-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(6): 172-178

doi:10.5923/j.ijfa.20170606.03

Impact of Corporate Governance and External Audit on Earning Management. Evidence from the Financial Sector of United Arabs of Emirates (UAE)

Monzer El Bodan1, Mehmet Aga2, Ahmad Abu Alrub2

1DBA Student at Cyprus International University, Lefkosa, Turkey

2Department of Accounting and Finance, Cyprus International University, Lefkosa, Turkey

Correspondence to: Monzer El Bodan, DBA Student at Cyprus International University, Lefkosa, Turkey.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The study focus towards presenting a clear picture of the impact of corporate governance along with external audit on earning management based in UAE. The effect of corporate governance and external audit on earning management was examined using generalized linear model. The results were compiled to research whether corporate governance characteristics and external auditor variables compel earning management. The findings aid the Securities Exchange members in the assessment of the parts of Corporate Governance framework and also help the External Auditor in improving the nature of reported income. The present research highlights two relevant implications of findings. First, the increasing in CEO duality and board activity affects earning management of financial sector in UAE; second the positive influence of ownership structure and board size on Discretionary accruals (DA). The study recommends having a small size board, not to separate between the role of chairman and CEO, and that increasing board activity will reduce level of earning management.

Keywords: Corporate Governance, External Audit, and Earning Management

Cite this paper: Monzer El Bodan, Mehmet Aga, Ahmad Abu Alrub, Impact of Corporate Governance and External Audit on Earning Management. Evidence from the Financial Sector of United Arabs of Emirates (UAE), International Journal of Finance and Accounting , Vol. 6 No. 6, 2017, pp. 172-178. doi: 10.5923/j.ijfa.20170606.03.

Article Outline

1. Introduction

- The corporate world is considered to be under strict surveillance in terms of rules and regulations to protect the stakeholder’s interests. However, in the near past few corporate scandals shaken the business world happened in late 1990’s and in the start of this century. These scandals were seen and witnessed in the western world, which mostly included big names of business world like Enron, WorldCom, and HealthSouth.The effects of such financial and management scandals were also noticed in UAE economy majorly because of its rapid growth in the corporate world. The UAE stock market including both Dubai stock exchange and ADX are emerging as strong stock markets by continues economic growth. Economic Review (2013) reported, “as a result of the increase in oil prices, the real gross domestic product per capita of the UAE has swiftly increased”1. The increased in economic growth attracted many investors in UAE to invest in companies. The number of sophisticated investors is increased and therefore, the importance of financial reporting is gaining much attention. To shelter the interests of stakeholders in UAE, the need of monitoring framework is essential as well as to implement corporate governance in real terms as given by the instruction regarding financial disclosure by Abu Debi exchange stock ADX and Dubai Financial Market DFM to discourage all unhealthy activities that can affect the stakeholder’s rights.Many major empirical studies were conducted to find the reasons regarding Corporate Governance implementations and fair disclosures of financial positions and they have found that the earning management phenomenon prevailing inside the firms (Goncharov, 2005 [20]). Earning management is used to paint the financial reporting into favorable picture for some specific reasons (Loomis, 1999 [32]). Therefore, after such incidents this grey area attained much consideration all around the globe by the accountants and regulators, which can be easily witnessed in the accounting literature. Earning Management not only masks the financial picture but also vague facts for the stakeholders.Stakeholders deemed accounting information to be relevant and valuable because of its relation with equity market value (Kallunki and Martikainen, 1997 [23]). These accounting information reflected in financial statements are always considered as bench mark by shareholders for extrapolating future returns (Dechow, P.M. and Dichev, I.D., 2002 [14]). Companies reported their earnings for giving valuable information to shareholders in market who used accounting numbers for future prediction. The positive/negative information helps them to react accordingly in markets. The earnings of the company and future expectations about the firm value are always related and it has been proved by empirical researches (Liu and Thomas, 2000 [31]).The accounting researchers have found that low earnings reporting have association with low information content of the financial reports showing significant management manipulation (Kallunki and Martikainen, 1997 [23]). In the market base researches it is often found that the relationship is not positive and note worthy between earnings disclosure and stock returns. A comprehensive review of (Lev 1989 [28]) can be seen in which negligible relationship of earnings disclosures and its explanatory value effect on shares returns were noticed.However, Lev (1989 [28]) argued that the in all likelihood reasons for the poor factual execution reliably found in the disclosed profit exploration is inclination, presented by accountants who give estimation rehearses or inventively "abuses" the process of income estimation. Thus, author suggests that the investigation on outcomes of income related reporting must be controlled and make it a central part of the income quality examination plan (Lev, 1989 [28]). This has prompted an extensive and developing the collection of experimental investigations and researches that examines the presence of earning management. Accordingly, income quality gets to be sketchy when directors have a motivator to oversee reported profit deftly (Healy and Wahlen, 1999 [21]). This artful conduct changes shareholder’s point of view about the nature of reported income.This research is going to study the following research question: Do the corporate administration by Corporate Governance and external audit monitoring influences the quality of earning management in financial organizations of UAE?This research makes contribution in different ways. First there is few prior study available on the earning management in United Arab of Emirates, this research will bring some improvement and updating in earning management research in UAE to add to the existing literature. Secondly this study will examine the impact of corporate governance and external audit on publicly listed company in the UAE to explore the viability of the corporate governance combined code on constraining earning management for 2011 to 2015.

2. Literatures

2.1. What is Corporate Governance?

- Corporate governance is a wide term that explains the sequential steps, traditions, policies, ethics, legal compliance and the bodies that guide, supervise, direct and control the companies. It encompasses various actions of the governing parties in administration and follow-up of their organizations. It is a business process, which is driven as per ethics, and is value based. It primarily aims at maximizing wealth of the organization by enhancing the income generation capacity Infosys, (2017). (Murthy, N. and Narayan, R. 2003 [34]) connotes great governance is all about increasing shareholder’s value on feasible basis with simultaneous fair treatment with all concerned parties such as investors, suppliers, customers, employees, public authority and the society. The main objective of the corporate governance is to offer opportunity to the wise, effective and risk bearing management in treading their organization to the path of long-term success (Bhagat, S. and Bolton, B., 2008 [4]). (Charron, D.C., 2007 [7]) Corporate governance’s vitality pops up in modern corporations due to the separation of management and ownership control in the organizations. The interests of the shareholders are conflicting with the interests of the managers. (Khan, 2011 [24]) argued that the principal agent problem is reflected in the management and direction related problems due to the differential interest of the firms’ stakeholders. (Mak, Y.T. and Li, Y., 2001 [33]) describes corporate governance as the processes and structure by which the business and affairs of the company are directed and managed. Originating from point of view of agency issue, corporate governance instruments are accepted to have positive effect to moderate the organization issue. Corporate governance may be seen as the relationship between an organization's governance and shareholders. It is characterized as "the framework by which business enterprises are coordinated and controlled". It is broadly trusted that the usage of a decent corporate governance system presents organizations an organized way to better governance rehearses, powerful oversight and control instruments which prompt open doors for development, financing and enhanced execution (Solomon, 2007 [39]). The public-sector is mostly controlled by the government of UAE. The highest authority in UAE is the regulatory bodies.Some of the important factors defining corporate governance are: ownership structure, board size and board activities, which have been thus assigned as sub variables of corporate governance. Recapitulating the aim of the research study is: Do the corporate administration by CG and external monitoring compels earning management hones in the UAE? The researcher took corporate governance as the variable explaining the corporate administration. It was so because corporate governance encompasses all the factors that are responsible for the administering the companies such as composition of board members, board activities, ownership structure and CEO duality. Corporate governance provides the foundation of corporate management whose decisions, activities and power influences the overall performance of the company. Size of board members is associated with the quality of decisions since the areas of interest of different board members and majority opinion produces the final results (Álvarez, A.I.F., Gómez, S. and Méndez, C.F., 1998 [3]). Board activities reflect the extent and frequency of involvement of the board members in the management meetings and discussions. It defines the administrator’s activity and promptness in taking crucial decisions. Further, ownership structure has been also bracketed under corporate governance since it will reflect the power and pecuniary interest of the owners of the company (Geraldes Alves, S.M., 2011 [18]). The ownership makes the individual accountable to their actions and decisions hence considerably influence the management. Lastly, CEO duality also impacts corporate governance since same individual is vested with the dual power of management as well as execution of the afire of the company. On one hand it could lead to coordinate efforts while excess power could lead to dictatorship and undermining the interests of other stakeholders (Krause, R., Semadeni, M. and Cannella Jr, A.A., 2014 [26], Ramdani, D. and Witteloostuijn, A.V., 2010 [37]). Henceforth, all these factors could substantially be associated with the performance of the company and perhaps be reflected in financial statements of the company. Therefore, the researcher embedded these variables under the head corporate governance as an independent variable so as to study its impact on dependent variable i.e. earning management.

2.2. Earnings Management in Corporates

- Earning Management happens, “when administrators use judgment in money related reporting and in orchestrating exchanges keeping in mind the end goal to alter budgetary reports to either deceive a few partners or stakeholders about the hidden monetary execution of the firm or to impact legally binding results that rely on upon reported book keeping figures while taking investment decisions” (Healy and Wahlen, 1999 [21]). So in simple, it is an activity to deceive by making numbers mystery and also cause harm financially and mentally. All the boards and auditors under the regulations of regulators are focused to seek and find the wrong doers by solving the puzzle of Earning Management before it convert into the fraud or embezzlement. The is a long debate for considering Earning Management as a crime because of the fact that crime must have 7 elements like commitment of crime occurred, responsible suspects, instrument of crime, suffers of the crime, reason behind this motive and the person who carried out this act and last is explanations from different aspects. Moreover Fraud or embezzlement can be defined as "the intentional, deliberate, misstatement or omission of material facts, or accounting data, which is misleading and, when considered with all other information made available, would cause the reader to change or alter his or her judgment or decision" (NACFE, 2003).Another common description of Earning Management given by Schipper (1989 [38]), a famous researcher who observe that “By earnings management I really mean, disclosure management, in the sense of a purposeful intervention in the external financial reporting process, with a view to obtaining private gain for shareholders or managers”.The major question one can arise when studying any UAE firm financial report, as this is not possible to reply unless performed the accounting research. “Despite the popular wisdom that earnings management exists, it has been remarkably difficult for researchers to convincingly document it. This problem arises primarily because, to identify whether earnings have been managed, researchers first have to estimate earnings before the effects of earnings management.” (Healy and Whalen, 1999 [21]). It’s just like a puzzle to solve that which part of earnings are natural and which is managed one.The most common phenomenon prevailing behind the EM is the undue favor to the management in the form of compensation or distribution of unfair profits to the higher tier employees of the company. Discretionary accruals are more visible in the firms where remuneration of top tier is linked with the value of firm’s stock especially when options are applicable. (Burns and Kedia, 2006 [6]; Cheng and Warfield, 2010 [8]).Earning Management should not be mingled up with the accounting choices as (Fields et al. 2001 [16]) “Although not all accounting choices involve earnings management, and the term Earnings management extends beyond accounting choice, the implications of accounting choice to achieve a goal are consistent with the idea of earnings management.”One of the reasons behind Opportunity EM is also the motivating forces for supervisors to take part in profit administration to meet or beat desires and along these lines to impact stock costs.

2.3. Role of External Auditors in Monitoring Earning Management

- External audit refers to an outside organization or a firm that performs the assessment and verification of company’s accounts and financial records with independence and no internal control in lieu of fees. The primary aim of the researcher was to identify, assess and measure whether the corporate administration by CG and external monitoring compel earning management hones in the UAE. Therefore, external monitoring has been explained by taking external audit as independent variable. The external audit will gauge and oversee the activities and financial performance of the company and further verify the validity and effectiveness of its accounts and financial health (Lin, J.W., Li, J.F. and Yang, J.S., 2006[30]). External audit will act as a watchdog over the company performance and will perhaps affect the earning management of the company. It is so because a continuous evaluation and appraisal would be performed on the company performance free from internal control and biasness and will thus necessitate the management of its financial income and position. Further, the external audit parameter has been explained with the help of three sub variables such as: audit fees, audit tenure and international auditing firm relationship. These variables have been chose owing to its substantial impact over the variable external monitoring. Audit fees indicate the extent to which the services are being compensated for the amount of fees thereby affecting the external monitoring in both ways. It could lead to control on results on one hand or encourage the efficiency of the company on the other, hence the need to incorporate in the model to study its individual impact on earning management (Chi, W., Lisic, L.L. and Pevzner, M., 2011 [9]). Next, audit tenure indicates the time period for which the external auditing firm is associated with the company. Again it could impact the earnings of the company in dual ways. The long-term relationship could establish controls and biasness while on the other could improve the efficiency owing to the trust and reliability accorded with the audit firm (Davis, L.R., Soo, B. and Trompeter, G., 2002 [12]). Lastly, international auditing firm relationship with the audit firm could impact the financial performance of the company. On one hand, it could give global exposure to the firm and thus increasing the market value of the company on international standards compliance while on the other hand it could lead to tough competition, leakages of information and involvement of multiple cross border parties and affect the finance of the company (Lin, J.W. and Hwang, M.I., 2010 [29]).

3. Statistical Methodology

- The point at this part is to build up a hypothetical connection between each dimension of Corporate Governance (CG) and External Audit (EA) on Earning Management (EM) variables. It additionally gives a depiction and investigation of the techniques connected with collection and setting up the information considered important to verify the presence of a relationship between income administration as earning management and the characteristics of corporate administration furthermore, the outside reviewer as external audit.This study is conducted to use quantitative approach to study the relations and impact of proper framework of CG and strict external audit the activities of EM. For finding earning management the specific events are used specially the discretionary accruals and a set of independent financial and non-financial variables of the companies listed in ADX by their deep data analysis. The major goal was to develop a relationship between the explanatory variables with the EM and external audit by employing the control variables”. The current research examine the variables using generalized linear models (GLM), which extend the frame work of linear model to a wider range of response types, including categorical, binary, and skewed continues responses. This allows a common approach to statistical inference in the fitting and testing such models as well as diagnostic checking. (J.J. faraway 2016 [15]; Fox, J., 2015 [17]; Gill 2001 [19])

3.1. Sample Selection

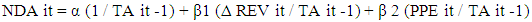

- All sample firms are listed in the Dubai Financial Market, Abu Dhabi Securities Market and Central Bank of UAE; the choice of firms was based on the availability of secondary data within their annual financial reports. The sample chosen for the current research study was fifty. In order to understand the relationship of proposed variables the data was collected from the secondary sources available in annual reports of the various finance companies registered under Central Bank of UAE and under UAE Stock Exchange. The other required information was extracted from the each of the selected company’s official website. It comprised of various finance companies namely, banks, insurance companies and investment companies. Another condition checked to reach the sample size of the subjects are their confidence level index, calculated using Sample Size Calculator developed by Creative Research Systems. The confidence level was taken at 95%, with workforce population size of 500. The margin error necessary to obtain a value closer to the population was calculated and the value obtained was 13.30%, providing an exact sampled population of 50 out of the total companies listed in Central Bank of UAE and UAE Stock Exchange (Creative Research Systems 2017 [11]). Since the study pertained to time series analysis, therefore the data had been collected over the period of five years i.e. from 2011 to 2015. The year 2011 was chosen to see whether the introduction of the UAE code of governance in 2007 have an impact on firms’ performance.Our statistical approach in measuring and decomposing accruals is based on the method proposed by (Jones, J.J., 1991 [22]), which is entirely different from the previous models that considered non discretional accrual NDA over the period of time as a consistent change but only those accruals that change the economic conditions. So the NDA were mathematically expressed by equation:

Where:TA it = Total accruals in year t for firm i;TAi, t-1 = Total assets in year t - 1 for firm i; ΔREVi, t = Change in Revenues in year t less revenues in year t - for firm I; ΔRECi, t = Change in accounts receivable in year t less receivables in year t - for firm I; PPEi, t = Gross property, plant and equipment in year t for firm i;T time from 2011 to 2015The advancement in detecting DA was given by Jones (1991) [22], in which he didn’t use the event study by considering NDA. He related NDA to change in the economic position of the firm by inducing such accruals like the gross property, plant and equipment (PPE) and the change in revenues (Δ REV) as explanatory variables. These values differ before and after the manipulation, which is explained by regression analysis.

Where:TA it = Total accruals in year t for firm i;TAi, t-1 = Total assets in year t - 1 for firm i; ΔREVi, t = Change in Revenues in year t less revenues in year t - for firm I; ΔRECi, t = Change in accounts receivable in year t less receivables in year t - for firm I; PPEi, t = Gross property, plant and equipment in year t for firm i;T time from 2011 to 2015The advancement in detecting DA was given by Jones (1991) [22], in which he didn’t use the event study by considering NDA. He related NDA to change in the economic position of the firm by inducing such accruals like the gross property, plant and equipment (PPE) and the change in revenues (Δ REV) as explanatory variables. These values differ before and after the manipulation, which is explained by regression analysis.4. Discussions and Result

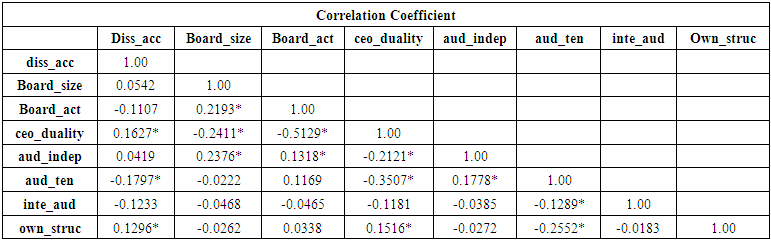

4.1. Correlation Analysis

- Correlation is a statistical tool that measures the existence, degree and direction of relationship across the variables. In the current research study, the researcher used Karl Pearson’s coefficient of correlation. The current study such as discretionary accrual, ownership structure, board members, board meetings, CEO duality, audit fees, tenure of audit firm and lastly international auditing firm relationship with the sample company (see Appendix).

4.2. Empirical Results

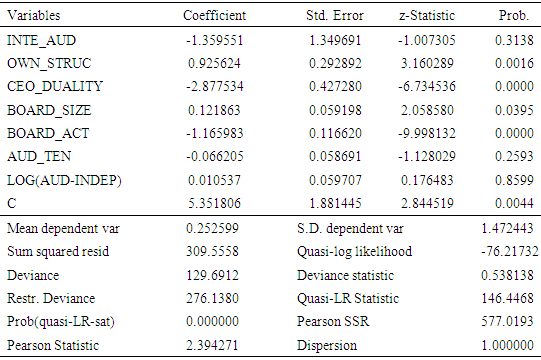

- Linear regression analysis is a statistical technique of estimating the dependent variables with the establishment of its relationship with various independent variables or predictors (Adejumo, A.O., Job, O., Isaac, T.D. and Oyejola, B.A., 2016 [2]). The various hypotheses proposed in the beginning of the study vis-à-vis Corporate Governance, External Auditor and earning management were tested with the aid of General linear models. According to (Ulf Olsson, 2002 [36]), “We have seen that log-linear models for cross-tabulations can be handled as generalized linear models. The linear predictor then consists of a design matrix that contains dummy variables for the different margins of the table. It is quite possible to introduce quantitative variables into the model, in a similar way as for regression models”. The researcher ran this model on the data set that revealed the following results:

|

5. Conclusions and Recommendations

- The study has examined the impact of corporate governance and external Audit on earning management in UAE. The present research highlights two relevant implications of findings. First, the increasing in CEO duality and board activity affects earning management of financial sector in UAE; second the positive influence of ownership structure and board size on Discretionary accruals (DA). In the current research, the researcher has focused to find the influence of CG and external audit on earning management of financial organization of UAE only. None of the non-financial organization has been considered in the study, which has limited insights of the study to a particular segment of the sector.The data found in annual reports of the financial organizations of UAE was limited to the FY 2015 only, the data of FY 2016 was seldom available, due to which the changes occurred in the earning management of organization due to change in corporate governance and external audits in year 2016 have not been included in the study.This study has opened the door for other researcher to explore some more extended topics related to earning management, CG, and external audit. The other researcher may determine the relevant number of board of directors in organizations so that decision making can be more effective. An individual study can be conducted to explore the optimal number of board meeting to improve the overall financial performance along with its effect on earning management. A longer sampling range would also be useful, preferably one extending to a period of at least ten years, to be able to observe how risk and performance have been affected before, during, and after the financial crises. This would provide information regarding post - recession relief.

Appendix

Note

- 1. The Economic Review is a quarterly research publication with articles by Kansas City, 2013

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML