-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2019; 8(1): 36-42

doi:10.5923/j.ijfa.20190801.03

Dividend Policy and Its Impact on Performance of Indian Information Technology Companies

Jahangir Chauhan1, Mohd Shamim Ansari2, Mohd Taqi3, Mohd Ajmal4

1Assistant Professor, Department of Commerce, AMU, Aligarh, India

2Associate Professor, Department of Commerce, AMU, Aligarh, India

3Post Doctoral Fellow (UGC), Department of Commerce, AMU, Aligarh, India

4Post Doctoral Fellow (ICSSR), Department of Commerce, AMU, Aligarh, India

Correspondence to: Mohd Taqi, Post Doctoral Fellow (UGC), Department of Commerce, AMU, Aligarh, India.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study is an attempt to evaluate the impact of dividend policy on profitability of Indian Information Technology (IT) companies listed on Bombay Stock Exchange. Companies were selected for the study based on market capitalization. Correlation matrix and panel regression model were used for testing of hypotheses. The major findings of the study reveal that the selected companies do not follow consistent pattern of dividend payments and the association between Price Earning Ratio (PER) and Dividend Payout Ratio (DPR) is low positive. However, there is a strong relation between ROE-ROA. Hausman Test reveals that random affect model is appropriate thereby indicating that performance of selected companies have significant impact on dividend policy of selected companies. Divided policy still regarded as one of the complicated area in corporate finance. Thus, the study will help all the stakeholders to develop further understanding on dividend policy.

Keywords: Dividend, Firm Performance, Earnings per Share, Price Earnings Ratio, Return on Assets, Return on Equity

Cite this paper: Jahangir Chauhan, Mohd Shamim Ansari, Mohd Taqi, Mohd Ajmal, Dividend Policy and Its Impact on Performance of Indian Information Technology Companies, International Journal of Finance and Accounting , Vol. 8 No. 1, 2019, pp. 36-42. doi: 10.5923/j.ijfa.20190801.03.

Article Outline

1. Introduction

- Dividend decisions are integral part of firm’s strategic financial decisions. It is a compensation payable to shareholders for risk tolerance, which is directly proportional to degree of risk taken (Lipson et al, 1998). Dividend decision has been one of the most complicated and critical aspect of corporate finance. Even after several decades since evolution of dividends theories; dividend decision has been one of the important unresolved problems in finance (Brealey and Myers, 2002). It involves how much of the firm’s earnings after interest and taxes should be distributed among shareholders after their investment in firms and how much be retained for future growth of the company. Among host of factors, affecting firms’ value, dividend policy is one of them. Shareholders return in the form of dividend or capital appreciation influenced by dividend policies of the firm like other financial decisions. Dividend policy primary goal is to maximise shareholders’ wealth. Whether firm’s dividend policy is relevant or not is still a subject matter of debate among financial economist. However, general opinion is that if dividend policy is relevant then there must be optimum dividend policy and if not relevant then any dividend policy is satisfactory. Rest of the paper are organised as follows: Literature subject were reviewed in section 2, research design has been discussed in section 3, data were analysed using appropriate statistical tools in section 4 and concluding remarks has been presented in section 5.

2. Review of Literature

- Dividend distribution and its policy is always an important area of concern for every business organization, investors, researchers, and funding agencies etc. Over the year’s financial economist have propounded different theories on dividend. Some are of the view that dividend is an important factor in influencing the value of firm while some are of the opinion that dividend is irrelevant factor. Dividend Irrelevance Theory stress that dividend policy neither influence the value of firm’s shares nor the cost of capital. This is because the value of firm’s shares depends upon firm’s earning capacity and riskiness of assets held by the firm. Dividend may affect the value of firm’s share due to information effect relating to management expectations and clientele effect where the payout patterns attract the shareholders due to dividend preferences. Thus, value of firm’s share is not dependent upon firm’s dividend policy under perfect market conditions (Miller & Modigliani, 1961). However, some are of the opinion that Miller and Modigliani ideal situation is hypothetical situation and does not actually exists as we cannot ignore factors like transactions cost, taxes, inflation, and bankruptcy. Therefore, dividend policy and firm’s performance are interdependent and shareholders prefer a higher dividend policy (McCabe, 1979; Anderson, 1983 and Abor & Bokpin, 2010). Dividend policy of a firm can affect the value of firm’s share and will ultimately leads to shareholders’ wealth maximization (Barker et al, 2001). Quantum of wealth maximization is an important parameter of firm’s performance (Azhagaiah & Priya, 2008). Factors like quantum of dividend paid, historical and project profits and earnings growth pattern etc. have been influencing the dividend policy of a firm (Pruitt & Gutman, 1991). Unlike interest, dividend is not fix obligation for companies. Firms are normally averse to change in dividend policy. Stable earnings are indicator of good image of the company (Foong et. al., 2007). Shareholders give relatively higher preference to current dividend rather than future uncertain capital gain. Thus, these theories indicate that firm value and dividend payout are inter-related (Amidu, 2007). Shares of companies paying higher dividends trade at a higher price in capital market because shareholders give more preference to current yield than capital appreciation in future, which is uncertain. This is the basic crux of bird-in-the-hand theory. Dividend is regarded relatively more certain than capital appreciation so firms should maintain higher dividend payout ratio and facilitate higher dividend yield. This policy would help in upward movement of stock price (Lintner J, 1956; 1962). There is information gap among managers and investors. The managers have private information about current and future prospects of firm while outsiders are not having such privileges. Thus, dividend policy of a firm can be used an indicator of firm’s future prospects for investors (Al-Malkawi, Rafferty & Pillai, 2010). The frequency with which firms can access the equity markets to raise additional capital increases with the increase in payment of dividend. Agency cost arising from disagreement between ownership and control influence the dividend policy (Easterbrook, 1984). It is not necessary that mangers may always adopt a dividend policy that would lead to wealth maximization for shareholders. Managers may also choose a dividend policy that may maximize their personal benefits. Some financial economist are of the opinion that higher dividend payout ratio can reduce the free cash flows left for the managers still they prefer to pay dividend to ensure wealth maximization for shareholders (DeAngelo & DeAngelo, 2006; DeAngelo et. al., 2007). Several studies have attempted to establish relationship of dividend policy with ratios such as profitability, debt to equity etc. Return on Assets has positive correlation with dividend payout ratio while debt to equity ratio and return on equity has negatively correlation with dividend payout ratio (Khan et al, 2016). Regression analysis conducted on Nigerian companies revealed that divided policy has positive relationship with profitability ratios (Adediran and Alade, 2013). Thus, effective dividend policy will enable companies to attract investors. Kolawole, E. et al (2018) through their study concluded that the dividend payout and retention ratios have a positive impact on EPS in the oil and gas firms of Nigeria which they observed. Priya, et al (2013) advocated that dividend policy ratios have significant effect on all firm performance ratios except return on investment (ROI) and return on equity (ROE). EPS, P/E and PB are significantly correlated with ROA while P/E is significantly correlated with ROE. Finally EPS and PB are significantly correlated with ROE.Yegon, C., Cheruiyot, J. & Sang, J. (2014) found that there is a significant positive relationship between dividend policies of organizations and firm’s profitability, there is also a significant positive relationship between dividend policy and investments and there is a significant positive relationship between dividend policy and Earnings Per Share. Khan, W., Naz, A. (2013) The results reveal that profitability of any firm positively affects dividend payouts while leverage has no significant effect on firm dividend payouts. Nishant B. Labhane, Jitendra Mahakud (2016) using the static panel data models prove that the firm with larger profitability, maturity and liquidity tend to have higher payout ratio while the firm with higher investment opportunities leverages and business risk have a lower dividend payout possibilities. Kanwal, M. & Hameed, S. (2017). The result of this study shows that dividend payout positively influenced on financial performance of firm.Masum, A. (2014) Panel data approach is used to observe the association between dividends and stock prices considering Earnings per Share, Return on Equity, Retention Ratio which positively correlated with Stock Prices, while the Dividend Yield and Profit after Tax has negative, insignificant relation with stock prices. Thus, the study indicates that Dividend Policy has significant positive effect on Stock Prices.Khan, et al (2016) results show that dividend payout ratio and leverage have significant negative relation with the return on equity in their study on the stock listed in PSE. While a positive relation found between return on assets, dividend policy, and growth in sales.Thirumagal, P.G. and Vasantha, S. (2018) observed negative impact of dividend policy announcement on share price of Automobile, Infrastructure & Construction, Energy, Information Technology and Pharmaceutical industry. The study found that dividend payout had significant negative impact on shareholders wealth for majority of the Indian industries. There was significant difference in share price between pre and post dividend announcement.Dividend payout is one of the significant components to enhance the performance of a firm’s share price. Most of the studies advocated that dividend policy has a positive impact on profitability, particularly EPS (Kolawole, E. et al (2018), Priya, et al (2013), Yegon, C., Cheruiyot, J. & Sang, J. (2014), Khan, W., Naz, A. (2013), Nishant B. Labhane, Jitendra Mahakud (2016), Kanwal, M. & Hameed, S. (2017), Masum, A. (2014) while very few studies shows that there is a negative impact of dividend policy or dividend announcement on share price/firm performance (Khan, et al (2016), Thirumagal, P.G. and Vasantha, S. (2018).In this backdrop this study is an attempt to explore; how dividend policy of a firm would be influencing profitability of a firm listed on Bombay Stock Exchange (BSE). The other objectives of the paper are as follows:Ÿ Check how dividend policy of a firm and its profitability are associated.Ÿ Analyze the impact of dividend policy on firm’s Return on Equity (ROE). Ÿ Evaluate impact of dividend policy on firm’s Return on Assets (ROA).In order to achieve the above objectives following hypothesis were framed and tested using correlation matrix and panel regression model.Ÿ µ01: There is no significant impact of DPR, PER and EPS on ROA across the panel. Ÿ µ02: There is no significant impact of DPR, PER and EPS on ROE across the panel.

3. Research Methodology

- This section deals with the research methodology adopted to accomplish the study. This study is an attempt to find impact of dividend policy on performance of firm.

3.1. Sample of the Study

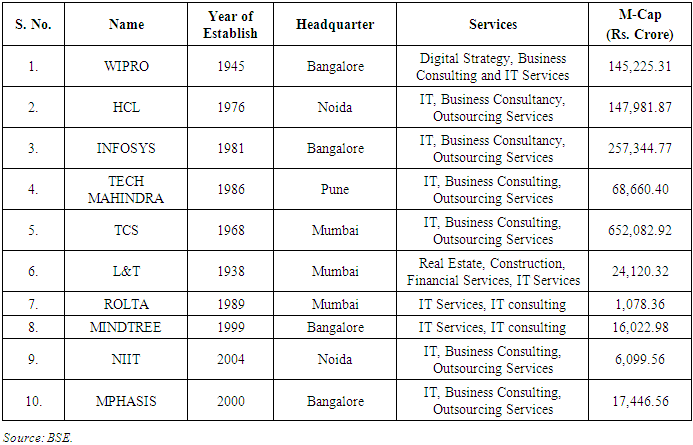

- The sample for the study is companies from IT sector. The companies were selected based on market capitalization (Table 1).

|

3.2. Source of Data

- Market capitalization data were collected from the official website of BSE. In order to calculate the ratios the data published by companies in their annual report were taken. The study is confined to only five financial years from 2012-13 to 2016-17.

3.3. Tools and Techniques for Data Analysis

- Correlation Matrix and Panel Regression Model (Fixed & Random Effect) are used to accomplish the study. Haussmann Test was used to the hypothesis.

3.3.1. Independent Variable

- Dividend Payout Ratio, Earnings per Share and Price Earnings Ratio are used as proxy variables for dividend policy.Ÿ Dividend per Share (DPS): DPS is the ratio between total dividend paid by the company and total number of shares outstanding. Total dividend includes even interim dividends also. DPS = (Total dividends paid out over a period - any special dividends) / Shares OutstandingŸ Earnings per Share (EPS): EPS is the quantum of Profit After Tax (PAT) and preference dividend that could be distributed among each shares held by equity shareholders. It helps in estimating the company’s capacity to pay dividend to its equity shareholders. It is one the important parameter in estimating market price of the equity shares of the company.EPS = (PAT – Preference Dividends) / Number of Shares held by equity share holdersŸ Dividend Payout Ratio (DPR): DPR is the proportion of dividend (DPR) distributed among the equity shareholders. It measures a relationship between earning available for equity shareholders and dividend paid to them. This ratio also helps in determining percentage of profits that is being retained by the company for the purpose of reinvestment or debt repayment. Dividend Payout Ratio = DPR /EPSŸ Price Earnings Ratio (PER): PER indicates the number of times the Earning per Share (EPS) is covered by its market price (MPS). This ratio is an important indication of risk and return profile of the particular company’s share. It helps the investor in determining whether or not to buy the shares of a company at a particular price. A high growth firms is expected to have a higher PER while share which is risky will have low PER. Higher ratio is an indicator of investors’ confidence in company’s future. It is also believed that firms with low reinvestment needs will have relatively higher PER. PER = (MPS / EPS)

3.3.2. Dependent Variable

- Return on Asset (ROA) and Return on Equity (ROE) are used to proxy for firm’s performance. Ÿ Return on Assets (ROA): ROA measures the relationship between net profits and total assets of the company. It is a measure of overall profitability and operational efficiency of the firm in using its total assets. ROA = PAT / Total AssetsŸ Return on Equity (ROE): ROE is the measures on the total equity funds of ordinary shareholders. It helps in indentifying that proportion of earning generated with ordinary holders’ funds. ROE = PAT minus Preference Dividend/ Shareholder's Equity

4. Results and Discussions

- Correlation matrix and panel regression models are employed to obtain the results and their results are interpreted to draw the conclusion for the study.

4.1. Correlation Matrix

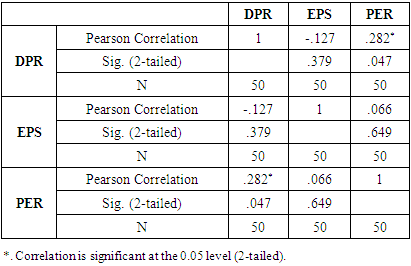

- Correlation Matrix is employed to verify the degree of association within the independent variables and between the dependent variables and independent variables. It helps us to find out which pair of variables has the highest correlation.

|

4.2. Panel Regression Model

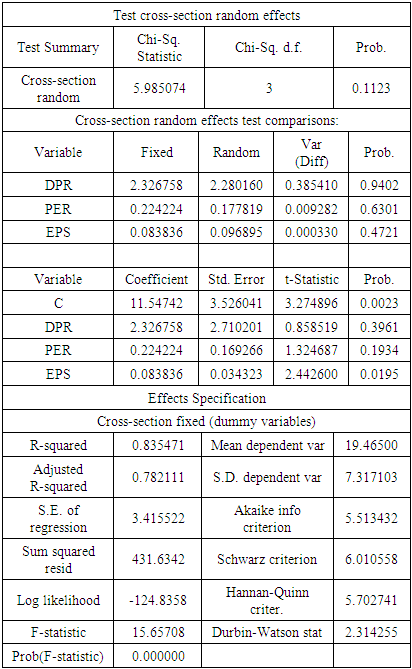

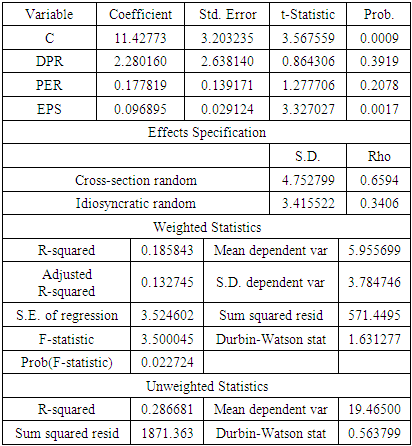

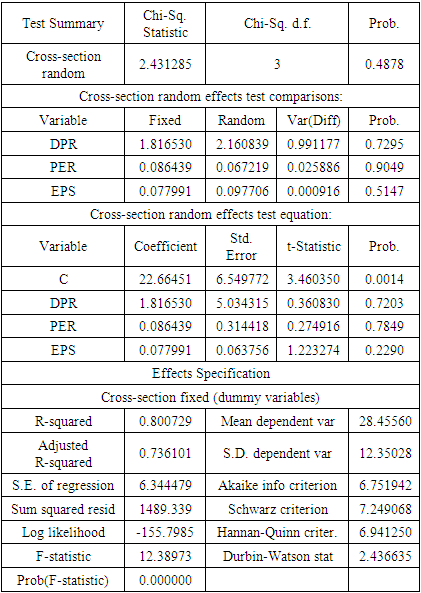

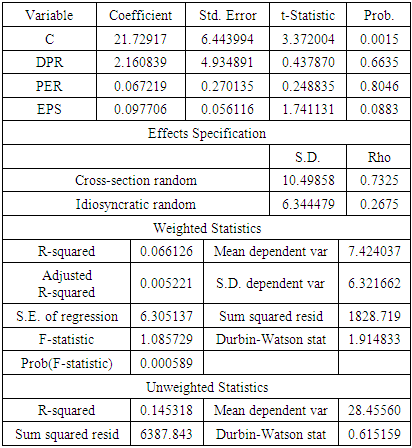

- Regression Model is a statistical tool used to establish association among variables. It facilitates in establishing fact that how the particular value of dependent variable will changes with any change in one of the independent variables; while keeping other independent variables fixed. Panel Regression Model helps in conducting multidimensional analysis over a period.In order to go for panel regression, first we will try to know that which method is best for our model. Two methods are available Ÿ Fixed effect model: It is assumed that attributes of certain variables does not vary across time and may or may not be correlated with the individual dependent variables. Therefore, it is tested to ascertain that whether fixed effects or random effects would be required to develop the model. It can be checked using Haussman test.Ÿ Random effect model: In this model, parameters are random variables and have similarity with hierarchy liner model. It is used to analyse panel data when we assume no fixed effects.Result and Discussions: Model I: (ROA c DPR PER EPS)µ01: There is no significant impact of DPR, PER and EPS on ROA across the panel. First, we estimate the model with random effect and then estimate the Hausman test to conclude about the method to be used for hypothesis testing. If the prob. Value of Hausman Test is less than 0.05; the null hypothesis will be rejected. This would indicate that using Fixed Effect Model for the study would be appropriate. If a null hypothesis accepted, it would be appropriate to use Random Effect Model.As the prob. value (0.1123) is greater than 0.05; the null hypothesis is accepted. Thus it could be concluded that fixed effect regression model is not appropriate as depicted in Table 3. It would be appropriate to use random effect model.

|

|

|

|

5. Conclusions

- Different dividend ratios considered for the study reveals that sample companies do not have any consistent pattern of dividend payment and trend is skewed in nature. It has also been observed from the correlation matrix that a very low positive association exists between Price Earnings Ratio and Divided Payout Ratio at 5% level of significance. Similarly it was also observed that association between ROA – EPS, ROE - EPS was low positive and significant at 1%. However, there is strong association positive between ROE- ROA at 1% level of significance. In this study two regression models were also used (i) Model I: ROA c DPR PER EPS and (ii) Model II: ROE c DPR PER EPS. The results of both the Models were significant thereby indicating that random effect regression model is appropriate. It could be concluded that performance of firm has a significant impact on the dividend policy of companies belonging to Information Technology Sectors.

6. Implications of the Study

- IT sector plays a significant role in service sector, which contribute maximum revenue to the Indian GDP. Dividend policy and pattern of its distribution has been an important issue of discussion in finance. The study would be helpful for users like managers who are interested in profit planning and investment. The paper will help the reader to develop further understanding on dividend policy, which is still on the most complicated subject in corporate finance. This study is also significant because an attempt has been made to develop appropriate dividend policy models.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML