-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(2): 19-26

doi:10.5923/j.ijfa.20180702.01

Impact of E–Taxation on Nigeria’s Revenue and Economic Growth: A Pre – Post Analysis

Chijioke N. Ofurum , Leonard I. Amaefule , Bossco E. Okonya , Henry C. Amaefule

Department of Accountancy, Imo State University, Owerri, Imo, Nigeria

Correspondence to: Chijioke N. Ofurum , Department of Accountancy, Imo State University, Owerri, Imo, Nigeria.

| Email: |  |

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study examined the impact of E-Taxation on Nigeria’s revenue and economic growth. Given that the purpose of introducing electronic tax system is to improve revenue collection which will in turn improve the country’s economic growth, the study empirically examined how the implementation of E-taxation in 2015 has affected Tax Revenue, Federally Collected Revenue and Tax-to-GDP ratio. The study made use of secondary data sourced from Federal Inland Revenue Service, and Central Bank of Nigeria Statistical and Economic Reports on quarterly basis from second quarter 2013 to fourth quarter 2016. The data were divided into two: pre e-tax period and post e-tax period. Means of the two sets of data were compared using a pre-post technique called paired sample t-test. Findings from the study revealed that the implementation of electronic taxation has not improved tax revenue, federally collected revenue and tax-to-GDP ratio in Nigeria. However, findings revealed that Federally Collected Revenue and Tax-to-GDP ratio significantly decreased after e-taxation was implemented. Also, Tax Revenue decreased after the implementation but the mean difference was not statistically significant. It was recommended amongst others that federal government through the Federal Inland Revenue Services should conduct more enlightenment seminars in all 36 states in the country to increase the knowledge on the use of all electronic services on their platform.

Keywords: E-Taxation, Tax Revenue, Federally Collected Revenue, Tax-to-GDP ratio, Implementation

Cite this paper: Chijioke N. Ofurum , Leonard I. Amaefule , Bossco E. Okonya , Henry C. Amaefule , Impact of E–Taxation on Nigeria’s Revenue and Economic Growth: A Pre – Post Analysis, International Journal of Finance and Accounting , Vol. 7 No. 2, 2018, pp. 19-26. doi: 10.5923/j.ijfa.20180702.01.

Article Outline

1. Introduction

- Taxation is one of the major sources of revenue in many countries, both developing and developed. According to Organisation for Economic Co-operation and Development (OECD) (2017), United State government revenue from taxes accounts for over 50 per cent of all government revenue since the past decade, and is expected to account for $5.6 million out of $6.7 million predicted to be generated in 2018 by the government. It has been ranked as a major source of revenue in countries such as UK, France, Sweden, Norway, and other high income countries. In Africa, tax revenue has significantly contributed towards the economic growth of different countries. According to OECD (2017) [1] the tax-to-GDP ratios in eight African countries namely: Tunisia, Morocco, South Africa, Senegal, Mauritius, Cote d’Ivoire, Rwanda and Cameroon ranged from 16.1% to 31.3%, in 2014. Tunisia had the highest tax-to-GDP ratio in 2014 (31.3%), followed by Morocco (28.5%). This figure is higher than tax-to-GDP ratio of some countries listed by Organisation for Economic Co-operation and Development as High-Income countries.In Nigeria, taxation has been existing even before the amalgamation in 1914 of the North and South protectorate to form the territory now called Nigeria. The types of taxes paid in those days are inform of homage paid to Oba’s household contribution for maintenance of peace and maintenance of security guards, soldiers, penalty paid for non -performance of civil right and contribution to educational development. However its place has not been well reorganized as it were in other countries. For example, while most countries both within and outside Africa categorize their revenues as tax-revenues and non-tax revenues, in Nigeria federally collected revenue is categorized under oil revenue and non-oil revenue. It is also discouraging to reveal that tax revenues has not contributed significantly toward the economic growth of Nigeria when compared with tax-to-GDP ratio of other African countries such as Cameroon, Senegal, Tunisia, and so on.It has been observed that in most countries where tax revenues significantly constitute a major part of the economy’s revenue, they have been using Electronic Tax system for years. E-taxation is an electronic self-service platform that enables taxpayers to file their tax returns and conduct other tax services online at their convenience irrespective of their locations once internet is available. According to the World Bank and PWC (2013) [2], 66 economies had fully implemented electronic filing for payment of taxes as at 2010, 20 of them adopted the system in the past 7 years. World Bank and PWC (2015) [3] Paying Taxes Survey in 2005 revealed that taxpayers are able to file tax returns electronically in about 45% of the countries that were surveyed. In 83% of the surveyed countries, taxpayers are able to complete at least one aspect of their tax compliance process electronically. In 2014, more than 24 countries instituted reforms that made it easier or less costly for firms to file returns and pay taxes and the most common feature of tax reforms globally was the introduction of, or enhancement of electronic filing system. Such changes were implemented in 18 countries including Costa Rica, Cyprus, Mozambique, Spain, Vietnam, Serbia, and Zambia, amongst others. Businesses in these countries now file returns electronically thus spending less time on compliance. The system also increased transparency and limited the opportunity for corruption and bribery, (Ezomike, 2016) [4]. In a bid to improve the Nigeria tax system for effective tax administration, the Nigeria Interbank Settlement System (NIBSS) and SystemSpecs Nigeria Limited partnered with the Federal Inland Revenue Services (FIRS) to provide electronic payment of taxes in Nigeria in 2015. Electronic taxation system was introduced to automate all core processes from tax registration, payment, assessment, monitoring exercise, tax audit and investigation, taxpayers file management and returns filing.Despite the improved technology integration in the Nigeria Tax system, it remains unclear how the implementation has affected government tax revenues specifically, and overall federally collected revenue and Gross Domestic Product.Motivation for the studyPoor contribution of tax revenues to total federally collected revenue in Nigeria, and the ratio of tax revenue to Gross Domestic Product is alarming. Whereas other African countries such as Ghana, Tunisia, Morocco, and so on, have their tax revenues constituting significant portion of their total revenue and Gross domestic Product, Nigeria being the giant of Africa has a significant low tax-to-GDP ratio when compared with these countries. Example, OECD (2014) [5] revealed that in Ghana 73 per cent of its total revenue was generated from tax; in Tunisia, tax revenue accounted for 31.3 per cent of her Gross Domestic Product, while in Morocco, tax-to-GDP ratio was 28.5 per cent. However, in Nigeria, tax-to-GDP ratio was 5.2 percent in 2014 (Federal Inland Revenue Service, 2015 [6], & CBN, 2016 [7]). Also available records shows that this figure has remained below 13 per cent since 2001, and tax revenues has not accounted up to 50 per cent of federally collected since this period.With the implementation of Electronic Taxation, it is expected that there will be a significant improvement in tax revenues, which will in turn affect total federally collected revenues and the economic growth at large as witnessed in other countries. However, since the implementation of E-Taxation in 2015 no empirical evidence has shown the extent to which the new technology has achieved this purpose, hence the need for this study. The following hypotheses were formulated to guide the studyHA1: The implementation of E-taxation has significant effect on tax revenue in Nigeria.HA2: The implementation of E-taxation has significant effect on federally collected revenue in Nigeria.HA3: The implementation of E-taxation has significant effect on tax–to–GDP ratio in Nigeria.The remaining part of this work is divided into four sections: section two reviewed the relevant conceptual, theoretical and empirical literatures. Section three shows the research methods applied. Data presentation, analysis and discussion of results were done in section four. Section five concluded the study and offered some recommendations.

2. Review of Related Literature

2.1. Conceptual Framework

- Concept of Taxation: Taxation refers to compulsory or coercive money collection by a levying authority, usually a government. The term "taxation" applies to all types of involuntary levies, from income to capital gains to estate taxes. According to McLure (2015) [8] taxation is a mandatory financial charge or some other type of levy imposed upon a taxpayer (an individual or other legal entity) by a governmental organization in order to fund various public expenditures. Taxation is seen by Aguolu (2004) [9], as a compulsory levy by the government through its agencies on the income, consumption and capital of its subjects. These levies are made on personal income, such as salaries, business profits, interests, dividends, discounts and royalties. It is also levied against company’s profits, petroleum profits, capital gains and capital transfer. According to Adams (2001) [10] taxation is the most important source of revenue for modern governments, typically accounting for ninety percent or more of their income.Tax is a common source of income generation for financing government activities. Individuals and organizations are expected to fulfill their obligations on tax payments as required by law to give the government the financial power, amongst other purpose of taxation. Effective taxation therefore becomes important as it is a source of required financial power for a government to rule its territory. E-TaxationE-taxation is the process of assessing, collecting and administering the taxation process through an electronic media. In the words of Che-Azmi & Kamarulzaman (2014) [11], E-taxation is one of the ways through which governments around the world utilize information and communication technologies to improve the delivery of public services and the dissemination of public administration information to the public. Wasao (2014) [12], describes electronic tax system as an online platform whereby the taxpayer is able to access through internet all the services offered by a financial authority such as the registration for a personal identification number, filing of returns and application for compliance certificate, a perfect example of such system is the Electronic taxation system that was rolled out by FIRS in Nigeria.According to Australian National Audit Office (2015) [13] e-taxation was first introduced in 1986 in the U.S.A. In Australia electronic tax-filling was introduced in 1987 through its modernization programme. By 1993, Canadian taxpayer’s commenced electronic filling of tax returns through the E-fills, Malaysia, Netherlands & Uganda all introduced electronic payment of tax to their taxpayers for the commences of both the revenue authorities and taxpayers in 2009. In March 2013, Egypt launched electronic payment of tax for its taxpayers, to keep pace with the international trades towards automated payments systems, especially for government services. Nigeria joined the trend in 2015 when Federal Inland Revenue Service (FIRS) in collaboration with Inter - bank settlement System (NIBSS) implemented the technology in the Nigeria tax system, (Okunowo, 2015 [14]). Electronic tax system was introduced by Nigeria Tax Authority to increase financial collection, administration, render services to the tax payers all the time from anywhere, reduce costs of compliance and improve tax compliance. It is rapidly replacing paper-based tax reporting systems. Promising many advantages over the traditional method of hard copy tax filing, these systems promise faster process, lower costs and increased efficiency. FIRS has a centralized Information Communication Technology (ICT) department that provides support services in terms of electronic systems to the entire organization all these to try and achieve its goals for achieving increased revenue collection and facilitating voluntary compliance by taxpayers.In the authority of Abdulrazaq (2015) [15] Elements of FIRS Electronic Tax Filing and Online Payment of Taxes are:Ÿ Taxpayers returns filed online: Taxpayers can file all their tax returns online, for example Companies Income Tax (CIT), Value Added Tax (VAT), Capital gains Tax (CGT) and Petroleum Profits Tax (PPT), through the online platform.Ÿ Tax payment on the platform: Taxpayers can pay their taxes online from their bank accounts effective March 2015. This application which was developed in collaboration with the Nigeria Inter-Bank Settlement System (NIBBS) is hosted on the respective commercial bank’s internet-banking platform.Ÿ Processing & issuance of Electronic Tax Clearance Certificates: Taxpayers can apply for a TCC online and get electronic tax clearance certificates via the platform.Ÿ Verification of Tax Identification Number (TIN): Companies can verify the TIN of their vendors on the platform. This would solve the stress encountered when filing Withholding Tax monthly.Ÿ Electronic correspondence with FIRS official.Ÿ Online imposition of late filing penalties and interests: The online platform automatically compute and impose interest and penalties for late submission of tax returns or late payment of taxes.Government revenueGovernment revenue is money received by a government. It is the amount of money that a company actually receives during a specific period. Revenues earned by the government are received from sources such as taxes levied on the incomes and wealth accumulation of individuals and corporations and on the goods and services produced, exports and imports, non-taxable sources such as government-owned corporations' incomes, central bank revenue and capital receipts in the form of external loans and debts from international financial institutions. Government revenue is an important tool of the fiscal policy of the government. Governments use revenue for the development of the country, such as: construction of roads, bridges, build homes, fix schools etc. The money that government collects pays for the services that is provided for the people. The sources of finance used by the central government are mainly taxes paid by the public.In Nigeria, federally collected revenue is divided into oil revenue and non-oil revenue. While oil revenue covers all revenue generated from oil and gas activities in the country, non-oil revenue looks at any revenue earned from sources other than oil and gas activities. While other countries within and outside Africa segment their revenues into tax and non-tax revenue, Nigeria preferred oil and non-oil due to the fact that oil is the major revenue driver of the economy.Gross Domestic ProductGross domestic product (GDP) is a monetary measure of the market value of all final goods and services produced in a period. Nominal GDP estimates are commonly used to determine the economic performance of a whole country or region, and to make international comparisons. The OECD (2017) [1] defines GDP as "an aggregate measure of production equal to the sum of the gross values added of all resident and institutional units engaged in production (plus any taxes, and minus any subsidies, on products not included in the value of their outputs). Coyle (2014) [16] states that "GDP measures the monetary value of final goods and services - that is, those that are bought by the final user - produced in a country in a given period of time. GDP is considered the "world's most powerful statistical indicator of national development and progress. Total GDP can also be broken down into the contribution of each industry or sector of the economy.In most developed and developing countries, Tax revenue accounts for a significant portion of their revenue. According to OECD (2015) [17] Denmark, Finland, Norway, Sweden, Timor-Leste have a tax-to-GDP ratio of above 50 percent in 2015, with Timor-Leste recording the highest ratio (61.5 per cent). In Africa, Cote d’Ivoire has tax to GDP ratio of 15.3 per cent, Cameroon has 18.2 per cent, and Ghana has 20.8 per cent while Nigeria has 6.1 per cent. In the lights of this study, the researcher wants to ascertain the extent to which e-taxation implementation in Nigeria has affected its contributions to the country’s GDP.

2.2. Theoretical Framework

- This study is on “implementation of e-taxation and its resultant effect on revenue generation in Nigeria”. Since e-taxation is an innovation newly introduced in an already existing system, it is therefore rational to discuss some innovation theories such as “The Theory of Innovation Diffusion”, “The Theory of Innovation Translation”, and other theories relevant to taxation.The Theory of Innovation DiffusionThe Shorter Oxford English Dictionary defines innovation as “the alteration of what is established; something newly introduced” (Oxford 1973 [18]). The Macquarie Dictionary adds “introducing new things or methods” (Macquarie Library 1981 [19]), and Roget’s Thesaurus offers the synonyms ‘newness’ and ‘change’. Diffusion of innovations is a theory that seeks to explain how, why, and at what rate new ideas and technology spread. Everett Rogers, a professor of communication studies, popularized the theory in his book Diffusion of Innovations; the book was first published in 1962, and is now in its fifth edition (2003). Rogers (2003) [20] argues that diffusion is the process by which an innovation is communicated over time among the participants in a social system, while diffusion is the process by which an innovation is communicated through certain channels over time among the members of a social system. Given that decisions are not authoritative or collective, each member of the social system faces his/her own innovation-decision that follows a 5-step process:1) Knowledge – person becomes aware of an innovation and has some idea of how it functions,2) Persuasion – person forms a favorable or unfavorable attitude toward the innovation, 3) Decision – person engages in activities that lead to a choice to adopt or reject the innovation,4) Implementation – person puts an innovation into use,5) Confirmation – person evaluates the results of an innovation-decision already made.The most striking feature of diffusion theory is that, for most members of a social system, the innovation-decision depends heavily on the innovation-decisions of the other members of the system. Rogers (2003) [20] argues that after about 10-25% of system members adopt an innovation, relatively rapid adoption by the remaining members and then a period in which the holdouts finally adopt. However, there is still a tendency of having failed diffusion. Failed diffusion does not mean that the technology was adopted by no one. Rather, failed diffusion often refers to diffusion that does not reach or approach 100% adoption due to its own weaknesses, competition from other innovations, or simply a lack of awareness.Rogers proposes that four main elements influence the spread of a new idea: the innovation itself, communication channels, time, and a social system. This process relies heavily on human capital. The innovation must be widely adopted in order to self-sustain. Within the rate of adoption, there is a point at which an innovation reaches critical mass. According to Rogers (2003) [20], the categories of adopters are innovators, early adopters, early majority, late majority, and laggards. In regards to e-taxation, Nigeria can be categorized as laggards because since its introduction in 1986, Nigeria being the giant of Africa failed to key into the innovation before other African countries. This theory is relevant to this study as the various elements that influence the spread of a new idea is been considered by the Federal Inland Revenue Services, more especially by involving Nigeria Inter-Bank Settlement System as a channel through which taxpayers can conveniently pay their taxes. Theory of Innovation TranslationAn alternative view of innovation is that of innovation translation proposed in actor-network theory (ANT). Theory of Innovation Translation is a theory of innovation in which, instead of using an innovation in the form it is proposed, potential adopters translate into a form that suits their needs. Actor-Network Theory (ANT) rather than recognizing in advance the essences of humans and of social organaisations and distinguishing their actions from the inanimate behavior of technological and natural objects adopts an anti-essentialist position in which it rejects there being some difference in essence between humans and non- humans. According to Latour (1986) [21], ANT considers both social and technical determinism to be flawed and proposes instead a socio-technical account in which neither social nor technical positions are privileged. In this socio-technical order nothing is purely social and nothing is purely technical. ANT deals with the social-technical divide by denying that purely technical or purely social relations are possible. What seems, on the surface, to be social is partly technical, and what may appear to be only technical is partly social. The model of translation as proposed in actor-network theory proceeds from a quite different set of assumptions to those used in innovation diffusion. Callon et al. (1983) [22] propose that translation involves all the strategies through which an actor identifies other actors and arranges them in relation to each other. Latour (1986) [21] argues that the mere ‘possession’ of power by an actor does not automatically confer the ability to cause change unless other actors can be persuaded to perform the appropriate actions for this to occur. In the context of this study, the actor is the FIRS charged with the sole responsibility of administering and collecting taxes from tax payers. These theory suggests that it is the responsibility of the body to translate existing e-taxation innovations in other countries to suit the need of the Nigerian government and citizens, and also insure its implementation by persuading tax payers to comply.

2.3. Empirical Review

- Monica, Makokha and Namusonge (2017) [23] in their study “Effects of Electronic Tax System on Tax Collection Efficiency in Domestic Taxes Department of Kenya Revenue Authority (KRA), Rift Valley Region’ adopted a case study research design to establish the effects of electronic tax payment on revenue collection efficiency by KRA in Rift Valley region; find out the effect of electronic tax filing on revenue collection efficiency, examined the effect of staff competency on revenue collection efficiency and to find out the level of taxpayers’ knowledge in operating electronic tax system. The main data collection tools were questionnaires that were administered to 130 respondents who included employees of KRA and tax payers. Descriptive & inferential statistics where employed as data analysis technique. Findings from the study revealed that most tax payers strongly agreed that they were able to fully access and operate iTax system. Employee competence (X3) was a significant predictor of the tax collection efficiency (Y) with the results as (t= -2.243, P=.154>5%). Taxpayers seeking clarifications on tax issues online is minimal. Handling of iTax issues raised by taxpayers was not satisfactory and KRA management and other staff in other departments were partially supportive of iTax system.Owino, Otieno and Odoyo (2017) [24] in their study, “Influence of Information and Communication Technology on Revenue Collection in County Governments in Kenya: A Comparative Study of Migori and Homa Bay County Governments”, used a correlation study research design to determine the influence of ICT system for single business permits on revenue collection; evaluate the influence of ICT system for land rates on revenue collection; establish the influence of ICT system for property rates on revenue collection and establish the influence of ICT system for bus park on revenue collection in Migori and Homa Bay County Governments, Kenya. The target population was 864 consisting of 848 revenue clerks and 16 revenue officers from which a Sample size of 86 respondents were selected using stratified random sampling technique. Primary data were collected with the use of questionnaire, and analyzed using percentages, means and regression techniques. The findings showed that a strong and almost a perfect association existed between ICT systems adopted in County Governments and the revenue collection; the application of the information communication technology systems explain up to 91.9% variation in revenue collection efficiency in the county governments. Further findings revealed that the application of these systems improves revenue collection efficiency in the county governments.Eneojo and Gabriel (2014) [25] in their study “Taxation and Revenue Generation: an Empirical Investigation of Selected States in Nigeria” examined the extent to which tax revenue generation has contributed towards the economy’s total revenue and Gross Domestic Product and also the effect of tax evasion and tax avoidance on revenue generation in Nigeria. The study employed both primary and secondary sources of data. Using a survey research design, the study focused on all staff of Federal Inland Revenue Service Abuja FCT office, the States Board of Internal Revenue in Kogi State (North Central Zone), in Delta State (South Southern Zone), in Ondo State (South Western Zone), in Niger State (North Western Zone), in Ebonyi State (South Eastern State) and Abuja FCT was chosen by the researcher to replace Taraba State (North Eastern State). For the secondary data, Internally Generated Revenue by the six Geo-Political Zones, taxes collected by Federal Inland Revenue Service, Abuja FCT, and the country’s GPD were collected from 2002 to 2011. Both descriptive and regression analysis were carried out on the data. Findings from the study revealed that taxation has a significant contribution on revenue generation, taxation has a significant contribution on Gross Domestic Product (GDP) and tax evasion and tax avoidance have a significant effect on revenue generation in Nigeria.Oriakhi and Ahuru (2014) [26] examined the relationship between federally collected revenue and specific tax revenue generation sources such as custom and Excise Duties (CED), value added tax (VAT), petroleum profit tax (PPT), company income tax (CIT). Secondary data were collected for each of the tax sources from 1981 – 2011. The study employed advanced econometric analysis such as regression, co-integration, error correction modelling and pairwise granger causality tests. The various income taxes were used as the independent variables while “Federally collected Revenue” was used as the dependent variable. The study concludes that the various income taxes were statistically significant and have positive relationship with federally collected revenue. The Granger causality shows that custom and excise Duties and value-added Tax granger causes federally collected revenue.

3. Data and Methods

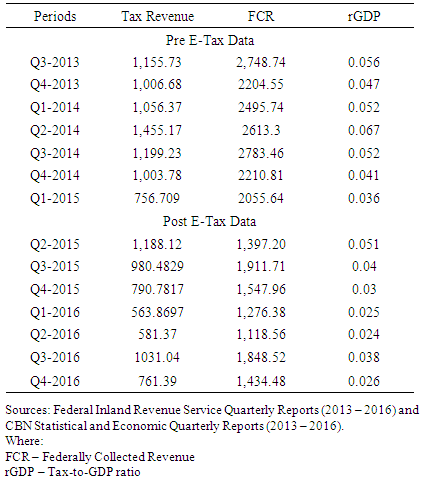

- Secondary data sources were utilized for this work, the data were sourced from Federal Inland Revenue Service tax report and Central Bank of Nigeria Statistical bulletin and Quarterly Economic Reports. The data sourced were Tax revenue, federally collected revenue and Tax-to-GDP ratio. For the purpose of this study, quasi-experimental research design was adopted. Among the different types of Quasi-experimental designs the Pre-Post (difference in time) design was considered appropriate for the study. It calculates the effect of a treatment (i.e., an explanatory variable or an independent variable) on an outcome (i.e., a response variable or dependent variable) by comparing the average change over time in the outcome variable for the treatment group, compared to the average change over time for the control group.This method best suit the purpose of this work as the researcher divided the income generated through tax into two, based on the time electronic taxation was implemented in Nigeria (i.e. revenue generated before the implementation and after the implementation); in the same manner, federally collected revenue and the country’s Tax-to-GDP ratio were also grouped. For each group of the time series data, their means were compared to determine the extent to which the newly implemented system has caused a change.

|

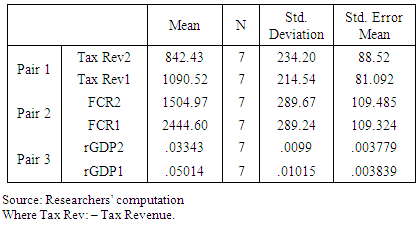

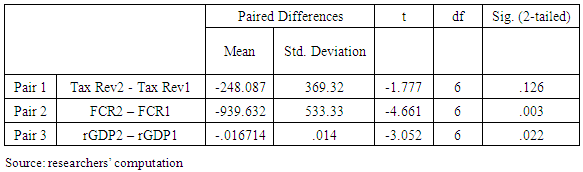

4. Data Analysis and Discussion of Results

|

|

5. Conclusions

- This study examined the impact of E-Taxation on Nigeria’s Revenue and economic growth. We studied E-Taxation’s impact on the country’s tax revenue, federally collected revenue and tax-to-GDP ratio. Analysis on the three pairs of data revealed that the implementation of electronic taxation has not improved tax revenue, federally collected revenue and tax-to-GDP ratio in Nigeria. However, the researchers are optimistic that in a long run, the benefits of electronic taxation will outweigh the cost based on the facts that most new innovations always have compliance challenges at the beginning. Against this findings the following recommendation were made.Ÿ Federal government through the Federal Inland Revenue Services should conduct more enlightenment seminars in all 36 states in the country to increase the knowledge on the use of all electronic services on their platform.Ÿ All existing tax payers should be given mandate on when they are expected to complete their e-registration and e-filling.Ÿ Mobile version of FIRS electronic tax portal should be created and made available for different types of mobile operating system such as Android, Windows and Apple OS. This will no doubt increase the adoption rate by tax payers as mobile phones are being increasingly used.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML