-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(2): 27-35

doi:10.5923/j.ijfa.20180702.02

Exchange Rate Fluctuations, Delivery of Foreign Exchange Services and Economic Growth in Nigeria

Anthonia Uduak Ubom1, Uduak Emmanuel Joseph2, Gabriel Thompson Udofa3

1Department of Banking and Finance, University of Uyo, Uyo, Nigeria

2Department of Marketing, University of Uyo, Uyo, Nigeria

3Department of Accountancy, Akwa Ibom State College of Science and Technology, Ikono, Nigeria

Correspondence to: Anthonia Uduak Ubom, Department of Banking and Finance, University of Uyo, Uyo, Nigeria.

| Email: |  |

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this paper, the relationship between exchange rate fluctuations,delivery of foreign exchange services and economic growth in Nigeria was examined. Major problems identified were that over some years now, exchange rate among the major traded currency (dollar) and the naira has fluctuated significantly thereby affecting the delivery of market transactions (spot and forward). The forward transaction is very low compared to the spot transaction. These subsequently led to reduction in the economic growth of Nigeria, measured in terms of growth rate of gross domestic product among others. On these grounds, this work was aimed at establishing relationships that exist between the dutch auction, interbank, bureau de change exchange rates, values of spot and forward transactions and growth rate of gross domestic product (gdpr), unemployment rate (uner) and s per capita income (pci) in Nigeria from the year 2010 to 2016. The expost facto research design was used and the research methods were descriptive and analytical in nature. Tool of analysis was the Ordinary Least Square (OLS) multiple regression model. It was discovered among others that, inverse relationship exists between gdpr, interbank exchange rates and values of spot transactions, between unemployment rates and interbank exchange rates and between per capita income and dutch auction, bureau de change exchange rates, values of the spot and forward transactions. Also, positive corelation exist between gdpr, dutch auction and bureau de change exchange rates. On these grounds, it was concluded that the variables of exchange rate fluctuations, delivery of foreign exchange services affect economic growth both positively and negatively. On the bases of these, it was recommended among others that market participants should undertake forward transactions to serve as an insurance cover for their spot transactions, exchange rate between the naira and the United States dollar be reduced to the barest minimum to encourage producers who sourced raw materials externally to continue/remain in business. This will cut down the rates of unemployment and per capita income will improve.

Keywords: Exchange Rate Fluctuations, Delivery of Foreign Exchange Services, Economic Growth, Foreign Exchange Market

Cite this paper: Anthonia Uduak Ubom, Uduak Emmanuel Joseph, Gabriel Thompson Udofa, Exchange Rate Fluctuations, Delivery of Foreign Exchange Services and Economic Growth in Nigeria, International Journal of Finance and Accounting , Vol. 7 No. 2, 2018, pp. 27-35. doi: 10.5923/j.ijfa.20180702.02.

Article Outline

1. Introduction

- Just like individuals and business firms, a country cannot operate entirely on its own. Certainly it must relate with other countries for one thing or the other. The foreign exchange market creates an avenue for countries to interact through international trade relationships. The exchange rate is the main determinant of price in this market. Unfortunately over some years now, specifically, from the year 2011 to recently, the rate of exchange among major traded currencies and the naira in the international market have fluctuated significantly. As at October 3, 2017, the rate of exchange between naira and the United States dollar was

367/US$, naira and British pound sterling was

367/US$, naira and British pound sterling was  407/₤1 and naira to euro was

407/₤1 and naira to euro was  359/€1. In October 27, 2017, the official buying rate of US dollar to a naira was

359/€1. In October 27, 2017, the official buying rate of US dollar to a naira was  360/US$1 while the parallel buying rate was

360/US$1 while the parallel buying rate was  363/US$1. Again, the regulated/weighted dutch auction rates, interbank rates and the bureau de change rates have fluctuated significantly within this period. The major focus in this work was on the rate of exchange between the US dollar and the Nigerian naira. The sharp increase in the exchange rate of these two currencies was observed long ago but our concentration in this work is since the year 2011 when a naira to US dollar was

363/US$1. Again, the regulated/weighted dutch auction rates, interbank rates and the bureau de change rates have fluctuated significantly within this period. The major focus in this work was on the rate of exchange between the US dollar and the Nigerian naira. The sharp increase in the exchange rate of these two currencies was observed long ago but our concentration in this work is since the year 2011 when a naira to US dollar was  155/US$. From there, it rose to

155/US$. From there, it rose to  160,

160,  174 and so on. These have resulted in high level fluctuations in the volumes and values of spot and forward transactions in the foreign exchange market, subsequently leading to fall in investment, low trade, rise in unemployment, increase in the price of commodities, reduction in the level of manufacturing output, volume of goods and services in the domestic market and declining disposable income and rise in the poverty level among others. Macroeconomic variables have also shown significant declining and marginal increases in their values and these have been issues of concern to all. On these grounds, this paper was developed to examine the influences of exchange rate fluctuations, delivery of foreign exchange services on the growth of the Nigerian economy from year 2010 to 2016. This period was chosen because skyrocketed rises in exchange rates have occurred within then. The rate of exchange was measured by the exchange rates of the dutch auction system, interbank and bureau de change, delivery of foreign exchange services was measured by the values of the spot and the forward transactions in the foreign exchange market and economic growth measured by the growth rate of gross domestic product, unemployment rate and per capita income. Note should be taken that the variables of exchange rate in this study deviates a little from the works of Garba, 1997 who identified three tier exchange rate system as the official rate, the export proceeds exchange rate and the “free fund” exchange rate (the bureau de change/parallel market rates). In this work, instead of the exports proceeds rate, the interbank exchange rate is used. Also, while Oladele, 2015 used the official rate and the parallel exchange rate in his work, this work deviates from his in that the interbank rate is added. Again, in this work, two more variables of economic growth (unemployment rate and per capita income) were also considered in addition to the growth rate of gross domestic product.Specifically, the objective of this paper was to examine the relationship that exist among the exchange rates, values of the spot and the forward transactions and the growth rate of gross domestic product, unemployment rate and per capita income in Nigeria. The research hypotheses were stated in their null forms as follows:i. H01: there is no significant relationship between the growth rate of gross domestic product (gdpr) and dutch auction, bureau de change, interbank exchange rates, values of the spot and the forward transactions in Nigeria from the year 2010 to 2016. ii. H02: there is no significant relationship between unemployment rate (uner) and the dutch auction, bureau de change, interbank exchange rates, values of the spot and the forward transactions in Nigeria from the year 2010 to 2016.iii. H03: there is no significant relationship between per capita income (pci) and the dutch auction, bureau de change, interbank exchange rates, values of the spot and forward transactions in Nigeria from the year 2010 to 2016.This paper is divided into five sections. Section one is the introduction which is being concluded, section two is the theoretical review while the research methodology is presented in section three. Section four presents the empirical review while the summary, conclusions and recommendations are made in the last section, five.

174 and so on. These have resulted in high level fluctuations in the volumes and values of spot and forward transactions in the foreign exchange market, subsequently leading to fall in investment, low trade, rise in unemployment, increase in the price of commodities, reduction in the level of manufacturing output, volume of goods and services in the domestic market and declining disposable income and rise in the poverty level among others. Macroeconomic variables have also shown significant declining and marginal increases in their values and these have been issues of concern to all. On these grounds, this paper was developed to examine the influences of exchange rate fluctuations, delivery of foreign exchange services on the growth of the Nigerian economy from year 2010 to 2016. This period was chosen because skyrocketed rises in exchange rates have occurred within then. The rate of exchange was measured by the exchange rates of the dutch auction system, interbank and bureau de change, delivery of foreign exchange services was measured by the values of the spot and the forward transactions in the foreign exchange market and economic growth measured by the growth rate of gross domestic product, unemployment rate and per capita income. Note should be taken that the variables of exchange rate in this study deviates a little from the works of Garba, 1997 who identified three tier exchange rate system as the official rate, the export proceeds exchange rate and the “free fund” exchange rate (the bureau de change/parallel market rates). In this work, instead of the exports proceeds rate, the interbank exchange rate is used. Also, while Oladele, 2015 used the official rate and the parallel exchange rate in his work, this work deviates from his in that the interbank rate is added. Again, in this work, two more variables of economic growth (unemployment rate and per capita income) were also considered in addition to the growth rate of gross domestic product.Specifically, the objective of this paper was to examine the relationship that exist among the exchange rates, values of the spot and the forward transactions and the growth rate of gross domestic product, unemployment rate and per capita income in Nigeria. The research hypotheses were stated in their null forms as follows:i. H01: there is no significant relationship between the growth rate of gross domestic product (gdpr) and dutch auction, bureau de change, interbank exchange rates, values of the spot and the forward transactions in Nigeria from the year 2010 to 2016. ii. H02: there is no significant relationship between unemployment rate (uner) and the dutch auction, bureau de change, interbank exchange rates, values of the spot and the forward transactions in Nigeria from the year 2010 to 2016.iii. H03: there is no significant relationship between per capita income (pci) and the dutch auction, bureau de change, interbank exchange rates, values of the spot and forward transactions in Nigeria from the year 2010 to 2016.This paper is divided into five sections. Section one is the introduction which is being concluded, section two is the theoretical review while the research methodology is presented in section three. Section four presents the empirical review while the summary, conclusions and recommendations are made in the last section, five. 2. Theoretical Review

- This section reviews literature relevant to this work. Specifically, the nature and concepts of foreign exchange, exchange rate, service delivery, the foreign exchange market, and the spot and forward market transactions are discussed.

2.1. Nature and Concept of Foreign Exchange and Exchange Rate

- The term foreign exchange refers to the means of payments for international transactions. It is made of convertible currencies that are acceptable for the settlement of international trade and other external obligations such as interests, profits, dividends and transfers (Ubom, 2010). In the balance of payments, foreign exchange covers monetary authorities claim on non -residents in the form of bank deposits, treasury bills, short term and long term government securities. Foreign exchange also include european currency units, other claims usable in the event of balance of payments needs, non-marketable claims arising from inter-central bank and inter-governmental arrangements without regard to whether the claim is denominated in the currency of the debtor or creditor (Clarke et al, 1993).Foreign exchange operation involves an exchange of domestic currency for foreign currency. This currency is used in the purchase or sell of certain goods and services in the international market, (Ubom, 2010 and Ubom, 2017). Major trading centers are Abuja, Port Harcourt, Uyo, Lagos, United Kingdom, Frankfurt, New York, London and Singapore, etc. Participants are kept in close contact through the use of telephone, fax messages, computer terminals and other communication networks (Pilbeam, 1998).Most international transactions require the currency of the buyer to be exchanged for the currency of the seller. The relative demands and supplies of various currencies determine their relative price or exchange rate. Therefore, one obvious factor that affects the international competiveness of a country’s industry is the exchange rate between the country’s currency and other currencies (Bodie et al, 1995) and (Byrns and Stone, 1992). An exchange rate is simply the price of one country’s currency expressed in terms of another country’s currency.In practice, most trading of currencies take place in terms of the U.S. dollar. (Ross et al, 1998). According to Jhingan, (2000), exchange rate is the rate at which one currency is exchanged for another. It is the price of one currency in terms of another currency. It is customarily defined as the price of one unit of the foreign currency to a unit of the domestic currency. Therefore as exchange rate fluctuates, the naira value of goods priced in the foreign currency similarly fluctuates. The exchange rate translates all prices (including wages and interest rates) in one currency into their value in another currency. A low exchange rate of dollar (for instance) to the naira, makes investment in the United States appeal more to Nigerian investors, so Nigerian capital will flow into United States.However, if the dollar falls in international markets, Nigerian investors will be out of luck and what looked like a good foreign investment if exchange rates are stable may be spectacular if foreign currency’s exchange rate rises. In this view, one can say that an exchange can rise through appreciation or revaluation or fall through depreciation or devaluation. Exchange rate is like other prices in that changes in supplies and demands cause it to fluctuate unless under government control. There is appreciation of the nation’s currency if the market forces cause foreign currencies to become cheaper. Depreciation of the domestic currency (e.g. naira, in Nigeria) means that foreign currencies have grown in value, thus a depreciating naira buys fewer dollars than previously.A fixed exchange rate regime is one where the currency is tied “pegged” directly to the value of another currency e.g. Botswanian Pula and Venezuelan Boliver that are pegged to the United States’ dollar. On the other hand, a floating exchange rate regime is a system that allows its currency value to change freely. Here, the market dictates movements in the exchange rate and it is often called managed float due to interventions by the Central Bank to avoid excessive appreciation or depreciation. The fixed regime increases macroeconomic discipline and reduces transaction costs of trade but there is loss of monetary policy independence while in the floating system, exchange rate volatility is persistent, high inflation and high transaction cost (Rewane, 2015). The flexible exchange rate however, allows demand and supply for currencies in the international market to set exchange rates but it seldom survive if inconsistent with powerful market forces.

2.2. Delivery of Foreign Exchange Services

- A service is defined as a deed performed by one party for another. A customer cannot keep the service; rather the service is experienced, used or consumed. Services are not physical, they are in tangible meaning that you cannot hold or touch it. Services cannot be stored that is why we say they are “perishable”. Services encounter are primarily social encounters and the rules and expectations related to service vary from culture to culture. The international service providers needs to understand the factors that affect customer’s considerations in service evaluations and to emphasize the various dimensions of service quality accordingly. In addition, service barriers encountered in different markets (the foreign exchange market) such as the requirements for local certification, local providers and other requirements that favour local, over international service providers must be properly managed (Perreault and McCarthy, 2002), (McCarthy and Perreault, 1990) and (Dana, 2008).Technically the word delivery means the ability to get the services from the provider to the consumer. The delivery system therefore involves channels where service move from provider to consumer. So from here we have that “service delivery system” is a distribution channel of core and supplementary services. Here there is need to differentiate between potentials for delivery information base on core products (those that responds to customers primary requirements) and simply providing supplementary services that facilitate the purchase and use of physical goods. The foreign exchange market provides both services. For effective and efficient delivery, speed and convenience of place and time have become important determinants. Many services are delivered in real time while customers are physically present. For instance taking e-commerce transaction in the foreign exchange market, at the end of it, you must be paid by a cashier in the bank or you withdraw at automated teller machine (ATM) among others.The foreign exchange market is an over the counter market that exists for the sales and purchase of foreign currencies. The market passes through the banking network of the world. To ensure smooth delivery in this market, traders must balance their demand and capacity needs through buffering materials. For service, buffering means customers are waiting in the service process (e.g. two working days for spot transactions and a month or more days for forward transactions) so the service process manager must balance demand and capacity, design a waiting system/queues configuration and management of customers psychology of waiting (e.g. experience of paying for academic research publications) (Lovelock and Wirtz, 2011). Foreign exchange services are delivered through the foreign exchange market arrangements which are basically the spot and forward transactions. In the foreign exchange market, the banks, bureau de change/parallel market dealers are the service companies/providers. These are the intermediate buyers of foreign exchange in the market. They serve as intermediaries between the buyers and sellers of foreign exchange. The channels for the services is direct to the customers or to the intermediaries that sells to the customers, they focus on identifying ways to bring the customer and principal or its representative together through franchising, agents, brokers and electronic transfers, etc (Zeithaml and Bitner, 2003). These market intermediaries bring the buyers and sellers of foreign exchange together through the spot and forward market arrangements.

3. Research Methodology

- This section presents the research methodology. It covers the research design, research hypotheses, and sources of data, methods of data collection, model specification and techniques of data analysis.

3.1. Research Design

- A research design is a master plan specifying the methods and procedures for collecting and analyzing needed information. It is a framework of the research plan of action (Zikmund, 1994). In this research, the expost facto research design and the descriptive and analytical research methods are adopted. The descriptive methods of analysis transforms raw data into a form that makes it easy to understand, analyze and interpret. It also examines the statistical significance of various independent variables about a single dependent variable. On the other hand, the analytical research method involves data processing (using analytical tools) with little or no alteration. The expost facto design means that the events had already occurred and there are effects of the independent variables on the dependent variables the period remained unchanged.

3.2. Research Hypotheses

- Based on the research objectives, the following null hypotheses were formulated:i. Ho1: there is no significant relationship between the growth rate of gross domestic product (gdpr) and dutch auction, bureau de change, interbank exchange rates, values of the spot and the forward transactions in Nigeria from the year 2010 to 2016. ii. H02: there is no significant relationship between unemployment rate (uner) and the dutch auction, bureau de change, interbank exchange rates, values of the spot and the forward transactions in Nigeria from the year 2010 to 2016.iii. H03: there is no significant relationship between per capita income (pci) and the dutch auction, bureau de change, interbank exchange rates, values of the spot and forward transactions in Nigeria from the year 2010 to 2016.

3.3. Sources of Data and Methods of Data Collection

- The sources of data in this work are mainly secondary sources, thus secondary data are employed. They were gotten from the Central Bank of Nigeria annual reports, statement of Account and statistical bulletin. Others were textbooks, journal articles, periodicals central Bank of Nigeria bullions, etc. These made the research purely a desk research. Internet facilities were also used in generating data.

3.4. Model Specification

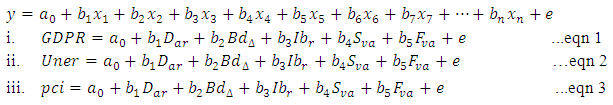

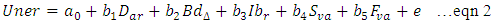

- From the research hypotheses, the following models are specified:

Where:gdpr = Growth Rate of Gross Domestic ProductUner = Unemployment Ratepci = Per Capita IncomeDar = Dutch auction exchange rateBdΔ = Bureau de Change exchange rateIbr = Interbank exchange rate Sva = Values of Spot TransactionFva = Values of Forward Transactionb1 – bn = regression Coefficientsy = Dependent variables (gdpr, Uner and dinc)X1–X2 = Independent Variables

Where:gdpr = Growth Rate of Gross Domestic ProductUner = Unemployment Ratepci = Per Capita IncomeDar = Dutch auction exchange rateBdΔ = Bureau de Change exchange rateIbr = Interbank exchange rate Sva = Values of Spot TransactionFva = Values of Forward Transactionb1 – bn = regression Coefficientsy = Dependent variables (gdpr, Uner and dinc)X1–X2 = Independent Variables 3.5. Techniques of Data Analysis

- The tool of analysis used in this work is the multiple regression model of the Ordinary Least Square method. This regression model investigates the effect of two or more independent variables on a single interval or ratio scaled dependent variables (Zikmund, 1994). In this study, variations in the dependent variables are attributed to changes in each of the independent variables as specified in the models. For test of hypotheses, the F-ratio was used to evaluate the statistical reliability of the result estimate. This involved comparing Fcal value with Ftab. If Fcal > Ftab, then the value of R2 adequately reflects the variations in the independent variables and this shows the strong predictive power of the model. When Fcal < Ftab, the overall significance of the regression model is hampered, implying that the model is weak.

4. Empirical Review

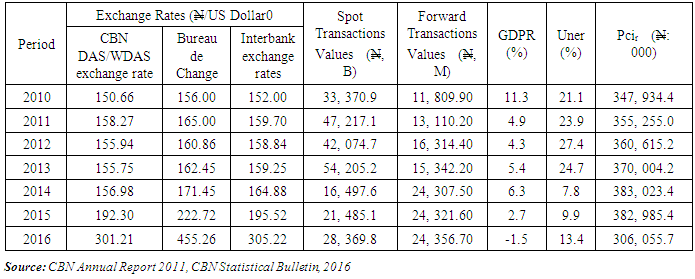

- This section is designed to analyze the data collected. The data are those of the dutch auction/weighted Dutch auction system rates, bureau de change exchange rates, interbank exchange rates, values of spot and forward transactions and the growth rate of gross domestic product, unemployment rates and per capita income in Nigeria from the year 2010 to 2016. These data are presented in table 1.

4.1. Data Presentation

4.2. Data Analysis

- Table 1 shows the relationships that exist among the dependent variables used in this study. Considering the effects of the Dutch auction, bureau de change, interbank exchange rate and the values of spot and forward transactions on the growth rate of gross domestic product in Nigeria from the year 2010 to 2016, it was observed that from the year 2010 to 2012, when the rates of exchange ranged between

150.66 to

150.66 to  165.00 and the values of spot transactions increased from

165.00 and the values of spot transactions increased from  33, 370.9billion to

33, 370.9billion to  47, 217.1billion while the value of forward transaction increased form

47, 217.1billion while the value of forward transaction increased form  11, 809.90million to

11, 809.90million to  13, 110.2million, the growth rate of gross domestic product reduced from 11.3% to 4.9%, unemployment rate rose from 21.1% to 23.9% while per capita income increased at a marginal rate from

13, 110.2million, the growth rate of gross domestic product reduced from 11.3% to 4.9%, unemployment rate rose from 21.1% to 23.9% while per capita income increased at a marginal rate from  347,934.4 billion to

347,934.4 billion to  360,315.2 billion.Between the year 2012 and 2013, when the rates of exchange still dangled between

360,315.2 billion.Between the year 2012 and 2013, when the rates of exchange still dangled between  155.94 and

155.94 and  162.45, spot transactions reduced from

162.45, spot transactions reduced from  47, 217.1billion in year 2011 to

47, 217.1billion in year 2011 to  42, 074.7billion in 2012 and kicked up again to

42, 074.7billion in 2012 and kicked up again to  54, 205.2billion in 2013, the forward transaction had risen from

54, 205.2billion in 2013, the forward transaction had risen from  13, 110.2million in 2011 to

13, 110.2million in 2011 to  16, 314.4million in 2012 and dropped again to

16, 314.4million in 2012 and dropped again to  15, 342.2million in 2013. During these periods, the growth rate of gross domestic product had fluctuated from 4.9% to 4.3% and back to 5.4% respectively, unemployment rate rose from 23.9% to 27.4% but dropped slightly to 24.7% in the respective periods while per capita income increased marginally from

15, 342.2million in 2013. During these periods, the growth rate of gross domestic product had fluctuated from 4.9% to 4.3% and back to 5.4% respectively, unemployment rate rose from 23.9% to 27.4% but dropped slightly to 24.7% in the respective periods while per capita income increased marginally from  35, 323.70billion to

35, 323.70billion to  35, 326.24billion and N42, 816.52billion respectively.From year 2014 to 2016, the exchange rates moved between

35, 326.24billion and N42, 816.52billion respectively.From year 2014 to 2016, the exchange rates moved between  156.98 and

156.98 and  455.26 to a dollar within the Dutch system, bureau de change and interbank exchange arrangements. During this period, spot transactions increased from

455.26 to a dollar within the Dutch system, bureau de change and interbank exchange arrangements. During this period, spot transactions increased from  16, 497.6billion to

16, 497.6billion to  28, 369.8billion while the forward transactions increased marginally from

28, 369.8billion while the forward transactions increased marginally from  24, 307.5million to

24, 307.5million to  24, 356.7million. The economic growth variables at this time had dropped significantly, the gdpr reduced from 6.3% to 2.7% and down to -1.5%, however, unemployment rate which had improved in 2014 by reducing to 7.8% now rose to 9.9% and 13.4% respectively while per capita income that recorded marginal increase to

24, 356.7million. The economic growth variables at this time had dropped significantly, the gdpr reduced from 6.3% to 2.7% and down to -1.5%, however, unemployment rate which had improved in 2014 by reducing to 7.8% now rose to 9.9% and 13.4% respectively while per capita income that recorded marginal increase to  43, 073.74billion in 2014 reduced to

43, 073.74billion in 2014 reduced to  42, 932.91billion in the year 2015. The analysis so far showed that as exchange rates increased with fluctuating increases in spot and forward transactions, the growth rate of gross domestic product reduced significantly to -1.5% in 2016 meaning the country was surviving on borrowing. Unemployment rate was also on the rise except for years 2014 and 2015 meaning that 86.6% of the working force in Nigeria was gainfully employed as at year 2016 compared to years 2011 to 2013.

42, 932.91billion in the year 2015. The analysis so far showed that as exchange rates increased with fluctuating increases in spot and forward transactions, the growth rate of gross domestic product reduced significantly to -1.5% in 2016 meaning the country was surviving on borrowing. Unemployment rate was also on the rise except for years 2014 and 2015 meaning that 86.6% of the working force in Nigeria was gainfully employed as at year 2016 compared to years 2011 to 2013.4.3. Relationship Analyses

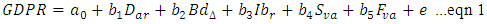

- This section analyzes the hypotheses earlier stated in this work. The first hypothesis was stated as follows in its null form:There is no significant relationship between the growth rate of gross domestic product and the dutch auction, interbank, bureau de change exchange rates, and the values of the spot and forward transactions in Nigeria from the year 2010 to 2016. The regression equation was given as:

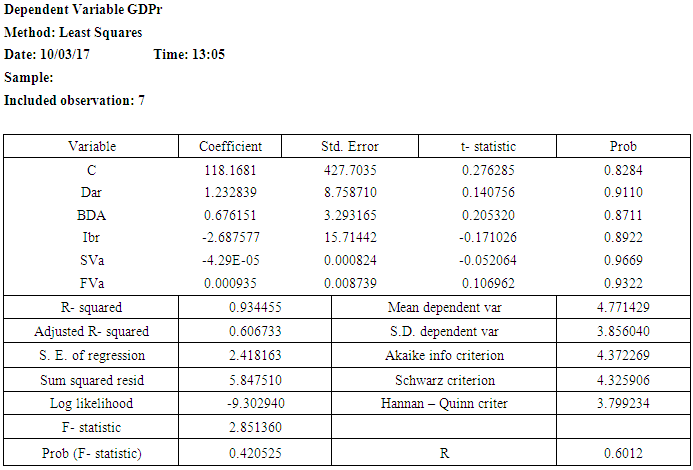

The regression result was stated as follows:

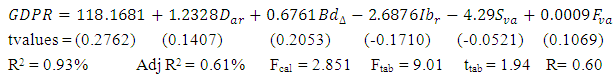

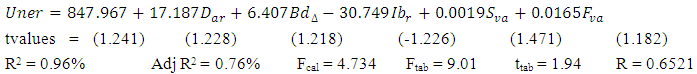

The regression result was stated as follows: From the regression result above, within the period under review, the growth rate of gross domestic product (gdpr) had remained at

From the regression result above, within the period under review, the growth rate of gross domestic product (gdpr) had remained at  118.168billion when the dutch auction, bureau de change, interbank exchange rates, and values of spot and forward transactions equaled zero. A 1% increase in the dutch auction exchange rate increases the growth rate of gross domestic product (gdpr) by 1.23%, a 1% increase in the bureau de change exchange rates increases the gdpr by 0.68%, a 1% increase in the interbank exchange rates reduces gdpr by -2.68%, a

118.168billion when the dutch auction, bureau de change, interbank exchange rates, and values of spot and forward transactions equaled zero. A 1% increase in the dutch auction exchange rate increases the growth rate of gross domestic product (gdpr) by 1.23%, a 1% increase in the bureau de change exchange rates increases the gdpr by 0.68%, a 1% increase in the interbank exchange rates reduces gdpr by -2.68%, a  1 increase in the spot and forward transactions reduced and increased the gdpr by –

1 increase in the spot and forward transactions reduced and increased the gdpr by – 4.29bilion and

4.29bilion and  0.0009million within the period under review respectively. No independent variable was statistically significant as all tcals were below the 1.94 value of ttab. The value of Ftab was 9.01 compared to Fcal of 2.85 meaning that the null hypothesis which states that no significant relationship exist among the variables of exchange rate fluctuations, service delivery in the foreign exchange market and growth rate of gross domestic product was accepted and the alternate hypothesis rejected. R2 was 0.93 meaning that 93% of changes in gdpr were explained by the independent variables. The remaining changes of 7% were caused by other variables not included in the model. R value of 60% showed an above average relationship between growth rate of gross domestic product and measures of exchange rate fluctuations/service delivery in the foreign exchange market.The second hypothesis was aimed at establishing the relationship among variables of exchange rate, service delivery and unemployment rate. The second hypothesis was stated as follows in its null form:There is no significant relationship between unemployment rate and the dutch auction, bureau de change, interbank exchange rates, values of spot and forward transactions and unemployment rate in Nigeria from the year 2010 to 2016. The regression equation was given as:

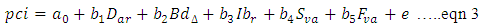

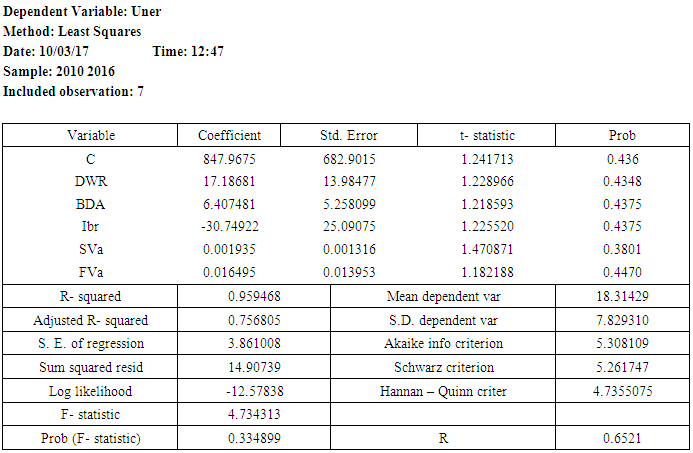

0.0009million within the period under review respectively. No independent variable was statistically significant as all tcals were below the 1.94 value of ttab. The value of Ftab was 9.01 compared to Fcal of 2.85 meaning that the null hypothesis which states that no significant relationship exist among the variables of exchange rate fluctuations, service delivery in the foreign exchange market and growth rate of gross domestic product was accepted and the alternate hypothesis rejected. R2 was 0.93 meaning that 93% of changes in gdpr were explained by the independent variables. The remaining changes of 7% were caused by other variables not included in the model. R value of 60% showed an above average relationship between growth rate of gross domestic product and measures of exchange rate fluctuations/service delivery in the foreign exchange market.The second hypothesis was aimed at establishing the relationship among variables of exchange rate, service delivery and unemployment rate. The second hypothesis was stated as follows in its null form:There is no significant relationship between unemployment rate and the dutch auction, bureau de change, interbank exchange rates, values of spot and forward transactions and unemployment rate in Nigeria from the year 2010 to 2016. The regression equation was given as: The regression result was stated as

The regression result was stated as The regression result above showed that unemployment was 847.967% when the independent variables equaled zero, within the period under review. A 1% increase in the dutch auction exchange rate increased unemployment rate by 17.18%, a 1% increase in bureau de change exchange rate increased unemployment rate by 6.407% while a 1% increase in the interbank exchange rate reduced unemployment by -30.74%. However,

The regression result above showed that unemployment was 847.967% when the independent variables equaled zero, within the period under review. A 1% increase in the dutch auction exchange rate increased unemployment rate by 17.18%, a 1% increase in bureau de change exchange rate increased unemployment rate by 6.407% while a 1% increase in the interbank exchange rate reduced unemployment by -30.74%. However,  1 increase in spot and forward transactions resulted in a very insignificant increment in unemployment rate to the tunes of

1 increase in spot and forward transactions resulted in a very insignificant increment in unemployment rate to the tunes of  0.0019billion and

0.0019billion and  0.0165million respectively. The independent variables were able to explain 96% variations in unemployment rate while the remaining 4% variations were caused by other variables not included in the model. No independent variable was statistically significant as their values were below 1.94 value of ttab. The fcal value of 2.851 was less than ftab value of 9.01 thereby implying that the null hypothesis which states that there is no significant relationship between unemployment rate and variables of exchange rate fluctuations and the delivery of foreign exchange services was accepted and the alternate rejected. The R value of 0.65 showed an above average relationship among the variables studied.The third hypothesis sought to establish the relationship that exist between per capita income and dutch auction, bureau de change, interbank exchange rates, values of spot and forward transactions in Nigeria from the year 2010 to 2016. The regression was given as:

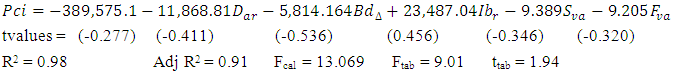

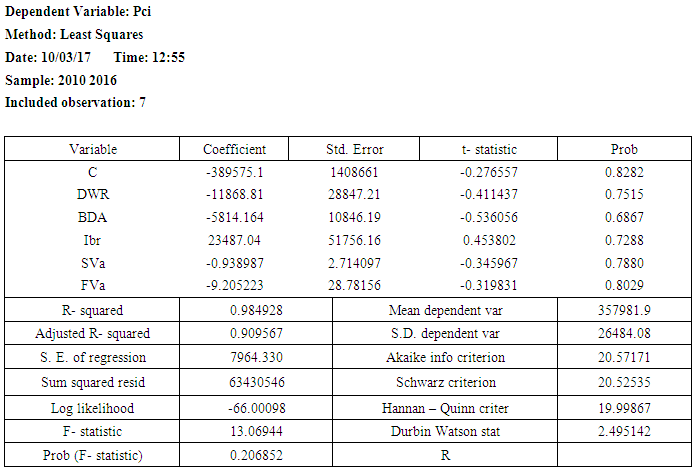

0.0165million respectively. The independent variables were able to explain 96% variations in unemployment rate while the remaining 4% variations were caused by other variables not included in the model. No independent variable was statistically significant as their values were below 1.94 value of ttab. The fcal value of 2.851 was less than ftab value of 9.01 thereby implying that the null hypothesis which states that there is no significant relationship between unemployment rate and variables of exchange rate fluctuations and the delivery of foreign exchange services was accepted and the alternate rejected. The R value of 0.65 showed an above average relationship among the variables studied.The third hypothesis sought to establish the relationship that exist between per capita income and dutch auction, bureau de change, interbank exchange rates, values of spot and forward transactions in Nigeria from the year 2010 to 2016. The regression was given as: The regression result was stated thus:

The regression result was stated thus: The regression result above showed that per capita income was -

The regression result above showed that per capita income was - 389, 575.1 when the independent variable equaled zero, within the period under review. A 1% increase in the dutch auction exchange rate reduced per capita income by -N11, 868.81billion. Also, a 1% rise in bureau de change exchange rate reduced per capita income by -

389, 575.1 when the independent variable equaled zero, within the period under review. A 1% increase in the dutch auction exchange rate reduced per capita income by -N11, 868.81billion. Also, a 1% rise in bureau de change exchange rate reduced per capita income by -  5, 814.164billion. However, a 1% increase in the interbank exchange rate increased per capita income by

5, 814.164billion. However, a 1% increase in the interbank exchange rate increased per capita income by  23, 487.04billion. Again,

23, 487.04billion. Again,  1 increase in the spot and forward transactions reduced per capita income by -

1 increase in the spot and forward transactions reduced per capita income by -  9.389billion and -

9.389billion and -  9.205billion respectively. The independent variables were able to explain 98% of variations in the per capita income while the remaining 2% variations were caused by the variables not included in the model. No independent variable was statistically significant as all tcals were below the 1.94 value of ttab. The Fcal of 13.069 was greater than Ftab of 9.01 indicating a rejection of the null hypothesis which states that there is no significant relationship between per capita income and the dutch auction, bureau de change, interbank exchange rates, values of spot and forward transactions in Nigeria from the year 2010 to 2016.

9.205billion respectively. The independent variables were able to explain 98% of variations in the per capita income while the remaining 2% variations were caused by the variables not included in the model. No independent variable was statistically significant as all tcals were below the 1.94 value of ttab. The Fcal of 13.069 was greater than Ftab of 9.01 indicating a rejection of the null hypothesis which states that there is no significant relationship between per capita income and the dutch auction, bureau de change, interbank exchange rates, values of spot and forward transactions in Nigeria from the year 2010 to 2016.4.4. Results and Discussions

- The main objectives of exchange rate policy were to preserve the value of the currency, maintain a favorable external balance and the overall goal of macroeconomic stability among others. Our focus on this work had been on the macroeconomic performance as measured by growth rate of gross domestic product, unemployment rate and disposable income. It was discovered that inverse relationships exist between gdpr, interbank exchange rate and spot transaction, unemployment rate and interbank exchange rate and between disposable income and the dutch auction exchange rate, values of the spot and forward transactions, meaning that as the interbank exchange rate increases, growth rate of gdpr decreases. In essence, the monies being exchanged are not directed at productive purposes that should boost the domestic market with more goods and services. Since there is no production with the funds so exchanged, unemployment kicks up as reflected in the relationship between interbank exchange rates and unemployment rate. Many producers cannot produce, thereby closing down factories, thus, unemployment rises. The positive relationship recorded among gdpr, dutch auction and forward transactions value are completely marginal, meaning that a greater part of funds being exchanged in Nigeria are directed at other usages, probably unproductive. The total amount of funds channeled to the productive sector is minimal. Again, the exchange rates may be too high for producers to cover cost and realize profits (especially those importing raw materials). So, they stay away from buying foreign exchange. However, it was discovered that a high positive correlation exist between gdpr, dutch auction and bureau de change rates and these were in line with the findings of Oladele, 2015.The positive relationship between unemployment rate and dutch auction and bureau de change exchange rates showed that these exchange rates have contributed to reduction in unemployment rates. However, the rate of reduction is not significant as many are still unemployed. Considering the independent variables, they do not impact significantly on the measures of economic performance, meaning that insignificant contributions are made by them to the growth rate of gross domestic product, unemployment rate and per capita income in Nigeria. Other variables not included in the model may generate a different result. The inverse relationships between per capita income and dutch auction exchange rates, bureau de change rates, values of spot and forward transactions are just confirmation that the country borrowed to consume within the period, because, as unemployment is not reduced, per capita income automatically is affected negatively, it reduced until zero and this is confirmed in the gdpr of -1.5 in 2016 and unemployment rate of 13.4%. Interbank exchange rates only increased per capita income by

5, 537.084billion within seven years. In other words, the independent variables affect economic growth variables negatively.

5, 537.084billion within seven years. In other words, the independent variables affect economic growth variables negatively.5. Summary, Conclusions and Recommendations

- The focus of this work had been on exchange rate fluctuations, delivery of foreign exchange services and economic growth in Nigeria from the year 2010 to 2016. Current economic trend showed that exchange rate had risen significantly making it difficult for businesses to strive. As a result, the domestic market is negatively affected, unemployment rose and per capita income reduced. Section one introduced the work, reviewed literature in section two, presented research methodology in section three, analyzed, interpreted the data and discussions of findings made in section four. This section five summarizes the work, draw conclusion and made recommendations based on findings of the study.From the discoveries so far made, the conclusion of this work is that a rise in interbank exchange rates reduced the growth rate of gross domestic product (gdpr) and unemployment rates in Nigeria between the year 2010 and 2016. Also, a rise in the values of spot transactions also reduced gdpr within the period. However, a rise in the dutch auction and bureau de change exchange rates increased the growth rate of gross domestic product and a rise in interbank exchange rates also increased per capita income. The negative value of gdpr of -1.5% in 2016, implies the consumption of the country had been autonomous. So from these, recommendations are that:i. Participants in the foreign exchange market should undertake forward transactions to serve as an insurance cover (shield) for their spot transactions.ii. Spot transactions should be closely monitored and regulated by the market authorities to minimize the gap between the spot and forward transactions.iii. The exchange rate of the bureau de change should be closely monitored by monetary authorities to reduce the gap between these rates and the official rates.iv. Foreign exchange acquired by Nigerians should be channelled to the productive sectors of the economy to enhance economic growth.v. Government should adopt measures that would bring down the exchange rate of the naira to a US dollar, so that Nigerian producers who make use of imported raw materials can continue in business.

Appendix A

Appendix B

Appendix C

References

| [1] | Bodie, Z. Kane A. and Marcus, A. J. (1998). Essentials of Investments. Chicago: Richard Irwin Inc. Pp. 293. |

| [2] | Byrns, R. T. and Stone, G. W. (1992). Economics. New York: Harper Collins Publisher. Pp. 854. |

| [3] | Clarke, E., Levasseur, M., and Rousseau, P. (1993). International Finance. New York: An International Thomas Publishing Company. Pp. 141 - 150. |

| [4] | Dana-Nicoleta Lascu (2008). International Marketing, 3e. Mason, USA: Cengage Learning, Pp. 272 & 505. |

| [5] | Garba, P. Kassey (1997). The Nigerian Foreign Exchange Market: Possibilities for Convergence in Exchange Rates. Nairobi: African Economic Research Consortium Research Paper, 55, March Series. Pp. 9 and 13. |

| [6] | Jhingan, M. G. (2000). Money, Banking, International Trade and Public Finance. New Delhi: Vrinda Publications Private Ltd. Pp. 431. |

| [7] | LoveLock, Christopher and Wirtz, Jochen (2011). Services Marketing “People, Technology, Strategy” 7th edition. New Jersey: Pearson Educational Inc. Pp. 44 – 46. |

| [8] | McCarthy, E. Jerome and Perreault, William D. J. (1990). Basic Marketing. Boston: Richard D. Irwin Inc. Pp. 732. |

| [9] | Oladele, Alabi R. (2015). Foreign Exchange Market and the Nigerian Economy. Journal of Economics and Sustainable Development, ISSN 2222-2855, Vol.6, No.4, Pp. 105 – 106. |

| [10] | Perreault, William D. and McCarthy, E. Jerome (2002). Basic Marketing: A Global Managerial Approach. New York: McGraw Hill/Irwin. Pp. 251. |

| [11] | Pilbeam, Keith (1998). International Finance. New York: Palgrave. Pp. 65 – 71. |

| [12] | Rewane, Bismark J. (2015). Exchange Rate Management: Evolution of the Nigerian Foreign Exchange Market. CBN Bullion, Abuja: CBN Research Unit, Vol. 39, No. 1. Pp. 15 – 16. |

| [13] | Ross, Stephen A., Westerfield, R. W. and Jordan, B. D. (2006). Fundamentals of Corporate Finance. New York: McGraw Hill/Irwin. Pp. 70 - 75. |

| [14] | Ubom, A. U. (2010). Foreign Exchange Flows and Economic Development in Nigeria. 2nd Annual International Conference on Economics, Business and Entrepreneurial Development in Collaboration with The Academy of Business and Public Policy, University of Uyo, Uyo Nigeria, Pp. 134 -143. |

| [15] | Ubom, A. U. (2010). The Impact of Financial Crises on Foreign Exchange Flows in Nigeria. Journal of Administrative Science, Department of Marketing, University of Uyo, Uyo; Vol. 1, No. 1, Pp. 223 -224. |

| [16] | Ubom, A. U. (2017). Dynamics of International Finance and Investments. An Unpublished Monograph Series 1, Pp. 27 – 29. |

| [17] | Zeithaml, Valarie A. and Bitner, Mary Jo (2003). Services Marketing: International Customer Focus Across the Firm. New York: McGraw Hill Companies, Pp. 382. |

| [18] | Zikmund, W. G. (1994). Business Research Methods. Olrlando: the Dryden press. Pp. 42 – 44 and 575. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML