-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2020; 9(1): 1-6

doi:10.5923/j.ijfa.20200901.01

ICT Investment and Banks Financial Peprformance in Nigeria

Meshack Aggreh1, Charles A. Malgwi2, Mercy S. Aggreh3

1Accounting Department, Edo University Iyamho, Nigeria

2Accountancy Department, Bentley University, 175 Forest Street, Waltham, MA, USA

3Accounting Department, Veritas University Abuja, Nigeria

Correspondence to: Charles A. Malgwi, Accountancy Department, Bentley University, 175 Forest Street, Waltham, MA, USA.

| Email: |  |

Copyright © 2020 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Investment, irrespective of the level of risk, generate a return (positive or negative). ICT investment in the banking industry in Nigeria has increased geometrically over the years with mixed performance outcomes. The objective of this study is to ascertain the longitudinal nature, extent and magnitude of the return on ICT investment in the banking industry in Nigeria. The study utilized a longitudinal research design, covering all the 15 Deposit Money Banks (DMBs) listed on the Nigerian Stock Exchange with secondary data for the period 2010-2017 financial years. The effect of ICT investments on Bank performance was analyzed using panel regression. In conducting the analysis, the study adopts a dynamic framework in the analysis by the estimation of lead variables of ICT investment. The findings of the study reveal that ICT investment does not always result in instantaneous positive effects on financial performance in the immediate period. However, the result shows evidence of a dynamic pattern in the response as positive effects of ICT investment is observed to begin from the following year (ICT +1) and significant at 10% and is even stronger the year after (ICT +2) and significant at 5%. The study recommends that banks should improve their ICT investments while engaging a quality staff training.

Keywords: ICT Investment, Bank financial performance, Return on Assets

Cite this paper: Meshack Aggreh, Charles A. Malgwi, Mercy S. Aggreh, ICT Investment and Banks Financial Peprformance in Nigeria, International Journal of Finance and Accounting , Vol. 9 No. 1, 2020, pp. 1-6. doi: 10.5923/j.ijfa.20200901.01.

Article Outline

1. Introduction

- Basically, ICT investment (ICTINV) refers to the information and communication technology infrastructure of an organization comprises of its physical ICT asset stock. The effects of ICT are seen in improvements in productivity and economic growth at the level of the firm (Brynjolfsson & Hitt, 1996) and the economy overall (OECD, 2004). A PWC (2016) report identified technology as one of forces that are disrupting the role, structure, and competitive environment for financial institutions and the markets and societies in which they operate. It is now becoming obvious that the accelerating pace of technological change is the most creative force and also the most destructive in the financial services ecosystem today. Therefore, the application of information and communication technology strategies to banking services has become a subject of fundamental importance and concerns to all banks and a prerequisite for local and global competitiveness. The Nigerian banking industry has witnessed significant change and improvement in the structure of the banking industry via investment in ICT over the last decade (Adewale and Afolabi 2013). ICT investments in technologies such as Internet banking, mobile banking and various Automated Teller Machine (ATM) products are now replacing the traditional delivery methods. Investment in ICT enhances multifactor productivity (MFP) which essentially refers to technical progress in the production process or in the quality of output can increase the level of output without additional investment in input. An improvement in MFP is considered to be of great importance as it reflects structural gains that are permanent. Research suggests that the unique value of ICT is that it enables fundamental changes in business process and organizational structures that can enhance MFP (Dedrick, Gurbaxani, and Kraemer, 2003). The overall increment and improvement is expected to reflect on corporate bottom-line such as return on assets (ROE).The impact of investment in ICT on performance of companies and whether it pays off or not is an area of discourse with a long history. From the 1980s and in the early 1990s, empirical research generally did not find relevant performance/productivity improvements associated with ICT investments (Strassmann, 1990; Lovemann, 1988; Bender, 1986; Franke, 1987; Roach, 1989). These earlier researches showed that there was no statistically significant, or even measurable, association between ICT investments and productivity at any level of analysis chosen. Solow (1987) has termed this occurrence and relationship as the “productivity paradox”. Several decades later the debate is still on and is an issue is still at the front burner. For example, Abubakar, Nasir, Haruna (2013) for Nigerian banks found positive effects of ICT investments on return on equity but negative on efficiency. Binuyo and Aregbeshola (2014) South African banks indicated that the use of ICT increases return on capital employed as well as return on assets technology but effects on cost efficiency was higher. Ekwonwune, Egwuonwu, Elebri and Uka (2017) and Dabwor, Ezie and Anyatonwu (2017) found positive outcomes. Some other studies argue to the contrary (McKinsey, 2004) found no links.However, a key challenge of majority of the studies on the effect of ICT investment on performance and almost all extant studies on the issue in the issue in Nigeria banks is the emphasis on a static relationship and the failure to assess the relationship between ICT investment and performance as a dynamic process which this may have either heightened the existence of mixed findings or have undermined the robustness of available evidence in this area especially from the Nigerian environment. Basically, the effects of ICT investments have been argued to follow a dynamic pattern with positive gains showing after longer lags (Brynjolfsson and Hitt, 1998; Brynjolfsson and Hitt, 2000). Therefore, the time structure clearly matters when looking at the productivity effects of ICT. Benefits that derive from an IT investment can, depending on the nature of the investment, take several years to show result. Bryjnolfsson et. al. (2004) found lags of two-to three years before the strongest organizational impact of ICT were noticed. Before a new ICT infrastructure can be fully integrated and used to its full abilities, both the users and bank staffs need to be given the corresponding training in order to accept the new technology. Failure to recognize the presence of the time lag can lead to severely distorted perspectives on the link between ICT investment and firm performance. This study addresses this gap by adopting a dynamic distributive lag procedure in investigating the effect of ICT investments on firm performance. This is expected to provide fresh and robust insight into the relationship. In addition, this study employs a more robust approach in evaluating corporate performance. The objective of the study is to examine the impact of ICT investment on performance of Nigerian banks using a dynamic framework.

2. Literature Review and Hypothesis

- De Young (2007) in their research analyzing the effect of e-banking on the performance of banks by studying US community banks markets and compared the performance of virtual click and mortar banks with brick and mortar banks. Their findings concluded that e-banking improved the profitability of banks, hence increasing their revenues. Their study also reveals that, e-banking is largely driven by the factors of minimizing the operating costs and maximizing operating profit. Mohammad (2011) in their study on the impact of ICT investment on profitability in Pakistani banks shows ICT channels has increased competition among banks, absence of long queue, reduction in manual banking, increase in banks profit though it has borne considerable cost of implementation. Sadr and Seyed (2013) in their study on the relationship between ICT investment and profitability in selected Asian countries, the results suggesting that there is a short run steady-state relationship between this variable for a cross-section of countries and vice versa. Three common measures of bank profitability was used, namely; the return on assets and return on equity. The findings show that ICT has a positive effect on profitability.Oyewole, Abba, El-Maude, and Gambo (2013) assessing investment in ICT and bank performance: evidence in Nigeria. The study examines the impact of e-banking on ROA, ROE and NIM from a period of 2000-2010, Panel data comprised of audited financial of eight banks that has adopted e-banking. The research reveals that investment ICT begins to contribute positively to bank performance in terms of return on assets (ROA) and net interest margin (NIM) with a time lag of two years, while a negative was witnessed in the first year of adoption. Chibueze, Maxwell and Osundu (2013) examined the effect of ICT investment and bank performance in Nigeria from a judgmental sample of four banks being quoted on the Nigerian stock exchange. The study aimed at looking at the effect on return on equity and return on assets. The research employs the use multiple regression ant t-test in data analysis of data from books of account of the four banks. The finding from data obtain on the activities of these bank reveals that the ICT has positively and significantly improved the return on equity (ROE) of Nigerian bank. On the contrary, it has not significantly improved return on assets (ROA). Hassan, Mamman and Farouk (2013) assessing electronic banking products and performance of Nigerian listed money deposit banks where six (6) banks were systematically selected. The research aimed at examining the effect of e-banking product on the performance of Nigerian DMBs, determine the impact of ATM transaction on performance of Nigerian banks, to ascertain the influence of electronic direct on performance of banks, to examine the influence of SMS alert on performance and to investigate the contribution of electronic mobile on performance. The research adopts Ex-post factor correlational designs, systematic sampling technique in selecting the sample size and multi longitudinal panel regression technique in data analysis. The study uses audited books of accounts of the selected banks to measure performance in terms of return on equity (ROE). The study reveals that the adoption of e-banking product has strongly and significantly on the performance of bank, while on the other hand it reveals that e-direct and SMS alert has not significantly on the performance of banks. The evidence from Nigerian study shows mixed result from positive to negative impact of e-banking on banks’ performance.Arnabodi and Claeys (2010) analyzing the innovation and performance of Europeans banks adopting internet bank. The study analyzes the reason for adopting two online strategies in 60 sixty largest European banks and determine specific feature for the adoption of e-banking. The paper uses t-test to test the difference between internet and non-internet banks. The study analyze Europeans banks performs from a period of 1995 to 2005. The finding reveals that since the introduction of e-banking banks could cut down cost especially labor cost. However, it is unclear whether these productivity gains compensate the initial cost of IT investment. The finding also reveals that there is few synergies to gotten from internet banking. Based on the reviews above, the study specifies the null hypothesis as follows;H1: ICT- Investment has no significant effect on bank financial performance in Nigeria.

3. Theoretical Framework

- Resource-Based Views (RBV)Initiated in the mid-1980s by Wernerfelt (1984), Rumelt (1984) and Barney (1986), the resource-based view (RBV) has since become one of the dominant contemporary approaches to the analysis of sustained competitive advantage. A central premise of the resource-based view is that firms compete on the basis of their resources and capabilities (Peteraf and Bergen, 2003). The concept of the RBV emerged in the strategic management research since the early 1990s. Researchers have drawn on a variety of theoretical perspectives to explain the wide range of ICT impacts on business processes and on the organization as a whole. The resource-based view (RBV) have been the most common approaches used. According to the resource-based view (RBV) firm performance is based on its specific resources and capabilities, which are difficult to imitate and create a sustained competitive advantage. Differences in ICT resource endowment, such as higher investments in ICT and their combination by firms are strategic resources that banks invest in and this enhances organizational capabilities and eventually lead to superior firm performance (Bharadwaj, 2000).

4. Methodology

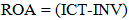

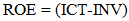

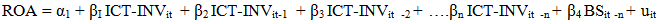

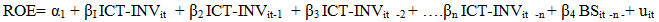

- This study utilized a longitudinal research design. The study population consisted of all banks quoted companies in the Nigerian Stock Exchange (NSE). As the study period, there were about 15 deposit money banks quoted on the Nigerian stock exchange. The study covered the 15 Deposit Money Banks (DMBs) on the commercial list of the Nigerian Stock Exchange. Secondary data was utilized for this study. The necessary data was extracted from the annual reports of the Banks for the period 2010-2017 financial years. The effect of ICT investments on Bank performance was analyzed using panel regression. The pooled OLS, random effects (RE) and fixed effects (FE) were estimated. The Breusch-Pagan Lagrange Multiplier (LM) test for RE and the Hausman test for both random and fixed models were conducted including an F-test for the FE model to enable us to determine which model was better. The suitable models for the research were chosen in line with the results of the tests. However, testing for group wise heteroskedasticity using the Wald test and autocorrelation by the Wooldridge test was carried out to help improve the efficiency of the model. If heteroskedasticity and autocorrelation existed in the model, robust standard errors could easily be calculated to enhance the efficiency of estimators.Model Specification {Distributive-Lag (D-L) Model}The study builds on the models of but deviates strongly by introducing dynamic considerations in the relationship between ICT investments and performance of Banks. Bryjnolfsson et. al. (2004) found lags of two-to three years before the strongest organizational impact of ICT were noticed. We begin by specifying the static functional relationship between ICT Investment and bank performance;

| (1) |

| (2) |

| (3) |

| (4) |

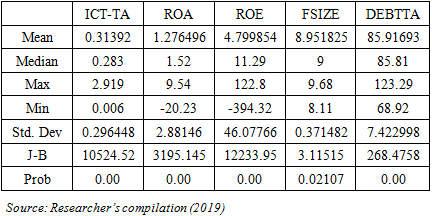

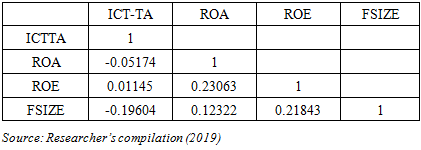

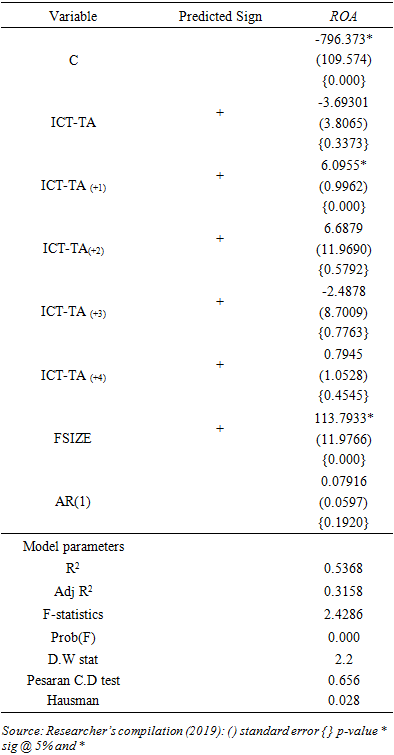

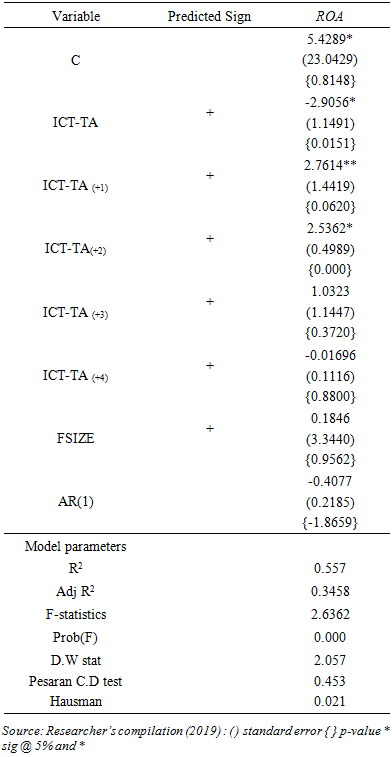

5. Presentation of Results

|

|

|

|

6. Conclusions

- The effects of ICT are seen in improvements in productivity and economic growth at the level of the firm and the economy overall. Therefore, the application of information and communication technology strategies to banking services has become a subject of fundamental importance and concerns to all banks and a prerequisite for local and global competitiveness. Advancements in technology are helping to shape the future of the banking industry. Globally, investment in ICT for banks have developed rapidly and many institutions are racing to combine new technologies, including cloud computing, artificial intelligence and voice recognition, to help provide financial services. Investment in ICT enhances multifactor productivity (MFP) which essentially refers to technical progress in the production process or in the quality of output can increase the level of output without additional investment in input. An improvement in MFP is considered to be of great importance as it reflects structural gains that are permanent. This study examines the effect of ICT investment on the performance of Nigerian banks. In conducting the analysis, the study adopts a dynamic framework in the analysis by the estimation of lead variables of ICT investment. The rationale for this is noted earlier is that the effects of ICT investments have been argued to follow a dynamic pattern with positive gains showing after longer lags Therefore, the time structure clearly matters when looking at the productivity effects of ICT. The findings of the study reveal that ICT investment does not result in instantaneous positive effects on ROE in the immediate period. However, the result shows evidence of a dynamic pattern in the response as positive effects of ICT investment is observed to begin from the following year (ICT +1) and significant at 10% and is even stronger the year after (ICT +2) and significant at 5%.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML