-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(5): 147-152

doi:10.5923/j.ijfa.20180705.03

Determine the Impact of the Related Party on the Financial Reporting Quality Using Factor Analysis - Case Study of Algerian Institutions -

Krim Fayçal1, Amer Aicha2, Souar Yousef3

1Department of Economics, Commercial Sciences, University Kasdi Merbah, Ouargla, Algeria

2Laboratory DEAA, University Ahmed Draya, Adrar, Algeria

3Laboratory MIFMA, University Taher Mouley, Saida, Algeria

Correspondence to: Amer Aicha, Laboratory DEAA, University Ahmed Draya, Adrar, Algeria.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study analyses the relationship between the financial reporting and related party using factor analysis method. We find that accounting and auditing increase the quality of information and this contributes to protecting companies from fraud and manipulation. We argue that governance has a lower impact on the financial reporting in Algerian institutions. The survey conducted on a group of accountants and auditors confirm this argument. Overall, our results indicate that accounting and auditing can lead to better financial reporting via their impact on the quality of information.

Keywords: Financial Reporting Quality, Accounting, Audit, Governance, Factor Analysis

Cite this paper: Krim Fayçal, Amer Aicha, Souar Yousef, Determine the Impact of the Related Party on the Financial Reporting Quality Using Factor Analysis - Case Study of Algerian Institutions -, International Journal of Finance and Accounting , Vol. 7 No. 5, 2018, pp. 147-152. doi: 10.5923/j.ijfa.20180705.03.

Article Outline

1. Introduction

- The recent crisis has caused a business environment changes and revealed the weaknesses in financial reporting quality, and highlighted the need to improve the quality of accounting system, governance processes and the audit, in order to answer the needs and expectation of the economic agents, whether internal or external, because the financial statements give the very first impression about a firm to various stakeholders are the result of a accounting processing, and the objective of the financial statements is to provide truthful information about the financial condition, results, cash flows and changes in the financial position of the entity that is useful for a number of users (Kozuharov et al [2015]).There are many other users of financial statements who have less of a demand for “True and Fair View” (TFV). Governments demand tax information from companies, debtholders demand information about companies’ ability to service their debt and labor unions require information to negotiate labor contacts, Forces of informational demands from different contracting parties influence the outcomes of financial reports (Soderstrom, Sun [2007]). This study attempts to identify the relation between financial reporting quality and the accounting system, the audit and the governance, and examines the effect of the related party on the financial reporting quality using the factor analysis, and the objective of this method is to determine (DeCoster [1998]):- The number of common factors influencing a set of measures.- The strength of the relationship between each factor and each observed measure.We investigate whether and how financial reporting quality related to accounting, audit and governance, we will look into the definition of the financial reports is nature, we also discussed the relationship between financial reports quality and accounting information, regulation, disclosure, audit and governance. Financial statements are generally manipulated to inflate/deflate income and expenses as the need may be, this is why we should define/ clarity the impact of the related party on the financial reporting quality.To test the relationship between financial reporting quality and the related party, we use the factor analysis method, this method determine (DeCoster [1998]):- Identify the nature of the constructs underlying responses in a specific content area.- Determine what sets of items “hang together” in a questionnaire.- Demonstrate the dimensionality of a measurement scale.- Determine what features are most important when classifying a group of items.- Generate “factor scores” representing values of the underlying constructs for use in other analyses.

2. The Relation between Financial Reporting Outcomes and Accounting

- Every transaction a company undertakes is with either a related or an unrelated counterparty, i.e, with a counterparty who has some extra-transaction relationship with the company through employment, ownership, or both; or with a counterparty who has no extra-transaction relationship with the company for financial reporting purposes, it is not purely the “related party-ness” of a transaction that warrants particular attention, but rather the transaction’s potential economic effect on the company; Financial accounting standards show which of these transaction require disclosure (Henry et al [2012]), and lead to similar financial reporting outcomes, which makes meaningful comparison of financial reports (Soderstrom, Sun [2007]). By financial reporting outcomes, we mean the quality of financial reporting, measured in a variety of ways (Holthausen [2009]). Our study examines the impact of accounting standards and accounting disclosure on the financial reporting quality. Because many forces shape the quality of financial reporting, and accounting standards should be viewed as one of those forces. Indeed, the international accounting literature suggests that the effect of accounting standards alone may be weak relative to the effects of forces such, auditor quality and, regulation, enforcement, ownership structure, and other institutional features of the economy in determining the outcome of the financial reporting process (Holthausen [2009]).A fundamental concern of accounting standard setters is to ensure that financial reporting is informative and reliable. This concern has stimulated a vast amount of research on the quality of financial reporting (Marinovic [2013]), Therefore Provide predictable information can lead to reliance on financial reporting. Moreover, financial accounting information is the product of corporate accounting and external reporting systems that measure and routinely disclose audited, quantitative data concerning the financial position and performance of publicly held firms (Bushmen, Smith [2003]).It should be noted that, Users of accounting information are generally interested in assessing current performance as well as estimating future performance, and there is considerable debate concerning how well various accounting measures reflect these goals. Some of a firm’s transactions require only a mechanical application of accounting rules while other types rely on the judgment of the firm’s managers and accountants. This judgment introduces errors both intentional as well as unintentional. Intentional errors are often referred to as discretionary. However, with respect to quality, the source of the error does not matter; both types reduce the quality of accounting information (Chaney et al [2009]).So that, we cannot address the issue of accounting quality unless we agree on what accounting is supposed to do. Financial reports then take on meaning as products supplies to a customer (Penman [2002]).Corporate disclosure of information can take several forms and the annual report to stockholders is a very important form of periodical corporate disclosure (Singhvi, Desai [1971]), It is often said that financial reporting should have the objective of providing all relevant information to capital market. So if both historical cost information and fair values are relevant, should be reported. Nothing here subtracts from that position. The issue is which measurement basis should go through the discipline of the accounting system to determine the summary, bottom-line numbers, earnings and book value on which investors and analysts focus (Benman [2007]).Several of the accounting theory literatures argue that financial reporting reduces information asymmetry by disclosing relevant and timely information. because there is considerable variation in accounting quality and economic efficiency across countries, international accounting systems provide an interesting setting to examine the economic consequence of financial reporting (Soderstrom, Sun [2007]). The reduction of uncertainty and information asymmetry would smooth the communication between managers and other related interested parties, such as shareholders, lenders, regulatory and supervisory authorities (Latridis [2010]).

3. The Relation between Financial Reporting Quality and the Governance

- The effect of sound governance practices on the quality of financial reporting has recently received attention from researchers, and the main focus has been the relation between audit committees and fraudulent financial reporting (Goodwin, Seow [2002]). The new governance rules of 2002 came after a series of corporate scandals involving accounting irregularities and share price manipulation. The most notorious of these scandals is perhaps the collapse of the energy company Enron in 2001 (Chaochharia, Grinstein [2006]). Prior accounting research and the accounting profession have focused primarily on the board of directors and the audit committee. For instance, the public oversight board (POB1993) defined corporate governance as “those oversight activities undertaken by the board of directors and audit committee to ensure the integrity of the financial reporting process” (cohen et al [2008]). So that the focus of part this paper is to analysis the relation between the financial reporting quality and the corporate governance’s roles.Also the main provisions in corporate governance are (Chaochharia, Grinstein [2006]):- All firms must have a majority of independent directors.- Independent directors must comply with an elaborate definition of independent directors.- The compensation committee, nominating committee, and audit committee shall consist of independent directors.- All audit committee members should be financially literate, in addition, at least one member of the audit committee is required to have accounting or related financial management expertise.- In addition to its regular sessions, the board should hold additional sessions without management.One of the fundamental principles of good corporate governance is transparency (e.g., OECD, [2004]). In its simplest form, the principle states that an organization should disclose all the information in its possession that stakeholders would find useful in evaluating the organization and in making economic decisions regarding it. Thus, stakeholders are able to obtain a clear and complete “picture” of a corporation’s activities and financial situation (C. Gaa [2009]).

4. The Relation between Financial Reporting Quality and the Audit

- Corporate governance proponents consistently emphasize the internal audit function's role in enhancing financial reporting quality. Nonetheless, the internal audit function's role in the financial reporting process is not yet fully understood and empirical evidence concerning the impact of internal audit function quality is minimal, (Abbott et al [2016]). Otherwise the external auditor plays a significant role in monitoring financial reporting quality and hence can be viewed as an important participant in the governance process (cohen et al [2008]).Audit committee members, along with management and auditors provide oversight with respect to financial reporting. Audit committees have specific responsibility for overseeing financial reporting activities. Regulators and the accounting profession have touted the role of audit committees in protecting investors, and accounting research suggests that market participants see audit committees as providing meaningful oversight of the financial reporting process (Mcdaniel, et al [2002]). The literature suggests that an effective audit committee should play an important role in strengthening the financial controls of an entity. A number of studies have found that companies with an audit committee, particularly when that committee is active and independent (Goodwin, Seow [2002]).

5. Results and Discussion

5.1. Statistical Method Used

- Is the light of the objectives of the study and the nature of variables, and the method of measurement (Factor Analysis), a set of statistical package science (spss v21) in the entry and processing of data collected from the form.The research is conducted in order to identify current issues and ambiguities in the area.

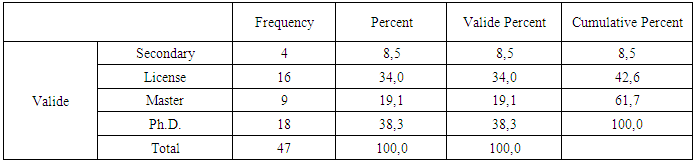

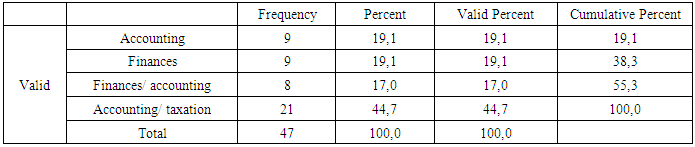

5.2. Applied Study

- The sample of the study included the accounting and auditing professionals in Algeria, where 65 forms were distributed to accountants, auditors and academic, 47 valid forms of analysis were retrieved and approved.

|

|

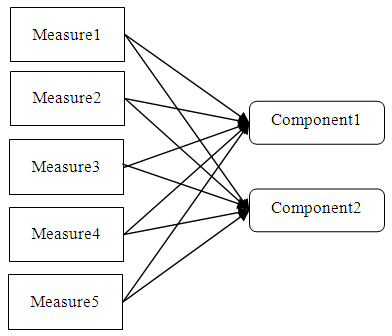

|

| Figure 1. The model for principal components analysis |

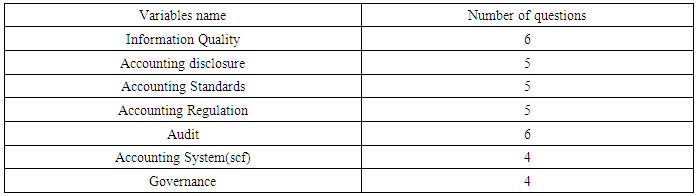

5.3. Correlation Matrix

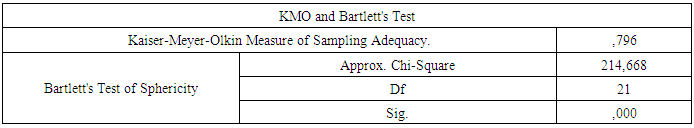

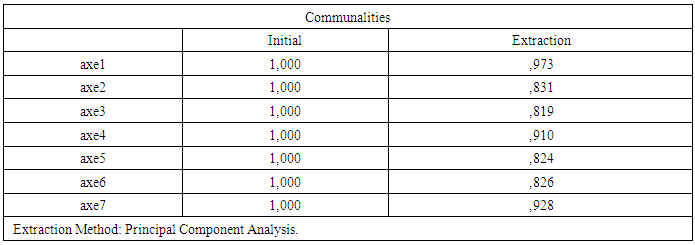

- The most important assumption to achieve the condition of the factor analysis method is that the correlation between the variables is zero and this is what was achieved in our study, which indicates the integrity and validity of the data and analysis of the results, as shown in Table 4.

|

|

|

|

|

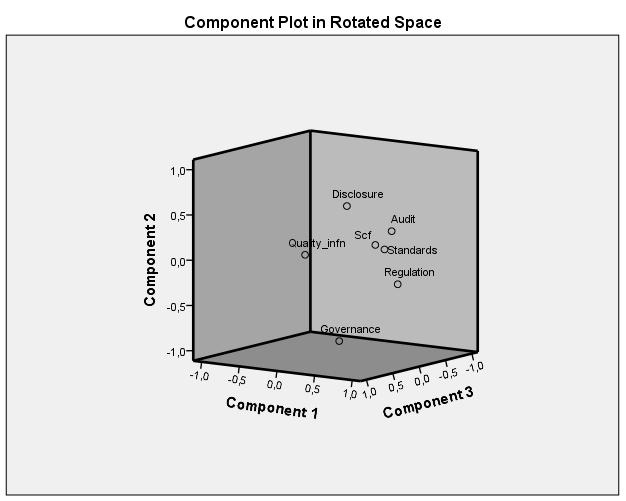

| Figure 2. Example of an image with acceptable resolution |

6. Conclusions

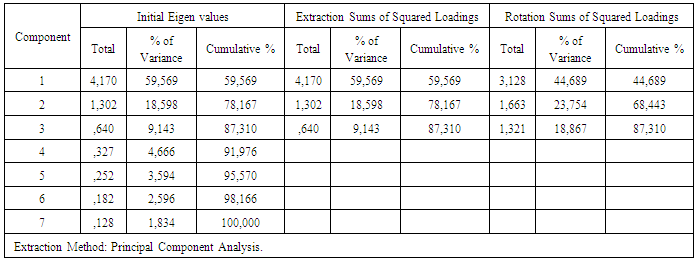

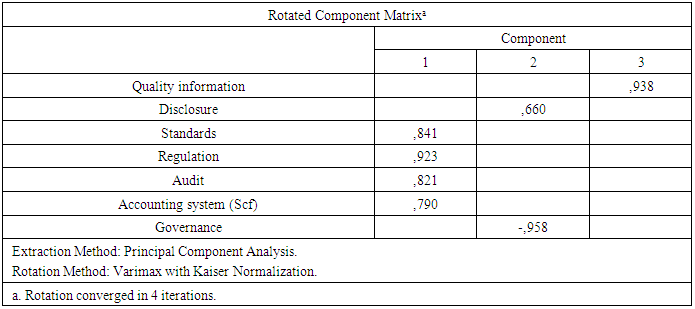

- These studies determine the impact of the related party on the financial reporting quality point to a variety of factors that influence that quality and suggest that the accounting standards are also important as regulation, audit and accounting system. This study demonstrates three factors (components) that explain the variation between the variables of the study:- The first factor includes: accounting standards, accounting regulation, audit, and accounting system.- The second factor includes the disclosure.- The third factor includes the quality of information.The three factors together explain 87% of the information in the financial reporting. The audit contributes to obtaining reliable accounting information in decision making and improving the effectiveness of the internal control system. Also the quality of the financial reporting reflects the quality of the audit in its information. Disclosure plays a crucial role in helping to promote financial reporting quality.Recent work suggests that existing measures of the audit and the accounting information are correlated with the financial reporting quality. As such, it is conceivable that the audit has an important effect on how the adoption of accounting standards affect financial reporting quality. As the accounting information will increase the competitiveness of companies by providing transparency in their financial reporting. Also, the governance can ensure the quality of the financial reporting process.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML