-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2018; 7(1): 1-6

doi:10.5923/j.ijfa.20180701.01

Environmental Costs Accounting and Reporting on Firm Financial Performance: A Survey of Quoted Nigerian Oil Companies

Tochukwu Gloria Okafor

Department of Accountancy, Nnamdi Azikiwe University Awka, Nigeria

Correspondence to: Tochukwu Gloria Okafor, Department of Accountancy, Nnamdi Azikiwe University Awka, Nigeria.

| Email: |  |

Copyright © 2018 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study is aimed at ascertaining the effect of environmental costs on firm performance. To achieve this objective, the study made use of financial reports of Oil and Gas Companies quoted in the Nigerian Stock Exchange Market from years 2006-2015. Regression analysis was employed with the aid of Statistical Package for Social Sciences (SPSS). The results of the statistical analysis indicate that better environmental performance positively impact business value of an organization. Moreover, environmental accounting provides the organization an opportunity to reduce environmental and social costs and improve their performance.

Keywords: Environmental Accounting, Reporting, Firm performance, Sustainability, Environmental costs, Stakeholders needs

Cite this paper: Tochukwu Gloria Okafor, Environmental Costs Accounting and Reporting on Firm Financial Performance: A Survey of Quoted Nigerian Oil Companies, International Journal of Finance and Accounting , Vol. 7 No. 1, 2018, pp. 1-6. doi: 10.5923/j.ijfa.20180701.01.

Article Outline

1. Introduction

- The use of natural resources and continuous emissions of greenhouse gases by industries around the world are on increase. This is traceable to industrial revolution of late 18th century where economic activities in many areas moved from agriculture to manufacturing. Production shifted from its traditional locations in the home and thatched workshops to factories. The industrial revolutions lead to economic improvement for most people in the industrialized society.These economic developments are not without costs. Industrialization which required the use of natural resources including energy brought about factory pollutant and greater land use, which harmed the natural environment (Mastrandrea and Schneider, 2008 [1]). This is evidenced in environmental degradation and atmospheric pollution generally experienced in the world and particularly in Nigeria today.However, the increase in global environmental awareness and the campaign for sustainable economic development is redirecting the attention of firms towards environmental sensitivity. Sustainable development as is generally known focuses on the creation of wealth and prosperity, whilst considering the true importance of social and environmental aspects, allowing business and public organizations to meet triple bottom line in sustainable management.The search for sustainability has made various global institutions to set out policies that guide human interaction with the environment. These guidelines have great effect on corporations, as they are made to understand that their business strategies affect the society, can influence behaviour and disorganize the physical, social and economic environment.Environmental accounting, as defined by Ministry of Environment (2002 [2]) in “Environmental Accounting Guidelines”, is an account aimed at achieving sustainable development, maintaining a favorable relationship with the community, and pursuing effective and efficient environmental conservation activities. This type of accounting enables a company to ascertain the cost of conserving the environment while carrying out her normal business activities, discover benefits and gains from such activities, and provide the best means possible for quantitative measurement and encourage the communication of the results. Proper disclosure of accounting information relating to the environment is a very important aspect of accountability.Environmental accounting enables companies and other organizations to increase their public trust and confidence. This however will lead to fair assessment of the organizations.According to an environmental protection agency based in USA, environmental costs include costs of complying with environmental laws. The agency specifically stated that it includes environmental remediation costs, pollution control equipment costs and non-compliance penalty. Based on the meaning of environmental degradation, environmental cost could also cover the cost incurred to prevent degradation, cost of re-stating the environment to its original state, cost of restoring depleted environment to its normal position. Profit ascertainment requires the subtraction of recurrent costs from revenues. Most often, the costs that leads to changes in the environment, which affect people adversely and cause damages to the environment are not taken into consideration before profits are determined. In other words, the profits are wrongly determined. The result of this, in most cases, is reporting of wrong and excessive profits which will also mislead the decision makers.Accountants, being the basic stakeholder and life wire of economic development cannot claim ignorant of environmental issues effect on business management, accounting, and audit and system of disclosure. Environmental protection and the involvement of accountant is becoming a common subject of discussion among the accountant the world over. Presently, accountants are expected to be proactive in taking their roles in the process of environmental protection. The emergence of liberalization and removal of trade barriers makes it clear that the costs of environmental degradation resulting from the activities of industries should be included in corporate account to a possible extent, which is the reason for the importance of environmental accounting and reporting in the world today.The study focused on the oil and gas industries quoted in the Nigerian Stock Exchange Market. It covered a period of ten years, 2006-2015. The work is anchored on stakeholders’ theory.The basic proposition of the stakeholders’ theory is that the success of firm depends on the successful management of all the relationships between the firm and the stakeholders. This term was originally introduced by Stanford Research institute (SRI) referring to those groups whose support is indispensable for the organizational existence (Freeman, 1983 [3]).Now-a-days, unfavourable environmental effect on economic development has become worrisome. The collective ecological footprint of the planets population is unsustainable and the current trends of growth and environmental degradation suggest we are going to encounter more problems in the future. Doorasam (2015 [4]), in his study believes that managers may not easily invest large amounts of money unless they are made to understand the amount of money they could save by adopting cleaner production techniques and technologies. This has great implication for the environment, and businesses which also make use of natural capital. Therefore, there is need for type of accounts which provide full measure of business performance and shareholder value creation, integrating economic, environmental and social factor into corporate behavior with the aim of sustaining resources for future generation; hence the need for environmental accounting.The major objective of this study therefore is to ascertain the effect of environmental costs accounting on firm performance. Specifically, the study intends to:• Determine the effect of cost of environmental remediation and pollution control on return on assets (ROA)• Ascertain the effect of environmental laws compliance and penalty cost on ROA• Determine the effect of donations and charitable contributions cost on ROAAs guide to the study, it is hypothesized that environmental cost accounting does not significantly affect the performance of quoted oil companies in Nigeria.

2. Review of Related Literature

2.1. Environmental Acts and Regulations in Nigeria

- The constitution of Nigeria which guides the activities of the nation recognizes the need to improve and protect the environment and makes provision for this through relevant sections of the constitution which include: Section 20; this makes it an objective of the Nigerian State to improve and protect the air, land, water, forest and wildlife of Nigeria. Section 12 establishes, though implied, that international treaties (including environmental treaties) ratified by the National Assembly should be implemented as law in Nigeria. Moreover, the National Environment Standards and Regulation Enforcement Agency (NESREA) Act of 2007 which replaced the Federal Environmental Protection Agency (FEPA) Act; is a pool of laws and regulations aimed at protecting and sustaining the development of the environment and its natural resources. The regulation provides authority needed to foster compliance with local and international laws on environment, such as environmental sanitation and pollution prevention and control through monitory and regulatory measures; Section 8 (1)(K) of the act gives the Agency the power to issue and review laws on air and water quality, effluent limitations, control of substances harmful to the environment and other forms of environmental pollution and sanitation. Lastly but not the least Section 4 and 5 of NESREA demands that industries should report cases of discharge occurrence and make available to the agency a comprehensive list of chemicals used for production. Nigeria Environmental Law Research Institute (2011 [5]).Though the above regulations exist there is no guideline on environmental accounting for firms in Nigeria, accounting and reporting on environmental issues are wholly voluntary. The level of environmental cost accounting by oil and gas companies is still too far from being satisfactory or meeting international standard practices.

2.2. Environmental Accounting and Firm Performance

- Environmental Protection Agency (EPA, 1995 [6]) declared that environmental cost information can be applied in internal management decisions. The term Environmental accounting belongs to the area of accounting -related activity, method and system for recording and analysis (Shaltegger et al 2008 [7]). Study carried out by Rufelawaty and Budi (2010 [8]) discovered that environmental cost information generated through accounting for environment can help in company growth. The absence of such information increases the stress of accounting for costs and struggles to reduce costs to managers. The study by Larrinaga and Babbington (2001 [9]) revealed that companies can achieve cost savings that can improve their performance by implementing environmental accounting. Elewa’s study in (2007 [10]) discovered that implementing environmental accounting leads to profit growth resulting from cost reduction of yearly production. According to De Beer & Friend (2006 [11]), Environmental accounting has other advantage order than cost reduction. It can also be used to indicate potential for environmentally beneficial investment to yield significant financial benefits by avoiding environmental liability.Financial Performance as a way of definition is a subjective measure of how well a firm can use assets from its primary mode of business and generate revenues. It is a process of measuring the results of a firm’s policies and operations in monetary form. This study focuses on determining whether sustainability accounting will help to improve company’s financial performance. Return on assets being a better metric of financial performance than other measures like return on equity (ROE), return on sales etc (Hagel, Brown & Davision 2010 [12]) was used as a metric for financial performance in this study.

2.3. Environmental Cost Accounting and Stakeholders’ Information Needs

- Naturally, shareholders care for the attitude of their company regarding the environment. They pay attention to the economic consequence of environmental behaviour of the business and how this behaviour impacts on return on investment. Other users of accounting information, such as customers, suppliers, competing companies, state bodies, the public, mass media, movements and initiatives concerned with environmental protection, etc; pay attention also to the company approach to the environment. Investors constantly demand that companies should go for environmental accounting strategies that will reduce environmental damage and increase shareholders’ value. The objective of sound environmental management is to enhance environmental report by reducing the environmental impact while increasing the enterprise value, (Schaltegger and Sturm 1989 [13]).Yakhou and Dorweiler (2003 [14]), stated that Companies are expected to partake in environmental accounting for the following reasons:• to let the consumers know that the company is taking their responsibilities seriously• to act in accordance with the national guidelines• to abide by the financial reporting requirements.• to show the company’s concerns on issues of environment and communicating such to a range of stakeholders.

2.4. Empirical Review

- Scholars have done different works on the area of environmental accounting and firm performance and have obtained varying results.Bassey, Effiok & Eton (2013 [15]), in their work whose objective is to examine the impact of environmental accounting and reporting on organizational performance of selected oil and gas companies in Niger Delta region of Nigeria, found that firms which are environmentally friendly will significantly publish environmental related information in their financial statements and other reports of the business.In a work aimed at evaluating the relationship between provision environmental accounting information and improving management performance of companies of pharmaceutical industry accepted in the Tehran stock exchange; Azar, Shahbazi, Abad & Moasavi (2014 [16]), concluded that a relationship exists between improving management performance and environmental accounting information disclosure of the companies accepted in Tehran stock exchange.Mohammad, Sutrisno, Prihat & Rosidi (2013 [17]) also researched on effect of environmental performance and environmental information disclosure as mediation on company value. The researchers selected 59 companies in Indonesia, their major findings is that environmental accounting implementation has not been able to affect company value through environmental information disclosure.Lubomir & Dietrich (2009 [18]) carried out a research on the topic captioned “Does better environmental performance affect revenues, costs or both? Evidence from transition economy. The work used unbalanced panel data of Czech firms from 1996-1998. The analytical results indicate strongly that better environmental performance improve profitability by driving down costs more than it drives down revenue.In a work on; The effects of environmental disclosure on financial performance in Malaysia, Norhasimah, Norhabibi, Nor, Sheh & Inaliah (2015 [19]), whose objective is to find out whether environmental disclosure practice exist among top 100 company of market capitalization in Malaysia for the year 2011, and its relationship with financial performance, the analysis shows mixed results between the existence of environmental disclosure practices in Malaysia and company financial performance.The empirical review shows varying results on the relationship between environmental accounting and firm performance. Some show positive relationship, some negative and some mixed results. Most prior researches in the area were done on other countries and geographical locations outside Nigeria. None of them used the core environmental cost data used in this work against firm performance measure to evaluate performance. Most prior studies on environmental accounting disclosure or reporting in Nigeria have been exploratory and descriptive; focusing on discussing the environmental phenomenon. Some of the works that focused on oil and gas especially the one reviewed in this work concentrated on Niger Delta area of Nigeria and dwelt on reporting and not performance. Knowledge update is also required in terms of time scope. Based on the review, there are evidence of gap in Knowledge and literature, hence this study.

3. Methodology

- The study covers a period of ten years from 2006-2015 using only secondary data. The data for analysis were sourced from published financial reports of quoted oil companies listed in the Nigerian Stock Exchange. The reason for the choice of Nigerian oil sector is because it is involved in a lot of environmental issues. Moreover, majority of firms in this sector are multinationals and have long been involved in practice of environmental accounting. The statistical tool used for data analysis is multiple regressions. The independent variables employed in the study are: Cost of Environmental Remediation and Pollution Control, Cost of Environmental Laws Compliance and Penalty, Donations and Charitable Contributions (DCC) representing the environmental costs and one dependent variable; return on asset (ROA) as a measure of firms’ performance.

3.1. Model Specification and Variables Measurement

- Using a single dependent variable return on assets (ROA) and three independent variables; Cost of Environmental Remediation and Pollution Control (ERPC), Cost of Environmental Laws Compliance and Penalty (ELCP), Donations and Charitable Contributions (DCC), a model was formulated thus; [ROA=f(ERPC+ELCP+DCC)].The model uses a linear regression equation to test the hypothesis of the study.ROA = β0+β1X1+β2X2+β3X3+еWhere:ROA = Return on Assetβ0 = Interceptβ1-3 = Coefficient of the independent variablesX1 = ERPC (Represented by Total Cost of Environmental Remediation and Pollution Control)X2 = ELCP (Represented by Total Cost of Complying with Environmental Laws and non Compliance Penalty)X3 = DCC (Represented by Total Donations and Charitable Contributions)е = Residual or error term

3.2. Presentation of Results and Discussion of Findings

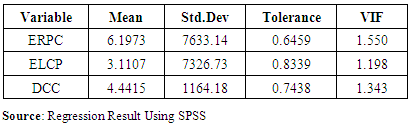

- Table 1 show that, during the time of the study the Environmental Remediation and Pollution Control, Environmental Laws Compliance and Penalty and Donations and Charitable Contributions have on average a mean score of 6.21, 3.11 and 4.44 respectively. The standard deviation of Environmental Remediation and Pollution Control is the highest at 7633.14 indicating its low contribution to the Quoted oil companies’ performance model, this can be confirmed by significant value of t- statistics in the coefficient table, Donations and Charitable Contributions on the other hand, has the lowest standard deviation which shows its higher significant to the model of the study. This is confirmed by the values of the mean with Environmental Remediation and Pollution Control having highest mean and DCC with lowest mean.

|

|

3.3. Relating Environmental Costs to Return on Asset of Quoted Oil Companies in Nigeria

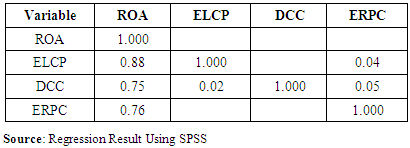

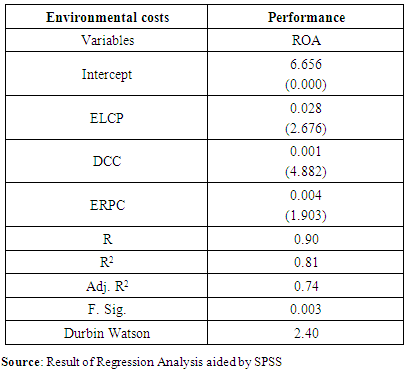

- In this study, environmental costs are represented by three variables which include; Environmental Laws Compliance and Penalty, Donations and Charitable Contributions and Environmental Remediation and Pollution Control. Return on Asset measured by net profit as a percentage of net assets value was used in the study as a proxy for performance. The results of the regression analysis are shown in the table below.

|

4. Conclusions

- Based on the findings of this study, spending on issues that concerns the environment boosts the performance of quoted oil companies in Nigeria. This therefore implies that those at helm of affairs of these oil companies should increase their involvement in environmental activities for improved and sustainable performance.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML