-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(2): 21-30

doi:10.5923/j.ijfa.20200902.01

Factors Affecting Perception of Taxpayers towards the Seriousness of Tax Evasion in Bale Robe Town Administration, Oromia, Ethiopia

Bijiga Gerba Kenno

College of Social Sciences and Humanities, Madda Walabu University, Bale Robe, Oromia, Ethiopia

Correspondence to: Bijiga Gerba Kenno, College of Social Sciences and Humanities, Madda Walabu University, Bale Robe, Oromia, Ethiopia.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The perception of Taxpayers towards the seriousness of tax evasion is influenced by several factors such as tax fairness and equity, probability of being audited, culture, and the understanding (perception) towards the government and taxation. Thus, the objective of this study is to investigate taxpayers’ perception on the seriousness of tax evasion in Bale-Robe Town Administration. The target population for this study incorporated tax authority and self-employed taxpayers of category “A”, category “B”, and category “C” in Bale Robe town administration. A total sample of 358 taxpayers was randomly taken from the total 4,160 taxpayers that have made registration. Tax officers were purposively selected by the researcher with the intention of collecting sufficient and relevant data for this study. This study has used both primary and secondary data. Primary data were gathered through structured questionnaire and interview with officers and taxpayers authorities. Secondary data were also collected by reviewing of related published and unpublished materials. It is indicated that tax evasion has been widely practiced in the study area. The result of the study revealed that tax evasion stemmed from lack knowledge about taxation, perceiving tax evasion as culture, trend of tax audit and the degree of detection, perceiving tax evasion as a minor crime and issues related to tax fairness and equity. Lastly, the findings of the study recommend tax authorities and policy makers continuously work hard in creating awareness and tax knowledge through the provision of trainings and education to taxpayers and improve unfairness and inequitable trends of tax payment. In doing this it is possible to reduce tax evasion and consequently raise the required tax revenue to foster the economic development of the region in particular and the country at large.

Keywords: Tax evasion, The Perception of Taxpayers, Tax System, Bale Robe Town

Cite this paper: Bijiga Gerba Kenno, Factors Affecting Perception of Taxpayers towards the Seriousness of Tax Evasion in Bale Robe Town Administration, Oromia, Ethiopia, International Journal of Finance and Accounting , Vol. 9 No. 2, 2020, pp. 21-30. doi: 10.5923/j.ijfa.20200902.01.

Article Outline

1. Introduction

- In developing countries, like Ethiopia, taxation is the best instrument which the governments use as a source of revenue. Since self-financing capacities are not often sufficient, revenue generation in the form of tax is highly important. Tax collection is carried out with the purpose of meeting the ever-expanding expenditure for the supply of public goods and services, that is, to finance the administrative machinery of the government and the fulfillment of basic infrastructures like roads, telecommunication, electricity and other basic social services such as education, health and water supply facilities [1].Being good citizens, taxpayers are obliged to perform their civic responsibilities. In this regard tax payment assumes a central position. The government demands taxpayers to report all incomes and payments of all taxes by fulfilling the provisions of laws, regulations, and court judgments [2]. Taxpayers are also required to fill their tax returns, declaring all taxable income accurately, and disbursing all payable taxes within the given pay period in normal circumstances [3].Many studies suggested many different reasons why taxpayers try to evade the amount of tax they have to pay. Some of the factors could be attributed to perceived level of tax fairness and equity, lack of provision of basic social services in turn for the amount tax paid, lack of transparency and prevalence of corruption, perceived level of Tax Law enforcement, perception on government spending and paying tax culture and habit [4], [5], [6] and [1].For the purpose of payments of business income tax, tax payers are categorized into three, namely category A, Category B, Category C based on the volume of their sales for a tax year and form of business. Category A taxpayer includes a body; any other person having an annual gross income Birr 1000,000 or more. Category “B” taxpayer includes being a person other than a body, having an annual gross income of Birr 500,000 or more but less than 1,000,000 [7]. These categories have the obligation to maintain records and books of accounts to be supported by appropriate vouchers and submit profit and loss statement for that tax year within the time prescribed in the Federal Income Tax Proclamation no. 286/2002. Category “C” includes a person other than a body having annual gross income of less than Birr 500,000 those taxpayers whose annual turnover is estimated by the Tax Authority at Birr 100,000 0r less [7] and [8]. A standard statement method is used to determine the income tax liability of category ‘C’ taxpayers, unlike aforementioned tax categories. Category ‘C’ of taxpayers is not required by the law to prepare financial statements for their transactions and their income is estimated by Tax Authority for tax payment at fixed rates. This makes it the most problematic categories of taxpayers and challenging to tax group [7].

1.1. Statement of Research Problem

- Tax evasion is defined as “a deliberate refusal of a taxpayer towards his/her tax obligation.” [9]. It includes income failure to record, cost overestimation, low-benefit announcements, and others. In process of tax evasion, while the amount of public services supplied by the government reduces, the amount of resources accumulated by the taxpayers increases. This leads to adverse impact on economic growth. In other word, tax evasion has negative effects on the entire economic system [10].Tax evasion is growing international and national concerns for tax authorities and public policy makers as it seriously threatens the capacity of government to raise public revenue particularly in developing countries like Ethiopia [11]. Due to a number of reasons taxpayers may not fulfill their obligations. In a situation where there are tax evaders tax revenue gap is created which means the difference between tax revenue which would be raised under hypothetical (as plan) and the actual amount of tax collected.In the Growth and Transformation Plan (2010), the Ministry of Finance and Economic Development pointed out that there was a plan of increasing tax to GDP ratio to 17% in the five years plan. However, the evidence obtained recently shows that the tax to GDP ratios has decreased. As cited in Muleye [12], the contribution of income taxes to the government’s total revenue to GDP was 12.2% which made it lower as compared to other African countries such as Rwanda (14.1%), Malawi (15.6%), Zambia (17%), and Kenya (17.7%). Tax mobilization and collection has not been carried out to the extents that the government demands in Ethiopia. This challenge call for thorough investigation toward identifying the root causes of the problem and uncovering some other obstacles overlooked yet.In fact researches have been conducted on national, regional and local level focusing on VAT in Ethiopia operating costs and compliance [13], assessing the gaps and problems between business community and tax authority in Dire [14], problem associated with Taxpayers and revenue authority in Dessie [15], and, tax payers perception on the seriousness of tax evasion in Dessie [12], factors affecting voluntary compliance of taxpayers’ attitudes in Arbaminch [16] and taxpayers’ knowledge and tax compliance in Tigray by [17]. The findings of these studies indicated that the reasons for the general low level government revenue may be different from one region to another. Study has not been undertaken on tax evasion environment and perception of taxpayers in Bale Robe town administration. Currently this town is not collecting enough taxes and people are not complying, the issue is to identify the root cause. Identification of the specific location factors and problems is indispensable to fill the gap. Thus, the first motive to conduct this study is to fill the research lacuna that were not addressed by any one of the earlier studies, particularly taxpayers’ perception on the seriousness of tax evasion in Bale Robe town. Hence the study aimed at to answer the following basic research questions at the end:-v What factors influence taxpayers to evade taxes in Bale Robe Townv What is the understanding level of the taxpayers themselves on the seriousness of tax evasion

1.2. Objective of the Study

- The general objective of this study was to investigate taxpayers’ perception on the seriousness of tax evasion in Bale-Robe Town Administration. This study also attempted to achieve the following specific objectives:Ø To examine factors that influence taxpayers to evade taxes in Bale Robe Town AdministrationØ To assess the understanding level of the taxpayers themselves on the seriousness of tax evasion

2. Review of Related Literature

- In this section basic concepts about tax evasion and factors that influence tax evasion are addressed. It is broadly classified into two major parts: theoretical and empirical.

2.1. Theoretical Review

- The challenge of tax evasion is as old as taxes themselves. Investigation and explanation of the seriousness of tax evasion and eventually, finding the appropriate mechanisms to alleviate it is of paramount importance for tax authorities and public policy makers as tax evasion seriously threatens the capacity of government to raise public revenue [18] and [11]. Studies have been carried out by focusing on tax evasion behavior and related problems as cited and discussed by Endashaw [19]. Tax evasion behavior (perception) of taxpayers in this regard is determined by a host of factors such tax knowledge, education, income, peers’ or other taxpayers’ influence, ethics, legal sanction, complexity, relationship with taxation authority, perceived fairness of the tax system, ethics and attitudes towards tax compliance, awareness of offences and penalties, and tax education, possibility of being audited and tax rate [3] and [20].Based on “Fischer's Model of tax compliance” some studies largely classified the aforementioned variables into four major factors [19], [21], [22] and [23] which include demographic factors, noncompliance opportunity factor, tax system/structure (institutional factors), attitude and peer influence (Social factor). The demographic factor incorporates age, gender, and education. Noncompliance opportunity factor includes tax rates and income level while (institutional factors) includes probability of detection and penalty. Social factor includes on equity and fairness of tax system and peer influence.

2.1.1. Demographic Factors

- Demographic factors such as age, gender and education have been studied by many scholars. Concerning the impact of age on tax evasion behavior of taxpayers, different studies concluded differently. As cited in [23], there is a negative relationship between tax compliance attitude and age. That is as the age of taxpayers increases, they become less compliant. Contrary to this, some findings postulate association between tax compliance attitude and age; older people are more compliant as cited in [19]. With regarding to the impact of gender, some studies [24] and [25] argued that female taxpayers are more compliant than male taxpayers while other suggested [26] and [20] gender has no significant impact on compliance attitude of taxpayers.It is clear that developing tax knowledge in taxpayers is an important element in operating a successful tax system. Knowledge as one of the factors in compliance is related to the taxpayers’ ability to understand taxation laws, and their willingness to comply [27]. The aspect of knowledge that relates to compliance is the general understanding about taxation regulations and information pertaining to the opportunity to evade tax. Attitude towards tax compliance can be improved through the enhancement of taxation knowledge [8]. In other words, taxpayers’ compliance behavior is affected by tax knowledge and perception. Tax knowledge has positive correlation with perceptions of fairness, tax ethics and attitudes to other’s tax evasion and perceptions of the fairness of the tax system increases as tax knowledge is enhanced. When a taxpayer has a positive attitude towards tax, this will reduce his or her inclination to evade tax payment [28].

2.1.2. Social Factors

- In the country where is no deep culture and habit of paying taxes the degree of tax evasion is high and consequently low revenue generation. In such country intentional or unintentional tax evasion is considered acceptable and commonly practiced among taxpayers. Many taxpayers might be willing to comply in full, but are unable to do so because they are not aware of, or do not understand, their full obligations. Those taxpayers understand their obligations, may not know how to meet them or may be unable to do so for other reasons. In the developing countries, like Ethiopia, where information access is no sufficient it would be futile to overlook lack of awareness rather it is can be taken as the major factor that determine tax compliance behavior. Taxpayers will readily accept any new system introduced if they have ample knowledge to understand the system [29]. Thus, creation of awareness would enhance taxpayers’ ability to understand the importance of tax on country’s economic development and increase their confidence in fulfilling their responsibilities as taxpayers [30].The taxpayers’ perception towards the seriousness of tax evasion may be influenced by their perception of fairness of tax system. As to James [31] a good tax system is designed based on appropriate set of principles, like equality or fairness and certainty. The most widely accepted criteria in determining a tax system is fairness [4]. Apparently, high tax rates increase the tax burden and hence, lower disposable income of the taxpayers. Taxpayers may think that they are paying too much in relation to their income and vis-à-vis others. In such situation they may develop unnecessary attitudes in their mind that their personal tax burden is unfair and choose to declare only part of their earnings. In other words, Lamessa [32] argued that because of lack of ability to pay various small business operators accumulate their annual tax obligation. Due to lack of enough disposable income taxpayers are compelled to consume the return from the sales and ultimately tax evasion becomes unavoidable and leads to tax arrears. This holds true for category ‘C’ taxpayers. On the other hand, unfairness of a tax system paves the way for the shift of tax burden from dishonest to honest taxpayers. And therefore, taxpayers should pay their tax liabilities on the basis of capacity to pay and the burden of tax should be distributed among individuals who do have such abilities.

2.1.3. Institutional Factors

- Organizational effectiveness of the tax authority has attracted the attention of many scholars in dealing with revenue generation. Regarding tax collection effectiveness, which refers to the ability of the Authority in establishing trustworthy tax system, law enforcement and fairness of a tax system, is indispensable. As stated in Bird and Oldman [6] tax Authorities are required to show aggressive attitude with regard to the correctness of the taxpayers’ actions. Some taxpayers may fail to record or make mistakes unintentionally, while others still cheat purposefully. Being reluctant to take corrective action on these errors and falsification may distort the whole structure because it may lead the diligent and honest taxpayers to careless and dishonest. This is to mean that tax administration should not only work on improving tax collection by taking necessary measures but also must protect who comply with tax law. Tax administration inefficiency is positively related to tax evasion due to the fact that lack of taxpayers respect for a tax system. The more the tax administration is inefficient, the presence of larger delinquency in tax payments and vice versa. In other words, in case tax authorities are perceived weak by the taxpayers the possibility of the occurrence of tax evasion is high. Thus, tax authority needs to be strong enough in order to implement the tax law effectively and efficiently. Tax assessment, collection, awareness creation, providing information and enforcement are the functions that should be performed effectively and efficiently by the Tax Authority for it indicates that it will be perceived as strong and powerful by the taxpayers.

2.1.4. Economic Factors

- Fjeldstad and Ranker [5], however, argued that improvement in tax administration efficiency alone is not enough. As stated in Due and Friedlaender [1] taxpayers’ attitude about the general level of tax system and increment in taxation is depended on attitudes towards the desirability of governmental programs on attitudes about the government itself. The local government’s capacity to provide services determines the citizen’s willingness to pay their tax liabilities. This may the case because public attitude taxation can be adversely affected when the government is highly corrupted and misappropriate the taxpayer’s money. Taxpayers should receive comparable social services in lieu of what they paid as tax and if the government used the money raised in the form of tax for non-public services, it will bring adverse effects. Thus, the government must be transparent to and honest for its citizens in respect to providing enough information about how it utilizes the taxpayers’ money. The effect of tax rate is another economic variable that affect tax evasion behavior of taxpayers. As noted in [33], “the increase in tax rate strengthens the incentive to report less income to compensate the reduced income”. It suggested that there a positive relationship between tax evasion and tax rate. Another study done [34], stated that “tax rates were negatively correlated with tax compliance”. Still another study [35] there is no relationship between tax compliance and tax rate.

2.2. Related Empirical Studies in Ethiopia

- Yohannis and Zerihun [14], in their study assessed the gaps and problems between the business community and tax authority of Dire Dawa. Their findings revealed that even though majority of the taxpayers had positive attitudes towards the general concepts of taxation, they were paying beyond their ability to pay and that they have no trust in the employees of the authority and in the overall tax estimation, assessment and collection procedures. Moreover, they argue, that the tax Authority of Dire Dawa City Administration was far from being effective in making the tax procedure objective, transparent and understandable to taxpayers. And therefore, as to them, improving working system and promoting transparency made by the tax authority would gradually develop trust in the minds of the taxpayers on tax system. A study conducted by Daniel [16], on factors affecting voluntary compliance of category ‘C’ taxpayers’ attitudes of Arba Minch. He find out that the major leading reason for the non-existence of voluntary compliance among category ‘C’ taxpayers was lack of awareness. Efficiency and effectiveness on the side of the Tax authority for the improvement of the tax assessment and collection procedures, creating awareness, enforcement of tax law have positive impacts on voluntary compliance of taxpayers while socio-cultural variables positively and negatively affect the attitudes of the taxpayers. Political factors, he argue, however, had nothing to do with the attitudes of taxpayers in his study area. In their article, Mesele and Tesfahun [15] identified problems associated with tax payers and revenue authority in Dessie Town. Result indicated that tax fairness and equity, organizational strength of the tax authority, awareness level of the taxpayers, cultural factors and provisional of social services by the government were the problems that the taxpayers were facing. On the other hands, tax authority were facing problems such as poor tax payers’ perception on the relevance of tax payment, taxpayers’ delaying in tax, declaration, starting business activity without trading license, and traditional mode of tax collection. Redae Berhe and Shailinder [17], jointly conducted a research on taxpayers’ views business taxation in Ethiopia focusing on Tigray Regional State. The objective of their study was t o obtain a comprehensive of overview of business income tax payers’ knowledge towards the tax law in Ethiopia in case of Tigray state. The result of their study showed that educated and younger people were engaged in business and self-employed in state. However, majority of business income tax payers did not know in which category they were categorized. Furthermore, this study indicated that due to lack of experience in business large number of taxpayers faced exposed to difficulties of preparing all the necessary documents for the purpose of their tax liability. Creation of awareness and building of tax payer’s knowledge was overlooked by the government and this became the challenges to the people to understand the tax system of the country and revenue generation in the region. Muleye [12], in his article investigated the tax evasion environment and attitudes of tax payers in case of Dessie town administration. By this study, he discovered that there was a deep rooted lack of paying tax ‘culture’ which became the largest obstacle to building a long-term base. The study further showed that a witting tax evasion was common and on increasing rate because of the fact that large number of the taxpayers perceived that tax evasion was a minor crime though they understood that it was their civic responsibility to pay their tax liability. In addition to the existing culture, it indicated that the seriousness of tax evasion in Dessie partly associated to perception of tax fairness, poor utilization of taxpayer’s money and lack of penalty.

3. Research Methodology

3.1. Data Sources and Collection Method

- Both primary and secondary data were used in this study. The primary data was gathered through questionnaires. The demographic of the respondents was first established in the questionnaire. Closed ended questions were included in it. Secondary data was also collected from official documents and records related to the issue under investigation; proclamation about taxes, policies and procedures of the taxes.

3.2. Sample Size and Technique

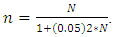

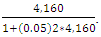

- The target population for this study incorporated tax authority and self-employed taxpayers of category “A”, category “B”, and category “C” in Bale Robe town administration, Oromia, who have made registration for the purpose. To select sample self-employed taxpayers, a sampling technique known as multi-stage was employed. Tax payers were first stratified into three strata according to their categories namely category “A”, category “B” and category “C”. The sample tax payers from each stratum were then selected through a proportional sampling method. According to Bale Robe town tax authority (2017), a total number of 4, 160 taxpayers were registered, of which 310, 262 and 3,588 were Category “A”, category “B” and category “C” respectively. From this 358 individual samples were drawn by using a simplest mathematical formula [36]

Where N=study population, n=sample size and e=error margin. It is assumed that the sample would have 95% reliability about population and a sampling error was 5%. Accordingly the total target population is 358 which derived from

Where N=study population, n=sample size and e=error margin. It is assumed that the sample would have 95% reliability about population and a sampling error was 5%. Accordingly the total target population is 358 which derived from  Sample size from each category of taxpayers was taken proportionally. Sample size from category ‘A’ was 27 (310x358/4160), category ‘B’ was 22 (262x358/4160), and category ‘C’ was 309 (3588x358/4160). A total 352 questionnaires were collected from the respondents, 6 questionnaires from category ‘C’ were remained uncollected. Bale Robe Town tax officials were purposively chosen for interview.

Sample size from each category of taxpayers was taken proportionally. Sample size from category ‘A’ was 27 (310x358/4160), category ‘B’ was 22 (262x358/4160), and category ‘C’ was 309 (3588x358/4160). A total 352 questionnaires were collected from the respondents, 6 questionnaires from category ‘C’ were remained uncollected. Bale Robe Town tax officials were purposively chosen for interview.3.3. Research Design

- The purpose of this study is to describe the perception of self-employed taxpayers about tax evasion environment in their town and their understanding on the extent of tax evasion. Therefore, descriptive research design was selected for this study.

3.4. Method of Analysis and Interpretation

- Data collected from primary and secondary sources were thoroughly and carefully crosschecked, analyzed and interpreted. That is, the raw data were processed by tabulating and classifying each response provided by the respondents. The data was analyzed, presented and interpreted using descriptive statistics method with table and percentage.

4. Results and Discussions

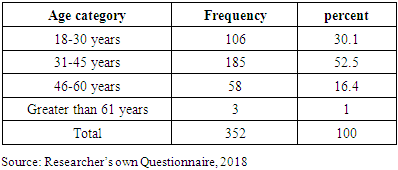

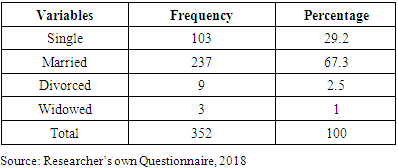

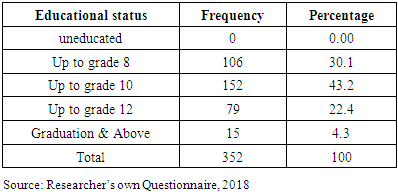

4.1. Demographic Characteristics of the Respondents

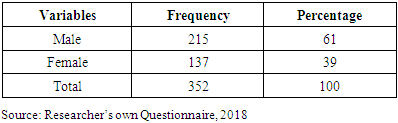

- Gender:In the sample of the study, both male and male genders were included. From the total sample of the study, the male gender had 61% while the female gender had contributed 39% of the respondents. From this percentage, it is possible to infer that there is a visible disparity vis-à-vis the genders’ participation in the business activity in the study area. This reveals perception of majority of the people that the main duty of female gender was limited to domestic work slightly remained to be significant since they are outnumbered by the male gender in engaging in business activities.

|

|

|

|

4.2. Taxpayers’ Knowledge about Taxation

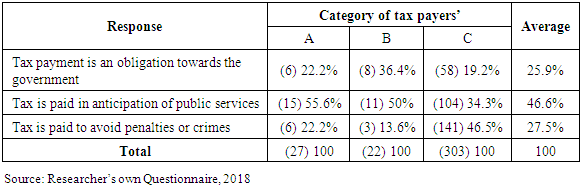

- The following table shows the response of the respondents regarding the reason why they pay taxes

|

4.3. Tax System and Tax Evasion Conditions in the Study Area

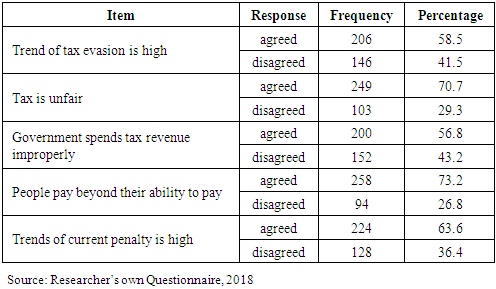

- Taxpayers’ perception about trends of tax evasion, fairness and equity of tax system, the government spending and penalty rate in relation to tax evasion may differ among the taxpayers and under this section this points will be seen as follows.

|

4.3.1. The Culture of Tax Evasion is High in Robe Town

- Research respondents were asked to respond to the prevalence or the extent of the culture of tax evasion in their town. In response to this question, 58.5% of the respondents agreed on the statement that ‘the trend of tax evasion is high while the remaining 41.5% of them disagreed with that. This result implies that most of the respondents unanimously agreed regarding the presence of trend of tax evasion in the study area. A tax related document obtained from Bale Robe Tax Revenue Authority office substantiates the result acquired from survey questionnaire with respect to the practice and inclination of taxpayers towards evading tax. This document consists of planned revenue and actual amount of taxes collected and the amount remained uncollected (variance) with its percentage for the last five years. This document does not tell us the reasons why the tax authority experienced high tax gap. However, based on the analysis made from respondents’ response and document, it is possible to conclude that tax evasion has been widely and commonly practiced in the study area.

4.3.2. Perception towards Tax Fairness

- As far as fairness of tax concerned, it is believed that tax levied is a fair tax and the taxpayers are treated equally in similar tax situations. Taxpayers’ perception towards the fairness of the tax has an impact on the tendency towards noncompliance. That means when taxpayers feel the tax is unfairly imposed; they will tend to evade paying taxes. Hence, tax evasion increased as considerable number of taxpayers considering taxes unfair. Regarding this issue, the respondents were requested to understand their perception about fairness. Hence, according to the taxpayers’ results in table 70.7% of the respondents agreed that tax is unfair 29.3% of the tax payers believed that it is fair. Hence from this finding we can conclude that majority of the respondents perceived that tax is not fair. This feeling of unfair tax system increases the propensity to evade. This finding is consistent with previous researchers that fair tax system is the significant variable which determine the perceptions of taxpayers. Also, the amount of taxes evaded increase when taxpayers perceived themselves to be victims of tax unfairness.

4.3.3. Taxpayers’ Perception towards Government Spending Tax Money

- As far as the perception of taxpayers on government spending, Fjelstad & Ranker (2003) discovered that taxpayers may develop positive or negative perception based on the state o affairs that government is spending tax revenue wisely and unwisely. If taxpayers perceive that the government is properly spending tax revenue for the purpose it is intended for, for instance, basic facilities such as public transportation, health, education and safety, then taxpayers will be increasingly likely feel faithful. Contrary to this, in the state of affairs that taxpayers believe government is spending the tax revenue poorly and badly, the taxpayers will be unfaithful and attempt to evade taxes. The respondents of the study area were asked to know their perception on government spending and its relation on tax evasion. In relation to this question, 56.8% of the respondents perceived that the government spends the money collected badly while 43.2% of the respondents agreed that the government used the tax revenue properly. The result obtained unanimously agreed with ideas that the manner that the government spends tax revenue affects the perception of the taxpayers negatively and positively. Tax evasion challenges that the tax authority of Robe town has been experiencing partly may be resulted from the negative perception that taxpayers had on improper utilization of money by the government.

4.3.4. Perception of the Taxpayers on the Amount of Tax They Pay

- It is the characteristic of good tax system to impose tax on the taxpayers based on the principle of equity. The taxpayers are generally required to pay tax on the basis of their ability and in relation to their earnings. If the taxpayers pay their tax liability according to their ability to pay, they may feel that they make equal sacrifice in the payment of taxes. If the taxpayers think that they pay tax too much in relation to their earnings, they may feel that they are exploited by the current tax system. In this state of affairs, tax evasion is likely to occur. As summarized in table 4.6, 73.2% of the respondents perceive that they are paying excessive amount of tax regardless of their ability, while 26.8% believe that they are paying tax in relation their earnings. From this one can understand that taxpayers are paying tax beyond their ability to pay which eventually compel them to believe evading tax is acceptable.

4.3.5. Perceived Level of Penalty Rate

- With respect to perceived level of penalty, the respondents were asked agree or disagree on the seriousness of the current penalty taken by the tax authority in case taxpayers fail to pay their tax liability. Hence, as it is indicated in table 4.6, majority (63.6%) of the respondents replied that the existing penalty is not high, 36.4% of the respondents agreed that the existing penalty is high. From this result, one can draw a conclusion that failure to pay tax is not considered as a serious issue among preponderant number of taxpayers. In case there is high penalty rate for such deeds the possibility to enforce the taxpayers to comply with the tax law is likely high. However, this finding has discovered that the severity of penalty imposed on any tax evasion is less likely serious which might have made the issue understudy a common practice in Bale Robe town.It is undeniable that tax law should be respected. However, it is difficult to believe here that law enforcement works always smoothly and positively. A study conducted in southern part of Ethiopia focusing on ‘factors affecting voluntary compliance of category ‘C’ taxpayers’ attitudes reveals this reality (Daniel & Shaik Abdul: 2017). They argued that “penalty or legal enforcement is not only the way out to ensure tax compliance”. This argument is to mean that the perception and attitudes that the taxpayers develop towards tax related punishment may have a significant relationship with a decision to avoid or evade tax. Taxpayers’ confidence towards the practiced system will cause taxpayers to lose their confidence. This eventually will lead to tax evasion.

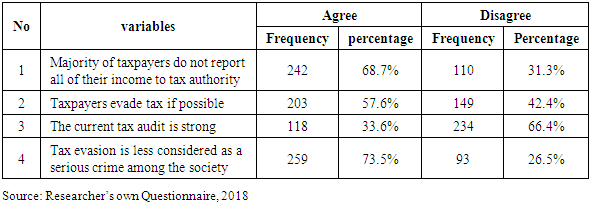

4.3.6. Taxpayers’ Understanding about Tax Evasion Condition in the Study Area

- Taxpayers’ understanding with regarding to tax evasion conditions is another important factor to be considered and analyzed duly. Accordingly, the respondents were requested for various questions to know their understanding about the tax evasion environment as summarized in the following table.

|

5. Conclusions and Recommendations

5.1. Conclusions

- The purpose of the present study is to assess the perception of taxpayers towards the seriousness of tax evasion in Bale Robe Town Administration. The results of this study add our understanding of the issue related to tax evasion environment and the perception of the taxpayers towards it in the selected area. Attempts have been made to identify the ‘underlying causes’ for the prevalence of tax evasion and these causes deep rooted in the perception of the taxpayers on tax system and related matters, and problems that taxpayers face in tax liability determination. People are engaging in tax evasion because they have no enough idea or awareness about taxation, there is a culture of tax evasion in the society, trend of tax audit and the degree of detection is not as such strong enough and eventually few people experienced penalty. Along with inefficiency and ineffectiveness on the side of tax authority to this, so many people perceive tax evasion as a minor crime. On the other hand this study has also discovered that taxpayers mainly category ‘C’ pay tax beyond their ability to pay. This might have developed a negative perception towards tax system in their minds. Hence, taxpayers’ tax evasion perception may depend on several factors such as tax fairness and equity, probability of being audited, culture, and the understanding (perception) towards the government and taxation.

5.2. Recommendations

- This study forwarded the following points as recommendations:v The perception of taxpayers on the seriousness of tax evasion plays a significant role in tax system. This perception might be negative or positive. To eradicate or minimize negative attitude, Bale Robe Tax Authority Office should continuously work hard in creating awareness and tax knowledge through the provision of trainings and education to taxpayers. Tax authority can aware taxpayers about the purpose tax collection has been made, how they are determining taxes and on what taxes are invested. Understanding all these concepts encourage taxpayers at least reduce their negative perception on tax and simultaneously increases the amount of tax to be paid.v This study has revealed that the current tax system is unfair and inequitable and, as a result taxpayers are evading taxes. Making tax system fair and equitable among taxpayers based on the income and ability of taxpayers as much as possible is recommendable here. A close follow up must be made to assess the income of the taxpayers and identify as they clearly report their income in order to make tax fair and equitable. This because by developing the minds of tax fairness and equity, taxpayers more likely prefer to share tax burden.v Bale Robe Tax Authority Office has to make its tax administration efficient. In order to create an efficient tax administration it must facilitate capacity building to its employee through education and training, computing and supporting the system's operations and allocating additional resources.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML