-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2019; 8(2): 57-64

doi:10.5923/j.ijfa.20190802.02

Homeowners’ Perception of the Factors Affecting Access to Housing Finance in Owerri, Imo State, Nigeria

Okey F. Nwanekezie1, Iheanyi J. Onuoha2

1Department of Estate Management, University of Uyo, Akwa Ibom State, Nigeria

2Department of Estate Management, Imo State University, Owerri, Imo State, Nigeria

Correspondence to: Okey F. Nwanekezie, Department of Estate Management, University of Uyo, Akwa Ibom State, Nigeria.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study investigated factors influencing homeowners' access to housing finance based on the perception of those who borrowed the loan and those who did not. It aimed to identify the predictive factors and variables that influence access to housing finance. It surveyed a cross-section of 450 respondents consisting 300 of those who had borrowed and 150 of those who did not borrow. Stratified random sampling was used and questionnaire was the main instrument of data collection. The gathered data was analyse using discriminate function. The result showed a significant discriminant function separating the two groups based on their perception of the variables. The Wilks’ Lambda’s F test and the standardized discriminant function coefficients, indicated that there are significant differences in perception between homeowners who borrowed and those who did not borrow as measured by appropriate collaterals, access and affordability criteria, repayment scheme and criteria, formal rules of access, type of loan provided, type/purpose of project financed, location factors/attributes. Nonetheless, access and affordability criteria variables were found to have shown the most predictive power in accounting for the differences in perception

Keywords: Housing finance and loan, Housing affordability, Home ownership, Lenders requirements, and homeowners’ perceptions

Cite this paper: Okey F. Nwanekezie, Iheanyi J. Onuoha, Homeowners’ Perception of the Factors Affecting Access to Housing Finance in Owerri, Imo State, Nigeria, International Journal of Finance and Accounting , Vol. 8 No. 2, 2019, pp. 57-64. doi: 10.5923/j.ijfa.20190802.02.

Article Outline

1. Introduction

- Finance is an essential requirement for housing development and is seen as the lifeline in real estate development (Tibaijuka, 2002, Ojo and Ighalo, 2008, Onyike, 2009; Kuma, 2015). Tibaijuka (2002) opined that the availability of adequate housing finance is the cornerstone of any valid and sustainable shelter project, while Akinmoladun and Oluwoye (2007) noted that the poor quality and quantity of housing is mainly due to weak and ineffective access to finance. For Onyike (2007) the significance of finance underscores the wish and efforts of every civilized government to see that most of her citizens, if not all have access to housing finance and are adequately housed. However, access to housing finance is increasingly becoming challenging for prospective homeowners particularly in developing economies. In most cases where homeownership top household's scale of preference, they often forgo expenditures on other domestic consumptions to meet their desired goal (Kuma, 2015). In Nigeria presently, 60% of the new houses developed each year are financed through personal income and savings and sometimes with the assistance from local cooperative societies (National Bureau of Statistics NBS, 2012; Onyike, 2007; Kuma, 2015). Furthermore, a report from the Living Standard Measurement Survey (LSMS) by NBS in 2012 revealed that only 38% of households' have formal bank accounts in South East Nigeria which equal the percentage of the overall national average and only 4% use formal credit in the development of their homes (Kuma, 2015). Perhaps that is why some literature evidence in some case studies indicates that stringent lending policies of formal institutions have influenced borrowers’ choice of finance and as well shifted their preferences to other informal sources of housing finance (Ojo, 2005; Ndibe and Kuma, 2010). This could be the reason many scholars (Onyike, 2007; Onyike, 2009ab; Akinwunmi, 2009; Ojo, 2005, 2004; Atali, 2010) posited that conventional public finance system has failed to offer credit solutions to housing needs of the majority of Nigeria.Mortgage finance usually has several requirements in which the prospective borrower must satisfy to qualify for the loan/mortgage. The various applicants often perceived these requirements in different perspective given their experience, background and the requirement. For instance, an applicant for loan who is required to have a landed property as collaterals may be reluctant if not discouraged from securing the loan. The repayment scheme and criteria is another factor that may affect the perception of an applicant. It is certain that not all the prospective applicants will perceive the requirement the same. While one may feel collateral requirement as a challenge but to another it could be repayment plan or type of loan provided. Thus, homeowners’ perception of these challenges or factors could account for low patronage of mortgaged finance or banking loan in the study area. As already noted there is a high rate of homeownership through personal savings and other informal sources of finance. Given this, one tend to ask, what are the challenges to housing finance in Nigeria and if there is any difference between perceptions of people who have borrowed and people who have not in the study area. To help answer the above poser, the following hypothesis was formulated. Ho: There is no significant difference between the perception of people who borrowed and those who did not.

2. Review of Related Literature

- Literature has identified several factors affecting homeowners’ perception access to housing finance. Ojo (2005), Onuoha (2011) among others have identified the following factors:

2.1. Appropriate Collaterals

- (Ojo 2005; Ojo and Ighalo, 2008; Kuma, 2015) found evidence suggesting that collateral such as titled land, government bonds, private shares, properties in urban or rural properties, and fixed deposit are collaterals often considered by financial institutions before granting loans to homeowners. For example, in Nigeria, issues related to land title remain a significant eligibility criterion applied by housing finance institutions for granting loans to prospective individuals who want to develop their properties. Perhaps, this is why Onyike (2009a) posited that the availability of collaterals and other vital inputs determine access to loan affordability. Thus, the decision of a household to finance housing development is dependent on the availability of collateral. However, when trying to borrow loan for housing development, institutional sources of housing finance are often inaccessible to most households especially the low-income earners due to collaterals such as titled land, a condition that has delayed the construction and development of housing.According to Ojo (2005) issues related to land title in Nigeria remain a significant barrier to housing finance. In many cases, there are often legal impediments to the ability of a property owner to pledge residential property as collateral (Diamon and Lea, 1992; Onuoha, 2011; Kuma, 2015). Again, the process of procuring a registered title to interests in land under the land use Act of 1978 in Nigeria is challenging, tasking, highly expensive and time-consuming. This has not only frustrated the take-off and execution of many viable housing projects but has denied many prospective developers access to mortgage loan due to lack of title collaterals. Ojo (2005) noted that this is very worrisome considering the main thrust of the Act which is to facilitate availability and accessibility of urban and rural land for development in Nigeria.

2.2. Access and Affordability Criteria

- Prospective homeowners feel reluctant to borrow loan from financial and mortgage institutions due to stringent conditions on access to loan and affordability. The decision to access loan for housing development in Nigeria and in particular Owerri is dependent on the income of the borrower, income security criteria viewed in terms of stability of employment and business, fixed annuity, method of repayment such as pensions and allowances, equity contribution of the borrower, cost of housing to be developed by individual (Ojo, 2005; Onyike, 2009a; Onyike, 2007; Onuoha, 2011). When one’s income is not even enough to meet one’s immediate needs such as food, financing housing under stringent lenders requirements will not be included in the budget. Onuoha (2011) observed that affordability criteria of financial institutions in Owerri are much hinged on the income profile of the applicants while accessibility is tied to the formal rules governing households' ability to obtain housing loan (Bramley1993; Onyike, 2007). For example, studies show that financial institutions require loan applicants to make a down payment as a condition for loan approval. Also, investigations revealed that low-income earners rarely apply for loans for housing development in Owerri due to the high emphasis on income as affordability criteria (Onyike, 2007; Ahmad, 2009; Onuoha, 2011).

2.3. Repayment Scheme and Criteria

- Repayment criteria of a financial institution may well determine the propensity of prospective homeowners to apply for housing finance. As such, the repayment scheme has been observed to be one of the factors underlying a potential homeowner's perceived probability of securing a loan from banks. Applicants who do not agree for a stipulated amortization period for loan repayment are likely to have their application rejected. Ojo (2005) and Onuoha (2011) also found that the probability of homeowners securing housing finance is considerably higher if the repayment is to be made in a short or medium term. Besides, the preparation schedule for loan repayment could have an input in the income of the borrower, interest rate, and loan amount (Ojo and Ighalo, 2008). In Nigeria, amortization and repayment periods vary with the type and sources of housing finance. Studies have found that repayment criteria of financial institutions are one of the major impediments to housing finance in Nigeria. For example, Onuoha (2011) observed that the payback period granted by banks is too short when one considers that housing development takes longer time to complete. While Ojo (2005) posits that long term loan agreement affords better opportunity for potential homeowners to complete their houses.

2.4. Formal Rules of Access

- Studies have shown that experience of those who have attempted to borrow from financial institutions had their loan application rejected or suspended because of what Ojo (2005) and Onuoha (2011) described as formal rules of access. Some financial institutions give additional conditions for loan approval. These conditions are to be strictly observed by prospective loan applicants. These conditions include the age of account with a lending institution, approved building plan, current tax clearance certificate, and evidence of insurance of the property to be financed and bank service charges (Ojo, 2007; Onuoha, 2011). According to Ojo (2005), genuine applicants who wish to develop a house of their own are often denied access to loan due to the short period they have operated an account with banks. Most financial institutions believe that the age of account kept with them builds confidence and ensures quick repayment of the loan. On building plan and presentation of tax clearance, potential borrowers are expected to deposit the architectural plan of proposed building and present evidence of tax clearance to the bank. In some cases, banks require three to five years of tax clearance as a prerequisite for granting loan (Ojo, 2005).

2.5. Type of Loan Provided

- Another commonly attractive motivation that determines the propensity of homeowners to initiate housing loan application is the type and nature of loan provided by the financial institutions. Most financial institutions provide short term, medium and long term finance for real estate development (Nwanekezie, 1996; Kuye, 2000). However, every potential homeowner intends to leverage on these categories of real estate finance options to achieve his objectives (Kuye, 2000).

2.6. Type of Project Financed

- Subjective evidence suggests that borrowers consider the type of project financed by financial institutions before seeking for a housing loan. Housing construction and development is complex and involves many skills and resources including huge financial commitments. As such, financial institutions hardly provide loans for all the categories of housing development. There is evidence that prospective borrowers may want to borrow a loan for different purposes. For example, a borrower may want a loan for constructing a house or for outright purchase, repairs/renovations and improvement purposes (Kuye, 2000). Nwanekezie (1996) observe that the probability of borrowers securing loans depends to a large extent on the type of project the financial institution finances. It is for this reason that (Ojo, 2005) posit that a borrower is attracted to housing loan if such an arrangement helps him to achieve his purpose.

2.7. Location Factors

- It has been said that one most important factor that influences access to housing finance is site and location-related factors. For example, site and location of the property such as neighborhood location, accessibility to popular places of employment, adequate availability of utilities and transportation as well as compliance with applicable federal, state or local land use law and zoning regulations improve the chances of prospective borrowers to obtain housing loan (Nwanekezie, 1996). According to the author, location determines accessibility while accessibility determines demand and consequently profitability. The implication is that financial institutions may be reluctant to finance any project; its location would not add any economic value to the property owner. Perhaps, this is why Ojo (2004) observed that properties located in urban and rural areas are rated differently by financial institutions. For example, banks prefer properties located in urban areas than the rural areas (Ojo, 2005). This is because pieces of property may have different values just because of the difference in location. Moreover, financial institutions perceive that there is general apathy among insurance firms to provide borrowers with mortgage indemnity guarantee insurance premium for properties located in rural areas (Ojo, 2004; 2005). However, it has been argued that when the provision of housing loan is greatly and strictly hinged on location attributes, potential borrowers are often discouraged from accessing the loan (Nwanekezie, 1996). Specifically, those whose properties are located in rural areas or are not in good locations may have their loan application rejected (Ojo, 2004; 2005).

3. Research Methods

- The sample frame was drawn from a population of homeowners who borrowed, attempted/or did not succeed in borrowing loan from banks for housing finance. Available data from the regional offices of the banks as of the time of the survey shows an estimated population of 1,500 documented loan applications. A total of 500 sets of questionnaires were distributed among the classes of respondents. For those who borrowed, 180 questionnaires were distributed, out of this number, 150 were returned representing 33.4% of the distributed questionnaires. For those who did not borrow, 320 questionnaires were distributed while 300 representing 66.6% were returned. Questionnaires were administered face-to-face to the participants. Several visits were made, and reminders sent including phones calls to the respondents.The questionnaire was limited to two parts. Part 1 contained general demographic questions of the participants designed to know their background information. While part 2 comprised a set of questions that were intended to shed light on participants’ awareness of housing finance and on the perception of factors that could influence access to housing finance. The distributed questionnaires tapped into the perception of the homeowners (those who borrowed and those who did not) on the seven (7) identified factors in the literature. Discriminant analysis was used in this study. The justification for the adoption of discriminant analysis is that the study covers two respondents – homeowners who borrowed and homeowners who did not borrow. Thus, the study involves the analysis of the differences in perception of two groups of sample populations. Discriminant analysis as described by Hair et al. (1987) is a multivariate statistical method used to study the differences and make a comparison between two or more defined groups on a set of the variable measured at interval scale. It involves creating a liner mixture or blending of two or more discriminating variables that differentiate best between groups. This could be done by applying a statistical decision rule of maximizing between-group variance relative to the within-group variance (Ramsover, 1985; Hair et al., 1987; Aliagha et al., 2014). The relationship is expressed as the ratio of between-group to within-group variances, and the linear grouping is a derivative of the following equation:Z = 1X1 + W2X2+W3X3.....+WnXn;Where Z is the discriminant score, W is the discriminant weights (discriminant coefficients), and X is the independent discriminating variables.

4. Results and Discussion

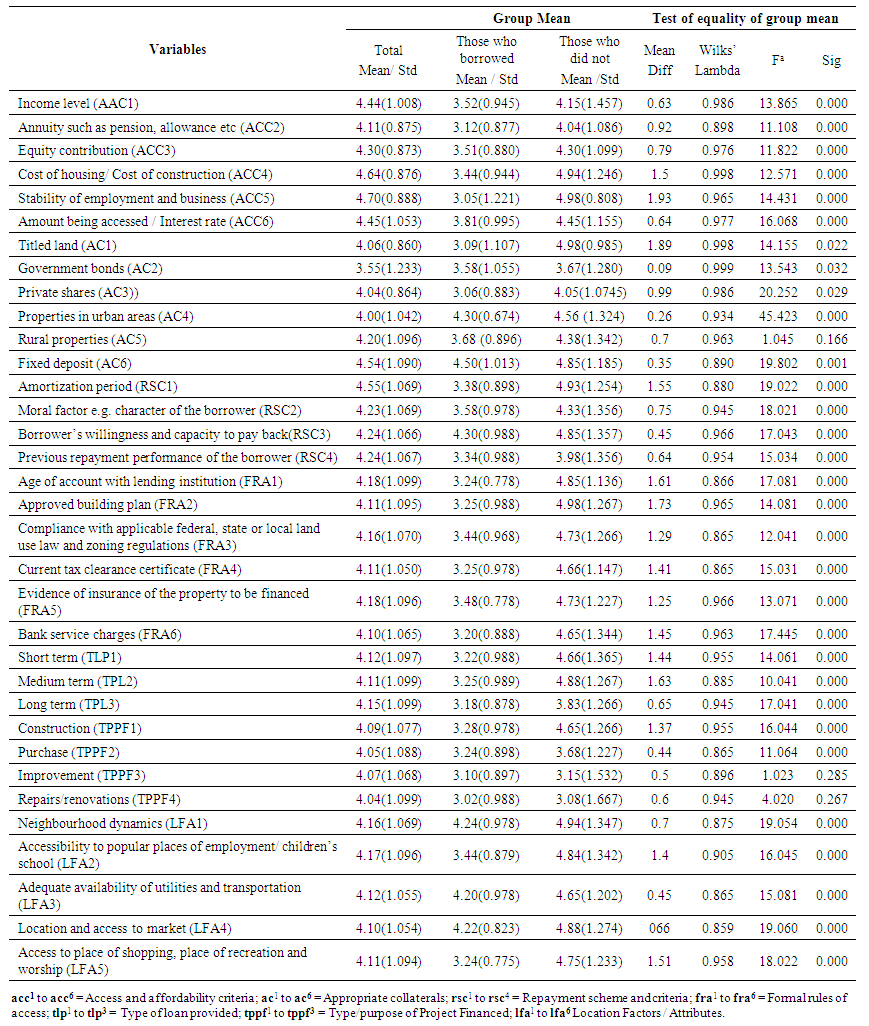

- The data gathered in filed survey were analysed using the discriminant function and the results are presented in tables 4.1 and 4.2.The Table (4.1) below shows the group means scores and tests of equality of group mean statistics used to identify variables and assess the perception of the two respondents (those who borrowed and those that did not) on factors and variables that affect housing finance. Thirty-four (34) variables were used to determine their perceptions.

| Table 4.1. Group Mean Differences and Test of Equality of Group Mean of Factors Influencing Access to Housing Finance in Owerri |

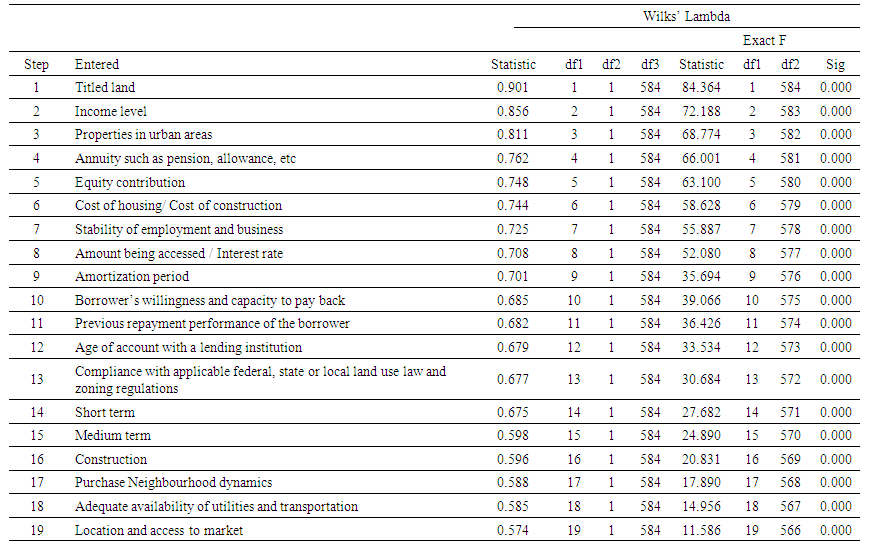

4.1. Predicting Discriminant Function for Propensity to Access Housing Finance and Testing of the Formulated Hypothesis

- In order to determine the most predictive variables that best differentiate the two groups and test the formulated hypothesis (those who borrowed and those who did not borrow) the “stepwise method of entering/remove” for deriving discriminant functions was used (Huberty and Barton, 1989; Aliagaha et al., 2014; Onuoha, 2017). Thus, the 34 variables in Table 4.1 above were subjected to the stepwise method. Table 4.2 below shows that at 30 iterations at 0.05 significant level were significant.

| Table 4.2. Predictive Model of Access to Housing Finance Variables entered/removed a,b,c,d |

5. Conclusions

- The study concludes that there are significant differences in perception between those who borrowed loan for housing finance and those who did not on the identified variables. It revealed that both those who borrowed and those who did not borrow perceived lenders requirements for housing finance as harsh based on their total mean score and values alone. It is also concluded that measures of access and affordability criteria, possession of registered title collateral (title deed) is perceived as the most difficult of lenders requirements for financing housing from those who have borrow. Other lenders requirements perceived by both those who borrowed and those who did not as stringent and restrictive to the growth of housing in the area are repayment scheme and criteria which include amortization period, moral factor e.g. character of the borrower borrower’s willingness and capacity to pay back (the borrower’s ability to repay the loans is one of the main concerns of the lender's decision), and previous repayment performance of the borrower etc.The study further concluded that for financial institutions, affordability criterion which some borrowers particularly the individual borrowers who fail to meet the conditions is the income security criteria viewed in terms of stability of employment and business. It is conclusion of this study that lenders perceive that there is general apathy among insurance firms to provide borrowers with mortgage indemnity guarantee insurance premium (MIG).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML