-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(4): 83-96

doi:10.5923/j.ijfa.20180704.01

Impact of Inventory Management on Firm Performance: A Case Study of Listed Manufacturing Firms in Ghana

Suleman Bawa1, George Effah Asamoah2, Ernest Kissi3

1Student Graduate/CEO Bonkanzo Ltd, Leeds University Business School, University of Leeds, Leeds, United Kingdom

2Senior Accountant, Finance Office, Kwame Nkrumah University of Science and Technology, Kumasi, Ghana

3Lecturer, Department of Building Technology, College of Art and Built Environment, Kwame Nkrumah University of Science and Technology, Kumasi, Ghana

Correspondence to: Suleman Bawa, Student Graduate/CEO Bonkanzo Ltd, Leeds University Business School, University of Leeds, Leeds, United Kingdom.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Despite numerous research on inventory management on firm performance, and manufacturing firm’s contribution to the Ghanaian economy, its contextual impact still need much investigation because of lack of clarity and divergent findings. The study aims to investigate the impact of inventory management on firm performance of listed manufacturing firms in Ghana. The study used a cross sectional secondary data designed to test whether there is any relationship between inventory management and firm’s performance of listed manufacturing firms in Ghana. The sample of this study included 140 firm-year observations from 14 listed manufacturing firms in Ghana Stock Exchange (GSE) over a 10-year period, from 2007 to 2016. Measures of firm performance which were profitability and operating cash flows were examined. Regression equations stated in the form of return on assets and operating cash flow was used in analysing firm performance data. Pearson correlation and multiple regression analysis was also used as proxies in relatedness to effective inventory management. The empirical results provided evidence that the main variable, inventory management have no effect on firm’s performance and is insignificantly related to firm performance of manufacturing firms in Ghana.

Keywords: Ghana Stock Exchange, Firm performance, Manufacturing firms, Inventory management, Profitability, Operating cash flow

Cite this paper: Suleman Bawa, George Effah Asamoah, Ernest Kissi, Impact of Inventory Management on Firm Performance: A Case Study of Listed Manufacturing Firms in Ghana, International Journal of Finance and Accounting , Vol. 7 No. 4, 2018, pp. 83-96. doi: 10.5923/j.ijfa.20180704.01.

Article Outline

1. Introduction

- The concept of inventory management in previous years has attracted attention from people in academia and industries (Prempeh, 2015, 2016; Fosu, 2016; Mensah, 2016; Mwanzi 2016). For instance, “the turnover of inventory represents one of the primary sources of revenue generation and subsequent earnings for the company” (Prempeh, 2016). As more than half of the investments firms are into current assets and inventory constitute one of the most significant component, the quantity of inventory availability at the right time is vital (Carter, 2002; Prempeh 2016). Because of the economic value of inventory, capital productivity is enhanced if inventory levels are effectively managed as inventories are idle resources of firms (Prempeh, 2016). In an effort to fasten inventory management on firm performance, many decisions are being taken to provide a direction and strategy for competitiveness and productivity. Empirical studies have had diverse findings conducted globally on inventory management. For instance, Prempeh (2016) reported that there is a significant positive relationship between inventory management and profitability. Evidence from previous studies (Luwumba, 2013; Appiah, 2014; Mwangi, 2016; Bingilar, 2016) also supported the direct relationship between inventory management and profitability. In contrary, Hornbrinck (2013), Mensah (2015) and Sitienei and Memba (2015) studies showed a negative relationship. However, almost all these studies fail to acknowledge the fact that inventory management also have an effect on firms operating cash flows. In this study, we focused exclusively on the effects of inventory management on firm performance of Ghana’s manufacturing firms. The study argue that effective inventory management will lead to profitability and significant operating cash flow. This is because the management of inventory is regarded as all the processes that goes into keeping the required level of inventory at the right time, place and quantity and include the controlling, coordinating, assembling, purchasing and how inventory is utilised for productivity (Prempeh, 2016). Pandey (2005) maintains that these processes maximise the return on funds invested to get a positive return. This is because according to Peterson and Joyce (2007) in relation to Pandey (2005), the return on funds invested into a business must be able to maximise profit above investment made. Prempeh (2016) noted that return on investment is maximised by reducing inventory cost or current assets, and by optimizing profit margins of inventory. Thus, profit can only be maximised by minimising cost as much as possible whilst maintaining quality at all times since there is always high demand for sales price reduction (Prempeh, 2016). However, in other to minimise cost and funds invested, inventory management tend to move by reducing inventory hold (Drury, 2002). To increase profitability and operating cash flow leading to firm performance, Peterson and Joyce (2007) noted that the direct contribution of inventory management is made possible by the following: i) Less dependent on importation through producing inventory needed by a firm itself. ii) Establishing inventory control systems to minimise inventory cost and maximize profit margins.iii) Proper implementation of control procedures and planning on the utilization of inventory and fixed assets turnover ratio. The need to understand the costs measures associated with inventory management to maximize profit remains unabated to the manufacturing industry in Ghana (Prempeh, 2016). Previous studies in their quest to research into the impact of inventory management on firm performance and profit maximizing measures used models such as six sigma (Dick et al., 2001, 2002, and 2008).Ghana’s manufacturing industry was chosen for this study because there have been little knowledge and studies that seek to investigate the impact of inventory management on firm performance. Hence, most studies on inventory management have predominantly been done in other countries and very few is available in Ghana. As such, the few studies tend to concentrate on only one or few manufacturing companies (Prempeh, 2016; Fosu, 2016). Thus, the motivation of the study on the impact of inventory management on firm performance of listed manufacturing firms in Ghana. Following empirical studies most especially (Mensah, 2015; Nwangi, 2016; and Prempeh, 2016), the effects of inventory management on firm performance cannot be over looked. Now the dominant question that is not easy to answer is, “does inventory management have a positive or negative effect on firm performance in Ghana manufacturing firms”? Given the complexity nature of inventory management, competitiveness, margin of benefits, carrying and holding costs distress and investment opportunities that can lead to firm growth, inventory management is vital to the manufacturing industry.

2. Previous Studies

- Inventory refers to stockpiles of tangible products (raw materials, supplies, work-in-progress and finished goods) kept by a firm for running of the business for manufacturing products for trade or reuse (Tersine, 1988; Pandey, 1995; Pycraft, 2000; Chase et al., 2004; Lwiki et al., 2013 and Ballou, 2014). Raw materials are basic inputs/parts of a product yet to be converted through a manufacturing or transformational process (Pandy, 1995 and Kakuru, 2000). Pandey (1995) defined work-in-progress as semi-finished manufacturing products that are at various stages of completion in a production process. Finished goods are products that have passed the various stages of production and awaiting distribution (Kothari, 1992). Inventory are a vital part of the production process because they link products to marketing, consumption and customer demand (Pandey, 1995). In relation to the manufacturing industry, this study defines inventory as stock that a company keeps for manufacturing its products for usage and sale.An inventory system refers to a set of policies and controls that a firm put in place to monitor and determine inventory levels, volume of inventory and replenishment that should be maintained (Chase et al., 1995; Prempeh, 2016). Inventory management is the planning, coordinating, controlling and organization of all inventory levels of raw materials, work-in-progress and finished goods (Kotler, 2002). Jessop (1999) added, stating inventory management as the art and science of maintaining stock levels set by management. The major objective of inventory management is to inform managers of how much and when to re-order and the appropriate safety stock levels in minimizing stock outs (Keth et al., 1994; Kotler, 2002) and to keep the most economical human and materials resources (Morris, 1995). Inventory management is necessary because sufficient amount of inventory is needed to minimise the rate of stock outs in a firm. In setting inventory level, firms should consider the costs such as ordering costs, holding cost and stock-out costs as revealed by Drurry (2004). Ordering costs relates to costs incurred in placing and receiving an order for the supply of inventory. Ordering cost include; purchasing department personnel expense, communication and paper work, inspection, insurance and other related costs (Gourdin, 2001). Holding costs are costs incurred in carrying inventory for current and future demand. These costs include taxes, theft, interest on funds financing, insurance, handling, opportunity cost and obsolescence (Lwiki, 2013). These costs are positively related to changes in inventory level (Gourdin, 2001). Stock-out cost results when a firm is unable to meet current internal and external inventory demands. Firms could lose customers to competitors during stock out. However, this can be prevented or reduced with effective inventory management (Gourdin, 2001).

3. Theoretical Literature Review

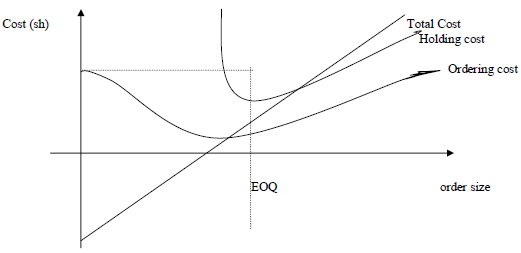

- Inventory and its management as defined above are related to various models as they form the basis of an effective mechanisms that guide managers to institute effective inventory management mechanisms leading to significant firm performances. When firms in Ghana manufacturing industry adopts and focus comprehensively on the following models of inventory management approaches, it will enhance cost minimization. This is because they form the basis of how inventory management can improve performance. Pareto (ABC) Model: As a model derived from Vilfredo Pareto principle of 1887, under the ABC system inventories are grouped according to priority as ‘A’, ‘B’, and ‘C’ with breaking points (Pandey, 1995; Bloomberg et al., 2002; Obiri-Yeboah et al., 2015; Drury, 2006). Items of highest value are given greater attention and classified “A”, items with highest control are classified “B” and items of relatively low value are classified “C” (Ravinder and Misra, 2014). Costly financed, demand and highly revenue generation items are careful monitored under class “A” over less economic and demand class “C” elements (Priyanka and Hemant, 2015). This is because, it will be unreasonable to give equal attention to inventory which increase costs and reduce profit (Pandey, 1995).Just in Time Model (JIT): This strategy is aimed at reducing associated inventory cost to improve financial performances (Shin et al., 2015). JIT is a system developed to eliminate non-valued-added activities (Drury, 2006) because it helps to produce items of high quality at required time, improvements to strategies and fixing immediate setbacks (Lucey, 1994; Obiri-Yeboah et al., 2015). Under this system, materials are ordered when required, hence, leading to waste reduction, value maximisation and lead to productivity (Kootanaee et al., 2013). Economic Order Quantity (EOQ): It is used to determine and control the optimal level of inventory. Haris (1913) principle stipulates that EOQ is the level that minimises holding and ordering cost (Adeyemi and Salami, 2010; Ziukov, 2015; Olufemi et al., 2016; Mwangi, 2016). EOQ is the level at which re-order is made (Arora and Ceccagnoli, 2006) and quantities that minimises ordering of holding and re-order costs balance (Monks, 1996; Lucey, 1992; Dervitsiotis, 1981; Scheroeder, 2000). This is because as ordering costs decline, holding costs rises and converge at a minimum point of ordering cost curve and carrying cost line thereby regulating inventory purchase and storage for even production flow (Lwiki et al., 2013; Olufemi et al., 2016; Kumar, 2016). EOQ is shown graphically in figure 2.1 below:

| Figure 2.1. EOQ Model (Source: Adapted from Lwiki et al., 2013) |

4. Empirical Literature Review

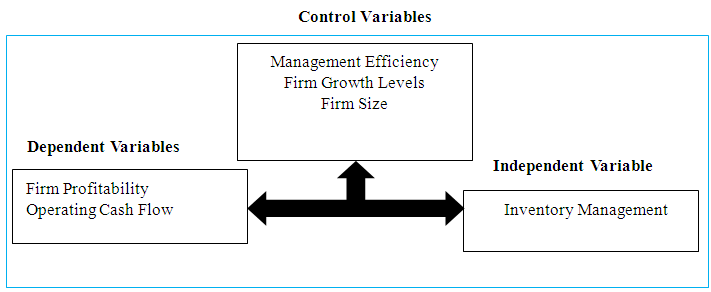

- Firm performances have received numerous attempt by scholars and researchers in the field of business but evidence-based literature on inventory management on firm performance in listed manufacturing firms in Ghana is rare. With diverse views of concentration of study and explanatory variables, this research is geared toward related literatures and their immediate effects and relevance. Prior reviews of literature on inventory management on firm performance (Prempeh, 2016; Akoto et al., 2013; Augustine and Agu, 2013; Radzuan et al., 2014; Lwiki et al., 2013; Munyao et al., 2015; Mwangi, 2016; Nwosu, 2014; Mwangi and Nyambura, 2015; Eckert, 2007; Etale and Bingilar, 2016; Naliaka and Namusonge, 2015; Fosu, 2016) revealed that efficient inventory management needs critical attention to attain success. Firstly, there is conflicting literature in Ghana’s manufacturing firms as to whether inventory management have an effect on firm performance (Prempeh, 2016; Fosu, 2016). Prempeh (2016), for instance, findings revealed a positive relationship which conflict with the findings of Fosu (2016) whose study revealed a negative relationship. In their studies, Prempeh (2016) used four listed manufacturing companies in Ghana Stock Exchange whiles Fosu (2016) used one Brewery company, Guinness Brewery Ltd. However, this study used fourteen listed manufacturing firms in Ghana Stock exchange. Secondly, it is not clear whether management efficiency (profitability), cash flow, firm size and growth levels determines firm performance (Mwangi and Nyambura, 2015, 2016; Fosu, 2016 and Prempeh, 2016). For instance, Prempeh (2016) used profitability to determine firm performance whilst Mwangi and Nyambura (2015, 2016) used the variables management efficiency profitability, cash flow, firm size and growth levels respectively and arrived at a similar finding of a significant positive relationship to firm performance. However, Fosu (2016) findings using only profitability revealed a negative relationship. To date, the magnitude of the significance relationship between inventory management and firm performance of manufacturing firms is unknown as they vary across studies especially in Ghana. For instance, studies reported low, moderate, high (r >.1, Ogbo and Ukpere, 2014; r >.4, Prempeh, 2016) and no relationship (r <.1, Fosu, 2016; r >.3, Akoto et al., 2013). The main reason for difference reported effects can loosely be attributed to population of study and variables used. This is because the larger the population the higher the standard deviation and the probability of giving a fairer representation of the study sample. As such, there are many variables that contribute to enhance firm performance. For instance, whiles some studies may use only profitability or operating cash flow to justify firm performance, other studies may consider not only both but other factors inclusively as well. Hence the direction of relationship has greatly been disagreed upon by researchers as seen from above. The current study sought to find evidence and to investigate whether there is a relationship between inventory management and firm performance of manufacturing firms in Ghana. Accordingly (Mwangi and Nyambura, 2015, 2016), profitability and operating cash flow of a firm helps evaluate inventory management and its effects on firm performance. Mwangi (2016) investigation used these two variables as well.This study therefore addresses the literature by: first determining the overall magnitude effects of inventory management on firm performance (profitability and operating cash flow) and second by testing the corresponding relationships and significance levels and last by identifying conditions that hinders effective inventory management on firm performance. Little attempts were made to capture the effects of inventory management on firm performance and manager’s perceptions. Eneje et al. (2012), Agus and Noor (2006) and Mwangi (2016) did measure manager’s perceptions on the effects of inventory management on firm performance. Mwangi (2016) and Prempeh (2016) also studied the effects of inventory management on firm performance. However, circumstances in Kenya and Nigeria may differ from those in Ghana. This study seeks to evaluate the impact of inventory management on firm performance of listed manufacturing firms in Ghana. Hence the study postulates that: H1: Inventory management have significant effects on firm performance of listed manufacturing firms in Ghana.H2: Inventory management have significant effects on profitability of listed manufacturing firms in Ghana.H3: Inventory management have significant effects on operating cash flow of listed manufacturing firms in Ghana.The current study therefore fills an evident gap in bridging inventory management of the modern and contemporary manufacturing firms in Ghana and how it contributes to firm performance and the Ghanaian economy in gross domestic product. The review of the framework shows how the study variables relate. Figure 2.2 below shows the conceptual framework.

| Figure 2.2. Conceptual Framework (Source: Adapted from Mwangi (2016)) |

5. Methodology

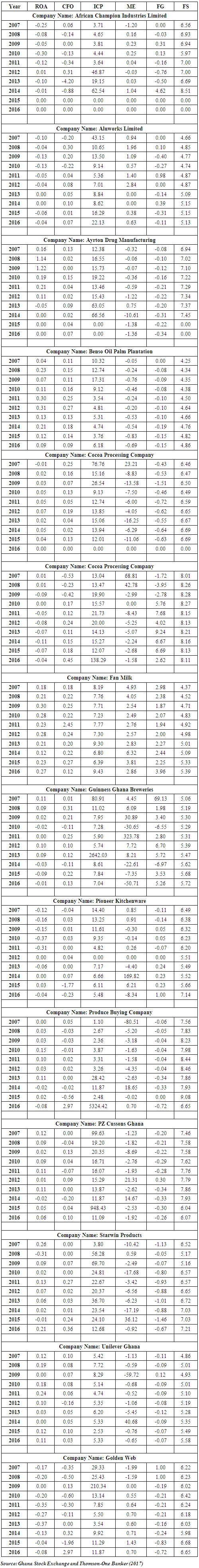

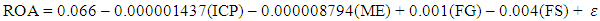

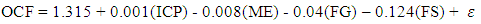

- In order to investigate the impact of inventory management on firm performance of listed manufacturing firms in Ghana, the study employed a descriptive research design. The study chose a descriptive research design because it is an operative tool for presentation of cause-effect arithmetical techniques such as regression and correlation enquiry and involved a great amount of numerical data (Huynh, 2011; Muturi et al., 2015). According to Amedahe (2002), this allows for accurate description of activities, objects and processes. Hence the motivation of the current study to use descriptive research in this study. This was because the study intended to investigate, compare and describe how variables such as management efficiency, firm growth and firm size affects inventory management on one hand and how inventory conversion period, return on assets and operation cash flow affects firm performance on the other hand. There is the need for every study to be alerted to the use of “multiple sources of evidence in that all evidence is of use to the researchers’ investigation, hence nothing is turned away” (Gillham, 2000, Bai and Zhong, 2008). Multiple sources of evidence are considered compelling and robust, time consuming, requires extensive resources and very tedious (Yin, 2003). Hence, the study used secondary data in the form of scholarly journals, annual financial statements of the sampled listed firms, internet and other publications relating to inventory management (International Journal of Finance and Accounting, 2016). Accounting data were collected using a data collection sheet from Thomson One Banker Database and the data examined to ensure quality standard, to rectify errors and omissions (if any identified) and to convert all data to a single currency, the Ghana cedi. Thus, some company’s financial statements were quoted in dollars and the study converted them to the prevailing interbank rate of $ 1.00 to the 4.5 Ghana cedis. To improve efficiency of the data analysis, the data was summarised and analysed to obtain the relationship using statistical package for social science and regression equations and output tabulated so that they are amendable. The empirical study consists of a cross-sectional study of fourteen (14) listed manufacturing firms in Ghana Stock Exchange. Hence the study conducted a cross-sectional 10-year study covering 2007-2016. A 10-year period was also used by majority of researchers such as Prempeh (2015, 2016), Fosu (2016), Mensah (2015), Mwangi (2016) to ensure an accurate description of the relationship between the dependent and independent variables and so give a fair analysis of their collinearity. Using a period of 2007 to 2016, data of audited annual financial statements of listed manufacturing firms in Ghana Stock Exchange, the study attempted to explore the key investigation problem: “Does inventory management have effects on firm performance?” The relevance of inventory management and its impact on firm performance need much to be studied, hence investigation. This was to enable the study to understand the phenomenon of the impact of inventory management on firm performance of listed manufacturing firms in Ghana at a particular time in other to give a fair representation of the sample. Hence, the study used multiple sources of evidence such as journals, Thomson One Banker, Ghana Stock Exchange, listed companies’ website, for the purpose of understanding the research context and understand constraining issues on the scope of the study. Resulting from extant empirical investigation (Mwanzi 2016; Prempeh, 2016 and Fosu, 2016), study used regression equations with the aid of statistical package for social sciences to analyse collated data. A two-stage technique (Pearson correlation and multiple regression analysis) were used to analyse the collated data (Prempeh, 2016; Fosu, 2016; Mwangi, 2016). The Pearson correlation was used to test the linear relation between inventory management variables and firm performance variables (profitability and operating cash flows). The study constructed two dependent variables; profitability and operating cash flows as a performance measure of selected firms and calculated using return on assets and cash flows from operation respectively.In other to test and address H1, H2 and H3, the study used inventory conversion period as a proxy to measure inventory management. An overview of all variables used for the analysis are presented to ensure consistency with empirical studies on inventory management. The study measure firm performance using profitability and operating cash flow. Hence, the study compute profitability using return on assets, and compute operating cash flow using the ratio of operating cash flow to sales. For the purpose of analysis, return on assets variable was measured as a ratio of net income to total assets whilst operating cash flow measures the cash flow from operations. The study again control for the published audited financial statements by aligning or converting them to a single unified currency.

6. Data Analysis and Discussion

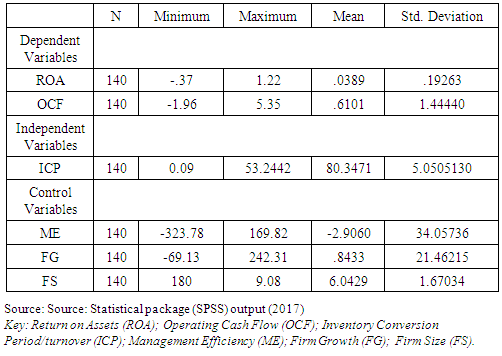

- In determining the impact of inventory management on firm performance, inventory conversion periods were used as the independent variable, profitability and operating cash flow form the dependent variables, while management efficiency, firm size and growth levels of firms formed the control variables. A ten-year period of listed manufacturing firm in Ghana was carried out and data was obtained from all the firms. Table 4.1 shows the key summary descriptive statistics of inventory management characteristics and measures of firm performance variables employed in this analysis.

|

|

|

|

|

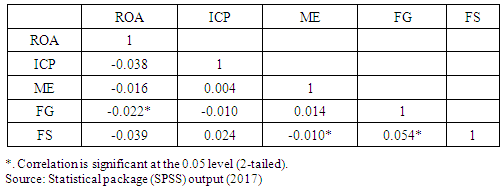

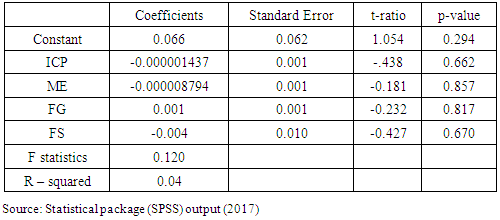

The results showed that there is a negative insignificant relationship between profitability and inventory conversion period, management efficiency and firm size. Profitability is positively related to firm growth of manufacturing firms. The R-squared value is 0.04, an indication that 4% of variation in return on assets is explained by the independent variables; inventory conversion period, management efficiency, firm growth and firm size. The calculated F statistics value of 0.120 shows that P-value 0.0178 < 0.05 and is insignificant at 5% level. Hence, the findings are observed to be conflicting to the second hypothesis and the study conclude that there is a negative insignificance relationship between inventory management and profitability of manufacturing firms in Ghana. Furthermore, Table 4.6 shows the results for the ordinary least squares using operating cash flow as a dependent variable.

The results showed that there is a negative insignificant relationship between profitability and inventory conversion period, management efficiency and firm size. Profitability is positively related to firm growth of manufacturing firms. The R-squared value is 0.04, an indication that 4% of variation in return on assets is explained by the independent variables; inventory conversion period, management efficiency, firm growth and firm size. The calculated F statistics value of 0.120 shows that P-value 0.0178 < 0.05 and is insignificant at 5% level. Hence, the findings are observed to be conflicting to the second hypothesis and the study conclude that there is a negative insignificance relationship between inventory management and profitability of manufacturing firms in Ghana. Furthermore, Table 4.6 shows the results for the ordinary least squares using operating cash flow as a dependent variable.

|

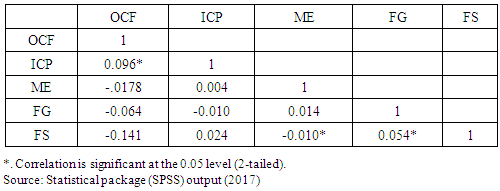

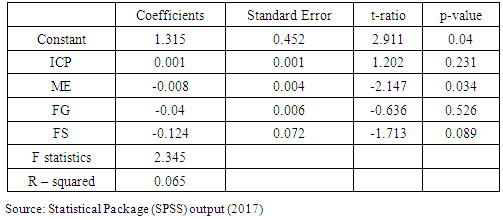

The results show that operating cash flow of manufacturing firms in Ghana have a relationship with inventory conversion period of manufacturing firms in Ghana. In addition, the results show a negative relationship between operating cash flow and management efficiency, firm growth and firm size. The resultant R-square value of 0.065 indicates that 6.5% of operating cash flow is explained by independent variables; inventory conversion period, management efficiency, firm growth and firm size. The calculated F statistics value of 2.345 shows an insignificance of P-value 0.006 < 0.05 at 5% level. Hence, the finding is also divergent from the third hypothesis and the study conclude that there is a negative relationship between inventory management and operating cash flow of manufacturing firms in Ghana.

The results show that operating cash flow of manufacturing firms in Ghana have a relationship with inventory conversion period of manufacturing firms in Ghana. In addition, the results show a negative relationship between operating cash flow and management efficiency, firm growth and firm size. The resultant R-square value of 0.065 indicates that 6.5% of operating cash flow is explained by independent variables; inventory conversion period, management efficiency, firm growth and firm size. The calculated F statistics value of 2.345 shows an insignificance of P-value 0.006 < 0.05 at 5% level. Hence, the finding is also divergent from the third hypothesis and the study conclude that there is a negative relationship between inventory management and operating cash flow of manufacturing firms in Ghana.7. Interpretation of Findings

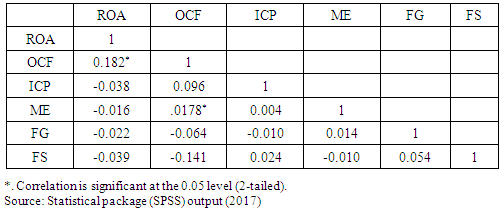

- From the study, it is observed that a change in inventory period, management efficiency and firm size have a negative influence on the profitability (Mwanzi, 2016) of manufacturing firms in Ghana. An indication that firm profitability is negatively influenced by inventory period, size of firm and inefficient management of inventory. The study results confirm that of Mwanzi (2016) and Sitienei and Memba (2015) whose findings also confirm same and that firm’s profitability is negatively related to inventory turnover and the conversion period of inventory (Mwanzi, 2016). As such, the study observed that the growth levels of firms are positively related to profitability, an implication that the level of firm growth (high and low) is directly related to profitability. This confirms the findings of Mwanzi (2016) as revealed by Farah and Nina (2016) that firm growth levels impact on profitability and is positively significant. Again, from the study, it was found that the operating cash flow of manufacturing firms in Ghana is related to inventory conversion period. This implies that the inventory period of firms negatively affects operating cash flow of manufacturing in Ghana. The study also observed that management efficiency, growth levels and firm size negatively influence operating cash flow (Mwanzi, 2016), an implication that poor management, firm growth levels and size adversely affects manufacturing firms in Ghana. This is because “a firm’s valuation is determined solely by its investment portfolio and not by the manner of its financing arrangements” (Miller and Modigliani, 1961, p.2) and efficient inventory management lead to effective use of firm’s resources (Predescu, 2008). The study found that with the exception of inventory conversion period, all other variables; management efficiency, growth and size of firm’s have a negative influence on operating cash flow. Overall, the impact of the independent variable on the dependent variable is been given by the t-ratio and p-values. The study observed that the return on assets t-ratio < 1 and the p-value > 0.05 whiles the operating cash flow t-ratio > 1 and p-value < 0.05. This implies that for the return on assets, inventory management have no impact on the dependent variable whereas for the operating cash flow, the independent variable has significant impact on the dependent variable. The study therefore observed that there is no significant impact of inventory management on firm performance of manufacturing firm in Ghana. The evidence by ROA, t = -0.438 < t*0.662 is supported by OCF t = 1.202 > t*0.231. Given this, we reject the alternative hypothesis and accept strongly the null hypothesis that inventory management does not have a significant effect on firm performance of manufacturing firms in Ghana. Also, from the descriptive statistics, the findings revealed that the average return on assets for manufacturing firms was 0.0389 and average operating cash flow was 0.6101 with average inventory conversion period of 80 days. Management efficiency was -2.9060, rate of firm growth was 84.33% with firm size of 6.0429. Furthermore, the Pearson correlation found a negative relationship “between profitability measured using return on assets” (Mwanzi, 2016, p.28) and operating cash flow and inventory conversion period, and a negative correlation between profitability and management efficiency, firm growth and firm size.Not only that, single return on assets model, the regression model found a negative insignificant relationship between profitability and inventory conversion period, management efficiency and firm size and that there is a relationship between profitability and firm growth. The study also observed that the dependent variables (profitability and operating cash flow) have an influence of 4% on the independent variable (inventory conversion period) and the control variables (management efficiency, firm growth and firm size). This the study established that there is an insignificant negative relationship between inventory management and profitability of manufacturing firms in Ghana. As such, using operating cash flow model, it was established that there is no relationship between operating cash flow and inventory conversion period of manufacturing firms in Ghana. The findings also showed that there is a negative relationship between operating cash flow and management efficiency, firm growth and firm size. The findings established that the dependent variable (profitability and operating cash flow) have an influence of 2.345% on the independent variable (inventory conversion period) and the control variables (management efficiency, firm growth and firm size). The study further established that there is a significant relationship between inventory management and operating cash flow of manufacturing firms in Ghana. From the findings of the study, we observed that inventory management have an insignificant negative impact on firm performance of manufacturing firms in Ghana.

8. Conclusions

- This research studied the impact of inventory management on firm performance of listed manufacturing firms in Ghana. A cross sectional audited accounts of fourteen listed manufacturing firms in Ghana Stock Exchange during 2007 to 2016 formed the basis for the data used for the analysis. The analysed research study revealed that firm’s performance is negatively insignificant to inventory management, but that efficient management leads to profitability of manufacturing firms in Ghana. Thus, incomprehensible to the expectancy of the study. Our findings deviate from the results of Prempeh (2016), Mwanzi (2016), Eneje et al., (2012) and Farah and Nina (2016) but confirm to that of Fosu (2016) that inventory management have no significant impact on firm’s performance. The results of this study stipulate that inventory management and conversion period of inventory is a significant variable that have a positive relationship on the performance of manufacturing firms in Ghana.

9. Recommendations

- Adequate inventory management enhances firm performances as its settles the bottlenecks in production of manufacturing firms in Ghana. To achieve this, firms must encompass as a procedure to train and re-train its staff to keep them updated on inventory management practises of contemporary times and technological advancement. The study also recommends that practices such as just-in-time, optimal inventory holding, and material requirement planning should be adopted for an effective inventory management. This is because they will help minimise cost and improve firm performances. The study further recommended that inventory managers of manufacturing firms in Ghana should focus on improving firm size and growth levels. As growth is negatively related to firm performance variables such as profitability and operating cash flow, this will enable firms to stand the test of time and be able to withstand mitigating circumstances that may impair growth and associated economies of scale.The study recommends that a further study can be done on the impact of inventory management on firm performance using other variables such as gross profit margin instead of profitability and operating cash flow.

10. Limitations

- However, this study was subjected to some limitations. As the study sort to evaluate the effect of inventory management on firm performance of listed manufacturing firms in Ghana, paramount among them is the retrieval of financial data. Not all the manufacturing firms listed in Ghana Stock Exchange have complete audited financial information from 2007-2016 and the study observed that some firms present their financial statements in dollars whilst others in Ghana cedi, hence making data difficult to convert to a common currency, the Ghana cedi. Again, the findings from the study may represent a partial opinion and disparities as the study relates to financial data variables and relied on secondary data sources such as journals, text books, lecture materials and audited annual financial data from Ghana Stock Exchange and Thomson-One Banker. The findings from the study may not also reflect that of other countries as is solely based in Ghana. Hence, the findings may not fully reflect the performance of manufacturing firms in Ghana.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML