-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(4): 86-90

doi:10.5923/j.ijfa.20200904.02

Received: Oct. 20, 2020; Accepted: Nov. 23, 2020; Published: Dec. 15, 2020

The Impact of the Economic Crisis on the Lebanese Banking System

Ali Sankari1, Bernard Al Osta2

1Faculty of Business and Administration, Lebanese University, Lebanon

2Masters of Business Administration, Lebanese International University, Kfaraaka, Lebanon

Correspondence to: Ali Sankari, Faculty of Business and Administration, Lebanese University, Lebanon.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper has presented a quantitative study of 109 employees and managers that are working in banks in different geographical locations in Lebanon to study the Impact of the Economic Crisis in Lebanon on the Lebanese Banking sector Performance. A model was designed by the researcher that evaluates the impact of the independent variable “Economic Crisis” on “Banking Performance” which is the dependent variable. The researcher studied the impact of “Shortage in Foreign Currency” (H1), “Public debt” (H2), “Eurobonds Postponement” (H3), “Inflation” (H4) on Banking Performance. The statistical results generated by SPSS showed a significant negative correlation between the variables stated in the hypotheses. As for the future Researchers we recommend to expand the methodology of the study to cover a qualitative data technique and to interview related personalities such as officials in BDL. Another future study is suggested to be related to find a systematic financial road to help Lebanon deal with its financial crisis.

Keywords: Economic Crisis, Lebanon, Banking Sector, Currency, Public Debt, Inflation

Cite this paper: Ali Sankari, Bernard Al Osta, The Impact of the Economic Crisis on the Lebanese Banking System, International Journal of Finance and Accounting , Vol. 9 No. 4, 2020, pp. 86-90. doi: 10.5923/j.ijfa.20200904.02.

Article Outline

1. Introduction

- Lebanon's economy is dependent on inflows of foreign currency from its large diaspora, but they have dried up as the country descends deeper into a crisis rooted in corruption, government mismanagement, a dilapidated power sector that bleeds billions and the civil war next door in Syria.The dollar shortage has made the scenario of a default on the country's enormous $87bn public debt - the third highest in the world compared with its gross domestic product (GDP) - increasingly likely.In addition, the effect of inflation on banking performance is an important and complex issue. It is important because it has been the primary concern of the investors, shareholders and lenders as well as the managers in planning their programmes for greater efficiency. Shortage of foreign currency reserves, though an issue hardly known or discussed outside academia and specialized business in industrialized countries, is regularly making headlines when a significant national economy is struck by it. This paper is going to evaluate the vast impact of The Impact of The Economic Situation on the performance of the Banking Sector in Lebanon.

1.1. Research Aim

- Lebanon has established a solid banking ground distinguished by a good performance, an efficient control, and good profitability. The Banking sector in Lebanon is reputable for its good performance, and is significantly contributing to the economic development of the country (Abdullah, 2019). But for the recent months, this could not be the case. Lebanese banks are facing a huge threat of reaching the edge of a recession, since many economic indicators has fallen down making Lebanon on the edge of a huge economic crisis like the one that hit Greece and Cyprus years ago, risking the whole economy to doom. Determining from what is present in the upcoming parts the researcher will depict the struggle imposed by the economic situation on Lebanese Banks in terms of Shortage in Currency, Public debt, the struggle of paying the Eurobonds debts and finally the huge effect of Inflation.

1.2. Research Questions

- The research questions addressed by this graduate project are: RQ1 – What is the impact of Shortage in Dollar on Banking Performance?RQ2 – What is the impact of Public Debt on Banking Performance?RQ3 – What is the impact of Eurobonds Postponement on Banking Performance?RQ4 – What is the impact of Inflation on Banking Performance?

1.3. Research Objectives

- The objectives of this research are: i. To explore the impact of Shortage in Dollar on Banking Performanceii. To investigate the impact of Public Debt on Banking Performanceiii. To examine the Eurobonds Postponement on Banking Performanceiv. To inspect the Inflation on Banking Performance

2. Theoretical Framework

- According to Athanasoglou et al. (2008), an economic crisis in the banking sector may affect performance due to a lot of factors.

2.1. Inflation

- The definition of Inflation can be presented as the decline if the value of money or even the continuous incline of the price of goods generally. This event can be perceived by some economists as the circulation of a bigger amount of money in the inflated area. A positive relation was discovered amongst the growth rate of money and the rate of inflation (Berger and Ponce, 2010). The main factor that causes the volatility of inflation, as seen by Dietrich and Wanzenried (2011), is when the rate of increases of the availability of the volume of purchasable goods surpasses that of the total purchasing power in said economy. In the United States, the main reasons that may directly affect the inflation are the energy prices, budget deficits, wage rates and money supplies as seen in the academic discoveries made by Durden (2011). It was observed that an important factor that relates to the inflation in some countries is the exchange rate of the currency in said countries (Paul, 1997). According to Elsas et al. (2010), the inflation phenomenon may be determined by the demand on goods surpassing said goods’ supply, but in the long run, the money supply is what usually affect the increase in the prices of these goods. Nevertheless, a study on the phenomenon of inflation in countries in Asia uncovered the fact that the money stock’s growth wasn’t the main cause of inflation there (Saini, 1982).

2.2. Shortage in Currency

- The topic of foreign exchange’s exposure regarding banks has been thoroughly studied academically in numerous occasions. For instance, one of the main factors that causes bank risks is the fluctuation of the value of the United States Dollar (USD), in accordance with Bracker’s (2009) study. This study has also focused on the numerous risk factors that are caused by the sensitivity of the stocks in banks. The study’s results were not constant as some negative and positive relations were seen amongst exchange rates and bank holding companies. Yet the exchange rate of foreign currency was not classified has an important risk in the conducted study.

2.3. Public Debt

- The public debt’s theoretical basis has been created by Gurley and Shaw (1973). In their perspective, the only way that an economy may truly have a strong growth is to have a stable system of finances where this type of debt is crucial and needed strongly. The factors that may cause the domestic dept to increase can be listed as: low output growth, high budget deficits, relatively narrow revenue (as seen in the 80s), high inflation rate, and large public expenditure growth as stated by Rapu (2003). The subsequent reasons that were stated by Ola and Adeyemo (1998) in their research about the increasing public dept. The government’s takes debt to:1- Provide financial coverage for economic depression or even any kind of natural disasters.2- Provide crucial capital for development plans like river basins constructions, agricultural projects, and dams construction in water ways.3- Provide present ventures in the aim of good revenue assemblage.

2.4. Lebanese Economic Situation

- External debtAfter the end of the civil war and to finance the huge reconstruction process, the Lebanese government engaged in a massive borrowing strategy. Meanwhile, the growth rate of Gross debt of year between 1993 and 1995 as well as 1995 and 2000 were 123% and 177% respectively. After 2005 till 2018, and except for year 2009, the GDP recorded a single digit growth rate, whereas the yearly growth rate of debt recorded 22% (Chbeir, 2019). These high numbers in debt have cause the Lebanese economy to chunk in revenues and servicing debt recording a percentage close to 45% spent by the Lebanese government as interest payments. By the end of 2019, the debt to GDP ratio scored a score close to 178% making Lebanon one of the most indebted countries close to Japan and Greece. The worst decision took by the Lebanese government was defaulting $1.2 billion Eurobond in early 2020 (Salti, 2020).Currency crisisWhile the official exchange rate of dollar to the national currency of Lebanon “Lira” is officially set at 1507 to 1 USD, the market trading of the currency was unstable due to the currency value depreciation in the black market (Suleiman, 2020). Latest reports show that Lira was trading at LBP 8,100 to US$1 in 2020 in the black market. This depreciation was mainly linked to the economy’s dependence on the imports (Bloomberg, 2020). Corruption and political instabilityAfter the worsening of the economic situation in Lebanon, protests broke out in many Lebanese regions starting October 2020. The protesters demanded the resignation of the government and political leaders and to bring the corruption into an end. In 2020, a newly formed government (later-on resigned) was put in power yet facing the same accusations of corruption (BBC, 2020). In November 2019, the central bank of Lebanon was accused of running a Ponzi scheme as it relied on fresh borrowing to service its debt. The bank denied the allegations stating that its action was in par with the 1963 Code of Money and Credit (Alison, 2019). “The pandemic brought the protests to a halt for some time but the port explosion in Beirut once again brought people to the streets, who, as reports state, have lost faith in the political elite (abc, 2020). Some estimates state that half of Lebanon's population is living near or below the poverty line and thousands of people have lost their jobs. There have been incessant power cuts and some residents have been calling the blackouts worse than those witnessed in the 1975–1990 civil war (Arnold, 2019).”

3. Methodology

3.1. Methods

- Deductive VS Inductive Saunders et al. (2009) characterizes 2 methodological means to deal in a study, the Deductive and the Inductive approaches. the researchers chose the "deductive" technique to elaborate this study. Exploratory VS Explanatory The researchers are going to use the Exploratory research purpose. Eisenhardt and Graeber (2007) clarify that “specialists in the exploratory kind tend to alter the course of the examination considering the discoveries, since exploratory investigations are expansive and need to investigate relationship as opposed to give positive response to investigate question.”Quantitative Methodology In this Paper, a quantitative data collection approach will be utilized, where numerical information is to be gathered keeping in mind the end goal to think of exact data, speaking to the contemplated speculations. Quantitative strategy strategies are vital for the gathering of basic measurable information, helping in attempted a target examination of gathered information, with more extensive review of members, and in addition creating exact discoveries and results.In view of the methodological decision of this paper, questionnaires will be distributed over 109 managers and employees, based on the “Non-Probability” sampling technique, keeping in mind the end goal to focus on the targeted populace. “Non-probability Sampling” “examining procedures are for the most part systems that encourages analysts to choose the example of the populace they are intrigued to study. This investigation will gather information from roughly 10 banks.The Questionnaires are distributed by hand and emails to the selected respondents, whereas the questionnaire is divided into the following parts: Part A: Banks and Employee’s DemographicsThis part of the graduate project questionnaire is going to cover the demographics of employees such as their gender, age, years of experience etc.Part B: Lebanese Economic Variables The first part directly related to the study is the “Lebanese Economic Variables”, this part is going to address the following variables: Shortage in Foreign Currency Deposits, Public Dept, Eurobonds Postponement and Inflation. Part C: Lebanese Banking System Performance The Last part of the questionnaire is going to cover the impact of the economic Situation on the Performance in the Lebanese Banking System. Some of the questions are based on Likert Scaling (ex: Highly agree = 5 to Highly Disagree = 1).

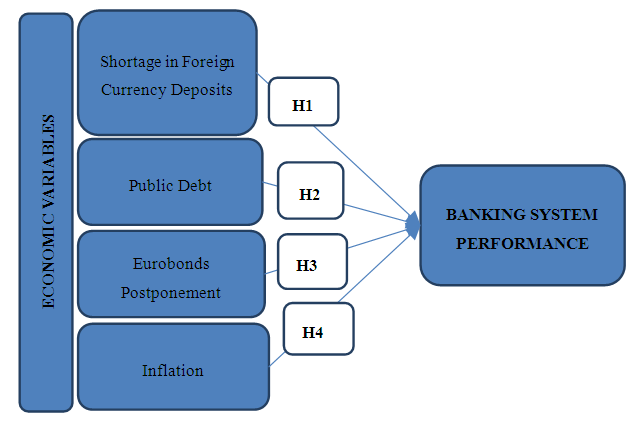

3.2. Research Hypotheses and Research Model

- • Research Hypotheses H1: Shortage in Foreign Currency Negatively Impacts Banking PerformanceH2: Public Debt Negatively Impacts Banking PerformanceH3: Eurobonds Postponement Negatively Impacts Banking PerformanceH4: Inflation Negatively Impacts Banking Performance

| Figure 1. Research Model |

4. Findings and Results

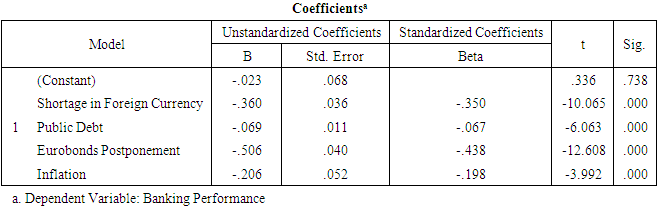

- Based on the “Multiple Linear Regression Analysis” the researcher found a significant relation between the dependent variable: Organizational Culture and the independent variables listed in the table below, helping in reaching a conclusion about whether the research hypotheses are accepted or rejected. According to the results presented in the table below all hypotheses related to independent variables are negatively correlated with Banking Performance.” Thereafter, Banking Performance is negatively influenced by the variables listed in the following: Shortage in Foreign Currency Deposits, Public Dept, Eurobonds and Inflation. Thereafter, H1 – H2 – H3 – H4 – H5 are accepted. The linear regression would be: Banking Performance = -0.350 Shortage in Foreign Currency - 0.67 Public Debt - 0.438 Eurobonds - 0.198 Inflation.

|

5. Conclusions

- This paper has presented a quantitative study of 109 employees and managers that are working in banks in different geographical locations in North Lebanon. This will help the researcher in studying the Impact of the Economic Crisis in Lebanon on the Lebanese Banking sector Performance. A model was designed by the researcher that evaluates the impact of the independent variable “Economic Crisis” on “Banking Performance” which is the dependent variable. “In the methodology, the researcher issued the specific investigation methodology process wherein the investigator constructed the model. The researchers, and in order to discover the right methodology used the following techniques for their study to come back-up with the most correct outcomes on the cease of their studies. The deductive, explanatory and quantitative evaluation had been used so as to evaluate the hypotheses. The researcher has dispensed her questionnaire over 109 employees and managers.”For the Hypothesis (H1) stating that: “H1: Shortage in Foreign Currency Negatively Impacts Banking Performance”, the statistical results generated by SPSS showed a significant correlation between the variables stated in the hypotheses. This is represented by the significance values presented in the research model which is lower than 0.05. This is followed by a negative correlation presented in the regression model, thus a negative correlation exists between “Shortage In Foreign Currency” and “Banking Performance”. For the Hypothesis (H2) stating that: “H2: Public debt Negatively Impacts Banking Performance”, the statistical results generated by SPSS showed a significant correlation between the variables stated in the hypotheses. This is represented by the significance values presented in the research model which is lower than 0.05. This is followed by a negative correlation presented in the regression model, thus a negative correlation exists between “Public debt” and “Banking Performance”. For the Hypothesis (H3) stating that: “H3: Eurobonds Postponement Negatively Impacts Banking Performance”, the statistical results generated by SPSS showed a significant correlation between the variables stated in the hypotheses. This is represented by the significance values presented in the research model which is lower than 0.05. This is followed by a negative correlation presented in the regression model; thus, a negative correlation exists between “Eurobonds Postponement” and “Banking Performance”. For the Hypothesis (H4) stating that: “H4: Inflation Negatively Impacts Banking Performance”, the statistical results generated by SPSS showed a significant correlation between the variables stated in the hypotheses. This is represented by the significance values presented in the research model which is lower than 0.05. This is followed by a negative correlation presented in the regression model; thus, a negative correlation exists between “Inflation” and “Banking Performance”. This study contributed in the field of economy and finance by setting a clear view for researchers and leaders on how economic crisis could start and how they could impact the whole financial system in a country. The contribution sets a distinct case over a middle eastern country with its own economic and political variabilities. The limitations of this study are related mainly to the narrow time-frame of the project which is not sufficient to cover the practical and theoretical part of this study. Another limitation is the studied population, which is low to generalize the results. A final limitation is the difficulty to access organizations in such difficult economic situation.As for the future Researchers we recommend to expand the methodology of the study to cover a qualitative data technique and to interview related personalities such as officials in BDL. Another future study is suggested to be related to find a systematic financial road to help Lebanon deal with its financial crisis.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML