-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(5): 133-141

doi:10.5923/j.ijfa.20180705.01

Impact of Oil Price Shocks on Exchange Rate in Algeria

Mohammed Djebbouri

Finance and Banking Department, Moulay Tahar University, Saida, Algeria

Correspondence to: Mohammed Djebbouri, Finance and Banking Department, Moulay Tahar University, Saida, Algeria.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The aim of this paper is to investigate the impact of oil price shocks on the exchange rate of the Algerian economy which is dominated by the oil sector. To attain this aim, we used the following methods: Johansen test of cointegration, the application of Vector Error Correction Model (VECM), the impulse response function and variance analysis to test the dynamic relationship between oil price shocks and the exchange rate. The data collected is analyzed through using six macroeconomic variables: the exchange rate, the Algerian dinar (DZD) against the US dollar, the real GDP growth rate, the inflation rate, the interest rate, the balance of trade and the world price of Algerian crude oil along an annual data from 1980 to 2017. Thus, the present findings confirm that the shocks in world prices of crude oil play an important role in explaining the movements of the Algerian dinar exchange rate. The results of the shock response and analysis of the variance tests showed that there is a significant negative impact of the oil price shocks on the exchange rate in Algeria.

Keywords: Oil shocks, Exchange Rates, Vector Error Correction Model, Algeria

Cite this paper: Mohammed Djebbouri, Impact of Oil Price Shocks on Exchange Rate in Algeria, International Journal of Finance and Accounting , Vol. 7 No. 5, 2018, pp. 133-141. doi: 10.5923/j.ijfa.20180705.01.

Article Outline

1. Introduction

- Since the mid-1970’s, there have been outstanding links between fluctuations in oil prices and economic activity in several countries in the world. Thus, a plenty of economists have viewed these price movements as the main and most important source of business cycle fluctuations and several empirical studies have shown that shocks in oil prices have always been followed by violent global economic crises.Since then, many efforts have been exerted to study and analyze mechanisms through which oil price shocks can affect macroeconomic performance and measure and reduce the impact that such shocks can have on economic activity. In this matter, the previous theoretical studies focused on the channels of supply shock and the modifications in traditional demand, however, the first empirical studies generally assessed the "GDP" on the variable oil price and several other variables (Rasche and Tatom, 1977).After studying the mechanism of transmission and spread of shocks resulting from oil prices across the various macroeconomic variables, and after the initial theoretical studies proving the existence of strong relations between oil price fluctuations with these variables, several empirical studies based on numerous approaches and methods of economic measurement have applied and tested these theoretical relations between macroeconomics and the development of oil prices in various countries of the world, especially for the US economy and the other OECD economies (Organization for Economic Co-operation and Development), while the number of studies remains limited for developing countries, and particularly those exporting oil.The Algerian economy is primarily centered on the oil production. The oil or hydrocarbons sector is regarded as the backbone of its economy since it produces more than two-thirds of national wealth. Further, hydrocarbon exports are the main engine of the national economy; it represents more than 95% of the total exports. Besides, revenues from petroleum represent more than 75% of tax revenues. That is why, the hydrocarbon sector is the most important source of national reserves of foreign currency and denotes an important source of national savings too and which allow for significant investment rates.Thus, the developments in oil prices are reflected in the performance and behavior of the various basic macroeconomic variables in the Algerian economy, the most important of which is the currency exchange rate, where movements and fluctuations in oil prices have developments and corresponding changes in the revenues from hydrocarbon exports and which have been contributed to the definition and financing of development strategies since the Algerian independence, 1962. As the increasing reliance on these revenues in the financing of the country's treasury has caused the Algerian economy to suffer from severe crises, characterized by declining economic growth rates, external account deficits, reduced exchange reserves and the devaluation of the local currency.Historically speaking, Algeria has gone through flourishing economy due to the high prices of oil followed by periods of stagnation. Thus, over the last 50 years, oil prices have fluctuated rapidly and in 1973 it was followed by the subsequent flow of oil revenues into the economy, the fall in oil prices has been accompanied by a profound impact on the Algerian economy. The decline in oil revenues was either due to a sharp drop in oil prices or a decline in production. Previous periods of sharp declines in oil prices were: 1982-1986, 1998-1999 and 2009-2008.The first period - the 1980s - is the most similar to the current declines in oil prices. A similarity between the decline in oil prices today and the decline in the 1980’s is that the decline in oil prices was the result of the expansion of oil production outside the OPEC (OPEC), and increasing efforts in many developed countries to improve the efficiency of oil extraction and reduce the cost of production, as well as the management of energy conservation which was led by the International Energy Agency through its strategy, and which gave rise to the transformation of the oil market to the consumer market.In unprecedented levels, oil production in both the United States and Canada was not considered the direct cause of the collapse of oil prices but certainly it can be regarded among the reasons beyond the price collapse. Therefore, stabilized oil prices over USD 100 for more than three years 2011 to 2014 as well as the greed of oil producers around the world gives American oil producers time to develop their potential and invest in the production of high shale-oil and benefit from a profit margin between 30 and 50 dollars a barrel.The Algerian economy relies primarily on oil revenues and dollar exchange rates. The significance of the dollar exchange rate for Algeria and the general oil producers is that oil is traded in US dollars around the world markets. The importance of the relationship between oil prices and the exchange rate has been noted by many economists. They have shown that changes in the price of crude oil play a crucial role in creating exchange rates.Through following the phases of the Algerian dinar exchange rate, it is clear that it has fallen over several years. Economists have different views on the explanation of the sharp devaluation of the Algerian currency, but they all assert that the country's economy is vulnerable to economic shocks; it is not based on solid economic fundamentals that are not subject to relative market volatility.On the one hand, observers believe that the value of the Algerian dinar fell as a direct result of the decline in the oil prices. This collapse occurred immediately after the decline of oil prices in the international market. If this explanation is correct, the Algerian dinar will continue to weaken over the next year as long as the Algerian economy depends on oil as the only source of income. Thus, it will make it vulnerable to external shocks and then dealing with oil price volatility and uncertainty is a major challenge for the Algerian authorities.This study aims at demystifying the effects of shocks in the price of oil on the exchange rate in the national economy, especially as the crises of oil and currency devaluation together put Algeria in a severe economic crisis.The article is organized as follows: In the first section, we review the relationship between oil prices and exchange rate by addressing the summary of the results of some previous studies. In the second section, we focus on the standard study of the impact of shocks in crude oil prices on the Algerian dinar exchange rate, which includes the methodology and data, then the experimental results and the conclusion.

2. The Relationship between the Oil Prices and Exchange Rates

- From the theoretical perspective, several models have been fostered to determine the nature of the relationship between oil prices and exchange rates (Krugman, 1983; Golub, 1983; McGuirk, 1983; Rogoff, 1991). In this, several studies have examined the analysis of the impact of oil price shocks on the exchange rate and found a strong relationship between the two variables (Benassy-Quéré et al., 2007; Chen and Chen (2007); Korhonen et al. (2007); Nikbakht (2009); Lizardo and Mollick (2010); Ferraro, Rogoff, and Rossi (2011); Mehmet Eryigit (2012); Courage and Kin (2014); Nag Upadhayaya and Kaushik (2014); Zhang (2014); Drachal (2018)).The investigation of Benassy-Quéré et al., 2007 used the cointegration model and causality model to determine the relationship between oil prices and the dollar exchange rate for the period 1974-2004. The results showed that the causal relationship extends from oil prices to the exchange rate. In the long term, they found that 10% rise in oil prices would lead to a dollar gain of 4.3%. The researchers predicted that a future inverse relationship between these two variables could arise because of China's entry as a major consumer of oil.Chen and Chen (2007) verified the nature of the long-term relationship between the exchange rate and oil prices using monthly data for Panel data during 1972: Q1 - 2005: Q10 for the G7 Countries. Their study indicated that there was cointegration between exchange rates and real oil prices. The results showed that oil prices are the dominant variable of real exchange rate changes and found that using oil prices, exchange rates can be predicted and then yields can be generated through these forecasts.Korhonen et al. (2007) estimated the real exchange rate in OPEC countries from 1975 to 2005 and three oil-producing Commonwealth Independent States (CIS) from 1993 to 2005 using panel co-integration methods. Their results show that real oil price has a direct effect on the equilibrium exchange rate in oil-producing countries.Nikbakht (2009) studied the long-run relationship between real oil prices and real exchange rates from 2000:01 to 2007:12 by using monthly panel of seven OPEC countries (Algeria, Indonesia, Iran, Kuwait, Nigeria, Saudi Arabia, and Venezuela). His results show that there is a long-run and positive linkage between real oil prices and real exchange rates in OPEC countries.Lizardo and Mollick (2010) investigated the cointegration relationship between oil prices and exchange rates. Thus, the study finds that oil prices explain significantly the movements in the value of the US dollar against major currencies during the period from 1970 to 2008. Exactly, the increases in real oil prices significantly lower the value of the dollar against the currencies of oil-exporting countries, such as: Canada, Mexico and Russia. On the other hand, the currencies of oil importers are falling against the US dollar, such as Japan when the price of oil rises.Ferraro, Rogoff, and Rossi (2011) examined the possibility of a stable and reliable relationship between the US dollar and the Canadian dollar and oil prices, and there was a weak correlation between the exchange rate and oil prices for the monthly data and a quarter. In the case of daily data, the relationship between the exchange rate and oil prices was strong and stable.The study of the Mehmet Eryigit (2012) aimed at analyzing the dynamic relationship between shocks in oil prices, exchange rates, interest rates and the index of the stock market (ISE-100) in the Turkish economy using the Vector Auto Regression Models (VAR). The results then revealed that there was no cointegration between oil prices and exchange rates. However, the use of dynamic shocks between variables by analyzing Impulse Response to Cholesky, the results showed that a shock in oil prices had a positive impact on the ISE-100 and a negative impact on the exchange rate. The impact of the shock on the stock index faded after the third week, while it faded after nine weeks on the interest rate and exchange rate.The study of Courage and Kin (2014) used the Generalized Autoregressive Conditional Heteroscedasticity (GARCH) model to analyze the impact of oil price and the interest rate on the nominal exchange rate between the US dollar and Rand in South Africa. Based on the results obtained, 01% increase in the interest rate leads to a Rand increase of 0.0025% which is consistent with the economic theory; however, the results indicated that the increase in oil prices by 01% decreases in the value Rand by 0.0012% against the US dollar.The study of Nag, Upadhayaya and Kaushik (2014) aimed at analyzing the relationship between the two variables using the Indian rupee and the US dollar. This was accomplished by means of the linear regression of the real exchange rate (Dollars Américain/ Indian Rupee) on the following variables: The real balance of the local currency, domestic real GDP and foreign, difference between domestic and foreign interest rates and oil prices. The results identified a common cointegration relationship between the studied variables. Further, the Error Correction Model (ECM) indicated that the real balance of the local currency and domestic real GDP and foreign are significant determinants of the real exchange rate in the Indian economy. High oil prices contribute to the decline of the Indian currency against the US dollar, but the coefficient of variable was not statistically significant.The study of Zhang (2013) tested the long-term relationship between oil prices and the real exchange rate of the US dollar. The results show that all the variables are integrated in first order. Besides, the study found a conitergration between the exchange rate of the US dollar and oil prices. However after controlling the structural shocks in 1986 and 2005, the results showed a negative correlation between the real exchange rate and oil prices finding a long-term relationship between the two variables.The study of Drachal (2018) used the Granger causality test, and the non-linear Diks–Panchenko test, to analyze the causal dynamics between spot oil price, exchange rates, and stock prices in Poland, the Czech Republic, Hungary, Romania, and Serbia. During the period from 1970 to 2008, the results found that oil price negatively impacts exchange rates, and that stock prices negatively impact exchange rates. The outcomes are generally consistent among the analyzed countries, and they are similar to those from the US.The strongest linkages were found for the Czech Republic, Hungary, and Romania (both through variables and as causality in variance). Oil price impacts both stock prices and exchange rate for these countries. A weaker influence of oil price to exchange rate in Serbia was also found. However, as different tests were giving different conclusions, the outcomes should be taken with great caution.

3. The Econometric Study of the Impact of Shocks in Oil Prices on the Algerian Dinar Exchange Rate

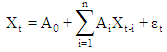

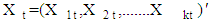

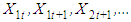

- This step of our study aims at econometrically measuring the impact of shocks in crude oil prices on the Algerian dinar exchange rate. To achieve this aim, we have chosen to conduct the analysis from 1980 to 2017 through the implementation of a dynamic model that takes into account random shocks past and present, and this was what has been interpreted by the VAR0. This model is regarded as an appropriate experimental tool which helps to understand the nature of the impact of these shocks for their ability to provide a comprehensive and accurate description of the true dynamic structure of the system studied.It can also be said that the VAR model is based on the hypothesis of convergence of economic development to describe the dynamic behavior of a vector containing a variable (K) linearly correlated, so X vector can be modeled as follows:

In which

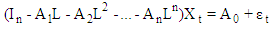

In which  This model can be written in another form using the lag operator (L):

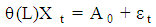

This model can be written in another form using the lag operator (L): That is:

That is:  Where:

Where:  Random Error term with

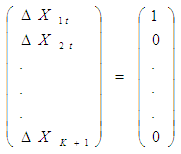

Random Error term with  n: The number of lag length of an AR process.t: Time - Impulse Response Functions AnalysisShock analysis aims to measure the impact of a shock on the variables studied. For example, the change at a given moment to et has implications for

n: The number of lag length of an AR process.t: Time - Impulse Response Functions AnalysisShock analysis aims to measure the impact of a shock on the variables studied. For example, the change at a given moment to et has implications for  and the symbol for the variable is

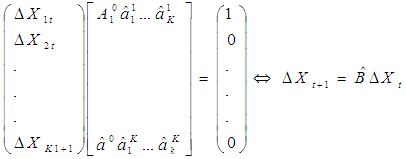

and the symbol for the variable is  at the time t.If there is a shock at (t) on e1t, then it impact will be as follows: At the time t

at the time t.If there is a shock at (t) on e1t, then it impact will be as follows: At the time t At the time t+1

At the time t+1  Where:

Where: : The matrix of estimated parameters of the model

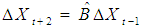

: The matrix of estimated parameters of the model And generally at t+h

And generally at t+h The values of change at each interval are called impulse response functions (IRFs). This confirms the hypothesis that there is no correlation between eit errors. In the case of a correlation between random compounds, this can be estimated in the following relationship:

The values of change at each interval are called impulse response functions (IRFs). This confirms the hypothesis that there is no correlation between eit errors. In the case of a correlation between random compounds, this can be estimated in the following relationship:

3.1. Data and Methodology

3.1.1. Data

- Through the explanatory theories of the determinants of the exchange rate, it is indicated that both the economic growth rate, inflation, interest rate, balance of trade and world oil prices are the most important and specific variables of the Algerian dinar exchange rate against the US dollar (indirect quote) during the study period 1980-2017.This study was based on the reports of the International Monetary Fund's (Statistics-IFS International Financial) to obtain data on macroeconomic variables; however, the average annual global price of Algerian crude oil was generated by the Organization of Petroleum Exporting Countries (OPEC) and the Energy Information Administration (EIA). In our analysis, we use six macroeconomic variables: the Algerian dinar against the US dollar (LNER), the real GDP growth rate (LGDPG), the inflation rate (LINFL), the interest rate (LINTERESTR), the balance of trade (BALANCET) and the world price of Algerian crude oil (LOILP).

3.1.2. The Empirical Methodology

- For the econometric study, a set of tests will be used in the modern econometrics and which is based on the test of the time series characteristics in terms of the stationary or the appropriate standard tests in the short and long term, such as Augmented Dicky fuller, the Johansen cointegration test (Johansen-Juselius) and the use of the Autoregressive Model (VAR) or Vector Error Correct Method (VECM) can be applied, the impulse response functions (IRFs) and the Variation Decomposition (VDCs).The period of the empirical study is selected in order to take into account fluctuations and shocks in oil prices which have had a significant impact on the Algerian dinar exchange rate against the US dollar that left an unprecedented negative economic effects manifested in the gradual increase in prices of many materials, especially when treasury revenues decreased due to the fall in oil prices that produces a shock in Algeria that becomes difficult to deal with or get out of them with minimal damage.Prior to 1990, Algeria's exchange rate policy was the systematic intervention in the foreign exchange market to maintain the fixed exchange rate. In 1994, this policy changed, so Algeria adopted the management floating exchange rate and intervened at intervals to counter the strong upward pressure or downward on the Algerian dinar.The shocks in oil prices are a price shock. Further, oil price shock is defined as the random changes in the oil price function. The large random and non-random fluctuations in the price of oil affect the US dollar at the level of economic activity in general and the exchange rate in particular. The size of this impact depends on the nature of the economy. The impact is significant in the economies in which the hydrocarbon sector's exports dominate the trade balance and the main source of the accumulation of foreign exchange reserves in the economy.Algeria is known for its rent-driven economy, which was shaken by the oil price crisis in the global market at the beginning of 2015. The sharp and continuous declines in oil prices led to a deterioration in exchange-rate levels. The flow of reserves led to the deterioration of the Algerian dinar exchange rate, the Algerian dinar depreciated against the US dollar from 93.24 dinars to 77.9 dinars.

4. Empirical Results

4.1. Tests of Stationary and Cointegration of the Variables of the Study

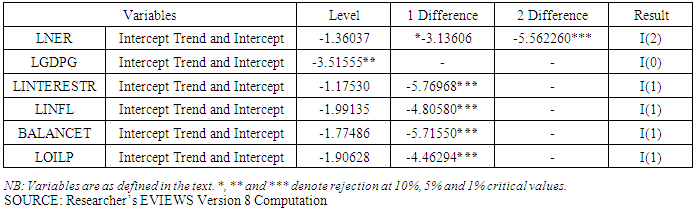

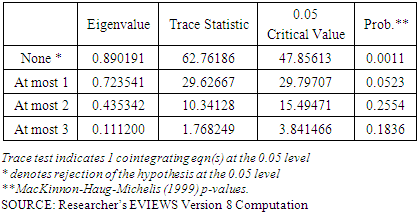

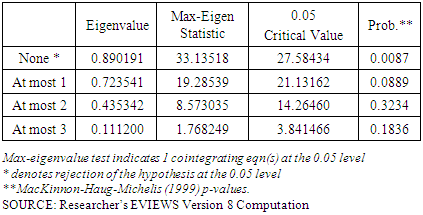

- Prior to estimation of the study model, one must first examines the unit root of the time series of the study variables, and then verify the existence of a cointegration between the variables of the model. The results of the Augmented Dicky fuller tests clearly indicate the absence of a unit root at a variable level of real GDP growth rate (LGDPG). The results reveal stationary at level, while the results of the tests show the non-stationary of the following variables: the exchange rate of the Algerian Dinar against the US dollar (LNER), the interest rate (LINTERESTR), the inflation rate (LINFL), the trade balance (BALANCET) and the world price of oil (LOILP).After an identical test in the first difference, the following series became stationary and integrated of order 1: interest rate, inflation rate, trade balance, and world oil price, whereas the LNER remained non stationary. Further and after making the second difference, the result show that the LNER is integrated of order two I (2). In the case of cointegration relationships, the test of the possibility of a common path between variables is only between integrated variables of the same order. Thus, the results of the Johansen Cointegartion test confirm the existence of the cointegration between the variables: INFL, BALANCET, OILP and INTERESTR (see table 2 and 3). Table 1 provide the unit root regression results in levels and differences of the variables entered in the model and the corresponding critical value of 10%, 5% or 1% to reject the null hypothesis of the presence of a unit root.

|

|

|

4.2. Impulse Response Functions and Variance Decomposition Analysis

- The methodology applied involves the application of the Vector error correction model (VECM) (used to correct the disequilibrium in the cointegration relationship) after determining the appropriate number of lag length of the VAR model based on the Akaike and Schwartz parameters, then estimating the Impulse Response Function (IRF) to analyze the degree of balance adjustment after an oil shock, and estimate the reaction after the oil shock to allow tracking of its impact and to identify the time period for its impact.The purpose of the Variance Decomposition study is to determine the share or extent of each innovation contribution to the error variance of the studied system variables.

4.2.1. Stability of Vector Error Correction Model

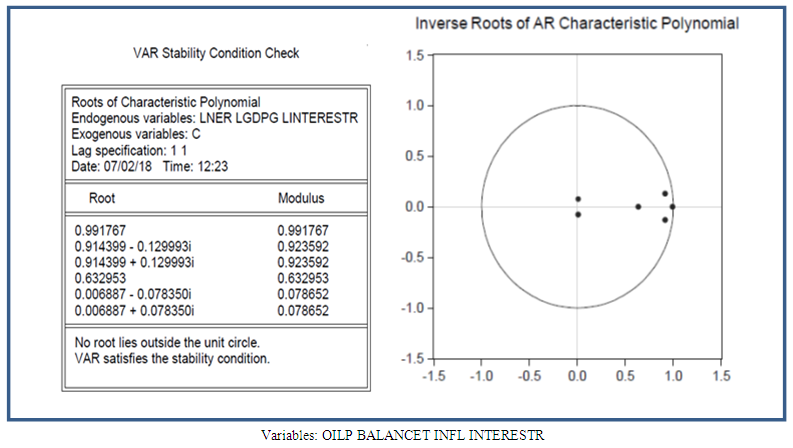

- After the error correction model has been estimated and the optimal lag length has been selected as one year for each variable based on the criteria: SC (Schwarz), AIC (Akaike) and Log Likelihood. Then, the VAR model used by the Polynomial Roots of Characteristic has been confirmed to be stable since it is known that the model stability condition is that the Modulus parameters are less than the number integer 1, that is, all the roots are located within the Unit Circle. From Figure 1 below, the stability of the VAR model used in the study is achieved, indicating that the results of the estimated shock response function can be relied upon.

| Figure 1. Roots of Characteristic Polynomial |

4.2.2. The Analysis of Impulse Response Functions

- The impulse response functions (IRFs) enables us to measure the sudden influential shock on a given variables of the system studied in both the short run and the long run so as to explore the intricate and interactive relationships of the model including the investigated variables. Likewise, the implementation of the random structural shock on the world oil prices and the analysis of its influence on the exchange rate on the variables of the system (interest rate, economic growth rate, the inflation, and the trade balance). Especially, it tries to predict the sudden impact of the oil prices on the Algerian dinar exchange rate (the indirect quote of the Algerian dinar against the US dollar).We applied structural price shock (LOIP) value in the first period by one standard deviation (-1.64). We noticed that the exchange rate and other variables remained the same in the same period, but they reacted significantly in the following periods. The results were as follows:It was noticed that a positive response was recorded in the Algerian Dinar exchange rate (NER) over the Horizon period (3.106%), (3.083%) and (3.100%) in the second, third and fourth periods in order, and that was why the Algerian dinar depreciated against the US dollar (indirect quote) in these rates following the negative shock in the world oil price. This indicates that the decline in oil prices had a negative and significant impact on the exchange rates of the Algerian dinar in the post-shock periods. While in subsequent periods the impact of the shock began to decline gradually until the tenth period where the shock impact started to disappear.

4.2.3. Variance Decomposition Analysis

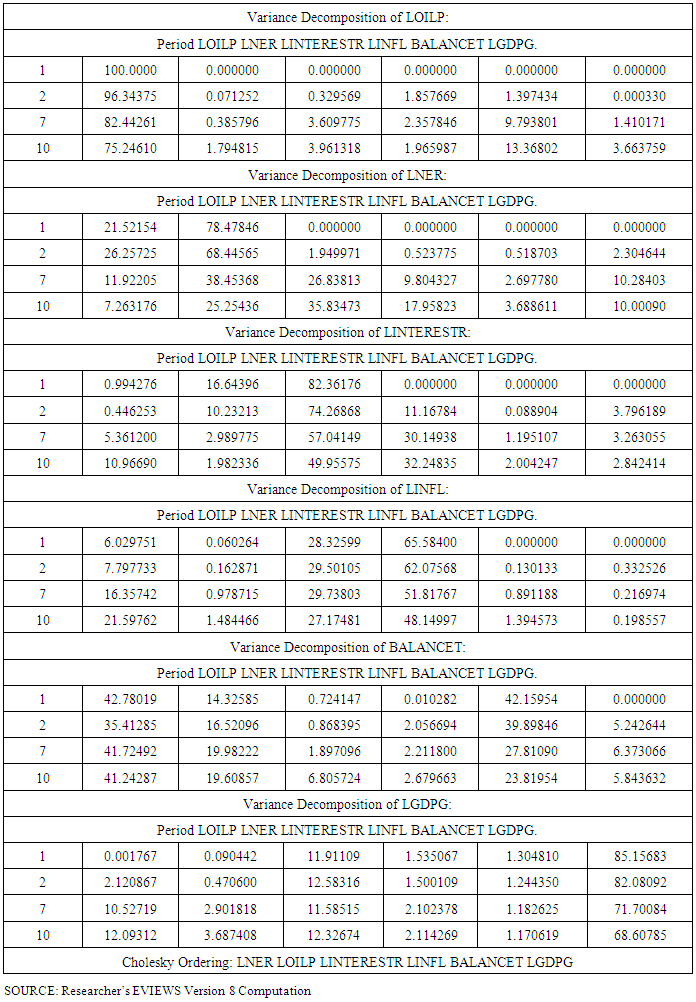

- Table 4 describes the variance decomposition at four different time horizons (1, 2, 7, and 10 years) to identify the relative importance of external shocks in explaining the variability of variables in the model over the long term, The results reveal that the shocks in the prices of crude oil (LOIP) contribute to explain about 96.34% of the variability in oil prices in the second period, falling to about 75.24% in the tenth period, while contributing to explaining about 26.25% of the variability in the Algerian dinar exchange rate (LNER) and falling to about 7.26% in the tenth period. In the long run, it is noted that the impact of shocks in oil prices on the exchange rate is declining. The oil price shocks account for about 35.41% of the variability in the BALANCET balance in the second period, increasing to about 41.24% in the tenth period. The results also show that the variance of the forecast error for the interest rate, inflation and growth rate, which can be explained by the shocks in oil prices is about 0.45%, 7.79% and 2.12% in the second period respectively, and 10.96% 21.59% and 12.09% at the end of the ten years.

|

5. Conclusions

- This study focuses on the examination of the dynamic relationship between the shocks of crude oil prices and the exchange rate in Algeria. Further, this investigation was due to the result of the strong correlation of the Algerian economy that is often influenced with the successive shocks of the oil prices that led the last oil crisis and the financial crisis as well, with the sector of hydrocarbon. Thus, since 2014 Algeria has been suffering from a severe crisis. And due this, Algeria becomes too vulnerable to a sharp and worrisome deterioration in the dinar exchange rate against the US dollar at a time when the country's revenues from dollars appear to be falling steadily.Thus, if the situation is not controlled and an atmosphere of confidence is not created in the economy, the country may face many repercussions in the future, the most important of which are the deterioration of the purchasing power of the currency, the risk of increasing inflation, the deterioration of the balance of payments position and the decline in foreign exchange reserves in light of the general scarcity of foreign exchange in the necessary expenditure on the development projects.The study aimed at testing the effects of oil price shocks on the exchange rate in Algeria. To attain the objectives of the study, the analysis of annual data for time series has been used to cover the period 1980-2017 using the appropriate standard methods.The results of the study that used the unit root test showed that the values of the time series of the following variables are integrated with the same class (INTERESTR, INFL, BALANCET, and OILP).And with the use of Johansen test to conduct the cointegration test, it was found that there was a common correlation between these variables. Then, it has been confirmed that The Vector Error Correction Model (VECM) was stable based on its use over the selected Lag length and it was a unique period.Moreover, the Impulsive Response function estimated that a negative shock in oil prices was offset by a significant decrease in the dinar exchange rate from the second period and continued to decline throughout the response period. The results showed that the decline in crude oil prices had a strong impact on the decline in the exchange rate in the periods of the study. In addition, the negative oil price shocks adversely affected real GDP growth rates and balance of trade balance up to the tenth period.Through analyzing the variance decomposition over ten year period to determine the relative importance of external shocks in explaining the volatility of variables in the model over the long term, it was found that the shocks in crude oil prices contribute to explaining about 26.25% of changes in the Algerian dinar. This deceased to nearly 7.26% in the 10th period. It was also noted that the shocks in oil prices explain about 35.41% of the changes in the balance of trade in the second period, and increase to about 41.24% in the tenth period.The study recommends diversifying Algeria's economy by increasing the direct investments at the major non-oil producing sectors of the economy, expanding small and medium enterprises to secure the hydrocarbon sector by means of protecting against the fluctuations of shocks of oil prices and adopting a number of measures and policies to reduce negative impacts and undesirable economic effects on the price of oil. The exchange rate resulting from the volatility of oil prices following a series of economic, monetary and financial policies helps to sustain economic expansion, diversify production and increase integration into the global economy.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML