-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2021; 10(1): 1-11

doi:10.5923/j.ijfa.20211001.01

Received: Aug. 23, 2021; Accepted: Sep. 24, 2021; Published: Oct. 15, 2021

Microfinance Services and Financial Performance of Youth Owned Small and Medium Enterprises in Nairobi City County

Vincent Linus Onduart1, Ibrahim Tirimba Ondabu2

1Department of Economics, Finance and Accounting, Jomo Kenyatta University of Agriculture and Technology, Kenya

2Department of Economics, Finance and Accounting, KCA University, Kenya

Correspondence to: Ibrahim Tirimba Ondabu, Department of Economics, Finance and Accounting, KCA University, Kenya.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Purpose: The purpose of this study was to establish the effect of microfinance services and financial performance of youth owned small and medium enterprises in Nairobi City County, Kenya. Materials and Methods: The study employed descriptive research design with a target population of 3,500 registered youth owned SMEs in Nairobi City County out of which a sample size of 350 registered youth owned SMEs in Nairobi City County was selected. Primary data was used and which was collected by use of self-administered research questionnaires. Descriptive and inferential statistics were used for data analysis using SPSS version 17 and multi-linear regression model. The data was presented using statistical tables and graphs. Results: The results determined that MFIs loans have a positive correlation coefficient with MFI loans, savings, training, and role modelling. The study further established that many youth entrepreneurs do not utilize MFIs services to improve the financial performance of their businesses. Unique contribution to theory, practice and policy: To the policy makes, the study recommends that the government and Microfinance Institutions’ (MFIs) Board of Management should establish the outreach of microfinance through creating awareness of the activities and operations to small and medium enterprises (SMEs). Further, MFIs should do capacity building to SMEs on financial management skills and intensify the use and facilitation of ICT in facilitating marketing and business management to help SMEs reach services and information that can help them grow and develop.

Keywords: Financial performance, Microfinance Institution, Small or medium-sized enterprise

Cite this paper: Vincent Linus Onduart, Ibrahim Tirimba Ondabu, Microfinance Services and Financial Performance of Youth Owned Small and Medium Enterprises in Nairobi City County, International Journal of Finance and Accounting , Vol. 10 No. 1, 2021, pp. 1-11. doi: 10.5923/j.ijfa.20211001.01.

Article Outline

1. Introduction

- Based on the consultative group to assist the poor (CGAP), a microfinance institution (MFI) is defined as an organization that provides financial services to poor business owners or individuals in form of credit, insurance, or savings. On the other hand, the study by Karlan and Valdivia (2011) indicated that microfinance is considered a provision of small-scale capital to low-income individuals. Financial services are crucial in providing youth with the opportunity to improve their businesses as well as livelihoods, hence resulting in poverty reduction. There is a need for small business owners to diversify the range of financial services.Microfinance services are critical in promoting youth-owned Small and Medium Enterprises (SME’s) that create an efficient and competitive market as well as labor production (Karlan & Valdivia, 2011). However, labor, energy, costs, and resources should be harnessed through operational efficiencies that incorporate interventions such as the establishment of enabling legal as well as a policy framework to facilitate capital investments, capacity building and technology adaptations in Youth owned SME’s (Abdulsaleh & Worthington, 2013). The primary goal of the microfinance industry is to help the vulnerable and poor population across the world. The previous studies indicated that the youth are bankable and the microfinance industry plays a significant role in the informal financial sector in many developing economies around the world (Bruhn & Zia, 2011). For instance, by 2016, there were over 150 million microfinance clients, with about 50% youth. The challenges faced by youth is that most of MFIs focus on existing businesses and it may not be possible for the youth planning to start up a small business to acquire financial support. Youths need more financial services as well as skill training among other inputs to ensure the success of their enterprises (Mwobobia, 2012). The report by Kenya Micro and Small enterprises SME’s are considered businesses in both formal and informal sectors that may be grouped into the farm and non-farm categories with no more than fifty workers and turnover not exceeding four million Kenya shillings. However, SMEs in Kenya contributes between 20-28% to the country’s GDP and also employ over 18% of the overall labor force in the country. Most of the SMEs are self-financed or financed by family loans or funds from other informal sources (Okoth et al., 2013).Recent studies have examined the role of MFIs in reviewing their significant effects on poverty reduction by use of longitudinal multipoint survey data of the households. The findings indicate that MFIs have sustained the effort of reducing the poverty level in many parts of the world. Youth and women have been the main target of the MF due to their ambitions in starting new businesses. However, studies justify that MFIs have not yet reached the poorest in most of the developing nations in Asia and Africa (Gichuki, Njeru & Tirimba, 2014). The interconnection of the MF and government has shown significant results in improving the performance of SMEs, with a small poverty impact in the macro-level environment. Youths are considered to be the driving force of economic growth, and the government should put across initiatives that would facilitate job creation and poverty reduction. Previous studies such as that of Osa and Rambo (2013), showed that youth-owned SMEs are failing since many young entrepreneurs have not taken advantage of MFIs services offered to them, which makes them lack funds and financial management skills. MFI's services propel the prosperity of youth-owned SMEs since they can utilize opportunities such as access to credit facilities and loans to help them grow their businesses. Youths lack financial advice on how to manage finances and business resources that are offered by MFIs.Studies on the effect of microfinance services and how they affect SME's performance have produced mixed reactions. While some find the existence of a positive effect between microfinance services and performance one of the key aspects the result in the success of the SMEs, Okoth et al. (2013) and Osa and Rambo (2013) found a negative effect between microfinance services and performance. Moreover, there are very limited studies on the effect of microfinance services on the performance of youth-owned enterprises.Mwobobia (2012) researched the impact of microfinance services by incorporating rigorous quantitative evidence and had inconclusive findings. Another study by Okoth et al. (2013) examines the effect of MFIs on SMEs in Kenya and discovered that they increased employment opportunities and alleviated poverty. The study by Ochanda (2014) identified a close correlation between MFIs loans and the financial performance of SMEs. The concept of microfinance services on youth-owned SMEs is still a grey area in most of the counties in Kenya since there are no adequate measures that show their impact on the financial performance of businesses (Karlan & Valdivia, 2011). The study aims at filling the research gap by examining how microfinance services influence the financial performance of youth-owned SMEs in Nairobi City County. The general objective of the study was to determine the influence of microfinance services on the financial performance of youth-owned small and medium enterprises in Nairobi City County, Kenya. The Specific Objectives of this study are: to examine the influence of loan facilities provided on the financial performance of SMEs in Nairobi City County, Kenya; to evaluate the influence of savings mobilization on the overall financial performance of youth-owned SMEs in Nairobi City County, Kenya; to assess the influence of financial training and financial on the performance of SMEs in Nairobi City County, Kenya and to establish the influence of role modeling on the financial performance of youth-owned SMEs in Nairobi City County, Kenya.

2. Literature Review

- The previous studies have discussed various factors that influence the financial performance of SMEs. The literature on services offered by MFIs is extensive and to review it one needs to focus on specific elements. This literature review concentrated on MFIs services such as loans, financial training, savings, and role modeling. The main purpose was to compare contrast and provide a critical review of the past literature and its relationship with the current research. The review mainly focused on arguments on how MFIs services influence the financial performance of youth-owned SMEs by presenting the international concept and then narrowing it to Kenya and Nairobi City County.

2.1. Microfinance Loans and Financial Performance

- The access to finance determines the capacity of an enterprise to achieve success factors such as the choice of technology, market performance as well as access to fundamental resources that influence the overall performance of the market. Loans enable youths to secure capital for business start-ups or expansion, which is the primary obstacle faced by entrepreneurs in the SME sector. The findings by Kersten et al. (2017) suggest that lack of access to credit is among the main factors that hinder the growth and expansion of enterprises. The study conducted by Zulfiqar (2017) on 254 SME borrowers in India indicates that the program initiated on subsidized interest rates attracted small borrowers to obtain loans. The small firms that used the program reported increased sales that were proportional to the additional loan sources, suggesting that the firms were previously credit constrained.The lack of funds sets SMEs back by limiting their growth and sustainability and the capability to finance operating funds is crucial for SMEs' growth. The study by Chen, Chang, and Bruton (2017) established that a limitation of operating funds was the major cause for 25% of the Kenyan microenterprises that closed up. Acquiring startup capital was outlined as the main component for small-scale enterprises to prosper in the quest to establish industrious capability, to be involved in the competition, to build employment opportunities, and to play a role in poverty reduction in developing nations. Small-scale enterprises are in danger due to meager securities and a shortage of data on their capability to pay for credit acquired (Omondi & Jagongo, 2018). Bashir and Ondigo (2018) acknowledged that MFIs are crucial for the financial growth of SMEs. The key objective of offering credit to SMEs is to offer them start-up capital or credit to increase stocks.The review has been undertaken to assess the impact of financing SMEs by microfinance institutions on the growth and development of SMEs. Maina (2012) researched microfinance services' contribution to entrepreneurial development in Kenya. Maina established that banks in Kenya are moderately lively by the principles of assisting the developing countries to grow. Maina study also revealed that MFIs have assisted to cover the gap for capital necessities of small and medium enterprises (SME). Luyirika (2010) researched the role of microfinance in the socio-economic development of women in Uganda. Findings established that MFIs lend money to SME entrepreneurs to enable them to expand their investment prospects, minimize the interest rates to avoid utilization of all profits to pay the interest, and also maximizes the extension time to enable the growth of the business.In a study of access to financial services in Brazil, Kumar (2005) deduced that increased financial access would be promoted by sound overall macroeconomic and financial sector policy. Beyond that, the government could and should undertake regulatory reforms to enable financial markets to function more smoothly, and undertake targeted policies to improve access. However, care should be taken to ensure that such targeted policies let the excluded groups participate efficiently in financial markets. This would direct the focus toward a review of incentives rather than public financing of special programs.Access to financial services also enables SMEs to deal with shocks or economic strains that may occur. SMEs utilize MFI loans to add stock to their businesses (Akingunola, Olowofela & Yunusa, 2018). However, the extent to which these financial services have contributed to the growth of SMEs in Nairobi City County is yet to be established thus the rationale for the study. According to Daniels (2013), the primary challenges facing youth-owned SMEs involve poor access to markets as well as limited access to financial services. Youths also suffer from the lack of tangible securities and knowledge on procedural bureaucracies of credit borrowing that hinder them from accessing credit from formal credit institutions. The challenges forced most of the youths to confine themselves to narrow markets where the profit margins are low because of the intense competition (Koech, 2011). With access to loan facilities, youths can grow their small business to large-scale enterprises.

2.2. Microfinance Financial Training

- Financial training among youths owning businesses is fundamental since it provides material capital that assists in empowering them to participate in the economic growth of the country (Luyirika, 2010). MFIs have been participating in training programs to equip entrepreneurs with knowledge of financial management, business projection, and planning. The study conducted by Akisimire (2010) on the impact of the training program in Uganda argues that the funds used in training should be diverted to other projects such as safety and health in an organization or to reduce interest rates on loans. However, other studies consider training fundamental for the growth and sustainability of SMEs. For instance, giving youths money that has no proper management skills may be tempted to spend the funds on things such as social entertainment, alcohol, or gambling. The study by Bosma et al. (2011) on the importance of training concludes that education is a significant factor that has a positive impact on the financial growth of entrepreneurs with both large and small stocks. Financial knowledge amongst small-medium youth entrepreneurs is crucial in making sure that SMEs expand from small and medium to big enterprises. According to Brandon (2013) report, SMEs capital capability is a crucial element in increasing SME financing. It was also reported that some MFIs took part in improving the capability for SMEs through financial literacy training. However, it was observed that trying to establish this aptitude at an institution-level was not likely to be maintainable and a costly method amongst MFIs (Chepkirui, 2011). Therefore, although MFIs desire to offer SMEs the ability to tackle finances, the majority of them are constrained by the costs related and the possibility of transferring this expense to the ultimate consumer minimizes the original idea of offering reasonable financing to SMEs.A Study by Ramezanali and Djamchid (2018) pointed out that some factors such as micro-entrepreneurs with higher education degrees, male entrepreneurs and singles, businesses that have higher monthly revenue and operating income and companies operating with formal records are more likely to default compared to those without formal registration.The research by Dalberg and Morgan (2012) established that microfinance customers exposed to training have the likelihood to keep flawless repayment records in comparison to untrained business persons. This was as a result of the enhanced business outcomes that are 16% higher for trained businesspersons with reference to sales. Some MFIs vigorously trail methods to train on business skills. According to Chepngetich (2016), the rapidly developing countries have seen Human Resource Development (HRD) as proceeding significantly and thus capitalize more in HR in the form of capacity building and acquiring contemporary skills. Improving human training may enable SMEs to stay competitive. The survey by International Labour Organization (2013) also adds that there is a need to train business persons to enable them to have skills for production and enterprise supervision to generate profits from the loan acquired. Luyirika (2010) suggests that MFIs can constantly train business persons on credit usage and reimbursement and deliberate with them before they take away the assets. This is since the customers asserted that if granted more malleable conditions they would have the ability to repay the credit. Therefore, this study seeks to find out whether the training services offered by MFIs have contributed to the growth of SMEs in Nairobi City County.In Kenya, most of the youths owning SMEs have relatively low levels of investment education. The statistics indicate that less than one out of ten business owners have an efficient formal education (Kaufmann & Stone, 2012). Similarly, a study conducted in Zimbabwe indicates that SMEs attract low priority to financial training as well as often unwillingness of the owners to acquire more financial knowledge due to the weak costs of the enterprises in marketing strategies and cash management. According to Zulfiqar (2017), youth entrepreneurs should be trained to enhance their financial management skills in bookkeeping, preparation of financial statements, budgeting, and credit control and tax calculation. From the reviewed studies, it is evident that appropriate financial training programs improve SMEs income and MFIs should establish ways to measure the impact of training on youth-owned SMEs.

2.3. Microfinance Savings

- Savings involves putting aside part of the generated income to consume or reinvest it later in the business (Bashir & Ondigo, 2018). The amount saved in an enterprise can either be kept home, in a savings account, or invested in capital markets. According to Bashir and Ondigo (2018), the accumulation of savings is essential for any business person who wishes to secure services that allow small transactions as well as easy access to funds. Savings is important to the entrepreneurs, but it is considered costly and risky compared to other sources of income such as asset building. Some studies argue that savings a critical for the maximization of profits for MFI managers as well as external shareholders. Based on Akisimire (2010), findings, savings mobilization by MFIs in countries such as Uganda face stiff competition in the market due to the new entry of commercial banks as well as the downscaling of old banks. However, the competition has been beneficial to the SME owners because of the high interest rates on savings and reduces revenue to lend among MFIs. The study by Chepkirui (2011) considers reinvesting profits as the main source of finance for SMEs with a share of 69%, savings of 40%, and bank loans of 30%. From the study, it is evident that the importance of saving is about 40% that contributes to the success of SMEs as well as the expansion of SMEs to provide more services to the entrepreneurs. According to Chepkirui (2011), MFIs are required to have an organized management structure as well as an information system to ensure that the clients’ deposits are safe. The savings mobilization should not only focus on the growth of MFIs but also the sustainability of SMEs in liquidity levels and investment opportunities. Firms require reliable savings institutions to boost their growth opportunities to ensure that they can support SMEs saving services. A South African study by Dalberg and Morgan (2012) identified that too much liquidity may be harmful to youth investors since they may be unable to spend it wisely. Therefore, cash flow management training is essential in assisting young investors to manage their savings. The first challenge is SME entrepreneurs’ inability to afford tangible security for loans. Consistent saving enables young to gain trust in financial institutions (Chepngetich, 2016). SME entrepreneurs are usually very small businesses owners who in most cases own limited assets, are not credible, and have little revenue. According to Chepngetich (2016), it is a challenge since it indicates these MFI clients are not able to provide any security to microfinance providers against loans. This could result in microfinance institutions (MFIs) increasing interest rates or reject many loan applications. Again, savings help in resolving issues associated with to poorly institutional capability of microenterprises. Poorly designed business ideas that do not consider demand and expenses make the micro-investment unmanageable and microfinance may wrongly be blamed for not assisting the investors to come up with the appropriate business structure. For example, in small businesses, entrepreneurs might not account for the loan that they acquire. Consequently, in most cases, they result in utilizing their savings to solve personal issues (Koech, 2011). The problem is when it is time to repay the loan that was acquired from savings mobilization, the entrepreneur is obliged to use savings to pay the initial loan. This may result in a malicious cycle where the entrepreneur gets besieged with debt. Saving mobilization also faces a challenge due to a shortage of knowledge about microfinance services and information on when and how the investor can use the accumulated savings (Bosma et al., 2011). Many micro-entrepreneurs have diminutive formal education resulting in two problems: poor knowledge of the presence of financial services for low revenue earners and limited access to microfinance services offered by MFIs. Bosma et al. (2011) further asserted that overcoming these challenges can lead to SMEs ability to stand shocks through insurance, increase their earnings and productivity, increase their savings and increase their income. However, saving mobilization is a critical factor that motivates young entrepreneurs to work harder and achieve the savings target set by MFIs for them to enjoy benefits such as loans or financial management training.

2.4. Microfinance Role Modeling

- According to Bosma et al. (2011) Role modeling involves an action of people to identify with other individuals and match their cognitive skills as well as patterns of behaviors. The matching of skills is important since people believe that their traits are close to each other and may help in shaping individuals’ character. Individuals are also attracted to the role models who help them to expand their knowledge in business by learning how to execute new tasks and apply new skills (Brandon, 2013). In many cases, MFIs organize youth entrepreneurs into groups who give a guarantee to loan repayment rates attained by an organization.The mutual trust between the youth investors in a particular group enables it to be the building block of a wide social network that allows group members to look up to each other (Chepngetich, 2016). This reduces the cost of MFIs in monitoring loans since the members ensure the loans are paid or if there is any repayment failure they become liable. However, groups have been associated with free-riding whereby a member may not work hard since other members will help in repaying the loan. The study by Mwobobia (2012), argues that to ensure success in any group, imperfection must be addressed to ensure successful cohesion of the members and their relationship with MFIs. The study investigating the importance of role models as well as the strength of positive relationships reports that role models are crucial in inspiration and motivation, self-efficacy, building confidence, and enabling investors to learn by example. The study by Mwobobia (2012) on the challenges facing SMEs reports that persistence on collateral security adversely affected the growth of SMEs and the interest rates charged were unreasonable and investors should learn from the mistakes made by others. Similarly, a study in Saudi Arabia on the cost of acquiring capital indicates that SMEs in the kingdom are dissatisfied with established banking institutions as this was due to financial institutions often requiring tangible securities not affordable to many small-scale entrepreneurs and there is a great need for forming groups (Beck, Demirguc-Kunt, and Levine, 2011). In addition, Daniels (2013) argues that there were long procedural issues such as a lot of paperwork, collateral security, and high processing fees and prepayment charges, issues that affected the growth of SMEs. Groups are crucial in dividing the work among members as well as joining efforts to achieve a common goal. The survey by Koech (2011) on the constraints of youth-owned SMEs and the common constraints identified included start-up funding, insufficient training, and lack of digitalization. The study on the impacts of microfinance services on the growth of small and medium enterprises in Machakos County and found a strong significance between the MFIs and youth investors. The study concluded that loans and skills development offered to SMEs contributes to growth. The study by Omondi and Jagongo (2018) on the effect of microfinance institutions on the growth of small-scale businesses in Kisumu County and established that role modeling was the most significant impact of MFIs and MFIs played a crucial function on the growth of employees whereby microfinance clients are subjected to ensuring youth receive appropriate advice from mentors.

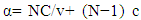

3. Methodology

- The study adopted descriptive design to guide towards collecting and analyzing data on the effects of MFIs on the financial performance of youth-owned SMEs, which involves the exploration of various variables. Descriptive research design according to Creswell and Creswell (2017) is ideal for studies seeking to determine the effect and influence relationships of a phenomenon. The design includes a statistical approach that is appropriate for data analysis and interpretation.The target population is the complete collection of populaces, proceedings, or matters that are of interest in which the researcher desires to probe; the populace shapes a foundation from which the sample amount or the study was selected. The target population in the study was the small-medium enterprises in Nairobi City County, Kenya. According to the public procurement oversight Authority (2018), there are 15,602 SMEs registered in Nairobi City County. The target population was 3,500 SMEs in Nairobi City that are primarily owned by youths. The choice of Nairobi City County was appropriate since the city has multidimensional characteristics of running SMEs thus offering a representation of the Kenyan SMEs in both urban and rural areas. The researcher randomly picked 10% of the 3500 estimations of youth-owned SMEs thus 350 SMEs were the sample for the study (Mugenda & Mugenda, 2012). The study used primary data and which was collected by use of self-administered questionnaires. To guarantee reliability in the study, the study employed the Cronbach alpha for reliability test. Cronbach's coefficient alpha estimates the reliability of the measuring scale by determining the internal consistency of the test and the average correlation of items within the test. In essence, Cronbach’s alpha represents the correlation between answered items in the questionnaire. When there is a close correlation, Cronbach's alpha will reveal a high score. This view is supported by Andrew et al. (2011), who further states that a score above 0.9 would reveal either an incorrect scale being used or one which is too narrow.

| (1) |

| (2) |

and the independent variables will be presented by

and the independent variables will be presented by  , while random variation in y and X will be indicated by

, while random variation in y and X will be indicated by

4. Research Findings and Discussion

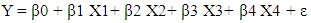

4.1. Age of Respondents

- Rspondents were requested to tick their age bracket and the findings are as shown in the figure 4.1:

| Figure 4.1. Respondents Age |

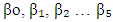

4.2. Period of Working at the Enterprise

- Respondents were asked to indicate the period they have worked at their enterprises. The responses are as presented in Figure 4.2.

| Figure 4.2. Period of Working at the Enterprise |

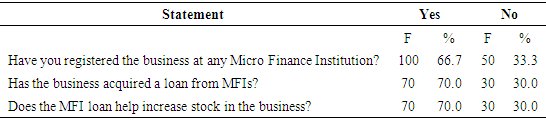

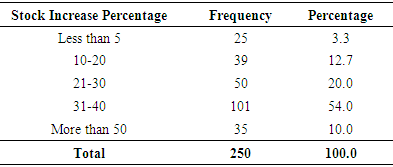

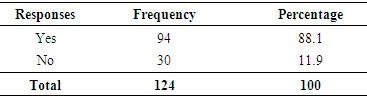

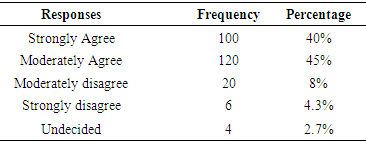

4.3. MFI Loans and Performance of Youth-Owned SMEs

- The first objective of the study was to determine whether the provision of MFIs’ loans affects the growth of SMEs in Nairobi County. The first approach involved finding out whether the business was registered at any Micro Finance Institution, acquired a loan from MFIs, and whether the loan helped to increase stock in the business. Findings are presented in Table 4.1.

|

|

|

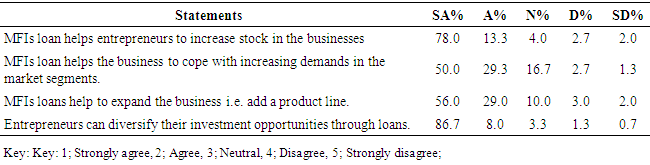

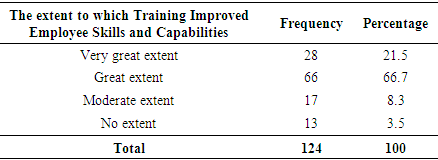

4.4. Influence of MFIs Training on Youth-owned SMEs

- The second objective of the study was to find out whether the provision of MFIs’ training affects the growth of SMEs in Nairobi City County. The study sought to find out whether the SME entrepreneurs had attended any training, to which extent and whether the training was helpful in enabling them not only manage the SMEs prudently but also organize their houses in order to qualify for MFI loans and to strategize also appropriate measures to repay such loans. The findings on this are presented in Table 4.4:

|

|

|

|

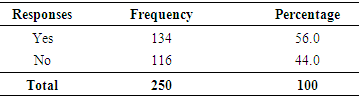

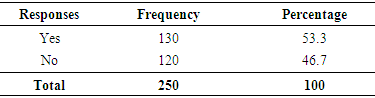

4.5. Savings Mobilization and Financial Performance of Youth-Owned

- The study intended to assess whether youth-owned SMEs are influenced by savings mobilization. The respondents were asked whether their business performance is affected by saving mobilization. The findings are as presented in Table 4.8.

|

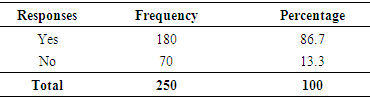

4.6. Influence of Role Modelling on the Youth-owned SMEs

- The study having intended to establish whether role modelling affects the performance of youth owned SMEs established that role modelling plays a vital role in terms of influencing SMEs performance as shown in table 4.9:

|

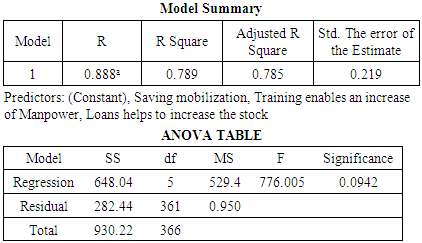

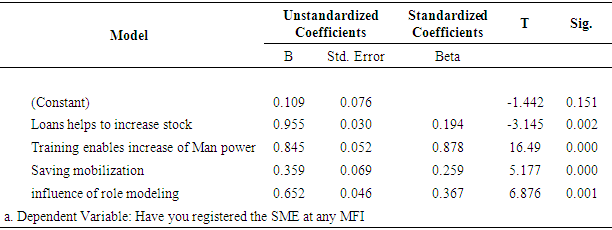

4.7. Regression Analysis

- The researcher used coefficients from linear regression to establish whether there is a relationship between the independent and dependent variables. Results of regression summary are presented as follows:

|

|

5. Summary, Conclusions, and Recommendation

5.1. Conclusion of the Study

- The study concludes that Microfinance institutions are very crucial in the growth of youth-owned SMEs in Nairobi City County. The research findings established that the role of microfinance institutions toward SMEs growth is of significant importance. Some SMEs interrogated established that there was a definite change in stock, sales, and human capital after obtaining an MFIs loan. Training in management, record keeping, marketing, and customer services are also crucial in managing a business effectively and ensuring its growth. Microfinance institutions are an asset to developing countries. The services they provide are aimed at fulfilling the prerequisites and wishes of the local people and their small up to medium enterprises. The problems that SMEs face range from lack of collateral, lack of knowledge of MFI services, failure to account for the loan acquired, and inability to pay loans.The financial intermediation services by MFIs will provide a platform for the attainment of considerable growth and sustainability of SMEs. An overall conclusion can be drawn that there is a positive relationship between MFI credits and SMEs performance and growth. This relationship is a result of the close business relationship between the MFIs and SMEs based on trust and increased access to finance, which nurture dynamic growth in the SME industry.

5.2. Recommendations of the Study

- Based on the findings of this study recommends that Government and MFIs should establish the out-reach of microfinance through creating awareness of the activities and operations to SMEs. The government should design a way to enhance entrepreneurial skills to Micro and Small Enterprises by offering them education on business initiation skills and management. MFIs should train SMEs on financial management through seminars and workshops and employing field agents to sensitize the business owners on the benefits of financial skills before granting loans to train them on how to account for the finance. MFIs should also intensify the use and facilitation of ICT in facilitating marketing and business management to help SMEs reach services and information that can help them grow and develop. Most of the Micro and Small Enterprises have a low level of education, and the government should establish ways to improve entrepreneurial skills in this sector by offering them education on business skills and management. Curriculum change in Kenya is a necessity as entrepreneurial studies are taught in colleges and universities and not in primary or secondary schools.

5.3. Suggestion for Further Study

- A related study can be done to analyze the economic challenges affecting microfinance institutions in financing and training SMEs. A similar study on the extent to which MFIs influence the growth of SMEs in other counties and compare the results with that of Nairobi City County can also be conducted.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML