-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(3): 67-76

doi:10.5923/j.ijfa.20200903.03

Received: July 22, 2020; Accepted: August 7, 2020; Published: August 15, 2020

Implementation of International Public Sector Accounting Standards and Transparency & Accountability in the Public Sector

Edwin Izueke 1, Fab Onah 1, Christopher O. Ugwuibe 1, Felicia Okwueze 1, Sylvia Agu 1, Chuka Ugwu 1, Christian Ezeibe 2

1Department of Public Administration & Local Government, University of Nigeria, Nsukka

2Department of Political Science, University of Nigeria, Nsukka

Correspondence to: Christopher O. Ugwuibe , Department of Public Administration & Local Government, University of Nigeria, Nsukka.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The utility of International Public sector accounting Standards (IPSAS) in achieving transparency and accountability in the public sector accounting has been established. The motivation for the study was that in Nigeria, transparency and accountability of public sector officials have been seriously lacking and IPSAS was seen as a panacea to achieving the twin virtues. This study examines whether the implementation of International Public Sector Accounting Standards (IPSAS) has achieved public sector transparency and accountability in Nigeria since its adoption in 2014. A qualitative survey of the agencies in the 5 states of south east Nigeria was carried out and analysis done using analytical discourse technique. We found out that the extent of the implementation of IPSAS in Nigeria has not achieved transparency and accountability in the public sector, in Nigeria. We find that political will, use of accrual bases of accounting and internet facilities are the underlying factors for a full implementation of IPSAS and that they were all lacking in our study area. The framework of analysis was principal -agent theory, which explained that the agents, the public sector officials pursue their interest first before those of their principals-the citizens. The lack of political will stems from the agents not wanting to be transparent and held accountable for their actions. Regulatory agencies should penalize the officials lacking the political will.

Keywords: IPSAS, Principal-agent theory, Accountability, Transparency, Extent of implementation

Cite this paper: Edwin Izueke , Fab Onah , Christopher O. Ugwuibe , Felicia Okwueze , Sylvia Agu , Chuka Ugwu , Christian Ezeibe , Implementation of International Public Sector Accounting Standards and Transparency & Accountability in the Public Sector, International Journal of Finance and Accounting , Vol. 9 No. 3, 2020, pp. 67-76. doi: 10.5923/j.ijfa.20200903.03.

Article Outline

1. Introduction

- Nigeria’s quest to re-position its economy as one of the top 20 economies in the world by the year 2020 as encapsulated in vision 20: 2020 has given rise to various policies and reforms of government, all targeted at preparing a fertile ground for the actualization of the vision [1]. One of the measures is the adoption of and implementation of IPSAS. It is one of the world’s best practices in achieving transparency and accountability. It has long been established that many countries prefer Accrual Basis IPSASs to the Cash Basis IPSAS because of its ability to improve transparency and accountability of many public sector institutions across the world [2].Streamlining the accounting system in accordance with “world’s best practices” will result in consistency and transparency in the financial management of the country, ensure good governance, boost the confidence of investors, and contribute to strengthening the economy [3]. Accountability, probity and transparency are some of the qualities that are required of governance and are considered as the major drivers of good governance/administration. Any leader who displays these virtues indeed helps to rekindle sustainable confidence in the citizenry [4]. Accountability reduces corruption to its barest minimum and is a prerequisite for the successful attainment of vision 2020.Accountability is defined as the degree to which public officials are held responsible for the way in which they implement fiscal policy [5]. The body defines fiscal transparency as “the clarity, reliability, frequency, timeliness, and relevance of public fiscal reporting and the openness to the public of the government’s fiscal policy making process. Accountability connotes the idea of doing more and being able to account for every aspect of the resources involved in the processes. This implies that there is a contractual agreement either by verbal or written or simply understood that a public officer must give account of his actions in regard to the property to the owner (the public, government or his representatives). Public accountability has dimensions such as political, bureaucratic, legal, professional and financial accountability. In this study, financial accountability is of interest because they squarely fit into our definitions above. Financial accountability is specifically answerability of governments and their officials on the generation and use of public funds through rendition of accounts of how the funds were generated and used [6].These two concepts in fiscal sphere are siblings. Transparency seems to be the elder sibling before accountability. It is the relevance, completeness and timeliness of fiscal information provided by the government that would make the public to be able to ask relevant questions about the fiscal operations of government. UNDP (2008), argued that accountability and transparency are indispensable pillars of democratic governance that compel the state, private sector and the civil society to focus on results, seek clear objectives, develop effective strategies, and monitor and report performance [8]. A transparent government has accountability in mind in being transparent. Financial transparency manifests in four ways: reporting entities accurately and fully disclosing all transactions including disclosures of stakeholders who have beneficial ownership in the entities, the management and shareholding structure of the entities; reporting entities and the substance of their transactions in accordance with internationally recognized accounting standards; regulatory authorities having access to every and all information that they may require from the published financial statements; and there being no exceptions to the above three except in cases of national security [9]. Transparency is rooted in a visible commitment to be held accountable [9]. The implication of the above arguments is that transparency requires participation by the citizenry or their elected representatives in the financial management process and accountability is submission to the citizens by managers of public funds, the two are thus closely linked and inseparable. Accountability and transparency are therefore twin concepts which are fundamentally a key part of good governance [10].Accountability allows the public to screen and discipline their officials. It may also induce those officials to pander to public opinion. Several trends have brought fiscal transparency and accountability and participation into critical focus [5&11].The trends include:• The proliferation of good governance norms and standards that emphasize greater transparency, participation, and accountability in all government matters,• The introduction of modern public finance management systems and good practices in countries around the world,• The dramatic growth, spread, and use of information and communication technologies.• Greater decentralization and devolution of powers to sub national levels of government, including the power to raise, allocate, and spend public resources.Inadequate disclosure of government fiscal risks and operations means lack of transparency and accountability which contributed to fiscal crises in many countries. This made the citizens to call for greater transparency and accountability in the use of public fund. Arab springs, Wall Street saga in U.S are examples. Governments must present accurate and complete information on their revenue, expenditures and other transactions, as a way of showing greater accountability and stewardship and thereby court trust from its publics and constituents [10].In view of this, the government of Nigeria in 2010 took a decision to commence gradual compliance with all general purpose financial statements of Ministries, Departments and Agencies (MDAs) to the provision of an acceptable global accounting system: the International Public Sector Accounting Standards (IPSAS) for all public sectors in Nigeria comprising the federal, state and local governments. The implication is that the three tiers of government, namely; federal, state and local governments were as from January 2013, required to adopt the use of IPSAS in all accounting procedures; ensures citizens’ participation which avails them avenues to ask questions, and make provisions for checks and balances in governance. IPSAS as a sound government accounting standard is a critical part of a nation’s institutional infrastructure. It has become a recognized benchmark for evaluating and improving public sector accounting in most developing countries [12].The International Public Sector Accounting Standards Board (IPSASB) develops IPSAS, accrual-based standards used for the preparation of general purpose financial statements by governments and other public sector entities around the world. The use of accrual basis of accounting in the public sector as a framework for reporting is best suited to serve the information needs of its user, concluding that governments implementing accrual basis IPSASs stand a better chance to achieve increased transparency and accountability expected of a good governance system compared to their counterparts reporting on the cash basis accrual system [13]. IPSAS based reports provide clear information to citizens regarding the extent to which government officials comply with the appropriations authorized by their elected representatives. This means that stakeholders including citizens are encouraged to actively participate in ensuring accountable governance through questioning non-compliance behaviours of government officials [10]. Through these standards, the IPSASB aims to enhance the quality, consistency, and transparency of public sector financial reporting worldwide. This implies that IPSAS as a transparent system must be capable of promoting openness through a comprehensive reporting. IPSAS is thus perceived as the principal public sector accounting tool employed by most governments to gather, record, classify and summarize fiscal and financial activities of government transactions into information for use by interested stakeholders [14].Public sector organizations has worked with a variety of financial reporting processes mainly cash based accounting system and this has made the organizations face the challenges posed by lack of standardized international reporting practice. IPSAS set out uniform guidelines for accounting in public sector entities. The standards enable comparison of data between organization and countries, it also improves the quality of general purpose financial reporting by public sector entities leading to better informed assessments of the resource allocation decisions made by governments thereby increasing transparency and accountability; assess how well the resources have been utilized; impact on policy processes and people, etc [4]. Full and effective implementation of IPSAS has the potential of making governments transparent and improves accountability. Statistical research by [15,16,&17] found evidences that transparency in government’s fiscal operations are characterized by better fiscal performance and reduced corruption levels. It was argued also that transparency in fiscal operations provide citizens with the information that allow them to hold their government accountable for the use of public resources and to limit wasteful spending and corruption [18,19]. Application of IPSAS would result in including material liabilities for public sector entities on their balance sheet. This affects the debt figures which will have implications for public trust on government.The debt crisis and entrenched corruption in Nigeria have illustrated the dire consequences of insufficient transparency and accountability of governments and poor public financial management and reporting. Government however, is not risk free and the failure of fiscal management in the public sector has an economic impact that will far exceed the impact of losses incurred by corporate failures [20]. This is probably why the need to build a framework for sustainable social growth through proper accountability and increased transparency in Nigeria public sector was emphasized [21].

1.1. Literature Review

- International Accounting Standards for the Public Sector (IPSAS) In more advanced climes, issues of governance are done with utmost transparency and probity, which gives room for citizens to be actively involved in policy and decision making. Probity, transparency and accountability are the essential benefits of IPSAS [12]. It has been noted that the adoption of IPSAS avails the citizens opportunity to participate in policy and decision making of their countries [22]. It was further pointed out that IPSAS as a sound government accounting standard is a critical part of a nation’s institutional infrastructure. It is a benchmark for evaluating and improving government accounting in most developing countries like Nigeria [23]. IPSAS enhances credibility of financial information, public trust and attracts foreign investments [24]. From the foregoing observations, an attempt at the summary of the prospects of IPSAS is as follows: • Probity, transparency and accountability in government • Greater citizen participation in policy and decision making • Institutional infrastructure for good governance • Benchmark for evaluation and improvement of government accounting practices • Informed assessment of resource allocation decisions made by government• Improved credibility and integrity of financial reportsTransparency and accountability concepts represent demands and obligations from the public and governments or officials respectively. Both form the core value of IPSAS as instruments of enabling government or public officials to give account of their stewardship. IPSAS provides the comprehensive accounting information system needed to improve public sector accountability [25]. This is because it is based on accrual basis of accounting and accrual based financial reports are of higher quality than cash based reports. The main purpose of IPSAS is to improve the quality of the general purpose financial reports (GPFRs) of public sector entities for decision-making and allocation of resources [3]. Compliance with IPSAS standards ensure that the financial reporting of public entities reflects a true and fair view of the financial position and shows transparency and accountability in the management of public resources.There is need for high-quality and timely accrual-based financial reporting in the public sector. Accrual reporting is the recording of the economic substance of transactions when they occur rather than when cash settlement occurs. It is fundamental to good decision making, transparency and accountability. There is significant accrual adoption activity underway across all regions of the world [26].The main advantages of government accrual accounting given in the literature are:Ø Reliable cost and pricing information [27,28]Ø Stewardship or accountability for assets and liabilities [27,29&30]Ø Information is available faster [27]Ø The provision of forward-looking information, for example on the ability to provide the services on an ongoing basis [28,30]Ø Similarity to commercial accounting, which facilitates training and understanding [30] Ø Standard-based accrual accounting correlate swell with other public sector financial disciplines, such as budgeting or cash management [31]Directly: implementing IPSAS without altering any of their requirements ensures accrual basis of accounting. IPSAS adoption leads to the attainment of development goals. IPSAS enable a more comprehensive and accurate portrait of the financial position and performance, and the impact and sustainability of public policies. They provide a better basis for decision-making at different levels of governments and provide robust support to public financial sector. IPSAS are high quality standards that set requirements for high-quality financial information in the interest of users, that is to say financial information that is relevant, faithful, understandable, timely, comparable, verifiable and internationally consistent.Applying IPSAS means having financial reports prepared on the basis of standards acknowledged at the international level, and thus financial reports that can be understood, analyzed, compared, audited anywhere on the basis of a shared international language [32]. The presence of an efficient and transparent financial reporting system has become extremely important for the government especially in view of increasing awareness for use of public funds by government and can be very helpful for countries in enhancing the credibility of financial information, public trust and attracting foreign investors [33]. IPSASs based financial statement comprises of the following components: (a) A statement of financial position; (b) A statement of financial performance; (c) A statement of changes in net assets/quality; (d) A cash flow statement; (e) a comparison of budget and actual amounts either as separated additional financial statements or as a budget column in the financial statements; and notes that comprise a summary of significant accounting policies and compliance with regulations. The World Bank in collaboration with the office of the Accountant-General cited in [34], conducted research and formed that the 2010 financial report of Nigeria has no record in the consolidated account for external aids and grants; no complete disclosure of financial activities of controlling entities such as NPA, NNPC and CBN; unrealistic gain/losses due to foreign exchange were not reported; payments on behalf of their parties were not disclosed; inability of controlling entities of the Federal Government of Nigeria to pay their account as at when due; no account for undrawn assistance and inadequate disclosure of cash out of direct controls for instance under litigation.Therefore, the mission of this study is all about critically assessing the implementation of IPSAS and investigation of whether the adoption has improved transparency and accountability of the public sector in the south eastern states.

1.2. Objectives of the Study

- IPSAS has been adopted in Nigeria since 2013, approximately 7 years now. We therefore, set out to investigate the implementation and ascertain whether its implementation has achieved transparency and accountability in Nigeria in the public sector.The specific objectives are to:Investigate whether IPSAS is fully implemented in the public sector of south east Nigeria. • Examine whether the extent of the implementation of International Public Sector Accounting Standard (IPSAS) has improved transparency and accountability in the south east public agencies in Nigeria.• Ascertain the challenges of implantation and adoption of IPSAS in public sector agencies in the South East Nigeria. • Proffer measures/strategies for improvement.

2. Methodology

2.1. Research Methods

- The study adopted a qualitative approach in gathering the data. This method, was used to evaluate the extent of the implementation of the International Public Sector Accounting Standards (IPSAS), and the achievement of accountability and transparency in the accounting system in the public agencies in South East Nigeria. This also provides in-depth and rich information about the participants’ views on the operations of IPSAS as well as reports from the accounting offices. The interviews and focus group discussions were used to run a checklist on the IPSAS implementation standards and challenges against effective implementation of IPSAS.

2.2. Participants/Procedure

- The population of the study comprises staff of the finance departments in five ministries each in the five states in the South East Nigeria, totaling 2001(sources: Personnel units of the ministries).Nigeria, as a developing country is our focus considering the rate of lack of transparency and accountability in developing countries. The sample size of the study was 100 drawn from five ministries in the States, 20 from each state. The study area is Enugu, Anambra, Ebonyi, Imo and Abia states. In-depth interview, and Focus Group Discussion (FGD) were used in the data collection. The interviewees were mainly unit heads and finance officers in various finance departments in the selected ministries within the five states in the South East Nigeria. The FGD comprises accountants, accounting officers, and unit heads. This will involve twenty participants, four participants in each of the FGD. The purpose of the FGD was to engage the stakeholders in interactive session in order to brainstorm on the relevant provisions on IPSAS in public agencies, explore the challenges of the implementation of IPSAS in the public sector and to broaden information base on the subject matter. Structured interview guide was used to assess the implementation of the provisions of IPSAS in the selected ministers and challenges of IPSAS implementation was developed. Purposive sampling technique was used to enable the researcher select those who have relevant knowledge on the subject matter. Questions on IPSAS are technical and would require those who are knowledgeable in the area to avoid prejudice information.

2.3. Design/Statistical Analysis

- Exploratory design is adopted in this work considering the fact that adoption of IPSAS is considerably new in Nigeria. In the qualitative data, descriptions of the major findings were made and conclusions drawn from the descriptions.

3. Theoretical Perspectives

- This study is hinged on the theories of accountability with particular reference on Neo-institutional Economic (NIE) frameworks. Theories of accountability developed out of the thoughts and ideas of stewards – stakeholder relationship. One of the categories of the theories is Neo-Institutional Economic framework [35&36]. It is a theory very germane in explaining the relationship between principal and agent with regards to transparency and accountability. It states that the agent is more at an advantage than the principal. The leader, public officials and managers are the agents while the citizens and shareholders are the incapacitated principals [37].The model argues that the principals’ effectiveness in ensuring accountability is determined by the agent. However, the principals (the citizens) capacity to make the agents (government officials) to be accountable rests on the availability, accessibility and completeness of information provided by the agent. In the Nigerian context, the requisite information is not available, accessible and complete. Also, the institutions and sanctions that would have checkmated the agents are also controlled by the agents making it difficult for the principal to control the agents. The NIE theory asserts that when the institutions, information, sanctions are gotten right, service providers will deliver the required services [37].Proper implementation of IPSAS by the agents will avail the citizens the financial information necessary with which to compel them to be accountable and transparent. Without the proper implementation, government business will be shrouded in secrecy and the citizens will not have basis for demanding for accountability. Decision making about government revenues and expenditures has historically been always shrouded in secrecy – the purview of presidents, governors and officials in executive corridor. Often the business, community, civil society organizations, and the broader citizenry have little or no access to information on public financial management [8]. They are deprived of oversight functions.

4. Findings and Discussions

- In order to buttress the findings interview reports are presented here. The following officials were interviewed in order to ascertain the extent of implementation of IPSAS1. Director account production in Accountant General Office.2. Director of Local Government in the Ministry of Local Government.3. Chief Accountants in the Accountant Generals Office.4. Auditors General for Local Governments.5. Directors of Finance, Ministry of Local government and Chieftaincy Affairs.6. Directors of Accounts, Ministry of Finance.

4.1. The Extent of the Implementation of IPSAS in Nigeria

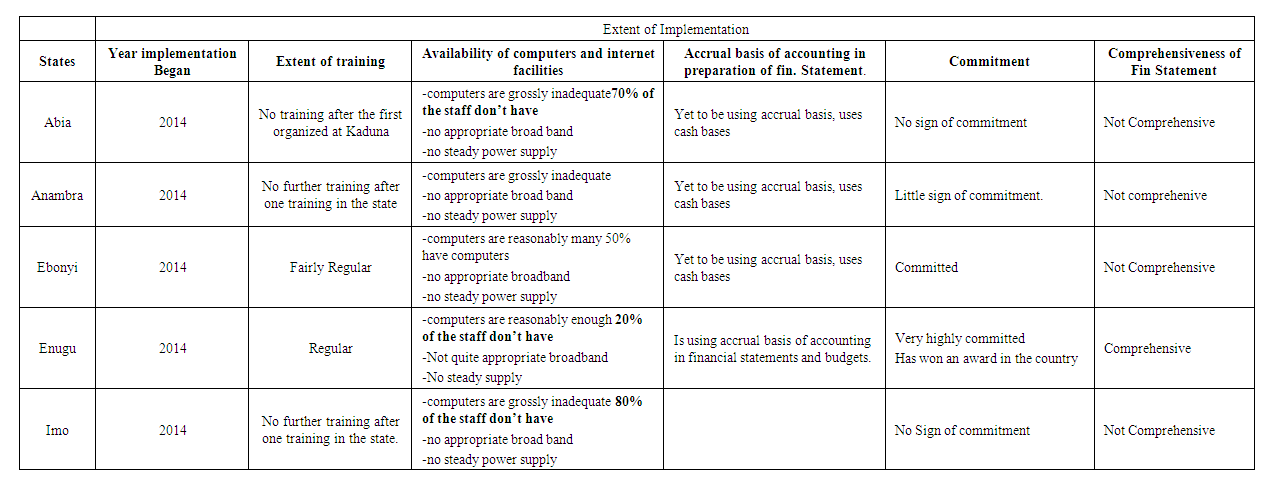

- In measuring the extent of the implementation of IPSAS, the respondents were interviewed based on the stipulated guidelines for effective implementation of IPSA. The key indices used were: the use of accrual basis of accounting, availability of computers and internet resources, extent of training of the personnel, the comprehensiveness of the financial statements, etc.These indices were further broken down as follows:1. The use of accrual basis of accounting: This basis contains disclosure of assets and liabilities, and a statement of changes in net assets/equity.2. Availability and use of computers and internet services and resources: This measures the availability and use of computers, servers, broadband and necessary software in quantity and appropriateness in the implementation of IPSAS. It measures the usage of these facilities in the preparation of accounts and financial statements. 3. Extent of the training of personnel: This looks at the regularity of training of the staff involved in IPSAS implementation.4. The comprehensiveness of financial statements: A financial statement that is a product of full IPSAS implementation must contain the following:v Cash flow statementv Information about compliance with legislative and regulatory regulationsv Columns that show variances in the budgetv Financial statements of previous periodsv Financial statements that can be understood and compared anywherev Financial performancev Accrual basis of accountingTable 1 below is a summary of the interviews on the extent of the implementation of IPSAS.

| Table 1. Extents of The Implementation Of IPSAS By States |

4.2. The Implementation of IPSAS and Achievement of Transparency and Accountability in the Public Sector of South East Nigeria

- The two variables (1) implementation and (2) transparency and accountability were measured differently before a concluding analysis of the effect of one on the other. The respondents all confirmed that Abia, Anambra, Imo, Ebonyi and Enugu states have adopted IPSAS in 2014 and that it was extended to the local governments in 2015. Economic planning officers were sent to Kaduna for training on IPSAS. The states appointed Mold Computers and Company Ltd as her consultant. The states are using Pastel Accounting Partner Nigeria Build Software. Below is a summary of the interview responses on the standing of the states.The level of improvement of accountability was ascertained through interviews with other finance and accounts officials that were not heads or directors. This was to prevent any bias from the directors in defending their agencies. The level of accountability were measured using the following indices:Ø Regularity of the publication of government financial informationØ Availability and accessibility of government financial informationØ Government’s presentation of complete and accurate financial informationØ Information showing how revenue was raised and usedØ Full disclosure of liabilities and debts Ø Availability of information containing the worth of the government to the citizensØ Information proving efficient allocation of financial resourcesThe respondents noted that government financial information of all the states except Enugu has not been regularly published, and are only published when a new regime comes into power. They stated that even when there is a publication, it was not complete such as not having full disclosure of government’s liabilities. A case in point was in Anambra state, where the outgoing governor published that he left 7 billion naira in the state treasury. However, his successor alleged that the state was owing 12 billion naira in pensions and contracts.From the respondents we gathered that since the financial information were not regularly published, the issue of availability, accessibility, disclosure of liabilities, the worth of government and efficient financial allocation were not there. However, in Enugu state the respondents agreed that financial information has been available and discloses government’s liabilities. Most of the indices of transparency and accountability such as publishing financial information, full disclosure of governments assets and liabilities and making financial information accessible to the citizens are still a far cry from the data presented table.The data on the implementation of IPSAS shows that the fundamental issue that will help in improving government transparency and accountability is seriously lacking. That is the use of accrual basis of accounting in preparing financial statement. It is clear that without the use of accrual basis of accounting in preparing financial statements there cannot be full disclosure of assets and liabilities; and complete account of government cannot be presented. In order for the implementation of IPSAS to result significantly in improved accountability in the, the financial statements and budgets should be on accrual basis of accounting.A summary of the respondents’ position on improvement of transparency and accountability showed they have not improved, since there has not been regular publication of complete and accurate financial information. We concluded that it is only one state out of five that has been highly disposed to transparency and accountability since the implementation of IPSAS.Therefore, the implementation of IPSAS has not achieved transparency and accountability in south eastern states of Nigeria public sector. Applying our theoretical framework we see that the agents (the governors, accountant generals and the executives) did not show the required commitment because of their selfish interests. Unfortunately the principals (the citizens) didn’t have the cohesion, resources and voice to call the agents to give correct account of their stewardship. The implication of ineffective implementation of IPSAS is that, despite the prominence of accountability in the public sector in the development agenda and focus on accountability and transparency as means of achieving good governance, far less efforts have been made to systematically integrate the proper accounting system for global best practices in Nigeria public sector. Despite the benefits of IPSAS and the necessary framework already developed, public organizations in the South East Nigeria find it difficult to migrate to this new accounting system. The epileptic use of this accounting system signifies why there is a huge problem of accountability in Nigeria.

4.3. Challenges against Effective Implementation of IPSAS in Nigeria

- Discussions on the challenges facing the effective implementation of IPSAS was done with the focus group and interviews with the Directors- Accounts Production, in the states, Auditors General for Local Governments, Chief Accountants and others. We found out that there were many challenges such as political will, appropriate law, inadequate training of staff, Staff lacking ICT skills, implementation cost, etc.Lack of political willIn all the states, another major challenge is lack of political will of the leadership. This is manifest in poor funding, inadequate equipment, non-use of experts in the valuation of assets, no fair and true view of liabilities, non-adoption of accrual basis of accounting and lack of relevant laws. Each state was directed to appoint a consultant. The state in the South East chose Mold Computers Ltd. Lack of political will has serious implication for accrual basis of accounting. This is because with accrual basis of accounting, the true worth of a government could be easily seen.Lack of Appropriate Law(s)From the interviews of key officials of the states e.g. the Directors Accounts Production, in the states, Auditors General for Local Governments, we found out that there were many challenges. The first challenge they highlighted was lack of appropriate law(s) for the adoption of IPSAS. They noted that both the Accountant General and Auditor General of the states prepare their reports based on the provisions of the Finance (control and management) Act of 1958 as amended and the Audit Act of 1956. The Auditor General for Local governments in Imo state retorted, “There is no IPSAS adoption nor implementation when there are no laws backing them. It is when something is in existence that you talk about challenges” when he was asked about the challenges.The implication is that the adoption IPSAS is not captured by the two acts. Therefore, adopting IPSAS without amending the laws to capture IPSAS is illegal adoption and nobody can be charged to court for not adopting or properly implementing IPSAS. Inadequate and inappropriate equipmentThe states do not have central servers for the local governments to be connected. Most of the computers are still operating on Windows 7 which will not allow some software and applications to run for IPSAS. The software available are outdated and needs to be upgraded. The consultant, Mold Computers and Company, Kaduna, is operating in the cloud while states except Enugu state do not use internet for their operations. The computers are not enough and are not modern in all the states the computers. The use of 54 digits instead of 10 formulas in keying things into IPSAS forms is a challenge against the 10 digits banks use and the 32 digits that was in use. ICT SkillsFrom the interviews conducted we gathered that majority of the workers that are supposed to be part of IPSAS implementation do not have the requisite ICT skills. In all the states more than 60% of the workers that should be involved in financial statements do not have the requisite ICT skill. Inadequate training of the staffIt was discovered that the state governments (Abia) sent some people to Kaduna, to their consultant in 2014, but no updating has taken place since then. The Auditors General for Local Governments tried to train local government staff on IPSAS but could not train them enough due to inadequate fund and the limit to his own training. Those trained were not fully equipped. Enugu and Anambra States have been leading in the training of their staff on IPSAS with Enugu coming first.

4.4. Strategies for Effective Implementation

- From the recommendations put forward by the respondents we came up with the following: Political WillIt was discovered that all the challenges facing the full adoption and implementation of IPSAS is lack of political will on the part of the leaders. Therefore, the federal government should be more to encourage state governors to develop the will to fully implement IPSAS. They should be educated on the benefits accruing from the adoption of IPSAS.Training and Retraining of the StaffAll the respondents were of the opinion that for IPSAS to be effectively implemented the staff should be trained on it, and those who had the first training should be retrained. Apart from the training on IPSAS, they raised the issue that most of their staff lack the necessary ICT skills for the operation of IPSAS. Therefore, there is need for the training and retraining of the staff on ICT skills. Equipment and softwareIn our visit to the accounts production unit of the Accountant Generals office, we were told that they were still using windows 7 operating system against 10, 11, 13 etc. We found out that there were not enough computers. In fact, in an office of 10 persons, there were only two functional computers. There was no internet service in the ministries and there is little or no e-government presence, even at the publish stage. There is need to provide adequate computers, upgrade the software, and embark on online government in order to effectively implement IPSAS. All the state government except Enugu are using sage Pastel Accounting Partner Nigerian Build as IPSAS software. However, the software cannot be operated with the current operating systems in their computers. Accrual Basis The central issue in IPSAS is accrual basis of accounting and not cash basis or fund accounting. The states claimed to have adopted IPSAS but they are still using cash basis of accounting. The consultant even took the states to the fiscal responsibility commission to complain that what the states are doing in the name of IPSAS is not it. It was only Enugu state that has fully adopted accrual basis of accounting.There is the need to ensure that the states adopt accrual basis of accounting fully before they can effectively implement IPSAS. SanctionsThere should be appropriate and commensurate sanctions on defaulters. We observed from the Auditor General’s report that many MDAs do not render reports at all, not to talk of basing it on IPSAS.

5. Conclusions

- It is very clear that IPSAS has been adopted and is being implemented in the public sector accounting in south east Nigeria and by extension the whole Nigeria, since all the sections adopted it the same time. However, the poor implementation has made its effect on accountability and transparency not to be felt. This study could be replicated in other sections of the country. It is therefore, necessary that the leadership of these states should summon the political will to fully implement IPSAS in order to harness its benefits. The Nigeria public sector in discharging its duty should employ the use of IPSAS and ensure that those key functionaries entrusted with government resources must give account of their activities of and stewardship of both their successes and failures to the citizens. IPSAS has been acknowledged internationally as a veritable tool for good governance by enthroning transparency and accountability.

ACKNOWLEDGEMENTS

- We acknowledge and appreciate Tertiary Education Fund for funding this research work. This is an Institutional Based Research (IBR) Intervention of the University of Nigeria, Nsukka. We are grateful to the University of Nigeria, Nsukka for recommending our research group proposal to the TETFUND. We appreciate the Director, accounts production of Accountant General’s office, Abia state for his expertise contribution on IPSAS. The assistance of Permanent secretary Inter ministerial Affairs, Enugu state is hereby acknowledged. The staff of the ministries of finance in the states we studied.

Tetfund Grant Information

- The research was fully funded by TETFUND as an institutional Based ResearchThe TETFUND Ref No: UN/RC.250/TFC of November 26, 2018University Grant No: TETFUND/DESS/UNI/NSUKKA/2017/RP/VOL.1

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML