-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(1): 13-18

doi:10.5923/j.ijfa.20180701.03

Testing of Agency and Stewardship Theories on Financial Accountability in Sulawesi Region, Indonesia

Novi S. Budiarso, Silvya L. Mandey, Herman Karamoy

Sam Ratulangi University, Faculty of Economic and Business, Manado, Indonesia

Correspondence to: Novi S. Budiarso, Sam Ratulangi University, Faculty of Economic and Business, Manado, Indonesia.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study aims to analyze the effect of local government characteristics on the accountability level in local government financial statement. This study performs binary logistic regression for testing the effect of size of local government, financial dependency of local government to central government, audit findings, and financial statement distortion by local government on accountability of local government financial statement for period of 2012 to 2016 in Sulawesi Region of Republic of Indonesia. The results show that size of government and audit findings have significant effect on accountability of local government financial statement, but financial dependency of local government to central government and financial statement distortion by local government have insignificant effect. The results indicate that local government in Sulawesi Region behave as a steward for internal monitoring mechanisms, and behave as a agent for external mechanisms.

Keywords: Accountability, Local Government, Agent, Steward

Cite this paper: Novi S. Budiarso, Silvya L. Mandey, Herman Karamoy, Testing of Agency and Stewardship Theories on Financial Accountability in Sulawesi Region, Indonesia, International Journal of Finance and Accounting , Vol. 7 No. 1, 2018, pp. 13-18. doi: 10.5923/j.ijfa.20180701.03.

Article Outline

1. Introduction

- The implementation of administrative reform in the last decade have supported by many countries, such as Australia [42] Afrika [14, 17], Mauritius [9], and Indonesia [43]. Accountability is very important for government as a tool to attract the trust of public people or public who have highly interests. The consequence is while governments have no accountability then public people shall not believe about the running programme by governments [35].Reform on public sector should be followed by reform on accounting field because it will give informations and measurable value to justify the accountability of governments [11]. Semantically, accountability is very closely with accounting field in term to give better basic of public accountability and audit performance [6]. [39] explain that the mechanism of accountability can be seen in governmental financial reporting system. Furthermore, [37] explains that financial statements can be used by governments to show their responsibility to public people and at once to realize the public organization accountability. In Indonesia, the results of financial report review show that unqualified opinion for local governments are still far from than expected.

2. Literature Review

2.1. Agency Theory and Stewardship Theory

- Information on financial statements of local government that obtains unqualified opinion, illustrates the highly of quality and reliability on financial statements if compared to government financial statements that obtain adverse opinions. Several previous studies examined agency issues in the public sector [30, 1, 3]. A varied pattern of accountability among local governments is thought to be due to an agency conflict between government as agents and the community as principals [30]. The basic idea of this theory is that policymakers and public managers do not share the same interests of society [28, 20-22].Risk sharing is the basis of agency theory which extends the concept of risk sharing by linking it to agency issues that occur when interested parties have different goals and different job descriptions [16]. In addition to risk, [21, 22] explains that the agency theory is developed based on economic information, and the separation of the perpetrators of the two parties namely principals and agents, where the owner acts as the bearer of risk and manager as the executor of decision-making functions.Agency theory relates with two problems that can occur to agency relationships. The first problem is when there is a conflict of interest or purpose between the principal and the agent, as well as the high cost required to verify what the agent does [21, 22, 28]. The problem that arises is the principal can not ensure that the agent behaves in accordance with the wishes of the principal. The second is the problem of risk sharing that arises when principals and agents have different actions because of differences in risk preferences. [28] argue that when viewed from the point of ownership then identifying individual rights, costs and rewards will be allocated to the parties within an organization and spelled out in the contract while from the cost of agency costs, many problems with respect to the limitations of corporate theory can be viewed as a special case of agency agency relationships.The agency relationship is tied into a contract where one or more people who act as principals are hiring another person who act as agents to perform some tasks for the principal's interest. Implementation of this task requires the delegation of some decision-making authority to the agent. The principal may limit this distinction of interest by monitoring the actions of the agent with aim of limiting the activity of deviation from the agent and to ensure that the objectives by agents are aligned with the objectives by principal [28]. These monitoring actions have implications for the emergence of costs where monitoring costs are fees paid by principals to measure, observe and exercise to control on agent behavior. These costs include audit fees, executive compensation contract making, and contract termination costs with managers [34].Stewardship theory is a theory that views the relationship between principals and stewards based on the premise on the basis of behavior different from agency theory [16, 15, 13]. The actions and roles of managers are motivated by the need for self-achievement to gain intrinsic satisfaction through success in performing the duties and responsibilities and authority to gain recognition from superiors. Managers have motivations that are in line with principal objectives. There is no financial motivation underlying the actions of managers, managers acting in line with the interests of the organization. Managers understand themselves as responsible servants and behave accountably in managing resources and choose to exercise their authority for long-term organizational interests, to whom they are responsible and to place the interests of the entity above self-interest. Governance is come up by individual in context of psychological and situational in view of organizational so the results of organizational governance structures are rooted not only in the psychological and motivational factors by agents but also of organizational and cultural conditions that exist within an organization [13].Governance which oriented for service comes from the motivation of agents as well as the cultural conditions of the organization's leaders. The agent's accountable behavior will occur when the main values meet and the sense of responsibility is created, as a consequence the basic method of control over servant behavior can be reduced because the volunteer servants will be held accountable. Furthermore, unlike agency theory in which agents behave opportunistically and self-serving, motivated by econonomic considerations, service theories are based on higher level needs such as self-actualization through the fulfillment of personal values and aspirations. The initial needs are largely derived from outside the self and driven by rewards and sanctions while the next necessity is the inner motivation and function of personal motivation [13]. Servants in an organization behave responsibly to the effects of organizational action through the welfare of stakeholders. The issue of balance is the key to personal responsibility in relation to group welfare. Servants will strive to balance the obligation to stakeholders outside and within the company, as well as commit to the social environment and norms in society.

2.2. Hypothesis Development

- The studies of show that there is a significant and positive relationship between the size of the government and the disclosure of financial statements [4, 18, 26, 27, 12, 10, 8, 33, 41]. Reversely, indicates that the population as a proxy of government size in countries with GAAP regulation and the combination of countries with GAAP and non GAAP regulation has a significant relationship with the level of disclosure of financial statements, whereas in non-GAAP countries showed otherwise [23]. The results of [38] and [29], states that there is no significant relationship between the size of the government and the disclosure of financial statements.Ha1: Size of local governments have effect on their accountability of financial statements.The moral hazard behavior of the government on the management of DAU arises because the government does not take full consequences and is responsible for the actions and the less cautious. This behavior can either suggest activities that are not a priority, allocate or increase unnecessary spending components in an activity or vice versa, grant transfers for local governments accompanied by increases in expenditures or regional expenditures, in contrast to responses resulting from increases in revenues generated of taxes [2, 40, 31] The studies of [38, 26, 12, 41, 8] indicate that there is a significant relationship between financial dependence on central government with disclosure of financial statements, while [29] stated that there is insignificant relationship between local government dependency on financial statement disclosure.Ha2: Financial dependency of local governments have effect on their accountability of financial statementsContext of stewardship theory said that the government's motivation in managing is not based on individual goals but more instead to stewards where the local governments align their goals and interests with the goals and interests of the entity [13, 44] Government action is based on a commitment to common interests rather than self-interest. The implications of a financial reward incentive system for managers will be less effective against performance goals [7]. The government performs its duties and authority responsibly, since there is no motivation issue between the government and the community. Performance variations arise due to the structural situation with respect to the effectiveness of facilities supporting the actions of the government [15]. The result of [33] dan [12] show that audit findings influence the disclosure of local government financial statements, while [24] indicate that audit findings have no effect on the disclosure of local government financial statements.Ha3: Audit findings have effect on their accountability of financial statementsThe agency theory is becoma a rationale for some researchers to understand the phenomena in the public sector [5, 19, 27, 44, 29], The relationship between government and society is seen as an agency relationship where the community is the principal and the government is the agent. In this scenario the government is assumed to be self-serving and maximize its prosperity, the prosperity of the community is influenced by the actions of the government in terms of the selection of decisions [44]. The studies of [33] research indicate that there is a significant negative correlation between the rate of irregularities and disclosure of financial statements, while [25] study indicate that rate of deviation of positive financial statements significantly influences the disclosure level of the provincial government financial statements in Indonesia, while [36] show that the rate of deviation of financial statements does not affect the level of disclosure of the provincial government financial statements in Indonesia.Ha4: Financial statement distortion have effect on their accountability of financial statements

3. Research Method

- This study uses 42 financial statements of local government or LKPD in Sulawesi Region of Republic of Indonesia for period of 2012 to 2016 as the sample. In term for hypothesis testing then the study applies logistic regression as the tool for analysis due to analysis the association between a categorical dependent variabel has two values. The dependent variable for this study is accountability (symbolized by ACCOUNT) and proxied by dummy, where code 1 for unqualified audit opinion (or WTP) and code 0 for other audit opinions. Independent variables for this study are : (a) size of local government (symbolized by SIZE) which measured by total expenditures of local governments; (b) financial dependency on central government (symbolized by DEPEND) which measured by transfer fund by central government divided by total revenue of local government; (c) audit findings (symbolized by FIND) which measured by total audit findings based on review of The Supreme Audit Instituion (or BPK); and (d) financial statement distortion (symbolized by DISTOR) which measured by ratio of distortion value in Rupiah over total expenditures by local government. Model used in this research is as follows:

4. Results and Discussion

4.1. Descriptive Statistics

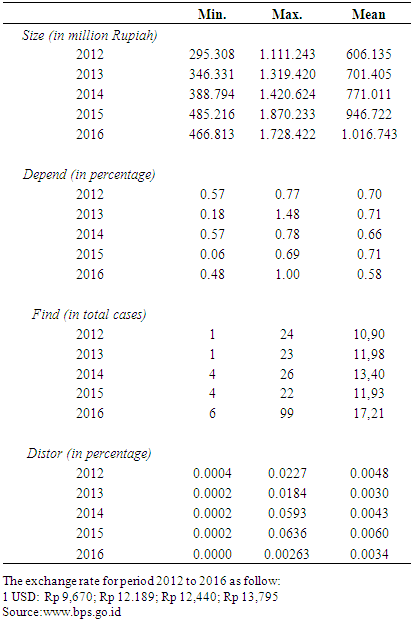

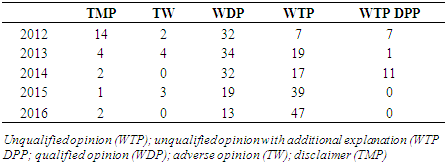

- Table 1 shows that the lower local government expenditures in Sulawesi region is happening in year of 2012 where the amount of expenditure is Rp.2.995.308.000.000, while lower local government expenditures in Sulawesi region is happening in year of 2015 with amount Rp.1.870.233.000.000. In averages, the local government expenditures are increasing from year 2012 to 2016 which means there is an increasing size of local governments for those periods. Table 1 shows that financial dependency of local government to central government is higher enough but the highest dependency is exist in year of 2013 and 2015 which is 0.71 in average. Table 1 also shows that the audit findings are increase in period of 2012 to 2016 which indicates the existence of agency problem. Table 1 shows that the financial statement distortion by local government in period of 2012 to 2016 have increase which indicates that local government have take decision and act not in line with public people interests.

|

|

4.2. Regression Results

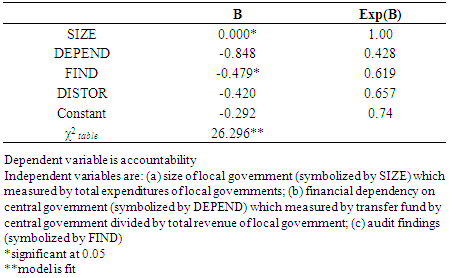

- Table 3 shows that χ2 tabel 26.296 is significant which means the model is fit, furthermore, we conclude that the data support hypothesis 1, there exists a positive association between size (SIZE) and accountability of local government financial statements, the result is in line with the studies of [4, 18, 26, 27, 12, 10, 8, 32, 40, 23]. It indicates that government size drive manager public act as steward for public interest. Size of local government increase the pressure to the public manajer behave accountable through reporting statement of how they spend the resources.

|

5. Conclusions

- The circumstances of accountability by local government financial reports in Sulawesi Region refers to the point of view of agency and stewardship theories, which is indicated by significant effect by size of local government and audit findings. These findings imply that if the local governments do not manage their expenditures then their act shall not align with public interests. Monitoring mechanisms of expenditures tend to make local government more accountable to citizen, and make the interest of local government and citizen align. Similar to mechanisms of expenditure, the audit mechanisms by SAI have tendency as a tool to align local government interest with citizen interest. In Sulawesi Region, the internal monitoring mechanism appears to be more effective implement for government behave as a steward, which place a higher value on public interest than self interest and behave accountable.From these findings, we propose several recommendations First, the limitation of this study is the use of relatively data that restrict on Sulawesi Region, in addition, further research can be performed using more data. Secondly, the implement of analysis tool for better accurate conclusion.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML