-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(1): 7-12

doi:10.5923/j.ijfa.20200901.02

Analysis of Financial Intermediation Activities on Economic Growth in Nigeria-Vector Error Correction Model Approach

Alimi A. A., Adeoye M. A.

Department of Management and Accounting, Faculty of Management Sciences, Ladoke Akintola University of Technology, Oyo State, Nigeria

Correspondence to: Alimi A. A., Department of Management and Accounting, Faculty of Management Sciences, Ladoke Akintola University of Technology, Oyo State, Nigeria.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

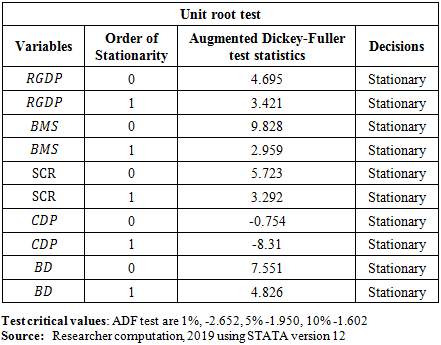

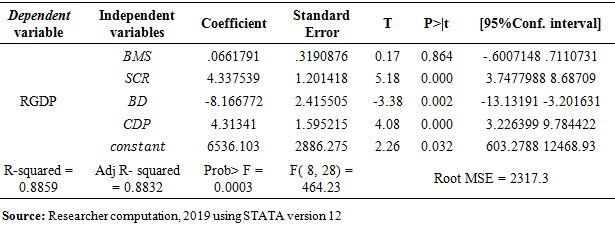

Financial intermediation activities are germane to economic growth and development through the financial services they render. This paper specifically evaluated the effect of financial intermediation activities on the growth of Nigeria's economy. Secondary data were used and sourced through the Central Bank of Nigeria Statistical Bulletins within 1983 and 2018. Descriptive statistics such as mean, median, skewness, and mode, etc. and econometric statistics like Ordinary Least Squares (OLS) were used to analyze the data obtained. The multiple regression results showed that the computed F-statistic with corresponding probability value (F (8, 28) = 464.23, Prob> F = 0.0003) and adjusted R2 (0.832), indicated that broad money supply (β =0.661791), size of credit (β =4.337539), and credit delivered to the private sector (β =4.31341) have a positive effect on economic growth at p≤0.05. The result of the co-integration test using trace statistics suggests a long-run relationship among the variables (Ho:n=4 that is, 32.9048<45.41) and the Vector Error Correction Model (VECM) was employed to evaluate the short-run effects of the cointegrated series. It was concluded that financial intermediation activities by banks had a statistically significant impact on the growth of Nigeria's economy.It is therefore recommended that there should be a reduction in lending rate associated with the size of credit, increased volume of credit delivered to the private sector, sustenance of on-going reforms and evolving measures to boost deposit mobilization which would spur investment, innovation and engender growth in the Nigerian economy. Also, there should be a review of monetary policy by the Central Bank of Nigeria (CBN) with the target of increasing the money supply to be able to reduce the costs of borrowing (lending interest rate). The achievement of this will motivate investors and encourage them to borrow more money.

Keywords: Financial Intermediation, Economic Growth, Vector Error Correction Model, Central Bank of Nigeria

Cite this paper: Alimi A. A., Adeoye M. A., Analysis of Financial Intermediation Activities on Economic Growth in Nigeria-Vector Error Correction Model Approach, International Journal of Finance and Accounting , Vol. 9 No. 1, 2020, pp. 7-12. doi: 10.5923/j.ijfa.20200901.02.

Article Outline

1. Introduction

- The cashless policy was introduced in 2012 by the Central Bank of Nigeria (CBN) to modify the cash-driven economy and condensed operational costs usually passed on to customers through other means. This was planned to promote financial intermediation, eliminate the incidence of corruption emanate from ineffective credit delivery system and also to lessen the amount of cash payment, boost electronic payment and finally to minimize to the barest minimum larger percentage of the Nigerians who still leave in a barbaric world of informal savings. Recent studies suggest that financial intermediaries play important roles in the growth of the real economy by channeling funds from savers to borrowers in a manner to facilitate investment in physical capital, spur innovation and the creative process. Also, the efficiency and effectiveness of economic policy are positively associated with how well financial markets operate. Through their financial activities, financial intermediaries increase efficiency and effectiveness in many ways for example by decreasing leakages in savings[1]. Financial intermediaries transfer funds from those who have savings to those who can put them into productive use [2]. Financial intermediation is the process by which intermediaries provide a linkage between surplus units and deficit units in the economy. Surplus units are firms/individuals who have excess funds above their immediate needs while those who need this fund for immediate investment programs are referred to as deficit units. It is the financial intermediaries that develop the facilities and instruments which make this lending and borrowing possible [3].Real Gross Domestic Product (RGDP) is officially the most popular measure of the economic output of a country [4]. RGDP indicates the market value of all officially recognized final goods and services produced within a nation at a specified period [5]. The thrust of this study is to explore the effect of financial intermediation activities on the growth of Nigeria economy.Statement of the problemNigeria's financial reform is an on-going process and has been implemented as part of the wide-range market-oriented economic reforms since the late 1980s [6]. Globally, the financial intermediation activities of banks mirror their unique roles as the instrument of growth in any economy. Central Bank of Nigeria (CBN) has imbued the total of N600 billion naira into the Nigerian banking sector to recapitalize the banks that have liquidity crisis and credit crux caused by excessive lending, extravagance, and sleaze [7]. The recent audits of the Nigerian banks by the Central Bank of Nigeria (CBN) have exposed the inefficiency and ineffectiveness of the banking sector and revealed that the majority of these banks were ill-managed and that corruption has almost destroyed the system. As a result, the CBN committed himself to clean the financial mess [8]. Factors that motivate financial intermediation activities in the economy are largely under-researched in Nigeria. This is considered very crucial to ensure that financial institutions have the desired impact on the economy at large. There is a dearth of research on the effect of bank intermediation activities on economic growth in Nigeria since the introduction of the merger and acquisition of banks in 2005. This study aims to fill significant gaps on this issue especially concerning intermediation activities of Nigerian Deposit Money Banks.Research hypothesis Ho1: Financial intermediation activities has no significant influence on the growth of the Nigerian economyHo2: Financial intermediation activities has a significant influence on the growth of the Nigerian economyThis paper is therefore divided into five sections. Section one deals with the introduction discussed above while section two dwells on the literature review, section three explains the methodology, section four deals with analyses and discussion of findings and finally section five explains conclusion and recommendations.

2. Literature Review and Conceptual Explanation

2.1. Theoretical Review

- Theory of Delegated Monitoring and Financial Intermediation An intermediary such as a commercial bank has delegated the task of costly monitoring of loan contracts carved with firms who borrow from it [9]. It has an overweight cost advantage in collecting the information because the alternative is either duplication of effort if each lender monitors directly or a free-rider problem in which case no lender monitors. As a result, financial intermediation theories are generally grounded on some cost advantage for the intermediary.Financial Repression TheoryFinancial repression refers to a wide array of policies that allow a government to place its debt with financial institutions at relatively low-interest rates [10]. Financial repression is caused by interest rate ceilings, liquidity ratio requirements, high bank reserve requirements, capital controls, restrictions on market entry into the financial sector, credit ceilings or restrictions on directions of credit allocation, and government ownership or domination of banks. Economists have commonly argued that financial repression prevents the efficient allocation of capital and thereby impairs economic growth [11].Information Production theorySurplus units could incur substantial search costs if they were to seek out borrowers directly. If banks did not exist, then there would be duplication of information production costs as surplus units would individually incur considerable expenses in seeking out the relevant information before they committed funds of specializing agents such as banks that choose to produce the same information [12].

2.2. Concept of Financial Intermediation

- Financial intermediation is the process by which intermediaries provide a linkage between surplus units and deficit units in the economy. For financial intermediation to succeed, three qualities are essential and these are cost, convenience and confidence [13]. Finance is germane for different purposes by different organizations, individuals and other economic agents. To provide the needed finance, there are varieties of institutions rendering financial services. Such institutions are called financial institutions. Commercial banks are among such institutions that render financial services. This is known as direct finance [3].

2.3. Review of Empirical Studies

- A recent study establishes the relationship between financial intermediation and economic growth, using country-specific data from China [14]. The study focused on the post-1978 reform period, using provincial data (28 Provinces) over the period 1985 to 1999. The study employed the use of a linear model, which expresses economic growth as a function lagged economic growth, financial development indicators (banks, savings, and loan-budget ratio), as well as a set of traditional growth determinants (population growth, education, and infrastructural development). The study uses the one-step parameter estimates for the Generalized Method of Moments (GMM) estimation and finds that financial intermediation has a causal effect and positive impact on growth through the channels of house-holds savings mobilization and the substitution of loans for state budget appropriations. However, the study reveals that bank, as an indicator of financial development, is significant but negatively related to growth.This was attributed to the inefficiency in loan distribution and the self-financing ability of the provincial governments. There is also a confirmation from another study that showed the positive impact of finance on economic growth [15]. He investigates the relationship between finance and growth, with emphasis on the effect of financial deregulation and banking law harmonization on economic growth in the European Union. The study establishes that financial intermediation impacts positively on economic growth through three channels.Evidence from a previous study posited emphasized that financial intermediation leads to economic growth in a small open economy of Sri Lanka using time series macro data for the period 1977-2008 [16]. This investigates the channel and the effect of financial intermediation on economic growth with a new framework. The model framework of the study was developed as per the endogenous growth theory. The model explains the joint effect of financial intermediation, trade openness and other economic factors on economic growth in Sri Lanka. The paper used Engle-Granger two-step methodologies to find out long term relationship between financial intermediation and economic growth and short-run dynamic of the model is explained by the granger causality test. The findings of the study revealed that financial intermediation impacts economic growth in the long run but the relationship is not strong. Further, the study reveals that financial intermediation promotes growth through the productivity channel rather than the accumulation of capital.

3. Methodology

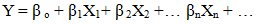

- The study area is Nigeria Deposit Money banks. This study focuses on these banks because they contributed majorly to the growth of Nigeria's economy using country aggregate level annual data from the Central Bank of Nigeria. Secondary data was used for this study. The data covered 36 years period, that is, between 1983 and 2018. The Data generated were analyzed through descriptive statistics such as mean, median and mode while the formulated hypothesis was analyzed through econometric statistics such as multiple regression at a 5% level of significance. Unit root test and co-integration tests were also used to test for the presence of stationarity and to establish a long-run relationship of the variables. Finally, this study proceeds to the Vector Error Correction Model (VECM) to evaluate the short-run effects of the cointegrated series.Model Specification The models shall take a general form of a multiple regression model expressed as follows:

| (3.1) |

are independent variables

are independent variables  is constant and

is constant and  represents the coefficient of independent variables.Model:To achieve the objective- “evaluate the effect of financial intermediation activities on growth of the Nigerian economy”, the model specified as:RGDP = ƒ (BMS, SCR, BD, CDP)Specifically, the model is given as:

represents the coefficient of independent variables.Model:To achieve the objective- “evaluate the effect of financial intermediation activities on growth of the Nigerian economy”, the model specified as:RGDP = ƒ (BMS, SCR, BD, CDP)Specifically, the model is given as: | (3.2) |

White noise residual /Error term in time t.

White noise residual /Error term in time t. and

and  represent the regression constant and regression coefficient of the variables.

represent the regression constant and regression coefficient of the variables.4. Results and Discussions

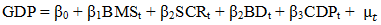

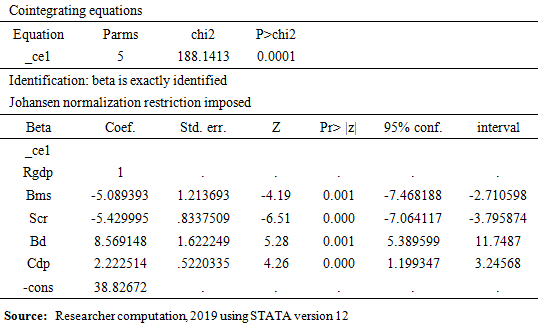

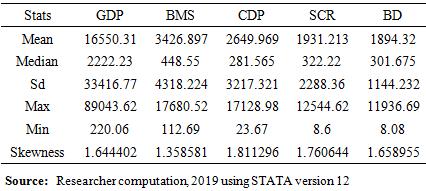

- Unit root testThe Augmented Dickey-Fuller (ADF) was used to investigate the stationarity of the data series. The test result shown in table 1 indicated that all the series are integrated at the difference of order one “I(1)”. Hence, the relationship of the series would be spurious if the existence of the unit root test were stated at the level.

| Table 1. Unit Root Test |

| Table 2. Johansen Co-integration Test using trace statistics |

| Table 3. Vector Error-Correction Model (VECM) |

| Table 4. Descriptive Statistics |

| Table 5. The Regression Result of the effects of Bank Intermediation Activities on economic growth |

5. Conclusions and Recommendations

- The study examined the effect of financial intermediation on economic growth in Nigeria using country aggregate level annual data sourced from Central Bank of Nigeria from 1983 to 2018. The study used the Ordinary Least Square Regression Analysis method to achieve the study hypothesis with the aid of STATA 12. The results of the study, therefore, revealed a statistically significant impact of financial intermediation activities on the growth of Nigeria's economy. This, therefore, suggest that the performance of the financial intermediaries such as banks influences economic growth and found out that credit delivered to the private sector indicates the capacity and efficiency of financial intermediaries in allotting funds to finance economic growth. The result of the unit root test showed that the stationarity of all the variables has been established. The Johansen co-integration test result showed that the long-run relationship exists among the variables and a short-run relationship was established using the Vector Error Correction Model (VECM). The financial intermediation activities indices in the study explain a greater proportion of changes in economic growth, however, it was found out that the indices that have an insignificant effect and unexpected relationship with economic growth, indicating that the banking intermediation role has not been completely explored on the Nigerian economy. This might due to the level of intractable challenges and complexity in implementing a policy that may enhance the smooth flow of financial intermediation to achieve the desired results. It is therefore recommended that there should be a reduction in lending rate associated with the size of credit, increased volume of credit to the private sector, sustenance of on-going reforms and evolving measures to boost deposit mobilization which would spur investment and engender growth in the Nigerian economy. Also, there should be a review of monetary policy by the Central Bank of Nigeria (CBN) with the target of increasing the money supply to be able to reduce the costs of borrowing (lending interest rate). The achievement of this will motivate investors and encourage them to borrow more money.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML