-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(4): 108-121

doi:10.5923/j.ijfa.20180704.03

Impact of Exchange Rate Movements on Indian Firm Performance

Mohammad Nagahisarchoghaei1, Morteza Nagahi2, Nadia Soleimani3

1Department of Computer Science, College of Computing & Informatics, North Carolina University at Charlotte, Charlotte, NC, USA

2Department of Industrial & Systems Engineering, Bagley College of Engineering, Mississippi State University, Starkville, MS, USA

3Department of Psychology & Educational Administration, Shahid Beheshti University, Tehran, Iran

Correspondence to: Nadia Soleimani, Department of Psychology & Educational Administration, Shahid Beheshti University, Tehran, Iran.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper presents the research results on the impact of real effective exchange rate (REER) on Indian firm performance. The analysis is based on a multivariate regression model, for the time period from 1 Dec 2011 to 1 Dec 2012 for the top 242 Indian firms of Bombay Stock Market. Our empirical analysis reveals that significant relationships between real effective exchange rate (REER) changes (fluctuations) and firm performance indexes through changes imports as well as foreign exchange liabilities sector. The impact size of imports indexes is different so that stores and spares imports and capital goods imports are more effective than other imports indexes to firm performance. The firm performance indexes such as growth performance (internal growth), profitability (EBIT), firm specifics (Capacity Utilization), and stock performance (P/E) have an obvious relationship to the changes of imports, foreign currency borrowings and total forex spending indexes. Other indexes that decrease the effect changes in exchange rate have on Indian firms include: bigger (P/E) ratio and higher internal growth rate.We also found a weak relationship between the real effective exchange rate (REER) and stock price per book value, stock price per sales, total assets value/shares outstanding and degree of operating leverage.

Keywords: Exchange rate, Exchange rate fluctuations, Real effective exchange rate, REER, Firm performance, Firm value, Firm spesifics, India

Cite this paper: Mohammad Nagahisarchoghaei, Morteza Nagahi, Nadia Soleimani, Impact of Exchange Rate Movements on Indian Firm Performance, International Journal of Finance and Accounting , Vol. 7 No. 4, 2018, pp. 108-121. doi: 10.5923/j.ijfa.20180704.03.

Article Outline

1. Introduction

- The share of global trade total world output has almost tripled since second world war. In approximately the last two decades, the global economy witnessed not only a rapid expansion in international trade but conjointly the growing salience of dynamic emerging economies in the world trade landscape. Emerging markets are becoming consistently important mercantilism centers because of the growing role of global supply chains and high-tech exports. India presents a great case for studying the impact of exchange rate fluctuation, not only because it is an emerging economy, but also because it has free-floating exchange rate market that is not fixed by government like China. Prior to the Balance of Payments crisis in 1991, the Indian monetary unit (Rupee) was pegged to a basket of currencies dominated by the US Dollar. In 1991, the external payment crisis forced the Reserve Bank of India (RBI) to implement a group of market oriented financial sector reforms recently, paradigm shift followed from fixed to market-based exchange rate regime in 1993. In August of 1994, the institution of Current Account convertibility and gradual liberalization of Capital Account along with other trade and financial liberalization measures meant a rise in total turnover in the foreign exchange market by more than 150 percent from USD 73.2 billion in 1996 to USD 130 billion in 2002-03, and further to USD 1100 billion in 2011-12. Exchange rate movements could affect firm performance through a number of channels, such as the cost of imported inputs relative to other factors of production, price of exports relative to foreign competitors, or the cost of external borrowing. However, the impact on firm performance is only one component in determining how exchange rate changes affect aggregate economic growth; it can be an important and significant determinant of the exchange impact.One of the important indicators for segmenting firms is exporting. Exporting firms are generally associated with a high level of productivity and profitability. A strong export sector could generate considerable spillovers to other sectors thereby promoting overall economic growth. In the last decade or so, India witnessed strong economic performance coupled with a strong export sector. Thus, it is quite conceivable that a policy that promotes exports is conducive to economic growth. The annual growth rate of India’s exports of goods and services increased from 16% in 1999–2000 to about 33% in 2010–2011. At the same time, India’s overall share of total world trade (which includes trade in both merchandise and services sectors) increased from 0.5% in 1990 to about 1.4% in 2010. As a result, India moved up seven places between 1999 and 2009, to secure its rank as the 14th largest trading center worldwide. During the period of 2000–2010, the growth of exports of commercial services has been faster than that of merchandise exports with the former registering an average annual growth rate of about 23% whereas the latter growing at a rate of about 18%. It is striking to note that the high export growth occurred despite the Indian real effective exchange rate that was appreciated by about 1.4% during the same period.Exchange rate fluctuations can have a substantial impact on the profitability of domestic industries. Price changes caused by movements in the exchange rate may: (a) change the terms of competition with foreign firms for domestic exporters and import competitors, (b) alter input prices for industries that use internationally-priced inputs or firms that import for resale, and (c) change the value of assets denominated in foreign currencies. Because of this diverse set of influences, exchange rate movements affect some industries differently than others, while the effect of exchange rate fluctuations on an industry should depend critically on the industry’s relation with the world economy. An appreciation of the home currency results in a lower the home-currency price of internationally-priced inputs, so production costs fall and industry profitability rises. Similarly, a depreciation increases the home currency price of these inputs, increasing costs and decreasing profitability. Finally, exchange rate changes directly affect the value of foreign denominated assets through the translation of values from one currency to another. For example, firms with foreign investments that have current and future cash flows denominated in foreign currency and the home currency value depend on the exchange rate. In most cases, a depreciation of the home currency increases the value of industries with net foreign denominated assets, while an appreciation decreases the value of these industries.Comprehending the sources of exchange rate fluctuations and their impacts on the economy has been a pressing issue for researchers following the breakdown of the Bretton Woods system. As a result, the economic impacts of the level and volatility of exchange rate movements are explored extensively using a variety of empirical and theoretical strategies. Nevertheless, we know very little about how changes in the level and volatility of exchange rates have an effect on productivity. Despite a major amount of analysis generated on the effects of rate of exchange movements on investment, growth, and export performance of firms, analysis on firm level productivity has been restricted. So it is crucial for us to have better view about how exchange rates fluctuations and movements will impact in micro level of economy. Besides, we need to understand that if exchange rate movements and fluctuations effect on firm productively directly or it will effect on other Macro level of economy, and subsequently this changes in Macro level will cause changes in productively.In this study, building on the heterogeneous firm literature, we tend to examine the impact of the exchange rate on firm performance through empirical observations including, 1. returns and profitability performance, 2. related to growth performance, 3. stock performance, 4. related to firm specifics, and 5. cash flow.To carry out our investigation, we tend to exclusively focus on firm level data collected from India (top 242 firms of Bombay Stock Market), an emerging economy which provides an interesting case study to explore the impact of exchange rate on firm performance from December 2011 to December 2012. The purpose of this study is to measure and determine impact of exchange rate fluctuation to firm performance for the top 242 Indian firms that have different international transactions or no international transactions (domestic firms) but may face indirect exposure to currency movements.The research is organized as follows – Section 2 provides a review of the literature. Section 3 describes the dataset in detail. Section 4 lays the empirical methodology and presents our results. The conclusions are presented in Section 5.

2. Literature

- In the majority of empirical studies, rising exchange rate fluctuation is known to demonstrate economically and statistically significant profitability, growth, investment, and to some degree, trade decreasing effects (Aizenman et al., 2012; Hameed, Kang, & Viswanathan, 2010; Nagahi et al., 2018). Caglayan and Demir (2013) and Miles (2002) find that exchange rate volatility negatively affects productivity growth and having access to foreign or domestic equity or debt markets does not reduce these effects. Moreover, foreign or publicly traded companies do not appear to perform significantly better than the rest. However, it was found that that productivity is positively related to credit market access. Additionally, while export-oriented firms react positively to currency appreciations, they are hurt more from volatility.In fact, Aghion’s work is one of the useful investigations which provides empirical proof that exchange rate uncertainty will have a negative effect on productivity growth. Furthermore, the productivity effects of heterogeneous access to external provided that despite the substantial increases in financial openness and international capital flows across countries, firm’s access to debt and equity markets, both foreign and domestic, is distributed quite unevenly, creating vital competitive asymmetries in those markets. The prior studies show that exchange rate volatility works its effects through: Changing the relative costs of production with both creative and destructive growth effects (Burgess and Knetter, 1998; Gourinchas, 1999; Klein et al., 2003; Chang and McAleer, 2012; McAleer, 2007; McAleer, 2009; Chang et al., 2011); Decreasing the degree of credit availability from the banking system (Bernanke and Gertler, 1990; Carlton, 2005) with contractionary effects on employment (Nickell and Nicolitsas, 1999; Sharpe, 1994) and investment (Fazzari et al., 1988); Reducing aggregate growth and productivity growth especially in countries where financial development is low (Aghion et al., 2009; Ramey and Ramey, 1995); Raising inflation uncertainty, which is found to reduce employment (Seyfried and Ewing, 2001), and growth (Grier and Grier, 2006); Increasing interest rates (UNCTAD, 2006) with negative growth effects (Nickell and Nicolitsas, 1999); 6. Detrimental firm balance sheets and net worth (Bernanke and Gertler, 1990; Braun and Larrain, 2005; Bredin and Hyde, 2011); Discouraging international trade by increasing transaction risk (Baum and Caglayan, 2010). According to the growth effects of exchange rate, uncertainty will ultimately depend on firm and country characteristics. For instance, in the presence of financing constraints firms that have access to domestic and/or foreign capital markets can deal with unexpected exchange rate shocks better than others. In the same way, the level of export orientation, leverage, import dependence, size, profitability, and productivity also determine the nature of firm response to exchange rate shocks (Klein et al., 2003). According to country specific factors, Gupta et al., (2007) currency crises are more likely to have contractionary effects in emerging markets than in developed or other developing countries. Generally, exchange rate uncertainty is expected to have more depressing growth effects in developing countries because of the following vulnerabilities in these markets: 1. Low levels of financial market deepening and the dearth of hedging instruments; 2. The presence of original sin and Dollarization with strong balance sheet effects; 3. Upper levels of openness and the invoicing of exports in hard currencies; 4. Higher levels of exchange rate pass-through; 5. Higher levels of exchange rate, capital flow, consumption, and growth volatility. Mitton (2006) uses static panel data techniques with 1141 publicly traded firms in 28 emerging markets (with the number of firms ranging between 2 and 136 per country) to explore the effects of stock market liberalization on firm performance and finds that firms with access to foreign capital grow faster and enjoy higher investment and profitability rates. In a similar way, using BEA data on U.S. MNEs and World scope data on publicly traded firms of emerging countries, and employing a static panel data analysis, Desai et al. (2007) find that US MNEs grow faster in the aftermath of sharp depreciation.This work is an investigation of microeconomic literature that focuses on the impact of exchange rate fluctuations on firm level performance. A sector of this literature concerns the impact of exchange rate changes on firm value measured by its stock returns. Instances of this particular sector of literature include Adler and Dumas (1984), Jorion (1990), Bodnar and Wong (2000), Dominguez and Tesar (2006), Forbes (2002), Parsley and Popper (2006).Aggarwal and Harper (2010) and Choi and Elyasiani (1997) examine foreign exchange exposure of “domestic” corporations of the U.S. and find that on average domestic company foreign exchange exposure is not significantly different from the exposures faced by multinational firms (MNEs). As expected, the quantity of domestic firms with significant foreign exchange exposure increases with the exposure estimation horizon. More attractively, the level of domestic firm exposure is significantly negatively related to asset turnover and firm size and positively related to the market to book ratio and financial leverage.Many studies indeed suggest that in practice, earnings management is used as a tool to buffer against various types of economic shocks to the operating performance of the firm, (Lambert (1984), Kandilov and Leblebicioğlu (2011), and Leuz et al. (2003)).A main finding is that real effective exchange rate changes and fluctuation affect performance through changes and fluctuations imports as well as forex liabilities sector but the impact is more pronounced for firms with smaller market power. The results hold true for various alternative measures of firm performance such as internal growth, profitability, net worth total assets value, P/E and inventory ratio. Real exchange rate appreciation benefits firms with higher dependence on imported inputs through a lower variable cost while it hurts the firms with a greater dependence on exports through lower price competitiveness (kose et al., 2009; Koutmos and Martin, 2003; Mehran, 1995). Data collection and methodology of the research are illustrated in next section.

3. Data Collection and Method

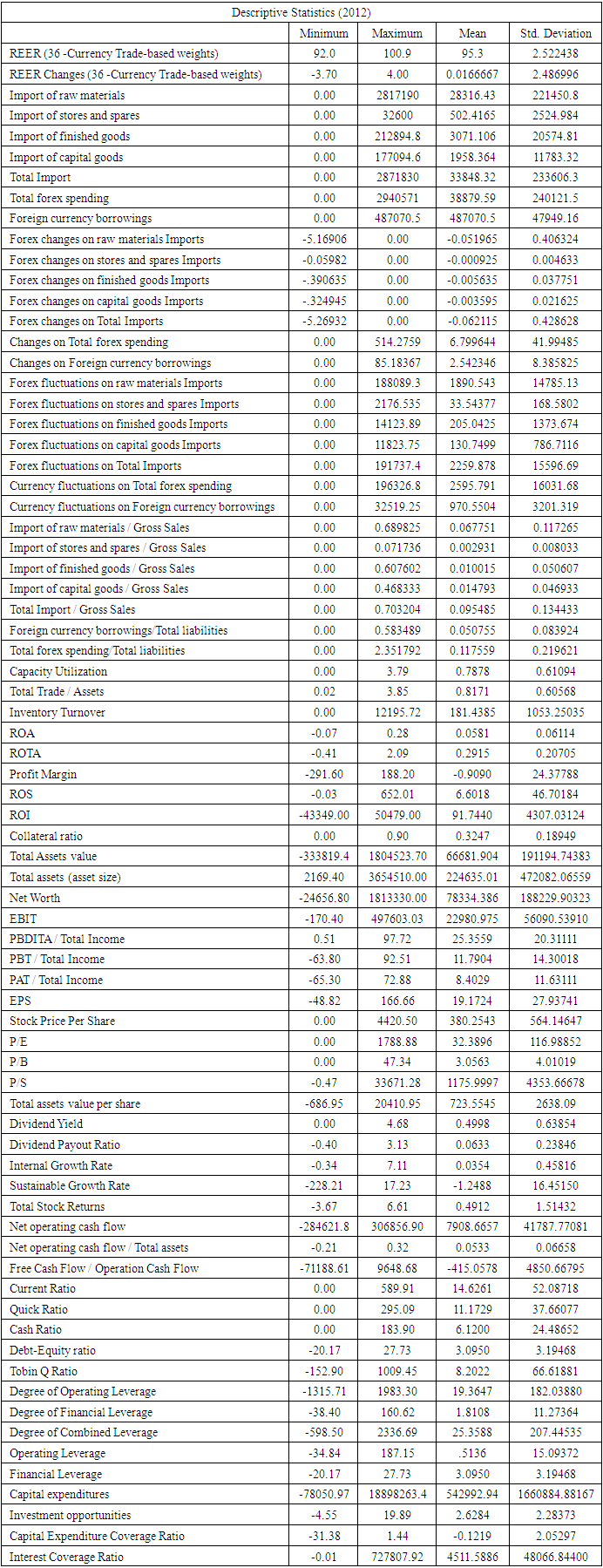

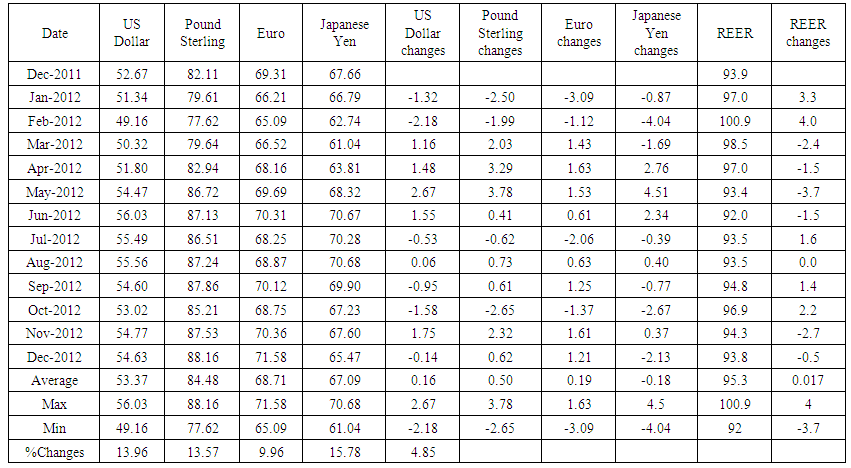

- Our primary source of data is the PROWESS database compiled by the Centre for Monitoring Indian Economy (CMIE). The primary database contains financial performance of over 27,400 companies. Out of these companies, we have included top 500 firms listed on the Bombay Stock Exchange (BSE) including variety industry group with different firm size and also including domestic firms, international firms and multinational firms. After collecting our index list, some firms did not have valid information or have some missing data, and we removed these firms from top 500 firms list. Finally, we chose 242 firms from the BSE 500 index over the period Dec. 2011-2012, in the aftermath of the 2008 crisis. Firms included under the BSE 500 index represent about 93 percent of the total market capitalization on the BSE and cover all the major industries in the Indian economy including construction, infrastructure, as well as non-traditional services such as software and ITeS. Since our focus is on 242 firms, we only include those in our sample. The database provides annual information on publicly traded non-financial firms (Both consolidated and standalone). In our investigation, we expected that exchange rate fluctuation can affect some of the multinational, international and domestic firms. Table 1 shows descriptive statistics of these 242 firms in 2011-2012.

|

3.1. Baseline Regression

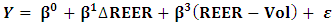

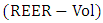

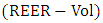

- The baseline specification for studying exchange rate effects is given by Equation 1:

| (1) |

represents firm performance index of firm i;

represents firm performance index of firm i; is the change in real effective exchange rate (36 -Currency Trade-based weights) with an increase indicating an Indian Rupee appreciation;

is the change in real effective exchange rate (36 -Currency Trade-based weights) with an increase indicating an Indian Rupee appreciation;  is the volatility of real effective exchange rate measured using standard deviation of monthly REER indexes of the year.

is the volatility of real effective exchange rate measured using standard deviation of monthly REER indexes of the year.  and

and  are used as coefficients of changes and volatilities of foreign currency of Indian firms. Equation (1), thus, we choose Import and Forex borrowing and Forex spending as exchange rate indexes that affected by exchange rate changes and exchange rate fluctuations.A crucial problem of firm-level studies is the classical omitted variable problem caused by unobserved firm characteristics. One solution to this is to control for as many firm-level variables as possible, but there is an obvious limitation imposed by the data set. ε is the regression error term.Both exchange rate movements and volatility have a statistically significant negative impact on import, foreign currency borrowing and forex spending indexes. To investigate the impact of exchange rate movements on firm performance further, nine hypotheses have been developed in the following sections. Tables 4-12 report multivariate analysis results relating firm performance indexes to changes (fluctuations) foreign currency accounts affected by exchange rate for the Indian companies. So we are expected that changes (fluctuations) exchange rate cause changes (fluctuations) imports, forex spending and foreign currency borrowings accounts. As a result, changes in firm performance indexes.

are used as coefficients of changes and volatilities of foreign currency of Indian firms. Equation (1), thus, we choose Import and Forex borrowing and Forex spending as exchange rate indexes that affected by exchange rate changes and exchange rate fluctuations.A crucial problem of firm-level studies is the classical omitted variable problem caused by unobserved firm characteristics. One solution to this is to control for as many firm-level variables as possible, but there is an obvious limitation imposed by the data set. ε is the regression error term.Both exchange rate movements and volatility have a statistically significant negative impact on import, foreign currency borrowing and forex spending indexes. To investigate the impact of exchange rate movements on firm performance further, nine hypotheses have been developed in the following sections. Tables 4-12 report multivariate analysis results relating firm performance indexes to changes (fluctuations) foreign currency accounts affected by exchange rate for the Indian companies. So we are expected that changes (fluctuations) exchange rate cause changes (fluctuations) imports, forex spending and foreign currency borrowings accounts. As a result, changes in firm performance indexes. 3.2. Variable Definitions

- The following sub-sections define the dependent and independent variables used in the empirical analyses in the present study. Our objective is to study impact of exchange rate on firm performance, hence we calculate 24 indexes that we expect are related with our title. We use real effective exchange rate (36 -Currency Trade-based weights) because Real Effective Exchange Rate is a concept that reflects the health of the economy and provides an excellent alternative for estimating the fair levels of a currency relative to a basket of major currencies in the world.

3.3. Independent Variable

- The discussion on exchange rate variables revolves around three aspects. 1) Use of nominal and real exchange rates, where the REER is adjusted by domestic and foreign inflation rates. When tested by Prasad and Rajan (1995), some differences in the results were observed, although they were described as negligible by the authors. Bartram and Bodnar (2007) also reported that nominal and real exchange rates are highly correlated. 2) The selection between bilateral exchange rates or the trade-weighted index. While a majority of studies have used the trade-weighted basket of currencies, the difference in results is not considerably noticeable (Bartram, 2004; Bekaert, 2011; Cheung, 2005; Elyasiani and Mansur, 2003; Elyasiani et al., 2007, Hawawini et al., 2003). However, the trade-weighted index may not represent the currencies that respective firms are exposed to and may introduce the effect of currency diversification for firms when exposure is examined. 3) Expectations regarding the value of currency may affect exposure. A currency will not be high-risk if a currency devaluation or currency appreciation is expected (Adler and Dumas, 1984; Crabb, 2002; Srinivasan and Wallack, 2003; Zhou et al., 2000). Forward premiums can be utilized as a proxy. Therefore, the firm’s value is exposed only to unexpected changes in the currency value. In this investigation, we use the real effective exchange rate as index is based on trade weights of India’s 36 main trading partners and is adopted from the Reserve Bank of India database.We choose three general foreign exchange currency indexes:1. Imports 2. Total Forex Spending and 3. Foreign Currency Borrowings, which affected by exchange rate changes and exchange rate fluctuations. As a result, we choose the following indexes as independent variables:1. Forex changes on raw materials Imports,2. Forex changes on stores and spares Imports, 3. Forex changes on finished goods Imports, 4. Forex changes on capital goods Imports, 5. Forex changes on Total Imports,6. Changes on Total forex spending, 7. Changes on Foreign currency borrowings, 8. Forex fluctuations on raw materials Imports, 9. Forex fluctuations on stores and spares Imports, 10. Forex fluctuations on finished goods Imports, 11. Forex fluctuations on capital goods Imports,12. Forex fluctuations on Total Imports, 13. Currency fluctuations on Total forex spending, 14. Currency fluctuations on foreign currency borrowings. These index directly related with exchange rate.

3.4. Dependent Variable

- As stated in Banz (1981) and Park et al. (2010), the common stock of small firms has, on average, more risk-adjusted returns than that of large firms. This phenomenon will henceforth be referred to as the size impact or small-firm impact. Firm performance may be driven by firm-specific factors, such as firm size. We use 1) industry type 2) capacity Utilization 3) total Assets as firm size indicator 4) total Assets value 5) net Worth 6) inventory Turnover as firm specific factors.We also use 24 indexes for covering the firm performance subject.A) Returns and Profitability performance: 1. Total Trade / Assets 2. ROA 3. ROTA 4. ROS 5. ROI 6. Profit Margin 7. EBIT;B) Stock performance: 1. Stock Price per Earnings 2. Stock Price per Book value 3. Stock Price per Sales 4. dividend Yield 5. Total Stock Returns;C) Related to Growth performance: 1. Capital expenditures 2. Internal Growth Rate 3. Sustainable Growth Rate;D) Cash Flow: 1. Net cash flow from operating activities 2. Net cash flow from operating activities / Total assets;E) Related to firm specifics: 1. Capacity Utilization.

3.5. Control Variables

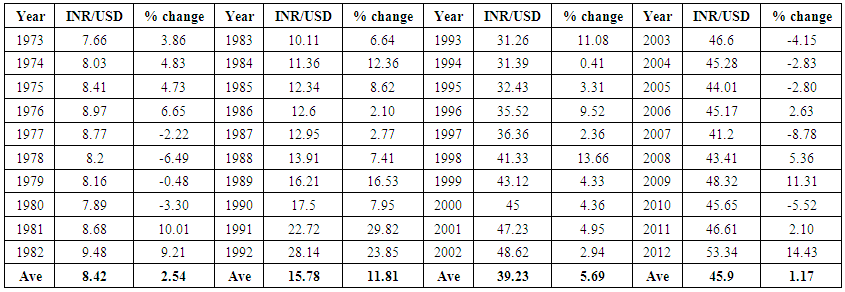

- In order to rule out the possible effects on firm performance from control variables. We follow the extent literatures to add a number of control variables. Below, we describe the various controls that we use in our multivariate tests and the theoretical reasons that led us to use them.A) Profitability: 1. PBDITA / Total Income 2. PBT / Total Income 3. PAT / Total Income;B) Leverages: 1. Degree of Operating Leverage 2. Degree of Financial Leverage 3. Degree of Combined Leverage 4. Operating Leverage 5. Financial Leverage;C) Financial ratios: 1. Current Ratio 2. Quick Ratio 3. Cash Ratio 4. Debt-Equity ratio;D) Stock specifics: 1. EPS 2. Stock Price per Share 3. Dividend Payout Ratio;E) Related to investment 1. Investment opportunities 2. Capital Expenditure Coverage Ratio 3. Interest Coverage Ratio 4. Free Cash Flow / Operation Cash Flow; F) Related to firm value: Tobin Q ratio;G) Foreign Currency ratios: 1. Import of raw materials / Gross Sales 2. Import of stores and spares / Gross Sales 3. Import of finished goods / Gross Sales 4. Import of capital goods / Gross Sales 5. Total Import / Gross Sales 6. Foreign currency borrowings/Total liabilities 7. Total forex spending/Total liabilities.H) Related to firm properties: 1. Total Assets 2. Total Assets value 3. Net Worth 4. Inventory 5. changes in Collateral ratio (Net Fixed Assets / Total Assets).Table 2 illustrates average of annual exchange rate of Indian Rupee against US Dollar for the period 1973 to 2012. It demonstrates Indian exchange rate has almost ceaselessly depreciated against US Dollar. Average of annual percentage of changes from 1990 - 2012 is 5.5635%. Another point 14.4389% changes in 2012 illustrates fluctuations of INR against USD is high. We choose this year for estimating impact of exchange rate on Indian firm performance. Another point after financial crisis (2008) changes and fluctuations of exchange rate were high. This illustrates Indian exchange rate is not stable yet.

| Table 2. Average of Annual Exchange Rate of Indian Rupee against US Dollar |

| Table 3. Present Some Descriptive Statistics of These Firm Level Data |

4. Research Results

- In this research, we tend to examine the impact of the exchange rate on firm performance through empirical observations including, 1. returns and profitability performance, 2. related to growth performance, 3. stock performance, 4. related to firm specifics, and 5. cash flow. To address these five areas, five below hypotheses are investigated using regression and ANOVA analyses in SPSS software version 23.0.

4.1. Hypothesis 1

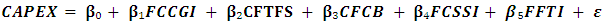

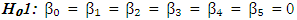

| (2) |

at least one of

at least one of  is nonzero.Where:CAPEX = Capital Expenditures is money spent with the intent of initiating future cash flow and a substantial ROI, we consider it as expenditure performance index;Forex Changes on Capital Goods Imports is Imports of capital goods account affected by changes of real effective exchange rate for firms' sample;Currency Fluctuations on Total Forex Spending is Total Forex Spending affected by fluctuations of real effective exchange rate for firms’ sample;Changes on Foreign Currency Borrowings is foreign currency borrowing account affected by changes of real effective exchange rate for firms’ sample;Forex Changes on Stores and Spares Imports is Imports of stores and spares account affected by changes of real effective exchange rate for firms’ sample;Forex Fluctuations on Total Imports is Total Imports account affected by fluctuations of real effective exchange rate for firms’ sample;

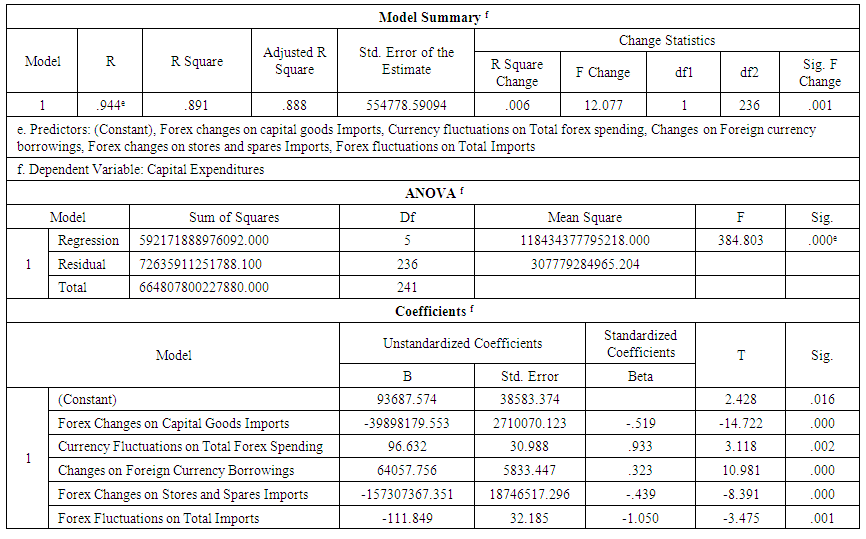

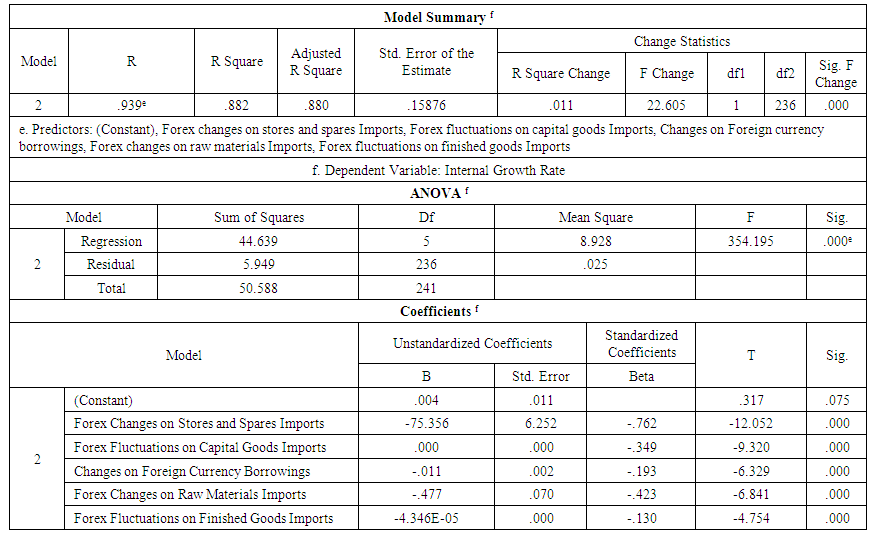

is nonzero.Where:CAPEX = Capital Expenditures is money spent with the intent of initiating future cash flow and a substantial ROI, we consider it as expenditure performance index;Forex Changes on Capital Goods Imports is Imports of capital goods account affected by changes of real effective exchange rate for firms' sample;Currency Fluctuations on Total Forex Spending is Total Forex Spending affected by fluctuations of real effective exchange rate for firms’ sample;Changes on Foreign Currency Borrowings is foreign currency borrowing account affected by changes of real effective exchange rate for firms’ sample;Forex Changes on Stores and Spares Imports is Imports of stores and spares account affected by changes of real effective exchange rate for firms’ sample;Forex Fluctuations on Total Imports is Total Imports account affected by fluctuations of real effective exchange rate for firms’ sample; = random-disturbance term.Table 4 reports results of estimating Equation 2 and includes multivariate regression model for the Indian companies has revealed that the Capital Expenditures are related to foreign currency accounts. Respectively, Table 4 presents a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that shows the regression and all coefficients are significant. For more detail about regression and ANOVA usage read authors’ prior works (Ahmadi, et al., 2014a; Ahmadi, et al., 2014b, Soleimani, et al., 2018).

= random-disturbance term.Table 4 reports results of estimating Equation 2 and includes multivariate regression model for the Indian companies has revealed that the Capital Expenditures are related to foreign currency accounts. Respectively, Table 4 presents a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that shows the regression and all coefficients are significant. For more detail about regression and ANOVA usage read authors’ prior works (Ahmadi, et al., 2014a; Ahmadi, et al., 2014b, Soleimani, et al., 2018). | Table 4. Multivariate Analysis for Equation 2 |

4.2. Hypothesis 2

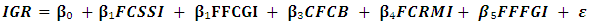

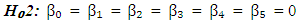

| (3) |

at least one of

at least one of  is nonzero.Where:IGR = Internal Growth Rate is The maximum amount of growth a company can sustain without needing to borrow money, make a new issue of stocks, or otherwise obtain a new source of financing. We consider it as internal growth performance index;Forex Changes on Stores and Spares Imports is Imports of stores and spares account affected by changes of real effective exchange rate for firms’ sample;Forex Fluctuations on Capital Goods Imports is Imports of capital goods account affected by fluctuations of real effective exchange rate for firms’ sample;Changes on Foreign Currency Borrowings is foreign currency borrowing account affected by changes of real effective exchange rate for firms’ sample;Forex Changes on Raw Materials Imports is Imports of raw materials account affected by changes of real effective exchange rate for firms’ sample;Forex Fluctuations on Finished Goods Imports is Imports of finished goods account affected by fluctuations of real effective exchange rate for firms’ sample;

is nonzero.Where:IGR = Internal Growth Rate is The maximum amount of growth a company can sustain without needing to borrow money, make a new issue of stocks, or otherwise obtain a new source of financing. We consider it as internal growth performance index;Forex Changes on Stores and Spares Imports is Imports of stores and spares account affected by changes of real effective exchange rate for firms’ sample;Forex Fluctuations on Capital Goods Imports is Imports of capital goods account affected by fluctuations of real effective exchange rate for firms’ sample;Changes on Foreign Currency Borrowings is foreign currency borrowing account affected by changes of real effective exchange rate for firms’ sample;Forex Changes on Raw Materials Imports is Imports of raw materials account affected by changes of real effective exchange rate for firms’ sample;Forex Fluctuations on Finished Goods Imports is Imports of finished goods account affected by fluctuations of real effective exchange rate for firms’ sample; = random-disturbance term. Table 5 reports the results of estimating Equation 3 and includes multivariate regression model for the Indian companies has revealed that the internal growth rate is related to foreign currency accounts. Respectively, Table 5 indicates a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant.

= random-disturbance term. Table 5 reports the results of estimating Equation 3 and includes multivariate regression model for the Indian companies has revealed that the internal growth rate is related to foreign currency accounts. Respectively, Table 5 indicates a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant. | Table 5. Multivariate Analysis for Equation 3 |

4.3. Hypothesis 3

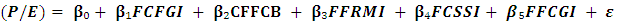

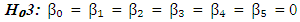

| (4) |

at least one of

at least one of  is nonzero.Where:

is nonzero.Where: =Stock Price / Earnings, we consider it as stock performance index;Forex Changes on Finished Goods Imports is Imports of finished goods account affected by changes of real effective exchange rate for firms’ sample;Currency Fluctuations on Foreign Currency Borrowings is foreign currency borrowing account affected by fluctuations of real effective exchange rate for firms` sample;Forex Fluctuations on Raw Materials Imports is Imports of raw materials account affected by fluctuations real effective exchange rate for firms’ sample;Forex Fluctuations on Stores and Spares Imports is Imports of stores and spares account affected by fluctuations of real effective exchange rate for firms’ sample;Forex Fluctuations on Capital Goods Imports is Imports of capital goods account affected by fluctuations of real effective exchange rate for firms’ sample;

=Stock Price / Earnings, we consider it as stock performance index;Forex Changes on Finished Goods Imports is Imports of finished goods account affected by changes of real effective exchange rate for firms’ sample;Currency Fluctuations on Foreign Currency Borrowings is foreign currency borrowing account affected by fluctuations of real effective exchange rate for firms` sample;Forex Fluctuations on Raw Materials Imports is Imports of raw materials account affected by fluctuations real effective exchange rate for firms’ sample;Forex Fluctuations on Stores and Spares Imports is Imports of stores and spares account affected by fluctuations of real effective exchange rate for firms’ sample;Forex Fluctuations on Capital Goods Imports is Imports of capital goods account affected by fluctuations of real effective exchange rate for firms’ sample; = random-disturbance termTable 6 reports the results of estimating Equation 4 and includes multivariate regression model for the Indian companies has revealed that the (P/E) is related to foreign currency accounts. Respectively, Table 6 shows a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant.

= random-disturbance termTable 6 reports the results of estimating Equation 4 and includes multivariate regression model for the Indian companies has revealed that the (P/E) is related to foreign currency accounts. Respectively, Table 6 shows a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant. | Table 6. Multivariate Analysis for Equation 4 |

4.4. Hypothesis 4

| (5) |

at least one of

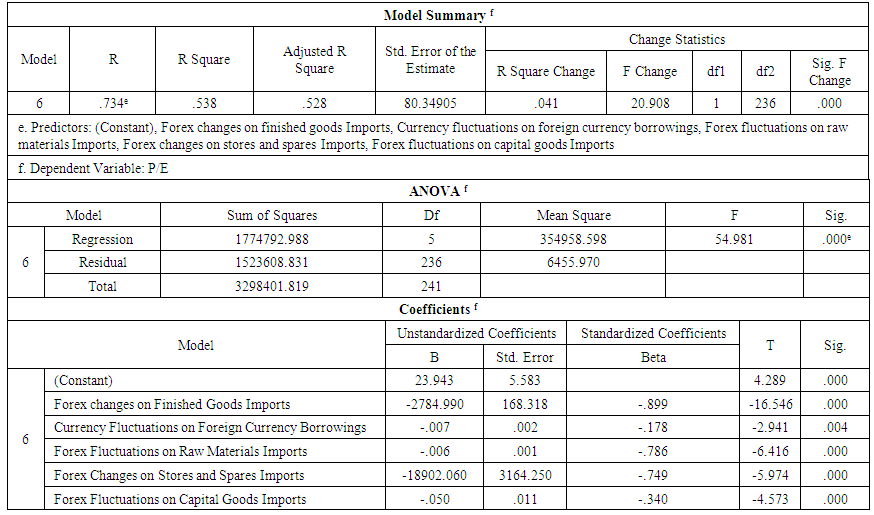

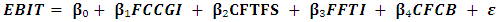

at least one of  is nonzero.Where:

is nonzero.Where: =Earnings before interest and tax, we consider it as profitability index;Forex Changes on Capital Goods Imports is Imports of capital goods account affected by changes of real effective exchange rate for firms’ sample;Currency Fluctuations on Total Forex Spending is total forex spending account affected by fluctuations of real effective exchange rate for firms’ sample;Forex Fluctuations on Total Imports is total imports account affected by fluctuations real effective exchange rate for firms’ sample;Changes on Foreign Currency Borrowings is foreign currency borrowings account affected by changes of real effective exchange rate for firms’ sample;

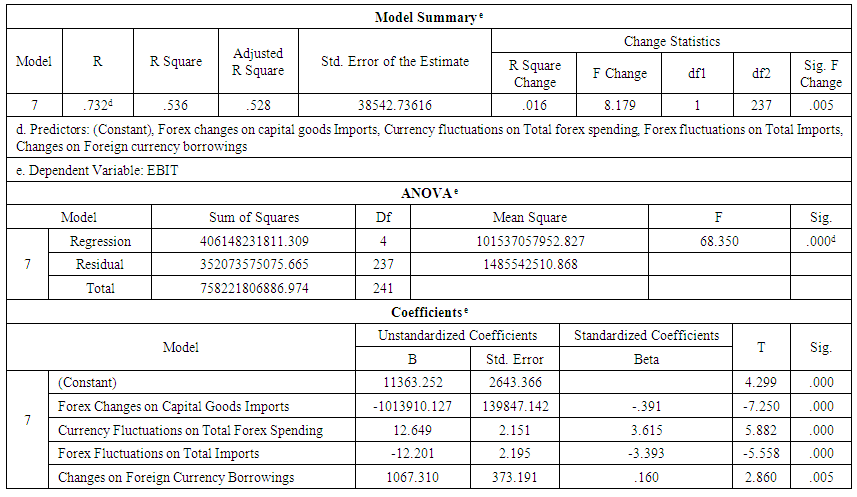

=Earnings before interest and tax, we consider it as profitability index;Forex Changes on Capital Goods Imports is Imports of capital goods account affected by changes of real effective exchange rate for firms’ sample;Currency Fluctuations on Total Forex Spending is total forex spending account affected by fluctuations of real effective exchange rate for firms’ sample;Forex Fluctuations on Total Imports is total imports account affected by fluctuations real effective exchange rate for firms’ sample;Changes on Foreign Currency Borrowings is foreign currency borrowings account affected by changes of real effective exchange rate for firms’ sample; = random-disturbance term.Table 7 reports the results of estimating Equation 5 and includes multivariate regression model for the Indian companies has revealed that the EBIT is related to foreign currency accounts. Respectively, Table 7 shows a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant.

= random-disturbance term.Table 7 reports the results of estimating Equation 5 and includes multivariate regression model for the Indian companies has revealed that the EBIT is related to foreign currency accounts. Respectively, Table 7 shows a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant. | Table 7. Multivariate Analysis for Equation 5 |

4.5. Hypothesis 5

| (6) |

at least one of

at least one of  is nonzero.Where:

is nonzero.Where: = Net Operating Cash Flow, we consider it as cash performance index;Forex changes on Stores and Spares Imports is Imports of stores and spares account affected by changes of real effective exchange rate for firms’ sample;Forex Changes on Capital Goods Imports is Imports of capital goods account affected by changes real effective exchange rate for firms’ sample;Currency Fluctuations on Total Forex Spending is total forex spending account affected by fluctuations of real effective exchange rate for firms’ sample;Forex Fluctuations on Total Imports is total imports account affected by fluctuations of real effective exchange rate for firms’ sample;

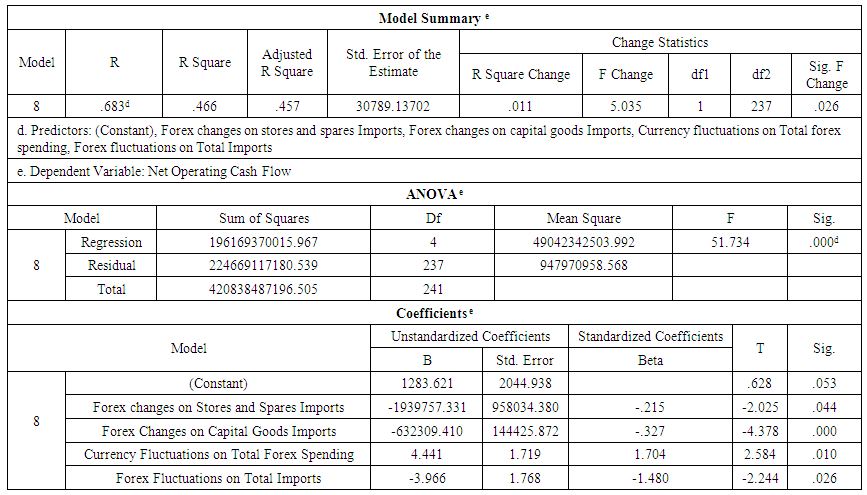

= Net Operating Cash Flow, we consider it as cash performance index;Forex changes on Stores and Spares Imports is Imports of stores and spares account affected by changes of real effective exchange rate for firms’ sample;Forex Changes on Capital Goods Imports is Imports of capital goods account affected by changes real effective exchange rate for firms’ sample;Currency Fluctuations on Total Forex Spending is total forex spending account affected by fluctuations of real effective exchange rate for firms’ sample;Forex Fluctuations on Total Imports is total imports account affected by fluctuations of real effective exchange rate for firms’ sample; = random-disturbance term.Table 8 reports the results of estimating Equation 6 and includes multivariate regression model for the Indian companies has revealed that the Net Operating Cash Flow is related to foreign currency accounts. Respectively, Table 8 shows a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant.

= random-disturbance term.Table 8 reports the results of estimating Equation 6 and includes multivariate regression model for the Indian companies has revealed that the Net Operating Cash Flow is related to foreign currency accounts. Respectively, Table 8 shows a model summary that shows R square is excellent and F change is significant., the ANOVA analyses that determines the regression and all coefficients are significant. | Table 8. Multivariate Analysis for Equation 6 |

5. Conclusions

- We observe that after the financial crisis (2008), fluctuations of Indian Rupee against US Dollar have increased (especially in 2012). Changes and fluctuation of exchange rates are important, and, therefore, we assess the impact of exchange rate on firm performance. Changes and fluctuations of the exchange rate will cause changes in the import and export patterns of a country and changes in the imports and exports of a country will cause changes in the economic conditions and firm’s performance in that country.We find that increasing changes (fluctuations) in exchange rates causes increased changes (fluctuations) of imports indexes results in reducing the net worth, total assets value and total assets of firms. Increasing changes (fluctuations) of the exchange rate causes increasing changes (fluctuations) of forex spending and foreign currency borrowings. As a result, this increases the net worth, total asset value and total assets.We find increasing changes (fluctuations) in exchange rates causes increasing changes (fluctuations) of imports indexes, forex spending, and foreign currency borrowings. This reduces (P/E) and internal growth rate.This implies that for firms with bigger (P/E) ratio, changes and fluctuations of exchange rates will have a lesser effect. Another point is that firms with higher internal growth rate, changes, and fluctuations in exchange rates will have a lesser effect.We find that increasing changes (fluctuations) in exchange rates causes increasing changes (fluctuations) of imports indexes. As a result, reducing the EBIT and capital expenditures. Increasing changes (fluctuations) of the exchange rate causes increasing changes (fluctuations) of forex spending and foreign currency borrowings. As a result, increasing EBIT and capital expenditures. This implies for firms with higher earning (EBIT) and higher capital expenditures, changes, and fluctuations in exchange rates will have a lesser effect.We also find that increasing changes (fluctuations) in exchange rates causes increasing changes (fluctuations) of imports indexes. As a result, reducing the Net Operating Cash Flow. Increasing changes (fluctuations) of exchange rate causes increasing changes (fluctuations) of forex spending and foreign currency borrowings. As a result, increasing Net Operating Cash Flow. Changes of stores and spares imports and changes of capital goods imports, are more effective than other indexes to firm’s performance indexes.We also find that a weak relationship between real effective exchange rate (REER) and Stock Price per Book value, Stock Price per Sales, Total Assets value / Shares outstanding, Degree of Operating Leverage.Finally, we don’t find any obvious relationship between real effective exchange rate (REER) and the following indexesA) Returns and Profitability performance: 1. Total Trade / Assets 2. ROA 3. ROTA 4. ROS 5. ROI 6. Profit Margin,B) Stock performance: 1. Dividend Yield 2. Total Stock Returns,C) Related to Growth performance: 1. Sustainable Growth Rate,D) Cash Flow: 1. Net cash flow from operating activities / Total assets,E) Related to firm specifics: 1. Capacity Utilization.

5.1. Limitations

- To enhance the reliability of this study, it would be beneficial to use time series data from sequence years in a specific time interval. Primary data was collected from top 500 firms listed on the Bombay Stock Exchange (BSE) and it might not the real representative the whole country (India).

5.2. Future Studies

- In future studies, increasing the sample size will improve the generalizability of our research’s results. We will analyze data from other major Indian stock exchanges such as National Stock Exchange of India (NSE). Additionally, we will categorize the study based on different criteria such as industry type, ownership structure, firm size to obtain more specific and valid results.

ACKNOWLEDGEMENTS

- We would like to express our very great appreciation to Dr. Madhumathi R Professor of Management Studies department at Indian institute of Technology Madras, for her valuable comments and constructive contributions to this research work.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML