Sourajyoti Sardar, Vishal Shinde, Shradha Singh

Department of Statistics and Information Management, Reserve Bank of India, Mumbai, India

Correspondence to: Sourajyoti Sardar, Department of Statistics and Information Management, Reserve Bank of India, Mumbai, India.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

This study explores the impact of Ind-AS - the new accounting standard on the financial health and performance of the listed companies in India alongside the few sectors of the economy. We have observed that sectoral impacts of Ind-AS are relatively range bound for the major heads of the financial statements. However, at the company level, this variation is considerably higher and significantly volatile for the minor variables. Majority of the changes occurring in the financial statements of companies are because of the changes in reported net worth (because of fair valuation of assets), financial instruments, provisions, finance cost and deferred taxes. The reported profitability numbers are relatively volatile because of changes in fair valuation of derivatives and financial instruments, amortisation of intangible assets, and reclassification of actuarial gains/losses. We have found that, impact of Ind-AS is more evident in the manufacturing sector as compared to the services.

Keywords:

Indian Accounting Standard, Ind-AS, Indian GAAP, Financial ratio, Relevance of financial information

Cite this paper: Sourajyoti Sardar, Vishal Shinde, Shradha Singh, Journey of Indian Corporates from Local to International Accounting Standard: An Impact Analysis, International Journal of Finance and Accounting , Vol. 7 No. 6, 2018, pp. 161-185. doi: 10.5923/j.ijfa.20180706.01.

1. Introduction

Accounting standards improve the transparency of financial reporting across all countries. Since 2007, the Ministry of Corporate Affairs (MCA), Government of India has been taking the initiatives to update the existing accounting and reporting standards, i.e. Indian Generally Accepted Accounting Principles (Indian GAAP or I-GAAP) and move towards the best practices at par with the world. In 2015, MCA notified a set of rules called the Companies Rules 2015, introducing the Indian Accounting Standards (Ind-AS) as a step towards convergence with International Financial Reporting Standards (IFRS). In short, GAAP is a collection of accounting generics, which give birth to IFRS, which is further reduced to Indian Financial Reporting Dynamics and finally converges to Ind-AS.The purpose of our study is to evaluate the effects of convergence into the Ind-AS accounting framework from the I-GAAP in financial statements. For this purpose, we have analysed both the Ind-AS and I-GAAP based financial statements of the 56 listed companies for a common period i.e. end March 2016, belonging to manufacturing, services, and power sectors.Through this study, we have tried to answer the following questions.1. Whether the change in accounting policy from I-GAAP to Ind-AS has any impact on the financials and performances of the individual companies together with the sectors/ industries they be-long.2. If yes, then what are the dimensions and magnitudes of this impact?3. How the changes in accounting standards have affected the performance of the Indian firms at various levels starting from individual company to industry?4. How significant the impact is?We have divided our investigations into several parts. At first, we have examined each of the financial statements items across the companies, studied the corresponding notes and presented the impact of changes in graphical and tabular format to gather the relevant information. Then, from those relevant information, we have collected the evidence of the key variables at the company, industry and sector level, which are largely impacted due to the change in accounting policy. We have also measured various ratios to understand the impact of Ind-AS in their financial performance in terms of ‘Capital Structure’, ‘Liquidity’, ‘As-sets Utilizations and Turnover’, ‘Expenditure’ and ‘Profitability and Profit Allocation’. Finally, we have tried to find out the statistical significance of the impact of Ind-AS on those key variables and financial ratios.MCA has mandated that, companies reporting the financial statements under Ind-AS for the first time, require the ex-post-facto reassertion of certain historical period information in the first set of reporting. Data pertaining to these restated periods have helped us to find the changes appeared in the key metrics of the companies including the financial position and performance. The cascading effect of Ind-AS adoption is beyond ac-counting. We have observed that, impact of the changes in accounting policy is not only different from one sector to other; it is different at industry level as well as individual company level depending on the operational characteristics of these industries and sectors. At the company level, the asset composition, investment position and equity arrangement of these companies played an important role in the transition into Ind-AS. For the broader items of the financial statements, i.e. total assets, equity, liability, income, expenses and profits, the transition effect is mostly range bound. However, we have experienced that the impact of Ind-AS is very much volatile for the granular level variables of the financial statements. Few of such variables are property, plant and equipment (PPE), financial investments, loans and security deposits, borrowings, provisions, revenue from operations, other income, employee benefits expenses, finance costs and deferred tax expenses.We have found that, impact of Ind-AS is more evident in the manufacturing sector as compared to the services. The impact in asset class is primarily adjusted through equity in the manufacturing sector. However, in services sector, both equity and liability have contributed in the asset side adjustment. We have witnessed that, property, plant and equipment, financial investments, loans and security de-posits, inventories (primarily in services sector) at the asset side and borrowings, provisions, deferred tax liabilities (net) and other financial liabilities (including deposits, redeemable preference shares, derivative instruments etc.) at the liability side are affected most due to convergence into Ind-AS. Although, revenue from operations (net of excise duty) has decreased, profit margin has improved for most of the companies during this transition.On the performance front, we have observed mixed impact among the companies for various performance ratios. On the leverage side, we have not witnessed much impact on the majority of companies. We have perceived improved financial health and liquidity situation for the manufacturing companies by observing the capital structure ratios and the liquidity ratios of the companies under Ind-AS reporting. We have also experienced improved operating profit margin for most of the manufacturing companies under Ind-AS. For the services sector, although an improvement in operating efficiency has been observed, operating profit margin has fallen for the majority of the companies. We have discussed the different aspects of the impact of Ind-AS adoption such as direction of the impact, their magnitude and possible reasons more elaborately in the ‘6. Findings’ section.This study will be useful to those, who make use of the financial statements of the companies on day-to-day basis and interested in the inter-temporal comparison of the financial health and performance between the Indian companies, which transmitted from one accounting framework to the other.

2. Literature Review

Worldwide, various studies have been conducted on the effects of IFRS conversion from local GAAP. Daske, H. et al. (2008) (e.g. [6]) examined the economic consequences of mandatory IFRS reporting around the world. They analysed the effects on market liquidity, cost of capital, and Tobin's q in 26 countries using a large sample of firms that are mandated to adopt IFRS. They found that, on average, market liquidity increases around the time of the introduction of IFRS. They also observed that, a decrease in firms' cost of capital and an increase in equity valuations, subject to the possibility that the effects occur prior to the official adoption date. They found that the capital‐market benefits occur only in countries where firms have incentives to be transparent and where legal enforcement is strong, underscoring the central importance of firms' reporting incentives and countries' enforcement regimes for the quality of financial reporting. Comparing the mandatory and voluntary adopters, they experienced that the capital market effects are most pronounced for firms that voluntarily switch to IFRS, both in the year when they switch and again later, when IFRS become mandatory.Terzi, et al. (2013) (e.g. [12]) investigated the statistical significance of the effects of transition from local GAAP to IFRS on accounting figures of 140 listed manufacturing companies of Turkey. The results of the study suggest that adoption of IFRS had a statistically significant effect on inventories, fixed assets, long-term liabilities, and shareholders’ equity. They have also indicated that, impacts of IFRS are different from one another at industry level.Zeghal et al. (2011) (e.g. [13]) examined the impact of IFRS convergence on the earnings of French companies. They found that IFRS adoption caused a reduction in the earnings management level.Stent et al. (2010) (e.g. [11]) studied the effects of IFRS on the financial statements and ratios based on the sample of 56 listed companies of New Zealand. The results show that majority of the firms are affected by the adoption of IFRS. The results also indicate an increase in the return on equity, return on assets, leverage and return on sales and decreases in asset turnover ratio under IFRS.In the Indian context, majority of the studies were carried out prior to the adaptation of Ind-AS and based on the companies those reported their financial statements in IFRS and Indian GAAP.The Institute of Chartered Accountants of India (2018) (e.g. [18]) carried detailed analysis on the impact of Ind-AS in their study ‘Indian Accounting Standards (IFRS converged): Successful Implementation Impact Analysis and Industry Experience’. In this study, they have carried quantitative as well as qualitative impact of Ind-AS on consolidated financial statements of select 170 listed companies from different industry groups. Their analysis was focused on Ind-AS transition impact on key financial parameters. They have also carried out qualitative analysis, wherein survey-based industry experience on implementation of Ind-AS gathered from few industry experts. The results of the study suggest no substantial impact on key financial parameters such as equity, total assets, tangible assets, borrowings, profit after tax, and revenue at the aggregate level. However, the study observed diversified impact among various industries as well as on individual companies.Pouradeli, A. N., and N. Nagaraja. (2018) (e.g. [10]) examined the influence of ordinary conversion of India monetary accounting to the IFRS on financial gain smoothing activities through investments and receivable’s loss provisions of Indian firms. The results indicate that there is no concrete evidence that IFRS, significantly IAS thirty-nine is related to mitigating financial gain smoothing activities of firms in India. However, financial gain smoothing activities do decline in usually listed firms of India once IFRS adoption.Ernst & Young LLP (2017) (e.g. [17]) carried out an exhaustive analysis on the impact of Ind-AS in their study “Ind AS transition - Journey of Indian corporates” based on 82 listed companies. They found that majority of the companies have the positive impact on net worth, positive to mixed impact on profits and adverse impact on revenue.Das, Surajit, and T. R. Saha. (2017) (e.g. [5]) in their research made a parallel comparison between IFRS and Indian GAAP and documented the basic difference between these two standards. The research was based on the analysis of five Indian IT companies, who adapted IFRS voluntary. Their analysis revealed that, although there is absolute difference in the quantitative indicators, calculated as per financial statement which is prepared as per IFRS and I-GAAP rules simultaneously, there is no statistical evidence (except liquidity position) to prove this difference. On the other hand, the regression analysis showed some indicative result that adoption IFRS can increase market value by way of foreign investors, foreign acquisition etc.Patil, Ameya et al. (2017) (e.g. [9]) examined the impact of IFRS convergence on the liquidity and profitability of India Information Technology (IT) Sector. They found that liquidity ratio shows an increase and profitability ratios show no significant difference. This also indicates that the Indian GAAP standards do not result in understatement or overstatement of earnings in case of IT sector companies.Amogh, N., & S. MariGowda (2016) (e.g. [2]) observed that the leverage ratios are not affected much due to IFRS convergence, but significant differences are observed in other ratios because of reclassification of assets and liabilities under different heads.Dr M. Muniraju & Ganesh. S. R (2016) (e.g. [7]) in their paper examined the awareness of stakeholders towards the implementation of IFRS in India and to know the impact of IFRS Convergence on Different Sectors. Their study indicated that the adoption of IFRS more beneficial to attract the world capital market and the adoption of rules regarding truthful worth accounting, lease accounting and tax accounting, as well as rules regarding the accounting of economic instruments, explain the changes within the key accounting ratios. Adoption of fair value accounting rules and stricter requirements of certain accounting issues are the reasons for the changes observed in accounting figures and financial ratios.Tawiah, Vincent, and B. Muhaheranwa. (2015) (e.g. [19]) in their research tried to find out the changes arised due to the differences between IFRS and Indian GAAP bring to quality and relevance of on financial statements and accounting ratios information. They have also tried to find out whether the impact of IFRS is same for all companies. They worked on eight ratios combining the Liquidity, Profitability and Leverage and used the Gray’s Index of conservation. This study concluded that Ind.AS will provide current and quality accounting information on accounting ratios but the quality level will not be same over the years.Bhargava, Vidhi, and D. Shikha. (2013) (e.g. [3]) in their paper discussed the impact of transition on various items of the financial statements and their impact on some powerful ratios. They found that, variation in total assets and liabilities is because of the reclassification among equity and liability and also because of the difference in the concept of revenue recognition. The valuation and depreciation of property plant and equipment is also a big cause of difference. Their analysis emphasise the fact that IFRS is a fair value principles based accounting which will improve quality of disclosures and enhance international comparability and understanding of financial statements.Daske, H. et al. (2008) (e.g. [6]) examined the economic consequences of mandatory IFRS reporting around the world. They analysed the effects on market liquidity, cost of capital, and Tobin's q in 26 countries using a large sample of firms that are mandated to adopt IFRS. They found that, on average, market liquidity increases around the time of the introduction of IFRS. They also observed that, a decrease in firms' cost of capital and an increase in equity valuations, subject to the possibility that the effects occur prior to the official adoption date. They found that the capital‐market benefits occur only in countries where firms have incentives to be transparent and where legal enforcement is strong, underscoring the central importance of firms' reporting incentives and countries' enforcement regimes for the quality of financial reporting. Comparing the mandatory and voluntary adopters, they experienced that the capital market effects are most pronounced for firms that voluntarily switch to IFRS, both in the year when they switch and again later, when IFRS become mandatory.

3. Conceptual Framework of IND-AS

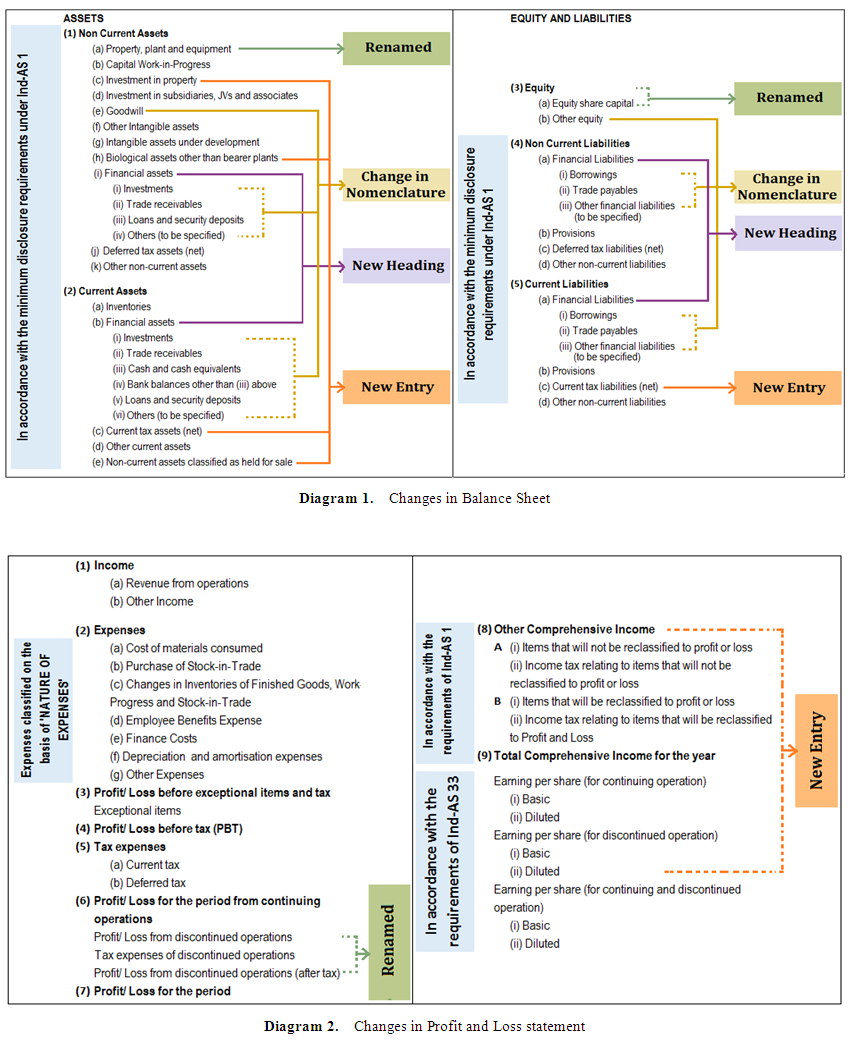

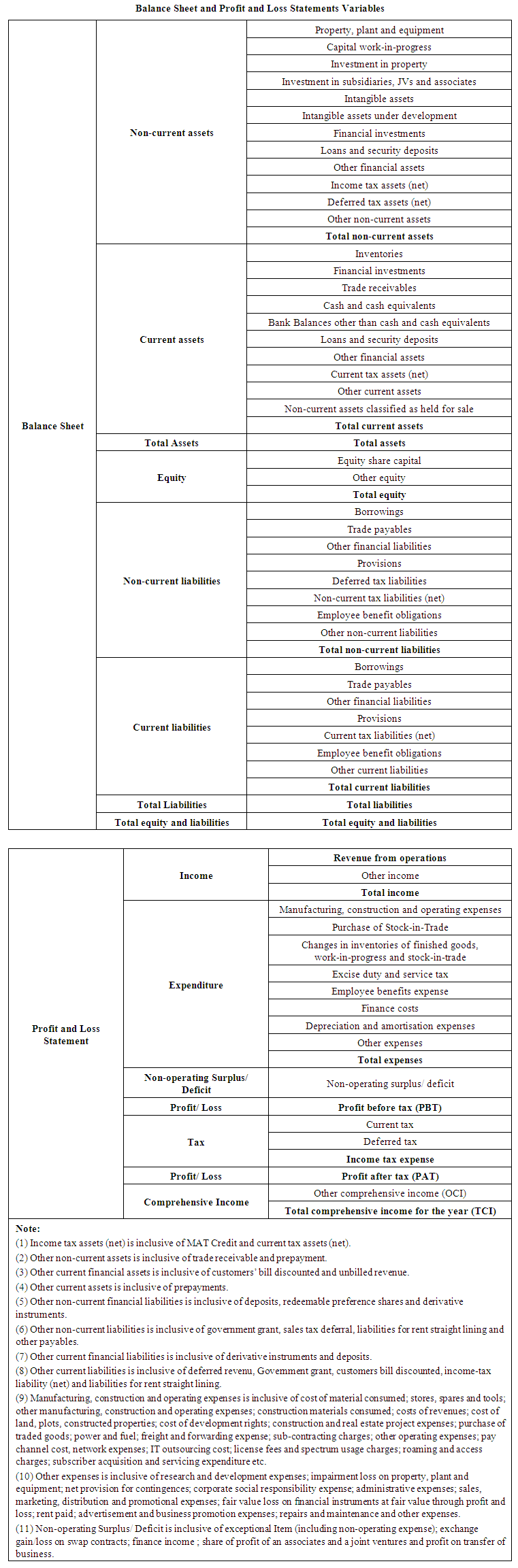

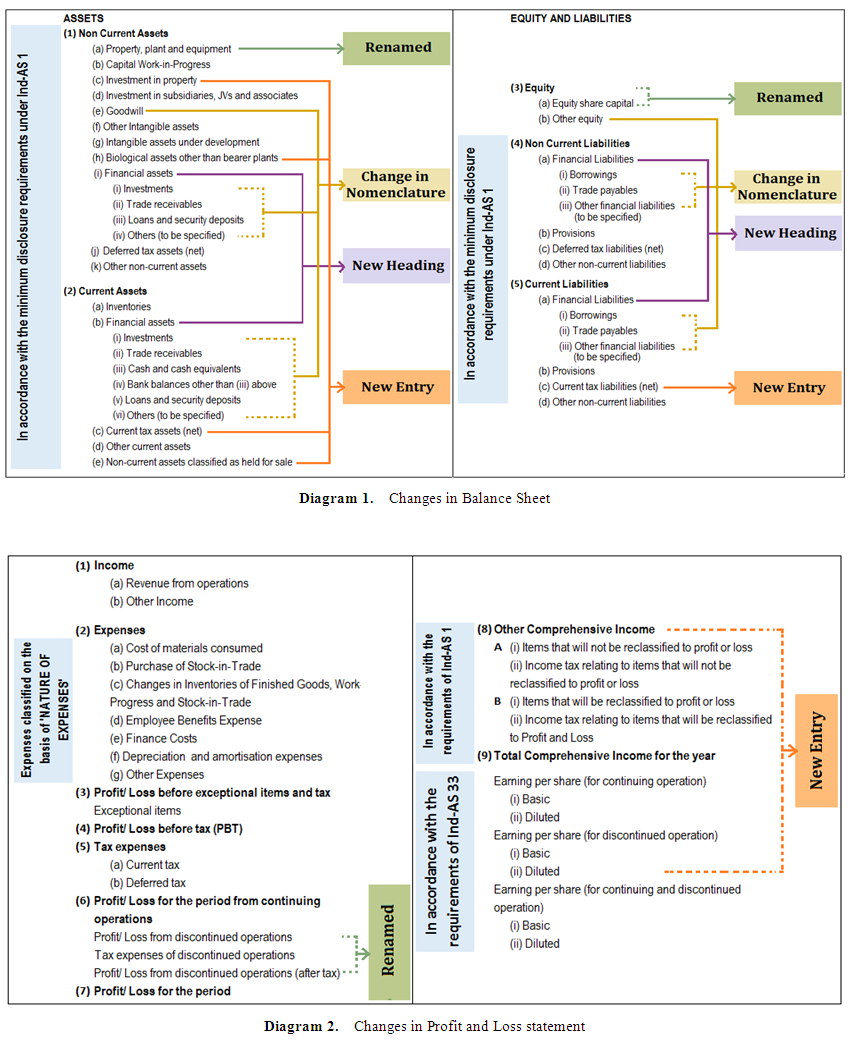

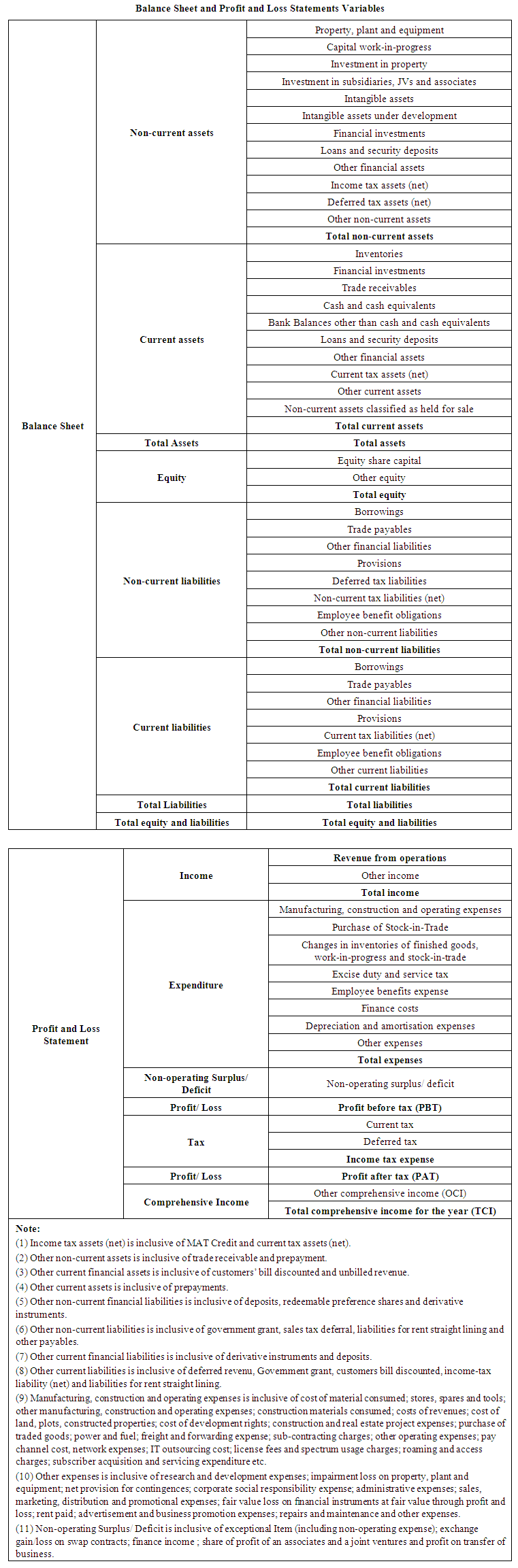

In this chapter, we have tried to present the objective of Ind-AS implementation along with its impact in terms of accounting practice, presentation and recognition criteria in the financial statements.The main objectives behind the adoption (or convergence) of Ind-AS over I-GAAP are (i) Presentation at fair value; (ii) Recognition of time value of money; and (iii) Making the financials more robust by distinguishing the uncertainties more timely (in the form of provisions) and amplified disclosures. Fair value accounting helps in valuation of the assets/ liabilities by recognizing the cost involved with asset acquisition as on date through Asset Retirement Obligation (ARO). ARO recognizes the present value of the instrument (time value of money) along with the imputed interest cost of such provision.Ind-AS 1 as well as the Companies Act 2015 defines a ‘Complete Set of Financial Statements’, which is consists of five different sections viz. (1) Balance sheet; (2) Statement of profit and loss; (3) Statement of changes in equity, (4) Cash flow statement; and (5) Notes. Statement of profit and loss entails two sub-parts viz. (a) Profit or loss section and (b) Other comprehensive Income (OCI).Fair value measurement is a fundamental concept forming the underlying basis for the Ind-AS framework. In I-GAAP, there is no framework for measuring fair value for financial reporting. As defined in Ind-AS, ‘Fair Value is a market-based measurement, not an entity-specific measurement. The main objective is to estimate the price at which an orderly transaction to sell the asset or to transfer the liability would take place between market participants at the measurement date under current market conditions (i.e. an exit price at the measurement date from the perspective of a market participant that holds the asset or owes the liability)’.Impact on Ind-AS on balance sheet and profit and loss statements can be categorized into three different parts viz. (i) Impact on accounting; (ii) Impact on recognition and (iii) Impact on presentation.We have exhibited the presentation changes in the balance sheet and profit and loss statements in the Appendix – 1.Impact on accounting on balance sheet comprises of (a) recognition of differed tax using Balance sheet approach (temporary differences) as compared to the Profit and loss approach (timing differences) in I-GAAP; (b) accounting for the mergers and acquisitions using fair value approach; (c) better clarity on the shift in various financial ratios due to the change in accounting policy.Impact on recognition on balance sheet comprises of (a) acknowledgment of long-term provisions on present value; (b) inclusion of ARO on present value basis for the asset; and (c) recognition of investments on present value.Impact on presentation on balance sheet comprises of (a) reclassification of financial instruments (viz. Convertible bond as equity and redeemable preference share as debt); (b) consolidation of Employee Stock Ownership Plan (ESOP) trust in accordance with the company’s consolidated financial statements. Impact on accounting on profit and loss statements comprises of (a) recognition of dividend on redeemable preference share as interest cost; (b) changes in amortization charges in agreement with the fact that intangible assets can have an indefinite useful life.Impact on recognition on profit and loss statements comprises of (a) timing of the revenue recognition; (b) recognition of revenues on multiples component contracts distinctly; and (c) reporting of revenue on gross basis but net of incentives and discounts.Impact on presentation on profit and loss statements comprises of (a) recognition of actuarial gain/ loss through OCI; (b) accounting for the investments made in an associate or a joint venture using the equity method (except the exemptions provided in Ind-AS 28); and (c) presentation of indirect taxes paid as part of cost line items.The Statement of Changes in Equity has been introduced in Ind-AS on the lines of IFRS. As per the statement of changes in equity, an entity must present a statement of changes in equity as a part of balance sheet.

4. Source of Data and Sample Size

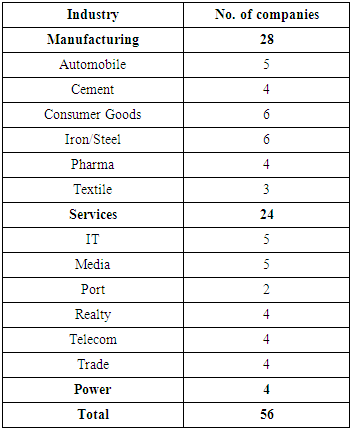

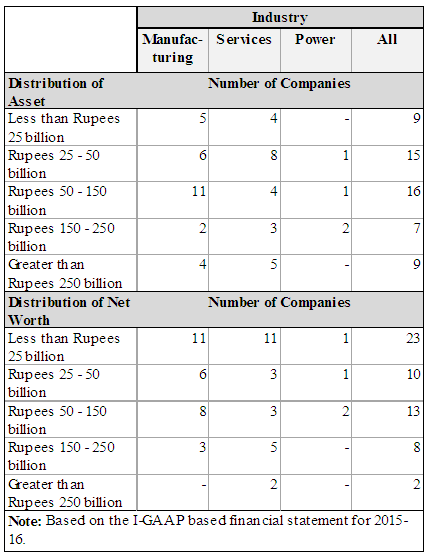

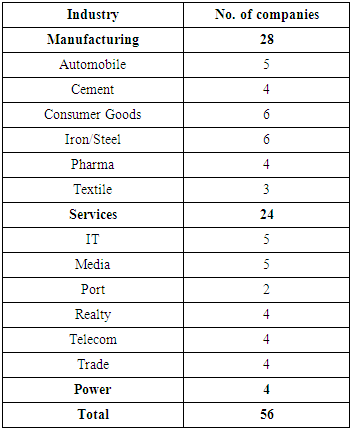

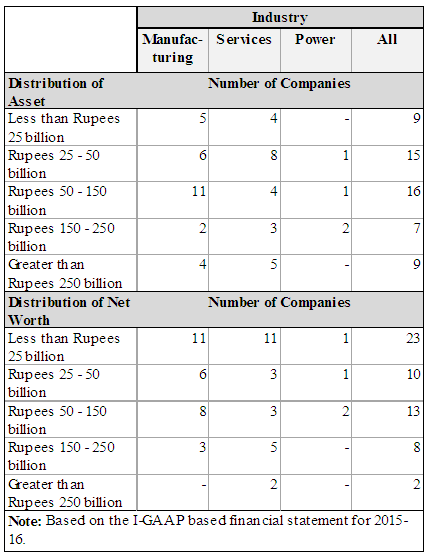

In this study, we have included 56 listed companies be-longing to the manufacturing, services and power (generation and distribution) sectors. We have collected the audited annual financial statements of these companies for the financial year 2016-17 available in the public domain. The presentation requirements under Ind-AS differs from the Indian GAAP. Accordingly, these companies have pre-pared financial statements, which comply with Ind-AS applicable for period ending on March 31, 2017, together with the comparative period data for the year ended March 31, 2016. For the ease of reconciliation with Ind-AS, these companies reclassified the previous GAAP information in accordance with the Ind-AS 101 (i.e. First time adoption of Indian accounting standards) and presented alongside the Ind-AS with ‘Adjustment (over Indian GAAP)’ figures for the year ended March 31, 2016. We have observed that, few companies, who maintain their accounts on calendar year basis, have provided such information as on December 31, 2016 and we have also included these companies in our study. We have used these ex-post-facto reassertion data of the financial statements variables as provided by these companies in our study. The list of balance sheet and profit and loss variables, which we have used in this study, are presented in Appendix – 2. We have presented the industrial break-ups of these selected companies in Table 1. We have also presented the size wise distribution of these 56 select companies in the Appendix – 3.Table 1. Industry wise break-up of companies

|

| |

|

5. Research Methodology

First, we have tried to gather the relevant information on the impact of Ind-AS on the financials of the companies by means of the graphical representation of data and colleting the corresponding useful material provided in the individual financial statements of the companies. We have also measured various ratios to understand the impact of Ind-AS in their financial performance. Finally, we have tried to find out the statistical significance of the impact of Ind-AS on those key variables and financial ratios.

5.1. Finding the Meaningful Information by Presenting the Data in Tabular and Graphical Format

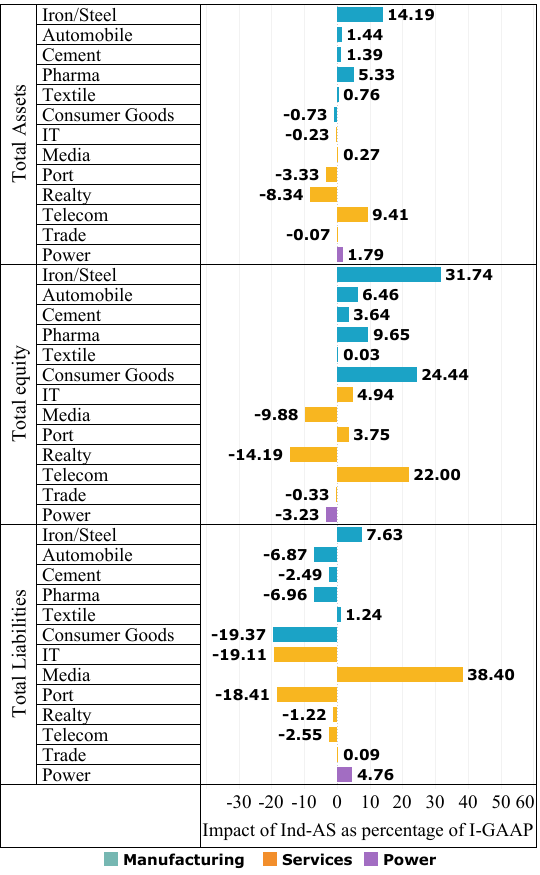

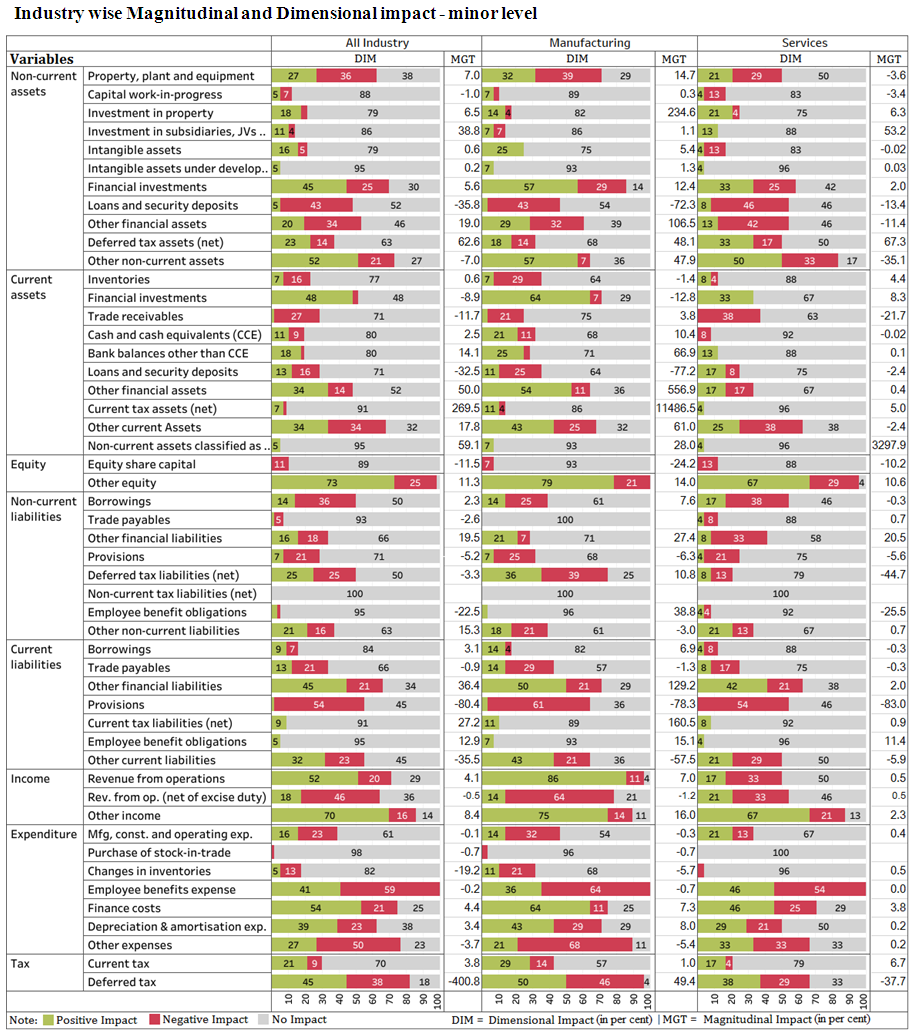

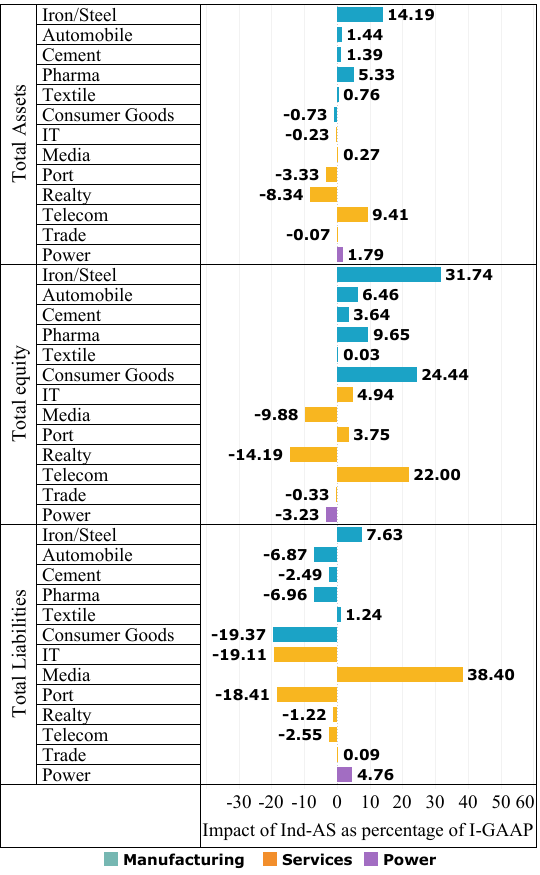

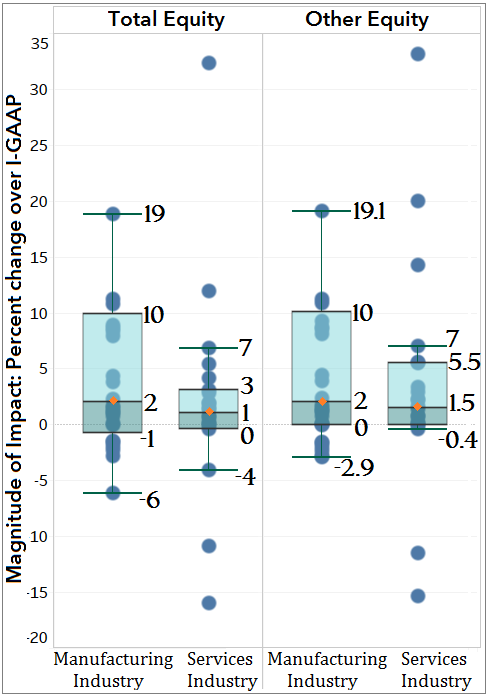

Financial Statement Variables: To gauge the impact of changes in accounting policy, we have tried to measure the impact in two different perspectives. The first one is direction of impact i.e. sign (positive/ negative/ no impact) of difference between the Ind-AS and I-GAAP figures and the second one is the actual impact in terms of percentage change of impact or the adjustment over I-GAAP, i.e. | (1) |

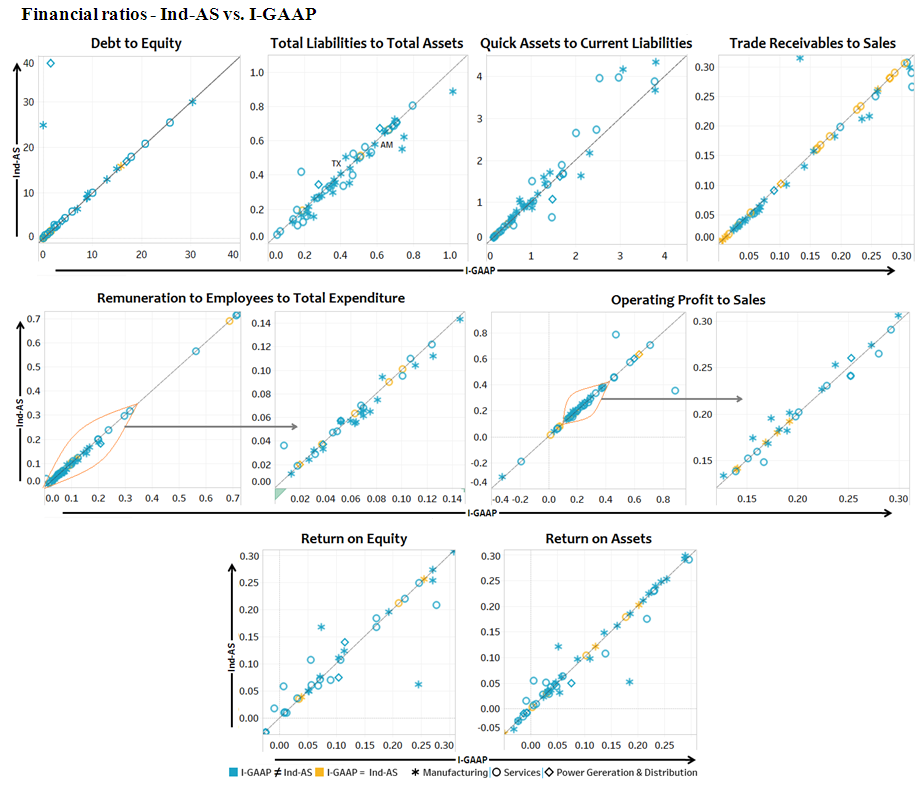

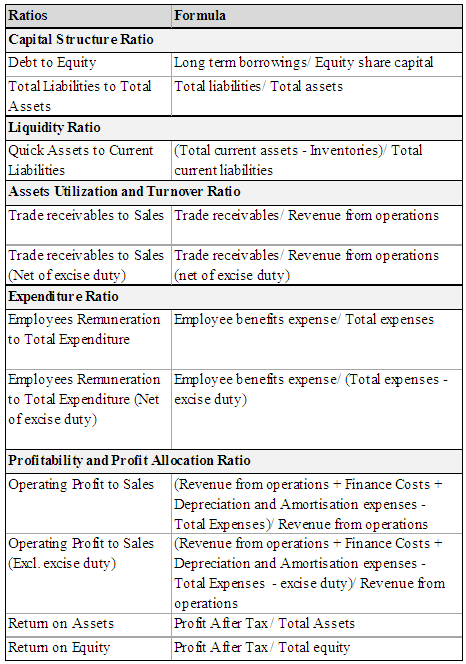

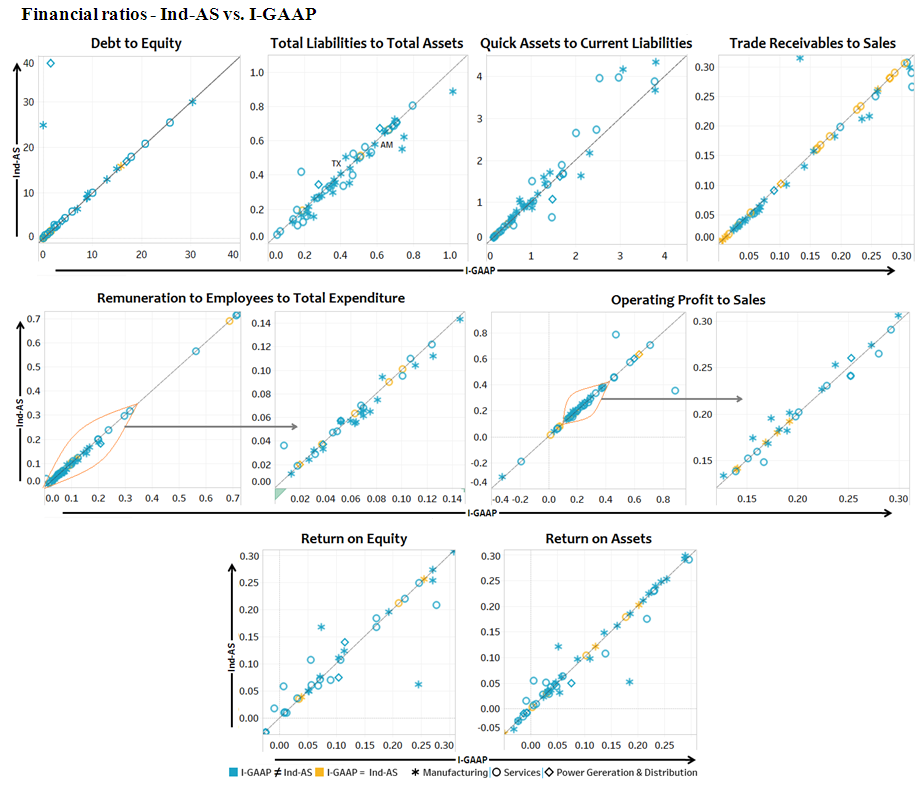

We have considered the absolute value of the denominator to make it more meaningful. We have termed the first one as ‘Dimension’ level impact and the second one as ‘Magnitude’ level impact. We have calculated both dimensional and magnitudinal impact at individual company, industry and sector level across all variables of the financial statement.To evaluate the sector level dimensional impact, we have first calculated the ‘Positive’, ‘Negative’ and ‘No Impact’ score1 for all the companies across all the variables of balance sheet and profit and loss. Then, from the set of company level qualitative figures across all variables of the financial statement, we have calculated the sector wise dimensional impact. The dimension level impact for a variable within a sector is categorised as ‘Positive’ when proportion of Positive impact at individual company level is considerably higher with in that sector. The concept is same for the ‘Negative’ impact. When proportion of ‘Positive’ and ‘Negative’ impact is relatively equal within a sector, we have named it as ‘Mixed’ impact. In case, majority of companies have no Ind-AS impact on a particular variable within a sector, we have termed it as ‘No Impact’.Financial Ratios: We have first calculated the financial ratios at the company level and sector level. With the similar approach, we have then calculated the dimension and magnitude level impact of Ind-AS for those ratios at company level as well as sector level. We have presented a list of these ratios (with formula) in Appendix -4. We have also plotted the Ind-AS ratios against the I-GAAP ratios across all the companies in the scatter diagram to evaluate its dimensional impact alongside the magnitude by seeing the position (deviation from the diagonal line) of the company with respect to the various ratios in the graph (refer Appendix -11).

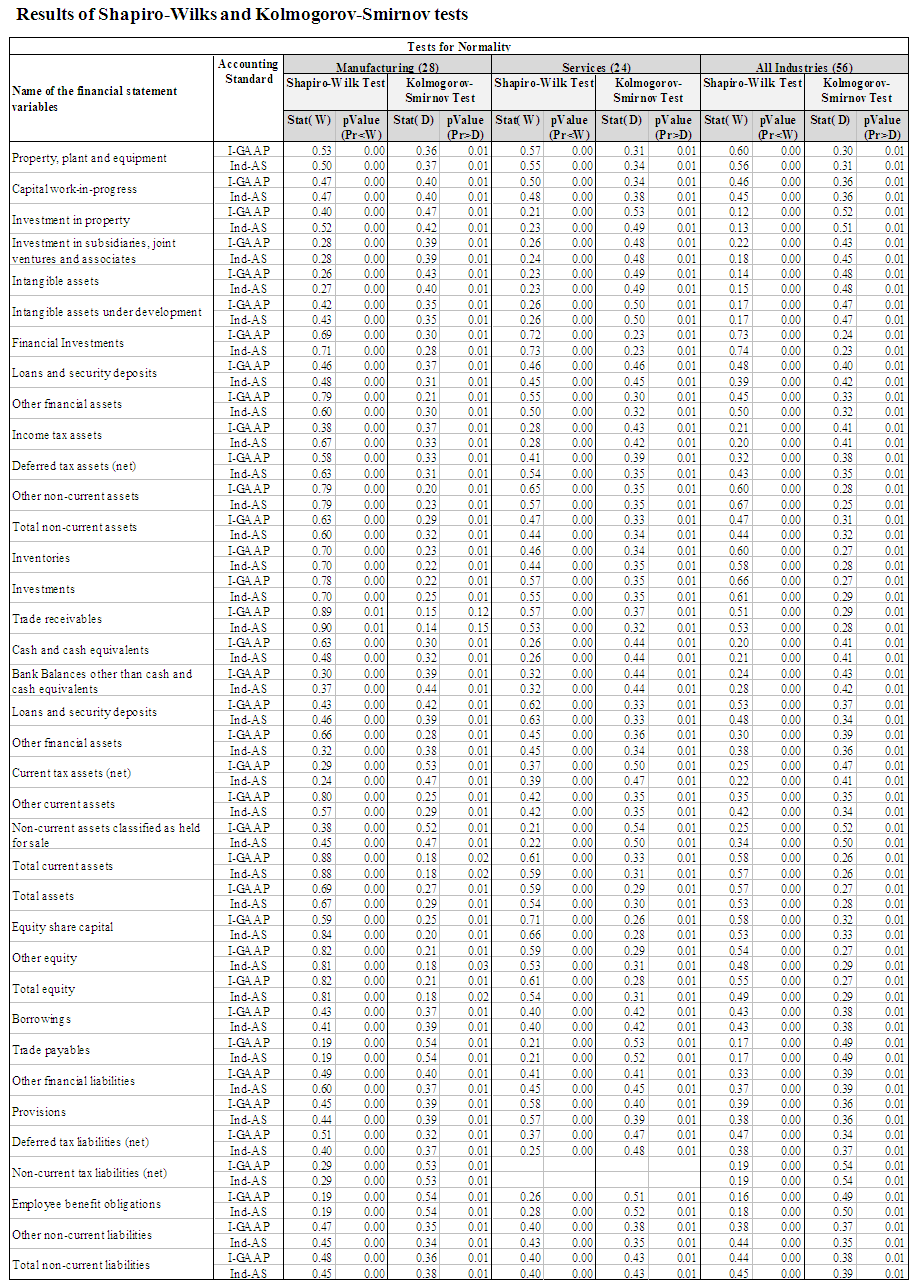

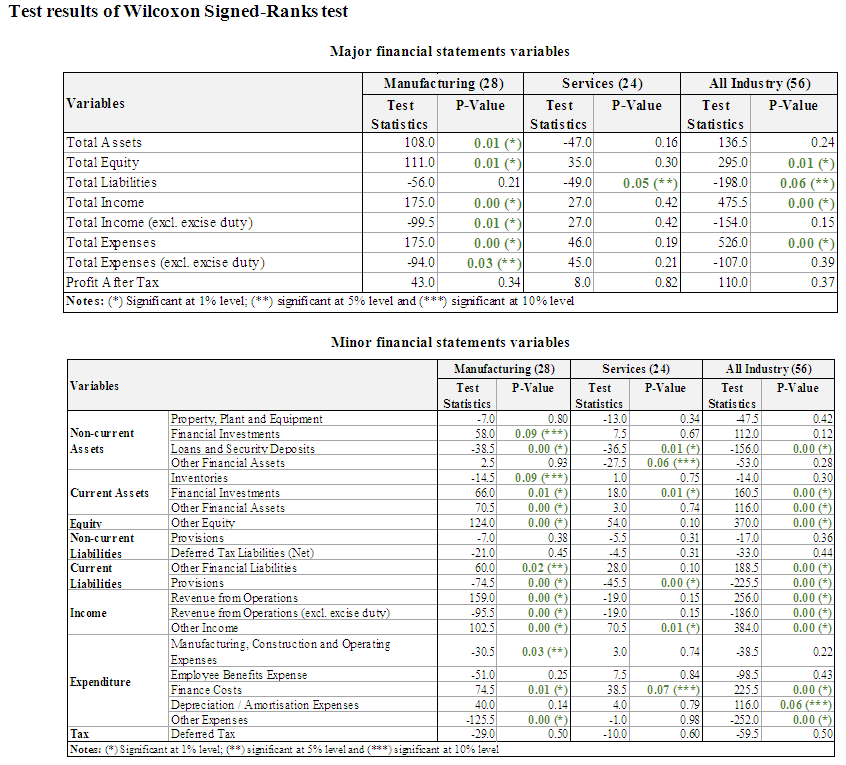

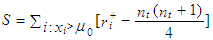

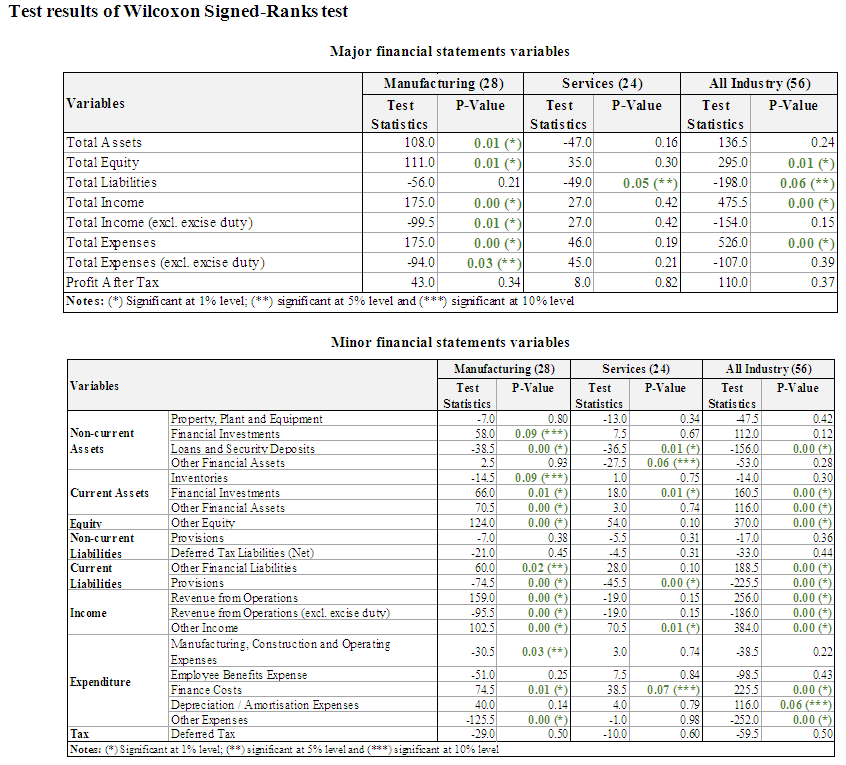

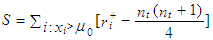

5.2. Non-Parametric Test to Measure the Statistical Significance of Ind-AS Impact

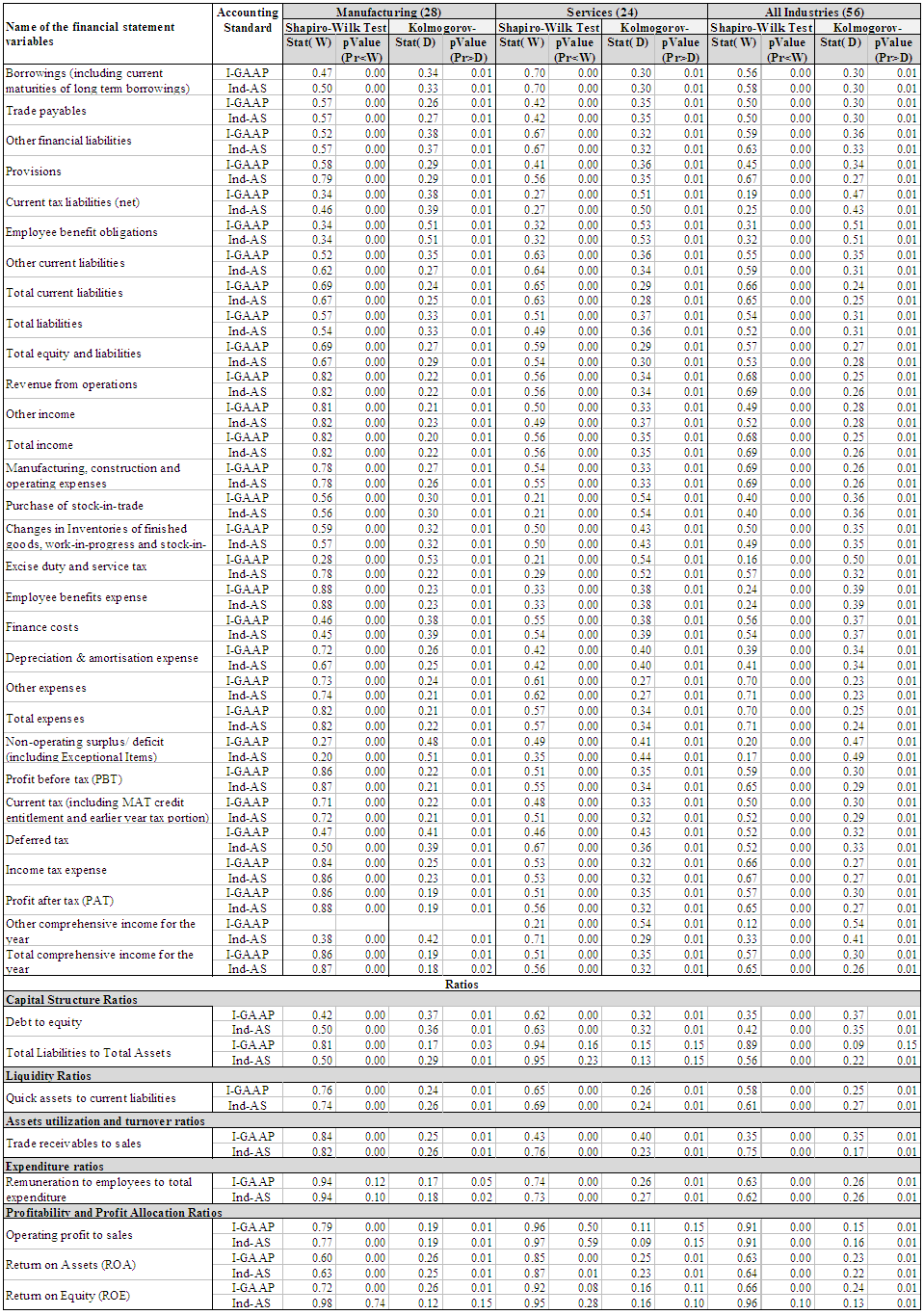

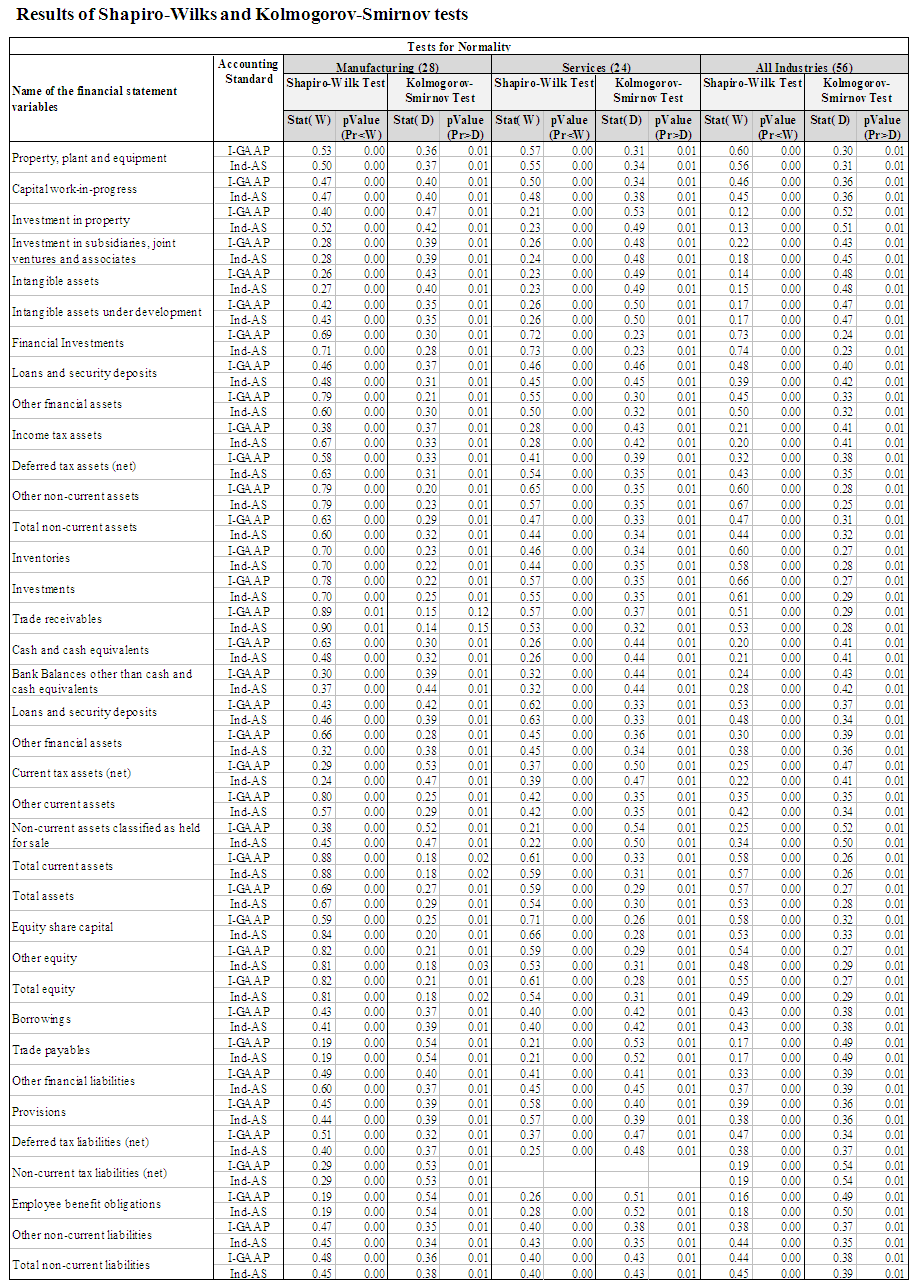

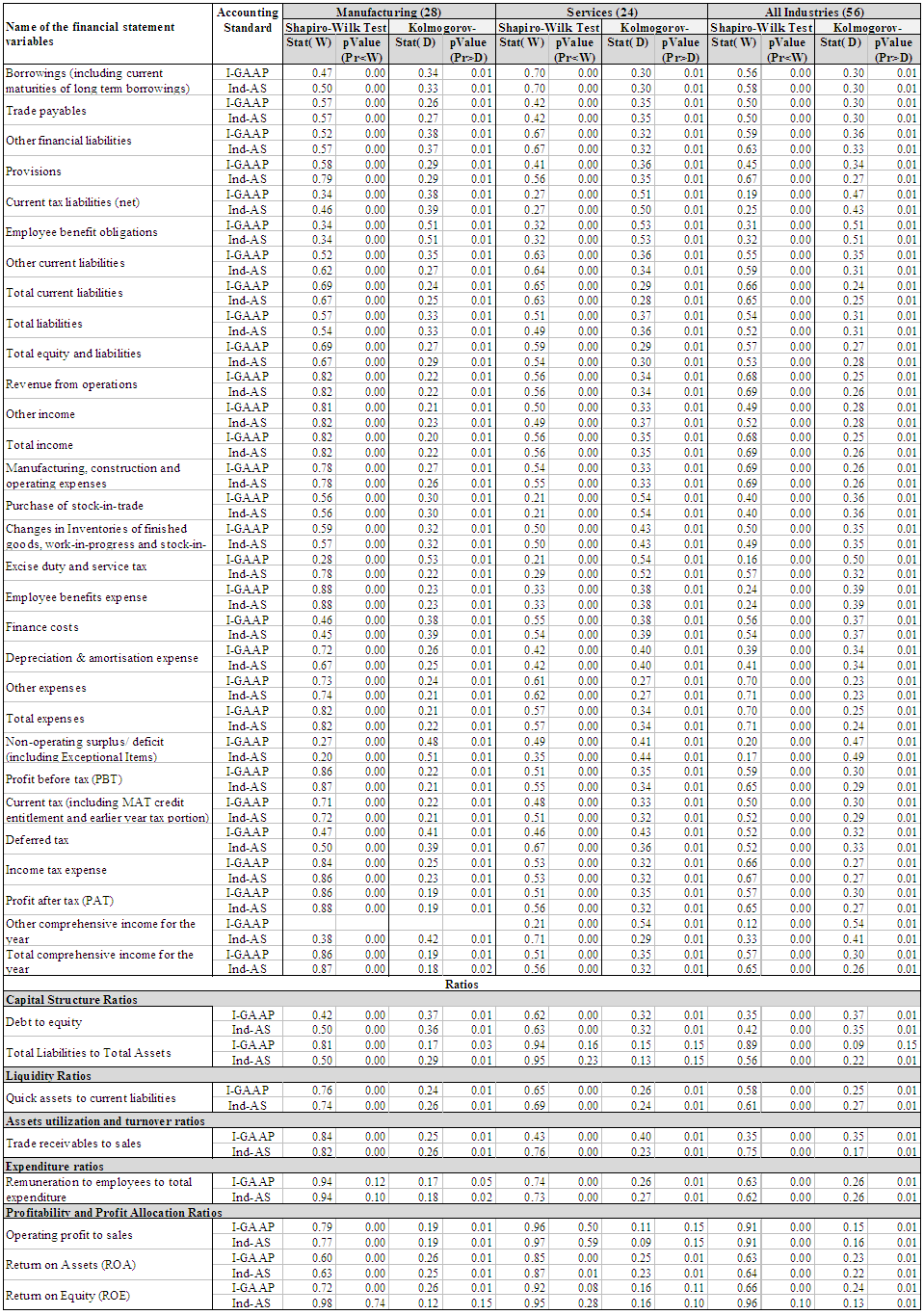

We have performed the non-parametric test to find out the statistical significance of the impact of Ind-AS on the important financial statements variables and the financial ratios alongside the dimension and magnitude level impact. First, we have examined, whether the variables are normally distributed or not by applying the Shapiro-Wilks and Kolmogorov-Smirnov tests (refer Appendix 5). Our result indicates that, the study variables and ratios are not normally distributed (p-value<0.05). Hence, we have used the Wilcoxon Signed-Ranks test2 for paired data (values of I-GAAP and Ind-AS for each of the study variables and ratios) to determine the statistical significance of the impact of Ind-AS. We have used the following hypotheses to determine whether there is any significant difference between the values of the study variables as well as the financial ratios, which are derived from the individual financial statements of the companies prepared in accordance with I-GAAP and Ind-AS.H01: There is no statistically significant difference between each presented financial variable of I-GAAP and Ind-AS based financial statements.H02: There is no statistically significant difference between each presented ratios of I-GAAP and Ind-AS based financial statements.Results of Wilcoxon signed-rank test are presented in Appendix 9 for financial statements variables and in Appendix 10 for financial ratios. We have also presented the descriptive statistics of the study variables and ratios in Appendix 6 and 7.

6. Findings

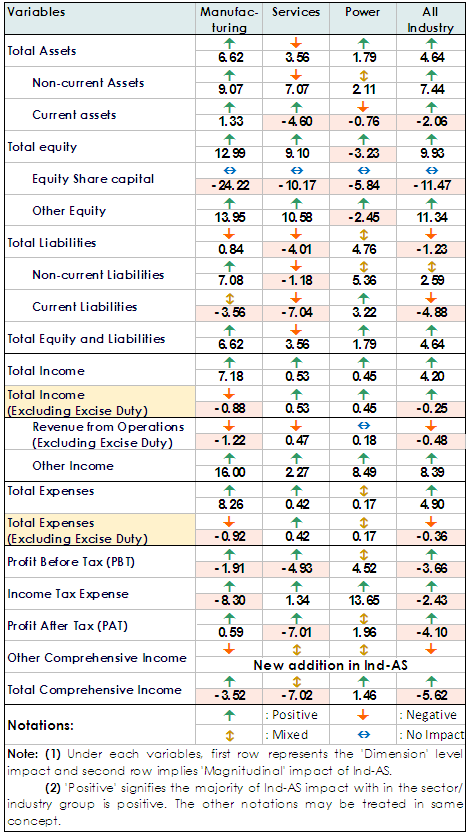

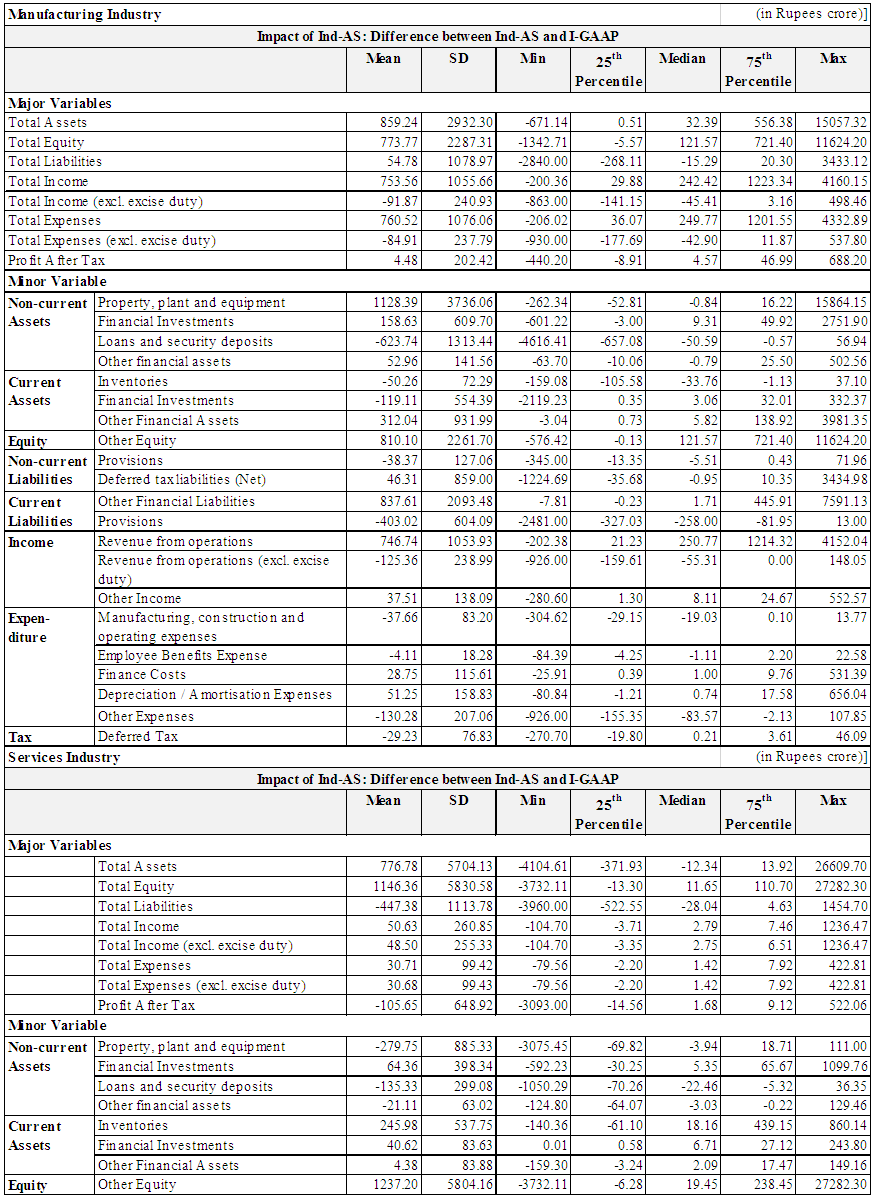

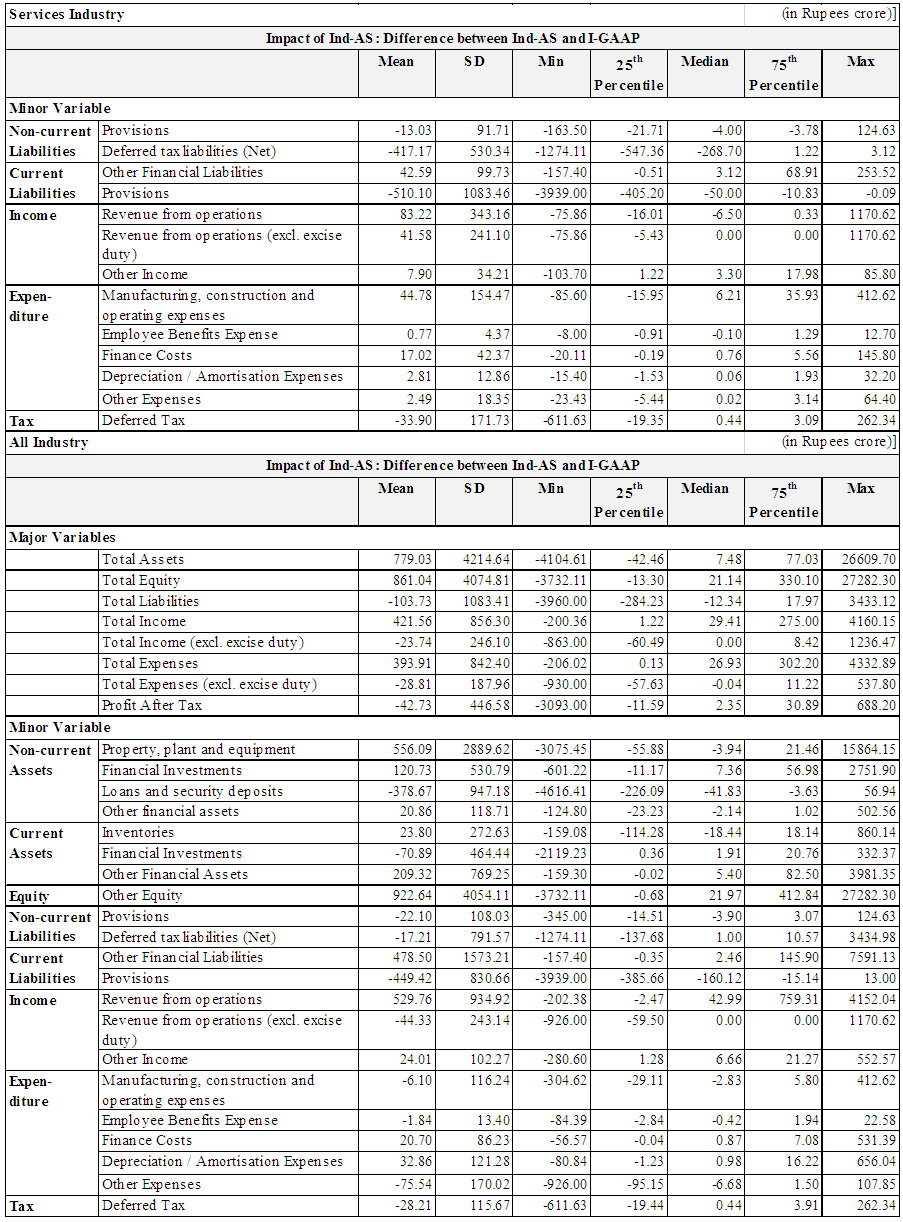

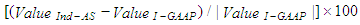

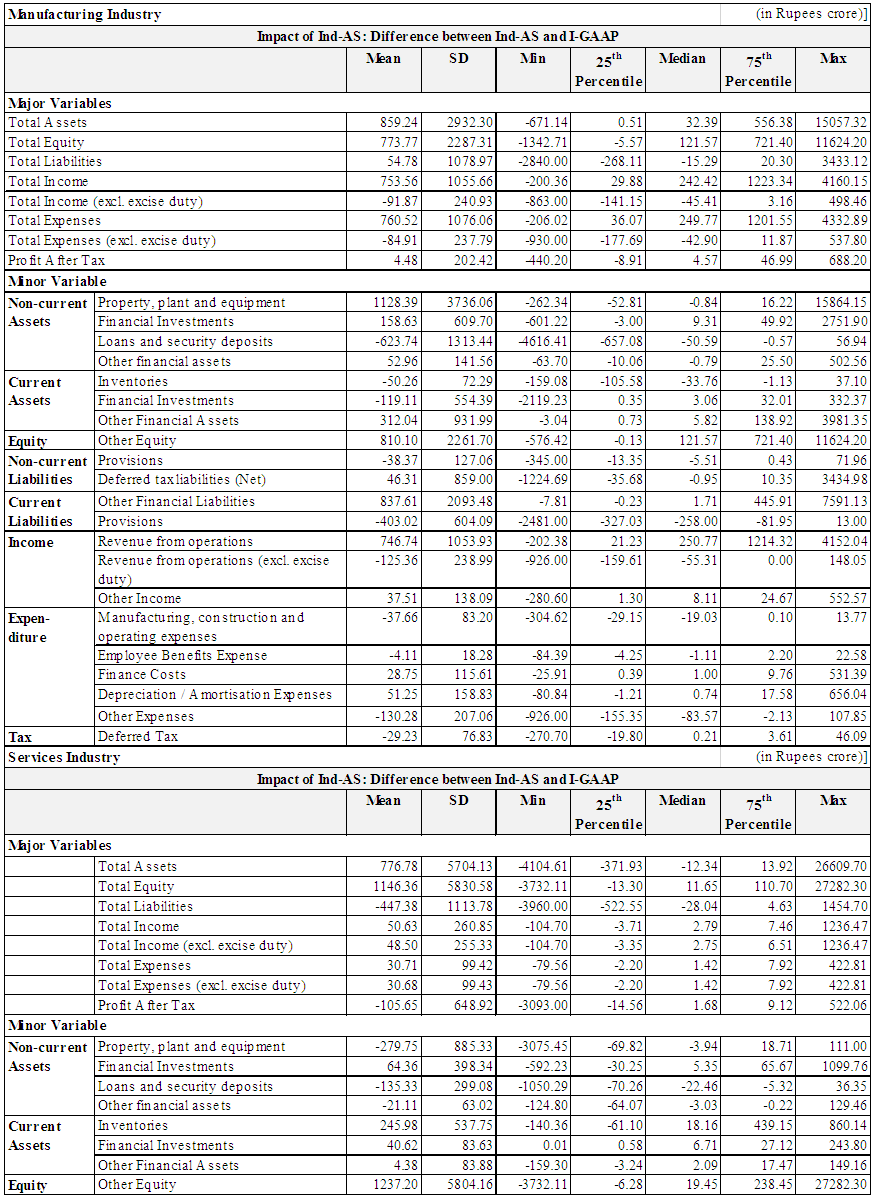

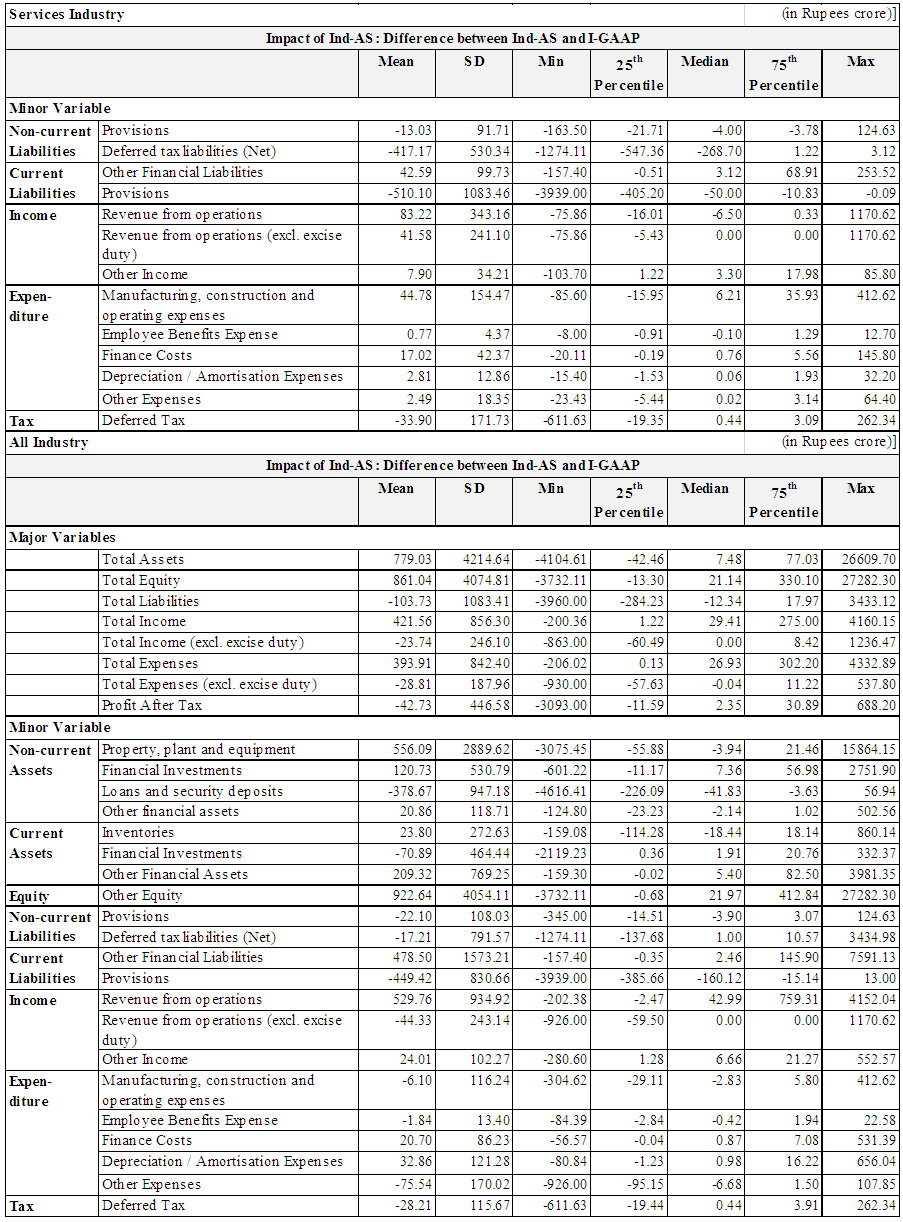

In this chapter, we have explained the dimensional impact of Ind-AS alongside the magnitudinal impact to understand the overall impact of Ind-AS more implicitly. In Table 2, major balance sheet and profit and loss variables are presented in terms of their dimension and magnitude of impact. Against each variable, we have presented the dimension level impact in the first row and the magnitude3 level impact in the second row.Table 2. Dimensional and Magnitudinal Impact of Ind-AS on major financial statement variables

|

| |

|

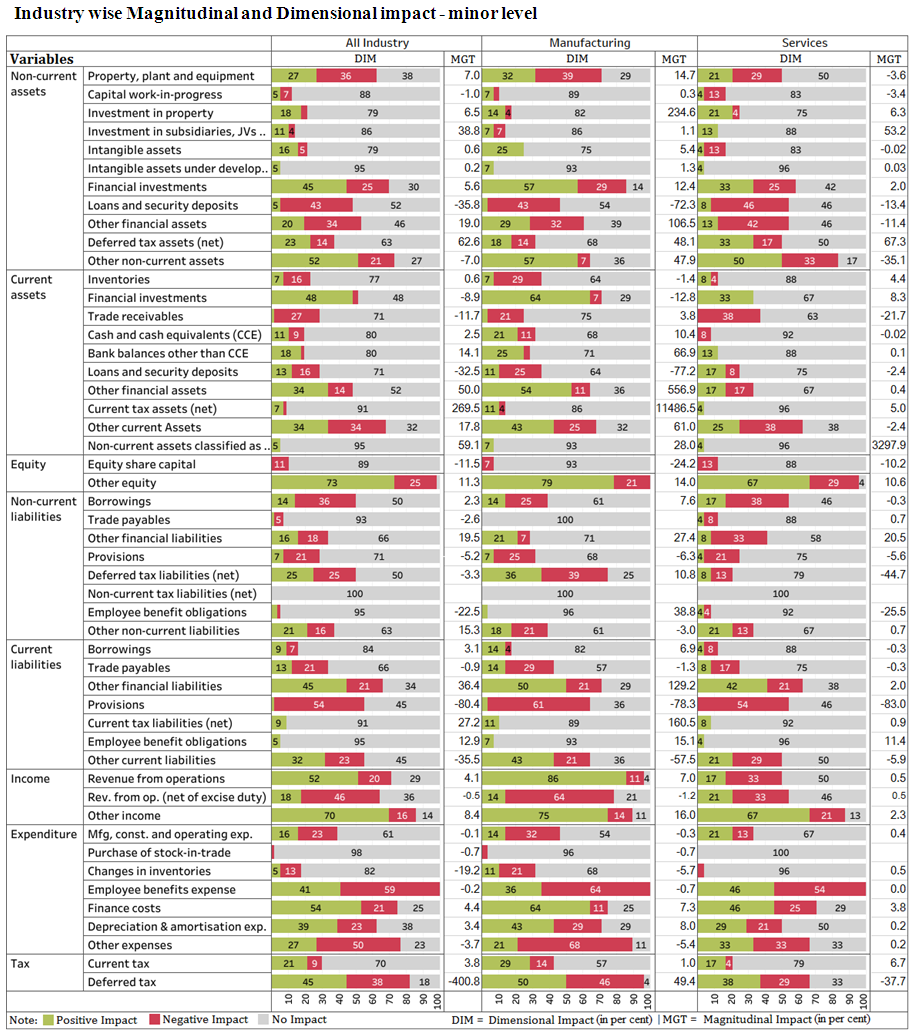

We have also presented the sector wise dimension and magnitude level impact of Ind-AS for the minor variables of financial statements in Appendix – 8.Here, we have discussed the broader variable wise impact of Ind-AS on manufacturing and services sectors. Then we have drilled it down to the industry and company level followed by the discussion on the contribution of the minor variables in the cumulative impact.The above impact is what we have understood from the graphical and tabular representation of data and notes of the companies' financial statements. Alongside, we have also presented the Wilcoxon signed-rank test result regarding the statistical significance of the financial variables, which we have found affected. Few cases we have provided the reason for the possible impact, which we have curated out from the notes of the individual company’s financial statements. Finally, we have discussed about the impact of Ind-AS on the performance of the companies by means of the financial ratios.

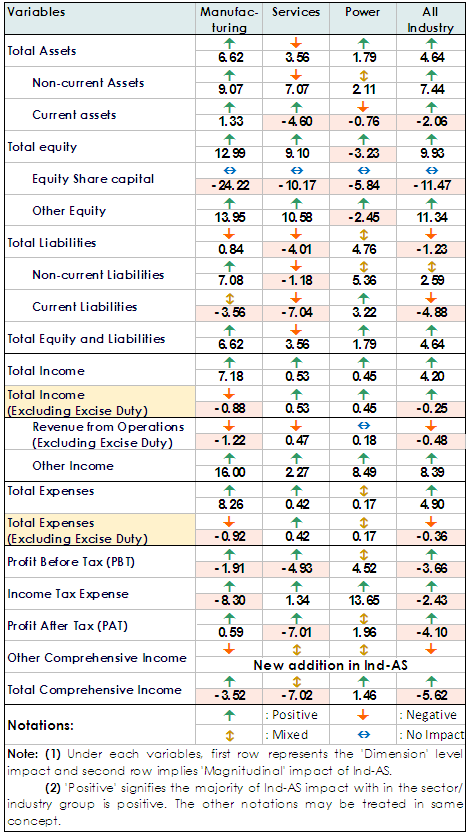

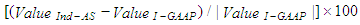

6.1. Asset

Iron & steel, pharmaceutical and telecom industries have reported increase in assets by substantial amounts and the increase is in the range of 5.3% to 14.2% (refer chart 1). While, port and real estate industries have observed material negative impact. At the company level, the impact of Ind-AS on assets for the manufacturing sector is within the range of -4.6% to 61.5%, whereas for the services sector the range is -12.4% to 16.8%. | Chart 1. Industry wise magnitudinal impact of Ind-AS on major balance sheet items |

In the manufacturing sector, non-current financial investments, other current financial assets (inclusive of customers bill discounted and unbilled revenue), other current and non-current assets (inclusive of trade receivable and prepayment) have significant positive impact both at magnitude and dimension level. Current financial investments has significant positive impact at dimension level, but the adverse impact on magnitude level; whereas PPE and other non-current financial assets have significant adverse impact at dimension level, but positive impact on magnitude level. For the services sector, non-current financial investments has significant positive impact both at magnitude and dimension level. Similarly, non-current loans and security deposits, other non-current financial assets (inclusive of deposits, redeemable preference shares and derivative instruments) and other current assets have significant negative impact both at magnitude and dimension level. Current financial investments and other non-current assets have significant positive impact at dimension level, but the negative impact on magnitude level. Statistical test reveals that, impact of Ind-AS on total assets is statistically significant at 1% error level for the manufacturing sector only. Test result also indicates that impact on current loans & security deposits and financial investments are statistically significant at 1% error level across all sectors. Impact of Ind-AS on other current financial assets, non-current investment and inventories are statistically significant for the manufacturing sector and other non-current financial assets is statistically significant for the services sector. Impact on PPE comes out as statistically insignificant across all sectors.

6.2. Equity/ Net-Worth

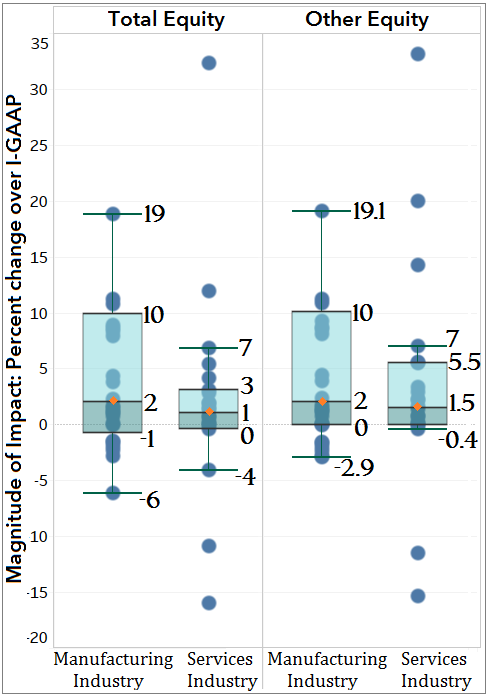

One of the important parameter representing the financial soundness of a company is its Total Equity or Net Worth. From the data, it appears that majority of the companies were able to successfully identify and utilize the various accounting policy choices available to their advantage. The impact of Ind-AS on total equity is positive for majority of the companies across all sectors and the same is also reflected by its magnitude. The impact has generally been advantageous on industries such as iron & steel, consumer goods, pharmaceutical, automobile, cement, textile, telecom, port and information technology. On the other hand, industries like media, real estate, trade and power have shown a mixed trend. Overall, net worth has witnessed an increase by 10 percentage points for the select 56 companies under Ind-AS reporting.We have used the company level magnitudinal figures pertaining to the total equity and other equity and drawn the ‘Box and Whisker plots’4 to measures the spread of the impact of Ind-AS on equity for the manufacturing and services sectors and presented in chart 2. The spread of the impact of Ind-AS on equity (as well as on other equity) is relatively vast in the manufacturing sector as compared to the services. We have witnessed that, changes in the total equity is largely contributed by the other equity. | Chart 2. Box and Whisker plots - Equity |

The Other Equity under Ind-AS consists of capital reserve, gain/loss on changes in the proportion held by non-controlling interests (NCI), re-measurement of net defined liabilities, security premium account and others. Others includes debt and equity instruments through OCI, effective portion of cash flow hedge reserve, revaluation surplus, exchange difference on translating the financial statements of a foreign operation, other items of OCI, money received against share warrants, etc. In manufacturing sector, iron & steel, consumer goods, pharmaceutical, automobile and cement industries have reported increase in equity by substantial amounts and the increase is in the range of 4% to 32% (refer chart 1). Impact of Ind-AS on equity for the iron & steel industry is highly impulsive with a standard deviation of 155% (range: -282% to 835%). In services sector, telecom, information technology and port have reported increase in equity in the range of 4% to 22%, whereas media and real estate industries have shown the material negative impact (refer chart 1). We have not observed much impact of Ind-AS on Equity Share Capital for most of the companies across industry group. However, due to very high adverse impact in few companies especially in iron & steel, real estate, media and power industries, we have experienced an adverse magnitudinal impact in equity share capital across industry group. From the financial statements of these companies, we have found that, adverse impact is arisen mostly due to the reallocation of redeemable preference shares from equity share capital to financial liability (under non-current borrowings) as it does not contain any equity component. On the same time, we have also found that employee welfare trust, which is financed through interest free loan by the company and warehousing the shares (for the distribution to the employees of the company) which have yet not vested, has been consolidated on line by line basis resulting a reduction in the equity share capital of the company.Statistical test indicates that, impact of Ind-AS on total equity and other equity are statistically significant for the manufacturing sector (as well as all industry level), but insignificant for the services sector.Some of the primary reasons for the increase in equity are (a) fair valuation of investments, resulting in a positive impact to retained earnings; (b) fair valuation of PPE; and (c) reversal of proposed dividend, which was earlier recognized as per I-GAAP. On the other hand, some of the key factors contributing to the adverse impact on net worth are (a) reclassification of financial instruments from 'equity classified' instruments to 'debt classified' under Ind-AS; (b) recognition of impairment loss on financial assets; and (c) fair valuation of PPE, which also had a negative impact on the net worth of a few companies.

6.3. Liabilities

On Liabilities side, the overall impact of Ind-AS is adverse in nature largely supported by the services sector. At industry level, iron & steel and media has reported noteworthy increase in the liability side, whereas consumer goods, information technology, port, automobile and pharmaceutical industries have exhibited substantial adverse impact (refer chart 1). At the company level, the impact of Ind-AS on liabilities for the manufacturing sector is in the range of -27% to 109% and for services sector the range is -39% to 129%.In the manufacturing sector, other current financial liabilities (inclusive of instruments and deposits) have significant positive impact both at magnitude and dimension level. Similarly, current provisions have significant negative impact both at magnitude and dimension level. Other current liabilities (inclusive of deferred revenue, government grant, customers bill discounted and current-tax liability (net)) have significant positive impact at dimension level, but negative impact on magnitude level; whereas deferred tax liabilities (net) have significant negative impact at dimension level, but positive impact magnitude level.For the services sector, other current financial liabilities have significant positive impact both at magnitude and dimension level, but current provisions exhibited the opposite impact.As per the statistical test, impact of Ind-AS on total liabilities is statistically significant for services sector. Test result further indicates that though the impact on current provisions is statistically significant, impact on non-current provisions and deferred tax liabilities (net) are statistically insignificant across all industry group. Impact of Ind-AS on other current financial liabilities inclusive of derivative instruments and deposits is statistically significant for the manufacturing sector.

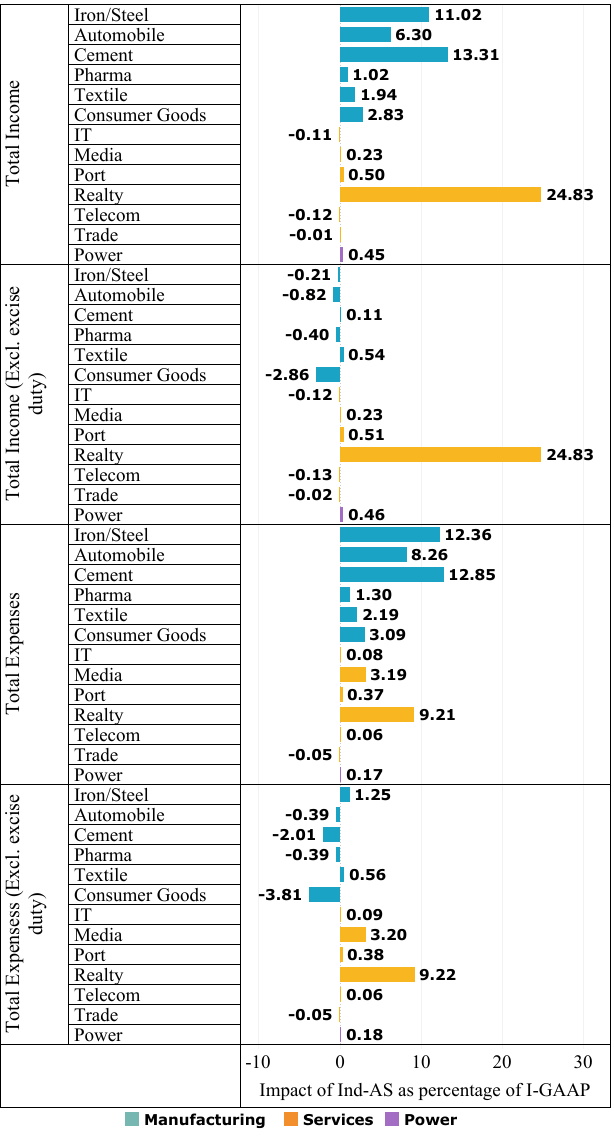

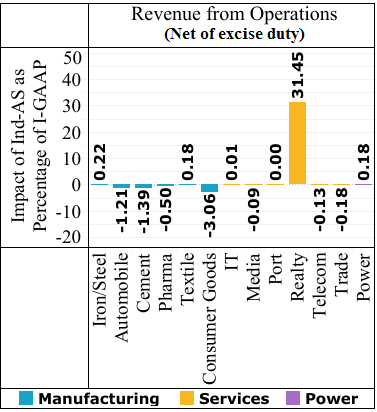

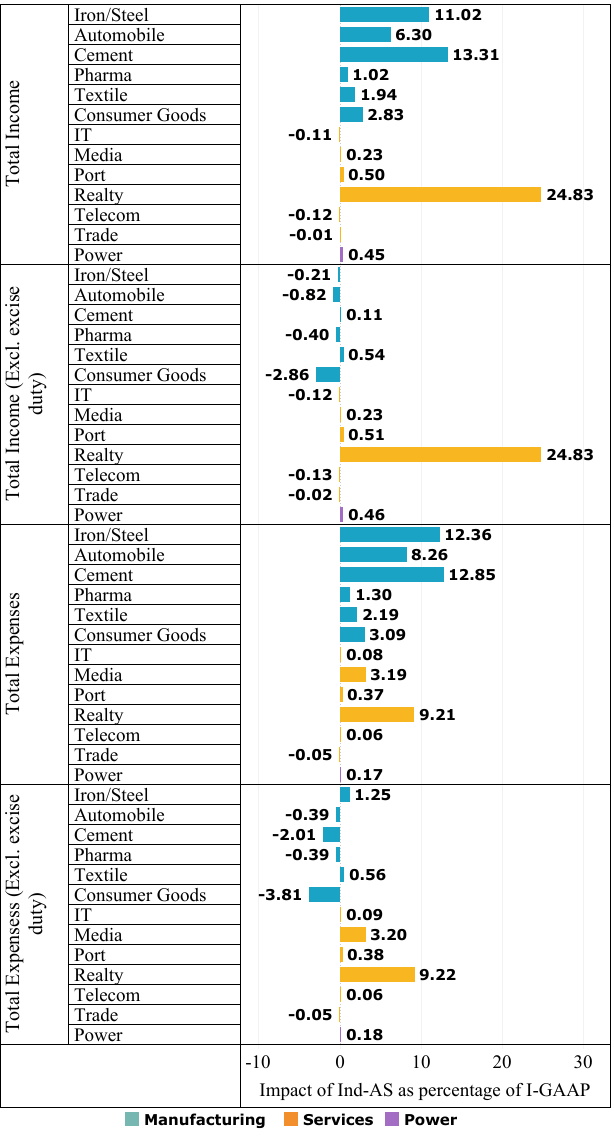

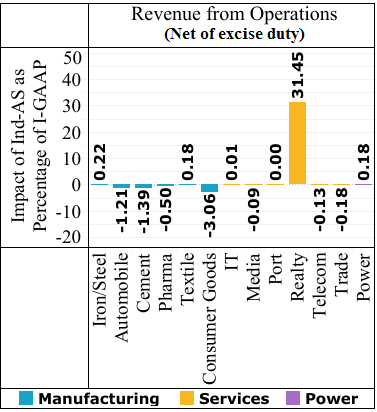

6.4. Income, Expenses and Revenue from Operation

Under the I-GAAP, revenue from operation is presented in terms of net of excise duty, which is now presented inclusive of excise duty under Ind-AS. Accordingly, to the extent of excise duty reported, revenues from operation (as well as total income) and expenses are expected to increase. As, excise duty is levied on the production and not sales, this change is prominently visible in the manufacturing sector. Although, this has no impact on the profit/ loss. In our study, we have presented the income, expenditure and revenue from operations excluding the excise duty and service tax alongside the reported one (refer chart 3 and 4) to understand the impact of Ind-AS on the income and expenditure side more evidently. | Chart 3. Industry wise magnitudinal impact of Ind-AS on major major profit and loss statement items |

| Chart 4. Magnitudinal impact of Ind-AS on Revenue |

Revenue (net of excise duty) is adversely impacted for most of the companies across sectors, but opposite trend at magnitude level is visible in services sector. The industries experiencing the prominent adverse magnitudinal impact on their revenue, include, automobile, cement, pharmaceutical and consumer goods industries. Nearly 50% of the companies resulted in a reduction of revenue (net of excise duty) in transition phase, which is stretched up to -11.4% by magnitude with an average of -2.12%. Increase in revenue is perceptible only for 15% of the companies. Although a substantial positive impact on revenue is evident in real estate industry, it is predominantly impacted due to a single company, citing the timing of recognition of revenue as the reason for the same.We have found that, potential reasons for the decrease in revenue are (a) recognition of revenue at fair value with adjustments for discounts, incentives, rebates etc.; (b) change in methodology of accounting the investments in joint ventures from proportionate consolidation method to equity method; and (c) deferral of revenue such as reassessment of revenue recognition criteria for sale of goods, change in accounting for customer loyalty programmes and segregation of financing components from sale price. In the manufacturing sector, other income, finance costs and depreciation & amortization expenses have significant positive impact both at magnitude and dimension level. Similarly, employee benefits expenses and other expenses have significant negative impact both at magnitude and dimension level. Deferred Tax have significant positive impact at dimension level, but the negative impact on magnitude level. For the services sector, other income and finance costs have significant positive impact both at magnitude and dimension level. Deferred tax have significant positive impact at dimension level, but the negative impact on magnitude level, whereas employee benefits expenses has significant negative impact at dimension level, but the positive impact on magnitude level.Statistical test tells that, result, impact of Ind-AS on total income and expenses, both including and excluding excise duty are statistically significant for manufacturing sector, but insignificant for the services sector. Interestingly, at all industry level, impact of Ind-AS on total income and expenses including excise duty is statistically significant but insignificant when excise duty is netted out. Impact of Ind-AS on other income and finance cost are statistically significant across all industry group. Impact on revenue from operations (both including and excluding excise duty), manufacturing, construction & operating expenses and other expenses are statistically significant only for manufacturing sector. Moreover, impact of Ind-AS on employee benefit expenses and depreciation & amortization expenses is insignificant across all industry group.

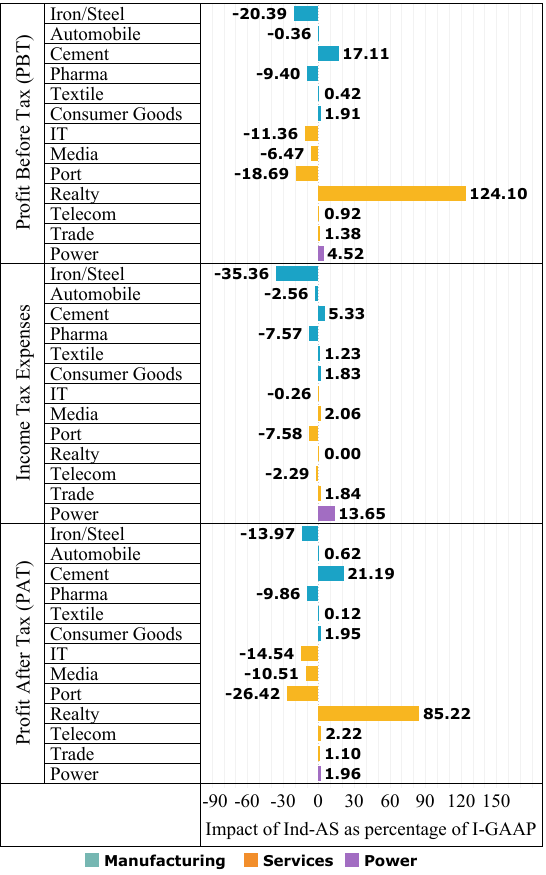

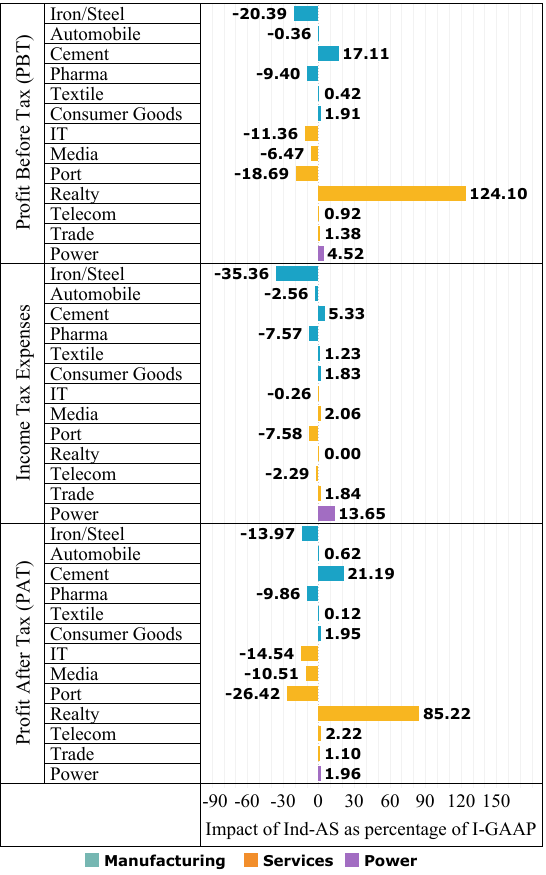

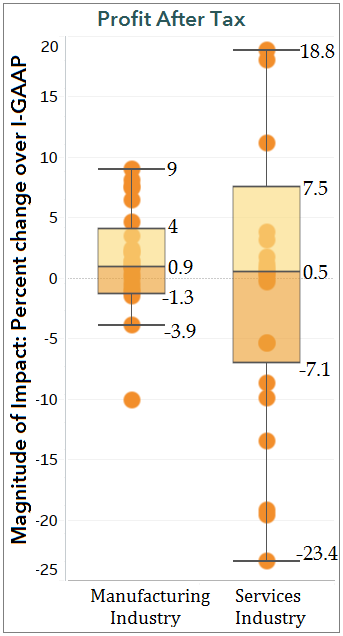

6.5. Profit/ Loss

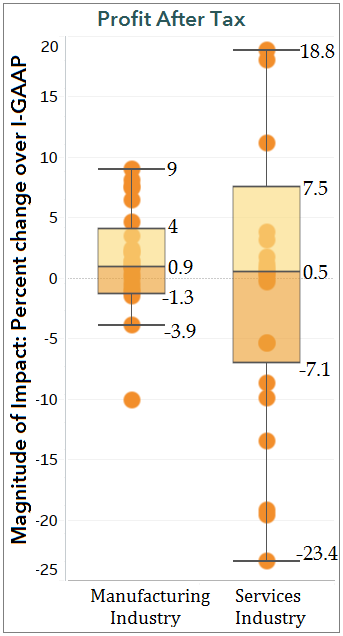

Profitability under Ind-AS has been impacted differently for companies. Although, the dimensional impact of Ind-AS on profits (PAT) is predominantly seen as positive for majority of companies (63%), the combined magnitudinal impact at all industry level is moderately negative. While its impact has generally been favorable on industries such as real estate, telecommunication, trade, cement, consumer goods, automobile, textile and power, industries such as information technology, media, port and iron & steel have witnessed adverse impact (refer chart 5). Impact on profits for almost 70% of the companies were in the range of -10% to 10%. However, in few companies, the impacts of Ind-AS on profit are significantly higher/ lower. The spread of company level magnitudinal impact of Ind-AS on profits (PAT) (refer chart 6) is relatively wide in the services sector as compared to the manufacturing. | Chart 5. Industry wise magnitudinal impact of Ind-AS on profit and tax |

| Chart 6. Box and Whisker plots - PAT |

The primary reasons for decrease in profits (in some cases offsetting the profit partially) are (a) recognition of impairment loss on financial assets using the expected credit loss (ECL) model; (b) amortization of borrowing cost as part of effective interest rate (EIR) method for financial liabilities classified as amortized cost; (c) share of profits in associates and JVs; (d) recognition of non-current provisions, contingent liabilities & assets on discounted amount as against the undiscounted amount as per I-GAAP; (e) recognition and measurement of employee stock options at fair value as compare to the intrinsic value in I-GAAP; (f) Foreign currency translation adjustments; and (g) Income tax adjustment. Under Ind-AS all derivatives are measured at fair value and changes recognized in profit and loss (except for derivatives forming part of effective hedge), whereas under I-GAAP, premium and discount on forward contracts were amortized over contract period and in other types of derivative contracts only unrealised losses were recognised in profit and loss resulted a decrease in profit level.The key reasons for increase in profits are (a) measurement of investments (mutual funds, government securities, etc.) at fair value through profit and loss; (b) capitalization of spare parts, major repairs & overhaul as PPE; (c) reclassification of government grants to profit and loss, which were earlier taken to capital reserve as per I-GAAP; (d) reversal of excess provision due to change in estimates of decommissioning liability; (e) re-measurements actuarial gains/losses through other comprehensive income; and (f) Income tax adjustment.Impact on Ind-AS on profit after tax is statistically insignificant across all industry level as per the statistical test.

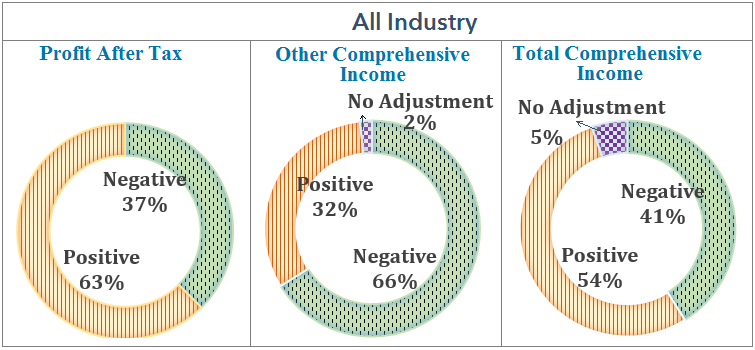

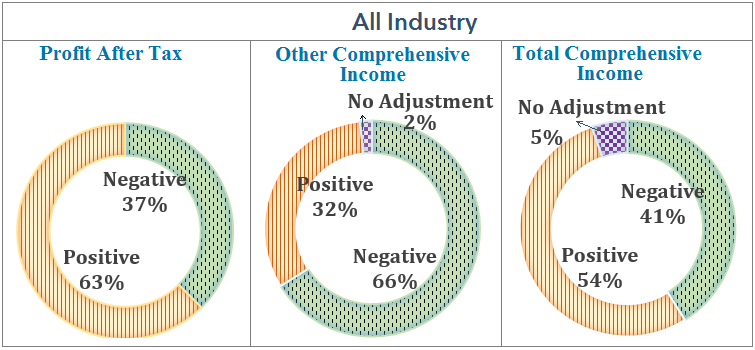

6.6. Other Comprehensive Income and Total Comprehensive Income

The concept of Other Comprehensive Income (OCI) and Total Comprehensive Income (TCI) is newly introduced in Ind-AS. Ind-AS 1 defines Other Comprehensive Income (OCI) as ‘comprising of items of income and expense (including reclassification adjustments) that are not recognized in profit or loss as required or permitted by other Ind-ASs’. It will provide a cushion to the profit/ loss (by reflecting the notional gains and losses outside the profit/loss and work as a barometer for upcoming threats or windfalls to net income (as it contains profit/loss on change in fair value for certain items). Nearly, 66% of the companies have reported the negative OCI (refer chart 7). This is predominantly observed for the manufacturing sector, whereas services sector presented the mixed impact. Overall, other comprehensive income has an adverse effect (around -1.5%) on profit. | Chart 7. Impact of Other Comprehensive Income |

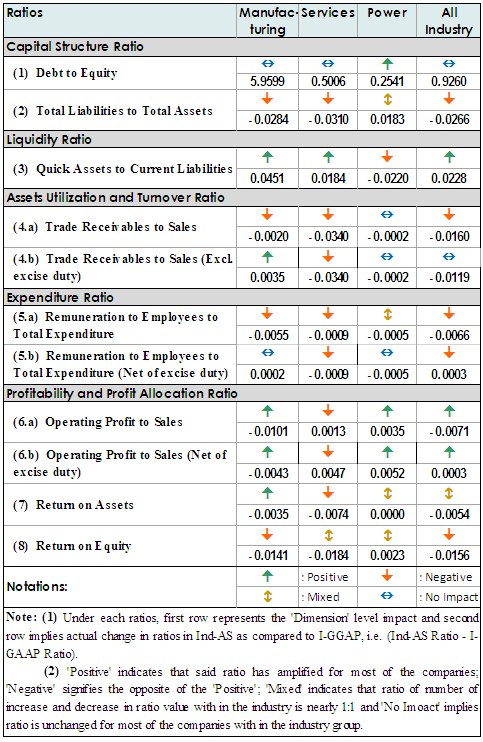

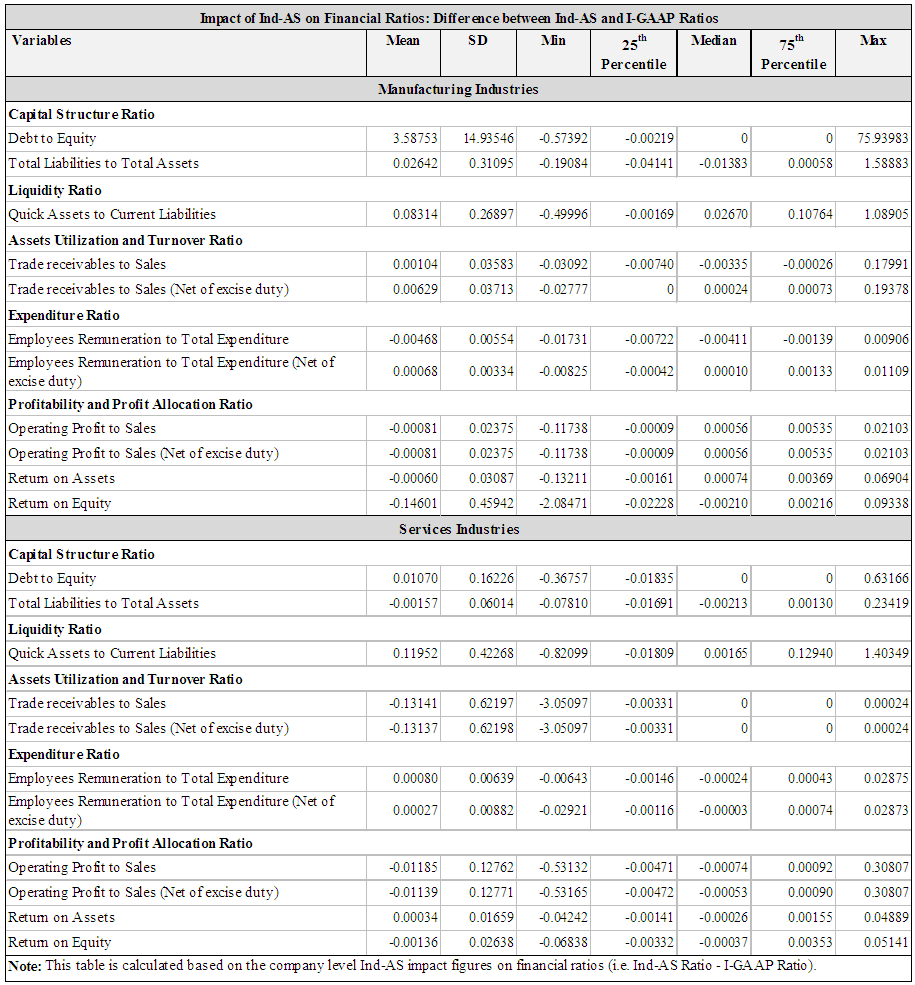

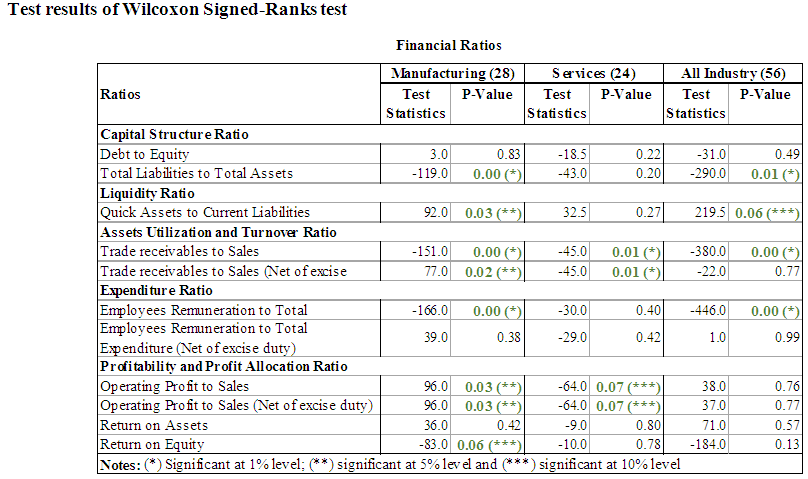

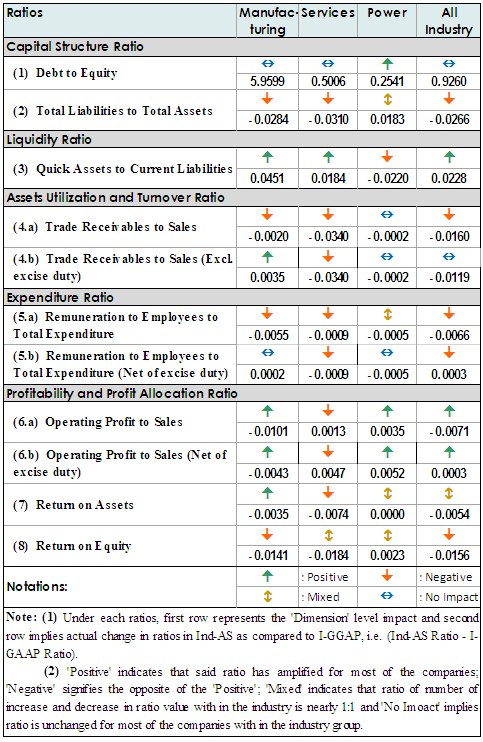

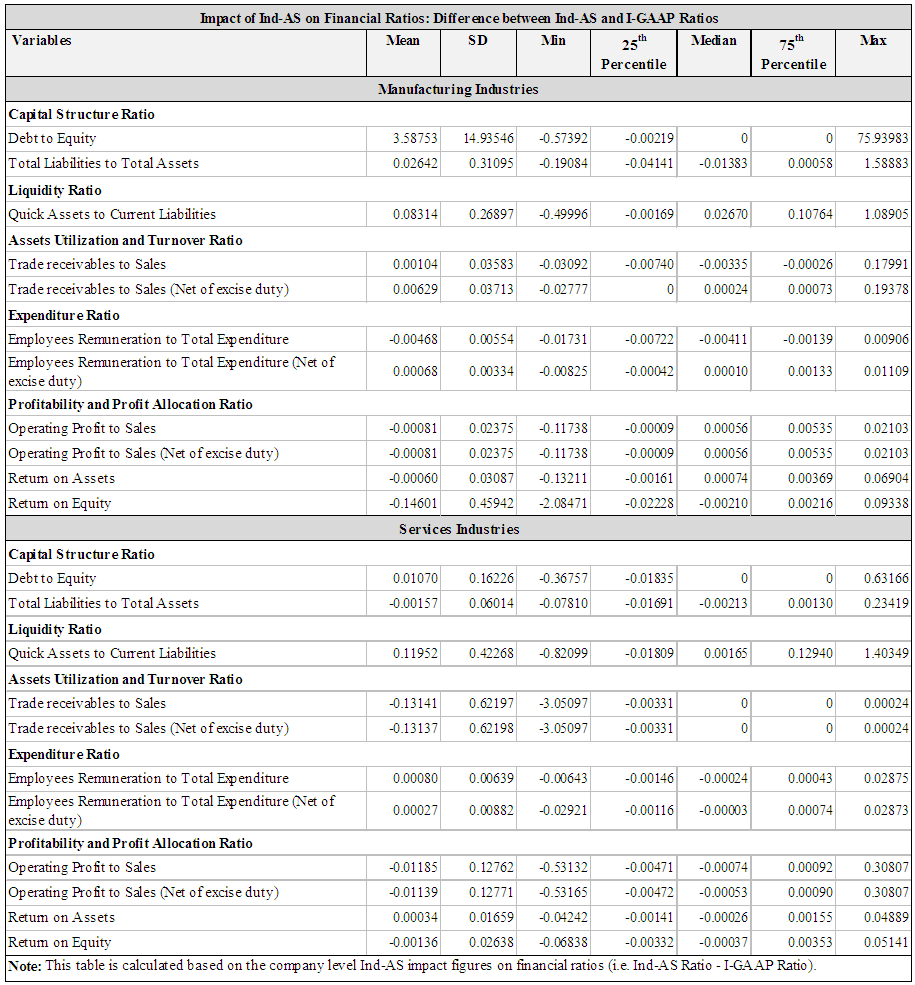

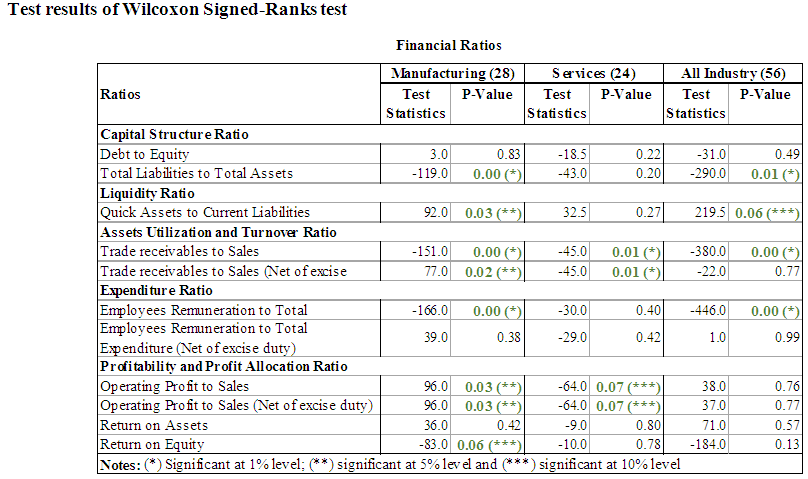

6.7. Financial Ratios

We have calculated the financial ratios at the company level as well as sector level for I-GAAP and Ind-AS. Our purpose is to gauge the impact of Ind-AS on these financial ratios. List of these ratios and their sector wise impact is presented in table 3. We have also plotted the I-GAAP values against the Ind-AS values for each of the financial ratios across all the companies and presented in Appendix – 11. In each graph, position of a value above the diagonal line represents that, ratio under Ind-AS has amplified, whereas position below the diagonal line represents exactly the opposite.Table 3. Impact of Ind-AS on Financial Ratios

|

| |

|

We have found that, leverage (Debt to Equity) ratio is unaffected for most of the companies across all industry level. Statistical test result also indicates that Debt to Equity ratio is insignificant. A declining trend in Total Liabilities to Total Assets ratio across all sectors indicates an enhanced financial health for the companies under Ind-AS. As per the statistical test, this ratio is statistically significant for the manufacturing sector, but insignificant for the services sector. As far as liquidity is concern, the Quick Ratio (Quick Assets to Current Liabilities) has improved for most of the companies under Ind-AS. Higher the quick ratio, better the company's liquidity position. Increase in quick ratio may also happen due to the high accounts receivables, i.e. the companies may have problems in collecting its account receivables. However, as we have found that impact of Ind-AS on ‘trade receivables is mostly negative or unchanged across companies, we may safely assume that the liquidity position for most of the companies have enriched under Ind-AS. Test result indicates that, this ratio is statistically significant for the manufacturing sector but insignificant for the services sector.Trade Receivables to Sales Ratio shows the relationship between unpaid sales and the total sales revenue. Lower Trade Receivables to Sales Ratio under Ind-AS framework indicates the improvement in operation. This ratio is statistically significant across all sectors. Remuneration to Employees to Total Expenditure ratio has come down for most of the companies across all the industries under Ind-AS. This ratio is statistically significant for the manufacturing sector. However, if we consider the expenditure as net of excise duty, it is statistically insignificant across all industry level. Profitability and profit allocation ratios have exhibited mixed impact under Ind-AS. Due to the convergence in Ind-AS, operating profit margin (Operating Profit to Sales Ratio) has increased for most of the companies under manufacturing sector, whereas services sector has exhibited the opposite direction. This ratio is statistically significant for both the manufacturing and services sectors. Return on Asset ratio has exhibited the similar kind of behaviour like Operating Profit Ratio, but proved statistically insignificant across all industry level. Return on Equity Ratio has decreased under Ind-AS for majority of the companies under manufacturing sector and proved as statistically significant for this sector.

7. Conclusions

This study provided several insights into how the new accounting standard i.e. Ind-AS adoption has impacted the Indian companies in terms of their financial and performance parameter. This study also delivers the understanding of this impact on the few sectors of the economy. The approach of this study is more on micro prospective of the finance rather than the macro. This study will be useful to those, who make use of the financial statements of the companies on day-to-day basis and interested in the inter-temporal comparison of the financial health and performance between the Indian companies, which transmitted from one accounting framework to the other.Ind-AS standards are different from the Indian GAAP framework primarily due to the fair valuation and its focus on the substance over legal form. We have observed that sectoral impacts of Ind-AS are relatively range bound for the major heads of the financial statements viz. assets, equity, liabilities, income, expenses and profits. However, at the company level, this variation is considerably higher and significantly volatile for the minor level variables of the financial statements.Iron & steel, pharmaceutical and telecom industries have reported increase in assets by substantial amounts while port and real estate industries have observed material negative impact. On Liabilities side, the overall impact of Ind-AS is adverse in nature largely supported by the services sector. At industry level, iron & steel and media has reported noteworthy increase in the liability side, whereas consumer goods, information technology, port, automobile and pharmaceutical industries have exhibited substantial adverse impact.The impact of Ind-AS on equity is positive for majority of the companies across all sectors and the same is also reflected by its magnitude. The impact has generally been favourable on industries such as iron & steel, consumer goods, pharmaceutical, automobile, cement, textile, telecom, port and information technology.Revenue (net of excise duty) is unfavourably impacted for most of the companies across sectors, but opposite trend at magnitude, level is visible in services sector. The industries experiencing the prominent adverse magnitudinal impact on their revenue, include, automobile, cement, pharmaceutical and consumer goods industries.Profitability under Ind-AS is impacted differently for different companies. Although, the dimensional impact of Ind-AS on profits is predominantly seen as positive for majority of companies, the combined magnitudinal impact at all industry level is moderately negative. While its impact has generally been favourable on industries such as real estate, telecommunication, trade, cement, consumer goods, automobile, textile and power, industries such as information technology, media, port and iron & steel have witnessed adverse impact.Our ratio analysis indicates that, on leverage (Debt to Equity ratio) front, most of the companies across all industry level are unaffected. Total Liabilities to Total Assets ratio (sometimes referred as Debt ratio) exhibited declining trend across all sectors and Quick Ratio (Quick Assets to Current Liabilities) has improved for most of the companies under Ind-AS. Profitability and profit allocation ratios have exhibited mixed impact under Ind-AS. Due to the convergence in Ind-AS, operating profit margin (Operating Profit to Sales Ratio) has increased for most of the companies under manufacturing sector, whereas services sector has exhibited the opposite direction. Return on Asset ratio has exhibited the similar kind of behaviour like Operating Profit Ratio, but proved statistically insignificant across all industry level. Return on Equity Ratio has decreased under Ind-AS for majority of the companies under manufacturing sector.Ind-AS has filled up certain gaps of the old accounting standard. We believe that immediate escalation or contraction in the performance matrix of the companies due to the change in accounting standard are unlikely to have a material impact on the business fundamentals and hence the underlying economic risks of these companies remain unaffected.As per the requirement of Ind-AS adoption, companies have presented the last three years balance sheet and two years profit & loss statements in their first time submission. Hence, on the performance front, a year-on-year comparative analysis may be more meaningful to gauge the underlying changes in their performance matrix, if any.The biggest challenge, which one may face while carrying out any industry wise (or corporate sector as a whole) year-on-year performance study by aggregating the data sets of the companies following the Ind-AS framework and the Indian GAAP framework. In another way, studying the performance of a company or a set of companies in the time series framework, which transmitted from one accounting framework to the other, is also thought provoking. For example, one may combine the property, plant and equipment and investment in property data of Ind-AS to carve out the tangible asset but the same cannot be used together with the tangible assets data of the companies under the Indian GAAP as the data compilation methodology of the two accounting framework are different.Selected sample size in our study is very limited when compared to all of the companies operating in the industry. In our study, we have focused on balance sheets and profit and loss statements of the companies and left the other parts of the financial statements aside. In addition, selection of the ratios are also limited in our study. We hope that, overcoming these constraints may provide better understanding in the future studies.

ACKNOWLEDGEMENTS

We would like to show our gratitude to Shri Anujit Mitra, Adviser, Reserve Bank of India for sharing his pearls of wisdom with us during the course of this research, and we thank Shri Anand Sawant for his contribution in collecting the data. Our thanks and appreciations also go to our colleagues for sharing their ideas in writing this research paper and people who have willingly helped us out with their abilities. Any errors are our own and should not tarnish the reputations of these esteemed persons.

Disclosure

The views expressed in these papers are those of authors and not that of Reserve Bank of India.

Notes

1. Let us say the value of a variable ‘A’ for a company under I-GAAP framework is ‘X’ and under Ind-AS is ‘Y’. Based on the value of (Y-X) of the variable A, we have marked it as ‘Positive’, ‘Negative’ and ‘No Impact’ if (Y-X)>0, (Y-X)<0 and (Y-X)=0 respectively.2. The Wilcoxon Signed-Rank Test statistic S is computed as | (2) |

Where,  is the rank of

is the rank of  after discarding values of

after discarding values of  , and

, and  is the number of

is the number of  values not equal to

values not equal to  . Average ranks are used for tied values. Average ranks are used for tied values. If

. Average ranks are used for tied values. Average ranks are used for tied values. If  , the significance of S is computed from the exact distribution of S, where the distribution is a convolution of scaled binomial distributions. When

, the significance of S is computed from the exact distribution of S, where the distribution is a convolution of scaled binomial distributions. When  , the significance of S is computed by treating as a Student’s t variate with

, the significance of S is computed by treating as a Student’s t variate with  degrees of freedom.3. As we are working with a relatively small sample, magnitude level impact should be used with certain precautions, as it is more indicative in nature rather than conclusive. Presence of outliers (which is very much there at individual variable level across the financial statements) can change the overall direction of impact of a variable at sector / industry level. To comprehend the sector / industry level impact of Ind-AS, dimensionality of impact may be considered more indicative in nature.4. Box and Whisker plots: In nonparametric terms, the central 'box' represents the distance between the upper quartile [3(n+1)/4th value] and lower quartile [(n+1)/4th value] with the median between them marked with a diamond, with the minimum as the origin of the leading ‘whisker’ and with the maximum as the limit of the trailing ‘whisker’. However, due to the very high or low (outliers) data points, farthest data points within 1.5 times the inter-quartile range has been used here to draw the whiskers.

degrees of freedom.3. As we are working with a relatively small sample, magnitude level impact should be used with certain precautions, as it is more indicative in nature rather than conclusive. Presence of outliers (which is very much there at individual variable level across the financial statements) can change the overall direction of impact of a variable at sector / industry level. To comprehend the sector / industry level impact of Ind-AS, dimensionality of impact may be considered more indicative in nature.4. Box and Whisker plots: In nonparametric terms, the central 'box' represents the distance between the upper quartile [3(n+1)/4th value] and lower quartile [(n+1)/4th value] with the median between them marked with a diamond, with the minimum as the origin of the leading ‘whisker’ and with the maximum as the limit of the trailing ‘whisker’. However, due to the very high or low (outliers) data points, farthest data points within 1.5 times the inter-quartile range has been used here to draw the whiskers.

Appendix 1-11

| Appendix 1 |

| Appendix 2 |

| Appendix 3 |

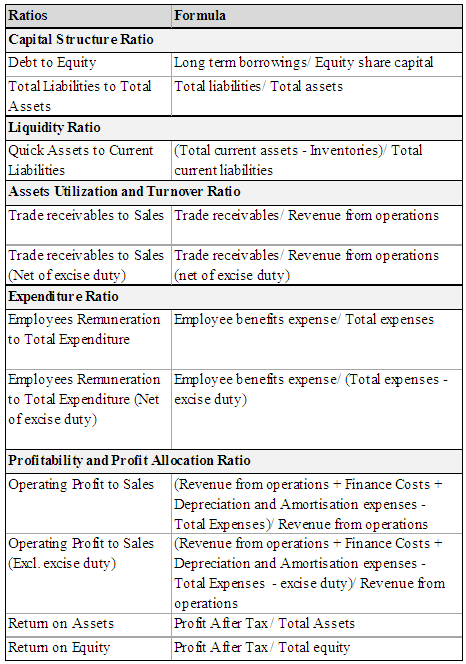

| Appendix 4 |

| Appendix 5 |

| Appendix 5 (Concld.) |

| Appendix 6 |

| Appendix 6 (Concld.) |

| Appendix 7 |

| Appendix 8 |

| Appendix 9 |

| Appendix 10 |

| Appendix 11 |

References

| [1] | Abhinaya, L. P., N. S. Vidyashree, and H. Manu, “IFRS in India-its impact on Indian corporate: Benefits and challenges”. |

| [2] | Amogh, Nisha, and S. MariGowda, “Impact of IFRS adoption on financial performance of corporates: A study on Sify technologies ltd”. |

| [3] | Bhargava, Vidhi, and D. Shikha, “The impact of International Financial Reporting Standards on financial statements and ratios”, The International Journal of Management 2, no. 2 (2013): 1-15. |

| [4] | Camfferman, Kees, and S. A. Zeff, "The Challenge of Setting Standards for a Worldwide Constituency: Research Implications from the IASB’s Early History", European Accounting Review 27, no. 2 (2018): 289-312. |

| [5] | Das, Surajit, and T. R. Saha, “IFRS and its impact on Indian companies: An empirical study”, Parikalpana: KIIT Journal of Management 13, no. 2 (2017). |

| [6] | Daske, Holger, L. Hail, C. Leuz, and R. Verdi, “Mandatory IFRS reporting around the world: Early evidence on the economic consequences”, Journal of accounting research 46, no. 5 (2008): 1085-1142. |

| [7] | Muniraju, M., and S. R. Ganesh, “A study on the impact of International Financial Reporting Standards convergence on Indian corporate sector”, Journal of Business and Management 18, no. 4 (2016): 34-41. |

| [8] | Nurunnabi, Mohammad, "The impact of cultural factors on the implementation of global accounting standards (IFRS) in a developing country", Advances in accounting 31, no. 1 (2015): 136-149. |

| [9] | Patil, Ameya, P. Kenjale, and A. Kanade, "IFRS Impact on Profitability and Liquidity Parameters for the Indian IT Sector-Case Study Approach", (2017). |

| [10] | Pouradeli, A. N., and N. Nagaraja, "Effect of IFRS Adoption on Income Smoothing in Indian Companies", Asian Journal of Research in Banking and Finance 8, no. 4 (2018): 48-60. |

| [11] | Stent, Warwick, M. Bradbury, and J. Hooks, “IFRS in New Zealand: effects on financial statements and ratios”, Pacific accounting review 22, no. 2 (2010): 92-107. |

| [12] | Terzi, Serkan, R. Oktem, and I. K. Sen, “Impact of adopting international financial reporting standards: empirical evidence from Turkey”, International Business Research 6, no. 4 (2013): 55. |

| [13] | Zéghal, Daniel, S. Chtourou, and Y. M. Sellami, An analysis of the effect of mandatory adoption of IAS/IFRS on earnings management, Journal of international accounting, auditing and taxation 20, no. 2 (2011): 61-72. |

| [14] | Report on 'Ind AS Impact', CRISIL Limited, (2016). |

| [15] | Report on 'The path to Ind AS conversion', Deloitte Touche Tohmatsu India Private Limited, (2015). |

| [16] | Report on 'Guide to First-time Adoption of Ind AS', Ernst & Young Associates LLP, (2015). |

| [17] | Report on 'Ind AS transition - Journey of Indian corporates', Ernst & Young Associates LLP, (2017). |

| [18] | Report on 'Indian Accounting Standards (IFRS converged): Successful Implementation - Impact Analysis and Industry Experience', The Institute of Chartered Accountants of India, (2018). |

| [19] | Tawiah, Vincent, and B. Muhaheranwa, "Conservatism Analysis on Indian Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS)", (2015). |

| [20] | The Companies (Indian Accounting Standards) Rules, 2015, [Online]. Available: http://www.mca.gov.in/MinistryV2/Stand.html. |

is the rank of

is the rank of  after discarding values of

after discarding values of  , and

, and  is the number of

is the number of  values not equal to

values not equal to  . Average ranks are used for tied values. Average ranks are used for tied values. If

. Average ranks are used for tied values. Average ranks are used for tied values. If  , the significance of S is computed from the exact distribution of S, where the distribution is a convolution of scaled binomial distributions. When

, the significance of S is computed from the exact distribution of S, where the distribution is a convolution of scaled binomial distributions. When  , the significance of S is computed by treating as a Student’s t variate with

, the significance of S is computed by treating as a Student’s t variate with  degrees of freedom.3. As we are working with a relatively small sample, magnitude level impact should be used with certain precautions, as it is more indicative in nature rather than conclusive. Presence of outliers (which is very much there at individual variable level across the financial statements) can change the overall direction of impact of a variable at sector / industry level. To comprehend the sector / industry level impact of Ind-AS, dimensionality of impact may be considered more indicative in nature.4. Box and Whisker plots: In nonparametric terms, the central 'box' represents the distance between the upper quartile [3(n+1)/4th value] and lower quartile [(n+1)/4th value] with the median between them marked with a diamond, with the minimum as the origin of the leading ‘whisker’ and with the maximum as the limit of the trailing ‘whisker’. However, due to the very high or low (outliers) data points, farthest data points within 1.5 times the inter-quartile range has been used here to draw the whiskers.

degrees of freedom.3. As we are working with a relatively small sample, magnitude level impact should be used with certain precautions, as it is more indicative in nature rather than conclusive. Presence of outliers (which is very much there at individual variable level across the financial statements) can change the overall direction of impact of a variable at sector / industry level. To comprehend the sector / industry level impact of Ind-AS, dimensionality of impact may be considered more indicative in nature.4. Box and Whisker plots: In nonparametric terms, the central 'box' represents the distance between the upper quartile [3(n+1)/4th value] and lower quartile [(n+1)/4th value] with the median between them marked with a diamond, with the minimum as the origin of the leading ‘whisker’ and with the maximum as the limit of the trailing ‘whisker’. However, due to the very high or low (outliers) data points, farthest data points within 1.5 times the inter-quartile range has been used here to draw the whiskers. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML