-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(3): 56-66

doi:10.5923/j.ijfa.20200903.02

Received: June 29, 2020; Accepted: August 3, 2020; Published: August 15, 2020

Evaluation of Forensic Accounting Techniques in Fraud Prevention/Detection in the Banking Sector in Nigeria

Ewa Uket Eko 1, Adesola Wasiu Adebisi 1, Eseneyen Jacob Moses 2

1Department of Accountancy, Cross River University of Technology, Calabar, Cross River State, Nigeria

2Bursary Department, University of Uyo, Uyo, Akwa Ibom State, Nigeria

Correspondence to: Ewa Uket Eko , Department of Accountancy, Cross River University of Technology, Calabar, Cross River State, Nigeria.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study evaluated the application of forensic accounting techniques in preventing/detecting fraudulent practices in commercial banks in Nigeria by specifically assessing the impact of commercial data mining, ratio analysis and trend analysis techniques in fraud detection/prevention. With the aid of descriptive statistics and Ordinary Least Square (OLS) model, the result revealed the application of forensic accounting techniques significantly enhanced detection/ prevention of fraud in the banking system. The study further revealed the importance of ratio analysis as well as trend analysis techniques in fraud detection/prevention. Also the study revealed the importance of commercial data mining software in fraud detection/prevention and the lack of capacity and awareness of most staff of the workings of data mining technology as well as the use of trend analysis technique in detecting/preventing fraud in the banks. It was recommended that commercial banks should mandatorily be required to acquire robust data mining software facilities as well as enhanced training on the application of data mining and its usefulness in the banking sector. Also, use of anonymous response hotlines be encouraged as well as extensive awareness put in place for the attention of the public as well as quick responses from the banks to queries.

Keywords: Forensic accounting, Fraud, Commercial banks, Data mining

Cite this paper: Ewa Uket Eko , Adesola Wasiu Adebisi , Eseneyen Jacob Moses , Evaluation of Forensic Accounting Techniques in Fraud Prevention/Detection in the Banking Sector in Nigeria, International Journal of Finance and Accounting , Vol. 9 No. 3, 2020, pp. 56-66. doi: 10.5923/j.ijfa.20200903.02.

Article Outline

1. Introduction

- According to Association of Certified Chartered Accountants (ACCA) & Ernst and Young (EY.) [1], the scale of financial crimes is enormous, with global estimates ranging from US$1.4 trillion to US$3.5 trillion annually. Underlying these trillions of dollars is criminal activities that damages human wellbeing and harms economies and societies throughout the world, Thomas & Dancey [39]. The banking sector globally plays a crucial role in economic development of any nation. In Nigeria while money supply to Gross Domestic Product (GDP) in 2018 stood at 19.63% and credit to private sector to GDP stood at 17.63%, every other sector revolves around the banking sector for credit management and so it is a critical sector in any developed or developing economies of the world. In view of the pivotal and critical role it plays in the economy, governments all over the world are keen in ensuring the sector is devoid of fraudulent manipulations and avoid the 2008 financial crisis in the US and Europe. In Nigeria because of socio-political and economic dynamics, there is a general upward trend in corrupt and fraudulent practices among the people. Nigeria has thus faced various financial crisis resulting from many failed banks and finance houses in the last two decades. There are various advanced fee and other investment frauds perpetrated in Nigeria and that has bedevilled the Nigerian economy and the world. This is fuelled by the emerging trend where societal appeal for power, authority and recognition is strong and compelling as many believe that power, authority and recognition can be achieved through acquisition of wealth, legally or illegally. This desire for wealth is also propelled by the need to take care of personal health, education, housing, security and other services which are the primary responsibilities of governments, but which governments have failed and/or neglected to provide.Also as stated by Ewa, Adebisi & Kankpang [9], Nigeria has thus experienced big investment frauds and trading scams that have resulted in the loss of billions of dollars from gullible people as it is alleged Nigeria’s financial sector does not have efficient fraud detection mechanism and the prevailing business laws are inadequate to prosecute offenders. Globally many financial institutions collapse like Fannie Mae, Freddy Mae, Stamford Group, Leman Brothers and Northern Rock in the US and UK are attributable to fraud. These criminal vices have led to reduction or even dis-investment from Nigeria and its attendant negative consequences on economic growth is enormous as unemployment is projected to hit 33.5 per cent by 2020 and national poverty rate of 40.09 per cent, NBS [26] & Ngigi [27]. Also with the introduction of electronic banking and enhanced Information and Technology (IT) infrastructures in the banking sector and in Nigeria generally, there is an astronomical increase in financial crimes, mismanagement and misappropriation of funds in the government agencies and the banking sector. In 2017, the Nigerian Deposit Insurance Corporation (NDIC) reported that frauds and forgeries involved in the banking sector amounted to N12.01 billion.This growing level of fraudulent activities and the negative image on the banking sector is a cause of concern for necessary mechanism or controls that will address this cancer in the system. Against this backdrop is the introduction of forensic accounting techniques in curbing fraudulent practices and easy identification of infractions in the banking system in Nigeria.

1.1. Statement of the Problem

- As the fraudsters have over time developed and are continuously developing skills to outwit both internal and external auditors and management who are expected to superintend over the businesses, there is an urgent need to put in place mechanism to address this menace. As Wall and Fogarty [40] stated, fraud mitigation remains key in the justification for internal control implementation, auditing effect and regulatory design. Therefore there arises the need to evolve techniques to stem the tide of these fraudulent practices. In fact most of these frauds are perpetuated under the watchful eyes of both Internal and External Auditors without their knowledge interrogating a vexed question of the capacity of the auditors and the application techniques the organizations are adopting. Uncovering and fighting these fraudulent activities and illicit financial flows requires information on how, where, who owns, controls or ultimately benefits from any business involved in potentially illegal activities in the bank: namely, the beneficial owners. Could the ineffectiveness in tackling this menace therefore be as a result of the lack of application of forensic accounting techniques in banks’ operations in Nigeria?It is in the light of the above that this study attempts to evaluate the extent to which Forensic Accounting techniques can help in the prevention and detection of fraudulent activities in the banking sector in Nigeria.

1.2. Objectives of the Study

- Anchored on fraudsters’ continuous development of skills to outwit both internal and external auditors and management, this study is to evaluate the probable effect of forensic accounting techniques on fraud prevention and detection in the banking sector in Nigeria. Specifically to:i. Ascertain the effect of commercial data mining technique (CDM) on fraud prevention and detection in commercial banks in Nigeria.ii. Ascertain the effect of the application of ratio analysis technique (RAS) in fraud prevention and detection in commercial banks in Nigeria.iii. How the application of trend analysis technique (TRD) prevents or detects fraud in commercial banks in Nigeria.

1.3. Research Question

- The research question for the study is to examine to what extent can forensic accounting techniques (commercial data mining, ratio analysis and trend analysis) detect or prevent fraudulent activities in the banks in Nigeria.i. To what extent can the application of commercial data mining technique (CDM) prevent or detect fraud in commercial banks in Nigerian.ii. To what extent can the application of ratio analysis technique (CDM) prevent or detect fraud in commercial banks in Nigerian.iii. To what extent can the application of trend analysis technique (CDM) prevent or detect fraud in commercial banks in Nigerian.

1.4. Research Hypotheses

- The research hypotheses are:HO1: The application of commercial data mining technique (CDM) has no significant effect on fraud prevention and detection in commercial banks in Nigerian.HO2: The application of ratio analysis (RAS) technique has no significant effect on fraud prevention and detection in commercial banks in Nigerian.H03: The application of trend (TRD) analysis technique has no significant effect on fraud prevention and detection in commercial banks in Nigerian.

2. Literature Review

2.1. Theoretical Framework

- Several attempts have been exerted on defining fraud. This is so because it evokes a visceral reaction in the society. It could be described as a trick with a purpose to obtain someone else assets. It thus involves deception, confidence and trickery. Fraud can thus be distilled into four basic elements of false representation of a material nature which is false, and or recklessly so but is believed and acted upon by the victim and the victim suffers damages resulting from his reliance thereon. This study is anchored on rational choice theory and the fraud deterrence cycle following the rational behaviour of man in satisfying his wants and the deterrence of management to stem the tide of individuals’ quest for illegal acquisitions.

2.1.1. Rational Choice Theories

- The Rational choice theories which were developed by Marcus Felson and Lawrence Cohen (1968) (cited by Felson & Clarke in [15] are applicable to employee fraud by combining elements of classical theory as well as economic theory in explaining the criminal behaviour of individuals. Human beings from a classical perspective are considered inherently reasonable and hedonistic who rationally evaluate the possible costs and benefits of a given act (Beccaria, 1764 cited by Hollinger & Davis [17]. Ordinarily people are tempted to take decisions that will avoid pain but with maximum amount of satisfaction notwithstanding breaking the law of the land (Bentham, 1789 cited by Hollinger & Davis [17].

2.1.2. Fraud Deterrence Cycle Theory

- Individuals may not often make distinction between the outrageous and the fraudulent or between bad judgment and wrong doing. A systematic and rigorous approach is essential to manage transactions from the prism of deterrence, discovery, investigation and remediation, [16]. Fraud deterrence cycle according to Golden, Skalak and Clayton [16] is an interactive process with four main elements of corporate governance, transaction level controls, retrospective examination of governance and control processes and investigation and remediation of suspected or alleged problems.

2.1.3. Fraud Triangle

- Classic fraud theory explains the reasons behind fraud as a triangle of perceived opportunity, perceived motivation and perceived rationalization. Edwin Sutherland in his book White Collar Crime in 1949 is credited to have coined the term and so he is seen as the initial contributor to the model. The fraud triangle theory was propounded by Cressy [7] in an attempt to understand what precipitates, inspire or motivates people to commit fraud or crime. Through extensive interview of fraudsters in prisons, he postulated that every fraud has three things in common – motivation or pressure, rationalization and opportunity to commit the crime. Fraud or crime will occur only when there is pressure of motivating factor on the fraudster. These factors may be extreme financial need, organizational action, entailed organizational rewards or punishment for individuals not meeting set targets. Notwithstanding the desire to commit fraud, without the second leg of the triangle – existence of opportunity, the fraud will not occur. There must therefore be a distinctive avenue or situation for the fraudster to gain access or control over the resources to be defrauded. These opportunity ranges from weak internal controls in the organization, absence of proper accountability and disproportionality between the perceived benefits of the fraud and the perceived costs of being detected and punished. According to the theory, although there may be pressure and opportunity to commit fraud, without rationalization fraud will not occur. Rationalization thus completes the precipitating factors that must be present for fraud to occur. Rationalization is self-justification for deviant act which involves justifying the crime under the circumstance by giving excuses why the action is necessary as perpetrators need a way to justify their actions as being acceptable or normal.

2.2. Conceptual Framework

2.2.1. Fraud and Its Classification

- The word Fraud has many definitions according to the circumstance. Fraud as a crime includes all the multifarious means that man invents to get an advantage over others by false representation. Fraud as a tort in the other hand is defined as a material representation by the defendant which is false and which was not actually believed by the defendant to be true and was made with the intent to be acted upon and indeed it was acted upon innocently by the compliant to his detriment. However, to the layperson, fraud is dishonesty in the form of an intentional deception or manipulation of material facts with clear intension to deceive by coercing people to act against their own best interests for the fraudster’s material gain.Fraud may be classified according to those committed against organizations or committed on behalf of the organizations. Employee fraud is a fraud where the victim of the fraud is the organization while financial statement fraud is fraud committed on behalf of the organization by making the financials of the organization look better than they actually are. Fraud may also be classified under occupational fraud taxonomy. Occupational fraud is the use of one’s position in the organization for personal enrichment through the deliberate misuse or misapplication of the organization’s resources or assets. This involves use of official resources for personal benefit. This ranges from asset misappropriation, corruption and fraudulent falsification of an organization’s financial statements. Occupational fraud classes include employee embezzlement, management fraud, investment scams, vendor fraud, customer fraud and miscellaneous frauds. The Association of Certified Fraud Examiners [2] defined Occupational fraud as "the use of one's occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization's resources or assets".

2.2.2. Forensic Accounting

- Forensic Accounting has been defined by many scholars according to their perspective of the subject matter. Whereas Zysman [43] defined forensic accounting as the integration of accounting, auditing and investigative skills, Joshi [20] defined forensic accounting as the application of specialized knowledge and specific skill to stumble up on the evidence of economic transaction. On the application of forensic accounting while Coenan [6] opined that it involves the application of accounting concepts and techniques to legal problem, Akintoye [3], Degboro and Olofinsola [8] and Singleton, Bologna, Singleton and Lindquist [38] opined that it involves with the relationship and application of financial facts to legal problems. Forensic accounting is also seen as the practice of utilizing accounting, auditing and investigative skills to assist in legal matters, Manning [22]; Murray [25]; Owojori & Asaolu [33].As the discipline is changing in response to the growing needs of corporations, so it is being redefined as the application of financial expertise and detailed examination and analysis of financial documents and records for use as evidence in a court of law, Howard & Sheetz [18]; Ramaswamy [34]; Sage Forensic Accounting [36] and Zysman [34].

2.2.3. Forensic Accounting Tools

- Among the tools employed by experts in the profession to carry out investigation, detailed examination, analysis and diagnosis of financial transactions with a view to giving expert advice include; Data mining, ratio/vertical and horizontal analysis and trend analysis.

2.2.3.1. Commercial Data Mining

- Data mining is the application of specialized software that looks for anomalies, patterns and correlations in databases to predict outcomes. It facilitates the extraction of hidden predictive information from large databases and has great potential to assist organizations identify trends, anomalies and other unusual activities thus allowing businesses to make proactive knowledge driven decisions. Data mining software are extremely helpful in detecting fraud as it has scripting capabilities and can search organizations’ databases for anomalies and suspicious patterns that are symptoms of fraud. Some of the commercial data mining software are Audit Command Language (ACL) and CaseWare IDEA.

2.2.3.2. Ratio Analysis

- Ratio analysis is the act of measuring the relationships among different financial statement items as well as between these items and nonfinancial data. While vertical analysis is a method of comparing elements of a financial statement with a common base item, horizontal analysis is used to understand the ratio of change in different financial statement items over a defined period. Ratio analysis as a forensic accounting technique is used to compare either on a historical basis, industry basis or against a defined benchmark. It identifies fraud therefore by examining the patterns of the data to highlight possible deceitful transactions. Vertical analysis in the other hand expresses financial statement numbers to percentages. The technique is very useful for fraud detection because percentages are easily understood by all and sundry. When vertical analysis is applied in analysing changes in income statement, gross sales are set at 100 per cent while all other amounts are converted to a percentage of sales. Horizontal analysis focuses on changes over period. While under ratios and vertical analysis, statements are converted to numbers that are easier to understand and the numbers are compared from period to period, under horizontal analysis, the changes in amounts from period to period are converted to percentages.

2.2.3.3. Trend Analysis

- Trend analysis is one of the important forensic accounting techniques that can be deployed to identify frauds. Emphasis is on focusing on the transactions which are exceptional in nature. It may be difficult to identify certain transactions from the current data but if the transactions current entries are compared with the previous year data entries they can easily be identified as fraudulent. By comparing sales and bad debts data over the years in an organization, it is easy to establish if the level of sales increases is at the same rate as bad debts increases. Under such scenario, it could be suspected that such bad debts are nothing but the product of fraudulent sales transactions or manipulations entered in the system to increase turnover. Such fraudulent manipulations could not be identified without the help of trend analysis over a defined period.

2.3. Empirical Review

- There are numerous researches carried out on impact of forensic accounting and fraud prevention and detection both in Nigeria and globally. In examining forensic accounting and financial Crimes, Izedonmi and Ibadin [19], looking at some basic and common financial crimes in corporate organizations in Nigeria revealed the motivations for financial crimes are built around some risk factors, such as incentive (or pressure), opportunity and rationalization surrounding the financial criminals. In the study that examined the application of forensic auditing in fraud control by analysing the trend of fraud cases, Zachariah, Masoyi, Ernest and Gabriel [41], recommended the employment of forensic auditing in Nigeria by amending the Audit Act to incorporate compulsory inclusion of forensic auditors in each audit team. In the study examining the level of forensic auditors’ ability to fulfil effectiveness in detecting, investigating and preventing fraud, Njanike, Dube and Mashayanye [28] found among other constraints, lack of technical capacity by auditors, lack of necessary resource materials, and management interference on audit assignments and non-recognition of the profession. Also on the need to enhance capacity, Okafor and Agbiogwu [29] in their study on the effect of forensic accounting skills on the management of fraud in banks in Nigeria highlighted the need to enhance accountants’ skills as it aids in the discharge of their duties. However, in their study, Enofe, Omagbon and Ehigiator [12] examined the impact of forensic audit on corporate fraud and concluded that frequent utilization of forensic audit services will significantly help in detecting, preventing and reducing incidences of fraud.Investigating the relative merits of engaging forensic accountants when drawing up an audit plan to effectively identify management fraud, Okoye and Gbegi [30] study revealed forensic accountants effectively modified the scope and nature of audit tests when the risk of management fraud was considered high by proposing special audit procedures. They recommended more training and the involvement of forensic accountants’ right from the planning stage of an audit when there is suspicion of management fraud risk. In investigating how forensic accounting services can prevent and manage fraud in Microfinance banks, Bassey [5] employed litigation support and forensic investigation services as independent proxies and the study revealed an active engagement of both litigation support and forensic investigation services by Microfinance banks drastically reducing fraud and playing a significant role in the prevention of crimes and corruption. In examining agreement amongst stakeholders on the effectiveness of forensic accounting in the control of financial fraud, qualities of financial reports and internal control, Modugu and Anyaduba [23] adopting a survey research method revealed significant agreement among the stakeholders on the effectiveness of forensic accounting in controlling fraudulent practices, improvement in the quality of financial reports as well as improvement in the quality of internal control procedures in the organizations. On his part Ejoh [10] investigated the impact of forensic accounting application in monitoring internal controls, detection and prevention of financial fraud in Nigeria. The study which employed survey research design and enlisted 150 accountants, auditors and top management staff revealed the application of forensic accounting techniques is effective and significant in fraud detection, prevention and in monitoring and evaluating internal controls.In investigating the role of forensic accounting in curtailing financial crimes, Enofe, Agbonkpolor and Edebiri [11] study revealed the dire need for forensic accountants in the banking sector in Nigeria as forensic accounting is an effective tool to addressing financial crimes. In its ability in combating fraudulent activities in the banking sector, Ezejiofor, Nwakoby and Okoye [14] study revealed that forensic accounting is an effective tool for handling financial crimes and ensuring corporate governance in the banking sector. Examining the relationship between fraud detection and forensic accounting services, Enofe, Okpako and Atube [13] found the application of forensic accounting services by organizations affected the level of fraud incidences in the organizations. Investigating the effect of forensic investigation methods on corporate fraud deterrence in Nigerian Banks, Onodi, Okafor and Onyali [31] adopting a survey research design method revealed among others the existence of a significant relationship between the forensic investigative methods and corporate fraud deterrence. But examining the impact of using forensic accounting on financial corruption, Albdullah, Alfadhl, Yahya and Rabi [4] adopting survey research method to gather respondents for the research revealed existence of significant relationship between forensic accounting methods and the effectiveness of audit firms in detecting financial corruption. In examining data mining framework for prevention and detection of financial statement fraud following the alarming proportion of reported financial statements frauds globally, Rajan and Nasib [35] proposed data mining framework for prevention and detection of fraudulent practices in financial statements whose features includes the various financial ratios measuring profitability, liquidity, safety and efficiency and also incorporating behavioural characteristics. Surveying data mining techniques used in fraud detection and prevention, Sheela and Sandip [37] stated that data mining is a powerful tool applied by many enterprises to enhance their operations and competitive advantage. They stated that although there are studies on data mining and various data mining techniques that can be used to detect and identify different types of fraud, this study arose due to little research that synthesizes various facets of fraud that uses the data mining technique. The study thus categorized fraud into four categorizes management fraud, customer fraud, network fraud and computer based fraud. In the study to explore the effectiveness of data mining classification techniques in detecting firms that issue fraudulent financial statements, Kirkos, Spathis and Manolopoulos [21] investigated the usefulness of decision tree, neural networks and Bayesian Belief Networks in the identification of fraudulent financial statement and found dependency between falsification and the ratio, debt to equity, net profit to total assets, sales to total assets, working capital to total assets and Z score under Bayesian model. The decision tree model revealed falsification of financial statements with distress. Investigating detection of financial fraud using data mining techniques, Monsa [24] revealed logistic regression model tool as the leading data mining tool employed by many organizations in detecting financial fraud.In a study on fraudulent activities and forensic accounting services of banks in Port Harcourt, Nigeria, Onuorah and Ebimobowei [32] employed a sample of (24) banks and analysed the data with the aid of least-squares, and Granger Causality. The study revealed a significant impact of forensic accounting applications on the level of fraudulent activities in the banks as forensic accounting services gives banks good mechanisms that help to detect these fraudulent activities.

3. Research Methodology

- The study is geared towards evaluating the application of forensic accounting techniques in fraud prevention and detection in the banking sector in Nigeria. The study sampled respondents from commercial banks operating in Cross River State, Nigeria. A survey design was adopted for the study. Its anonymity necessitated by the sensitive nature of the subject of this study allowed participants to make honest responses. The population of the study consisted of 170 senior and management staff of the 15 commercial banks branches in Cross Rivers State. They include accountants, auditors, IT specialists and economists. Using purposeful sampling, 150 out of the population of 170 were selected to participate in the study and 150 structured questionnaires were distributed. A five-point Likert scale (strongly agree – 5points, agree – 4points, undecided – 3points, disagree – 2points and strongly disagree – 1point) was used to grade the responses and logically reflect the degree of the ranking. The number of questionnaires distributed yielded 140 useful responses which were then used in the data analyses. Since this study is an opinionated research, the questionnaire instrument was structured to elicit responses from the research participants. The questionnaire was divided into two sections, A and B. Section A contained the demographic data of the respondents while section B contained critical belief questions that elicited responses on the impact of forensic accounting techniques in fraud prevention and detection. The instrument was designed so as to enable respondents choose from the five optional probable responses to each belief question.

3.1. Techniques of Data Analysis

- This study examined the extent of the application of forensic accounting techniques using proxies as commercial data mining technique, ratio analysis technique and trend analysis technique in detecting and preventing fraudulent activities in the banking sector in Nigeria using multiple regression analysis. This model is suitable because the research focus is on examining the relationship between forensic accounting techniques and fraud prevention and detection in Nigerian banks. All estimations were performed using SPSS 20.0 software.

3.2. Model Specification

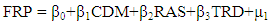

- The model specification used to examine the forensic accounting techniques as the determinants of fraud prevention is specified functionally as:Fraud prevention/detection = f (Forensic accounting technique) = FP = f (CDM, RAS, TRD)It is stated econometrically as:

Where: β0 = Unknown Constant term to be estimatedFRP = Fraud Prevention/Detection CDM = Commercial Data Mining Software techniqueRAS = Ratio Analysis techniqueTRD = Trend Analysis techniqueμ = Stochastic error term β1 – β3 = Unknown coefficients to be estimatedβ0, β1, β2, β3

Where: β0 = Unknown Constant term to be estimatedFRP = Fraud Prevention/Detection CDM = Commercial Data Mining Software techniqueRAS = Ratio Analysis techniqueTRD = Trend Analysis techniqueμ = Stochastic error term β1 – β3 = Unknown coefficients to be estimatedβ0, β1, β2, β3

3.2.1. A Priori Expectation

- This is a theoretical statement which expresses what a probable result analysis would be. In this study, it is assumed commercial data mining technique, ratio analysis technique and trend analysis technique are to be positively related to fraud detection and prevention. The coefficients of β1, β2, β3 > 0.

4. Data Presentation

4.1. Test of Hypotheses

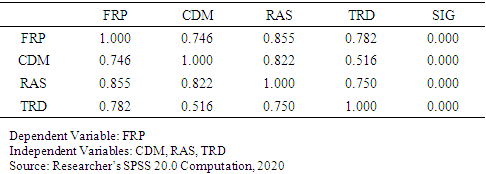

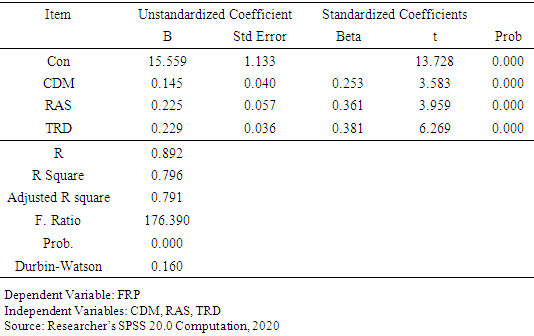

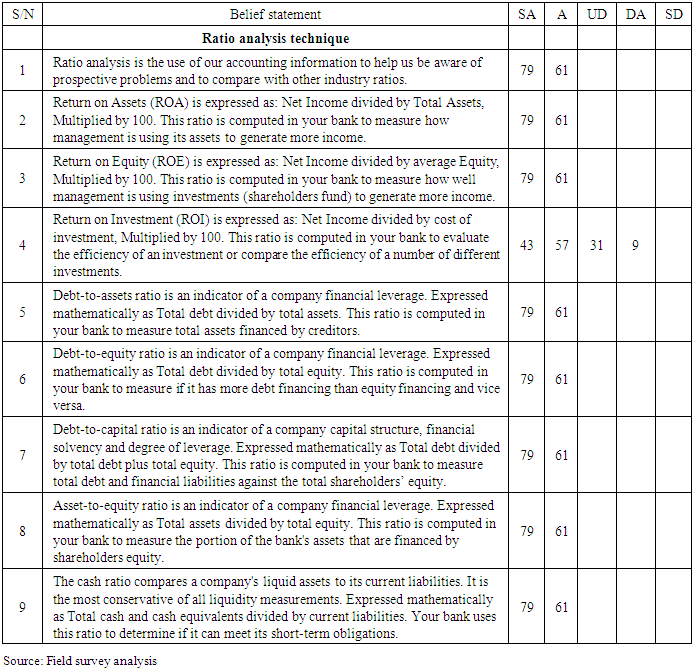

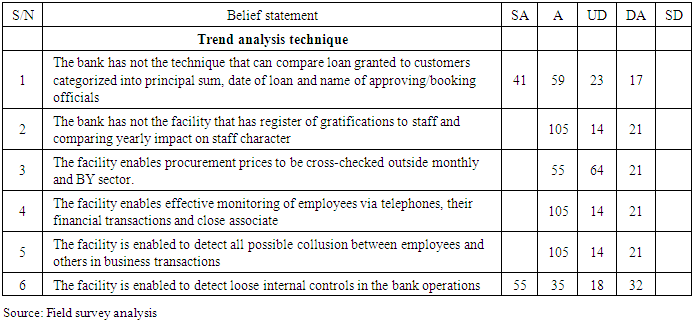

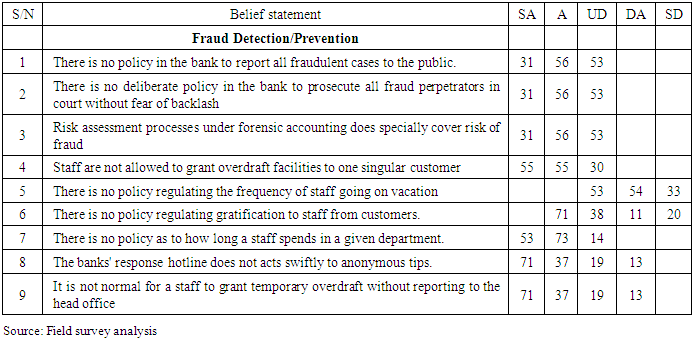

- Hypothesis 1:HO1: The application of commercial data mining technique (CDM) has no significant effect on fraud prevention and detection in commercial banks in Nigerian.HA1: The application of commercial data mining technique (CDM) has a significant effect on fraud prevention and detection in commercial banks in Nigerian.Decision rule: accept HO1 if probability of t-stats is greater than 0.05 else reject HO1. From our model we can see that CDM has a probability of 0.000 which is less than 0.05, therefore we reject the notion that the application of commercial data mining technique (CDM) by banks has no significant effect on fraud prevention and detection in the commercial banks in Nigerian rather accept that, the application of commercial data mining technique (CDM) has significant effect on fraud prevention and detection in the commercial banks operations. This implies that commercial data mining technique has a significant effect in preventing or detecting fraudulent activities in the banking system in Nigerian. This is in agreement with [24,35&37].Hypothesis 2:HO2: The application of ratio analysis (RAS) technique has no significant effect on fraud prevention and detection in commercial banks in Nigerian.HA2: The application of ratio analysis (RAS) technique has a significant effect on fraud prevention and detection in commercial banks in Nigerian.Decision rule: accept HO2 if probability of t-stats is greater than 0.05 else reject HO2. From our model we can see that ratio analysis technique has a probability of 0.000 which is less than 0.05. Arising from the result, the null hypothesis is rejected while the alternative hypothesis that ratio analysis technique has a significant effect on preventing and detecting fraudulent activities in the banking system in Nigeria is accepted.Hypothesis 3:H03: The application of trend (TRD) analysis technique has no significant effect on fraud prevention and detection in commercial banks in Nigerian.HA3: The application of trend (TRD) analysis technique has a significant effect on fraud prevention and detection in commercial banks in Nigerian.Decision rule: accept HO3 if probability of t-stats is greater than 0.05 else reject HO3. The model result shows a probability of 0.000 which is less than the test significance of 0.05. Arising from the result, the null hypothesis is hereby rejected while the alternate hypothesis that trend analysis technique has a significant effect in preventing and detecting fraudulent activities within the banking system is accepted.

5. Discussion of Findings

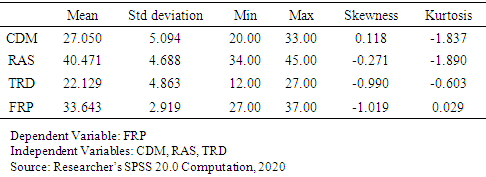

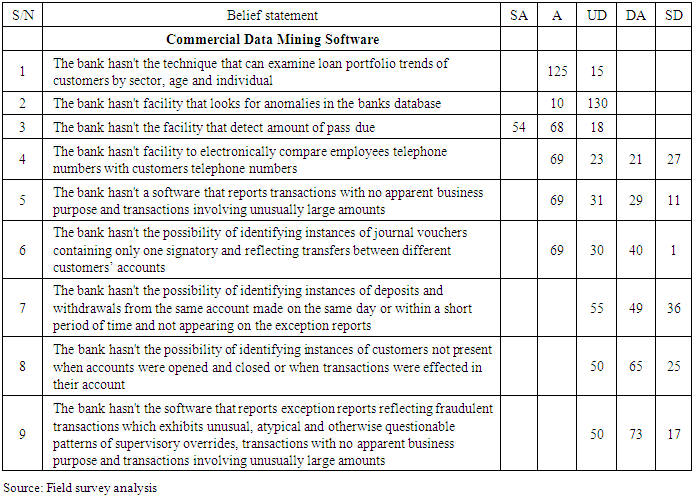

- The descriptive statistics in Table 2 shows that the mean response for the entire commercial data mining is 27.0500 which indicated that the average responses to the nine belief statements clustered around the undecided responses. This implies their lack of awareness of the functionality of data mining technique in detecting and preventing fraudulent activities in the banks. The standard deviation of 5.09383 is an indication of the degree of dispersion of the total responses from the mean response. The maximum and minimum values are 33.00 and 20.00 respectively.

|

|

|

5.1. Summary of Findings

- This study revealed that a significant relationship exists between forensic accounting techniques application and fraud detection and prevention as the three forensic accounting techniques investigated have positive relationship between with fraud detection and prevention in commercial banks in Nigeria. The study specifically showed that data mining software is a veritable in detecting and preventing fraudulent practices in the banking sector. Also, the study highlighted the importance of ratio analysis technique as it is also a veritable tool to detect and prevent fraudulent activities in the banking operations. Thirdly, the study showed the importance of trend analysis technique in detecting and preventing fraudulent practices.

5.2. Conclusions

- Arising from the analysis of participants’ responses, many bank staff are ignorant of what data mining software is all about and so they were on the fence in their responses to the belief questions put across to them. Also from the analysis of participants’ responses, there is limited awareness of trend analysis technique as a tool that can be employed to detect or prevent fraud in the system.

5.3. Recommendations

- In view of the observations and findings that the application of forensic accounting techniques have the potential to detect or prevent fraudulent practices in the banking system and the apparent weaknesses highlighted, we recommend as follows:1. All commercial banks as a regulatory policy should be mandated to install robust commercial data mining software in their internal audit units and Servers across the branches. Also as the banks embraces technology, there should be human capacity building through staff training in information technology system.2. Anonymous response hotline should be introduced in all the banks and extensive awareness put in place for the attention of the public.3. The data mining software should incorporate features that will capture independently from the branch management instances where deposits and withdrawals from same account are made on a given date to be used in cross checking the exception reports from branches on the subject matter. Also features that will capture exception reports reflecting fraudulent transactions with unusual questionable patterns of supervisory overrides or transactions with no apparent business purposes as well as instances where accounts are either opened or closed or transactions are effected in an account in the absence of the account holder.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML