-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(1): 13-20

doi:10.5923/j.ijfa.20200901.03

Should the Power of Block Chain Technology be Included in International Reserves Held by the Central Banks? Case Study Ripples as One of the Cryptocurrencies

Settimba Muhamad , Wataba Pryor , Qiao Yue , Patrich Miguel Ajos

School of Economics, Shandong University, Jinan, PR China

Correspondence to: Wataba Pryor , School of Economics, Shandong University, Jinan, PR China.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Investigation on the role of the Monetary authority on the economic growth in Uganda from 1986-2016. Cryptocurrency urbanization has a theoretical measurement between Bitcoin and Ripples on Economic growth throw incorporations. We find that an exchange's transaction volume indicates whether or not it is likely to close. Less popular exchanges are more likely to be shut than popular ones. In the long-run analysis, the results confirm the direction of relationship from economic growth to fiscal consumption which defines causality from the service sector to economic growth.

Keywords: Block Chain Technology, Ripples, Investment proficiency, Central Bank

Cite this paper: Settimba Muhamad , Wataba Pryor , Qiao Yue , Patrich Miguel Ajos , Should the Power of Block Chain Technology be Included in International Reserves Held by the Central Banks? Case Study Ripples as One of the Cryptocurrencies, International Journal of Finance and Accounting , Vol. 9 No. 1, 2020, pp. 13-20. doi: 10.5923/j.ijfa.20200901.03.

Article Outline

1. Introduction

- International reserves are external assets held by the monetary authorities for conducting international transactions, intervention in the foreign currency market as well as maintaining confidence in the exchange rate (Cryptocurrencies et al.,,,,). These reserves should usually represent some claim on non-residents and be easily convertible to cash but do not necessarily have to be on a tangible asset (e.g. gold bullion). Besides providing the liquidity to engage in international transactions, (Lee,) also notes that since the 1997/98 East Asian Financial crisis there has also been a shift in the demand for foreign reserves beyond necessary transactional purposes. Countries have there been holding international Reserves as a means of providing a degree of self-insurance in likely hood that the economy is subjected to an economic shock hence allowing adjustments to occur on payment balances (Zhang,,,). It is also possible that by holding stocks of foreign exchange reserves above what is necessary for transactional purposes, countries can then finance a sudden stop and defend against a speculative attack. International reserves, therefore, allow a country to manage its not only domestic financial stability but also its exchange rate. In very open economic systems, currency mismatches can arise. If this mismatch impacts on confidence in the financial system, it could then lead to bank runs and capital flight. By acting as the lender of last resort, the central bank, through its holdings of international reserves can provide liquidity support to International reserves are external assets held by the monetary authorities for conducting international transactions, intervention in the foreign currency market as well as maintaining confidence in the exchange rate (Okedi,). These reserves should usually represent some claim on non-residents and be easily convertible to cash but do not necessarily have to be on a tangible asset (e.g. gold bullion). International reserves are external assets held by the monetary authorities for conducting international transactions, intervention in the foreign currency market as well as maintaining confidence in the exchange rate (Stephen, n.d.) These reserves should typically represent some claim on non-residents and be easily convertible to cash but do not necessarily have to be on a tangible asset. Liquidity engagement in foreign transactions, which also notes that since the 1997/98 East Africa financial crisis was a shift on demand for international reserves beyond the required transactional purposes. Holding foreign reserves in many countries provide the degree of self-issuance in an economy which allows adjustments to occur on the balance of payments (Winston et al.,). It is also possible that by holding stocks of foreign exchange reserves above what is necessary for transactional purposes, countries can then finance a sudden stop and defend against a speculative attack on the currency. International reserves, therefore, allow a country to manage its not only domestic financial stability but also its exchange rate (Obstfeld,). In very open commercial systems, currency mismatches can arise. If this mismatch impacts on confidence in the financial system, it could then lead to bank runs and capital flight. By acting as the lender of last resort, the central bank, through its holdings of international reserves, can provide liquidity support to banks faced with either scenario. For countries at risk of capital flight, reserve accumulation can enhance The Governor Bank of Uganda issued a statement warning the public about the practice of ‘One Coin Digital’ which claims to deal in a digital currency known as ‘One Coin’. The investor told his pastor that he was looking for more money to invest in this once in a lifetime opportunity(MAS & FSNWG,). Where the investor saw the possibility of a lifetime, his pastor foresaw danger, grave danger. Faced with excited investors, worried people and warnings from the Central Bank, one is right to ask the question: Is digital or cryptocurrency an opportunity or a scam?

2. Literature Review

- What is cryptocurrency? Most of the money in a modern monetary system is what’s called fiat money which has no intrinsic value but is used as a medium of exchange because a specific government deems to adapt its usage. The Uganda Shilling, the Euro, the US dollar are all examples of fiat money. As another form of transaction, Fiat currencies designed to exchange digital information through a process made possible on certain principles which in used to secure the transactions and to control the creation of new coins (Blomström, M., Fors, G., & Lipsey, n.d.)The first cryptocurrency to be created was Bitcoin in 2009. Today there are hundreds of other cryptocurrencies, often referred to as Altcoins. One has to understand that digital currencies represent two things in one whereby there is Innovation in payment systems and a new form of money. The supply of digital coins regulated by software and the agreement of users of the system and manipulated by any government, bank, organization or individual.2.1. Legality much as cryptocurrencies are legal in most countries of the world, and they are subject to restrictions and regulations. In some states, licensed financial institutions banned from handling the currency. Several countries prefer Bitcoin currency as a form of payment of real estates, and there are some other ways considered in a transaction where traders register through websites and the web site alerts when a buyer wants to trade (Maloumby-baka & Kingombe,). Direct trade engages both parties in negotiations and fulfilling the transaction if a deal is agreed. Exchange trades. Similar to a stock market, both the seller and buyer register with an online exchange. The exchanges act as an intermediary who holds everyone’s funds. You place an order stating the amount and type of currency you wish to sell, and the price per unit you want to sell. 2.2. Scams just like fiat money many traders refer to the coin as fake most traders don't know the genuinely used currency and the economic values and become a challenge to convince a trader on how he has duped (Bajo-Rubio,). The main features of digital currency scams are under commission agents due to pyramid setups whereby investors are promised high returns that are based on aggressiveness of recruiting new traders and the currency is centralized and buying or selling is controlled through a central web site or a series of websites which are in effect clones of a parent website while genuine cryptocurrencies are decentralized.2.3. Causes of the high transaction costs of remittances to and within AfricaAfrican countries experience high costs on transactions of different currencies which due to underdeveloped financial and payment in infrastructures within rural areas which contribute to the keeping remittance cost so high since money transacted may not circulate that makes inefficient remittance services (Graham, n.d.) Ineffective remittance services result in social fees for remittance senders and receivers, as the former may not have easy access to remittance service providers, and the latter may not be able to collect the funds transferred promptly. Relates to the underdeveloped financial system in Africa, as witnessed by its under-banking. The consequence of this will be the limited use of the financial services, which contributes to increasing remittance such an underuse of the existing formal economic infrastructures will result in a lack of transparency in the market and a lack of competition (Graf Von Der Schulenburg et al.,). The lack of transparency by agents is the most important factor explaining high remittance prices, because it gives no chance to remitters to compare. This is a big issue for Somalia in particular but in many other developing countries MoneyGram that in SSA control 2/3 of the market, are unchallenged and free to impose their own –usually high –prices (Aggawal, G,). Furthermore, some African put in more exclusivity arrangements that limit the institutions authorized to offer remittance other causes of the high prices of payments include exclusive partnerships between banks and MTO. However, there have been initiatives in recent years to end these agreements. Also, the anti-money laundering and combating the financing of terrorism (AML-CFT) regulations have contributed to this, although there have been initiatives in recent years to simplify AML-CFT rules for low-value transfers. Elimination of clauses to open market competition happened in Morocco and Senegal, the remittance price reduction, depends on different ways on control of the currency so crucial that some countries are now considering retiring their fiat currency to introduce national digital currency (Arcand,). Ignoring cryptocurrencies is not a wise course of action. A country that shuns cryptocurrencies may soon find it costly to participate in international trade. Investing in cryptocurrency transaction and awareness should be adopted by Uganda, which could ease the operation in the country. Such regulations would also allow the state to earn capital gains tax from people who invest or deal in cryptocurrencies (Scandizzo, P. L., P. B. R. Hazell,). The Bank of Uganda published and advised citizens on how the currency is under scrutiny which communication could make clients stay in fear of investment in a hallmark of the pyramid scheme concept. One coin also teases significant financial gains for those who can recruit others to invest, which characteristic that has sparked criticism and accusations of being a scam (Aggawal, G,). The warning represents the latest scrutiny directed toward one coin, which has drawn regulators across Europe, also sparking an investigation by police in London. By being the first cryptocurrency storing documents in its new block chain and a new set of standard arises which move even comes as regulators and academics in Uganda who have set for developing virtual currency regulations.

3. Proposed Methodology

- The study employs two approaches to assess the viability of including Bitcoin in the international reserves portfolio of the Central Bank of Barbados. The first approach is a counterfactual simulation where it assumes that a fixed proportion of the Central Bank's collection of foreign currency balances invested in Bitcoin (Aggawal, G, 2006). The actual exchange rate changes are then applied to the portfolio to compare the simulated relative to the actual outcome. This assessment provides an assessment of the potential differences in volatility and returns that could have resulted from investments in Bitcoin. Relatively small investment ratios of 0.01, 0.1, and 1 per cent considered, and for comparison purposes, a scenario where five per cent of the reserves invested in Bitcoin believed. In the second approach, Monte Carlo methods to investigate the effects of randomly generated shocks on developing countries' portfolio of international assets over various forecasted time horizons (Schulenburg et al.). The likelihood that the stock of global reserve assets is exhausted in a given year of the simulation period then calculated over 5000 model iterations.

3.1. Cryptocurrencies as Part of the International Reserves

- Counterfactual simulations done over the period 2009 to present suggests that adding Bitcoin to the reserve portfolio of the central bank would not significantly increase volatility but could provide opportunities to offset exchange rate depreciation against major currencies such as the Pound and the Euro. Data Description and Proposed Methodology, the proposed study comprises the data of developing and emerging countries from 2000 to 2015 (Hurlburt & Bojanova,). Percentage of net Crypto Currency and the dependent variable and the data of prescribed variables are to be discovered by world development indicators World Bank have taken from World Development Indicators. Data of terrorism activities w take from World Bank), the capital flight data will be calculated by using one coin analysis constant, as 100% of the transaction when accepting bitcoins, unlike using credit cards done by for the case of 37 African developing countries (Blundell,). Total investments calculated by taking the first difference of gross fixed capital formation.The data of other economic indicators calculated from IMF's balance of payment statistics, direction of trade statistics, international financial statistics (IFS), the World Bank development indicators (WDI) and global development finance (Bank,).

3.2. Cryptocurrencies as Part of the International Reserves

- Counterfactual simulations done over the period 2009 to present suggests that adding Bitcoin to the reserve portfolio of the central bank would not significantly increase volatility but could provide opportunities to offset exchange rate depreciation against 14 major currencies such as the Pound and the Euro (Davis,) Assumption of figures in fixed amount of reserves held in balances denominated in a particular currency at the beginning of the period affected by exchange rate changes.

4. Theoretical Model

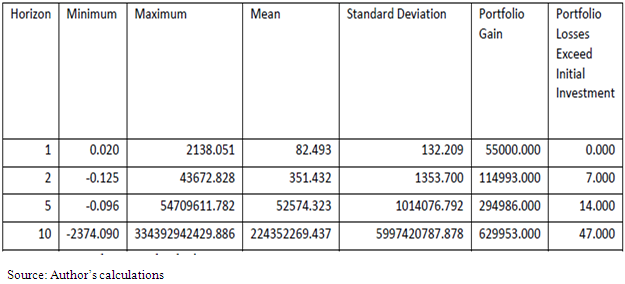

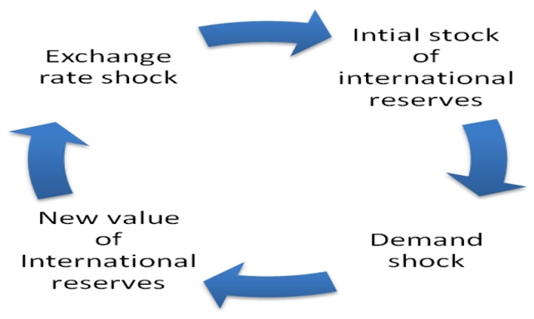

- As for the observations we could use some approaches, Monte Carlo methods to investigate the effects of randomly generated shocks on Developing countries’ portfolio of international assets over various forecasted time horizons (Hurlburt & Bojanova,). The likelihood that the stock of foreign reserve assets is exhausted in a given year of the simulation period calculated over 5000 model iterations. International reserves at the end of each period influenced by demand-side shocks, exchange rate shocks and the initial stock of foreign reserves (Figure 1). In each year of the simulation, the projected demand for imports and international payments is set equal to last period's reserves, plus randomly generated amounts and exchange rate shocks. The mean and standard deviation of these shocks are set equal to their historical value for the period (Moore & Christin, 2013). The steps in the simulation set to one month, and a single run performed for 1-, 2-, 5- and 10-year horizons. The analysis replicated 5,000 times, and summary statistics presented.

| Figure 1 |

4.1. Empirical Evidence

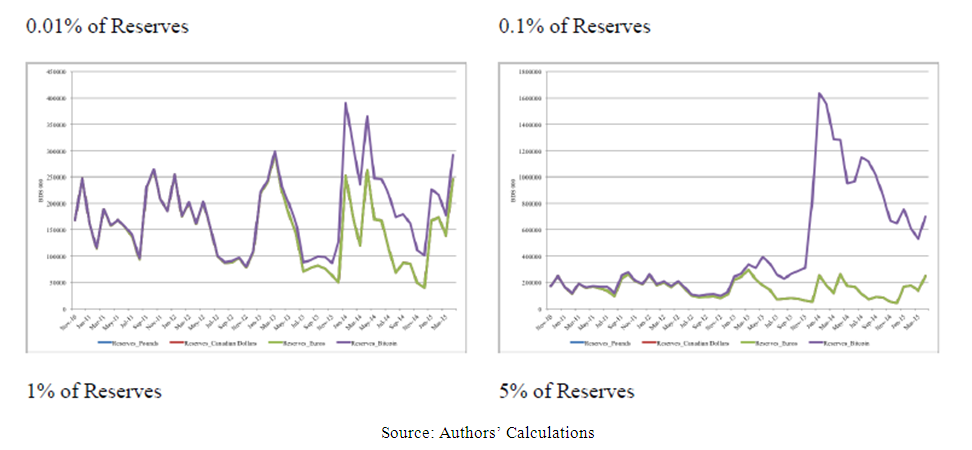

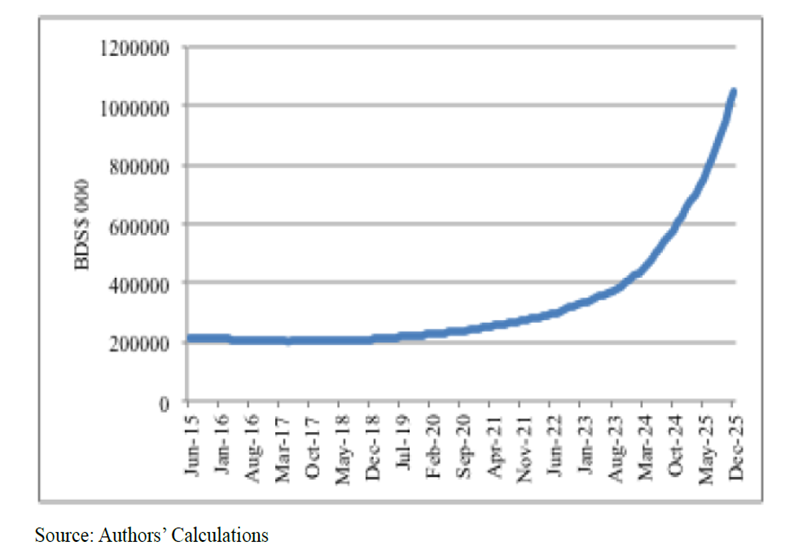

- An emerging digital instrument referred to as even cheaper than cell phones, that is the crypto-currency Bitcoin (payment system) made possible by the Internet. Being an innovative peer to- peer online payment system based on cryptography that conceptually was introduced in 2008 in a white paper with the network launched in 2009. But it was only through the first Angel investment in 2011 that more started to pay attention, with thousands of merchants all over the world adopting it in 2012. Believed to be able to revolutionize the remittances market worldwide, in terms of reducing remittance transaction costs drastically. Generally asserted that because transactions are performed amongst users directly, that is, without the need of banks or any other financial intermediary in an entirely decentralized way, transfer fees will be significantly lower(Moore & Christin,). Because users and volunteer developers keep track of transactions and update the records of transactions in real-time. It is worth highlighting that no single user, company or central authority, but all the Bitcoin network is in charge of keeping track of such transactions and updating their records. "The records of all confirmed transactions kept on a shared public ledger — that is, a big publicly available spreadsheet — known as the block chain that is visible to anyone and has, at least so far, proven impossible to tamper. The block chain doesn't work without the Bitcoin. They are the same thing. It is possible to build applications on top of that technology but not take Bitcoins away. However, venture investors are increasingly talking about the value of this type of distributed ledger system as a basis for all kinds of applications, not just currency. The block chain, whose performance and integrity are enforced with Cryptography to ensure validation of transactions, allows Bitcoin wallets to know what their balance is and to make new transactions by the spender (Bank,). One coin speed transaction analysis has its traditional transfer instruments globally, and users can claim the same digital dollar, as in the case of fraud. "Hence, this infant technology could change the financial system (Bank,). It could reduce the cost and increase in the speed and accuracy of financial transactions; it could truly disrupt the banking business. Or it could fizzle. But already it is raising a host of policy questions – about financial stability, consumer protection, choking off terrorists' finances, and tensions between established and upstart financial institutions and between regulatory agencies”. For diaspora communities who provide critical aid and capital flows to developing countries, the technology of a distributed ledger can drastically reduce the time and costs to send money overseas. Equity-based incubators invest early and feed into angels, who in turn feed into Venture Capitalists. They all build up a stake in the company, which they hope will exit one day and return the money. In general, portfolios denominated in Pounds, Canadian Dollars and Euros all pretty much follow a similar pattern. This result is not surprising given that most major currencies revert to the purchasing power parity equilibrium against the US dollar (Moore & Christin,). They are assuming that 0.01 per cent of reserves invested in Bitcoin or any of the other three significant currencies held by the Central Bank of Barbados from November 2010 to April 2015 (Figure 3), suggests that the volatility of reserves would have been quite similar over the period. However, the one coin reserves at the end of April 2015 would have been $291,926, more than 20 per cent greater than had these seem funds held in balances of any of the other major currencies.

| Graph 1. Counter Factual simulation with different portfolio holdings in One Coin |

|

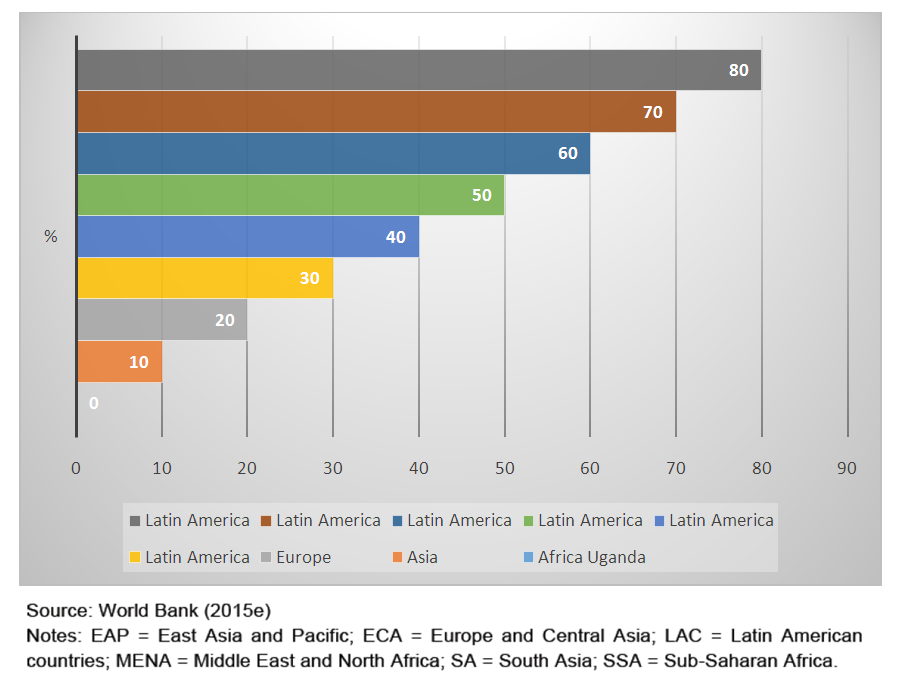

| Figure A.1. Average total costs (%) of remittances by regions |

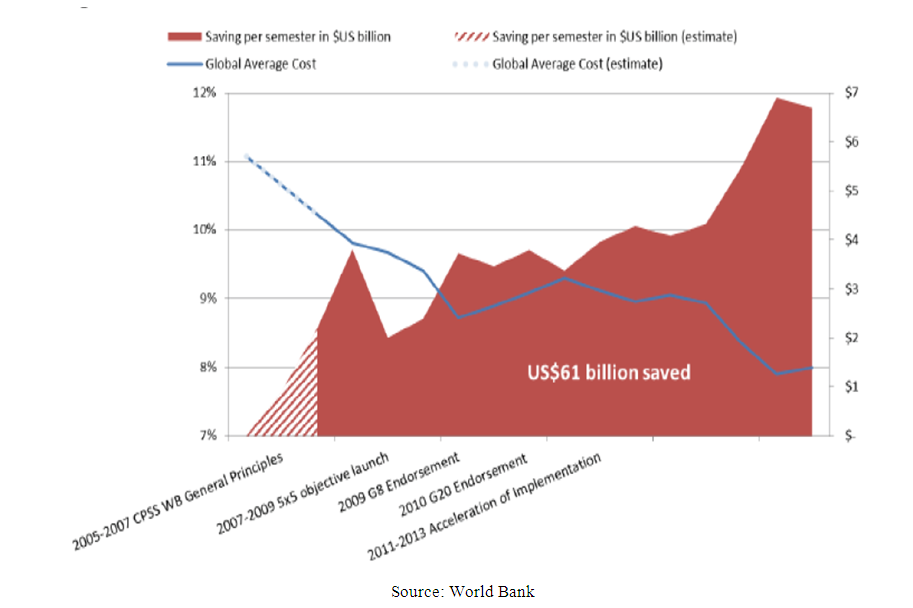

| Figure A.2. Global trends in remittance costs, global policy actions and related Savings |

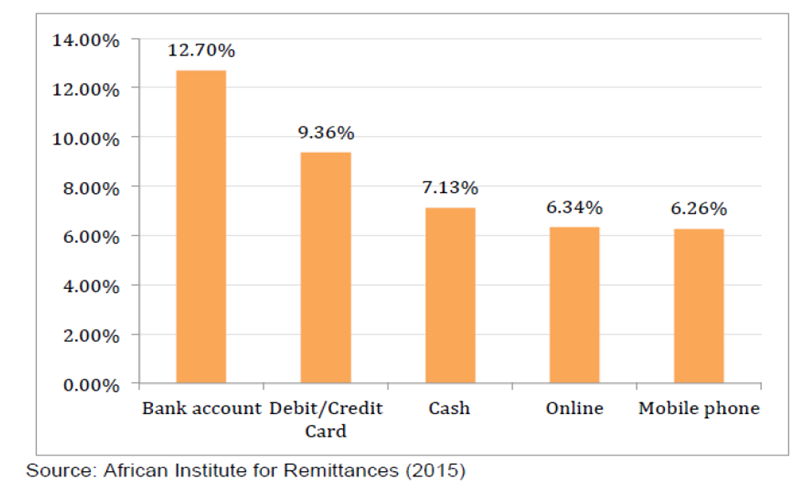

| Figure A.3. Total average cost (%) for remitting to and with Africa by the main formal channels |

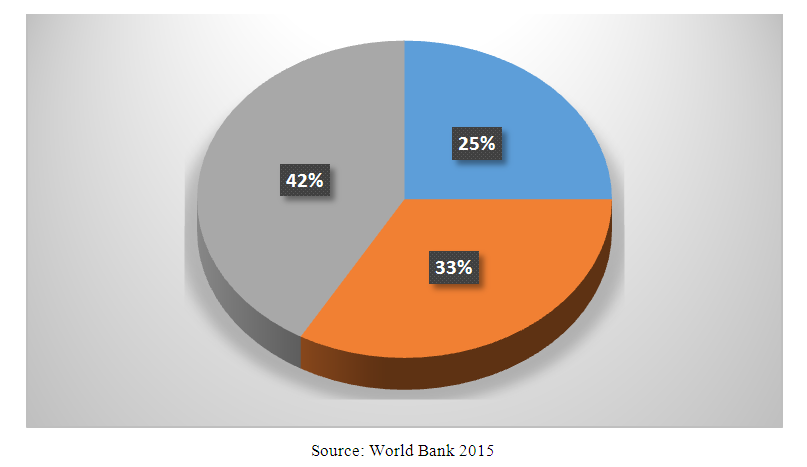

| Figure A.4. Total average cost (%) for remitting worldwide by RSP type |

| Graph 2. Fore casted foreign Exchange balances with 0.01% one coin portfolio |

5. Conclusions and Policy Implications

- Adoption of cryptocurrency would be a potential benefit of those holding Bitcoins as part of the portfolio of the international reserves using the case of Barbados in recent years the proportion of digital transactions done using digital currencies has grown significantly. As a result. Also, the value appreciation of Bitcoin portfolio would have generated a significant return for the Bank. However, the paper notes that as the proportion of reserves held in Bitcoin rises, the volatility of reserves would also increase. The proportion in a transaction usually not exceed 10 per cent of all sales in a short run so recommended that Bitcoin incorporates into the portfolio of foreign balances of the Central Banks, that its share should be relatively small. Generally, the result of this study suggests that increasing adoption of Bitcoin and ripples under cryptocurrency can influence income generation in the young age through central Banks. Future research works should pay attention to the present empirical evidence in the study area to investigate issues, which have not been addressed by this research. Moreover, it will be better if future research works study the problem using panel data analysis.Bitcoin has enjoyed wider adoption than any previous crypto- currency; yet its success has also attracted the attention of fraudsters who have taken advantage of operational insecurity and transaction irreversibility. We study the risk investor’s face from Bitcoin exchanges, which convert between Bitcoins and hard currency. We examined the track record of 40 Bitcoin exchanges established over the past three years, and find that 18 have since closed, with customer account balances often wiped out. Fraudsters are sometimes to blame, but not always. Use of proportional hazard we find that an exchange's transaction volume indicates whether or not it is likely to close. Less popular exchanges are more likely to be shut than popular ones. We also present a logistics show down that confirms popular exchanges are more likely to suffer a security breach.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML