-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2021; 10(1): 12-20

doi:10.5923/j.ijfa.20211001.02

Received: Aug. 19, 2021; Accepted: Sep. 24, 2021; Published: Oct. 30, 2021

Exploring the Factors Influencing Investment Decision of Workers of Ghana Ports and Harbour Authority, Takoradi

Peter Besah Avevor1, Kennedy Oppong Fosu2, Kingsley Aidoo-Acquah1, Kwadwo Ankomah1, Ewuradjoa Ohene-Bredu3

1Faculty of IT Business, Ghana Communication Technology University, Takoradi Campus, Ghana

2Internal audit Ghana Communication Technology University, Accra, Ghana

3Ghana Ports and Harbour Authority, Takoradi, Ghana

Correspondence to: Peter Besah Avevor, Faculty of IT Business, Ghana Communication Technology University, Takoradi Campus, Ghana.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

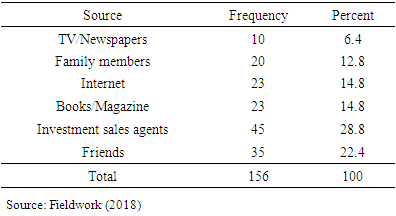

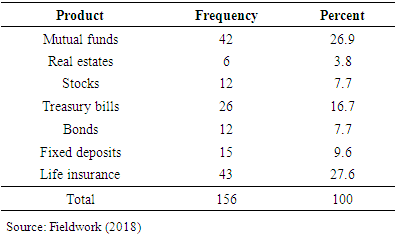

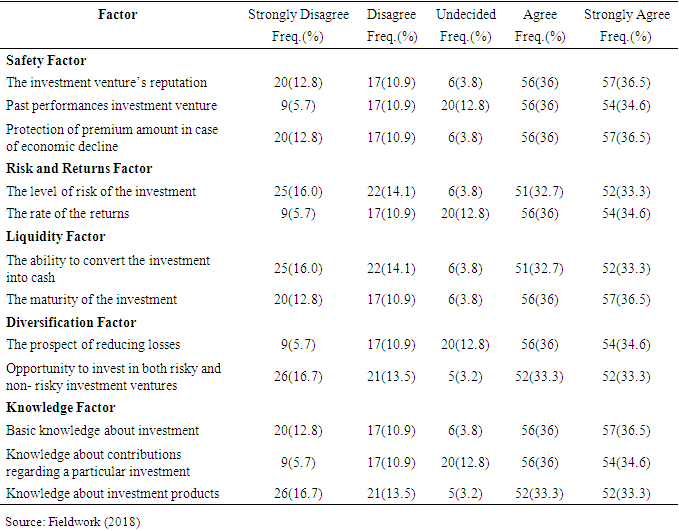

This research explored the factors which influence investment decision of workers of Ghana Ports and Harbour Authority, Takoradi using a quantitative research approach, with descriptive survey as the design. The population of study comprised both permanent and contract staff of the organization. A total of 254 employees were selected using random sample method, with 61.4% response rate and a set of questionnaire as the research instrument. Frequencies and percentages were relied upon for analyzing the obtained data. The study revealed that investment sales agents, TV/Newspapers, family members’ referrals, social media as well as the Books/Magazine were the main sources of investment information to workers of GPHA. Again, insurance policy is the commonest investment product workers relied upon. Also, safety, risk and returns, liquidity, and diversification factors were the main factors influencing investment decision of workers of GPHA. It is recommended that the Central Bank of Ghana should develop clear measures to protect the premium of investors. Again, the Management of GPHA should periodically organize sensitization and public education programs for its employees on investment decisions in order to increase the level of knowledge of staff members of organization in terms of investment.

Keywords: Assets, Financial, Financial literacy, Investment, Returns, Risk, Savings, Workers

Cite this paper: Peter Besah Avevor, Kennedy Oppong Fosu, Kingsley Aidoo-Acquah, Kwadwo Ankomah, Ewuradjoa Ohene-Bredu, Exploring the Factors Influencing Investment Decision of Workers of Ghana Ports and Harbour Authority, Takoradi, International Journal of Finance and Accounting , Vol. 10 No. 1, 2021, pp. 12-20. doi: 10.5923/j.ijfa.20211001.02.

Article Outline

1. Introduction

- Investment has become a widely discussed topic over the past decades. It is mainly concerned with wealth creation and wealth maximization. People often invest with the hope of obtaining good returns. Investment is also a means of growing one’s wealth [1]. It is believed that when people invest their savings bonds, mutual funds, stocks and other investment channels their wealth appreciates and accumulates, and ultimately earn extra income on their premium. People also invest in order to achieve financial goals or towards specific projects such as starting a business, buying a land, buying a car, building or buying a house, among others. When investment is properly done it helps people to achieve these objectives as they earn higher returns than the normal savings account [2]. As part of the strategies for better retirement, some people invest part of their savings. They buy stocks, bonds and other long term investments in order to ensure they live a comfortable life after years of active service. [2] Investment is seen as the process of buying financial securities or instruments with the main intention of getting higher returns or yield in the near future. Investment is about taking risks based on the state of the market or economy at a given time. Investment is also defined as the deliberate process of setting money aside to buy securities or physical assets with the expectation of it appreciating or yielding good returns after a particular period of time. It is usually issued by a financial institution or corporate body [2].In their study, Malviya and Pandey identified various types of financial investments. They include savings and fixed deposit, physical assets such as gold, diamond, silver, real estate and lands. Others are marketable investments such as debentures and securities, non-marketable investments, transferable and non-transferable investments [3]. The ever-increasing advancement in technology has made the accessibility of products and services less difficult [2]. Today, one does not need special qualifications to invest and one does not need to be enormously rich to invest. All that is needed is a certain level of financial literacy or awareness. In support, Organisation for Economic Co-operation and Development (OECD) posits that good financial literacy skills enable people to make good financial decisions including how to use or invest their monies. The absence of financial literacy potentially makes people display behavioural patterns that can make them vulnerable to financial crisis [2]. Financial literacy is vital in investments since it helps investors to maintain a positive attitude towards money. It also makes available the appropriate knowledge and skills investors need to assess the most suitable financial products and financial instruments for them. In order to make prudent investment decisions, Ohene-Bredu challenges investors to do a lot of research to gain a lot of insight into the investment they intend to undertake and seek proper advice especially if they are investing in foreign stock markets [2]. In recent times, investment has changed in developing countries in Africa and Ghana is no exception. There are several financial instruments and investment institutions in Ghana. These institutions often provide clients with sophisticated and refined financial packages. People are now embracing investment, with some investing directly through the Ghana Stock Exchange whilst others invest through financial or investment institutions in the country [2].As a way to make the lives of especially workers easier, a number of investment instruments or opportunities have been made available to them. For instance, in developed countries such as the USA, UK, France, Germany, etc. a number of investment packages have been made available in various organizations for the workers. Some of these investment opportunities available in organizations are marketable and liquid whilst others have been found to be non-marketable and highly risky [4]. Despite the upswing of investment packages in both developed and developing countries, many workers in Ghana appear not to be showing much interest in the investment opportunities available to them. The seeming low interest of some workers in the formal sector of Ghana to invest may be due to some bad experiences in the past. Many investors sometimes struggle to get the returns on their investments from investment companies [2].In Ghana, there have been several instances of investment fraud. There is also the issue of illegal sales of investment policies to individuals [5]. For example, people who invest their savings in an investment company never received the expected returns [6]. There is also the case of the DKM microfinance where many people invested their monies because the company promised a lot of luxurious profits to customers. In the end, many of the clients could not receive their returns, leading to much disappointment and erosion of confidence in the activities of microfinance companies in Ghana [7]. In spite of the few above cases of investment failures in Ghana, there is a wide recognition of paucity of knowledge as far as issues of investment are concerned in the country. There are concerns on what are the major considerations of people in respect to investment decisions. Although scholars have identified factors such as tax saving, diversification, affordability, liquidity among others as the reasons people tend to sign onto investment policies, the situation in Ghana is not very clear. According to Ohene-Bredu, there seem to be limited literature on the factors influencing investment decisions of Ghanaian workers including those in Ghana Ports and Harbour Authority (GPHA), Takoradi [2]. Given the ever-increasing relevance of investment in today’s economy, it is of huge importance that studies be done into the issue of investment in order to help push back the frontiers of people’s ignorance. It is in the light of this that this study finds relevance. Specifically, the study explored the sources of investment information available to workers, products workers of GPHA have invested in, and the factors which influence workers’ decision to invest using Takoradi Ports as a case.

2. Literature Review

- Understanding the concept of InvestmentInvestment is of huge importance to every individual and every economy. Nations will find it very to thrive without investments. Investment is the process of creating wealth and putting money to good use without having to work for it. This means that investment ensures that people actually put that hard-earned monies to good use with the view to creating more wealth. On their part, Iyer and Bhaskar conceived investment as buying a monetary asset with the aim that more income will flow from it in the near future or the price would appreciate or increase in order to be sold [2]. Again, the term ‘investing” is associated with activities which involve employing the money (funds) during a given time period with the aim of enhancing the investor’s wealth. Usually, funds which are invested come from savings, borrowed money and or assets already owned by the individual. As investors decide to forego consumption and rather invest their savings, they expect to enhance their future consumption possibilities through expanding their wealth [8]. In an attempt to further bring clarity to the concept, Estrada identifies two main types of investment, namely real investment and financial investment. Generally, real investments entail some kind of tangible asset, such as land, machinery and factories whereas financial investments consist of contracts in paper or electronic form including stocks, bonds, etc. [8][9] Fabozzi and Drake wrote on the different types of investments. The scholars stated that there are two types of investments, namely; direct investment and indirect investments. The views expressed by Fabozzi and Drake have been supported by Estrada [8]. However, Estrada goes ahead to explain direct investment as involving the use financial markets but indirect investment entails financial intermediaries. The author adds that the main distinction between these two types of investments lies in the fact that applying direct investment facilitates buying and selling of financial assets and the management of individual investment portfolio themselves [8]. In essence, direct investments in the financial markets involve all the risk and their success often depends on an adequate understanding of financial markets, its fluctuations and on the abilities to analyze and to evaluate the investments and to manage their investment portfolio.On the other hand, investors tend to use indirect investment to buy or sell financial instruments of financial intermediaries (financial institutions) that invest large pools of funds in the financial markets and hold portfolios. It is believed that indirect investment relieves investors from taking decisions about their portfolio. Investors as shareholders with the ownership interest in the portfolios managed by financial institutions (pension funds, insurance companies, investment companies, commercial banks), are entitled to their share of dividends, interest and capital gains generated and pay their share of the institution’s expenses and portfolio management fee [8].Direct investing involves the purchase and sale of securities in portfolio. There are three main types of securities under direct investing namely, money market securities, capital securities and derivative securities. Money market securities include treasury bills and commercial papers whilst examples of capital securities are stocks and bonds [8,2]. Indirect Investing deals with investing through mutual funds and closed-end funds. Here, investors do not have full control of the investment; they only choose to buy or sell their securities. For investments to be effective people need to be financially literature. In support of this assertion, Individuals with lower financial knowledge are not likely to accrue wealth or save or invest towards retirement. Financial literacy impacts on investors’ behavior. When there is low financial literacy, it tends to affect investors’ behaviours. It is sometimes very difficult to determine investors’ behavior as they behave irrationally at times due to the fear of losing their investments [2]. [2] Connor and Becker posited that investors are rational beings who are mostly concerned with wealth maximization. [2] Scholars including Singh and Murgea reject the claim by Connor and Becker when they opined that decision making by investors is not often based on rationale analysis or factors but is also largely influenced by emotional and psychological factors. This is also the case when it comes to investment decisions. In deepening Murgea’s contention, [11] Byrne and Utkus submit that emotions tend to influence decisions concerning investment as a result of human behavior. Nonetheless, Connor and Becker believe that there is the need to study the values and attitudes of people in order to help them improve their investment decisions [2].Investment Opportunities (Products)There are various investment opportunities available to people to achieve their goals in life today. In places such as India, a number of avenues exist for individuals with respect to investment opportunities in the country [10] Geetha and Ramesh further identified equity, fixed investment (FI) bonds, corporate debenture, company fixed, bank fixed, life insurance, real estate and mutual funds as some of the investment opportunities in the country [10]. Similarly, [12] Patil and Nandawar classified investment into traditional investment and alternative investment. Traditional investment includes bonds, cash, real estate (residential and commercial) and equity, whilst alternative investments are considered as a tool to reduce investment risks through diversification. Alternative investments are mainly associated with low correlation of financial investment like bonds and stocks, difficulties in determining the current market value of an asset. Alternative investments are relatively liquid which often demands cost of purchase and sale which may be considerably high [12]. In the views of Beattie [13], there are three types of investments namely, ownership investments, lending investments and cash equivalents. Ownership investments focus on the mind of people in terms of profitability which is linked to investment. Examples of ownership investments are real estate, collectibles, stocks, business and precious objects [14,2].Investment stocks are similar to shares. This is because both stocks and shares entail purchasing a share in the equity of a business in the light that the share price would increase so as to generate more profits [12]. It is widely contended that investment in stock market is good which should be considered since it generates more profit, despite its associated high investment to investors. Thus, people who may want to go into the stock investment are advised to clearly understand the market dynamics and also have adequate knowledge and skills regarding the factors which influence the investment markets [2]. Business or EntrepreneurshipThe amount of money which is pumped into a business by an individual is in itself an investment [15]. Entrepreneurship is considered as one of the toughest investments to make by individuals. Nonetheless, when individuals are committed to this through creation of a product or service, they stand to make great fortunes [2]. Real EstateAccording to Ohene-Bredu, a real estate can be residential or commercial. Residential real estate is the commonest real estate known by people. It includes the purchasing of properties, when an individual is not able to raise the required amount for the property, the individual can borrow from a bank or company to complete the private property [2]. On the other hand, commercial real estate involves the sale or purchase of apartments, retail space, office buildings, hotels and other commercial properties [2].Lending InvestmentsLending investments simply entail the bank or financial institutions investments. These institutions often tend to offer lower risk ownership of investment. Examples of the lending investment are saving accounts, mutual funds and bonds [16,2]. Bonds are regarded very essential in the investment typology. With a bond, a fixed income of investment of an investor is loaned to either a government or corporate organization for a period of time on an interest. The interest is usually fixed. It can be established that most developing countries are into bond agreements with banks in the developed countries. For example, the Government of Ghana issued a $ 2.5 billion dollars bond to offset its energy sector debts [17]. Bonds can be used by companies, district or municipal assemblies, states and even sovereign government to raise funds to support their projects [2]. Mutual FundsAs an emerging area of investment in developing countries including Nigeria and Ghana [18], mutual funds are often operated by professional managers in investment. These allocate funds so as to produce capital gains for the fund’s investment. Notable mutual funds in Ghana are the Databank E-pack and M-fund. Other funds operating in Ghana include E-pack, M-fund and life insurance. The E-pack investment fund was introduced in Ghana around 1994 with GHC 200 billion and 12000 investors. The E-pack is a long term investment initiative established by the Databank to assist individuals in Ghana with their financial needs. With the E-pack investment plan there is no maximum amount of money an individual can invest into, you can invest as higher as your strength can lead you [2]. The Money Market Fund (M-Fund) was established in the year 2004. It is a low-risk investment mutual fund that works as an investment alternative to a savings that helps you meet your short term financial goals. Databank believes that planning for a short term is as important as planning for a long term. Short term investment package helps in the easy access of your funds and the peace of mind in knowing that your money invested is safe and secured [2]. M-Fund is a short term investment package for individuals that offer better returns.Life Insurance One of the investment packages that have been trending recently in Ghana are life insurance policies. Most of the insurance companies and banks in Ghana now offer life insurance policies. The life insurance policies promote savings and provide insurance covers to individuals. The life insurance policies cover areas such as health, death, education, wedding, among others [19,20].Factors which influence workers’ decision to investThe debate on which factors will influence people’s decision to invest has been age-long. Researchers and practitioners in the field of finance have all shown unending interests concerning the factors which affect workers’ decision to invest. Since there would be pension for any individual working in any organization, health, birth rate among other family issues there is the need to consider the factors that would motivate individuals to invest [2]. Many countries both the developed and developing world have realized the huge financial burden in attaining their socio-economic development and sustainability of their economies so there is the urgent need to consider the issues of investment at the workplace [21]. [22] Millarn and Devonish argued that various factors influence workers’ decision to invest. For examples, in a study in the United Kingdom factors such as knowledge on the investment and advice on investment influence people’s decision to invest [22]. Knowledge about a given investment enables potential investors the opportunity to know more about the products they wish to invest their resources in. Potential investors have the greater responsibility on the individual to know the capital, asset and contributions regarding a particular investment [23] Praba observed that normally individuals have very little knowledge about investment capital. Patil and Nandawar found that individuals do not have basic knowledge on some investment products. For example, they lack basic knowledge on the difference between money market securities and the bond of governments [12]. Other factors which affect investment decisions are past market trends, risk appetite, horizon of investment, surplus investible and he returns of the investment [12]. Other scholars including [24] Stolper, and [25] Fischer and Himme have identified current financial position of workers, financial goals, risks and returns and expenditure as factors which affect investment decisions of workers.[26] Sellapan and Jamuna identified demographic factors such as the main factor as exerting influence on investment decisions. Veena researched the topic Determination of factors exerting influence on investment [27]. Behaviour with special Focus on working women stated that, of all the demographical factors, age is very key in influencing investment decisions of individual and potential investors. He further asserted that educational qualification of respondents influences their behaviour to invest and that, academically inclined persons do make very informed investment decision than those with less academically inclined person [27]. In a research conducted by Preethi and Kuttalam, it was found that respondents of ages between 30 to 40 years are investment thirsty and that they are eager and interested to take any investment opportunity that comes their way [28]. [27] Veena identified age, marital status, level of education, occupation, income level and family size as demographic factors that influence investment decisions. According to Veena, social factors such as household financial needs and daily money movement management, family influence on decision making, family members opinion on investment and source of financial information also impact on investment decision of people [27]. Psychological factors including confidence level, investor optimism, investor conservatism and investor beliefs affect investment behavior of people [27]. The accounting literacy is categorized under other factors which are summarized into fundamental factors, technical factors, and market information factors. Al-Tamimi posits that the idea of get rich-quick and the likes also significantly affects investment behaviour of individual [29].

3. Methodological Approach

- The quantitative research approach was relied upon in this study, with descriptive survey as the design. The population of study was made up of the permanent and contract staff of GPHA. Takoradi. In all, there were 906 workers made up of 770 permanent staff and 136 contract staff of the organization. However, this study focused on the permanent staff of the Organization. [30] Using Kirk’s sample size determination table, 254 respondents were selected for the study out 770 permanent staff through simple random (lottery method) sampling technique. The simple random approach was used because almost every staff at G.P.H.A invests one way or the other through insurance, investment companies among others. The researchers used a structured questionnaire to gather data from the respondents. However, during the actual data collection, 156 respondents returned their filled questionnaires. This represents a 61.4% response rate. The respondents were drawn from various departments including the safety department, the welfare department, the security department and the HR department. The permanent employees (770) of the various departments all took part in the study. The data collected from respondents was coded and processed using the Statistical Product and Service Solutions (SPSS) whilst descriptive statistical tools such as frequencies and percentages were used. Tables and graphs were used to present the results for easy appreciation.

4. Results and Discussion

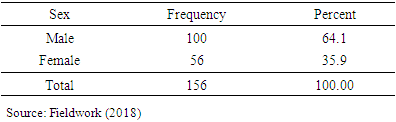

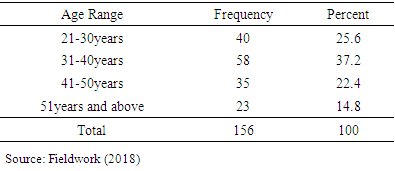

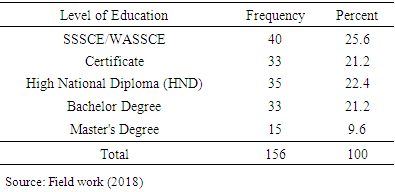

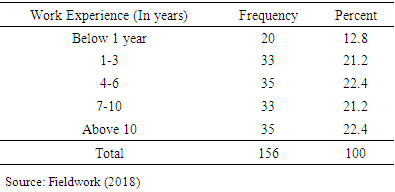

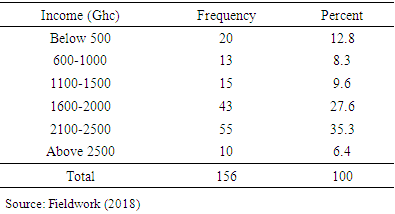

- The results and discussion is presented in two parts. The first part looks at the demographic data of respondents whilst the other part considers the key issues which informed this research. Demographic characteristics explored in this research are sex, age, educational level, working experience and the monthly income of the respondents. For instance, Table 1 shows 69.4% of the respondents were males whilst 35.9% were females. Thus, the majority (64.1%) of the respondents were males. The male dominance may be attributed to the kind of jobs which take place at the institution. For instance, more males are often needed to plan, build, manage, develop and control all the sea ports in Ghana as well as providing port facilities and services to port users [2].

|

|

|

|

|

|

|

|

5. Conclusions

- The study showed that sources of investment information available to workers of GPHA are investment sales agents, TV/Newspapers, family members’ referrals, social media as well as the Books/Magazine. Besides, mutual funds, real estates, stocks, treasury bills, bonds, fixed deposits and life insurance policies are the investment products available workers at GPHA, Takoradi often engage in. Of these, insurance policy is the commonest product workers employ. The main factors influencing investment decisions of workers of GPHA are safety, risk and returns, liquidity, and diversification factors. It is therefore recommended that the premium of clients who invest in any investment product should continue to be protected by the investment companies. Also, the Central Bank of Ghana should come out with clear measures to protect the premium of investors. Again, the Management of GPHA should organize periodic sensitization and public education programs for all its employees on investment decisions in order to increase the level of knowledge of staff members of organization in terms of investment.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML