-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2019; 8(3): 73-79

doi:10.5923/j.ijfa.20190803.01

Role of Credit Reference Bureau on Financial Intermediation: Evidence from the Commercial Banks in Kenya

James Baariu Mungiria, Ibrahim Tirimba Ondabu

Department of Economics, Accounting & Finance, KCA University, Kenya

Correspondence to: James Baariu Mungiria, Department of Economics, Accounting & Finance, KCA University, Kenya.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study discusses the role of the Credit Reference Bureau on financial intermediation among the commercial banks in Kenya. The study uses a descriptive survey research design. The study population consists of all the 45 commercial banks licensed by the central bank of Kenya under the banking act as at 31st May 2019. The study adopts a census population approach to study all the banks. The study uses secondary data collected from annual supervision reports of CBK, and the respective bank's audited accounts relate to the total loans, total non-performing loans, and interest earned on investments. Also, the credit reports done annually by reference bureaus were used to obtain data for the period between 2010 and 2018. Quantitative data collect was analyzed using the latest SPSS software, version 22.0. The study applies both descriptive and inferential statistics. Results generated are then presented in tables and explanations given in prose. Inferential statistics included the Pearson correlation analysis and Correlational relationships among the number of loans offered defaulted loans and the interest earnings on loans by commercial banks bank in Kenya. Linear regression analysis was conducted to establish the significance of the variables. ANOVA was used to test the relationship between independent variables and dependent variable. The Chi-Square test was also performed. Both the mean of the study and the mean before the introduction of CRB were used to check if there is a statistical difference between the means. The study establishes that credit reference bureau checks have a role in the financial intermediation (non-performing loans) in commercial banks in Kenya. Further, the study found that non-performing loans have a negative correlation with credit reference bureau checks. It can, therefore, be concluded that a relationship exists between credit reference bureau information and the level of financial intermediation as shown through non-performing loans in Kenya commercial banks.

Keywords: Credit reference bureau, Financial intermediation, Commercial banks in Kenya

Cite this paper: James Baariu Mungiria, Ibrahim Tirimba Ondabu, Role of Credit Reference Bureau on Financial Intermediation: Evidence from the Commercial Banks in Kenya, International Journal of Finance and Accounting , Vol. 8 No. 3, 2019, pp. 73-79. doi: 10.5923/j.ijfa.20190803.01.

Article Outline

1. Introduction

- This paper presents findings from a quantitative research study that was carried out on the commercial banks in Kenya regarding the effect of a credit reference bureau on non-performing loans. It describes the relationship between credit information sharing and the accumulation of bad debts in Kenya's commercial banks. This introductory section discusses the rationale for this study and the background of the research.

1.1. Financial Intermediaries

- As defined by Chen (2019), financial intermediaries such as investment banks, commercial banks, pension funds, and mutual funds are entities that serve as the link between two parties in business transactions. Financial intermediaries are beneficial to an average consumer such as liquidity, safety, and economies of scale involved in investment banking, asset management, and commercial banking. In the case of Non-bank intermediaries that do not accept deposits from the public, they provide leasing, factoring, insurance plans, and other financial services. Much economic participation in the securities exchanges and use strategic loan term plans for growing and managing their funds. Generally, the stability of the country's economy depends on the works of financial intermediaries and the development of the financial services sector.Financial intermediaries accept funds from entities that have excess capital and take them to parties that require those finances. This process of movement of funds builds efficient markets and brings down the cost of doing business. Commercial banks connect lenders and borrowers by offering capital from other financial entities and central banks. Insurance firms gather premiums for policies and provide policy directions and benefits. Finally, a pension fund collects finances acting on behalf of its members and distributes payments to pensioners (Chen, 2019).

1.2. Non-performing Loans

- A loan is referred to us non-performing if servicing of that loan is past due for more than 90 days, and there is every reason for lenders to believe that payments may not recover it in full. These are overdue loans that are characterized by either delay payments or no payment at all (Warue, 2013).As defined by Aduda and Gitonga (2011), non-performing loans are those loans whose beneficiaries have failed to honor them according to loan terms and usually exposes lenders to potential loses. Non-performing loans have adverse effects on the lender as they impair their ability to meet costs, discourage private investors, and limit the extent of loans to other borrowers (Warue, 2013).In the long run, non-performing loans affect the survival and growth of lenders such as commercial banks, and according to Mwengei (2013), if no proper measures are taken to manage them, they can cause banks' failure. The worst scenario to the shareholders may be a decline in the net profits of banks because non-performing loans create mismatches between liabilities and assets; they heighten liquidity problems hence their exponential increases may lead to insolvency and wind up.Also, improvements in non-performing loans can be a clear reflection of those borrowers and businesses have insurmountable challenges to make any payment, and this indicates the overall economic system of the country is in limbo (Turan & Koskija, 2014). The rise of non-performing loans is also associated with the malfunctioning of the credit policy of the lender.

1.3. Credit Reference Bureau

- A Credit Reference Bureau is a body that gathers information on credit consumers from various sources and shares with lenders for creditworthiness evaluation. The information should be relevant, reliable, and comprehensive for open application by the recipients (Sinare, 2017). Credit reference bureau has become a vital component of the financial infrastructure that enables financiers to enhance risk evaluation, and borrowers can acquire at competing for interest rates (FSD Kenya, 2011).In many countries, financial institutions, particularly commercial banks, share credit information on the suitability of their borrowers to acquire loans. According to Jappelli and Pagano (2005), this happens either independently by a third party or voluntary through reference bureaus or on a compulsory basis through public credit registers. Sharing of information among lenders promotes a careful selection of loan applicants, increases lending and minimizes default risks. Hence, currently, approvals take a shorter time than before the introduction of credit information sharing among industry players.Because of failures in commercial banks to manage credit risk and as a way of finding a lasting solution, the credit reference bureau commencement in Kenya following the amendment of banking act 2006 giving birth to credit bureau regulations of 2007. These regulations made it compulsory for the deposit protection fund and licensed bodies under the law to share information on defaulted loans through the credit reference bureau. The above resulted from negotiations and agreements between the central bank of Kenya, the office of the attorney general, bankers association of Kenya and the ministry of finance to deal with the challenges bedeviling lenders in the Kenyan context (CBK Report, 2007).In 2010, credit reference bureaus found its roots in Kenya. They are licensed and closely supervised by the central bank of Kenya as provided for in the banking act 2008. The introduction of CRB was a crucial development in the banking sector as lenders hoped to lower the number of non-performing loans. However, borrowers did not welcome this idea and saw it as a direct "blacklist" (CBK Report, 2012).It is in line with the CRB's effects on the number of loans offered, the number of defaulted loans and interest earnings on investments and research gaps therein that motivated the researcher to seek the examination of the impact of credit reference bureau on financial intermediation in Kenya by focusing on commercial banks. This survey was carried out on the commercial banks headquartered in Nairobi.As profit-making entities, commercial banks should have proper credit scoring mechanisms that will ensure that they only extend credit facilities to customers who can repay. A better credit management mechanism not only secures loans from borrowers but also rewards those who have impressive credit repayment history (Ahmad, 2013). The core business for the formation of CRB was to assist lenders in making accurate and faster decisions regarding giving out loans. CRB gathers and disseminates credit reports to lenders for evaluation of client creditworthiness. The repayment of loans at an agreed cost gives a positive impact on loan performance and overall financial strength of commercial banks (Gaitho, 2013).Despite the presence of CRB in the country, Kenyan commercial banks' non-performing loan (NPL) ratios according to global rating agency Moody's (2018) report, rank the highest among major economies in Africa. According to the Central Bank of Kenya (2018) data, the ratio of bad loans to total loan books among Kenyan commercial banks stood at 12.3% at the end of October 2018, having come down from 12.7% in August the same year. Further, the CBK data for nine months to December 2018 indicates that non-performing loans rose from Sh260 billion to Sh326 billion in a similar period in 2017. The above increase was due to massive defaults, particularly from small businesses.Although there are numerous past researches on the use of CRB to manage loans in Kenyan commercial banks, non-performing loan ratios kept escalating and threatening the very fabric of financial performance of commercial banks. It was, therefore, necessary to relook into the role of CRB on financial intermediation among Kenyan commercial banks and provide adequate insights showing how CRB affected the number of loans given to customers, the number of defaulted loans and interest earnings on loans. The general objective of the study is to investigate the role of a credit reference bureau on financial intermediation in Kenya by focusing on commercial banks.

2. Literature Review

- This section presents a theoretical review and an empirical review of the literature relevant to this study. The practical review discusses past studies on the impact of a credit reference bureau in financial intermediation concerning loan management and performance in commercial banks.

2.1. Theoretical Review

- The study is anchored on two theories: moral hazard theory and information sharing theory as described below:

2.1.1. Moral Hazard Theory

- Moral hazard implies that a party to a financial transaction enters into an agreement without good faith or provides false information about the actual position of his or her creditworthiness for certain individual gains (Mirrlees, 1999). Moral hazard may happen when one party is cloistered from risk and possess more information about its intention and actions than the second party paying for the adverse effects of the said risk (Einav & Finkelstein, 2011). In this circumstance, each party may have a chance to benefit from acting in violation of the principles stipulated in the contract. For example, sometimes borrowers may not use the money borrowed following the agreement they sign with lenders. As argued by Koo (2011), some choose to divert the funds borrowed to highly risky investments once they receive the loans.According to Myerson (2011), there has been a manifestation of problems of moral hazard in commercial banks at various stages of the financial crisis. This inefficiency, as argued by economists, often emanates from information asymmetry. In this case, the most informed party about its intentions or actions has the propensity to behave unacceptably; hence, instantaneous growth requires the active participation of the borrowers and lenders (Yang, 2015). The moral hazard which is efficient can happen when loans given by commercial banks do not bring about a welfare loss to the community by troubling the borrower in servicing of the loan, but borrowers get better deals thus uplifting their living standards.In terms of the relevance of this theory to the study, an absolute credit culture is developed particularly to borrowers to make sure that they utilize their loans in the intended businesses without diverting any money to direct consumption. To achieve this, lenders need to scrutinize the ability of borrowers to invest wisely and according to agreed terms before granting those loans. In so doing, lenders shield themselves from accumulating non-performing loans.

2.1.2. Information Sharing Theory

- This theory was first put forward by Akerlof in 1970 and reviewed in 2007. He argues that lenders neither know the credit history and nor the intention of the loan applicant. Thus, complete factual data on the credit applicant's scorecard should be made available to the lender to make an informed decision to lower credit risk or write-offs. The sharing of information minimizes the bank's evaluation of credit applicants and lessens competition among banks since they do not fear to get an adverse selection of applicants anymore. Credit information availability is critical to both borrowers and lenders since it helps them make informed decisions on who should get the loan and how much (Boyd & Hakenes, 2013).The theory of information sharing assumes that all credit data is available to all lenders to access. However, this is only possible with advanced technology. Also, ignorance and illiteracy amongst industry players may be a hindrance to better credit information sharing. Credit information sharing is highly relevant to this study since it reveals hidden actions of credit applicants, including updated, accurate data about their borrowing eligibility and capacity.

2.2. Empirical Review

- Commercial banks have over the years experienced high loan defaults. They are believed to reduce profits since banks are unable to recover the principle money plus interest agreed. An upward movement of non-performing loans shows the inability of credit policy, and it has contributed to the financial crisis. The increase in non-performing loans has been one of the major causes of the collapse of banks (Irum, Rehana & Muhammad, 2012).As argued by Turner and Varghese (2007), credit bureaus come in to help address the problem of defaulting by giving information about the credit applicant’s probability to repay. In this case, the lender heavily relies on this information on determining whether to approve the loans. However, sometimes incorrect evaluation of the borrower results in the wrong classification, i.e., High-risk applicants as low-risk borrowers and vice versa. The net effect is that these rates push low-risk borrowers out of the market. High-risk applicants unjustly receive subsidies and drawn into the market. As a result, average prices go up to reflect the lopsided presence of high-risk borrowers. As a reaction, banks ration credits in such a manner that given two applicants with the same risk preferences and profiles, one would receive a loan and the other one misses. They concluded that credit information sharing minimizes default chances to a great extent.A study conducted by Brown and Zehnder (2006) indicates that the sharing of credit information helps to increase loan repayment rates since credit applicants understand that good credit history enhances their probability of to access higher loans. Also, due to the fear of being blacklisted by the reference bureau, borrowers make payments as per the agreed terms with the lender. Accordingly, credit risk management on the side of lenders becomes effective.According to CBK (2011), the bank supervision report, the banking industry recorded growth in assets contributed by growth in direct deposits, retention of profits, and injection of capital. Over the last quarter of 2010, bank performance connected to credit information sharing and agent banking. This means that interest earned on loans was higher since default cases had reduced.A study was carried out by Koros (2015) on the impact of a credit reference bureau on the credit market performance among commercial banks in Kenya. He used a census approach of 43 banks using secondary data and relied on Data for 2008 and 2014. The researcher employed a descriptive research design and inferential statistics in the form of regression analysis done. He established a positive relationship between credit information referencing and credit performance in banks.Similarly, Muthoni (2014) conducted a study to determine the relationship between credit information sharing and loan defaulting in commercial banks. Muthoni sought to examine the overall effect of credit referencing on credit risk management among commercial banks in Kenya. She collected data on credit availability and the default of banks sampled. Both exploratory and descriptive research designs were applied, and Regression analysis performed on the panel data collected. The study showed that credit information sharing significantly minimizes default rates in banks, thus improving profitability.

3. Methodology

- This section discusses the study research design, population of the study, the sample design, data collection methods, and data analysis as well as presentation of results. The review uses a descriptive survey research design. The study population consists of all the 45 commercial banks licensed by the central bank of Kenya under the banking act as at 31st May 2019. The study adopts a census population approach to study all the banks.The study uses secondary data because it is available and considered enough to address the study problem and objectives. Collected data from annual supervision reports of CBK and the respective bank's audited accounts relate to the total loans, total non-performing loans, and interest earned on loans. Also, the credit reports done annually by reference bureaus were used to obtain data for the period between 2010 and 2018.Quantitative data collect is analyzed using SPSS software, version 24.0. The study applies both descriptive and inferential statistics. Results generated are then presented in tables and explanations given in prose. Inferential statistics included the Pearson correlation analysis and Correlational relationships among the number of loans offered defaulted loans and the interest earnings on loans by commercial banks bank in Kenya. Linear regression analysis was conducted to establish the significance of the variables.The following analytical model was adopted:

| (1) |

= error term associated with the regression model.ANOVA was used to test the relationship between independent variables and dependent variable. The Chi-Square test was also performed. Both the mean of the study and the mean before the introduction of CRB were used to check if there is a statistical difference between the means.

= error term associated with the regression model.ANOVA was used to test the relationship between independent variables and dependent variable. The Chi-Square test was also performed. Both the mean of the study and the mean before the introduction of CRB were used to check if there is a statistical difference between the means.4. Findings, Summary, Conclusions, and Recommendations

4.1. Findings of the Study

- This section presents results on the role of a credit reference bureau on financial intermediation in Kenyan commercial banks. The study collected Data from CBK's supervision reports and Kenya Credit reference bureau reports, and Loan performance information obtained from the published financial statements of 45 commercial banks. Data was collected between 2014 and 2014, covering five years. Data for Chase Bank Ltd, Imperial Bank Ltd, and DIB Bank Kenya Ltd were unavailable for the period 2014-2017 because they had collapsed. There was no data between 2014 and 2015 for Spire Bank Ltd, Victoria Commercial Bank Ltd, Charterhouse Bank Ltd, Mayfair Bank Ltd, and HFC Ltd because they were licensed to start operations from 2016. Therefore, data for 37 remaining commercial banks were used for analysis.

4.1.1. Descriptive Statistics

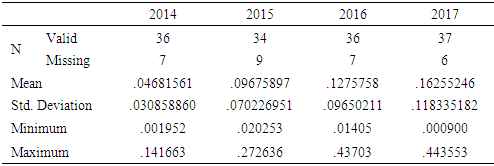

4.1.1.1. Non-Performing Loans

- The study sought to determine the movement of non-performing loans across the period between 2014 and 2017. The non-performing loans' movement was measured as per the ratios of non-performing loans for the years 2014, 2015, 2016, and 2017. The results are indicated in Table 4.1 below.

|

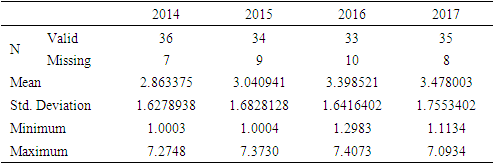

4.1.1.2. CRB Checks

- The study also sought to determine the movement of data checks from CRB by commercial banks in Kenya across the period between 2014 and 2017 as measured by the natural logs. The results are shown in Table 4.2 below.

|

4.1.2. Inferential Statistics

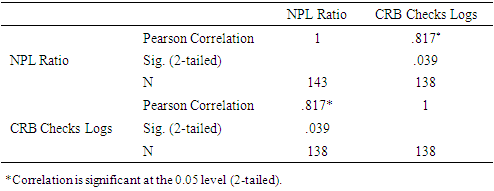

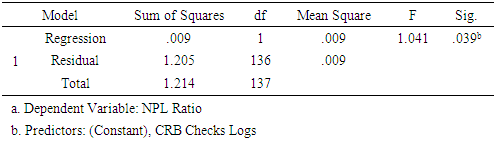

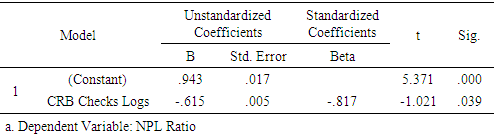

- Inferential statistics analysis was conducted to estimate the relationship between the credit reference bureau and the performance of loans. Both correlation and regression analysis and Pearson correlation were conducted to determine the strength of the relationship between check logs of credit reference bureau and performance of loans as measured in the ratio of gross non-performing loans and advances and total loans of commercial banks in Kenya. Linear regression analysis was conducted to establish the effect of the credit reference bureau and performance of loans of commercial banks in Kenya.

4.1.2.1. Correlation Analysis

|

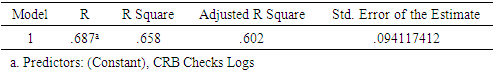

4.1.2.2. Regression Analysis

|

|

|

The regression equation shows that holding CRB checks to a constant zero, non-performing loans would stand at 0.943. Further, a unit increase in CRB checks shared would lead to a decrease in nonperforming loans by a factor of 0.615 units. At a 5% level of significance and a 95% level of confidence CRB checks shared by commercial banks showed a 0.039 level of significance; hence, it was significant at p≤0.05.

The regression equation shows that holding CRB checks to a constant zero, non-performing loans would stand at 0.943. Further, a unit increase in CRB checks shared would lead to a decrease in nonperforming loans by a factor of 0.615 units. At a 5% level of significance and a 95% level of confidence CRB checks shared by commercial banks showed a 0.039 level of significance; hence, it was significant at p≤0.05.4.2. Summary of Results

- This section presents a summary of the study, discussions, conclusion, recommendations, and limitations of the study. Results show that there is an increasing mean ratio of gross non-performing loans between 2014 and 2017. The year 2017 had the highest non-performing loans with 0.16255246 mean of gross non-performing loans to gross loans and advances, and 2014 had the lowest with a mean of 0.04681561. Mwaniki (2018), reported that the stock of bad loans held by commercial banks significantly rose to Kenya shillings 66 billion between January and September 2018, showing the persistence of difficult business circumstances that have forced many households and small traders to default. This study finding is similar to that of Krueger and Tornell (2016) who pointed out those commercial banks were burdened with bad credits, thus weakening their capacity to initiate and fund new projects with good financial returns.There is a noteworthy increase in the number of CRB checks requested by commercial banks of Kenya h since the year 2014 from 2.863375 to 3.478003 in 2017 as measured in logarithms. Also, 2017 had the highest log of CRB checks with a mean of 3.478003 and 2014 had the lowest with a mean of 2.863375. The continued use of CRB checks by Kenya commercial banks is consistent with Frederic (2017) who argued that commercial banks attempt to solve the challenge of accumulating non-performing loans by coming up with innovative means for managing credit risk: engaging with credit reference bureaus for screening of loan applicants, loan commitments establishment of long-term customer relationships and credit rationing.Further, the study found out that there was a strong negative significant correlation coefficient between CRB check logs and the ratio of non-performing loans at the P≤0.05 significance level. The regression analysis showed that a unit increase in CRB checks shared would lead to a decrease in nonperforming loans by a factor of 0.615 units. At a 5% level of significance, CRB checks shared by commercial banks showed a 0.039 level of significance; hence, it was significant at p≤0.05.The study finding concurs with those of Gorter (2015) who established that credit information sharing is a negative correlation with the amount of non-performing loans. He divulged that credit information confirmation by the lender leads to a significant decrease in non-performing loans in countries with a high degree of lending. According to Mwaniki (2018), Kenyans have demonstrated a high level of appetite for loans borrowing from any source, banks, SACCOs, commercial banks, microfinance institutions, mobile loans.

4.3. Conclusions

- The study concludes that the independent variable, which is credit reference bureau checks impacted on the financial intermediation (non-performing loans) in commercial banks in Kenya. Further, the study found that non-performing loans have a negative correlation with credit reference bureau checks. The objective of the study, which was to establish the role of the credit reference bureau on financial intermediation in Kenya commercial banks, was thus met. According to the literature reviewed, there is a consensus from the empirical and theoretical studies that indeed, a relationship exists between credit reference bureau information and the level of financial intermediation as shown through non-performing loans in Kenya commercial banks.

4.4. Recommendations

- The study recommends that for the commercial banks in Kenya to enhance business performance and become sustainable, there is a need for continued engagement with Credit Reference Bureaus before issuing loans since CRB checks have a negative correlation with the ratio of non-performing loans. Commercial banks also need to implement policies that will regulate or control the number of credits they accumulate yearly. This study thus recommends that another study be conducted to increase the period under investigation. Another research is needed to investigate other important factors affecting financial intermediation in commercial banks, Kenya.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML