-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(6): 179-185

doi:10.5923/j.ijfa.20170606.04

The Role of Productive Zakat for Helping Poor Community in Rokan Hulu Regency (Case Study of National Amil Zakat of Rokan Hulu Regency)

Anthony Mayes, Deny Setiawan, Ufira Isbah, Hilmah Zuryani

University of Riau, Indonesia

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study aims to determine the extent of the role of productive zakat for helping the poor in the rokan hulu regency which identified as mustahik in entrepreneurship. Zakat which reserved for mustahik can be used as fund for business where the business developed by mustahik generally is small scale, which is not accessible by bank financial institution. The mentoring process involves planning, implementing, supervising and controlling also evaluating the program, becoming one program of the amil zakat in managing productive zakat, so it is expected to create economic circulation, increase the productivity of community businesses, increase income / yields economically and sustainable. The methodology used in this study is descriptive qualitative method to see the effect of productive zakat on the empowerment of the poor through the poverty index. This research consists of primary data and secondary data. Primary data is obtained from the survey results or distributed questionnaires, and conducted in-depth interviews with productive Zakat program managers in Baznas and Mustahik as participants of community empowerment programs through productive zakat. While secondary data is obtained from BAZNAS Program Report on the internet, some literatures, articles from magazines, journals, newspapers, or internet. This study uses a number of analysis tools, which are: headcount ratio, to find out how many and percentage of poor families; poverty gap ratio and income gap ratio, used to determine depth level of poverty; and the Sen index as well as the Foster, Greer and Thorbecke (FGT) indices, which are used to measure the severity of poverty. The analysis results shows that zakat can reduce the number and percentage of poor families, and reduce the depth and severity of poverty.

Keywords: Poverty, Productive Zakat, BAZNAS

Cite this paper: Anthony Mayes, Deny Setiawan, Ufira Isbah, Hilmah Zuryani, The Role of Productive Zakat for Helping Poor Community in Rokan Hulu Regency (Case Study of National Amil Zakat of Rokan Hulu Regency), International Journal of Finance and Accounting , Vol. 6 No. 6, 2017, pp. 179-185. doi: 10.5923/j.ijfa.20170606.04.

Article Outline

1. Introduction

- The problem of poverty is one of the main problems faced by the Indonesian people today, moreover, currently the global economy is experiencing a food crisis and energy crisis. High poverty rate in Indonesia is an evaluation object for this nation to find the right instrument to accelerate that poverty reduction. Various policies, sectoral, monetary, fiscal, or other policies turns out not been effective in reducing the poverty rate significantly for this nation. Although there are many programs aimed at poverty reduction, but the problem have not finished. The difficulty of solving the problem caused by the problems involving the poor is very complex.Indonesia is one of the countries with Muslim as majority population which is 216.66 million people or with a percentage of Muslims is 85 percent of the total population (BPS, 2015). This fact implies that zakat has a great potential and can contribute in reducing poverty. Zakat, infaq, and shadaqah (alms) (ZIS) data in Indonesia shows that there is an increase of zakat collection from 2002 to 2015. ZIS fund raising has increased by 5310.15 percent in 13 years. In 2005 and 2007, there was an estimated 100% increase in ZIS accumulation which is predicted because of a national disaster in the country (Aceh tsunami and Yogyakarta earthquake). If averaged from 2002 to 2015, the growth of ZIS accumulation reached an average rate of increase of 39.28 percent. This indicates that there is a considerable increase in public awareness for zakat through the zakat management organization (Organisasi Pengelola Zakat, OPZ). This growth trend also indicates an increase in public trust in OPZ's performance, both BAZNAS or LAZ.The government as the primary responsibility bearer must bear the main burden to overcome the poverty problem, including the state apparatus in every corner of the region. As one part of NKRI, Rokan Hulu regency actually had various poverty reduction programs. But the number of poor residents in Rokan Hulu regency is still high among the regencies and cities in Riau Province. Rohul regency has a high number of poor residents of 64.7 thousand people, or about 11.05 percent of the population in 2015. Lower than Kampar regency which is 72.2 people. Approximately 12.17 percent of the total poor population in Riau Province is in Rokan Hulu Regency. The lowest number of poor resident in Riau Province is located in Dumai City which is 15 thousand inhabitants.Building a zakat-based poverty eradication system is certainly not easy, there are needs cooperation with various parties to maximize the role of zakat for reducing poverty. This task is not only the responsibility of the government and the institutions that manage zakat, but it is our responsibility altogether as a Muslim to prosper the other Muslims who lack. Based on the report of National Board of Amil Zakat (Badan Amil Zakat Nasional, BAZNAS) of Rokan Hulu Regency, there is an increase of zakat fund in BAZNAS of Rokan Hulu regency in 2015 as of Rp. 2.960.952575, - increased by Rp 3,655,306,776, - in 2016. Largest distribution of zakat in Rokan Hulu regency is on its zakat manager (amil) which is Rp. 500,715,484, - in 2015 and at 2016 is Rp. 595,707,872.The potency and role of the existing zakat is expected to be a medium to reducing poverty and have great attention, completion of poverty eradication must be done immediately and zakat is expected to have a contribution to the poor especially those that need attention from all parties. Like the efforts done in the development of zakat potential through the efforts of Business Capital Loan, Fish Breeding, Agricultural Nursery, Animal Husbandry and Utilization of zakat of the poor for the empowerment of the Muslim Family and training also skills so that the poor will have an experience that can be used to change for a better life. (Amalia and Kasyful Mahalli, 2012).District in Rokan Hulu Regency which received the most productive business assistance is Rambah Sub-district with the number of beneficiaries are 40 families with the value of Rp. 141.500.000, -. While the sub-districts that received the least productive business assistance were Pendalian, Ujung Batu, Pagaran Tapah, and Kepenuhan Hulu with the number of beneficiaries are 5 families with the value of Rp. 29,000,000, Rp. 25.000.000, Rp. 22.452.000, and Rp. 25,000,000 each. The purpose of this study is to know the Role of Productive Zakat on Poverty Reduction in Rokan Hulu Regency.Based on the above background, then the formulation of the problem in this study is How the Role of Productive Zakat Against Poverty Reduction in Rokan Hulu District. In addition, the purpose of this study is To Know the Role of Productive Zakah on Poverty Reduction in Rokan Hulu District. Based on the above background, then the problem description in this study is How the Role of Productive Zakat Against Poverty Reduction in Rokan Hulu Regency. In addition, the purpose of this study is to know the Role of Productive Zakat on Poverty Reduction in Rokan Hulu Regency.

2. Literature Review

- a. The Definition and the Law of ZakatIn terms of language, the word zakat according to Majma (in Bariadi, 2003) has some notions, ie. al-barakatu or blessing, annamaa', that is growth and development, ath-thaharatu, that is purity, and ash-shalahu, that is doneness. In terms of jargon, even though the scholars argue it with a somewhat differing redaction between one and the other, but in principle are the same, that zakat is a part of the property with a certain prerequisite, which Allah Almighty obliges to its owner, to be handed over to those who are entitled to it.The zakat law is obligatory for capable Muslims. For the person who performs it will get the reward, while the one who leaves will get a sin. The repetition of zakat commands in the Qur'an indicates that zakat is one of the religious obligations that must be believed. Zakat is also the third pillar of the five pillars of Islam and has similar status to other Islamic pillars. The zakat law has also been described in the Legislation No. 23 of 2011 Article no 1 and no 2 about zakat, which reads: zakat is a property which must be issued by a Muslim or business entity to be granted to those entitled to it in accordance with Islamic law.b. Criterias and Types of ZakatAccording to Qardhawi (in Kartika Sari, 2006) the criteria of zakat are as follows: 1) Moslem, 2) Sufficient of one zakat unit (nisab), 3) Over one Haul or one year, 4) The property is good and halal, 5) Is productive, either real or unreal, 6) In full ownership, 7) Surplus of minimum basic needs (primary), 8) Free from debt on due. Zakat can be categorized into two types, (Hasan, 2006) namely: (1). Zakat fitrah. Zakat fitrah is a some of property which must be given by every mukallaf (Muslims, be of age, and sensible) and every person who has their livelihood borne under certain conditions and (2). Zakat Maal / Property. Zakat maal is zakat of wealth, covering business or trade, mining, agriculture, marine products and livestock products, findings, gold and silver and profession zakat. c. Wisdom and Distribution of ZakatAccording to El Madani (2013) there are many wisdom and benefits behind the zakat commands, among which are: (1). Zakat can familiarize the person who performs it to have a generous nature, while eliminating the stingy and miserly nature, (2). Zakat can strengthen the brotherhood, and increase the love and affection of fellow Muslims, (3). Zakat is one of the efforts in overcoming poverty, (4). Zakat can reduce the unemployment rate and its causes. Because the takings of zakat can be used to make new jobs, (5). Zakat can purify the soul and heart from resentment, and remove the envy and hatred of the poor against the rich and (6). Zakat can grows people's economy.According to Atabik (2015) this verse clearly states that there are 8 groups who are entitled to receive zakat. There are also some scholars who give a more detailed explanation of that eight groups, here are the descriptions: (1) Fuqara '(The Poor, The Need), (2) Masakin (The Poor), (3) 'Amilin (Zakat Management), (4) Muallaf, (5) Riqab (slave), (6) Gharimin (People in debt), (7) Sabilillah (people who fight in the way of Allah SWT), (8) Ibnu Sabil. d. Definition and Measurement of PovertyBasically poverty can be classified into two categories, namely (1) natural poverty and (2) structural poverty. Further Nasoetion (1996) says natural poverty is poverty caused by the low quality of natural resources and human resources so that the production opportunities can be done in general with relatively low level of efficiency. Structural poverty is poverty that is directly or indirectly caused by institutional arrangements.Poverty is often indicated by high levels of unemployment and underdevelopment. Poor people are generally weak in their work skill and have limited access to economic activities so that they will be left behind from other communities with higher potential. The measurement of poverty seen from the income level can be grouped into absolute poverty and relative poverty (Ginandjar: 1996). Someone is said to be poor in absolute terms if his income is lower than the absolute poverty line or in other terms the amount of income is not sufficient to meet minimum living needs. The size of the poverty line used by the Central Bureau of Statistics (Biro Pusat Statistik, BPS) is based on an absolute poverty approach, with reference to the definition of poverty by Sayogyo (2000). e. Utilization of Zakat on PovertyAccording to Wulansari (2013), utilization in zakat closely related to how its distribution. That condition is because if the distribution is right on target and appropriate, then the utilization of zakat will be more optimal in Legislation no. 23 of 2011 about the Management of Zakat, which explained about utilization that are: (a) Zakat can be used for productive businness in order to helps the poor and improving the quality of the people and (b) The utilization of zakat for productive business as referred in section (1) shall be done if the basic necessity of mustahik has been fulfilled.The principle of zakat in the economic ranks has the purpose to support certain parties who need to support themselves for one year ahead even expected throughout their life. In this context, zakat is distributed for develop the economy either through productive skill, or in the field of trade. Therefore the principle of zakat provides a solution to eradicate poverty and laziness, waste and accumulation of property so as to revive the macro and micro economy (Mursyidi, 2006).Productive zakat is distributing zakat funds to the every mustahik in a productive way. Zakat is given as business capital, which will develops their business to meet the needs of life throughout their life (Asnaini, 2008). According to Qardhawi (2005), Islam views poverty as one thing that is capable of endangering beliefs, morality, logical thinking, family and society. Islam also views it as a test that must be passed immediately. By this zakat, allowing the poor to participate in the society and also perform their duty in worshiping Allah SWT, and also participate in economic development.

3. Research Method

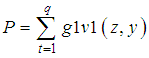

- This research was conducted in Rokan Hulu regency of Riau Province. This location was chosen because Rokan Hulu regency is one of the districts / cities in Riau Province with high poverty rate. This research was conducted for 6 (Months). As for the determination of the number of samples used in this study as a sample is 65 mustahik from 3182 mustahik that selected randomly in the region of Rokan Hulu Regency and who follow productive Zakat program in BAZNAS. The type of data used in this study consists of primary data and secondary data. Primary data obtained from the survey results or questionnaire distribution results, and conducting in-depth interviews with Mustahik as participants of community empowerment programs through productive zakat. While secondary data obtained from BAZNAS Program Report on the internet, some literatures, articles on magazines, journals, newspapers, and internet.This study uses two groups of data to be tested. First one is the family income data of mustahik before receiving zakat and the second is the income data after zakat has received. Based on previous research that has been done by Beik (2010), Hartoyo and Purnamasari (2010) and Anriani (2010), the first set of data obtained by deducting the amount of zakat which has been distributed with the second data set. To know the total amount of respondents' income validly and correctly, this research uses two approaches. First, reviewed from income, and the second, reviewed from expenditure (Beik, 2009). If there are differences in the values from both approaches, then the largest value will be selected and used as the primary data.As for data processing, this research uses a number of analysis tools, namely: (1) Headcount Ratio, (2) Poverty gap and income gap (income gap ratio), (3) Sen Index and (4) Foster, Greer, and Thorbecke Index (FGT Index).1. Headcount RatioHeadcount ratio is an analytical tool used to measure poverty level. This ratio is used to find out how many real poor people based on the country's poverty line and calculate the percentage. The poor are defined as people who have income below the poverty line. In this study, the one will be studied is a mustahik family that given productive zakat funds by Baznas of Rokan Hulu Residence, so the parameter is the income of families below the poverty line. The formula for calculating this ratio is:

Description:q = number of people / families who have income below the poverty linen = total population 2. Poverty Gap and Income Gap RatioThe Poverty Gap and Income Gap are the measurement tools used to identify and analyze the depth of poverty. The calculation formula is as follows:

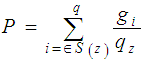

Description:q = number of people / families who have income below the poverty linen = total population 2. Poverty Gap and Income Gap RatioThe Poverty Gap and Income Gap are the measurement tools used to identify and analyze the depth of poverty. The calculation formula is as follows: Where:P = Poverty gap ratiog1 = z-yi, is the difference between the poverty line and the income of each individual.vi (z, y) is the weight assigned to the income deficit based on the income distribution yiz = poverty lineyi = individual i income

Where:P = Poverty gap ratiog1 = z-yi, is the difference between the poverty line and the income of each individual.vi (z, y) is the weight assigned to the income deficit based on the income distribution yiz = poverty lineyi = individual i income  Where:i = Income gap ratio

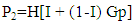

Where:i = Income gap ratio the difference between the poverty line and the individual incomeq = number of people who earn below the poverty linez = poverty line 3. Sen IndexThe Sen Index is the most popular and comprehensive poverty index (Patmawati, 2006). This index combines headcount ratio, income gap ratio, and Gini coefficients as an indicator of income distribution among the poor. The calculation formula is as follows:

the difference between the poverty line and the individual incomeq = number of people who earn below the poverty linez = poverty line 3. Sen IndexThe Sen Index is the most popular and comprehensive poverty index (Patmawati, 2006). This index combines headcount ratio, income gap ratio, and Gini coefficients as an indicator of income distribution among the poor. The calculation formula is as follows: Where:

Where: Sen IndexH = Headcount ratioI = Income gap ratio

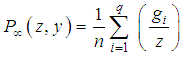

Sen IndexH = Headcount ratioI = Income gap ratio Gini coefficient of the poor 4. FGT IndexThis index was first introduced by Foster, Greer and Thorbecke (1984). This index, along with the Sen Index, is used to determine the severity of poverty. The calculation formula is:

Gini coefficient of the poor 4. FGT IndexThis index was first introduced by Foster, Greer and Thorbecke (1984). This index, along with the Sen Index, is used to determine the severity of poverty. The calculation formula is: Where:

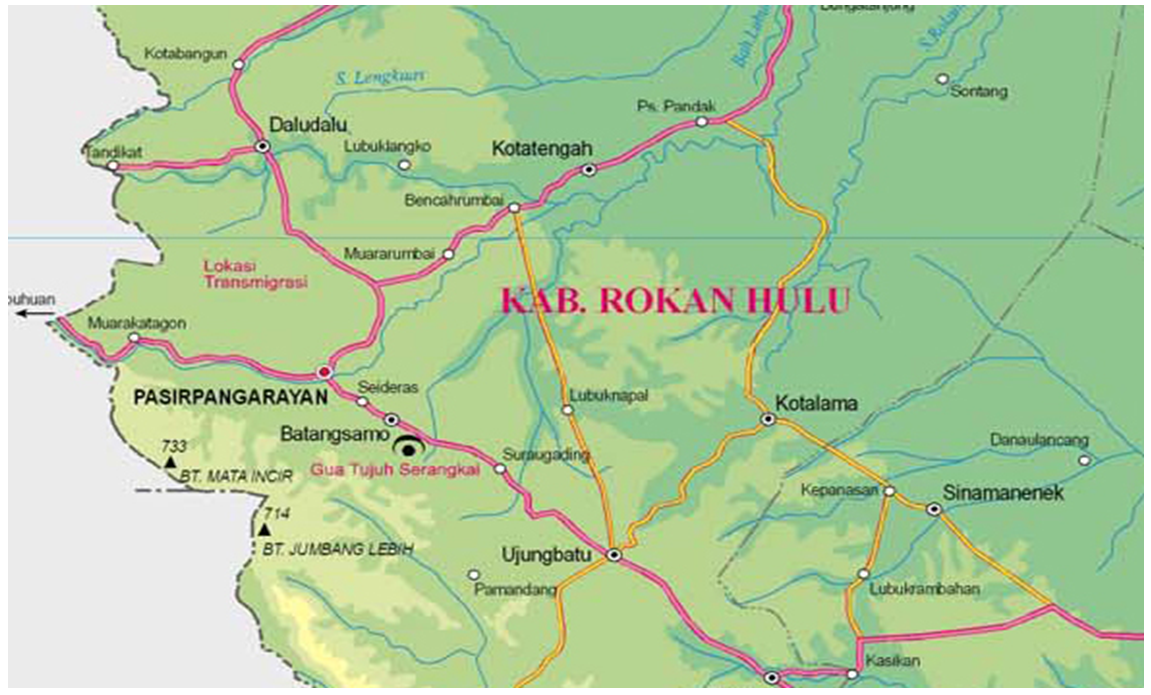

Where:  the difference between the poverty line and the individual incomeq = number of people who earn below the poverty linez = poverty lineα = parameter whose value is greater or equal to zero. In this study used the value of α = 2The location of this research can be seen from the following map:

the difference between the poverty line and the individual incomeq = number of people who earn below the poverty linez = poverty lineα = parameter whose value is greater or equal to zero. In this study used the value of α = 2The location of this research can be seen from the following map: | Figure 1. Map Location Research |

4. Research Result

- General characteristics of respondents, especially the recipients of productive business assistance in BAZNAS Rokan Hulu Residence was obtained based on a survey conducted in Rokan Hulu Residence which are Rambah District, Rambah Samo District and Rambah Hilir District with 65 respondents. The general characteristics of this respondent are explained from several criteria, as follows:1. Gender and Age LevelBased on the research results of male respondents has greater results of 47 people or 71.3% than female of 18 people or 27.7%. Because the man acts as head of the family and acts as decision maker.In terms of age, the majority of respondents are in a very productive age group, which are 31-45 years (64.6 percent), followed by the age group 46-60 years (26.2 percent). It indicates that the majority of respondents are young people who still have hope to improve and upgrade their quality and ability so that they can free themselves from poverty trap. Only 3 percent are in the over 60 years age group.2. Education Level and Number of DependentsMeanwhile, viewed from education aspect, the majority of respondents only from junior high school (52.3 percent). It illustrates that the zakat recipients mustahik generally are low educated. Only 32.3 percent are claimed to have high school education. Surprisingly, none of the respondents had ever attended college. This condition indicates that the education can be a variable that should given attention if the government intends to break the poverty chain. The higher the education the greater the opportunity to have a well-established family in terms of economy.Many people argue that household income levels will affect the quality of the family itself, where person quality is strongly influenced by the adequacy of basic needs. Furthermore, 96.6 percent of respondents were married with majority of the dependent family size are ranging from 4 to 6 people (50.8 percent). This fact illustrates that respondents generally have a relatively heavy family burden. However, there are about 1.5 percent of respondents who have a very heavy burden due to the large number of family members who become dependents, that is more than 7 people.From an economic point of view, the majority of respondents work as Traders (41.5 percent), followed by farmers (23.1 percent). This condition indicates that the profession of traders is a profession that absorbs the most labor from the middle to lower class. 3. Respondent's opinion on BAZNAS’s Productive Zakah ProgramRegarding the process of applying for business funds to the BAZNAS program, the majority of respondents said that the process of applying for business funds is quite easy as much as 49 respondents or 75.4%, followed by respondents stating that the process of applying for business funds is very easy as much as 11 respondents or about 16.9%. While respondents who stated difficult in the process of applying for business funds as much as 5 respondents or 7.7% of the total respondents. This indicates that the requirement of applying business funds of Zakat Productive program does not make it difficult for the mustahik who want to apply for assistance.One of the characteristics of productive zakat program is the existence of the assistance pattern for its mustahik, this can be seen in the table above. Based on the above table as many as 17 respondents or about 26.2% stated that the mentoring pattern is running quite well. Furthermore, as many as 37 respondents or 56.9% said the pattern of mentoring went poor and as many as 11 respondents or about 16.9% stated bad mentoring pattern. This means that the lack of mentoring conducted by Baznas after the distribution of business fund. The worse, there are 11 respondents who do not get assistance after receiving the funds of productive zakat program.4. Discussion Analysis with Poverty IndexThe analysis results is based on data obtained hence result of research explain as follows:1. Headcount Ratio shows how many poor people are able to be helped through the utilization of zakat instruments. Based on the table, it can be seen that the ratio of the poor people before zakah has distributed is 0.55. After the zakah has been distributed, this ratio is decreases to 0.48. That means, there are decreases in the number of poor people from 55 percent to 48 percent.2. The Poverty Depth Index is measured using two instruments, namely the poverty gap ratio (P1) to measure the poverty gap and the income-gap ratio (I) to measure the income gap. The pattern of zakat distribution conducted by Baznas empirically able to reduce the level of poverty gap from Rp 414.078 to Rp 306.143. Similarly, the value of I which decreased from 0.26 to 0.19 where it shows a decrease in income gap. In general can be concluded that the productive zakat program runs quite effective in reducing the level of poverty depth, through the distribution of zakat to mustahik. These results provide empirical evidence of the role of zakat in reducing poverty.3. Poverty Severity Index. As explained previously, the index of poverty severity is measured using Sen Index (P2) and FGT Index (P3). The result of the analysis shows that the value of Sen index has decreased from 0.143 to 0.1056. Similarly with the FGT index number. The value of the FGT index also decreased from 0.09 to 0.06. It shows that the distribution of zakat to mustahik is able to reduce the severity of poverty of the poor who became partners and assisted by Baznas.

5. Conclusions

- The results of this study conclude that the mustahik characteristics that earns productive zakat funds from baznas are predominantly male gender, whereas based on this research the men reached 71.3%. Characteristics of educational background Baznas mustahik who receive zakat funds are dominated by society background of junior high school and then followed by high school. Zakat funding is also dominated by mustahik who has a productive age of 31-45 years are reached 64.6%. Overally mustahik states that the productive zakat program has been running well enough, it is stated by 81.5% of the respondents involved in this study, and very well are stated by 3.1% of the total respondents.From the above empirical data can be concluded that although the collected zakat funds are still quite small, but has a real impact in efforts to eradicate poverty through productive zakat programs. And zakat became an effective financial instrument in the capital problem of the poor. This can be seen from the Headcount Ratio which decreased from 0.55 to 0.48. The index of poverty depth also decreased where the poverty gap decreased from Rp. 414,078 to Rp. 306.143. Similarly, the value of I which decreased from 0.26 to 0.19 where it shows a decrease in income gap. The value of the Sen index also decreased from 0.143 to 0.1056. Similarly, with the FGT index. The value of the FGT index also decreased from 0.09 to 0.06. This shows that zakat is the right instrument in empowering the poor.This study is an indisputable proof that the instruments of zakat have tremendous potential. Therefore, in order for the productive zakat program to run effectively and increase the welfare of the poor significantly, it need the efforts of all Muslims, including government, zakat management agencies, and other civilians in Indonesia, in developing zakat according to their potential, so that zakat can be utilized in accordance with function. In addition, to be effective in achieving the objective of increasing the independence of mustahik businnes, it is necessary to have a targeted and efficient program with one of them assisting in managing funds for the need, so that the funds allocated to mustahik will ultimately increase their welfare and bring it out of poverty.As for some suggestions that can be given by the author are as follows:1. Implementation of productive business assistance programs in Rokan Hulu residence proved to reduce the poverty indicators of mustahiq who becomes its members. Therefore, the productive zakat fund utilization program as a work capital as been done through the business assistance program needs to be continuously developed by zakat management institutions in Indonesia. This intends to function zakat as an instrument to eradicate poverty can run more optimum.2. For the data supply of partners (mustahiq) who follow the business assistance program requiring renewal of data for every month, because it is very influential on income of each mustahiq whether increase or decrease in daily income. And re-register for revenue before joining the program for coaches and assistant if wants to create next business assistance program. The surveyed data should be clear, complete and in accordance with the villagers. And for people who have taken part in the business assistance program are better reports to the village government to be more clear and acknowledged that the program is recorded.3. Lack of coordination between BAZNAS of Rohul residence with residence and village government apparatus. For that cooperation in terms of valid data about the poor data synchronization occurs.4. The acceptance of productive zakat must be expanded, not only the recipient who has business.5. In further research, it is necessary to analyze the poverty indicator of the poor who not a member of the economic empowerment program. This aims to see the success rate of the program by comparing the change of poverty indicator of the poor who follow the economic empowerment program and the poor who do not follow it.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML