-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Finance and Accounting

p-ISSN: 2168-4812 e-ISSN: 2168-4820

2017; 6(6): 167-171

doi:10.5923/j.ijfa.20170606.02

Corporate Social Responsibility and Financial Performance: The Case of Safaricom Ltd

Wekesa Remmy Nyongesa

School of Business, University of Nairobi, Kenya

Correspondence to: Wekesa Remmy Nyongesa, School of Business, University of Nairobi, Kenya.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This document provides information on a study conducted to investigate the relationship between corporate social responsibility activities and financial performance. The case study approach was used in which Safaricom Ltd; a telecommunication company was selected. A correlational research design was used in which content obtained from secondary sources (annual financial reports) from 2009 to 2017 were analysed to reach conclusion. The study found out that there is an insignificant positive relationship between CSR and financial performance indicators (revenue, net income, and EPS). There is a 2.36%, 0.04% and 0.014% change in revenues, net income, and EPS as a result of investments in corporate social responsibility activities. The study recommends further research on multiple organizations from diverse economic sectors to compare and reach concrete inferences as it appears there are still inconsistencies from previous studies conducted.

Keywords: Corporate social responsibility, Financial performance, Corporate social investment, Social impact

Cite this paper: Wekesa Remmy Nyongesa, Corporate Social Responsibility and Financial Performance: The Case of Safaricom Ltd, International Journal of Finance and Accounting , Vol. 6 No. 6, 2017, pp. 167-171. doi: 10.5923/j.ijfa.20170606.02.

Article Outline

1. Introduction

1.1. Background to the Study

- Corporate social responsibility (CSR) has been an aspect of scholarly research for the past two decades [1]. notes that the concept of CSR has undergone metamorphosis from top managements' philanthropic activities to become a vital component of stakeholder management and has been incorporated into strategic performance models. Organizations, irrespective of the industries in which they operate, face immense pressure from competitors to run their operations in a socially responsible way. This is exemplified in their creation of codes of ethical conduct, publication of CSR reports, and invitation of independent auditors to evaluate execution of their CSR frameworks.Though there have been varying perceptions of what CSR entails, it was originally defined as the commitment to the society beyond the economic and legal obligations with an aim of managing and augmenting the ramifications of their operations on the economy, environment, and the society in its entirety ranging from firm to global scales [2-4]. According to [5], the Triple Bottom Line Concept that was suggested by Eklington in 2004, the 3Ps; People, Profit, and Planet are great determinants for business sustainability. The model enables firms to appreciate the strategic significance of CSR so that they can embrace it as a spring board for facilitating profitability. Thus, in the current dynamic and competitive business environment, organizations are adopting CSR to attain competitive advantage and enhance performance.

1.2. Problem Statement

- Safaricom acknowledges that Corporate Social Investment (CSI) issues are imperative to all stakeholders and are fundamental to its continued business success [6]. The underlying focus of CSI at Safaricom is to enhance responsible operation of its businesses with an aim of achieving overall satisfaction of employees, shareholders, customers, and the community as a whole. The partnerships that the company has with other existing companies create opportunities to communities as well as sustainable solutions aimed at improving the standards of living of the communities in which the company operates or serves. Safaricom's CSR activities revolve around fighting poverty, augmented access to quality education, increased access to maternal health care and improved access to clean water. The attainment of the Safaricom's positive social impact has been made possible through partnerships with over 1,200 organizations.[7] conducted a study on CSR and financial performance of Dangote Cement Plc and noted that there was a positive connection amid engagement in CSR and firm performance. Though there are diverse studies in the manufacturing sector that show a positive correlation amid expenditure on CSR and financial performance, some researchers such as [8] posit that the industry in which a firm operates determines the effectiveness of CSR in attaining competitive advantage and ultimately impacting the financial performance of the organization in question. According to [9], CSR is irrelevant for financial services and other service sector organizations as they do not have visible negative effects on the environment in form of pollutants. This view could be myopic and informs the objective of this study; to ascertain the link between expenditure on CSR and financial performance of Safaricom Ltd, Kenya's leading telecommunication company.

1.3. Research Objectives

- 1. To investigate the relationship between changes in revenue and CSR investment for Safaricom for the period 2009-2017.2. To determine the relationship between net income and expenditure on CSR for Safaricom over the study period of 2009-2017.3. To ascertain if there is any connection between CSR investment and earnings per share (EPS) of Safaricom Ltd from 2009 to 2017.

2. Literature Review

- Researcher [10] conducted an empirical analysis of studies on the relationship between corporate social investment and financial performance of organizations. The results from the analysis indicated that there has been increased investment in sustainable business activities, and that though there have been inconsistent findings, majority of the findings point to a positive connection between CSR investment and financial performance of organizations. Agency theory and stakeholder theory are cited by the author as core theoretical frameworks that underpin the continued investment in CSR by organizations. The study [11] posits that the agency theory holds that firms invest in CSR activities in conformity with the need to use resources for maximum profits as long as their operations are within the confines of the laws and regulations. On the other hand, [12] states that the stakeholder theory in this context implies that organizations need to consider the interest of the multiple stakeholders. Such stakeholders are affected by the firm's operations and have an impact organizations' corporate financial performance. Similarly, [13] conducted a study on the link between CSR investment and financial performance among cement manufacturing companies in Pakistan and established a positive connection. On the contrary, [14] researched on the connection amid CSR and performance of companies listed on the Nigerian Stock Exchange and established a significantly negative relationship. Another scholar, [15] conducted research on the relationship between CSR investment and financial prosperity of companies listed on the New York Stock Exchange and noted that there was no significant effect of CSR on financial performance. A study by [16] investigated the link between CSR expenditure and financial performance of companies listed at the Nairobi Securities Exchange (NSE). The authors note that there is a significant link between CSR expenditure and profitability and asset growth of organizations listed at the NSE. Researchers [17] investigated the relationship between CSR practices and financial performance of firms in the manufacturing, construction, and allied sectors of the NSE. The researchers found out that there was an insignificant positive relationship between CSR and financial performance. From these studies, it can be inferred that CSR has become a key research area among scholars. Governments and businesses are concerned about sustainability in terms of the social and environmental impacts with respect to their continued focus on economic or profit maximization for stockholders.Scholars [18] suggest that CSR is a business commitment to enhance continuous economic development by working ethically with all stakeholders. There are diverse benefits attributed to CSR activities including improving company reputation thus aiding in creating a positive image to consumers, investors, and creditors. The authors, in their study on the association between CSR and corporate financial performance indicate that majority of Asian companies have embraced disclosure of their investments in CSR. There is a significant positive relationship between investment in CSR and corporate financial performance and that company size too, influences a firm's participation in CSR. To date, through M-pesa and Safaricom Foundations, over four million people have been reached, over a million people have had access to health services, and almost 350,000 people having access to clean water. Safaricom has invested in diverse projects in which the core concern is to create large transformative programs [6]. For instance, the M-pesa Foundation Academy, Uzazi Salama project in Samburu, and Mau Eburu project, among others are geared towards enhancing access to quality education, maternal health and access to critical health information, and restoring the country's green ecosystem. Adoption of technology to facilitate app development and facilitation of information and knowledge sharing also forms the core objective of Safaricom's CSI initiatives. M-tiba, FarmDrive, and iProcure are some of the technological advancements that have enormous social impacts that have been and are continually supported by Safaricom's CSR investment.

3. Research Methodology

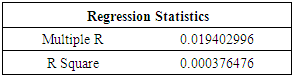

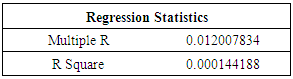

- The main focus of this research was to ascertain if there is a connection amid CSR and financial performance. Correlation research design was used to show the relationship between CSR and financial performance. Data on revenue, net income, and EPS was retrieve from the annual reports of Safaricom Ltd. for the period 2009 to 2017. The annual expenditure on CSR activities relative to the financial performance in terms of revenue, net income, and EPS were analyzed using SPSS and Excel Spreadsheet to reach the findings and make conclusions. The research relied on secondary data only; from audited annual financial reports of Safaricom from 2009 to 2017. The data required was collected, coded and categorized into diverse components for ease of analysis and interpretation of the relationships between the variables investigated. For ease of analysis, the money invested on diverse CSR components that Safaricom Ltd pursues under the M-pesa and Safaricom Foundations were collectively considered as CSI. Content analysis was used to ascertain the expenditure on CSR and this was coupled with regression analysis to determine the relationship between CSI and financial performance of the company over the selected study period.

4. Data Analysis and Findings

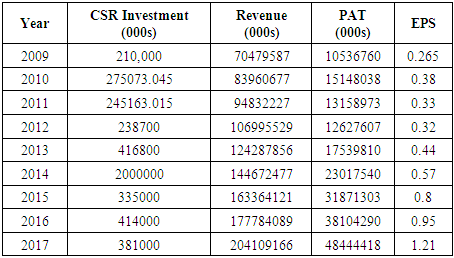

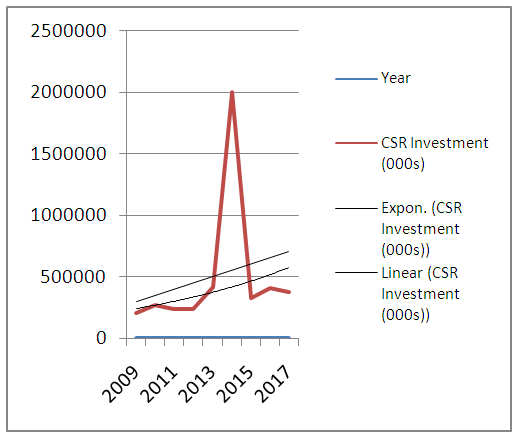

- The following table shows the varying amounts of CSR investments, revenues, profit after tax (net income), and earnings per share for Safaricom Ltd. for the period 2009 to 2017.

|

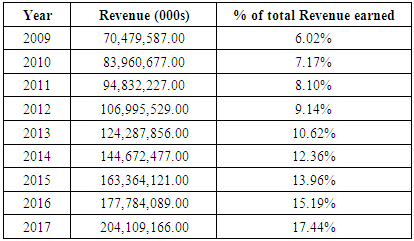

|

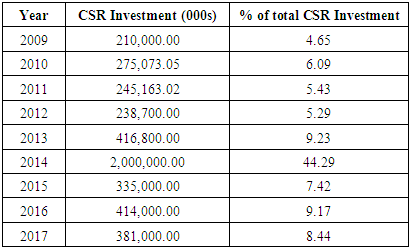

|

| Graph 1. Representation of CSI from 2009 to 2017 |

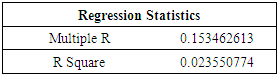

|

|

|

5. Conclusions

- The research conducted noted that the research objectives were effectively met. There is an insignificant positive relationship between CSR and financial performance indicators; revenues, net income, and EPS. The research has limitations as it focused on a single company and within Kenya alone. There is a need to conduct further research on multiple companies and in diverse economic sectors so that the findings can be compared and generalizations made.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML