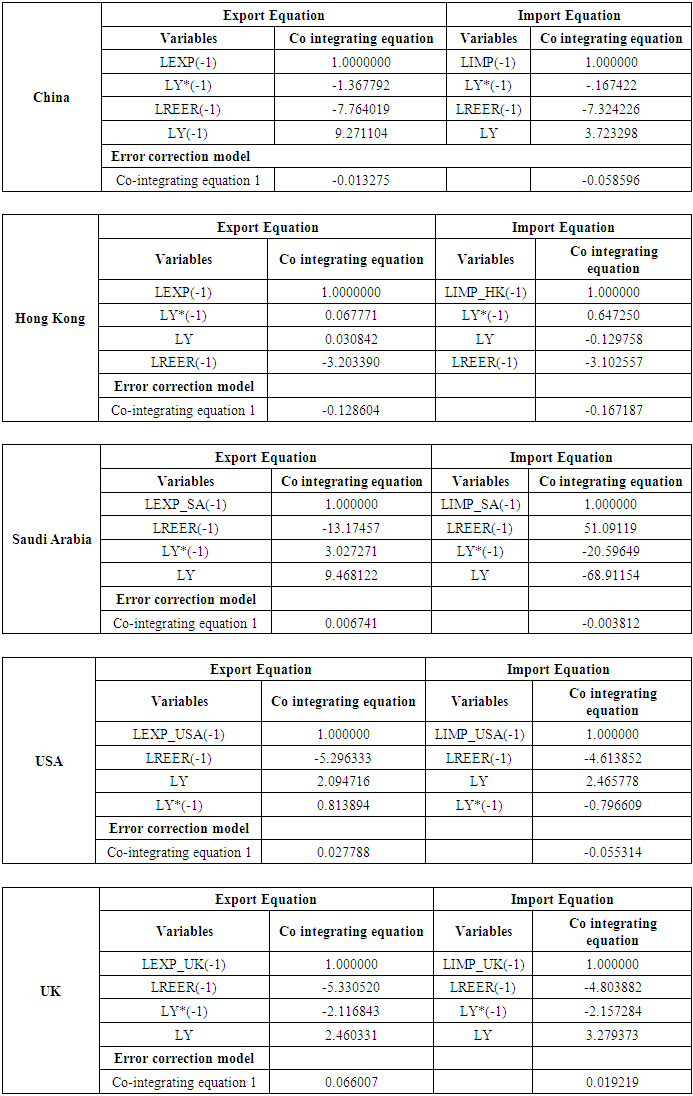

3.4. Vector Error Correction Model (VECM)

- After the evidence of co-integration relationship among the variables have been checked, the next step is obviously running the vector error correction model (VECM) using one less lag length (p-1). Where p is the optimal lag length determined with vector autoregressive (VAR), hence the optimal, lag length of the model was 2 and therefore vector error correction model (VECM) requires 1 lag length to run a regression. The following table depicts India’s Price elasticities of Export and Import demand with each of the countries (China, Hong Kong, Saudi Arabia, the United Kingdom and the United States of America), and to check whether the Marshall Learner condition hold in India.

|

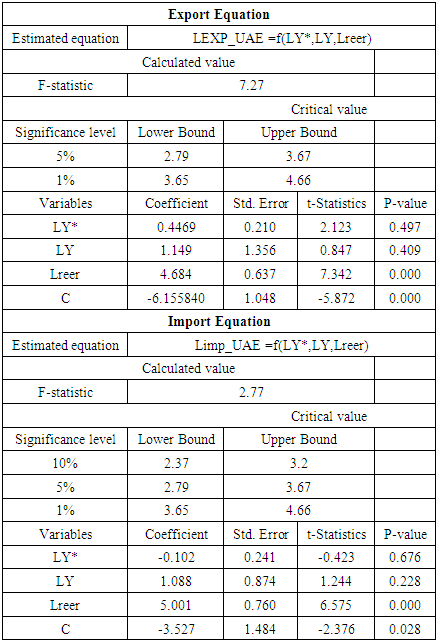

3.5. Auto Regressive Distribution Lag (ARDL)

- Auto Regressive Distribution Lag bounds testing approach to cointegration do not require same order of integration for all variables. The ADF test indicates that 1 variable which is real GDP of UAE is stationary at level while 3 other variables are stationary at 1st difference. Therefore an ARDL procedure of cointegration test can be applied to estimate the Export - Import Elasticities of India in connection with UAE. It is applied to examine the existence of long run equilibrium relationship among variables included in the model; the result was reported in the below table. The model is specified in its log form where the log of export and log of import is the dependent variable and real GDP in India, real GDP in UAE and real effective exchange rates are independent variables. The t - value which is more than 2 and the p- value which is significant at 5% shows the variable Lreer is significant. The test shows there was a long-run relationship between log of export and its independent variables which were evident in calculated F-statistic of 7.27 which is greater than the upper bound critical value of 3.67 at 5% level, therefor rejecting the null hypothesis of no co integration, while it is inconclusive that whether there is long run relationship between the log of import from UAE and the other variables are as the F statistic 2.77 which lies between upper and lower bound value at 10%. As it was at least not rejected the long run relationship, thereby it can be concluded that there was a long-run relationship between the export to and import from the UAE and all the other variables especially with the major variable in concern which is the exchange rate. Also, the sum total of the absolute values of export and import in response to 1% change in the exchange rate is more than 1 meaning that Exchange rate has a vital role in the trade balance of the country, and it holds Marshal leraner condition.

|

4. Conclusions

- This study empirically estimated the existence of the Marshall-Lerner condition for India with its seven major trading partners which are USA, UK, UAE, Saudi Arabia, Singapore, China and Hong Kong. Import and export trade elasticity has been calculated separately with each country to evaluate that “Whether India fulfill the M-L condition or not”. The study used an income of the trading partner (Y*), domestic income (Y) as controlled variables together with the independent variable exchange rate (Reer) to analyze the effect of exchange rate on India’s exports and imports. The study conducted the stationarity test and Johansen cointegration test as a requirement for further tests, and found all the variables are stationary at 1st difference except real GDP for UAE which was stationary at level. Therefore we used two different tests which were VECM and ARDL to estimate the Import and export trade elasticity in the case of 6 countries except for Singapore according to the requirement for each equation. The Eigen values and trace show that there is not even one co-integration relationship in the case of Singapore therefore we conclude the Marshall Learner condition doesn’t hold in India the case of Singapore. As far the effects of exchange rate on export demand" is concerned, the results are as per expectations, i.e., The empirical analysis confirmed that real exchange rate depreciation makes domestic goods competitive and boost exports and hurt import against her trading partners with the exception in the case of Singapore And finally to conclude about Marshall-Lerner condition, the study came up with the "findings that the sum of exchange rate elasticities of imports and exports is greater than one" in the case of six countries, i.e. USA, UK, Saudi Arabia, UAE, China and Hong Kong., while there is no evidence of the Marshall-Lerner condition in case of Singapore.

5. Policy Recommendations

- The result of the study indicates that in the long run, Marshall Lerner condition is verified in the case of India. This suggests that elasticity approach to the balance of payments adjustments (devaluation) are intended for efficient and effective management of the trade balance of India, but together with the diversification of export basket away from traditional export patterns to improve competitiveness according to the international market demand. However, there are some limitations in the present study, which is that the study can be improved by testing the existence of J-curve phenomena in the country.

ACKNOWLEDGEMENTS

- This research is supported by BA ISAGO University. Hence I take this opportunity to thank the management team at BA ISAGO for the kind of support. I appreciate and acknowledge the suggestions and the kind of motivation and encouragement for each stage of this study from Professor Sankaran at Pondicheri University, I would like to take this opportunity to express my profound gratitude and deep regard for his valuable suggestions and further this research would not have been possible without having enough resources / information and the data; therefore I take these opportunities to show my gratitude to all the journals which published articles and data which are relevant for this study. I would also like to extend my thanks to the IHS Markit for the EViews, the statistical package which I made use of my data analysis. Finally, I wish to thank my family for their support and encouragement to complete this paper successfully.

Conflict of Interest

- This research will be supported by BA ISAGO University with the publication charges.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML