-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(2): 31-41

doi:10.5923/j.ijfa.20200902.02

Deposit Money Banks Services and Economic Growth in Nigeria

Adebisi Adesola, Uket Ewa

Department of Accountancy, Cross River University of Technology, Calabar, Nigeria

Correspondence to: Uket Ewa, Department of Accountancy, Cross River University of Technology, Calabar, Nigeria.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study examined the impact of deposit money banks services on the growth of the Nigerian economy. The study was specifically meant to examine the impact of aggregate banks credits, aggregate banks deposits and effect of interest rates spread on the growth of the Nigerian economy. To achieve these objectives, Time series data were collected from the CBN statistical Bulletin using the desk survey method from 1984 to 2017. The data were analyzed using various econometrics techniques such as the descriptive statistics test, the augmented Dickey-Fuller (ADF) unit root test, correlation matrix, and Autoregressive Distributive Lag (ARDL) Model. Findings from the analysis showed that, there is an insignificant short and long run effects of aggregate banks credits on the growth of the Nigerian economy. It also revealed insignificant short and long-run effects of aggregate banks deposits on the growth of the Nigerian economy and furthermore, insignificant short and long-run effects of interest rates spread on the growth of the Nigerian economy. We recommend that deposit money banks should intensify efforts on deposits mobilization to enhance the availability of loanable funds for on-lending, as this will promote productivity of businesses and increase the economic growth of Nigeria and lastly, Interest rates should be set as low as possible to enhance and motivate investors to source for loans and depositors to increase their deposit for business expansion and growth in Nigeria.

Keywords: Credit, Deposit Money Banks, Economic Growth, Depositors

Cite this paper: Adebisi Adesola, Uket Ewa, Deposit Money Banks Services and Economic Growth in Nigeria, International Journal of Finance and Accounting , Vol. 9 No. 2, 2020, pp. 31-41. doi: 10.5923/j.ijfa.20200902.02.

Article Outline

1. Introduction

- One of the major functions performed by deposit money banks is granting of loans and advances to the productive sector for productive purposes. Loans could be defined as the amount extended out with a promise to repay both the principal and interest at a stipulated future date which may range from just a day to several years. Loans could be classified basically as short term, medium term or long-term loans depending on the maturity structure of the loan. Other functions performed by deposit money banks according to [12] are encouragement of savings, provision of capital needed for development, encouragement of trading activities through the use of cheques, encouragement of investment, provision of managerial advice to industrialists who do not engage the services of specialists and rendering financial advice. Deposit money banks are the most important institutions for savings mobilization and financial resource allocation. Consequently, these roles make them occupy important positions in economic growth and development. In performing this role, it must be realized that banks have the potential, scope and prospects for mobilizing financial resources and allocating them to productive investments. Therefore, no matter the sources of the generation of income or the economic policies of the country, deposit money banks would be interested in giving out loans and advances to their numerous customers bearing in mind, the three principles guiding their operations which are, profitability, liquidity and solvency, [13]. Most businesses in Nigeria have no access to banks’ credit due to poor accounting records, poor managerial skills, lack of credit worthiness and their inability to generate enough income to ensure loans repayment which is guaranteed at maturity date, so as to sustain a viable intermediation process. Nigerian government has recognized that one of the major weapons for reducing unemployment and poverty in the country is to stimulate the economy by supporting businesses through promotion of credits. This has resulted in the establishment and formulation of several credit schemes to guarantee the loans granted to businesses especially those in the priority sectors such as agriculture, manufacturing and export. Despite these schemes, there seems to be low access to credit by businesses in Nigeria, leading to low national productivity and massive unemployment. Equally, there are reported cases of bank charging arbitrary rate on loans, resulting in repayments problems and deterring businesses from accessing loans facilities by deposit money banks. In view of these, there are unanswered questions on whether banks credit has significant positive effect on the growth of national output in Nigeria. Furthermore, there abound many accusations that many banks are often not willing to release funds to these priority sectors since there are predominantly small-scale in nature. Instead, certain conditions such as high rate of interest, hidden bank charges and short repayment periods are introduced into their lending policies.The continuous dwindling naira value relative to other currencies and the high volatility of inflation rate has also hampered the ability of banks to grant credit. This is so, as the real value of money keeps falling thereby making the banking public to save less, the effect of this being the reduction in the volume of deposits and the loanable funds. Consequently, many business owners are unable to access funds for expansion and productivity. This in turn reduces the growth of the Nigerian economy. This study therefore, seeks to examine the effect of deposit money banks services on the growth of the Nigerian economy.

1.1. Objectives of the Study

- The broad objective of this study is to examine the effect of deposit money banks services on economic growth in Nigeria. The specific objectives of this study include: i. To assess the effect of aggregate banks credits on the growth of the Nigerian economy; ii. To examine the effect of interest rates spread on the growth of the Nigerian economy; To ascertain the effect of bank deposits on the growth of the Nigerian economy;

1.2. Research Questions

- Based on the above stated objectives, the following research questions were formulated: i. To what extent do aggregate banks credits affect the growth of the Nigerian economy? ii. What is the effect of interest rates spread on the growth of the Nigerian economy? To what extent do bank deposits affect the growth of the Nigerian economy?

1.3. Research Hypotheses

- The following research hypotheses were relevant for this study: HO1: Aggregate banks credits do not have any significant effect on the growth of the Nigerian economy; HO2: Interest rates spread do not have any significant effect on the growth of the Nigerian economy; HO3: Aggregate banks deposits do not have any significant effect on the growth of the Nigerian economy.

2. Literature Review

2.1. Theoretical Framework

- This study is anchored on the supply leading theory, the Wicksell theory of lending and economic growth. Other supporting theories were Robert Solow’s economic theory and the supply leading theory.

2.1.1. The Supply Led Finance Theory

- This theory was first developed by Patrick in 1966, and is based on the assumption that finance is the most important variable to real sector growth, [16]. Supply led finance theory is growth inducing or growth induced, which means finance is the most significant factor for promoting economic development. The theory held that the provision of funds by financial institutions through the extension of credit to businesses support the creation, transformation, expansion of industries and developmental projects thus enhancing the growth potentials of the economy. According to this view, the existence of financial sector as well as functioning financial intermediation in channeling the limited resources from surplus units to deficit units would provide efficient allocation of resources thereby, leading other economic sectors in the process. The supply led finance theory, emphasizes that finance and economic development are mutual and causal, meaning that finance and economic development have bidirectional causality.

2.1.2. Wicksell Theory of Lending And Economic Growth

- This theory was postulated by a Swedish economist called Knut Wicksell in 1901 with strong influence from the quantity theory of money. Wicksell based his theory on a comparison of the marginal product of capital with the cost of borrowing money, [22]. The theory by Wicksell therefore, took a monetary approach to economic growth. Wicksell argued that if the interest rate of borrowing money was below the natural rate of return on capital, entrepreneurs would borrow at the money rate to purchase capital goods, [23]. This would lead to increased demand for all types of resources and, in turn, their prices. Conversely, if the interest rate of borrowing money was above the natural rate of return on capital, entrepreneurs would sell the capital goods and hold money. This would lead to a lower demand for money and in turn the cost of borrowing. Wicksell connected the rate of interest with the production gap. The production gap represented the variance between what ought to be produced and what is produced. This theory is important to this study since it give a direct connection between the demand for and the cost of money and output in a country. It shows how interest rates affect borrowing, which in turn affects the purchase of capital goods and how production is affected. If interest rates are higher than the natural rate of return, borrowing will reduce therefore reducing economic growth as a result of low investment. On the contrary, if the rate of interest is lower than the natural rate of return, then more borrowing will take place and this will spur economic growth through more investment, [22].

2.1.3. Robert Solow Model of Growth

- This theory was suggested by Robert Solow in 1956. This is a model of long-run economic growth within the neoclassical economics framework. The model attempts to explain long-run economic growth means of capital accumulation, labour (population) growth, and the increases in productivity otherwise called technological progress. The Solow model has the following assumptions. First, it assumes that capital is subject to diminishing returns in a closed economy. Secondly, holding the stock of labour constant, the impact of the last unit of capital accumulated on output will always be less than the one before. Thirdly, given no technological progress or growth of the labour force, at some point the amount of new capital produced is only just enough to make up for the amount of existing capital lost due to depreciation. At this point there is no more economic growth, [17]. The Solow model added the component of changing technological context in order to reduce the effect of diminishing returns in the Cobb-Douglas model. The Solow model therefore suggested that production is a function of state of technology, supply of labour, and capital. The production function made technological progress equivalent to an increase in the effective supply of labour given the state of technology which grows not at the rate of population growth only, but at the rate equal to the sum of growth rate of population and productivity, [20]. This theory is relevant to this study in the following sense. First, the model approaches the level of economic growth from the output perspective just like in this research. Secondly, commercial loans are assumed to provide capital which is used to improve production in a country. The theory simply provides the connection between the capital, other factors of production and level of national output given the level of technology, [17].

2.2. Conceptual Framework

- Through assessing the literature review, the conceptual framework aiding the understanding of the connection between bank credit and economic growth was developed. The independent variables were majorly discussed in terms of bank aggregate credit, interest rate, inflation rate and aggregate bank deposit mobilization. The dependent variable is economic growth.Higher level of savings suggests that more money will be available with the banks for lending. Usually when the rate of savings increases, it serves as an incentive for people to save more, knowing fully well that their savings would earn them more income. Once this happens, the banks will in turn have sufficient loanable funds for businesses or investors. Availability of loanable funds with banks, holding lending rate constant leads to increase investment and economic growth.Higher interest rate makes the cost of borrowing funds expensive thereby impacting negatively on the level of economic activities. This is because households, firms and government often borrow money from banks and other institutions to finance their businesses. Similarly, high level of interest rate serves as signal for economic agents to save more money in return for better rewards, [5]. Also, low interest rates mean funds would be cheaper to borrow, and signals increasing investment. Firms usually source for funds to venture into investments in new factories, more efficient machines, raw materials, etc. expecting to earn more income from their investments. However, if the interest rate (cost of the loan) is greater than the expected return on investment, then it would not be economically plausible to undertake such investment and vice versa [4]. Thus, when interest rates are lower, firms are more likely to borrow and fund their operations resulting in economic growth.Higher inflation rate makes real value of money to fall resulting in a compensation demand by the providers of fund. If this happens, the cost of borrowing funds will also become expensive thereby impacting negatively on the credit demand by businesses and investors. This stiffens the economic activities of business units and by extension the national productivity of the economy.

2.2.1. Deposit Money Bank Loans

- In their work, [8] defined a loan as a written or oral agreement for a temporary transfer of a property, usually cash in cash form, from its owner called the lender to a borrower who promises to return it according to agreed terms. The terms involve interest, time of repayment and the pattern of the repayment. If the loan is a term loan, it is repayable when the lender demands for its repayment. If it is an instalment loan, the repayment will be based on the agreed monthly instalments. In case the lender requires a lump sum to be made at the end of the time agreed, then this type of loan is a time loan. Banks also classify their loans into categories such as, consumer loans, commercial loans, industrial loans, construction and mortgage loans, secured and unsecured loans, etc. In this study the adopted meaning of commercial bank loans is that used by [7] in which commercial bank loans were the sum of all the loans issued. Commercial bank loan is therefore any type of loan issued out to any type of borrower by a registered commercial bank in Nigeria. Credit is the extension of money from the lender to the borrower. Credit implies a promise by one party to obtain money or monies worth from another party with a view to refunding at a determined future date, [2]. Credit cannot be divorced from the banking sector as banks serve as a conduit for funds to be received in form of deposits from the surplus units of the economy and passed on to the deficit units who need funds for productive purposes. Banks are therefore debtors to the depositors of funds and creditors to the borrowers of funds. According to the Central Bank of Nigeria, the amount of loans and advances given by the banking sector to economic agents constitute bank credit, [6]. Credit is often accompanied with some collateral that helps to ensure the repayment of the loan in the event of default. Credit facility channels savings into investment thereby encouraging economic growth. Thus, the availability of credit allows the role of intermediation to be carried out, which is important for the growth of the economy.

2.2.2. Economic Growth

- The term economic growth is a term that is not easy to define, though it connotes changes in quantity. Economic growth can simply be defined as the sustained increase in the monetary value of the total output or productivity of an economy.Economic growth is simply defined as increase in a nation’s total wealth. However, this definition ignores the effect of the population on the wealth. It could be viewed as the continuous improvement in the capacity to satisfy the demand for goods and services, resulting from increased production scale, and improved productivity. This study assumes a statistically simplified definition of economic growth provided by [9] that economic growth is the process of increasing the sizes of national economies as indicated by macro-economic indicators especially the GDP per capita, in an ascendant but not necessarily linear direction.

2.3. Empirical Literature Review

- There are various related empirical studies carried out by various scholars in a view to establish the effect of bank services on economic growth. Presented here is a review of the summary of empirical literatures.In their research, [10] studied the relationship between bank credits and economic growth in Pakistan. The study modeled bank credit, inflation rate and lending rate on economic growth. The study employed the ordinary least square multiple regression technique. Findings showed that bank credit had a positive effect on economic growth in Pakistan. Also, inflation rate and lending rate had an insignificant effect on economic growth in Pakistan.In examining the effect of financial sector development on poverty reduction in Nigeria, [15] applied bank credit to the private sector, interest rate and money supply to measure financial sector development and per capita income to proxy poverty reduction. The error correction mechanism was applied to analyze the data collected for this study. It was showed that bank credit to the private sector had a significant effect on poverty reduction in Nigeria. Also, it was found that interest rate and inflation rate had insignificant effect on poverty reduction.In their work, [3] studied the effect of financial sector development on economic growth. Economic growth was proxied by gross domestic product growth rate and financial sector was measured using financial deepening variables. The Ordinary Least Square (OLS) technique was the method of data analysis. Findings showed that financial sector development had remarkable impacted on real sector growth. However, credit allocated to the private sector wields a significant impact while liquid liabilities and the size of financial intermediaries exert significant positive influence. In investigating how the financial and real sectors interact in Malaysia during the period 1986Q1 to 2011Q4, [18] adopted the ordinary least square approach and findings showed that real sector output has strong association with the banking sector and the banking sector is the major contributor to output growth.In examining the effect of financial deepening proxied by ratio of money supplied to GDP, ratio of credit to the private sector to GDP, money supply and interest rate spread on the growth of Nigeria Economy between 1981 and 2017 using Auto Regressive Distributed Lag Approach, [1] study found among others that there is neither significant long run relationship, nor short run causality among the proxies used to capture the exogenous and endogenous variables. It revealed the sorry state of Nigerian financial system development for the period under review.In their study, [14] assessing financial deepening on economic growth in Nigeria between 1992 and 2008 using the vector error correction technique found broad money velocity and stock market liquidity fostering economic growth. However, money stock diversification, economic volatility and market capitalization failed to promote growth.In his study [11], used ordinary least squared multiple regression to examine the effect of financial development on poverty reduction in Kenya. The study suggested that the causal link between financial sector development and poverty reduction is responsive to the choice of financial sector development index. In evaluating whether credit-view hypothesis holds in 11 OECD countries from 1987Q1 to 2003Q3, [19] applying co-integration tests revealed that the banking sector and real sector are related in the long-run in all countries. The Granger causality tests provided strong evidence of the credit-view hypothesis (i.e. banking sector lead real sector) in some countries while no causality between both sectors in other countries. Employing co-integration and vector error correction model (VECM) techniques to determine the link between bank lending, economic growth and manufacturing sector in Nigeria, [21] study revealed that manufacturing capacity utilization and bank lending rates significantly affect manufacturing output in Nigeria. This means that the growth of manufacturing output has not been enough to generate sizeable growth in the economy. The study has research gap in terms of not identifying relationship between manufacturing sector performance and economic growth in Nigeria.

3. Research Methodology

- Annual time series data were collected for the period 1986 to 2016 on Economic growth (Gross Domestic Product (GDP), Aggregate Bank Credit (ABCR), Aggregate Bank deposit (ABDP) and Interest Rate Spread (IRS). The desk survey method was used to extract the data on the variables from the data sources bearing in mind the study objectives and hypotheses. Gross Domestic Product, Bank Credit and Bank deposit are transformed into their natural log to ensure that their elasticities are duly captured and to control the robustness of the time series. Other variables were in their ratios and percentages and not transformed. Data used in this study was gotten from [6] Statistical Bulletin, Volume, 29, (2018).

3.1. Model Specification

- The structure suggested and adopted in this research is a version of the Wicksell (1901) theory of interest rate and economic growth. Wicksell argued that if the interest rate of borrowing money was below the natural rate of return on capital, entrepreneurs would borrow at the money rate to purchase capital goods. This would lead to increased demand for all types of resources and, in turn, result in output growth. Therefore, the relationship suggested by this theory can be expressed functionally thus:

| (1) |

| (2) |

4. Results and Discussions

4.1. Descriptive Statistics

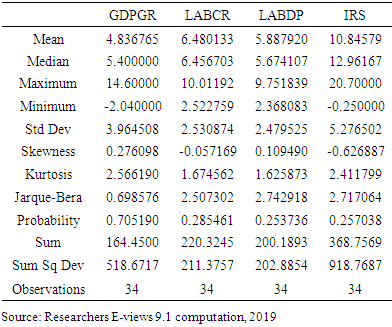

- Presented below is the descriptive statistics of the data set collected for this study. These data were keyed into the E-views statistical package which generated the result as presented in Table 1.

|

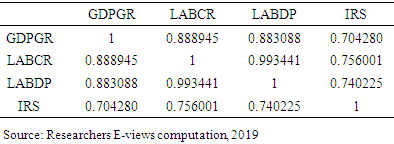

4.2. Correlation Matrix

- The correlation matrix was used to determine the relationship among the variables of this study. The result of the correlation matrix is presented in Table 2:

|

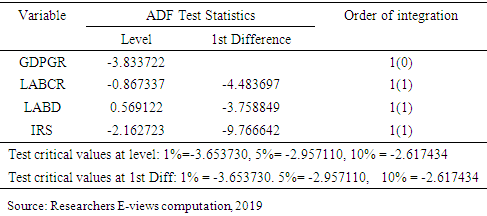

4.3. Unit Root Test

- In order to ascertain the appropriate ordinary least square model to use for the analysis, we conduct the Unit root test by checking for stationarity of individual variables in the study. This test was achieved through the Augmented Dickey Fuller approach, hereafter referred to as ADF. The result of the ADF is presented in Table 3.

|

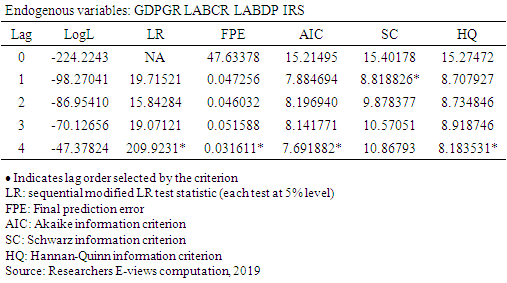

4.4. VAR Lag Order Selection Criteria

- In order to ascertain the appropriate lag length to use for the specification of our ARDL model, the VAR lag order selection criteria was applied. The result is presented in Table 4. From the table, most of the criteria showed that the lag four was the most suitable lag length for this.

|

|

|

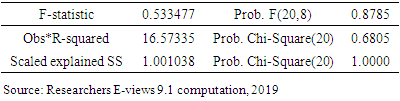

4.5. Test for Reliability of the Estimates

- In order to test whether the long run estimates of the results were reliable, the study applied Breusch-Godfrey serial correlation LM test, the normality test and the heteroskedasticity test.

|

|

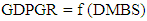

| Figures 1. Source: Researchers’ E-views 9.1 Computation, 2019 |

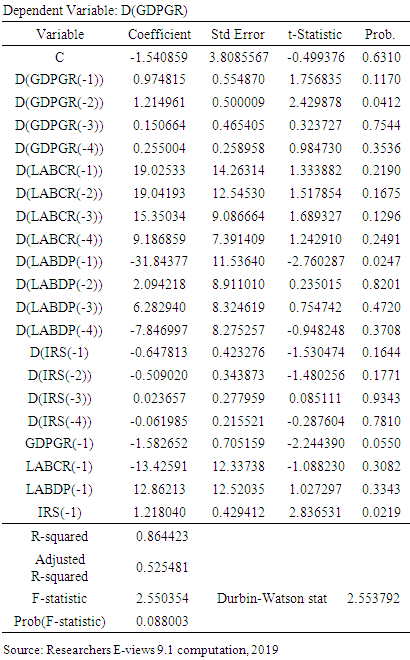

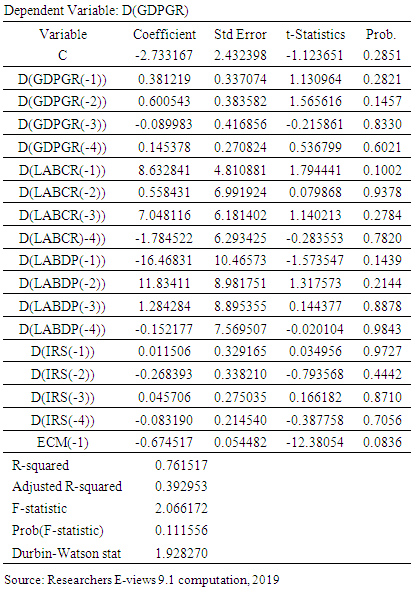

4.6. Short Run Dynamic Analysis

- Using ARDL approach, the study also assessed the short run dynamics of the estimates of the parameters as presented in Table 9:

|

|

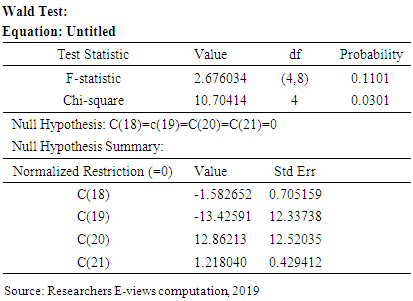

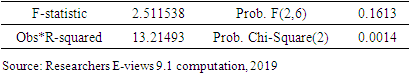

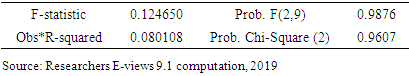

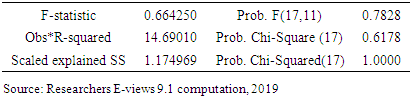

4.7. Test for Reliability of the Short Run Estimates

- In order to test whether the short run estimates of the results were reliable, the study applied Breusch-Godfrey serial correlation LM test, the normality test and the heteroskedasticity test.Extracts of the results of these tests are stated in Table 11:

|

|

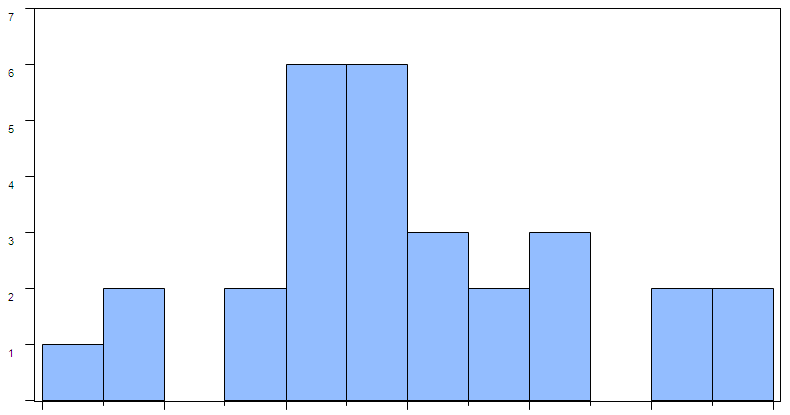

| Figure 2. Normality test (Source: Researchers’ E-views 9.1 computation, 2019) |

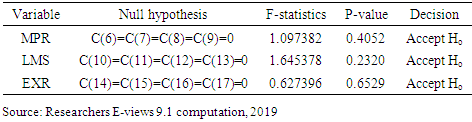

4.8. Test of Hypotheses

- Hypothesis oneHO1: Aggregate banks credits has no significant effect on the economic growth of Nigeria. H11: Aggregate banks credits has significant effect on the economic growth of Nigeria Decision Rule Accept H0: if calculated F-statistics value < Pesaran upper bound critical value Reject H0: if calculated F-statistics value > Pesaran upper bound critical value. From the regression result, Calculated F-statistics value = 1.097 Pesaran upper bound critical value = 4.01 Since the calculated F-statistics value of 1.097 is less than the Pesaran upper bound critical value of 4.01 at 5 per cent significant level, we accept the null hypothesis and reject the alternative hypothesis. It therefore means that aggregate banks credits do not have any significant effect on economic growth of Nigerian. Hypothesis twoHO2: Aggregate banks deposits have no significant effect on the economic growth of Nigeria. H12: Aggregate banks deposits have significant effect on economic growth of Nigeria. Decision rule Accept H0: if calculated F-statistics value < Pesaran upper bound critical value Reject H0: if calculated F-statistics value > Pesaran upper bound critical value. From the regression result, Calculated F-statistics value = 1.645 Pesaran upper bound critical value = 4.01 Since the calculated F-statistics value of 1.645 is less than the Pesaran upper bound critical value of 4.01 at 5 per cent level of significance, we accept the null hypothesis and reject the alternative hypothesis. It therefore means that aggregate banks deposits do not have any significant effect on the economic growth of Nigerian. Hypothesis threeHO3: Interest rates spread has no significant effect on economic growth of Nigeria. H13: Interest rates spread has a significant effect on economic growth of Nigeria. Decision rule Accept H0: if calculated F-statistics value < Pesaran upper bound critical value Reject H0: if calculated F-statistics value > Pesaran upper bound critical value. From the regression result, Calculated F-statistics value = 0.627 Pesaran upper bound critical value = 4.01 Since the calculated F-statistics value of 0.627 is less than Pesaran upper bound critical value of 4.01 at 5 per cent level of significance, we accept the null hypothesis and reject the alternative hypothesis. It therefore means that Interest rates spread do not have any significant effect on economic growth of Nigeria.

4.9. Discussion of Findings

- The result of the analysis of the data showed the insignificance of banks credit lending in stimulating the growth of the Nigerian economy which runs contrary to the various studies examined, (3,10,11,15 & 18). This is understandable as Nigeria has experienced a drastic drop in its manufacturing sector which is a major engine for borrowing due to multiple factors ranging from dearth and deplorable national infrastructures, cheap imported substitutes to unfavourable excise duty rate of imported raw materials as against excise duty rate on imported finished close substitutes. Many companies over the last three decades have folded up due to high cost of operations and presence of imported close substitutes that result in low patronage. Also, interest rate in Nigeria which runs in double digits is among the highest in the world and a disincentive to borrowing. While the rate of interest in countries in Europe, America and china ranges from 0.5 per cent to 3 per cent, in Nigeria it is on average 18 per cent. Nigeria land tenure system where most land is in the hands of the families, there is paucity of loanable collateral securities among rural farmers. This also inhibits bank credits as most farmers have no tangible and acceptable collateral to present as security to the banks.The dearth in bank deposits as revealed in the study is abysmal. This is due to the economic situation in the country which has eroded the middle class and most people operate on hand to mouth. This is evidenced in spite of the establishment of microfinance banks in the country, bank deposits are still very low.

5. Conclusions and Recommendations

- From our analysis, we found out that aggregate banks credits had a positive but insignificant relationship with economic growth in Nigeria. Again, aggregate banks deposits had an insignificant relationship with economic growth in Nigeria. Lastly, interest rates spread has an insignificant relationship with economic growth in Nigeria.Consequently, the study concluded that neither banks credits, banks deposits nor interest rates spreads play any significant role in enhancing the growth of the Nigerian economy and the welfare of its citizens. This is inconsistent with the work of Ijaiya and Abdulraheem (2000) which studied the relationship between bank credits and economic growth in Pakistan in which their findings revealed that bank credit had a positive effect on economic growth in Pakistan; but consistent with the study by [1] which examined the effect of financial deepening (proxied by ratio of money supplied to GDP, ratio of credit to the private sector to GDP, money supply and interest rate spread) on the growth of Nigeria Economy between 1981 and 2017 using Auto Regressive Distributed Lag Approach. The study found among others that there is neither significant long run relationship, nor short run causality among the proxies used to capture the exogenous and endogenous variables. It revealed the sorry state of Nigerian financial system development for the period under review.We therefore recommend as follows: i. Policies aimed at enhancing credit allocation to businesses should be implemented by the monetary authorities to boost the productivity of Nigeria, create jobs and reduce the poverty level in Nigeria. ii. Banks should intensify efforts to deposit mobilization to enhance the availability of loanable funds for on-lending as this will promote productivity of business and increase the per capita income of Nigerians. iii. Interest rates should be set as low as possible to motivate investors to source for loans and depositors to increase their deposit for business expansion and growth in Nigeria.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML