-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(5): 99-109

doi:10.5923/j.ijfa.20200905.01

Received: Nov. 11, 2020; Accepted: Dec. 12, 2020; Published: Dec. 26, 2020

Mediation Effect of Macro-Economic Factors on the Relationship between Banks’ Financial Soundness and Financial Performance

Peter Njagi Kirimi, Samuel Nduati Kariuki, Kennedy Nyabuto Ocharo

Business and Economics Department, University of Embu, Embu, Kenya

Correspondence to: Peter Njagi Kirimi, Business and Economics Department, University of Embu, Embu, Kenya.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Analyzing the effect of macro-economic factors is essential for business growth. The study analyzed mediation effect of macroeconomic factors on the relationship between financial soundness and financial performance of 39 commercial banks in Kenya using data from 2009 to 2018. The study was modeled on the theory of production with CAMEL variables as factor inputs and financial performance measures as factor outputs mediated by macro-economic factors. The study found that gross domestic product growth, interest rate, exchange rate and inflation had a mediating effect on the relationship between banks financial soundness and net interest margin. In addition, gross domestic product growth, interest rate and exchange rate were not mediators on the relationship between financial soundness and earnings per share as a financial performance measure. The study also established that exchange rate had mediation effect on the relationship between financial soundness and net interest margin and return on assets respectively. Further, inflation was found to have a positive mediation effect net interest margin, earnings per share and return on assets as measures of financial performance, there was absence of mediation effect when return on equity was used as financial performance measure. Bank management needs to understand the direction of the effect of mediation of macro-economic factors on banks’ financial soundness for effective financial soundness policy formulation to improve financial performance.

Keywords: Financial soundness, Financial performance, Macro-economic factors

Cite this paper: Peter Njagi Kirimi, Samuel Nduati Kariuki, Kennedy Nyabuto Ocharo, Mediation Effect of Macro-Economic Factors on the Relationship between Banks’ Financial Soundness and Financial Performance, International Journal of Finance and Accounting , Vol. 9 No. 5, 2020, pp. 99-109. doi: 10.5923/j.ijfa.20200905.01.

Article Outline

1. Introduction

- Commercial banks as key players in the banking sector are subject to regulatory requirements governing their prudential position and market conduct in order to safeguard the stability of the financial system. Commercial banks play a significant role in fulfilling the financial requirements of many firms. They form one of the economic machinery that acts as a financial intermediary between other sectors of the economy (Bloomenthal, 2019). Though, commercial banks adhere to regulations by Basel Accords and disclosure requirement contained in the prudential guidelines issued by regulatory authorities, more needs to be done pertaining to regulations and competition policy to put checks on the banking monopolization. Commercial banks do not only operate under environment of regulations as suggested by Atellah (2019), but also in a dynamic macroeconomic environment. Macro-economic factors such as interest rates, inflation, gross domestic product (GDP) and exchange rates influence production capacity of different sectors of the economy across the globe. After the global financial crisis of 2008, commercial banks struggled to ensure that they adhere to Basel Accords and prudential guidelines provided by regulating agencies to ensure that they remained financially sound. Globally, commercial banks operate under changing macroeconomic environments that have both direct and indirect influence on their financial performance (Siraj & Pillai, 2013). As a result, a major question that motivated the study emerged, that is, “Does macroeconomic factors have an indirect effect on the relationship between financial soundness and financial performance of commercial banks?” The current study departs from the findings of the reviewed literature in two jour ways. First, the current study seeks to investigate indirect effect of macroeconomic factors on the relationship between financial soundness and financial performance of commercial banks. Mostly, the reviewed literature demonstrates a direct relationship of macroeconomic factors on financial performance of commercial banks (Kosmidou, 2008; Zarrouk, Ben & Moualhi, 2016; Al-Nasser & Joriah, 2017; Fidanoski, Choudhry, Davidović & Sergi, 2018; Ndlovu & Alagidede, 2018; Eissa, Mosab, Najib & Faozi, 2018), except for Alabede (2012), Siraj and Pillai (2013) and Öhman and Yazdanfar (2018). The current study therefore seeks to confirm the findings of Siraj and Pillai (2013) and extend the literature on the indirect effect of macro-economic factors by investigating the mediating effect of macro-economic factors on the relationship between financial soundness and financial performance of commercial banks using a sample data of 39 commercial banks in Kenya for a period of 10 years from 2009 to 2018. The study therefore adopted four macroeconomic factors as suggested by Siraj and Pillai (2013), that is; GDP, interest rate, exchange rate and inflation. Secondly, most of the reviewed literature employs at most two measures of financial performance, hence the current study employs an increased scope of four financial performance measures, that is, net interest margin, return on assets, return on equity and earnings per share. The increased scope allows precise comparisons to be done using analysis from the same sample data.The rest of the paper is organized as follows: section 2 provides the review of the related literature, section 3 presents the methodology adopted, section 4 provides the results and discussion and section 5 provide conclusion and recommendation of the study.

2. Literature Review

- The current business systems are known to operate under economic conditions that are dynamic. The economic conditions directly influence the performance of businesses across the globe. Commercial banks are not an exception to this situation. Simiyu (2015) established that macroeconomic factors such as GDP, inflation, interest rate and exchange rates have influenced banks’ financial performance. Further, Hussien, Alam, Murad and Wahid (2019) found that GDP, inflation rate and money supply growth rate are macro factors that significantly influenced financial performance of Islamic banks in the Gulf Cooperation Council region. Empirical evidence shows that economic growth (GDP) is one of the major macro-economic factors that affect banks’ performance positively (Jara‐Bertin, Arias & Rodríguez 2014). This finding was supported by Ifuelo and Chijuka (2014) and Simiyu (2015) who found that real GDP growth rate positively impacts on banks’ performance. In Europe, Kosmidou (2008) while examining the determinants of banks' profits in Greece during the period of European Union (EU) financial integration established that the growth of GDP had a significant and positive impact on return on assets (ROA), while inflation had a significant negative impact on ROA. In addition, Al-Nasser and Joriah (2017) while examining the way in which the macro-economy affected Islamic banking performance in developing countries found that GDP, GDP growth, and inflation rate had a significant positive relationship with ROA. In another study by Fidanoski, Choudhry, Davidović and Sergi (2018), the results provided a positive impact of GDP growth on ROA and net interest margin (NIM) of Croatian Commercial banks. However, this view was contradicted by Combey and Togbenou (2017) who observed that in the long run, real GDP negatively impacts on banks financial soundness thus affecting banks’ performance.Ndlovu and Alagidede (2018) while examining the impact of industry structure and macroeconomic indicators on return on equity (ROE) of listed financial service firms established that macroeconomic influence banks’ financial soundness resulting to deterioration of ROE as one moves from competitive to concentrated industries. However, the study noted that GDP and interest rates had a direct positive impact on ROE, while inflation, unemployment and exchange rates had a direct negative effect. Zarrouk, Ben and Moualhi (2016) drew a comparison of Islamic and conventional banks in Middle East and North Africa (MENA) from 1994 to 2012 to ascertain whether the 51 Islamic bank’s profitability in MENA region is driven by the same forces as those driving conventional banks. The results established that Islamic banks perform better in environments where GDP is high leading to stronger banks capital and liquidity composition. Mohammed, Danjuma and Mohammad (2014) observed that inflation affect the purchasing power and opportunity cost of holding currency in the future, hence affecting asset quality as a component of banks financial soundness due to worsening loans policy. This was supported by Jara‐Bertin et al. (2014) and Khan (2015) who established that inflation negatively affects financial development of commercial banks. Eissa, Mosab, Najib and Faozi (2018) observed that while inflation rate had a positive association with ROA, GDP had a negative relationship with ROA. However, all macroeconomic factors had a significant effect on ROE. In addition, exchange rate, interest rate, and GDP had a significant negative effect on NIM. More empirical evidence shows that exchange rate fluctuations negatively affect banks’ financial performance (Manyok, 2016; Simiyu, 2015; Ifuelo and Chijuka, 2014). However, this was contradicted by Majok (2015), Lagat and Nyandema (2016), Sara and Muhammad (2013) who established that exchange rate fluctuations positively relate and affect financial performance of commercial banks. Empirical evidence by Alabede (2012) and Öhman and Yazdanfar (2018) in Sweden observed that GDP and inflation are not mediators on the relationship between banks’ internal factors and financial performance. However, Siraj and Pillai (2013) records that the impact of macroeconomic factors on financial performance of banks cannot be termed as direct, rather sometimes macro-economic factors acts as a mediators, hence the study was thereofre hypothesized as;H01: Macroeconomic factors do not have a mediating effect on the relationship between financial soundness and financial performance of commercial banks.

3. Methodology

3.1. Research Design and Sample Size

- The study employed causal comparative research design. Causal comparative design was appropriate for this study hence employed as ex-post-facto since the alleged cause and effect had already occurred (Frank & Rens, 2017; Richardson, 2018). The study employed data from audited annual financial statements from all 39 commercial banks in Kenya that had the data for 10 years starting from the year 2009 to 2018.

3.2. Operationalization and Measurement of Variables

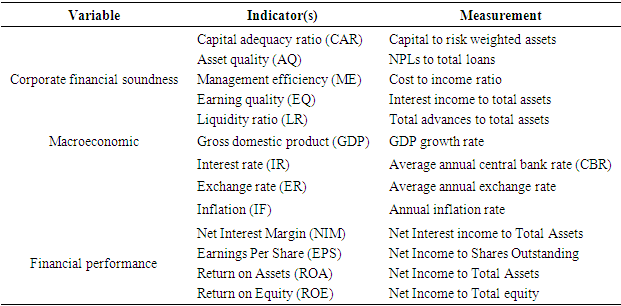

- Corporate financial soundness indicators were adopted from the CAMEL approach recommended by Basel Accords to evaluate banks’ financial soundness globally (IMF, 2018). CAMEL is an acronym for capital adequacy, asset quality, management efficiency, earning quality and liquidity. Net interest margin, earning per share, return on assets and return on equity were used as financial performance measures. In addition, GDP, interest rate, exchange rate and inflation rate were used as the main macro-economic factors that drive a country economy (Hussien et-al., 2019). The operationalization and measurement of the variables is presented in Table 1.

|

3.3. Research Model

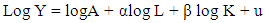

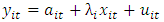

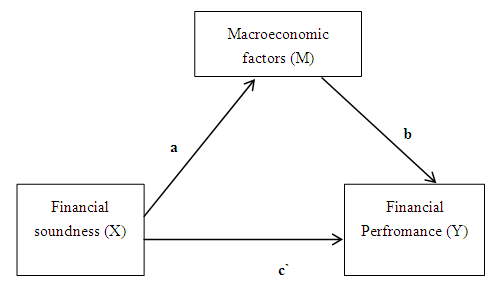

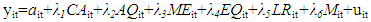

- The study employed the theory of production. The Cobb-Douglas production function in the form of Y = ALαKβ was used to model the study, where; A represented the level of technology, Y, L and K represented product quantity, labour and capital respectively and α and β represented the associated output elasticities. Upon linearization of the production function, the following model was obtained;

| (1) |

| (2) |

3.4. Determination of Mediation Effect

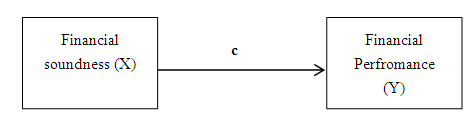

- To establish whether macroeconomic factors had a mediating effect, the study compared the total effect of the causal variable to the dependent variable and the complete or partial mediation effect when a macroeconomic factor was introduced as a mediating variable. In diagrammatic form, the study adopted the two diagrams to help determine the mediating effect. In Figures 1 and 2, financial soundness is the independent variable, financial performance is the dependent variable, c is the total effect of financial soundness on financial performance, c' is the direct effect of macroeconomic factor (M) on financial performance, b is the effect of the mediating variable on financial performance, a is the effect of financial soundness on the mediator. This analysis was done to establish whether there existed a complete mediation (where variable X no longer affected Y after M has been controlled making the direct effect to zero) or partial mediation (where direct effect is different from zero) when a macroeconomic factor was introduced as a mediator. Baron and Kenny (1986) argued that a variable is a mediator when variations in the independent variable significantly account for the variations in the presumed mediator and in addition variations in the mediator significantly account for variations in the dependent variable.

| Figure 1. Unmediated model |

| Figure 2. Mediated model |

| (3) |

| (4) |

3.4.1. Determination of Mediation Effect

- To establish whether macroeconomic factors had a mediating effect, the study compared the total effect of the causal variable to the dependent variable and the complete or partial mediation effect when a macroeconomic factor was introduced as a mediating variable. In diagrammatic form, the study adopted the two diagrams to help determine the mediating effect.

4. Results

4.1. Descriptive Results

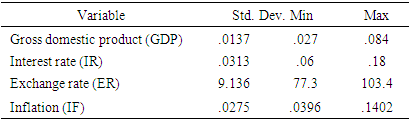

- Table 2 indicates that on average GDP grew by 5.59% during the period under study. The GDP growth rate deviated from the mean by 1.37%. In addition GDP growth ranged from 2.7% to 8.4%. Commercial banks also operated under a mean interest rate fluctuated of 9.95% deviating by 3.13% during the period under study. However, during the period, interest rate ranged from a minimum of 6% to a maximum of 18%.

|

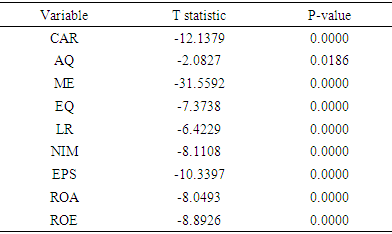

4.2. Diagnostic Tests

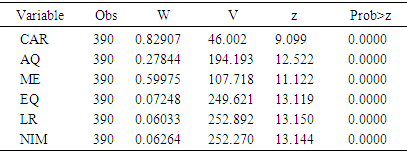

- Estimation of mediation effects relied on regression results, hence the need to ensure that all the assumptions of regression models were met to avoid biased results. First, stationarity test was carried out. Levin-Lin-Chu test in Table 3 indicated that data was stationery with absence of unit roots, hence did not vary with time. This implied that the data was good for forecasting.

|

|

|

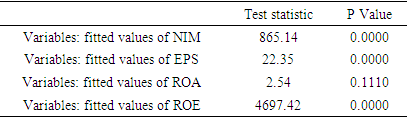

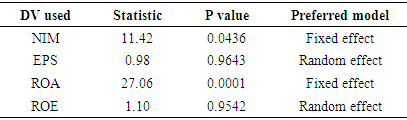

4.3. Robustness Check

- To ensure the robustness and reliability of the results, a decision was made to choose the best model to apply on the data when different financial performance measures were used. Hausman test was used to determine the best model between fixed effect and random effect.

|

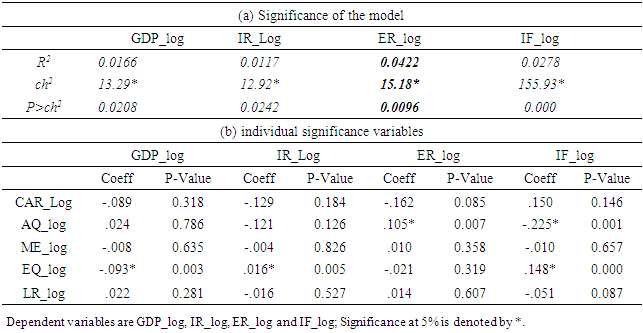

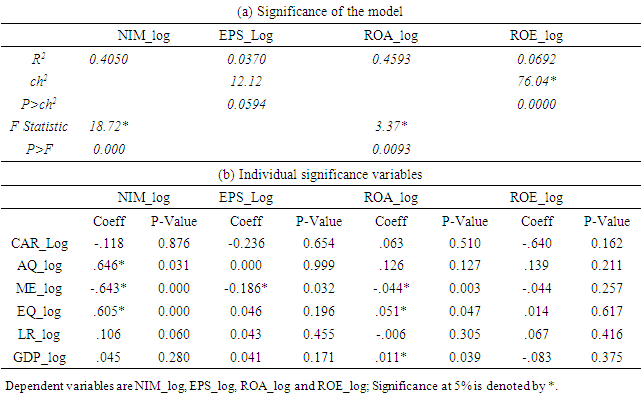

4.4. Mediation Effect of GDP

- The results in table 7 indicates that the model for estimation of path ‘a’ was significant (P-value 0.0208<0.05), hence a product of the coefficients was obtained which was -0.093.

|

|

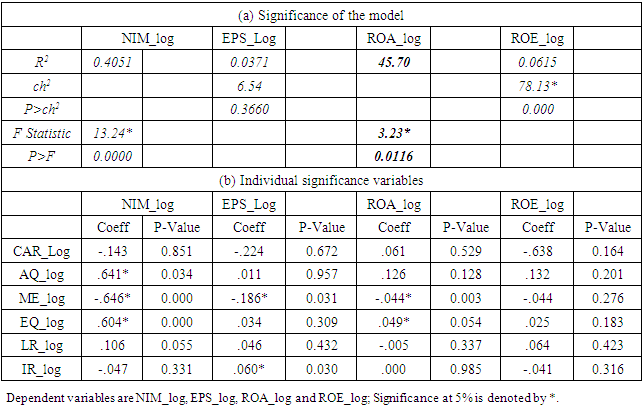

4.5. Mediation Effect of Interest Rate

- Results estimating path ‘a’ when interest rate was used as a mediator presented in Table 7 shows that the model was significant (p-value < 0.05). To estimate path ‘a’, a product of the model coefficients was obtained which was 0.016. Results in Table 9 indicate that the model for estimation of path ‘b’ was significant (p-Value < 0.05) when NIM was employed as financial performance measure. A product of coefficients was obtained which was -0.250. Mediation effect was obtained by getting a product of path ‘a’ and path ‘b’ which was -0.004. This indicated a negative mediation effect of interest rate on the relationship between financial soundness and NIM. This implied that an increase in interest rate increases the effect of banks’ financial soundness on NIM positively. An increase in interest rate leads to banks adjusting their lending rates upwards hence reducing the risk associated with inadequate liquidity. Banks are therefore able to continue lending to customers which provides banks with the much needed net interest income that boosts banks’ performance.

|

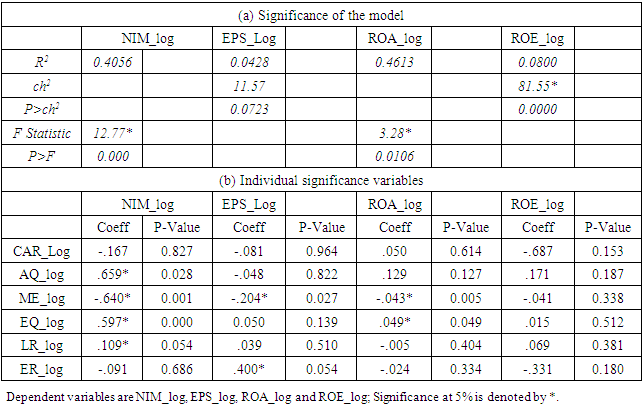

4.6. Mediation Effect of Exchange Rate

- Model results to estimate path ‘a’ when exchange rate was employed as a mediating variable are presented in Table 7. The results indicate that the estimation model was significant (p-value 0.0096<0.05), hence the product of the coefficients obtained was 0.105. The model results for estimating path ‘b’ when exchange rate was used a mediator were presented in Table 10 for the four financial performance measures used. Results in Table 10 indicate that the model for estimating path ‘b’, was significant (P-Value 0.000<0.005) when NIM was employed as financial performance measure, hence model coefficients were used to estimate path ‘b’ which was -0.027. The product of path ‘a’ and path ‘b’ was -002835 indicating a negative mediation effect of exchange rate on the relationship between financial soundness and NIM. This implied that an increase in exchange rate increases the effect of banks’ financial soundness on NIM. Commercial banks often sell foreign currency at a higher rate and purchases foreign currency at a lower rate, hence benefiting from the transactions done. Capital and liquidity levels are improved paving for more lending which results to an increased interest income which in essential for NIM determination.

|

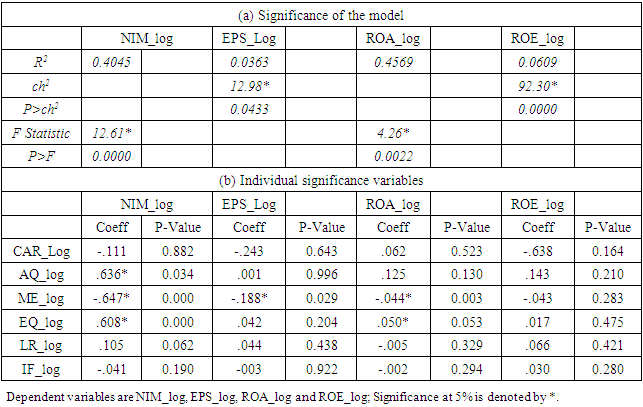

4.7. Mediation Effect of Inflation

- The model results to estimate path ‘a’ when inflation was employed as a mediator is presented in Table 7. The results indicate that the model was significant (P-value 0.000<0.05) hence, the product of coefficients obtained to estimate path ‘a’ was -0.033. Results in Table 11 indicate that the model for estimating path ‘b’ was significant (P-Value 0.000<0.05) when NIM was employed as financial performance indicator, hence a product of the coefficients obtained was -0.25. To estimate the mediation effect, the product of path ‘a’ and path ‘b’ was estimated as 0.00825 indicating a positive mediation effect of inflation on the relationship between financial soundness and NIM. The positive mediation indicates that the effect of banks financial soundness on financial performance would decrease. This could be attributed to the general increase in price level of commodities that reduces the purchasing power of money. As a result banks experience high demand for withdrawals and fewer deposits by customers which affects banks capital and liquidity. With prolonged inflation, banks experience a decrease in lending, hence denying them interest income.

|

5. Summary, Conclusions and Recommendations

5.1. Summary

- The study established that GDP as a macro-economic factor had a significant mediation effect on the relationship between financial soundness and NIM and ROA respectively. It was also established that GDP was not a mediator when EPS was used as financial performance measure. The positive mediation effect of GDP on the relationship between financial soundness and NIM implied that the effect of financial soundness on NIM would decrease. This implies that GDP growth in a country improves banks’ financial soundness resulting to diversification by banks in other sectors of the economy hence reducing banks interest income due to decreased lending which is crucial in NIM determination. In addition, the positive mediation effect of GDP on the relationship between financial soundness and ROA implied that GDP growth of a county decreases the effect of banks’ financial soundness on ROA. This could be associated with new investments that increase the cost of operation. Further, the decrease in ROA could be attributed to the increase in non-performing loans advanced to customers taking advantage of the economic growth. The study established a negative mediation effect of interest rate on the relationship between financial soundness and NIM. This implied that an increase in interest rate in the economy increases the effect of banks’ financial soundness on NIM. This could be associated with banks adjusting their internal lending rates upwards to avert the risk of inadequate liquidity. The adjustment of internal lending rates ensures that more gains are realized from the borrowers at a higher rate of loan repayment. Further, the study established that interest rate had a negative mediation effect on the relationship between financial soundness and ROA. Banks neutralizes the negative effect of the changes in interest rate on banks’ financial soundness by adjusting their internal lending rates upwards hence ensuring that their ROA remains stable.Moreover, the study found that interest rate had no mediation effect on the relationship between banks’ financial soundness and ROE. In addition, interest rate is not a mediator when EPS was adopted as a measure of financial performance. The study also established that exchange rate as a macro-economic factor had a negative mediation effect on the relationship between financial soundness and NIM and ROA respectively. The negative mediation effect of exchange rate on the relationship between financial soundness and NIM implied that an increase in exchange rate leads to an increase in banks’ net interest margin. Commercial banks gains from the activities involving exchange of currencies where they sells foreign currency at a higher rate and purchases foreign currency at a lower rate. The gains facilitates improvement of banks’ capital and liquidity resulting to more lending which bring in more interest income which in essential for NIM determination. The negative mediation effect of exchange rate on the relationship between financial soundness and ROA implies that an increase in exchange rate results to an increase in the effect of banks’ financial soundness on ROA. This is attributed to the transfer of the effect of exchange rate increase to customers by banks at a slight premium hence gaining from the premium. This results to improved banks’ capital and liquidity translating to improved performance. The study further observed that exchange rate had no mediation effect on the relationship between banks’ financial soundness and ROE. In addition, it was found that exchange rate could not act as a mediator on the relationship between banks’ financial soundness and EPS.The study established that inflation had a positive mediation effect when NIM, EPS and ROA were employed as measures of financial performance. The positive mediation effect of inflation on the relationship between financial soundness, NIM and ROA respectively indicates that the effect of banks financial soundness on financial performance would decrease. This could be associated to high demand for withdrawals and fewer deposits by customers due to the general increase in price level of commodities that reduces the purchasing power of money. As a result banks’ liquidity decreases which in return leads to a decline in NIM and ROA respectively. Further, increase in inflation could result to a decrease in borrowing by customers denying banks interest income. The positive mediation of inflation on the relationship between banks financial soundness and EPS indicates that an increase in inflation leads to a decrease in banks’ EPS. Decrease in banks’ EPS could be attributed to an increase in banks’ operation costs and an increase in non-performing loans resulting from failure by borrowers to meet their payment obligations in time thus affecting banks’ asset quality. Banks’ overall quality is affected resulting to low net income, hence decrease in EPS. Finally, the study established that inflation had no mediation effect on the relationship between banks’ financial soundness and ROE.

5.2. Conclusions and Recommendations

- The study concluded that GDP growth, interest rate, exchange rate and inflation have a mediating effect on the relationship between banks financial soundness and net interest margin. Banks’ management needs to understand how macro-economic factors influence banks’ financial soundness for efficient strategy and policy formulation relating to financial soundness to facilitate lending in order to increase interest income. The study also concluded that GDP growth, interest rate and exchange rate are not mediators on the relationship between financial soundness and EPS as a financial performance measure. However inflation was found to have a positive mediation effect, implying that it reduces the effect of financial soundness on financial performance. Bank managers therefore should consider the effect of inflation while laying down internal policies to improve earnings per share.Further the study concluded that GDP growth, interest rate, exchange rate and inflation do not have a mediation effect on the relationship between banks’ financial soundness and ROE. As a result, policy maker in the banking sector should lay down internal policies to govern internal banking systems that facilitate maximization of shareholders wealth.

5.3. Suggestion for Further Studies

- The study used data from commercial banks in Kenya and four macro-economic factors; hence a similar study is suggested in other countries across the globe using all macro-economic factors.

ACKNOWLEDGEMENTS

- I wish to acknowledge Dr. Samuel Kariuki and Dr. Kennedy Ocharo for their contributions and efforts in making this study a success.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML