-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(2): 49-55

doi:10.5923/j.ijfa.20180702.04

Earnings Management of Listed Deposit Banks (DMBs) in Nigeria: A Test of Chang, Shen and Fang (2008) Model

Musa Adeiza Farouk1, Muhammad Aminu Isa2

1Department of Accounting, Ahmadu Bello University, Zaria, Nigeria

2Department of Accounting, Bayero University, Kano, Nigeria

Correspondence to: Musa Adeiza Farouk, Department of Accounting, Ahmadu Bello University, Zaria, Nigeria.

| Email: |  |

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

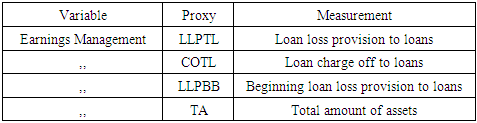

Purpose: The study examine the effect of loan loss provision on earnings management of listed DMBs in Nigeria. Using Chang, Shen and Fang (2008) model. Methodology: Earnings management variables comprises loan loss provision, total assets, loan charge off and beginning balance of loan loss. The population consist of 15 listed DMBs in Nigeria as at 2015. Annual reports were used to obtain data and accounts of banks which covers the period from 2008-2015. Panel regression technique was adopted and Stata 13 used as tool of data analysis. Findings: The findings revealed that, all the variables (loan loss provision, total assets, loan charge off and beginning balance of loan loss) have significant effect on discretionary loan loss provision of the banks. Practical Implications: Interested researchers in the area of earnings management of financial sector should consider the use of Chang, Shen and Fang (2008) model. Originality: The use Chang et al model to examine the level of earnings management of banks in Nigeria.

Keywords: Earnings Management, Discretionary Loan loss provision, DMB’s

Cite this paper: Musa Adeiza Farouk, Muhammad Aminu Isa, Earnings Management of Listed Deposit Banks (DMBs) in Nigeria: A Test of Chang, Shen and Fang (2008) Model, International Journal of Finance and Accounting , Vol. 7 No. 2, 2018, pp. 49-55. doi: 10.5923/j.ijfa.20180702.04.

Article Outline

1. Introduction

- The tendency for earnings management has been witnessed amongst companies in Nigeria which suggest that earnings management is fast becoming a key challenge for stakeholders in the Nigerian corporate setting. The challenges of the banking sector such as the collapse of Savannah Bank, Oceanic Bank and Intercontinental Bank has led the Economic and Financial Crimes Commission (EFCC), to summon top management of these banks. The result of fraudulent financial reporting has affected the stability of the financial system. This event is an indication that threat of earnings management lurks around. The implication of this is that, there will be continuous rise of skepticisms in the mind of investors, shareholders and other stakeholders on the credibility of financial reports of companies in Nigeria. In addition, earnings management practices have increased in recent years in the Nigerian banking industry to allure unsuspecting investors, or gain undeserved accounting-based rewards by presenting an exaggerated deceptive state of bank financial affairs. This can be attributed to the regulatory inconsistency and the choice available in accounting policies which have often called for the exercise of judgement in preparing financial statements. The implication of exercising these judgments is that, the self-serving information provided by managers may be as a result of manager’s intention to influence a particular contractual outcome which relies on reported earnings or to mislead the stakeholders about the underlying economic reality of the firm. Despite provisions enshrined in the accounting standards, it is an unimaginable situation to have accounting systems that are totally rule based without room for occasional judgement [1]. If at all this situation must be, it means providing rules for all facts and conceivable circumstances, which is totally and inhumanly impossible. Since new situation may require new accounting rules which arise regularly, the issue of occasional judgement in accounting has come to stay rather than its possible elimination. Therefore, serious efforts need to be made by researchers in order to devise ways through which the level of discretion by management can be detected and managed.Consequently, previous researchers such as [2] has shown that loan loss provision is one of the components of banks’ earnings subject to manipulation. Loan loss provisions is an item of expense listed on the income statement that reflects the evaluation management's current period of the level of future loan losses. Based on recognized risk of default on certain credit facilities, specific provisions were made while general provisions were made based on recognition of the fact that, the performance of credit facility accommodates some risks of loss no matter how little [3].Studies such as [4-6] in relation to earnings management in Nigerian Banking sector have considered using other models which are not useful in the financial sector without considering the most suitable model like discretional loan loss provision models such as [7] model. However, studies such as [8], [9] used [10] model. Also, [11] assessed the effect of discretionary loan loss provision using the same model but failed to use the most appropriate model for the financial sector. Furthermore, [12] used model developed by [13] which had been heavily criticized ignoring superior models. It is to this end, that the study seek to investigate the extent of earnings management in listed DMBs in Nigeria using the [7] model as a test.Based on the above highlighted objective, the study hypothesized that, [7] model do not significantly predict the level of earnings management in Listed DMBs in Nigeria.

2. Literature Review

- Earnings management involves the repetitive selection of accounting measurement or rules reported in a particular pattern. It is aimed at reporting a flow of income with a smaller variation, from trend than would otherwise have appeared [14].Reasonable opinion in respect of provision of large loan losses to influence earnings came up in the early 80s when there was revelation that Banks in the United State provided insufficient loan losses to understate net assets and profits [15]. Before this time, Authors such as [16] recognized the fact that, firms manage income for purposes of tax, confidence of the shareholders and expectations which are likely to follow the report of high earnings. But attention on the use of discretion to manage earnings, received worldwide drive after the crisis of Enron and other cases which was similar to cases of earnings management that came up. Most literature have acknowledged that loan losses also play significant roles in the financial crises witnessed, whose provision had direct effect on companies’ cash flows and also the earnings reported by them [7], [17]. Loan loss provision is an expense on the income statement which indicates managers’ evaluation of anticipated future losses. This signify that, an increase in loan loss provision reduces net income and vice versa. Since it is the result of managers’ evaluation of the probable loss that the company would incur if the borrower fails to repay his obligations as at when due, then the provision for it, is considered to have two parts: the discretionary and the non-discretionary portions. The Non-discretionary is a function of specific quality determinants in the loan portfolio non-accrual loans, renegotiated loans, loans past due over 90 days and specific analyses on troubled large credits, which implies internal grading system [15]. The discretionary portion are those accruals that largely depend on the outcome of the managers’ future expectation of uncertain events while non-discretionary portion, therefore, is the provision that is based on fair and objective analysis of the firm’s economic conditions [17].The use of definite accruals, including loan loss provision to detect earnings management had two advantages as suggested by [18]. The first advantage was that, the approach allows researchers to advance instinct for the important features that impact the behavior of the accrual, while the second advantage was that the approach could be useful in industries, where a certain form of trade can result in a specific accrual being material. However, he noted that, problems attributed with measuring earnings management through definite accruals do not affect banks and insurance because some particular accruals accounts are very essential. This was as a result of the specific nature of the business, and since it is composed of large accruals for banks and its provision also has a noticeable influence on earnings, loan loss provision is an important tool for earnings management in banking sector. It is worthy of being examined especially in the listed DMBs in Nigeria.

3. Methodology

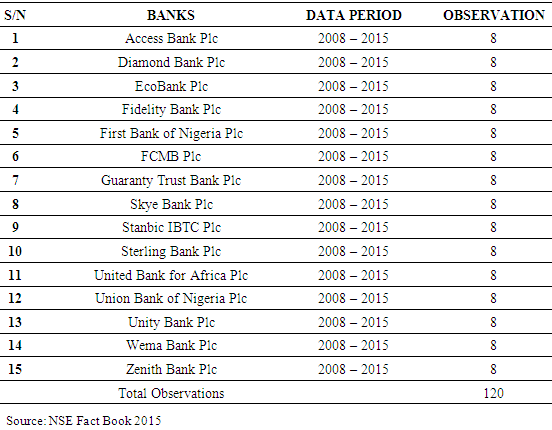

- The research design adopted was Ex-post facto. The study’s approach was quantitative and deductive in nature. Positivism paradigm was employed because it is dependent on quantifiable observations. This lead to statistical analysis through quantitative data collection and interpretation to establish what is without any form of human interaction within the study. Population of this study covers fifteen listed DMBs in Nigeria as at 31st December, 2008 and remain listed up till 2015. The data were extracted from the published annual reports and accounts of the banks. Variables such as loan loss provision, total asset, loan charge off and beginning balance of loan loss provision were used for the analysis. Panel regression technique was employed and Stata 13 was used as a tool of data analysis. Robustness tests such as heteroscedasticity test, multicolinearity test, langrange multiplier test and Hausman specification test were conducted to validate the result.

|

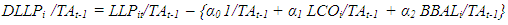

Where DLLP = Discretionary loan loss provisionLLP = Loan loss provisionLCO = Loan Charge-offBBAL = Beginning Balance of loan lossTAt-1 = Lagged Total Assetsα0 = Constant

Where DLLP = Discretionary loan loss provisionLLP = Loan loss provisionLCO = Loan Charge-offBBAL = Beginning Balance of loan lossTAt-1 = Lagged Total Assetsα0 = Constant4. Result and Discussion

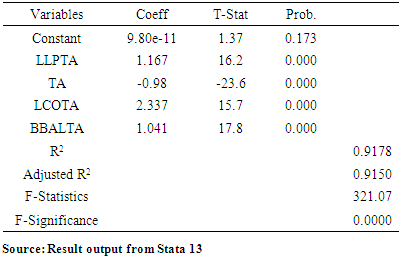

- This section discusses the loan loss provision model developed by [7] for financial sector and its applicability and usefulness in the listed DMBs in Nigeria. It also discusses the strength and significance of the relationship between the independent variables (Ratio of loan loss provision to total assets, inverse of total assets, loan charge off and beginning balance of loan loss provision) and the dependent variable (Discretionary loan loss provision).

|

5. Conclusions and Recommendations

- The study concluded that [7] model, significantly explained the level of discretionary loan loss provision in listed Deposit Money Banks in Nigeria. It is therefore, recommended that, future researchers who are interested in examining the earnings management of banks in Nigeria should adopt this model.

Appendix A

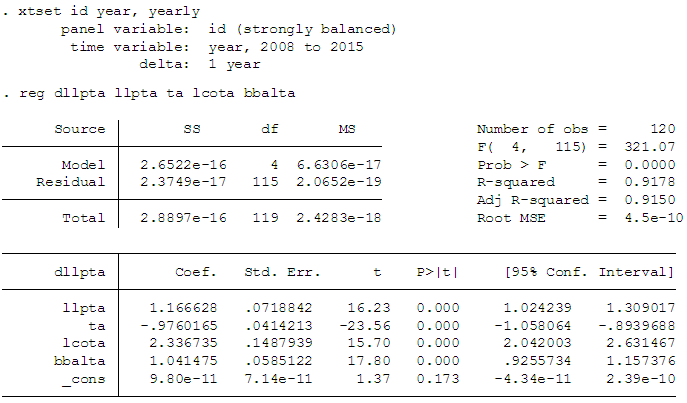

- Appendix A1 (Ordinary Least Square Regression Result)

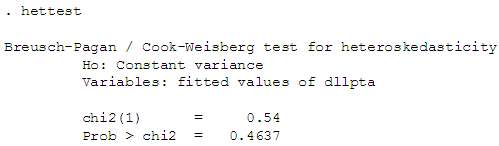

Appendix A2 (Heteroscedasticity Test Result)

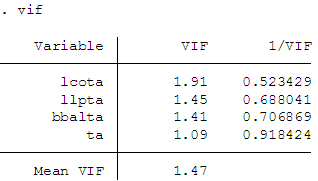

Appendix A2 (Heteroscedasticity Test Result) Appendix A3 (Multicollinearity Test Result)

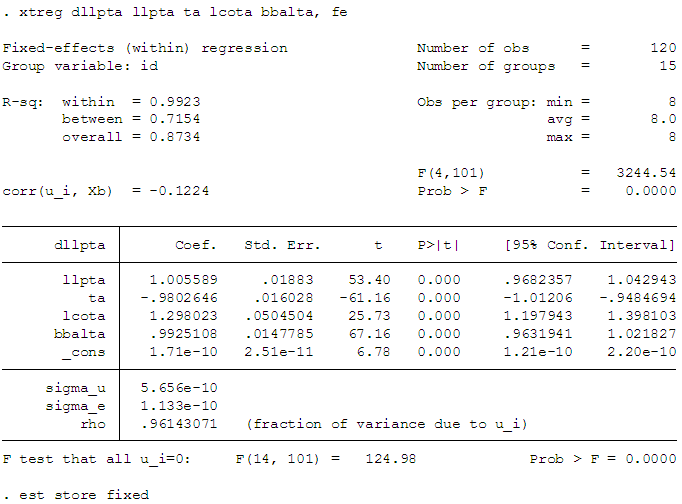

Appendix A3 (Multicollinearity Test Result) Appendix A4 (Fixed Effect Model Regression Result)

Appendix A4 (Fixed Effect Model Regression Result) Appendix A5 (Random Effect Model Regression Result)

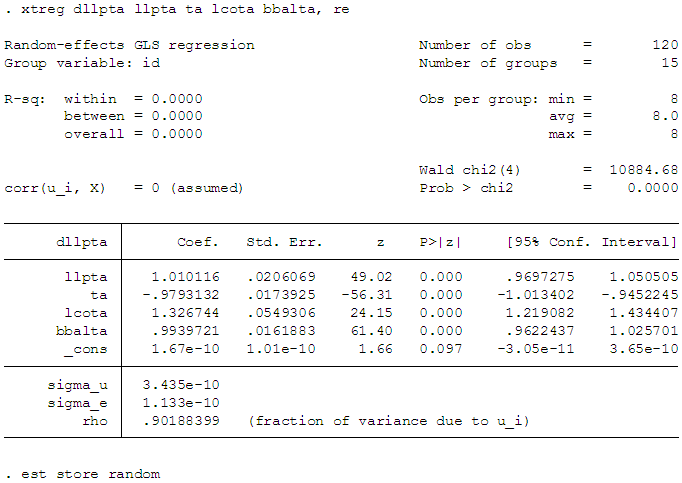

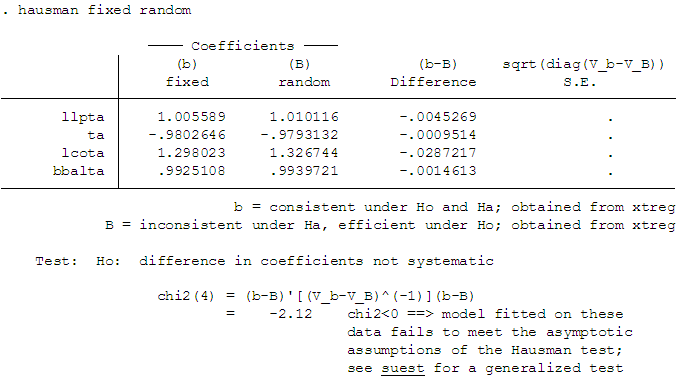

Appendix A5 (Random Effect Model Regression Result) Appendix A6 (Hausman Specification Test Result)

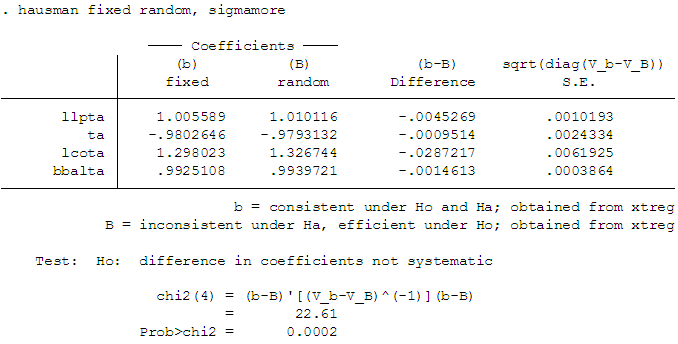

Appendix A6 (Hausman Specification Test Result) Appendix A7 (Seemingly Unrelated Estimate Result)

Appendix A7 (Seemingly Unrelated Estimate Result)

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML