Method S. Simbachawene

School of Economics and Finance, Xian Jiaotong University, Xian, China

Correspondence to: Method S. Simbachawene , School of Economics and Finance, Xian Jiaotong University, Xian, China.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

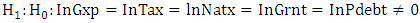

Understanding the relationship between government spending, tax revenue and financing sources is a fundamental prerequisite, which helps to comprehend the performance of country fiscal policies and avoid spending shock. This study aimed to estimate the co-integration relationship between spending, tax revenue, non-tax revenue, grants and public debts using Autoregressive Distributed Lags (ARDL) bound test and Impulse Response Function (IRF). The ARDL test use quarterly data from Q1 in 2000 to Q2 in 2017, the results revealed the existence of a long-run association between all fiscal variables included in the model, while the short-run revealed existence of a co-integration relationship between spending, tax revenue and non-tax. The error correlation term is -0.8733, which implies the system return at the speed of 87.33% toward equilibrium when spending shock occurs. The IRF results indicate, the impulse response of tax revenue to spending has slight both positive and negative effects which persist from a quarter (Q) 2 to quarter (Q) 6 and keep fluctuating at decreasing rate up to 12Q when it has very slight effects. Both methodologies provide fiscal adjustment mechanism and confirm tax revenue drive spending, which aligned with the tax-spend hypothesis. Emphasized more on internal resource mobilisation, stabilisation of fiscal policies, strengthening overall tax revenue systems as well as stimulating economic growth.

Keywords:

ARDL bound test, Impulse response function, Government spending, Public debt, Tax revenue, Grants

Cite this paper: Method S. Simbachawene , Taxes, Financing and Spending Synchronization in Tanzania: ARDL Bound Test and Impulse Response Function, International Journal of Finance and Accounting , Vol. 7 No. 3, 2018, pp. 67-75. doi: 10.5923/j.ijfa.20180703.02.

1. Introduction

Currently, Tanzanian economy has grown at an average of 6% to 7% and become among the fastest growing economies in sub-Saharan Africa. The achieved economic growth is a result of several economic reforms and effectiveness of current regime, which cut back unnecessary spending, stimulate resource mobilisation, increase control measures in tax revenue and maintain country macroeconomic stability. Tanzania highly depends on tax revenue; however, non-tax sources, public debts and grant are alternative options of government financing. Well-designed fiscal policies are among the critical factor, which determines the ability of the government to finance its budget; Tanzania experienced some regular fiscal reforms especially on tax revenue policies, which intended to improve tax system that aligned with government expenditure level that stimulates and boost economic growth. Some of the fiscal policies reforms include raising public revenue, increase equity on the tax system, reduce the tax burden, incentives to producers and investors, widening the tax base, simplifying tax structure, and administration. [7], [14], [20], [21], and [24], reforms simultaneously aligned with introduction and reviews of various tax laws and regulations within the country. The government spending should explode with government revenue to avoid an excess budget deficit [19] and mostly when government budget exceeds the tax revenue, borrowing is one of the standard options to offset the budget deficit. Nevertheless, debts associated with an interest that increase burden to the government, and a higher level of public debt tends to affect social expenditure and limit resources investment and other development projects [5], [8] and [13].The first objective of this paper is to establish existence of long run and the short run association between tax revenue, non-tax revenue, grants and public debts in respect to government expenditure, Secondly, provide an opportunity to understanding the extent of fiscal financing response when spending shock occurred, and finally, the empirical results contribute to literature review. This paper arranged into seven sections, introduction in section one, brief literature reviews presented in section two, followed by the methodology of the study in section three, empirical analysis and results in section four, discussion regarding results in section five, and finally provide the conclusion of a study.

2. Brief Literature Review

The earlier research regarding the economic consequence of financing government budget deficit using debts and whether a government should collect tax revenue and spend or government should spend and collect tax revenue were conducted during 1970’s. [9] argued that, when the government decide to increase taxes, it would also tend to increase the government spending, however [2] suggests government revenue and government expenditure should occur simultaneously for fiscal balance purpose. Several countries are struggling to maintain fiscal sustainability although countries vary on the fiscal adjustment method due to various factors including specific country economic dependence and elasticity of short and long-term in economic variables. Understand elasticity of tax revenue play a significant role in stabilising fiscal spending because a large amount of government expenditure usually financed by taxes, hence it increases precision on predicting the extent of spending expansionary and help during the adjustment of fiscal variables to avoid excess budget imbalances. Studies regarding the relationship between government expenditure and another source of income vary across the countries. [16], study the relationship between taxation and government expenditure in Turkey from 1981 to 2004 using bounds test approach, results indicated that in short-run and long-run, government spending has a positive impact on taxation and a country finance expansion of public spending through new taxes. Results also revealed a unit percent change in government spending tend to caused changes of 0.79% in short run and 0.84% in the long run while the ECM adjusted at the speed of 0.94% to the equilibrium in the next quarter. An additional [25] conduct study which focused on investigating “the what causes what” between government spending and taxation. Results suggest existed higher government spending predicted to increase tax in future, little evidence on consistent of economic instability leads to growth in government spending or revenues and found weak evidence on inflation causes growth in real government expenditures.Fiscal expansion policies using debt-financing option proposed by Keynesian have used to stimulate and promote economic growth of various countries, but highly dependent on public debt financing may affect economic growth. Suggested to emphasise more on fiscal management policies and give more attention because non-monitoring on fiscal response such as tax revenue, government spending, cost of debts services in relation to the public debts may lead to the inaccurate prediction of dynamic effects of fiscal shocks in the country [3]. Financing public expenditure with a significant portion of loan implicate public debts to reach a threshold level which affects public investment because public debts reduce spending capacity and productive investment such development projects tends to receive low debt share [11]. Public debt generally associated with additional cost, in which government required to repay with the principal amount, it was suggested government shall borrow where it is necessary because public debts tend to take away resources as well as reducing the amount of funding social spending pending such as health and education [13]. Increase public debt as the option of responding to fiscal shock on government spending increase risk to the government; public debts tend to increase more burden on the government and affect the economy in term of debt services, unemployment and inflation [25]. Public debts as a quick option of clearing gaps in budget imbalances, but debts are associated with the additional conditions to the government. High dependence on public loan claimed to affect other economic variables. The analysis that examined the influence of public debt with other economic performance in eleven EMU countries from 1960 to 2013 using ARDL bound test, results suggest public debt negatively influence economic output in the long run and at the short run, it revealed positive effects but depends on the countries characteristics and efficient of final allocation public debt. [10]Furthermore, Base on error correction model, [23] investigate causality effect between taxes and spending using quarterly data, results revealed bidirectional causality between taxes and spending at all level of government and support intuitive of fiscal spending decision through considering tax revenue. [19] investigate the cointegration and causality between government revenue and expenditure in nine Asian countries and found mixed results on a short run and long run, however, three countries out nine were cointegrated. [4], found causality runs from government spending to revenues and supports the spend tax hypothesis. In BRICS countries, the increase in tax tends to reduce production output and the tax rules, and spending rules indicate non-linearity [6].

3. The Methodology of the Study

3.1. Area of Study

This empirical study focused on central government using government expenditure and total revenue sources. Total expenditure includes development and recurrent expenditure while revenue sources include tax revenue, grants, public debt and other non-tax revenue. The study analyses the response effects on government revenue sources with respect to changes in government spending using time series data from quarter 1 in 2000 to quarter 2 in 2017. The expenditure and revenue sources data obtained from central Bank of Tanzania published with other economic statistics and reports in different time.

3.2. Data Analysis

Data were prepared using excel spreadsheet and analysed using Eview 9 software, Unit root test which measures the existence of stationary on variables was checked using Augmented Dick Fuller (ADF) Test. The Autoregressive Distributed Lags technique use criteria for Alkane Information Criterion (AIC) and Schwarz Information Criterion (SIC) to determine the optimal lag model that gives the lowest value of SIC and AIC. We checked the stability of the model using serial correlation LM test and CUSUM (Cumulative Sum Control Chart) test. The Long run and short run association between variables analysed using ARDL bound test with an optimal lag model base on AIC and SIC criteria and results compared with Pesaran upper bound critical value, and the impulse response function use data of the optimal lag model.

3.3. Mode Specification

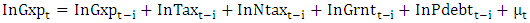

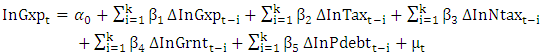

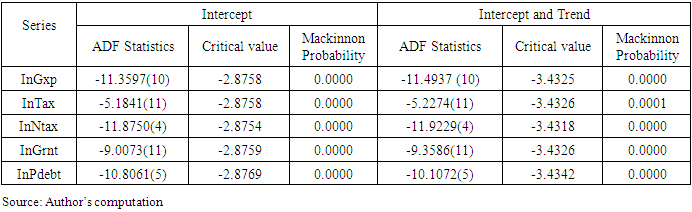

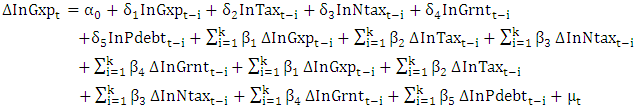

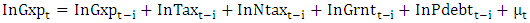

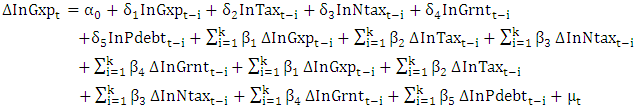

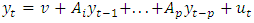

The autoregressive distributed optimal lags (ARDL) introduced by Pesaran et al. (2001) used to estimate the response effects of fiscal revenue sources in respect to government expenditure. The independent distributed lags variables used to predict the dependent distributed lags using the following mode estimates:  | (1) |

Whereby:- The estimated optimal lags model applied to find the long run and short run association between variables.

The estimated optimal lags model applied to find the long run and short run association between variables.

3.4. Auto-Regressive Distributed Lags (ARDL) Technique

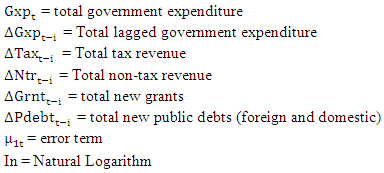

The analysis of the long run and short run relationship analysed using the ARDL modelling technique, which provides significant advantages, compared to traditional approach (Granger causality: 1987, Johnson cointegration: 1996) when analysing the existence of a long-run relationship among variables. These advantages include the ability of the model to estimate the short and long run relationship of variables simultaneously, model is more appropriate for analyzing small sample size, suitable estimator for analyzing data with mixed order of cointegration I(0) and I(1) among the variables, and it removes the problem of endogeneity in the model. The long-run relationship estimated using the following model:  | (2) |

Where  represents the long run relationship between variables with a maximum number of lags that gives a model with optimal results base on criteria as indicated. In estimating short-run association, we use the following model:

represents the long run relationship between variables with a maximum number of lags that gives a model with optimal results base on criteria as indicated. In estimating short-run association, we use the following model:  | (3) |

Whereby the expression symbol of  represent the short-run relationship between the variables,

represent the short-run relationship between the variables,  is the constant,

is the constant,  is the white noise,

is the white noise,  is the error correlation term, which measures the speed of adjustment towards equilibrium. The value of coefficient

is the error correlation term, which measures the speed of adjustment towards equilibrium. The value of coefficient  expected to be negative and significantly (usually range between 1 and -1), and the higher the coefficient value of

expected to be negative and significantly (usually range between 1 and -1), and the higher the coefficient value of  the higher the speed of adjustment to the equilibrium.

the higher the speed of adjustment to the equilibrium.

4. Empirical Results

4.1. Unit Root Test

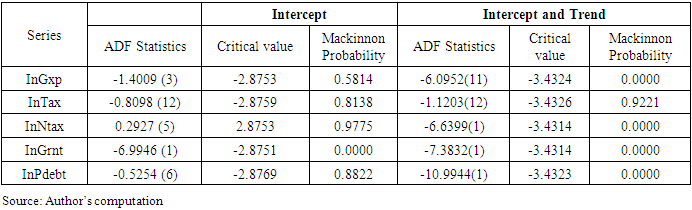

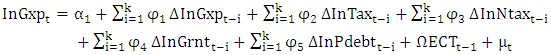

The first step is to analyse data by checking if there is any non-stationary existence in the data, we use Augmented Dick Fuller (ADF) test to investigate the order of integration independent and independent variables. The decision criteria is that, if the ADF statistic value is higher than critical value at 5% significant value, we conclude that, variable data are stationary and if it is less than 5% it is non-stationary. Performed unit root test at Level and results revealed mixed cointegration, but First-difference unit root test reveals variables are stationary as shown in table 1 and 2. Table 1. Dick Fuller Augmented Unit Root Test at level

|

| |

|

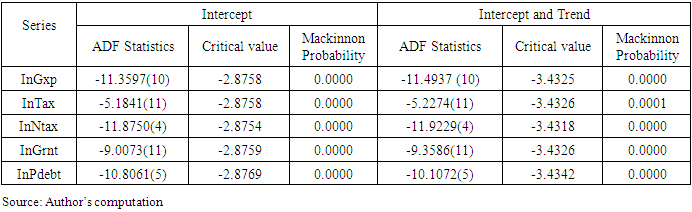

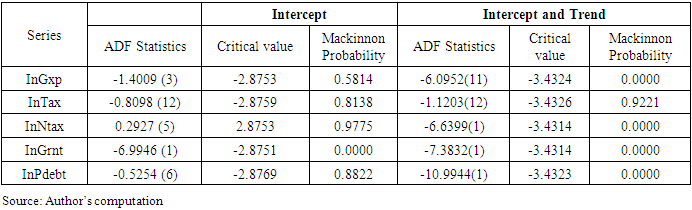

Table 2. Dick Fuller Augmented Unit Root Test at First-Difference

|

| |

|

The unit root series at first-difference are non-stationary, which implies there is a direct shock to the government expenditure with permanent impact to the series.

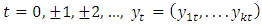

4.2. The Stability of the Model

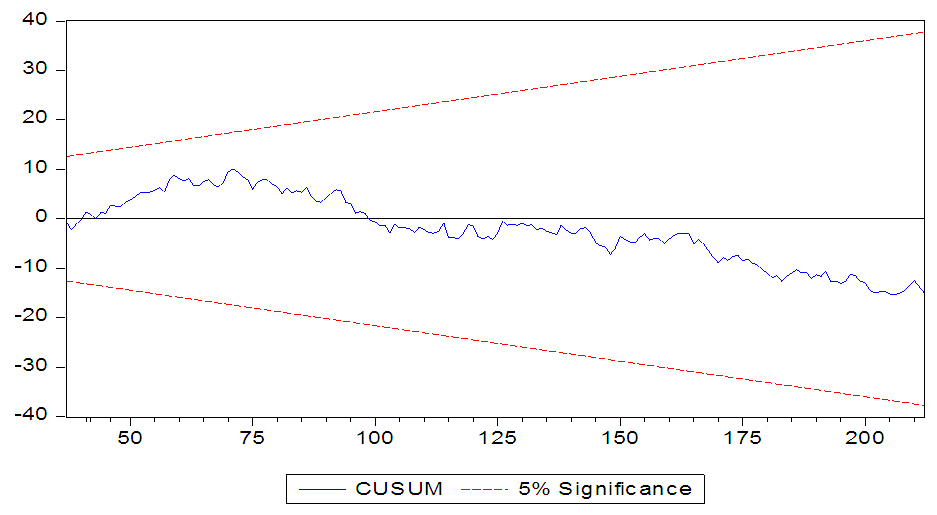

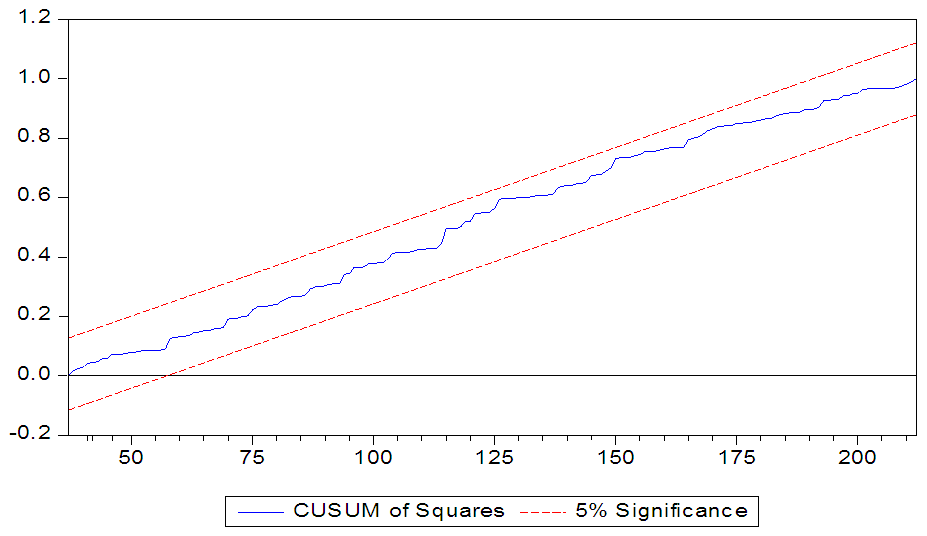

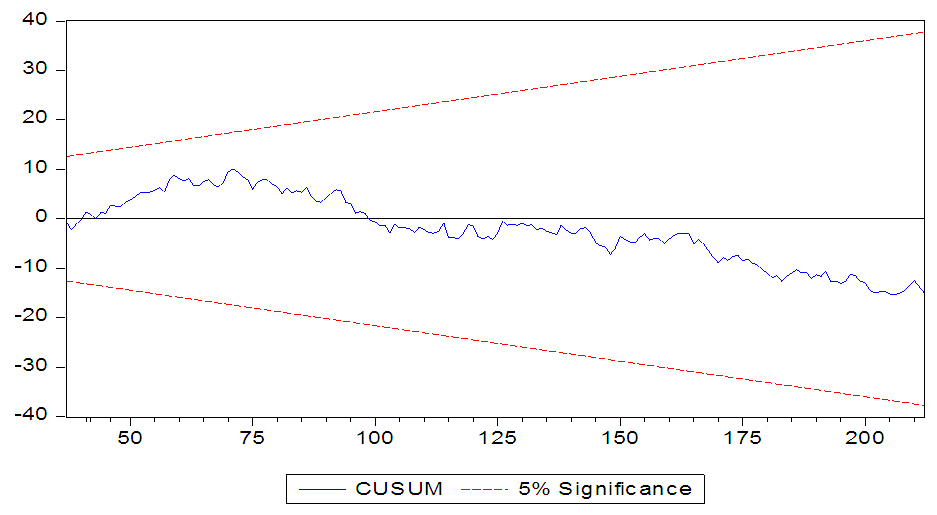

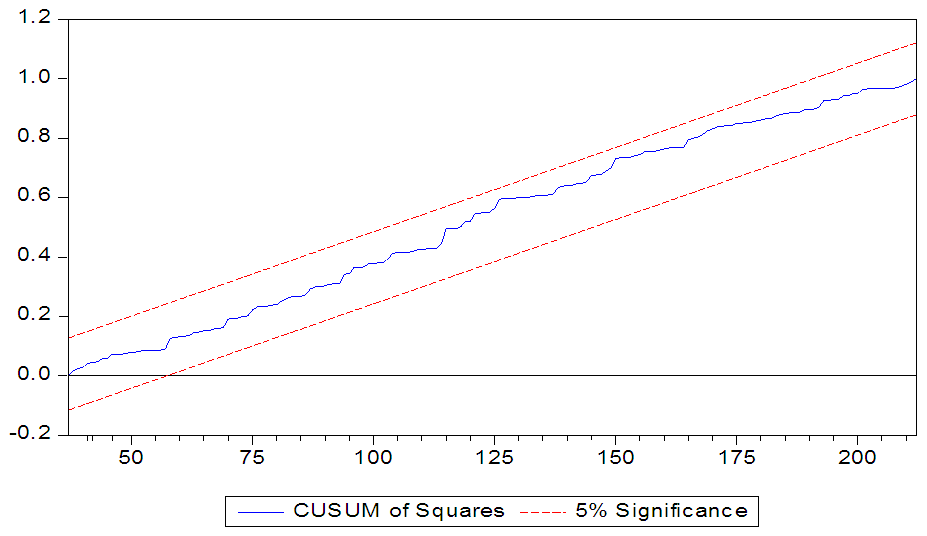

The analysis confirmed the stability of the model by using two different model stability test, the serial correlation and CUSUM (Cumulative Sum Control Chart) test. The serial correlation tested using residual diagnostic of serial correlation LM test, which indicates model has no serial correlation. (Obs. R square= 5.5487, Prob. chi2 = 0.1358, F statistics =1.6713), no serial correlation is determined by Prob. chi2 (13.58%) which is above 5% level. The stability diagnostic of recursive estimates used CUSUM test and CUSUM SQ test at 5% level to determine the stability of the model, CUSUM test and CUSUM SQ results shown in figure 1 and 2 respectively. | Figure 1. CUSUM Test (Source: Author’s Computation) |

| Figure 2. CUSUMSQ Test (Source: Author’s Computation) |

At CUSUM test results, the blue line should be within the two red straight line which implies model is stable at 5% significant level, both two statistical model stability test confirm the model is stable for further analysis. Variable parameters are stable, and no any structural breaks or small shift detected in the mean process.

4.3. Bound Test

4.3.1. The Existence of a Long Run Relationship

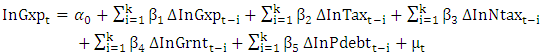

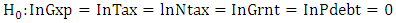

To determine the existence of long-run relationship between governments spending tax revenue, grants, public debt and non-tax revenue, use the following optimal ARDL model framework: | (4) |

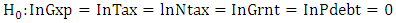

Estimating the long run relationship using equation [4] model that gives the lowest value of Alkane information criterion (AIC) and Schwartz Information Criterion (SIC). This model tested using a different automated selected number of lags, the optimal results obtained at lags 3 model base on selection criteria. (Length lag 3: AIC = 0.0817 and SIC= 0.4317)The variables expressed by symbols of  in equation [4] represent the long run relationship between the variables and testing its existence, the least square equation and the Wald F statistics used to test the hypothesis, which determines the existence of a long-term relationship among the variables. We tested the existence of long-run relationship between variables using the following hypothesis:- Null hypothesis

in equation [4] represent the long run relationship between the variables and testing its existence, the least square equation and the Wald F statistics used to test the hypothesis, which determines the existence of a long-term relationship among the variables. We tested the existence of long-run relationship between variables using the following hypothesis:- Null hypothesis  , which implies no any long-run relationship among the variables. Alternative hypothesis

, which implies no any long-run relationship among the variables. Alternative hypothesis  . there is evidence on long run relationship.The F test results obtained compared with bound critical values (5% significant level) base on the Pesaran table of lower and upper bound critical value. If the value of F statistics is higher than upper critical value, then we reject the null hypothesis and conclude that government spending, tax revenue, non-tax revenue, grants and public debt have long run association and jointly moving together. If the value of F statistics is less than upper critical value then, we accept the alternative hypothesis, which implies variables jointly are not equal to zero, and no long-run relationship, this model is unrestricted intercept and no trend.

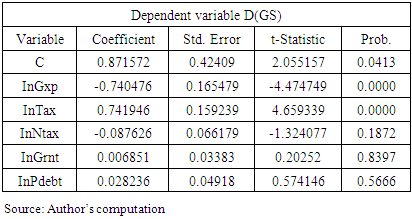

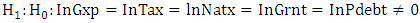

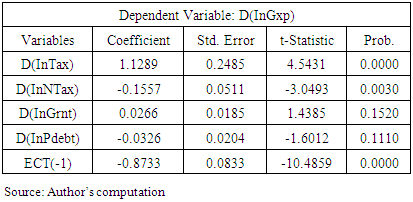

. there is evidence on long run relationship.The F test results obtained compared with bound critical values (5% significant level) base on the Pesaran table of lower and upper bound critical value. If the value of F statistics is higher than upper critical value, then we reject the null hypothesis and conclude that government spending, tax revenue, non-tax revenue, grants and public debt have long run association and jointly moving together. If the value of F statistics is less than upper critical value then, we accept the alternative hypothesis, which implies variables jointly are not equal to zero, and no long-run relationship, this model is unrestricted intercept and no trend.Table 3. The Long Run Coefficient Estimates

|

| |

|

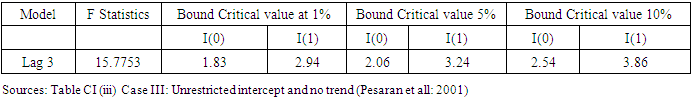

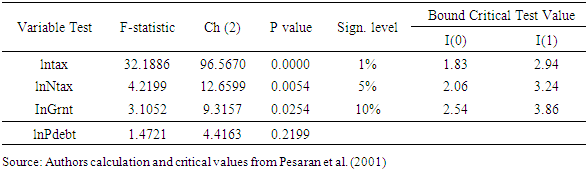

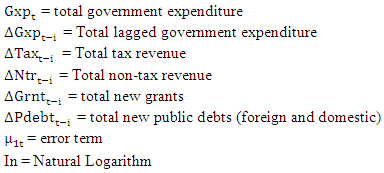

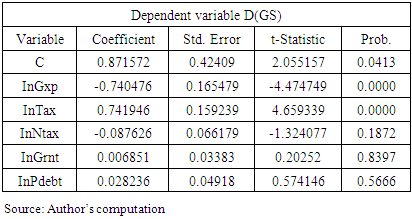

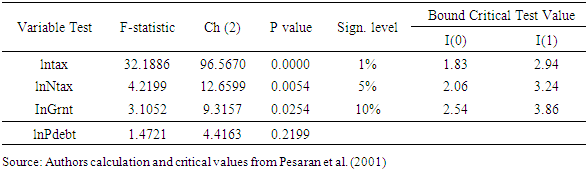

The long-run elasticity of estimated lagged government expenditure has a coefficient of -.0.741 and significantly; this advocated that previous government expenditure affected by current lagged government expenditure. Hence, 1% increase in previous government expenditure will decrease the current lagged government spending by 0.74%. The tax revenue coefficient is positive and significant, which implies that 1% increase in government spending will derive an increase of 0.74% from tax revenue sources. Non-tax revenue coefficient is negative and insignificant with coefficient value of 0.09. Grants coefficient is positive and insignificant with coefficient value of 0.007, and Public debt coefficient is positive and insignificant with coefficient value of 0.028 in the long run. The Wald test results indicate F statistic value is equal to 15.7753, compared with Pesaran at a critical value at 5% as indicated in table 4. The results indicate F statistics value is higher than Pesaran upper bound critical value, which is evidence of an existence of long-run relationship between government spending, tax revenue, grants, non-tax revenue and public debts. Hence, we reject the null hypothesis of no cointegration. Table 4. ARDL Bound Long Run Test

|

| |

|

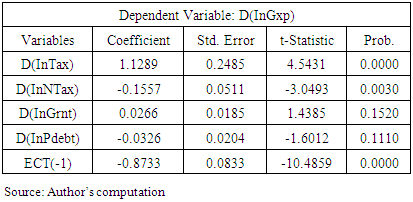

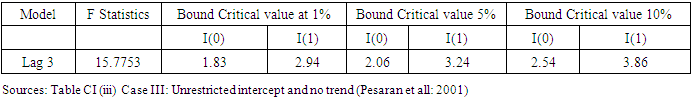

4.4. Short Run Analysis

Short run relationship and error correlation term shown in table 5, the tax revenue coefficient is positive and significant. The results imply government expenditure affected by previous quarterly spending. Increase in the spending by 1% will influence to increase the current tax revenue by 1.13%. Non-tax revenue coefficient is negative and significant, means in short run; an increase of 1% in government expenditure tends to reduce current non-tax revenue by 0.16%. Grants coefficient is positive, but insignificantly with coefficient value of 0.027. Public debts coefficient also is negative, and insignificantly with coefficient value of -0.033. The reduction in revenue sources dependence when the government expenditure increase caused by the option of financing sources substitution.Table 5. Short run and error collection term

|

| |

|

The results of the short-run relationship between the government spending, tax revenue, grants, public debt and non-tax revenue indicated in table 6. The results indicate there is the existence of a short-run relationship between government spending, tax revenue and non-tax but no evidence revealed on the short-run relationship between grants and public debts at 5% significant level.Table 6. Short Run ARDL Bound Test Results and Critical Value Test Value

|

| |

|

The error term coefficient (ECT) presented in table 5 use optimal lag 3 model, results indicate the error correlation term equal to -0.8733 and P value is less than 0.05, this implies that the ECM is moving with the adjustment speed of 87.33% towards long-run equilibrium.

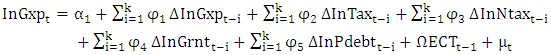

4.5. Impulse Response Function

Impulse response function used to correlate the effect of shock among the set of variables in the dynamic system when pulse responded to the variables change [12], it also used to estimate a small number of parameters and without imposing any restriction in the economy. This study adopts unrestricted VAR analysis, following [12], standard VAR model expressed as follows:- | (5) |

Where  of a random vector of

of a random vector of  the

the  represent

represent  fixed coefficient matrix, and the

fixed coefficient matrix, and the  represent fixed

represent fixed  vector of intercept term permitting chances of nonzero mean

vector of intercept term permitting chances of nonzero mean  is a K dimensional white noise , that is

is a K dimensional white noise , that is  and

and  for s not equat to t. The covariance matrix

for s not equat to t. The covariance matrix  assumed to be nonsingular unless stated. The following is a VAR deterministic model used to estimate the pulse response on variables when spending shock occurred:-

assumed to be nonsingular unless stated. The following is a VAR deterministic model used to estimate the pulse response on variables when spending shock occurred:- | (6) |

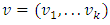

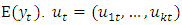

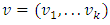

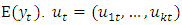

Whereby  is a vector component contain spending, tax revenue, non-tax revenue, public debt and grant.Unrestricted Vector Autoregressive (VAR) model analyses the effect of spending shock and other fiscal variables with the assumption of endogenous variables, the Cholesky -dof adjusted decomposition method for 70 quarters (Q) period used to estimate the strength response of tax revenue, non-tax revenue, grant, and public debt when shock occurred. Analysis use optimal lag model data which, provide the best results according to the Alkane information criterion (AIC) and Schwarz Information Criterion (SIC) criteria. Results indicate, the spending shock affects tax revenue with a positive effect on the 2nd Q, and keep fluctuation with negative and positive sign at decreasing rate and reached slight effects in Q10 (0.001). It indicates the persistence of slight effect with the increase and decreases in tax revenue on a quarterly basis with highest positive effects in Q2 (0.009) and negative value in Q3 (-0.009). The impulse response for non-tax revenue look little higher on the first 8 quarters, however, it immediately decreases in the 2nd Q and effect become low from Q 9 onwards. The grant impulse also respond with immediately negative effect in 2nd Q and effects becomes slightly lower in Q7. The public debt responds to adverse effects immediately in 2Q and stays positive in Q3 and Q4, and then keep in fluctuating with slight higher effects compared to tax revenue and non-tax revenues. The results of purse response function using multiple graphs of standard response error of analytic (asymptotic) presented in figure 3.

is a vector component contain spending, tax revenue, non-tax revenue, public debt and grant.Unrestricted Vector Autoregressive (VAR) model analyses the effect of spending shock and other fiscal variables with the assumption of endogenous variables, the Cholesky -dof adjusted decomposition method for 70 quarters (Q) period used to estimate the strength response of tax revenue, non-tax revenue, grant, and public debt when shock occurred. Analysis use optimal lag model data which, provide the best results according to the Alkane information criterion (AIC) and Schwarz Information Criterion (SIC) criteria. Results indicate, the spending shock affects tax revenue with a positive effect on the 2nd Q, and keep fluctuation with negative and positive sign at decreasing rate and reached slight effects in Q10 (0.001). It indicates the persistence of slight effect with the increase and decreases in tax revenue on a quarterly basis with highest positive effects in Q2 (0.009) and negative value in Q3 (-0.009). The impulse response for non-tax revenue look little higher on the first 8 quarters, however, it immediately decreases in the 2nd Q and effect become low from Q 9 onwards. The grant impulse also respond with immediately negative effect in 2nd Q and effects becomes slightly lower in Q7. The public debt responds to adverse effects immediately in 2Q and stays positive in Q3 and Q4, and then keep in fluctuating with slight higher effects compared to tax revenue and non-tax revenues. The results of purse response function using multiple graphs of standard response error of analytic (asymptotic) presented in figure 3.  | Figure 3. Response to Cholesky One S.D. Innovations ±2 S.E. from Q1-2000 to Q2-2017 |

5. Discussion

Co-integration relationship between government expenditure and revenues sources using ARDL test provide estimates of long-run and short-run effects among the variables. Regarding fiscal policy, it involves managing fiscal revenue, expenditures, financing policies and plans, which include developing tax policy and registration, borrowing from financial markets, and determine expenditure allocation. In every yearly, government estimates revenues and expenditure of the following fiscal year, the fiscal spending expected to consider the ability of raising tax revenue and other financing mechanism to ensure government spend according to the financing structure. The tax revenue is inelastic in both long run (0.742), and short run (1.1289) effects and the increase in the previous spending will affect the current tax revenue by increasing revenue as per specified coefficient value. A large percentage of spending financed by tax revenue, hence in long-run effects, increase in one unit of expenditure shall aligned with 0.74 increase in tax revenue. Non-tax revenue both indicate elastic for the long run (-0.0876), and short run (-0.1557), the increase in government revenues tend to reduce the non-tax revenue source dependence because non-tax revenue substituted by other revenue sources due to its periodical payment in nature. The grants source also reveal inelastic for the long run (0.006851), and short run (0.0266), the increase in government expenditure affect the grants by raising the amount of grant in the long run equivalent to coefficient value. Public debts source revealed inelastic for the long run (0.0282), increase in government expenditure, in the long-run, tends to increase the public debts. With respect to increasing one unit of government spending, the grants and public debt tend to increase at the rate of 0.007 and 0.028 in long-term respectively. When the government decide to increase spending, shall involve the formulation of stable tax policy, increase tax collection and other non-tax sources at the coefficient level specified in the ARDL model both in short run and long run. The impulse response function indicates tax revenue have positive and negative effect when responding to the spending shock; this implies when government increase spending it should also increase tax revenue at least once in every two Quarter as per specified multiplier effect up to Q9, where it turned into very slight effect. The impulse response of tax revenue is not significant with highest positive effect in Q3 at 0.009 and has no permanent sign effect throughout the period under analysis. Non-tax revenue indicates negative coefficient and insignificantly in the long-run due to the nature of revenue, its sources include fees and charges, penalty, license and permit, which government received from a different period and its shortage substituted with other revenue sources. In responding to spending shock, non-tax revenue have slightly similar effect with tax revenue except the non-tax revenue impulse effect are little higher and became less effect at Q 9. Public debt and grants are among the external revenue source, which used to offset the budget deficit. However, its nature of financing associated additional cost to the government and with conditions, which may risk the attaining the objectives of the loan. Due to this, the government may decide to reduce public debts and increase dependence on other revenue sources, which have less burden to the government. The impulse response for grant and public debt tends to fluctuate at decreasing rate with a negative and positive sign; the public debt becomes steady at Q12 with no effect while the grant at Q11 has very slight effects equivalent to tax revenue and non-tax revenue.

6. Conclusions

The ARDL bound test approach analysed the effects of fiscal variables; results conclude that there is an existence of a long-run relationship between spending and fiscal financing variables included in the model. In a short run, a relationship exists between spending, tax revenue and non-tax revenue, and no short-run relationship revealed between spending, grants and public debts. In case of government spending shock, the system conveyance back to the equilibrium level at the speed of 87.33% in the following quarter. The effect of a long run and short run association, provide an indication that the spending decision shall simultaneous made by considering all fiscal variables except public debt and grant in short run, and continue emphasising strengthening fiscal policies especially in increasing tax revenue performances.During spending shock, the impulse response of tax revenue conforms to the tax-spend hypothesis while non-tax revenue conforms to the spend-tax hypothesis both with no significant effect however the effect of tax revenue is small compared to all variables. The ARDL test coefficient provides estimates value for structuring fiscal financing balances in short run as well as in the long-run while impulse response function provide understand the magnitude of how fiscal revenues sources respond to spending shock.

References

| [1] | Adegbite, T. A. (2015). The Long Run Effect of Interest Rate and Money Supply on Petroleum Profit Tax (Pet) In Nigeria. IOSR Journal of Business and Management (IOSR-JBM), PP 18-26. |

| [2] | Barro, R. J. (1979). On the determination of the public debt. Journal of Political Economy 87(5), 940-971. |

| [3] | Carlo Favero and Francesco Giavazzi. (2007). Debt and the Effects of Fiscal Policy. Nationa Bureau of Economic Research (NBER Working Paper 12822). |

| [4] | Christian Richter and Dimitrios Paparas. (2013). Tax and Spend, Spend and Tax, Fiscal Synchronisation or Institutional Separation? Examining the Case of Greece. University of East London: International Network for Economic Research. |

| [5] | Eduardo Lora and Mauricio Olivera. (2007). Public debt and social expenditure: Friends or Foes? Emerging Markets Review 8, 299-310. |

| [6] | F. Jawadi, Sushanta K. Mallick and Ricardo M. Sousa. (2011). Fiscal Policy in the BRICs. Núcleo de Investigação em Políticas Económicas -NIPE. |

| [7] | Fjeldstad, O. H. (1995). Taxation and Tax Reforms in Tanzania: A Survey. Bergen Norway: Chr. Michelsen Institute, Development Studies and Human Rights. |

| [8] | Fosu, A. K. (2009). The External Debt-Servicing Constraint and Public-Expenditure Composition in Sub Saharan Africa. Helsinki, Finland: UN University World Institute for Development Economics Research (UNU-WIDER). |

| [9] | Friedman, M. (1978). The limitation of tax limitation. Policy Review, 7-14. |

| [10] | Gómez-Puig, Marta and Sosvilla-Rivero, Simon, (2015) Causality and Contagion in EMU Sovereign Debt Markets, Research Institute of Applied Economics. |

| [11] | Greiner, A. (2004). An endogenous growth model with public capital and sustainable government debt. Japanese Economic Review. |

| [12] | Helmut Lütkepohl (2005) New Introduction to Multiple Time Series Analysis, Springer-Verlag. |

| [13] | Kgakge-Tabengwa, G. G. (2014). Impact of Shocks on Public Debt and Government Expenditure on Human Capital and Growth in Developing Countries. Journal of Economics and Behavioral Studies, 44-67. |

| [14] | Luoga, F. (2003). The Viability of Developing Democratic Legal Frameworks for Taxation in Developing Countries: Some Lessons from Tanzanian Tax Reform Experience. Law, Social Justice & Global Development Journal. |

| [15] | M. Hashem Pesaran, Yongcheol Shin and Richard J. Smith. (2001). Bound testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 289–326. |

| [16] | Mahmut Zortuk and Nevın Uzgoren (2008). The relationship between the taxation and government expenditure in Turkey - bounds test approach. Banks and Bank Systems, 3(1). |

| [17] | Miguel Angel Tinoco-Zermen, Francisco Venegas-Martınez and Vıctor Hugo Torres-Preciado. (2014). Growth, Bank Credit, and Inflation in Mexico: Evidence from an ARDL-Bounds Testing Approach. Latin America Economic Review, 23:8. |

| [18] | Muhammad Irfan Javaid Attaria and Attiya Y. Javed. ((2013). Inflation, Economic Growth and Government Expenditure of Pakistan: 1980-2010. Procedia Economics and Finance 5, 58 – 67. |

| [19] | Narayan, P. K. (2005). The government revenue and government expenditure nexus: empirical evidence from nine Asian countries. Journal of Asian Economics 15, 1203–1216. |

| [20] | Nehemia Osoro, N. O. (1995). Tax reforms in Tanzania: Motivations, directions and implications. Nairobi: African Economic Research Consortium. |

| [21] | Nehemiah E. Osoro, Philip I. N. Mpango, Hamisi H. Mwinyimvua. (1999). Enhancing Transparency in Tax administration in Tanzania. Dar Es Salaam: EAGER/ PSGE. |

| [22] | Stephen M. Miller and Frank S. Russek. (1990). Co-Integration and Error-Correction Models: The Temporal Causality between Government Tax and Spending. Southern Economic Journal Vol. 57, No. 1, 221-229. |

| [23] | TRA, (2016). Tanzania Revenue Authority- Annual Report 2014-2015. Dae Es Salaam: Tanzania Revenue Authority. |

| [24] | William Anderson, Myles S. Wallace and John T. Warner. (1986). Government Spending and Taxation: What Causes What? Southern Economic Journal, Vol. 52, No. 3 , 630-639. |

| [25] | Zugravu Bogdan Gabriel and Dobranschi Marian. (2012). Public Debt Service and its Impact on Public Expenditures. Journal of economic-financial theory and practice, 655-664. |

The estimated optimal lags model applied to find the long run and short run association between variables.

The estimated optimal lags model applied to find the long run and short run association between variables.

represents the long run relationship between variables with a maximum number of lags that gives a model with optimal results base on criteria as indicated. In estimating short-run association, we use the following model:

represents the long run relationship between variables with a maximum number of lags that gives a model with optimal results base on criteria as indicated. In estimating short-run association, we use the following model:

represent the short-run relationship between the variables,

represent the short-run relationship between the variables,  is the constant,

is the constant,  is the white noise,

is the white noise,  is the error correlation term, which measures the speed of adjustment towards equilibrium. The value of coefficient

is the error correlation term, which measures the speed of adjustment towards equilibrium. The value of coefficient  expected to be negative and significantly (usually range between 1 and -1), and the higher the coefficient value of

expected to be negative and significantly (usually range between 1 and -1), and the higher the coefficient value of  the higher the speed of adjustment to the equilibrium.

the higher the speed of adjustment to the equilibrium.

in equation [4] represent the long run relationship between the variables and testing its existence, the least square equation and the Wald F statistics used to test the hypothesis, which determines the existence of a long-term relationship among the variables. We tested the existence of long-run relationship between variables using the following hypothesis:- Null hypothesis

in equation [4] represent the long run relationship between the variables and testing its existence, the least square equation and the Wald F statistics used to test the hypothesis, which determines the existence of a long-term relationship among the variables. We tested the existence of long-run relationship between variables using the following hypothesis:- Null hypothesis  , which implies no any long-run relationship among the variables. Alternative hypothesis

, which implies no any long-run relationship among the variables. Alternative hypothesis  . there is evidence on long run relationship.The F test results obtained compared with bound critical values (5% significant level) base on the Pesaran table of lower and upper bound critical value. If the value of F statistics is higher than upper critical value, then we reject the null hypothesis and conclude that government spending, tax revenue, non-tax revenue, grants and public debt have long run association and jointly moving together. If the value of F statistics is less than upper critical value then, we accept the alternative hypothesis, which implies variables jointly are not equal to zero, and no long-run relationship, this model is unrestricted intercept and no trend.

. there is evidence on long run relationship.The F test results obtained compared with bound critical values (5% significant level) base on the Pesaran table of lower and upper bound critical value. If the value of F statistics is higher than upper critical value, then we reject the null hypothesis and conclude that government spending, tax revenue, non-tax revenue, grants and public debt have long run association and jointly moving together. If the value of F statistics is less than upper critical value then, we accept the alternative hypothesis, which implies variables jointly are not equal to zero, and no long-run relationship, this model is unrestricted intercept and no trend.

of a random vector of

of a random vector of  the

the  represent

represent  fixed coefficient matrix, and the

fixed coefficient matrix, and the  represent fixed

represent fixed  vector of intercept term permitting chances of nonzero mean

vector of intercept term permitting chances of nonzero mean  is a K dimensional white noise , that is

is a K dimensional white noise , that is  and

and  for s not equat to t. The covariance matrix

for s not equat to t. The covariance matrix  assumed to be nonsingular unless stated. The following is a VAR deterministic model used to estimate the pulse response on variables when spending shock occurred:-

assumed to be nonsingular unless stated. The following is a VAR deterministic model used to estimate the pulse response on variables when spending shock occurred:-

is a vector component contain spending, tax revenue, non-tax revenue, public debt and grant.Unrestricted Vector Autoregressive (VAR) model analyses the effect of spending shock and other fiscal variables with the assumption of endogenous variables, the Cholesky -dof adjusted decomposition method for 70 quarters (Q) period used to estimate the strength response of tax revenue, non-tax revenue, grant, and public debt when shock occurred. Analysis use optimal lag model data which, provide the best results according to the Alkane information criterion (AIC) and Schwarz Information Criterion (SIC) criteria. Results indicate, the spending shock affects tax revenue with a positive effect on the 2nd Q, and keep fluctuation with negative and positive sign at decreasing rate and reached slight effects in Q10 (0.001). It indicates the persistence of slight effect with the increase and decreases in tax revenue on a quarterly basis with highest positive effects in Q2 (0.009) and negative value in Q3 (-0.009). The impulse response for non-tax revenue look little higher on the first 8 quarters, however, it immediately decreases in the 2nd Q and effect become low from Q 9 onwards. The grant impulse also respond with immediately negative effect in 2nd Q and effects becomes slightly lower in Q7. The public debt responds to adverse effects immediately in 2Q and stays positive in Q3 and Q4, and then keep in fluctuating with slight higher effects compared to tax revenue and non-tax revenues. The results of purse response function using multiple graphs of standard response error of analytic (asymptotic) presented in figure 3.

is a vector component contain spending, tax revenue, non-tax revenue, public debt and grant.Unrestricted Vector Autoregressive (VAR) model analyses the effect of spending shock and other fiscal variables with the assumption of endogenous variables, the Cholesky -dof adjusted decomposition method for 70 quarters (Q) period used to estimate the strength response of tax revenue, non-tax revenue, grant, and public debt when shock occurred. Analysis use optimal lag model data which, provide the best results according to the Alkane information criterion (AIC) and Schwarz Information Criterion (SIC) criteria. Results indicate, the spending shock affects tax revenue with a positive effect on the 2nd Q, and keep fluctuation with negative and positive sign at decreasing rate and reached slight effects in Q10 (0.001). It indicates the persistence of slight effect with the increase and decreases in tax revenue on a quarterly basis with highest positive effects in Q2 (0.009) and negative value in Q3 (-0.009). The impulse response for non-tax revenue look little higher on the first 8 quarters, however, it immediately decreases in the 2nd Q and effect become low from Q 9 onwards. The grant impulse also respond with immediately negative effect in 2nd Q and effects becomes slightly lower in Q7. The public debt responds to adverse effects immediately in 2Q and stays positive in Q3 and Q4, and then keep in fluctuating with slight higher effects compared to tax revenue and non-tax revenues. The results of purse response function using multiple graphs of standard response error of analytic (asymptotic) presented in figure 3.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML