-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(2): 36-48

doi:10.5923/j.ijfa.20180702.03

Burning Issues in the Nigeria Tax System and Tax Reforms on Revenue Generation: Evidence from Rivers State

Adum Smith Ovunda

Accountancy Department, Faculty of Management Sciences, Rivers State University, Port Harcourt, Nigeria

Correspondence to: Adum Smith Ovunda, Accountancy Department, Faculty of Management Sciences, Rivers State University, Port Harcourt, Nigeria.

| Email: |  |

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study examined the burning issues in the Nigeria tax system, tax reforms, and how they affect revenue generation in River State, Nigeria. Data were generated through primary sources and the use of multiple regression analysis was employed. A sample size of 80 respondents, determined by the Yaro Yamen’s formula, was selected. The t-test was used to establish sufficient evidence that the correlation coefficient is not zero. The F-statistic was also used in terms of testing for the model’s overall significance. The result indicated that tax reforms have positive relationship with and influence revenue generation very significantly as better reforms will lead to increase in total revenue. It was revealed that tax evasion and avoidance are negatively related with revenue generation because increase in such practices brings about very significant reduction in total revenue. The study also discovered that the relationship between multiple taxation and revenue generation is positive as multiplicity of taxes tend to increase the revenue base of government. However, it was concluded that the Nigeria tax system cannot operate effectively and efficiently except such burning issues as tax evasion and avoidance are reduced to the barest minimum while several others are also adequately addressed. On the basis of the findings and conclusions, the study recommended that without any delay, tax reforms should be carried as soon as the need arises, to effect relevant and necessary changes in the tax system so as to address the contentious and contemporary issues to boost the revenue earning capacity of government.

Keywords: Burning Issues, Nigeria Tax System, Tax Reforms, Revenue Generation

Cite this paper: Adum Smith Ovunda, Burning Issues in the Nigeria Tax System and Tax Reforms on Revenue Generation: Evidence from Rivers State, International Journal of Finance and Accounting , Vol. 7 No. 2, 2018, pp. 36-48. doi: 10.5923/j.ijfa.20180702.03.

Article Outline

1. Introduction

- Like any other government in the world, the Federal Government of Nigeria and indeed the various state governments have as their primary responsibilities, the protection of lives and property as well as the provision of basic social amenities for the citizenry. To be able to discharge these responsibilities effectively, the government needs adequate funding. Fund is therefore a necessity for any government to perform creditably, all things being equal. There are several sources of revenue at the disposal of government at all levels as provided for in 1999 constitution of the Federal Republic of Nigeria. Despite the numerous sources of revenue in the country, Nigeria still depends greatly on petroleum which contributes significant percentage of her annual revenue. As a matter of fact petroleum, unfortunately, remains the main stay of the Nigerian economy. In effect, it would not be out of place to discribe Nigeria as a mono-product economy because the oil and gas industry alone contributes over 83% of her annual income. There is no doubt therefore, that the nation called Nigeria may not be able to survive without the oil and gas revenue (Ogbonna, 2009). This is to say that Nigeria’s revenue earning potential is determined by unstable oil prices which in turn, are fixed and regulated by the forces of demand and supply in the world market. Recently, there was a serious decline in the price of oil - a trend which almost caused financial earthquake in the country. The dramatic fall in the price of oil led to a reduction in the revenue earning capacity of the country. This period of financial crisis did not rock the federal government alone. The state governments were also affected because the federation account could no longer deliver to them so much fund like they used to get as their portion of the national revenue.This era of dwindling revenue from the federation account witnessed an increase in the cost of running the government. As a means of survival, the various state governments resorted to alternative sources of fund. So falling back to internal revenue sources became an unavoidable alternative. This informed the willingness of government at all levels to device new means of raising fund or get more creative and committed in the way they collect revenue from existing sources.Prior to the early 80s, little or no attention was given to the State Board of Internal Revenue (SBIR) and this resulted to the loss of huge sums of money through tax evasion and avoidance. A survey carried out by Peat, Marwick, Ani, Ogunde and Co., Chartered Accountants revealed that each State Board of Internal Revenue was loosing between N12 million and N30 million annually due to very poor tax administration. During the late 80s and 90s, revenue allocation to states from the federal government was reducing and subsequently became grossly inadequate to cater for their financial needs at that time. Consequent upon this, state governments were compelled to formulate policies and programs aimed at enhancing their revenue generation capacity. To this effect, state governments charged their respective Internal Revenue Service Departments to intensify efforts towards improving internally generated revenue. Some state governments adopted the use of tax consultants to increase their revenue base. This idea of course, did not go down well with Nigerians. It attracted comments and reactions from various interest groups and individuals. Even though it was applauded by some small firms of chartered accountants, big ones declined it along side some company executives. While the revenue officers viewed the activities of these tax consultants as a usurpation of their powers, tax payers pondered on their modus operandi. The introduction of the tax consultants by some military governments in 1996, though meant to increase the revenue base of the governments, increased the number of taxes and levies which each tier of government collected.Over the years, state governments have indulged in the endless imposition of taxes and levies in their quest for higher revenues to effectively implement their policies and programs. For instance, the Rivers State government has just introduced the “Social Services Contributory Levy” which is purported to boost revenue generation and promote the provision of infrastructural facilities for the people of the state. These multiple taxes raised public outcry especially from the business community. The government responded by directing the Joint Tax Board to review and harmonize tax administration in Nigeria. The era of multiple taxation intensified tax evasion and tax avoidance; a situation where tax payers employ legal and/or illegal means of reducing their tax liabilities or not paying taxes at all.However, stopping multiple taxation and the twin menace of tax evasion and avoidance requires a sound policy of tax administration. All those identified above are some of the burning issues in the Nigerian tax system. Hence this study is aimed at examining the effects of these burning issues bedevilling the Nigerian tax system, and the various reforms put in place to address them on revenue generation in Rivers State.State governments in Nigeria are no doubt, confronted with series of challenges ranging from human capital development to infrastructural development. To meet these challenges, adequate funding is necessary but the allocation they get from the federal government is not enough to keep them going. It is in a bid to complement this effort that the state governments resorted to internally generated revenue sources. This again, has its attendant challenges, one of which is the use of tax consultants. The engagement of tax consultants by government to enhance tax collection and boost revenue has elicited reactions from far and near. Some renowned members of the accountancy profession have on several occasions opposed the use of tax consultants. According to Kayode Naiyeju, the former FIRST chairman at the 2011 Revenue Mobilization, Allocation and Fiscal Commission (RMAFC) members’ Retreat held in Akwa Ibom State, the preference for fax consultants in the act of collecting revenue negates the reform process presently going on in the country. He argued that the practice was also detrimental to the effort to modernize the tax administration system at the grassroots. “It is unfortunate that rather than review and update the existing structures for effective tax drive and collection, states and local governments have continued to demonstrate lack of interest in improving their lots towards improved revenue generation by preferring to use tax consultants to administer taxes, rather than to modernize their tax systems for enhanced revenue yield, and less dependence on allocation from the federation account” Naiyeju affirmed.Another burning issue in the Nigerian tax system is that of which tax authority should administer which taxes. The fall out between federal government and Lagos State over whose jurisdiction it was to administer VAT in the state exemplifies this problem. Also plaguing the system is the issue of multiple taxation as government at all levels indulge in the administration of multiple taxes. In fact, due to multiple taxation, many businesses have folded with several others relocating to countries where the tax system is deemed to be more friendly. Corruption is another issue because it affects the tax payers’ perception of the entire system thereby discouraging them from discharging their civic duties. Infrastructural facilities in the country are in a deplorable state. Thus most people wonder what the revenues realized from the taxes so collected are used for. Consequently, the sharp practices of tax evaders and avoiders are triggered off and the effect is a tremendous reduction in the total revenue that accrues from taxation. There ought to be an encompassing tax policy to usher in an efficient tax regime and strive towards making Nigeria have a single tax system. Otherwise the effort of government to foster economic growth and create the enabling environment for businesses to thrive will hit the rocks. Nigerian tax structure is complex and because it is being taken advantage of by the government, it is fast becoming a source of disincentive to profitability and business growth. Most of the tax laws in Nigeria are in dare need of review to take care of some inherent loopholes while others need outright repeal. The relevant tax laws are in urgent need of review or outright repeal. However, taxpayers are very ignorant of the tax laws, their workings and applications because there is little or no tax education thereby making it difficult for them to disclose their true financial position. In the same vein, because there is no communication between the government and the people, they do not see the payment of taxes as a civic responsibility but a hindrance that must be avoided at all costs.Nevertheless, in the reform agenda which is directed towards addressing the burning issues in the Nigerian tax system, the efforts of some state governments must be commended. For instance, the people of Lagos State now have to pay only the land use charge because of the merger of ground rent, neighborhood development charge, ground rent, and tenement rate by the Lagos State government just recently. The tax reform process should not be an entirely federal government affair. The state governments and indeed the local government councils should be involved. They should always be consulted and their inputs considered during the tax policy formulation stage. They should also be fully incorporated during the implementation phase. All state governments should publish the list of approved or authorized taxes and levies within their states and local governments to educate the public. States and local governments should also have a role to play in the area of education and enlightenment of taxpayers on the benefit of compliance as well as the utilization of tax revenue. But the Nigerian tax system has undergone significant transformation in recent times with a review of the tax laws in order to repeal outdated provisions and enact new ones to address some of these burning issues in the system. It is in the light of the afore stated issues that this study was carried out to identify the issues that bedevil the Nigerian tax system, identify the various reforms that are put in place to address them, and to examine their effects and those of the current reforms on revenue generation in Rivers State.

2. Literature Review

2.1. The Nigeria Tax System

- The fiscal operation of Nigeria is arranged in such a way that it adheres to the tenets of a federal system of government practiced in the country: a fact that has serious implication on the management of her tax system. Fiscal federalism vis-à-vis tax administration in Nigeria is characterized by series of problems. Nigeria’s is a tax system that is lopsided and have the dominance of oil revenue. But despite the dominance of petroleum, taxation still remains an indispensable source of revenue.A tax is that compulsory levy which government imposes on the properties, profit, or income of corporate bodies or individuals within its jurisdiction, to raise fund for its activities and programs, and there is no guaranteed benefit therefrom. According to Kiabel (2001), it is a compulsory payment which government, for its sustenance, imposes on the income, profit or wealth of individuals or corporate bodies and which does not attract any guaranteed compensatory benefit. Taxes, generally, are assessed by a tax authority on the basis of certain rules of apportionment on persons or property. It is not necessary that the benefits associated with the payment of tax will be enjoyed contemporaneously or proportionately to contributions by individuals. In other words, the payment of tax does not attract a quid pro quo benefit. This is why no one can lay claim to the provision of certain amount of services because he has paid a certain amount of tax. A tax payer cannot sue government for not spending enough tax money in his locality even when he pays more tax than others. It should be noted here that a fine or penalty does not qualify as tax and should not be treated as such, even when it is imposed by a tax statute. Also, a tax is not the same thing as a debt even though a statutory arrangement can convert an undischarged tax liability into a debt payable to the government.The primary objective of taxation is to raise fund for the running of government. But this is not the case today as the purpose of taxation has gone beyond income generation. As a matter of fact, the paradox of modern tax system is that the goal of income generation cannot necessarily be achieved by mere imposition of taxes. However, successive governments in Nigeria have strived to use tax as a tool to manipulate the economy towards achieving certain goals. For purposes of income redistribution and economic regulation, tax rates are usually manipulated. For instance, the rates of personal income tax in Nigeria are progressively high, depending on the level of the tax payers’ income. Tax is also used to control inflation, protect infant industries, regulate consumption and encourage savings, safeguard the country’s balance of payment, etc.The Nigerian tax system features a wide range of statutes on which state governments depend to generate revenue for public use. The provisions that deal with assessing and collecting taxes on the incomes of individuals, families, trustees, communities and estates are governed by the Personal Income Tax Act (PITA). Under this Act, profits arising from a trade, business, profession or vocation are assessed to tax by the tax authority of the area in which the tax payer is deemed to be resident. The incomes to be charged to tax under this Act could be derived from within or outside Nigeria. Corporate bodies are assessed to tax pursuant to the provisions of Companies Income Tax Act (CITA). While Nigerian companies are charged to tax on their global income, foreign companies’ liability to tax is limited to that part of their profits that relate to business operation in Nigeria. However, there is also a provision under the Education Tax Act to the effect that the assessable profit of incorporated companies shall be assessed to Education tax to the tune of 2%, to promote education in the country. Companies engaged in the marketing of petroleum products are also assessed to tax under CITA. But Petroleum Profits Tax Act (PPTA) governs the assessment and collection of taxes from companies that engage in petroleum operations (exploration and production).Prior to 1967, there had not been anything like tax on capital or what is known today as Capital Gains Tax. In 1967, the Capital Gains Tax was introduced under the Capital Gains Tax Act and it charged to tax, all gains arising from the disposal of an asset by an individual or a corporate body. Also, in 1993, the Value Added Tax Act was introduced to replace what was initially known as “Sales Tax”. The Act provides for a tax at 5% on all VATABLE goods. However, the Customs and Excise Management Act provides for taxes to be charged on imported goods and on some goods produced locally in the form of customs and excise duties. Taxes are also imposed on certain transactions and documents under the Stamp Duties Act.The Nigerian tax system also makes provision for such incentives as tax relief. In a situation where an income is taxed in Nigeria and at the same time taxed in a foreign country, there is a provision for double taxation relief which is a function of a negotiated arrangement in which case the Nigerian government signed some tax treaties with other foreign countries. Under the Industrial Development (Income Tax Relief) Act, tax relief is granted to companies with pioneer status.The Nigeria arrangement is such that the federal government has under its legislative jurisdiction, almost all the juicy taxes even though states are also empowered to collect taxes. What obtains normally according to (Fakile, 2011) is a situation where the FIRS is responsible for the assessment and collection of taxes from corporate bodies while the responsibility to assess and collect taxes from individuals is that of the SIRS. The personal income tax that is due from an individual taxpayer in any year of assessment is payable to the state in which that taxpayer is deemed to be resident. Except for non-residents, residents of the FCT, officers of the Foreign Service, and members of the Nigerian Armed Forces whose taxes are payable to the federal government. Also, the local governments are by virtue of relevant statutes, allowed to charge and collect rates and levies (Fakile, 2011).

2.2. Tax Administration in Nigeria

- In Nigeria, taxes are administered by the organs of tax administration. These organs consist of the tax authorities, the Joint Tax Board (JTB), the Joint State Revenue Committee (JSRC) and the Tax Appeal Tribunal (TAT). Tax authority means the Federal Board of Inland Revenue (FBIR) for the federal government, State Board of Internal Revenue (SBIR) for state government, and the Local Government Revenue Committee (LGRC) for the local governments. The FIRS deals with corporate bodies. It also assesses and taxes the incomes of such other categories of individuals as residents of the FCT, non-residents, members of the Nigerian Navy, Army, Air Force, and external affairs officers. Partnerships and individuals that are resident in any state are assessed and taxed that State’s Internal Revenue Service (SIRS. In the same vein, businesses and even individuals that are located within a local government area pay specified levies, rates, and fees to the Local Government Revenue Committee of that area. While the taxes which the FIRS collect belong to the federal government, those collected by the SBIR go to the state government, and those collected by the LGRC go to the local government. As the highest unifying body of all tax authorities in Nigeria, the JTB acts as an adjudicating body and deals with such problems and disputes that may arise among tax authorities. In other words, the JTB is charged with among other responsibilities, the resolution of conflicts involving states as a result of issues that bother on income tax claims and individuals’ place of residence. In 1998, the State Joint Revenue Committee (SJRC) was established following the federal government’s directive in 1998 budget announcement that the local government should be included in the State Board’s activities. The SJRC has the responsibility of implementing whatever decision the Joint Tax Board comes up with as it also advises states and local governments on which tax collection method is appropriate. The Tax Appeal Tribunal (TAT) which any three or more of its members are empowered by law to sit and take decision on an appeal by either confirming or amending a disputed assessment, is responsible for the settlement of disputes between the tax payer and the tax authority which could be as a result of assessment-related grievances. However, if the decision of the Appeal Tribunal does not go down well with any party, it is expected that such part should approach the High Court and thereafter, the Appeal Court and finally, the Supreme Court.The SBIR (“The State Board”) with its operational arm, the SIRS (“The State Service”) which was established by S.85A of the PITD 1993 has the following composition:• The chairman who the state governor appoints from within the service and who must be a very experienced person in taxation.• Three other persons who the state commissioner of finance shall nominate on their personal merits.• The directors and heads of departments within the state service• A director from the state ministry of finance.• A secretary who the board shall appoint from within the service.• A legal adviser.However, the board’s quorum is made up of five members including its chairman. The State Board does everything within its powers and within the ambit of the law to ensure that taxes are collected efficiently and moneys realized get to the government. It also recommends to the JTB the appropriate tax policy reforms, legislation, treaties, etc. when necessary.The Local Government Revenue Committee is independent of the local government treasury as it takes charge of every operational arm under it. It charges and collects fines, rates, and levies and remits same to the local government chairman. Its chairman is the supervisor for finance. Other members include three local government councilors and two experienced tax personnel that the chairman shall nominate.Tax administration in Nigeria is confronted with series of challenges ranging from little or no taxpayer education, corruption, to lack of qualified tax personnel. Ola (2001) opined that total income tax revenue realized is low as a result of illiteracy, the tax authorities do not relate well with taxpayers, and lack of adequate qualified accountants. Ariyo (1997) relates the problems to apathy among Nigerian taxpayers due to the fact that they receive little or no value from the taxes they pay.Therefore, the problems of tax administration in Nigeria are as stated below: Corruption, lack of adequate and qualified tax personnel, poor government supervision, lack of revenue court, lack of data management, multiplicity of taxes, non-remittance of PAYE deductions, and tax evasion and avoidance.

2.3. Tax Planning

- The payment of taxes is a statutory obligation of every person be it individual or corporate body. As a matter of fact, stiff penalties including imprisonment terms await any individual or corporate body that defaults any tax law(s). Owing to the fact that there is no legal and moral escape route other than to pay whatever amount of tax that the laws of the country stipulates, the consensus has been there from ages that no taxpayer is obliged to pay more than what is necessary (ABWA, 2009). So taxpayers have taken the path of creating avenues that enable them pay any minimum amount of tax that is possible (ICAN, 2006). Similarly, Kiabel (2001) puts it clearly that taxation is a burden and tax payers would naturally seek out ways and means of lessening the burden. However, tax planning refers to the techniques, processes and procedures through which a tax payer minimizes or escapes tax liability. There are two sides to this coin. Firstly, the tax payer may seek to take advantage of all exemptions, concessions, rebates, allowances, and other tax benefits permitted by law. This of course, does not create any problem between the tax payer and the relevant tax authority in as much as it is done within the framework of the law. The other side is where the tax payer decides to dodge tax liability. Dodging tax liability here does not imply negligence or outright refusal to discharge his established tax liabilities. Rather the tax payer takes a proactive look at his business activities, relevant legislation and possible tax liabilities and then arranges his affairs in a manner that places his earnings outside the ambit of the law. He therefore does his business in such a way that his earnings attract little or no tax liability. This also falls within the legitimate practice of tax planning but sometimes, tax administrators and adjudicators frown at it. However, tax planning gives room for a businessman who is tax-conscious and working in conjunction with a tax expert to make a significant reduction in tax liability (ICAN 2006).

2.4. Tax Evasion and Avoidance

- Tax avoidance refers to the action and activity that are directed towards ensuring that little or no amount of tax is paid without infringing on any legal rule. It is that instance where a taxpayer plays smart to have his financial affairs arranged in manner that reduces his tax liability to almost nothing without going against any tax law. In other words, a taxpayer takes a critical review of the tax laws, takes advantage of the loopholes to pay less amount of tax. Tax avoidance is not illegal provided it is done within the framework of the law. In the case “Ayrshire Pullman Motor Services and David M. Vs Commissioner of Inland Revenue”, Lord Clyde stated as follows:No man in this country is under the smallest obligation, moral or otherwise, so to arrange his legal relations to his business or to his property as to enable the Inland Revenue to put the largest possible shovel in his stores. The Inland Revenue is not slow - and quit rightly - to take every advantage which is open to it under the taxing statutes for the purpose of depleting the tax payer’s pocket. And the taxpayer is in like manner entitled to be astute to prevent, so far as he honestly can, the depletion of his means by the Revenue (ICAN 2006:150). This statement points to the fact that tax avoidance is legal as it involves tactically reducing one’s tax liability under a tax law, standing by the provisions of the tax law, without breaking the tax law.Tax evasion is the act of minimizing tax liability or the outright refusal to pay tax through illegal means. Taxpayers evade tax through the deliberate omission of some of the sources of their incomes from returns, deliberate understatement of their incomes or deliberate overstatement of their expenses. This is to say that tax evasion is a criminal, fraudulent and deceitful means of dodging tax liability. Although tax evasion and tax avoidance have the same effect on revenue generation as they tend to reduce the amount of tax revenue that accrues to the government, they are two different concepts in the sense that the former is illegal while the latter is legal. This difference is further elucidated by a United States Judge-Justice Holmes in the case Bullen Vs Wisconsin (1916) 240 US 625 thus:When the law draws a line, a case is either on one side of it or the other. And if on the safe side, the taxpayer should not worry about what any authority or person may say, provided it is within what the law permits. When an act is considered as an evasion what is meant is that it is on the wrong side of the law (Kiabel 2001:68).Tax evasion, according to Farayola (1987), is a criminal way of fraudulently distorting or hiding facts and figures with the aim of reducing tax liability or not paying at all. However, it is obvious from the foregoing that tax avoidance is not an offence in the eyes of the law, but any tax avoidance scheme that the Revenue sees as culminating into an artificial or fictitious transaction, it has the power to set it aside.Tax evasion and avoidance are not just peculiar to Nigeria, they cut across nations and their causes are universal. Kiabel (2001) identified the absence of quid pro quo, embezzlement and mismanagement of monies realized from taxes, unfair distribution of amenities as some of the causes of tax evasion and avoidance in Nigeria.Tax evasion and tax avoidance have been identified as major setbacks in the revenue generating efforts of state governments in Nigeria. This dual menace have always made Nigerian government lose substantial amount revenue. The Rivers State Government has in recent times, confiscated property belonging to some individuals over the non-remittance of or discharge of tax liabilities. In 2009 for instance, the Nigerian Stock Exchange disclosed that 85% of corporate tax revenue generated in the country actually came from the 196 listed companies as against the 30,000 companies registered in the country. This disclosure is nothing but an indictment on tax authorities in Nigeria (Kiabel and Nwokab, 2009).However, tax evasion and avoidance, whether legal or illegal, both have an adverse effect on the revenue generation capacity of any government and should be checked appropriately.

2.5. Multiple Taxation

- Multiplicity of taxes otherwise referred to as multiple taxation describes the situation where the income, profit or wealth of an individual or corporate body is taxed more than once. The quest for higher revenue to government, purportedly to meet its developmental needs drives the government to endlessly impose different taxes and levies on individuals, partnerships and companies. The 1980s saw the prevalence of multiple taxation because they became more pronounced at that time and it was in deed a period of decline in the states and local governments’ share of revenue from the federation account. Consequently, some state and local governments in Nigeria began to find other available sources of internally garneted revenue (Foluso, 2007). They therefore gravitated into multiplicity of taxes. Multiple taxation in Nigeria take several forms, for instance a tax payer’s earning is first taxed in form of PAYE. The same income will be subject to VAT if the tax payer purchases VATABLE goods and of course subjected to various other forms of taxes and levies if he sleeps in a hotel, buys alcohol or tobacco, or even buys fuel.The JTB has stated that the multiplicity of taxes imposed on businesses in Nigeria have unsavory consequences. Its chairman and chairman of FIRS, Mrs. Ifueko Omoigui, referred to multiple taxation as being “evil and illegal” describing it as a practice that makes the business environment in Nigeria very uncomfortable for investors. On the actual extent of the burden which multiple taxation places on businesses in Nigeria, the draft report of a study conducted by the Manufacturers Association of Nigeria (MAN) in collaboration with the Washington, United States’ based Centre for International Private Enterprise revealed that too many taxes imposed be the three tiers of government in Nigerian are suffocating the country’s business environment (Layi, 2010).Also, Engr. Vincent Furo, the president of Port Harcourt Chamber of Commerce, Industries, Mines and Agriculture, who commented on how multiple taxation affected the people as well as their effect on the internally generated revenue of Rivers State Government, faulted the manner in which some local governments in the state engaged in revenue drive, especially as it concerns the issue of multiple taxation. He stressed that tax must be legal hence, effort should be made to ensure that the negative effect of the revenue drive of the respective local governments are put to check especially with the attendant menace of the use of illegal revenue agents and quack consultants who indulge in and promote multiple taxation. A situation where touts purporting themselves as tax agents harass, intimidate and swindle the unsuspecting public and companies of their hard earned money in the name of revenue agents is unacceptable, he added. The most unfortunate thing about the practices of this so called “revenue agents” is that the money they collect never gets to the coffers of the state government but into some illegal pockets, thereby denying government major revenues and the public their hard earned money. The organized private sector is not left out. Some businesses are forced to shut down while others operate in secrecy and unnoticed to avoid constant harassment by touts. The consequence of this is that companies now evade tax to the detriment of the state government.Multiple taxation as a matter of fact, pose a lot of threats to the manufacturing sector in Nigeria because it increases the cost of doing business, destroys investors’ confidence and above all, it is counterproductive. However, some of the causes of multiple taxation include: reduction in states and local governments’ share of revenue from the federation account, greedy tax officials, and source of appeasing so called political god-fathers. Suffice it to say that multiple taxation has a negative effect on not just the revenue generation efforts of state governments in Nigeria but on the country’s business environment as a whole. It begets tax evasion and its attendant consequences, and therefore should be discouraged.

2.6. Tax Consultants and Revenue Generation

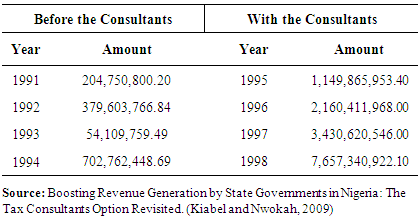

- Despite the fact that revenue from the federation account was going down, the cost of running government was rather on the high side. Then the need for reasonable amount of revenue to flow from internal sources. To achieve this objective, states and federal governments resorted to the use of tax consultants to enhance revenue generation through the Acceleration Revenue Generation Program. Consultants/monitoring agents were appointed by the federal government on VAT and withholding tax in the oil industry. In the same vein, some state governments also appointed tax consultants to boost revenue generation within their respective areas of jurisdiction. This initiative of course, did not go down well with taxpayers and revenue officials alike. There were series of comments and reactions. The tax payers lamented and expressed their concerns about how the said consultants went about their assignment. Revenue officials on the other hand construed the activities of the consultants as usurpation of their powers. However, small firms of chartered accountants embrace and applaud this practice even though the big chartered accounting firms and some company executives abhor it.Those who oppose the use of tax consultants argued that their appointment was illegal because it was not backed up by any tax law and as such, they were not bound by any law. Some even assumed the functions of a tax force and went about harassing taxpayers while others indulge in the act of negotiating tax liabilities. The use of tax consultants is a disincentive to foreign investment. Concerning the legality or otherwise of the appointment of the tax consultants, the Nigerian tax system empowers the Board in section 2 of CAMA 1990 to authorize any person in Nigeria or outside to exercise any of the powers or duties which the law confers on it. This is to say that the States Board of Internal Revenue (SBIR) can engage tax consultants for specific functions. The Nigeria government under General Abdulsalami Abubakar promulgated decrees that prohibited governments from engaging the services of external tax consultants to assess and collect taxes. The decree also prohibits the use of tax consultants in the area of tax monitoring exercises, but allowed them to carry out such secondary assignments as computerization, training, and research (Kiabel and Nwokah, 2009). On the issue of tax consultants negotiating tax liability, the proponents of the use of these consultants have argued that the negotiation of tax liability by the tax payers is simply an admission of guilt, pointing out that was not only in tax consultancy that professional accountants have been found guilty of unethical practices. On the use of unorthodox method of assessment, Kiabel and Nwokah (2009) argued that there was absolutely nothing unorthodox in the method of assessment which the tax consultants adopted. However, a study conducted by Kiabel and Nwokah in 2009 on “Boosting Revenue Generation by State Governments in Nigeria” revealed a dramatic increase in the internally generated revenue of Rivers State government from 1991 to 1998 due to the use of tax consultants. This result is as replicated in the table below.

|

2.7. Tax Reforms in Nigeria

- Tax reforms refer to the process and procedure by means of which structural and administrative changes in the tax system are effected. It is the continual process of recommending and implementing desirable changes which are directed towards achieving a better tax system. As new ideas and fashions take hold, as the technology of tax collection changes, and as the country’s economic circumstances are altered, there is bound to be new opportunities which will engender improvement in a country’s tax system. However, the primary objective of the reform process is to ensure an increase in the revenue base of the government. An improved revenue base is tantamount to the attainment of improved infrastructure, all things being equal. This will in turn lead to other structural reforms and positive changes in the economy. A good tax system is expected to provide appropriate incentives to protect the environment. This is to say that with the appropriate tax policy in place, it will be possible to cushion the effect of environmental challenges. As a matter of fact, if government at all levels need to ensure environmental protection, equity, economic growth and development, the tax system must be reformed in view of its enormous potential and contribution.A successful tax reform process should stem from a well thought out program of action and a clear perception of the problems of the pre-reform tax system; should be supported by leading policy makers and technocrats; should be carefully and systematically implemented and monitored; should make some effort to reduce the burden of tax on the poor; should pay attention to interactions among different components of the tax system, and recognize the importance of revenue adequacy; should invest more time and resources in the training and upgrading of the level of administrative performance.The Nigeria tax system today is one that is dominated by oil revenue. But this was not the case in the 1960s up till early 1970s, especially between 1960 and early 1970s when revenue generated from agricultural produce dominated the system. But since the discovery of oil in commercial quantity and the subsequent “oil boom”, oil revenue has taken dominance of the Nigerian tax system. As a matter of fact, oil revenue now contributes about 83% of Nigeria’s annual revenue (Ogbonna, 2009). Nigeria’s fiscal management, instead of transforming the country’s existing revenue base for efficiency, simply refocused it from one primary product based revenue to another thereby exposing Nigerian economy to the unstable, uncertain, and unpredictable international oil market. This is truly an issue that needed to be addressed hence, the series of tax reforms some of which include 1991 and 2003 policy reviews as well as the annual budget amendments.Ayodele (2006) identified the following as some of the reasons why Nigeria embarked on the reform of her tax system: for tax policy reforms in Nigeria: the need to diversify the country’s revenue portfolio to be able to withstand the effect of unstable price of oil in the international market and make her economy more viable and sustainable; to address the overdependence on petroleum and trade taxes by giving more attention to direct and indirect taxes like VAT that have great potential for expansion; to address the issue of threat to the country’s macroeconomic stability and her chances of growing economically occasioned by fiscal deficit; the need to reduce the country’s expenditure and strive towards increasing her tax revenue as highlighted by the study groups that reviewed her tax system in 1991 and 2003; and the need to effectively evaluate the performance of the country’s tax system to create room for tax planning.Since the introduction of the Structural Adjustment Program (SAP) in 1986, taxation has become a poverty-fighting tool. Before 1986, there was high concentration of tax measures on Personal Income Tax (PIT) when is was increased from

600 or 10% to

600 or 10% to  1, 200 or 12.5% for income exceeding

1, 200 or 12.5% for income exceeding  6,000. But this was not the case in the 1990s when minimum individual tax was reduced in 1990 from 1% to 0.5%. In 1996, the government increased children allowances from

6,000. But this was not the case in the 1990s when minimum individual tax was reduced in 1990 from 1% to 0.5%. In 1996, the government increased children allowances from  1,000 to

1,000 to  1,500 per child (up to a maximum of four children). This was further increased to

1,500 per child (up to a maximum of four children). This was further increased to  2,500 in 1998. 1997 saw the introduction of a dependent relative allowance of

2,500 in 1998. 1997 saw the introduction of a dependent relative allowance of  1,000 (up to two dependents) and was increased to

1,000 (up to two dependents) and was increased to  2,000 in 1998. Also, personal allowance of

2,000 in 1998. Also, personal allowance of  3,000 plus 1% of earned income was raised to

3,000 plus 1% of earned income was raised to  5,000 plus 20% of earned income. Such other tax relief’s as life assurance scheme which offers an exemption on paid premiums up to 10% of the insured capital, as well as certain disability allowances. The minimum tax free income was also raised from

5,000 plus 20% of earned income. Such other tax relief’s as life assurance scheme which offers an exemption on paid premiums up to 10% of the insured capital, as well as certain disability allowances. The minimum tax free income was also raised from  7,500 in 1995/1996 to

7,500 in 1995/1996 to  10,000 and to

10,000 and to  30,000. All these incentives were to encourage taxpayers to discharge their civic responsibilities as at when due. These initiatives of course, boosted compliance but revenue generation did not increase proportionately.A serious issue associated with the PIT is the fact that most employers fail to comply with the provision that requires them to register their employees, deduct their respective taxes at source through the PAYE system and remit same to the relevant tax authority. So non-compliant employers became liable to penalties to the tune of

30,000. All these incentives were to encourage taxpayers to discharge their civic responsibilities as at when due. These initiatives of course, boosted compliance but revenue generation did not increase proportionately.A serious issue associated with the PIT is the fact that most employers fail to comply with the provision that requires them to register their employees, deduct their respective taxes at source through the PAYE system and remit same to the relevant tax authority. So non-compliant employers became liable to penalties to the tune of  25,000 after PITA 1993 was amended in 2002.Another important landmark in tax reform in Nigeria was the introduction of the value Added Tax (VAT) in 1993, which became operational in 1994. VAT which is often referred to as the “Consumption Tax” replaced the Sales Tax which was adjudged to be narrow-based because it covered only nine categories of goods, excluding imported items. VAT proceeds which were shared among the federal, state and local governments increased thereby increasing the revenue based of the government.

25,000 after PITA 1993 was amended in 2002.Another important landmark in tax reform in Nigeria was the introduction of the value Added Tax (VAT) in 1993, which became operational in 1994. VAT which is often referred to as the “Consumption Tax” replaced the Sales Tax which was adjudged to be narrow-based because it covered only nine categories of goods, excluding imported items. VAT proceeds which were shared among the federal, state and local governments increased thereby increasing the revenue based of the government. 2.8. Tax Structure Reform

- The significant role played by tax in the economic advancement of the country makes its reform very important. The Nigerian tax system needs to be reformed in order to place it on a better footing so as to address the weaknesses inherent in the administrative machinery of the system. As a matter of fact, the era of over dependence on oil revenue will be bygone if proper tax reforms are put in place and the tax system is driven to operate at full potential. However, the following areas of reform have been identified by scholars and advocates of tax reforms:Commodity Taxation: This aspect of taxation which comprises value added tax (VAT), customs and excise duties is a major revenue earner of the Nigerian economy. In this area it has been recommended that such taxes as excise duties should be used to introduce some degree of progressivity into the system of commodity taxes and to compensate for the presence of externalities. Import duties on the other hand should be used as a tool to protect infant industries as well as provide protection for domestic producers and products, while export taxes should be eliminated where necessary.Income Taxes: This includes both Personal Income Tax and Companies Income Tax. In Personal Income Tax, adjustments are made to the effect that all necessary allowances are deducted before arriving at the taxable income upon which the graduated rates are applied. This has the effect of shrinking the tax base thus; it is recommended that the tax base be broadened.

2.9. Problems of Tax Reforms in Nigeria

- Despite the call from every nook and cranny for tax reforms, the reform process cannot go smoothly without a hitch. Some of the problems that are likely to affect the Nigerian tax reform agenda are as discussed below.Political Factors: Taxation in itself is simply the application of laws-tax laws. So for tax reforms to come to materiality, the recommended reforms must first be passed into law before implementation. This of course, will kick-start the various law making processes and the bottle necks associated with them. Apart from the rigorous process of law making, the political arrangement of Nigeria is so unstable that the policies and programs of a particular government are hardly implemented by another government. This is a serious problem as each government comes with different tax policies.Economic Factors: The agro-allied industries and small scale businesses in Nigeria are operated in such a way that appropriate records are not kept which will form the basis for assessment and collection of taxes. One would want to ask what impact tax reforms will make in these areas.Data Management: It is usually very difficult if not impossible to assess the availability of tax data and as such ascertain the effectiveness of any tax reform.Tax Structure: The Nigerian tax system was structured in accordance with the British method. The sophistication that is characterized by this structure has made it near impossible for tax to be effectively administered in Nigeria. The Nigerian tax system lacks the requisite administrative machinery to formulate and implement tax reforms.Macroeconomic Environment: Such other macroeconomic factors as inflation, unemployment, etc. make it practically difficult for tax reforms to come to place in Nigeria. Note however, here that tax reforms have impacted positively on the revenue generating efforts the Rivers State government and indeed, every other state government in Nigeria. The total revenue of the government has witnessed tremendous increase since the introduction Value Added Tax. Also, the various incentives in the form of reliefs introduced by the government in the area of Personal Income Tax aroused the interest, sincerity and willingness among taxpayers to pay their taxes as and when due. This in turn, increased the revenue earning strength of the government.

3. Methodology

3.1. Data Collection and Analysis Technique

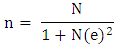

- This study employed primary data source in which questionnaires were distributed to a sample of respondents determined using the Yaro Yamen’s formula. The formula is defined as,

Where n = Sample Size N = Accessible Population e = Level of significanceThe size of the accessible population is 100. It is made up of 60 management staff (top and middle) of the RSBIR, 20 tax consultants, and 20 other chartered accountants from accounting firms. This gives a sample size is 80 by applying the Yaro Yamen formula.The questionnaire was designed based on the Likert’s 5 – point measuring scale, the original format. In this format, 5 is assigned to “Strongly Agree”, 4 is assigned to “Agree”, 3 is assigned to “Uncertain”, 2 is assigned to “Disagree”, while 1 is assigned to “Strongly Disagree” (Nachimas and Nachimas, 2009:466).To analyze data collected for the study, multiple regression analysis was employed and total revenue was regressed on tax reforms, tax evasion and avoidance, and multiple taxation. The coefficient of determination was used to test the percentage of total variation in the dependent variable (total revenue) that is explained by variations in the independent variables (tax reforms, tax evasion and avoidance, and multiple taxation). The t-test was also used to establish sufficient evidence to indicate that the correlation coefficient is not zero. While the F-statistic which is the test for the Analysis of Variance (ANOVA) was used to test for the overall significance of the model.

Where n = Sample Size N = Accessible Population e = Level of significanceThe size of the accessible population is 100. It is made up of 60 management staff (top and middle) of the RSBIR, 20 tax consultants, and 20 other chartered accountants from accounting firms. This gives a sample size is 80 by applying the Yaro Yamen formula.The questionnaire was designed based on the Likert’s 5 – point measuring scale, the original format. In this format, 5 is assigned to “Strongly Agree”, 4 is assigned to “Agree”, 3 is assigned to “Uncertain”, 2 is assigned to “Disagree”, while 1 is assigned to “Strongly Disagree” (Nachimas and Nachimas, 2009:466).To analyze data collected for the study, multiple regression analysis was employed and total revenue was regressed on tax reforms, tax evasion and avoidance, and multiple taxation. The coefficient of determination was used to test the percentage of total variation in the dependent variable (total revenue) that is explained by variations in the independent variables (tax reforms, tax evasion and avoidance, and multiple taxation). The t-test was also used to establish sufficient evidence to indicate that the correlation coefficient is not zero. While the F-statistic which is the test for the Analysis of Variance (ANOVA) was used to test for the overall significance of the model. 3.2. Model Specification

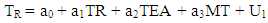

- The model for this study is based on the relationship that exists between total revenue and some of the burning issues in the Nigeria tax system identified in the study. This relationship is represented in the equation below.

| (1) |

| (2) |

4. Hypothesis Testing and Findings

4.1. Test of Hypotheses

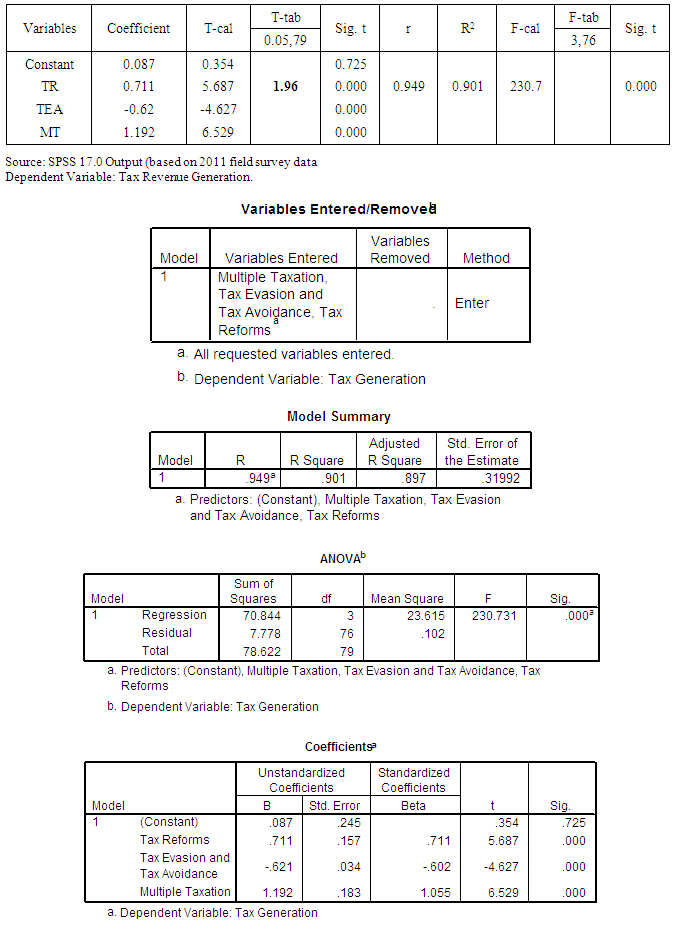

- Given that TR = a0 + a1TR + a2TEA + a3MT + U1TR = 0.087 + 0.711TR – 0.621TEA + 1.192MT T – Values = (0.354) (5.687) (4.627) (6.529).The table above shows that the correlation coefficient (r) is 0.949. This implies that a very strong correlation exists between tax revenue generation and the explanatory variables. However, the coefficient of determination (R2) is 0.901 which is to say that 90.1% variation in tax revenue generation is caused by variations in tax reforms, tax evasion and avoidance, and multiple taxation. Also, the F – calculated value of 230.7 has a corresponding significant F – value of 0.000 which implies a good model utility. Conventionally, F – calculated value of 230.7 > F- table (0.05 3, 76) value of 2.76 hence, a good model utility. Here the three hypotheses formulated for this study will be statistically tested.

4.1.1. Hypothesis One

- Ho1: Tax reforms do not have any significant influence on tax revenue generation.The test of significance conducted as shown in table 4.7 above depicts that tax reforms have a calculated t – value of 5.687 and a corresponding significant value/probability value (PV) of 0.000. The positive sign of the t – value (5.687) connotes direction. This therefore implies that increase in tax reforms or better tax reforms lead to increase in tax revenue generation. This is in agreement with the a’priori expectation (a1 > 0). However, given that the probability value (PV) of 0.000 is less than 0.05 level of significance, the researcher concludes that tax reforms significantly influence tax revenue generation in Rivers State. Conventionally, t – calculated = 5.687 > t – table(0.05, 79) = 1.96. Therefore the researcher upholds the earlier decision and rejects the hypothesis which states that “tax reforms do not have any significant influence on tax revenue generation”.

4.1.2. Hypothesis Two

- Ho2: Tax evasion and avoidance do not significantly influence tax revenue generation.The test of significance conducted as shown in table 4.7 above has it that tax evasion and tax avoidance have a calculated t – value of -4.627 and a corresponding significant value/probability (PV) of 0.000. The negative sign of the t – value (-4.627) explains the fact that increase in the sharp practices of tax defaulters reduces the total tax revenue generated. This is in agreement with the a’priori expectation (a2 < 0). Due to the fact that the probability value (PV) of 0.000 is less than 0.05 level of significance, the researcher rejects the hypothesis which states that “tax evasion and tax avoidance do not significantly influence tax revenue generation”. Conventionally, t – calculated = 4.627 > t – table (0.05, 79) = 1.96. Therefore, the researcher upholds the earlier decision reached and concludes that tax evasion and tax avoidance significantly influence tax revenue generation in Rivers State.

4.1.3. Hypothesis Three

- Ho3: Multiple taxation do not significantly influence tax revenue generation.The test of significance conducted as shown in table 4.7 above indicates that multiple taxation have a calculated t – value of 6.529 and a corresponding significant value/probability value (PV) of 0.000. This probability value is less than 0.05 level of significance. Therefore the researcher rejects the hypothesis which states that “Multiple taxation do not significantly influence tax revenue generation”. Conventionally, t – calculated = 6.529 > t – table (0.05, 79) = 1.96. Therefore, the researcher upholds the earlier decision and concludes that multiple taxation significantly influence tax revenue generation in Rivers State. Note that the positive sign of the value of the t – calculated (6.529) implies that multiplicity of taxes/levies increase tax revenue generation. This is in agreement with the a’priori expectation (a3 > 0).

4.2. Findings

- This study examined the burning issues in the Nigerian tax system and the various tax reforms put in place to address these issues, and how they affect tax revenue generation in the country using Rivers State government as the focal point. In the process of carrying out the study, three hypotheses were formulated to address the major objectives of the study and tested at 0.05 level of significance using the multiple regression model. The result of the first hypothesis revealed that the value of t-calculated (5.687) is greater than the t-tabulated value of 1.96. Based on the result, we rejected the null hypothesis (Ho1) which states that “Tax reforms do not have any significant influence on tax revenue generation”. However, tax reforms have always improved the revenue generating potential of state governments in Nigeria. For instance, the replacement of Sales Tax with Value Added Tax has increased the tax revenue which accrues to the government via indirect tax. Again, the various modifications in the graduated rates for Personal Income Tax, personal reliefs and other incentives have resulted to a tremendous increase in the revenue earning capacity of the government. For the second hypothesis, the test result showed that the t-calculated value of 4.627 is greater than the tabulated t-value of 1.96. Therefore, the null hypothesis (Ho2) which states that “Tax evasion and tax avoidance do not significantly affect tax revenue generation” was rejected. Tax evasion and avoidance reduce the total revenue that accrues to the government. This is because taxpayers choose to employ the various possible means of reducing the amount of tax payable or in most cases, shy away completely from the payment of taxes. The test of the third hypothesis showed that the calculated t-value of 6.529 is greater than the tabulated t-value of 1.96. Based on this, we rejected the null hypothesis (Ho3) which states that “Multiple taxation do not significantly influence revenue generation”. Multiple taxation on the one hand has the tendency of increasing the total revenue that accrues to the government. On the other hand, it discourages taxpayers from discharging their civic obligations of paying taxes thereby reducing the amount of money that goes to the coffers of government as revenue.

5. Conclusions

- Based on the findings of this study as discussed above, the following conclusions are drawn:• Tax reforms have significant influence on tax revenue generation.• Tax evasion and avoidance significantly influence tax revenue generation.• Multiple taxation significantly influence tax revenue generation.• Tax consultants have very crucial role to play in the transformation process of the Nigerian tax system.• The burning issues in the Nigerian tax system are surmountable through proper system of tax reforms.• The Nigerian tax system cannot achieve its full potential except the burning issues in the system are adequately addressed. However, the conclusions above have formed the basis for the following recommendations:• Tax reforms should be carried out at regular intervals to effect relevant changes in the Nigeria tax system where necessary. This is in line with Adebisi (2010).• The Nigeria tax laws should be reviewed and amended to address contentious and contemporary issues as well as close the loopholes that give way to tax avoidance.• Tax consultants should be used in the areas of research, computerization, and training, and not for the assessment and collection of taxes.• The tax authorities in Nigeria should be adequately staffed with qualified and well-motivated personnel to enhance productivity and rid the system of corruption. This is in line with Naiyeju (2010).• There should be regular training and retraining of tax personnel to boost their knowledge and skill.• Tax authorities in Nigeria should at regular intervals, organize seminars and public enlightenment programs to educate the general public on the need to pay taxes.• There should be proper data management to ensure that tax data are available and easily accessible.• Revenue courts should be established in every state of the federation to adjudicate and ensure easy dispensation of justice on tax matters. This is in line with Kiabel and Nwokah (2009), and Adebisi (2010).• Individuals should be made to pay only personal income tax and not other forms of taxes to avoid multiplicity of taxes.• The government should always embark on publicity to inform the taxpayers on changes in tax legislations and the need for compliance. This is in line with Kiabel and Nwokah (2009).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML